UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-32562

STANTEC INC.

(Translation of registrant's name into English)

300-10220 103 Avenue NW

Edmonton, Alberta

Canada T5J 0K4

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ X ]

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | STANTEC INC. |

| | | (Registrant) |

| | | |

| | | |

| Date: August 7, 2024 | | /s/ Theresa B. Y. Jang |

| | | Theresa B. Y. Jang |

| | | Executive Vice President and CFO |

| | | |

EXHIBIT INDEX

EXHIBIT 99.1

Stantec reports strong second quarter 2024 results and backlog of $7.2 billion

Q2 2024 Highlights

- Record net revenue of $1.5 billion, an increase of 16.8% over Q2 2023

- Adjusted EBITDA1 increase of 14.5% to $247.3 million and adjusted EBITDA margin1 of 16.6%

- Adjusted diluted EPS1 of $1.12, up 13.1% over Q2 2023

- Backlog of $7.2 billion, up 13.4% since December 31, 2023

EDMONTON, Alberta and NEW YORK, Aug. 07, 2024 (GLOBE NEWSWIRE) -- Stantec (TSX, NYSE:STN), a global leader in sustainable design and engineering, today reported its results for the three months ended June 30, 2024.

Stantec delivered strong second quarter earnings driven by its diversified business model and solid project execution.

Stantec generated record net revenue of $1.5 billion on the strength of 7.1% organic and 8.8% acquisition growth1. Stantec's Water business delivered double digit organic growth of 13.8%, as did Buildings with 13.6%. The Company's US region delivered 8.7% organic growth driven primarily by double digit growth in Water and Infrastructure, and high single digit growth in Buildings. Stantec also delivered 5% organic growth in Canada and 5.5% organic growth in the Global region. Adjusted EBITDA for the second quarter 2024 increased 14.5% or $31.3 million, while Adjusted EBITDA margin decreased by 30 basis points to 16.6%, primarily due to claim provision estimates which increased to historically normal levels compared to the second quarter of 2023. Stantec delivered diluted earnings per share (EPS) of $0.74 and adjusted diluted EPS of $1.12.

“Our solid second quarter results reflect continued strong operational performance,” said Gord Johnston, President and CEO. "We were also extremely busy throughout the second quarter advancing the integration of the ZETCON, Morrison Hershfield and Hydrock acquisitions, supporting our 2,700 new colleagues as they transition onto Stantec's systems and processes."

____________________________

1 Adjusted diluted EPS, adjusted net income, adjusted EBITDA, and adjusted EBITDA margin are non-IFRS measures, and organic growth, acquisition growth and DSO are other financial measures (discussed in the Definitions section of the Q2 2024 MD&A).

2024 Outlook

"Our outlook for the full year remains very positive and we are well positioned to deliver strong results for the year as we continue to execute our three-year strategic plan," said Mr. Johnston.

Stantec is revising and narrowing certain targets contained within its 2024 guidance:

| | Previously Published

2024 Annual Range | Revised 2024 Annual

Range |

| Targets | | |

| Net revenue growth | 11% to 15% | 12% to 15% |

| Adjusted EBITDA as % of net revenue (note) | 16.2% to 17.2% | 16.5% to 16.9% |

| Adjusted net income as % of net revenue (note) | above 8% | above 8% |

| Adjusted diluted EPS growth (note) | 12% to 16% | 12% to 16% |

| Adjusted ROIC (note) | above 11% | above 11% |

Stantec's targets and guidance assumed the average value for the US dollar to be $1.35, GBP to be $1.70, and AU dollar $0.90. For all other underlying assumptions, see the Assumptions section of the Q2 2024 MD&A. These targets do not include the impact of revaluing Stantec's share-based compensation, which fluctuates primarily due to share price movements subsequent to December 31, 2023, as further described below.

note: Adjusted EBITDA, adjusted net income, adjusted diluted EPS, and adjusted ROIC are non-IFRS measures discussed in the Definitions section of this MD&A.

