Current Report Filing (8-k)

August 26 2020 - 6:58AM

Edgar (US Regulatory)

false

0001549922

0001549922

2020-08-25

2020-08-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 25, 2020

Summit Midstream Partners, LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35666

|

|

45-5200503

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

910 Louisiana Street, Suite 4200

Houston, TX 77002

(Address of principal executive office) (Zip Code)

(Registrants’ telephone number, including area code): (832) 413-4770

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Securities Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Units

|

SMLP

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Tender Offers

On August 25, 2020, Summit Midstream Partners, LP, a Delaware limited partnership (the “Partnership”), issued a press release announcing the commencement of tender offers (the “Tender Offers”) by Summit Midstream Holdings, LLC, a Delaware limited liability company and subsidiary of the Partnership (the “Company”), and Summit Midstream Finance Corp., a Delaware corporation and subsidiary of the Partnership (the “Co-Issuer,” and together with the Company, the “Issuers”), to purchase for cash an amount of the Issuers’ 5.75% Senior Notes due 2025 (the “2025 Notes”) and 5.50% Senior Notes due 2022 (the “2022 Notes,” and together with the 2025 Notes, the “Notes”). The maximum amount of 2025 Notes that may be purchased in the Tender Offers will be a principal amount of 2025 Notes that could be purchased with a purchase price, excluding accrued interest, of up to $60,000,000, and the maximum amount of 2022 Notes that may be purchased in the Tender Offers will be a principal amount of 2022 Notes that could be purchased with a purchase price, excluding accrued interest, of up to $60,000,000 less the aggregate purchase price, excluding accrued interest, of 2025 Notes purchased in the Tender Offers A copy of the related press release is filed herewith as Exhibit 99.1 and is incorporated herein by reference.

Liability Management Initiatives

On August 25, 2020, the Partnership also announced that it continues to actively evaluate other liability management initiatives as well as potential asset sales or other divestitures of certain of the Partnership’s assets. These initiatives may involve other debt instruments, including the SMPH Term Loan or the Deferred Purchase Price Obligation (each as described in the Partnership’s Quarterly Report on Form 10-Q for the three month period ended June 30, 2020), and they may involve payments of cash, the transfer of common units pledged as collateral under the SMPH Term Loan and/or the issuance of new common units in connection with any potential transaction that seeks to amend or eliminate such debt instruments. Other initiatives may involve the Partnership’s revolving credit facility and the Notes, including future acquisitions of Notes through open market purchases, privately negotiated transactions, redemptions permitted under the terms of such Notes and the applicable indenture governing such Notes, tender offers, exchange offers or otherwise. The Partnership continues to evaluate the sale or other divestiture of its midstream systems and/or joint venture equity interests, as well as third-party financing options for all or a portion of its remaining share of capital expenditures related to the Double E Pipeline project. Discussions and negotiations regarding these types of initiatives can advance or terminate in a short period of time; accordingly, the timing of any announcement associated with these types of strategic initiatives is inherently difficult to predict.

These strategic efforts, if consummated, could involve material liabilities or obligations of the Partnership or its subsidiaries or key Partnership assets, and could have a material impact on the Partnership’s balance sheet, financial condition and results of operations. The closing of any such transaction may be subject to customary and other closing conditions, which may not ultimately be satisfied or waived. Accordingly, the Partnership can give no assurance that any such strategic initiatives will be completed.

The information furnished in this Item 7.01 shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and shall not be deemed incorporated by reference in any filing with the Securities and Exchange Commission, whether or not filed under the Securities Act of 1933 or the 1934 Act, regardless of any general incorporation language in such document.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Summit Midstream Partners, LP

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

By:

|

Summit Midstream GP, LLC (its general partner)

|

|

|

|

|

|

Dated:

|

August 25, 2020

|

/s/ Marc D. Stratton

|

|

|

|

Marc D. Stratton, Executive Vice President and Chief Financial Officer

|

3

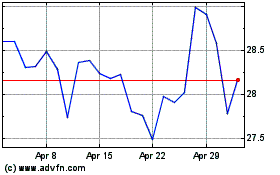

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Jun 2024 to Jul 2024

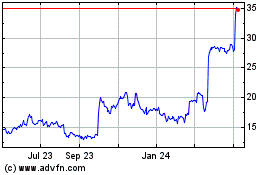

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Jul 2023 to Jul 2024