Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

November 14 2024 - 6:07AM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number 001-34919

SUMITOMO MITSUI FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

1-2, Marunouchi 1-chome, Chiyoda-ku, Tokyo 100-0005, Japan

(Address of principal executive offices)

|

|

|

|

|

|

|

|

|

| Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: |

|

|

Form 20-F ☒ |

|

|

|

Form 40-F ☐ |

|

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE INTO THE

PROSPECTUS FORMING A PART OF SUMITOMO MITSUI FINANCIAL GROUP, INC.’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-276219) AND TO BE A PART OF SUCH PROSPECTUS

FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

| Sumitomo Mitsui Financial Group, Inc. |

|

|

| By: |

|

/s/ Jun Okahashi |

|

|

Name: |

|

Jun Okahashi |

|

|

Title: |

|

Executive Officer & General Manager,

Financial Accounting Dept |

Date: November 14, 2024

Notice regarding Distribution of Interim Dividends from Surplus and Revision of

Dividend Forecast

Tokyo, November 14, 2024 --- Sumitomo Mitsui Financial Group, Inc. (“the Company,” Head Office: Chiyoda-ku,

Tokyo, President and Group CEO: Toru Nakashima) hereby announces that interim dividends from surplus with record date dated September 30, 2024 were resolved at the meeting of the Board of Directors held today, and its year-end and annual dividend forecasts on the fiscal year ending March 31, 2025 were revised.

1.

Distribution of Interim Dividends from Surplus

|

|

|

|

|

|

|

| |

|

Dividend for the

fiscal year ending

March 31,

2025 |

|

Most recent

dividend forecast

(Announced on

May 15, 2024) |

|

Dividend paid for the

fiscal year ended

March 31, 2024

|

| |

|

|

|

| Record date

|

|

September 30, 2024 |

|

September 30, 2024 |

|

September 30, 2023

|

| |

|

|

|

| Dividend per share

(Yen) (*1) |

|

180 |

|

165 |

|

135 |

| |

|

|

|

| Total amount of dividends

(Million Yen) |

|

234,858 |

|

- |

|

180,099 |

| |

|

|

|

| Effective date

|

|

December 3, 2024 |

|

- |

|

December 1, 2023

|

| |

|

|

|

| Source of

dividends |

|

Retained earnings

|

|

-

|

|

Retained earnings

|

| |

(*1) |

On October 1, 2024, the Company effected a three for one split of its common stock on the record date of

September 30, 2024. The amount of dividend per share is based on the number of shares before the stock split. |

2. Revision of

Dividend Forecast

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

(Yen) |

| |

|

|

|

| |

|

|

|

|

|

Dividend per share (*2) |

| |

|

|

|

|

|

| |

|

Record date |

|

|

|

Interim

|

|

Year-end

|

|

Annual |

| |

|

|

|

|

|

| |

|

Previous forecast

(Announced on May 15, 2024) |

|

(A) |

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Before the stock split |

|

|

|

165 |

|

165 |

|

330 |

| |

|

|

|

|

|

| |

|

After the stock split |

|

|

|

55 |

|

55 |

|

110 |

| |

|

|

|

|

|

| |

|

Revised forecast |

|

(B) |

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Before the stock split |

|

|

|

|

|

180 |

|

360 |

| |

|

|

|

|

|

| |

|

After the stock split |

|

|

|

|

|

60 |

|

120 |

| |

|

|

|

|

|

| |

|

Dividend paid for the fiscal year

ending March 31, 2025 |

|

(B) |

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Before the stock split |

|

|

|

180 (*3) |

|

|

|

|

| |

|

|

|

|

|

| |

|

After the stock split |

|

|

|

60 |

|

|

|

|

| |

|

|

|

|

|

| |

|

Change |

|

(B — A) |

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Before the stock split |

|

|

|

+ 15 |

|

+ 15 |

|

+ 30 |

| |

|

|

|

|

|

| |

|

After the stock split |

|

|

|

+ 5 |

|

+ 5 |

|

+ 10 |

| |

(*2) |

The amount of ”Before the stock split” is based on the number of shares before the stock split and

the amount of ”After the stock split” is based on the number of shares after the stock split. Regarding the actual amount of dividends per share, the interim dividends are based on the number of shares before the stock split and the year-end dividends are based on the number of shares after the stock split. |

| |

(*3) |

The amount is dividend per share for the fiscal year ending March 31, 2025 within “1. Distribution of

Interim Dividends from Surplus.” |

- 1 -

3. Reason

Due to revising earnings forcast on a consolidated basis for the fiscal year ending March 31, 2025 upward

in the Consolidated Financial Results for the six months ended September 30, 2024 announced today, the interim dividends for the fiscal year ending March 31, 2025 were revised to ¥180 per share, an increase of ¥15 from the

previously forecasted ¥165 per share.

Additionally, the

year-end dividend forecast was revised to ¥60 per share, an increase of ¥5 from the previously forecasted ¥55 per share after the stock split. As a result, after the stock split, the annual

dividends forecast was revised to ¥120 (before the stock split: ¥360) per share, ¥10 (before the stock split: ¥30) increase from the previous forecast.

This document contains “forward-looking statements” (as defined in the U.S. Private

Securities Litigation Reform Act of 1995), regarding the intent, belief or current expectations of Sumitomo Mitsui Financial Group, Inc. (“the Company”) and its management with respect to the Company’s future financial condition and

results of operations. In many cases but not all, these statements contain words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,”

“probability,” “risk,” “project,” “should,” “seek,” “target,” “will” and similar expressions. Such forward-looking statements are not guarantees of future performance and involve

risks and uncertainties, and actual results may differ from those expressed in or implied by such forward-looking statements contained or deemed to be contained herein. The risks and uncertainties which may affect future performance include:

deterioration of Japanese and global economic conditions and financial markets; declines in the value of the Company’s securities portfolio; incurrence of significant credit-related costs; the Company’s ability to successfully implement

its business strategy through its subsidiaries, affiliates and alliance partners; and exposure to new risks as the Company expands the scope of its business. Given these and other risks and uncertainties, you should not place undue reliance on

forward-looking statements, which speak only as of the date of this document. The Company undertakes no obligation to update or revise any forward-looking statements. Please refer to the Company’s most recent disclosure documents such as its

annual report on Form 20-F and other documents submitted to the U.S. Securities and Exchange Commission, as well as its earnings press releases, for a more detailed description of the risks and uncertainties

that may affect its financial conditions, its operating results, and investors’ decisions.

- 2 -

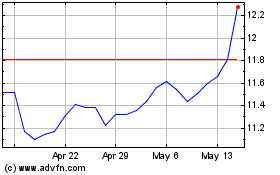

Sumitomo Mitsui Financial (NYSE:SMFG)

Historical Stock Chart

From Dec 2024 to Jan 2025

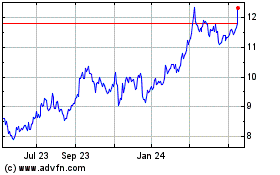

Sumitomo Mitsui Financial (NYSE:SMFG)

Historical Stock Chart

From Jan 2024 to Jan 2025