Stantec's outlook for net revenue growth remains robust. The Company now expects net revenue growth to be in the range of 12% to 15%, raising the lower end of the range from 11%. Stantec reaffirms expectations for organic net revenue growth in the mid to high-single digits. The Company continues to expect the US and Global regions to deliver organic growth in the mid to high-single digits and Canada to be in the mid-single digits. This has been complemented by increased expectations from acquisition net revenue growth, revised to high-single digit growth from mid to high-single digit growth.

The Company is narrowing its target range for adjusted EBITDA margin to 16.5% to 16.9% (previously 16.2% to 17.2%). This reflects the continuing confidence in solid project execution and operational performance, while recognizing that opportunities for margin and earnings enhancement from recent acquisitions will be muted during this initial period of transition and integration. As such, Stantec continues to expect adjusted net income to achieve a margin above 8.0%, adjusted diluted EPS growth to be in the range of 12% to 16%, and adjusted ROIC to be above 11%.

Effect of Long-term Incentive Plan

Consistent with guidance previously provided, the targets do not include the impact of revaluing Stantec's share-based compensation, which fluctuates primarily due to share price movements subsequent to December 31, 2023. Year to date, the revaluation resulted in a $6.4 million expense (pre-tax), the equivalent of 20 basis points as a percentage of net revenue and $0.04 EPS. If the LTIP metrics existing at Q2 remain constant to the end of the year, the impact of higher share-based compensation expense to the remaining two quarters would be approximately $0.6 million (pre- tax) or less than $0.01 EPS, and the full year impact would be approximately $7.0 million (pre-tax) or $0.05 EPS.

The above targets do not include any assumptions for additional acquisitions given the unpredictable nature of the size and timing of such acquisitions, or the impact from share price movements subsequent to December 31, 2023 and the relative total shareholder return components on our share-based compensation programs.

Q2 2024 compared to Q2 2023

- Net revenue increased 16.8% or $214.6 million, to $1.5 billion, primarily driven by 8.8% acquisition and 7.1% organic net revenue growth. The Company achieved organic growth in all regional and business operating units with the exception of Energy & Resources. Double-digit organic growth was achieved in the Water and Buildings businesses.

- Project margin increased 17.0% or $117.7 million, to $811.7 million. As a percentage of net revenue, project margin increased by 10 basis points to 54.4% reflecting solid project execution, particularly in the Water and Buildings businesses.

- Adjusted EBITDA increased 14.5% or $31.3 million, to $247.3 million. Adjusted EBITDA margin was 16.6%, in line with expectations. Compared to Q2 2023, adjusted EBITDA margin decreased by 30 basis points and by 90 basis points when normalizing for the Q2 2023 increase in long-term incentive plan (LTIP) expense that resulted from strong price appreciation. The quarter-over-quarter change in margin primarily reflects claim provision estimates increasing to historically normal levels compared to 2023.

- Net income decreased 3.9% or $3.4 million, to $84.6 million, and diluted EPS decreased 6.3% or $0.05, to $0.74, mainly due to a non-cash impairment charge of $16.5 million from the Company's real estate optimization strategy and higher administrative and marketing expenses as a percentage of net revenue.

- Adjusted net income grew 16.3% or $17.8 million, to $127.2 million, achieving 8.5% of net revenue—a decrease of 10 basis points. Adjusted diluted EPS increased 13.1% or $0.13, to $1.12. The LTIP revaluation had a minimal impact on adjusted diluted EPS in Q2 2024 and a downward impact of $0.05 in Q2 2023.

- Contract backlog increased to $7.2 billion at June 30, 2024, reflecting 8.2% acquisition growth and 3.0% organic growth from December 31, 2023. Organic backlog growth was achieved in all regional operating units, and double-digit organic backlog growth was achieved in the Environmental Services and Energy & Resources businesses. Contract backlog represents approximately 12 months of work.

- Operating cash flows increased $49.3 million, with cash inflows of $80.3 million, reflecting strong operational performance and collection efforts.

