Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 12 2024 - 5:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2024.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Enclosures:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 12, 2024

| | | | | | | | |

| | SUZANO S.A. |

| | |

| By: | /s/ Marcelo Feriozzi Bacci |

| Name: | Marcelo Feriozzi Bacci |

| Title: | Chief Financial and Investor Relations Officer |

SUZANO S.A.

Publicly Held Company

Corporate Taxpayer ID (CNPJ/MF) No. 16.404.287/0001-55

Company Registry (NIRE) 29.3.0001633-1

MATERIAL FACT

São Paulo, July 12th, 2024 – Suzano S.A. (“Company”) (B3: SUZB3 / NYSE: SUZ), in compliance with Law No. 6,404, from December 15th, 1976, as amended, CVM Resolution No. 44, dated August 23th, 2021 and CVM Resolution No. 80, dated March 29 th, 2022, both as amended, in line with the best corporate governance practices, hereby informs that it has executed an agreement on this date, through a subsidiary, with Pactiv Evergreen Inc. and its affiliates (‘Pactiv’) for the acquisition of all assets that make up the integrated plants for the production of coated and uncoated paperboard, used in the production of Liquid Packaging Board and Cupstock, located in the cities of Pine Bluff – Arkansas and Waynesville – North Carolina, both in the United States of America, with total integrated paperboard capacity of approximately 420,000 (four hundred and twenty thousand) metric tons per year (“Transaction”). The purchase price is USD 110,000,000.00 (one hundred and ten million dollars), to be paid in cash upon closing of the Transaction, subject to customary price adjustments. The completion of the Transaction is subject to verification of usual conditions precedent for transactions of this nature, including the approval of the Transaction by a foreign antitrust authority. At the closing of the Transaction, the Parties will execute (i) a transitional services agreement, under which Pactiv will provide services to Suzano on the acquired assets, and (ii) a long-term supply agreement, under which Suzano will supply to Pactiv the products currently produced in Pine Bluff and consumed by Pactiv, which will become a relevant customer of this new Suzano´s asset.

The Transaction is aligned with the, publicly known, Suzano’s long-term strategic avenue to “Advance in the links of the value chain, always with competitive advantage”, providing the Company with an entry into the North American paperboard market with competitiveness and scalability, having as main characteristics: (i) competitive assets well-positioned on the industry cost curve; (ii) excellent geographic location related to operational and logistics infrastructure, with ample access to low-cost wood and representing future optionality; and (iii) an operation that holds leadership in the North American segment. The Company aims to bring its operational knowledge and experience on the paperboard business, seeking to enhance the structural competitiveness and profitability of the acquired assets.

The Company reinforces that the Transaction does not represent materiality to its financial leverage and/or indebtedness.

The Transaction does not require the approval of the Company’s General Meeting, as it does not fall within or meet the parameters established in Article 256 of the Brazilian Corporations Law.

Lastly, the Company reiterates its commitment with capital allocation discipline and will keep shareholders and the general market informed about the progress of the Transaction, as well as any other matters of interest to its shareholders and the market.

São Paulo, July 12th, 2024.

Marcelo Feriozzi Bacci

Chief Financial and Investor Relations Officer

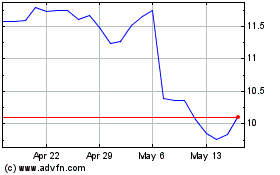

Suzano (NYSE:SUZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

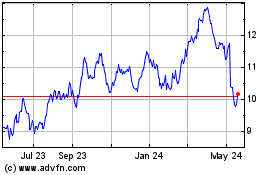

Suzano (NYSE:SUZ)

Historical Stock Chart

From Jul 2023 to Jul 2024