Current Report Filing (8-k)

December 30 2019 - 8:02AM

Edgar (US Regulatory)

false

0001549922

0001549922

2019-12-24

2019-12-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 30, 2019 (December 24, 2019)

Summit Midstream Partners, LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35666

|

|

45-5200503

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

1790 Hughes Landing Blvd, Suite 500

The Woodlands, TX 77380

(Address of principal executive office) (Zip Code)

(Registrants’ telephone number, including area code): (832) 413-4770

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Securities Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Units

|

SMLP

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 24, 2019, Summit Permian Transmission Holdco, LLC (“Permian Holdco”), a newly created, unrestricted subsidiary of Summit Midstream Partners, LP (“SMLP”) that indirectly owns SMLP’s 70% interest in Double E Pipeline, LLC (“Double E”) adopted an Amended and Restated Limited Liability Company Agreement (the “Permian Holdco Company Agreement”). Pursuant to the Permian Holdco Company Agreement, Permian Holdco established a new class of Series A Preferred Units representing limited liability company interests in Permian Holdco (the “Series A Preferred Units”) in addition to the existing common units representing limited liability company interests in Permian Holdco (the “Common Units”) held by Summit Midstream Permian II, LLC (“Summit Member”), a wholly owned indirect subsidiary of SMLP.

In connection with the entry into the Permian Holdco Company Agreement, an affiliate of TPG Capital, L.P. (“TPG”) contributed $30 million in exchange for Series A Preferred Units and, upon further capital calls by the Summit Member, has agreed to contribute up to $80 million in total for additional Series A Preferred Units. In addition, Permian Holdco and TPG have agreed to an accordion feature that allows TPG to contribute at its option up to an additional $60 million in exchange for Series A Preferred Units, under the same terms and conditions as the initial contribution. All contributions received from TPG will be applied toward Permian Holdco’s capital calls associated with Double E.

Permian Holdco will pay a quarterly distribution rate of 7% on the outstanding Series A Preferred Units and has the option to pay this distribution in-kind until the earlier of June 30, 2022 and the quarter following the date on which the Double E pipeline is placed in service.

At any time after February 28, 2022, upon the occurrence of certain conditions or events specified in the Permian Holdco Company Agreement, TPG may cause Permian Holdco to redeem all of the outstanding Series A Preferred Units for a cash price equal to an agreed amount necessary for TPG to achieve certain minimum return thresholds with respect to each Series A Preferred Unit so redeemed. SMLP has provided a limited guarantee of this redemption obligation, which will terminate upon receipt of FERC approval for construction of the Double E pipeline.

In addition, upon the occurrence of certain conditions specified in the Permian Holdco Company Agreement, TPG has the right to cause a sale of Permian Holdco to a third party.

Permian Holdco has the right to optionally redeem TPG’s preferred interests at any time, subject to a predetermined redemption price with respect to each Series A Preferred Unit so redeemed.

Pursuant to the Permian Holdco Company Agreement, certain actions of Permian Holdco require the consent of TPG.

Item 7.01 Regulation FD Disclosure.

A copy of the press release announcing the transactions described in this Current Report is furnished hereto as Exhibit 99.1.

In accordance with General Instruction B.2 of Form 8-K, the press release is deemed to be “furnished” and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall the press release and Exhibit be deemed incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, each as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Summit Midstream Partners, LP

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

By:

|

Summit Midstream GP, LLC (its general partner)

|

|

|

|

|

|

Dated:

|

December 30, 2019

|

/s/ Marc D. Stratton

|

|

|

|

Marc D. Stratton, Executive Vice President and Chief Financial Officer

|

3

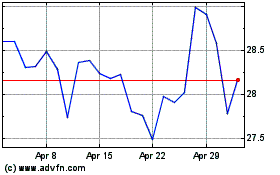

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Jun 2024 to Jul 2024

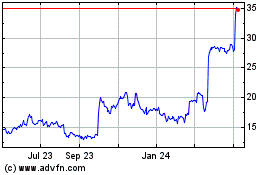

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Jul 2023 to Jul 2024