- DSO was 77 days, remaining below Stantec's target of 80 days.

- Net debt to adjusted EBITDA (on a trailing twelve-month basis) at June 30, 2024 was 1.7x, reflecting the funding of recent acquisitions, and remaining within the Company's internal target range of 1.0x to 2.0x.

- Consistent with Stantec's growth strategy, on April 30, 2024, the Company completed the acquisition of Hydrock Holdings Limited (Hydrock), a 950-person integrated engineering design firm headquartered in Bristol, England. Hydrock bolsters the Company's offering in the energy, buildings, and infrastructure markets.

- On August 7, 2024, the Company's Board of Directors declared a dividend of $0.21 per share, payable on October 15, 2024, to shareholders of record on September 27, 2024.

Year-to-date Q2 2024 compared to year-to-date Q2 2023

- Net revenue increased 14.2% or $356.2 million, to $2.9 billion, primarily driven by 7.2% acquisition and 6.8% organic net revenue growth. Stantec achieved organic growth in all of its regional and business operating units with the exception of Energy & Resources. Double-digit organic growth was achieved in the Water and Buildings businesses.

- Project margin increased $200.2 million or 14.8%, to $1,554.2 million. As a percentage of net revenue, project margin increased by 30 basis points to 54.3% due to solid project execution, particularly in the Water and Buildings businesses.

- Adjusted EBITDA increased $64.1 million or 16.2%, to $459.2 million. Adjusted EBITDA margin increased by 20 basis points over the prior period to 16.0%, and decreased by 10 basis points after normalizing for the LTIP revaluation. Consistent adjusted EBITDA margin was driven by strong net revenue growth and increased project margins, offset by higher administrative and marketing expenses as a percentage of net revenue primarily reflecting claim provision estimates increasing to historically normal levels compared to 2023.

- Net income increased 7.3% or $11.1 million, to $164.0 million, and diluted EPS increased 4.3% or $0.06, to $1.44, mainly due to strong net revenue growth and solid project execution, partly offset by a non-cash impairment charge of $16.9 million from Stantec's real estate optimization strategy and higher administrative and marketing expenses as a percentage of net revenue.

- Adjusted net income grew 21.0% or $39.9 million, to $230.2 million, achieving 8.0% of net revenue—an increase of 40 basis points and adjusted diluted EPS increased 17.4%, or $0.30 to $2.02. The LTIP revaluation had an impact of $0.04 on the 2024 year-to-date adjusted diluted EPS and an impact of $0.10 in the comparative period.

- Operating cash flows increased $69.5 million or 102.7%, with cash inflows of $137.2 million, reflecting strong operational performance and collection efforts.

Q2 2024 Financial Highlights

| | For the quarter ended

June 30, | For the two quarters ended

June 30, |

| | 2024

| 2023

| 2024

| 2023

|

(In millions of Canadian dollars,

except per share amounts and percentages) | $ | % of Net

Revenue | | $ | | % of Net

Revenue | | $ | | % of Net

Revenue | | $ | | % of Net

Revenue | |

| Gross revenue | 1,889.7 | 126.5 | % | 1,638.2 | | 128.1 | % | 3,611.1 | | 126.1 | % | 3,177.4 | | 126.7 | % |

| Net revenue | 1,493.3 | 100.0 | % | 1,278.7 | | 100.0 | % | 2,863.4 | | 100.0 | % | 2,507.2 | | 100.0 | % |

| Direct payroll costs | 681.6 | 45.6 | % | 584.7 | | 45.7 | % | 1,309.2 | | 45.7 | % | 1,153.2 | | 46.0 | % |

| Project margin | 811.7 | 54.4 | % | 694.0 | | 54.3 | % | 1,554.2 | | 54.3 | % | 1,354.0 | | 54.0 | % |

| Administrative and marketing expenses | 576.6 | 38.6 | % | 487.3 | | 38.1 | % | 1,119.5 | | 39.1 | % | 975.6 | | 38.9 | % |

| Depreciation of property and equipment | 17.2 | 1.2 | % | 14.7 | | 1.1 | % | 33.0 | | 1.2 | % | 30.2 | | 1.2 | % |

| Depreciation of lease assets | 32.0 | 2.1 | % | 30.2 | | 2.4 | % | 63.5 | | 2.2 | % | 61.1 | | 2.4 | % |

| Net impairment (reversal) of lease assets | 16.5 | 1.1 | % | 0.4 | | 0.0 | % | 16.9 | | 0.6 | % | (2.1 | ) | (0.1 | %) |

| Amortization of intangible assets | 31.8 | 2.1 | % | 26.4 | | 2.1 | % | 62.8 | | 2.2 | % | 52.7 | | 2.1 | % |

| Net interest expense and other net finance expense | 27.4 | 1.8 | % | 22.9 | | 1.8 | % | 51.6 | | 1.8 | % | 44.5 | | 1.8 | % |

| Other expense (income) | 0.9 | 0.1 | % | (1.4 | ) | (0.1 | %) | (4.8 | ) | (0.2 | %) | (5.3 | ) | (0.2 | %) |

| Income taxes | 24.7 | 1.7 | % | 25.5 | | 2.0 | % | 47.7 | | 1.7 | % | 44.4 | | 1.8 | % |

| Net income | 84.6 | 5.7 | % | 88.0 | | 6.9 | % | 164.0 | | 5.7 | % | 152.9 | | 6.1 | % |

| Basic and diluted earnings per share (EPS) | 0.74 | n/m | | 0.79 | | n/m | | 1.44 | | n/m | | 1.38 | | n/m | |

| Adjusted EBITDA (note) | 247.3 | 16.6 | % | 216.0 | | 16.9 | % | 459.2 | | 16.0 | % | 395.1 | | 15.8 | % |

| Adjusted net income (note) | 127.2 | 8.5 | % | 109.4 | | 8.6 | % | 230.2 | | 8.0 | % | 190.3 | | 7.6 | % |

| Adjusted diluted EPS (note) | 1.12 | n/m | | 0.99 | | n/m | | 2.02 | | n/m | | 1.72 | | n/m | |

| Dividends declared per common share | 0.210 | n/m | | 0.195 | | n/m | | 0.420 | | n/m | | 0.390 | | n/m | |

note: Adjusted EBITDA, adjusted net income, and adjusted diluted EPS are non-IFRS measures (discussed in the Definitions of Non-IFRS and Other Financial Measures section of the Q2 2024 MD&A).

n/m = not meaningful

Net Revenue by Reportable Segment

| (In millions of Canadian dollars, except percentages) | Q2 2024 | Q2 2023 | Total Change | | Change Due to Acquisitions | | Change Due to Foreign Exchange | | Change Due to Organic Growth | | % of Organic Growth | |

| Canada | 370.7 | 320.3 | 50.4 | | 34.4 | | n/a | | 16.0 | | 5.0 | % |

| United States | 775.6 | 667.2 | 108.4 | | 37.7 | | 12.6 | | 58.1 | | 8.7 | % |

| Global | 347.0 | 291.2 | 55.8 | | 40.4 | | (0.7 | ) | 16.1 | | 5.5 | % |

| Total | 1,493.3 | 1,278.7 | 214.6 | | 112.5 | | 11.9 | | 90.2 | | |

| Percentage Growth | | | 16.8 | % | 8.8 | % | 0.9 | % | 7.1 | % | |

Backlog

| (In millions of Canadian dollars, except percentages) | Jun 30, 2024 | Dec 31, 2023 | Total Change | | Change Due to Acquisitions | | Change Due to Foreign Exchange | | Change Due to Organic Growth | | % of Organic Growth | |

| Canada | 1,650.5 | 1,342.6 | 307.9 | | 183.8 | | n/a | | 124.1 | | 9.2 | % |

| United States | 4,174.2 | 3,950.8 | 223.4 | | 54.3 | | 129.1 | | 40.0 | | 1.0 | % |

| Global | 1,327.9 | 1,012.5 | 315.4 | | 279.3 | | 9.8 | | 26.3 | | 2.6 | % |

| Total | 7,152.6 | 6,305.9 | 846.7 | | 517.4 | | 138.9 | | 190.4 | | |

| Percentage Growth | | | 13.4 | % | 8.2 | % | 2.2 | % | 3.0 | % | |

Webcast & Conference Call

Stantec will host a live webcast and conference call on Thursday, August 8, 2024, at 7:00 AM Mountain Time (9:00 AM Eastern Time) to discuss the Company’s second quarter performance.

To listen to the webcast and view the slide presentation, please join here.

If you are an analyst and would like to participate in the Q&A, please register here.

The conference call and slideshow presentation will be broadcast live and archived in their entirety in the Investors section of Stantec.com.

About Stantec

Stantec empowers clients, people, and communities to rise to the world’s greatest challenges at a time when the world faces more unprecedented concerns than ever before.

We are a global leader in sustainable architecture, engineering, and environmental consulting.

Our professionals deliver the expertise, technology, and innovation communities need to manage aging infrastructure, demographic and population changes, the energy transition, and more.

Today’s communities transcend geographic borders. At Stantec, community means everyone with an interest in the work that we do—from our project teams and industry colleagues to our clients and the people our work impacts. The diverse perspectives of our partners and interested parties drive us to think beyond what’s previously been done on critical issues like climate change, digital transformation, and future-proofing our cities and infrastructure.

We are engineers, designers, scientists, project managers, and strategic advisors. We innovate at the intersection of community, creativity, and client relationships to advance communities everywhere, so that together we can redefine what’s possible.

Stantec trades on the TSX and the NYSE under the symbol STN.

Cautionary Statements

Non-IFRS and Other Financial Measures

Stantec reports its financial results in accordance with IFRS. This news release also reports the following non-IFRS and other financial measures used by the Company: adjusted EBITDA, adjusted net income, adjusted earnings per share (EPS), net debt to adjusted EBITDA, days sales outstanding (DSO), margin (percentage of net revenue), organic growth (retraction), acquisition growth, adjusted return on invested capital (ROIC), and measures described as on a constant currency basis and the impact of foreign exchange or currency fluctuations, as well as measures and ratios calculated using these non-IFRS or other financial measures. Additional disclosure for these non-IFRS and other financial measures, incorporated by reference, is included in the Definitions of Non-IFRS and Other Financial Measures section of the Q2 2024 Management’s Discussion and Analysis, available on SEDAR+ at sedarplus.ca, EDGAR at sec.gov, and the Company’s website at Stantec.com and the reconciliation of Non-IFRS Financial Measures appended hereto.

These non-IFRS and other financial measures do not have a standardized meaning under IFRS and, therefore, may not be comparable to similar measures presented by other issuers. Management believes that, in addition to conventional measures prepared in accordance with IFRS, these non-IFRS and other financial measures and ratios provide useful information to investors to assist them in understanding components of the Company's financial results. These measures should not be considered in isolation or viewed as a substitute for the related financial information prepared in accordance with IFRS.

Forward-looking Statements

Certain statements contained in this news release constitute forward-looking statements. These statements include, without limitation, comments regarding the Company's ability to capture future growth opportunities, adjusted diluted EPS and net revenue growth, adjusted EBITDA margin, adjusted ROIC, and the 2024 outlook. Readers of this news release are cautioned not to place undue reliance on forward-looking statements since a number of factors could cause actual future results to differ materially from the expectations expressed in these forward-looking statements. These factors include, but are not limited to, the risk of economic downturn, cash flow projections, project cancellations, access and retention of skilled labor, decreased infrastructure spending levels, decrease or end to stimulus programs, changing market conditions for Stantec’s services, and the risk that Stantec fails to capitalize on its strategic initiatives. Investors and the public should carefully consider these factors, other uncertainties, and potential events, as well as the inherent uncertainty of forward-looking statements, when relying on these statements to make decisions with respect to the Company.

Future outcomes relating to forward-looking statements may be influenced by many factors and material risks. For the three and six month periods ended June 30, 2024, there has been no significant change in the risk factors from those described in Stantec's 2023 Annual Report. This report is accessible online by visiting EDGAR on the SEC website at sec.gov or by visiting the CSA website at sedarplus.ca or Stantec’s website, Stantec.com. You may obtain a hard copy of the 2023 annual report free of charge from the investor contact noted below.

Investor Contact

Jess Nieukerk

Stantec Investor Relations

Ph: 403-569-5389

jess.nieukerk@stantec.com

To subscribe to Stantec’s email news alerts, please fill out the subscription form.

Reconciliation of Non-IFRS Financial Measures

| | For the quarter ended

June 30, | For the two quarters ended

June 30, |

| (In millions of Canadian dollars, except per share amounts) | 2024 | | 2023 | | 2024 | | 2023 | |

| Net income | 84.6 | | 88.0 | | 164.0 | | 152.9 | |

| Add back (deduct): | | | | |

| Income taxes | 24.7 | | 25.5 | | 47.7 | | 44.4 | |

| Net interest expense | 27.3 | | 22.3 | | 51.3 | | 43.0 | |

| Net impairment (reversal) of lease assets (note 1) | 18.4 | | 0.9 | | 18.9 | | (2.0 | ) |

| Depreciation and amortization | 81.0 | | 71.3 | | 159.3 | | 144.0 | |

| Unrealized gain on equity securities | (1.8 | ) | (3.3 | ) | (3.7 | ) | (7.2 | ) |

| Acquisition, integration, and restructuring costs (note 4) | 13.1 | | 11.3 | | 21.7 | | 20.0 | |

| | | | | |

| Adjusted EBITDA | 247.3 | | 216.0 | | 459.2 | | 395.1 | |

| | For the quarter ended

June 30, | For the two quarters ended

June 30, |

| (In millions of Canadian dollars, except per share amounts) | 2024 | | 2023 | | 2024 | | 2023 | |

| Net income | 84.6 | | 88.0 | | 164.0 | | 152.9 | |

| Add back (deduct) after tax: | | | | |

| Net impairment (reversal) of lease assets (note 1) | 14.4 | | 0.6 | | 14.7 | | (1.6 | ) |

| Amortization of intangible assets related to acquisitions (note 2) | 18.9 | | 14.6 | | 37.0 | | 29.1 | |

| Unrealized gain on equity securities (note 3) | (1.4 | ) | (2.6 | ) | (2.9 | ) | (5.6 | ) |

| Acquisition, integration, and restructuring costs (note 4) | 10.7 | | 8.8 | | 17.4 | | 15.5 | |

| | | | | |

| Adjusted net income | 127.2 | | 109.4 | | 230.2 | | 190.3 | |

| Weighted average number of shares outstanding - diluted | 114,066,995 | | 111,015,228 | | 114,066,995 | | 110,953,350 | |

| | | | | |

| Adjusted earnings per share - diluted | 1.12 | | 0.99 | | 2.02 | | 1.72 | |

See the Definitions section of the Q2 2024 MD&A for the discussion of non-IFRS and other financial measures used and additional reconciliations of non-IFRS financial measures.

note 1: The net impairment (reversal) of lease assets and property and equipment includes onerous contracts associated with the impairment for the quarter ended June 30, 2024 of $1.9 (2023 - $0.5) and for the two quarters ended June 30, 2024 of $2.0 (2023 - $0.1). For the quarter ended June 30, 2024, this amount is net of tax of $4.0 (2023 - $0.3). For the two quarters ended June 30, 2024, this amount is net of tax of $4.2 (2023 - $(0.4)).

note 2: The add back of intangible amortization relates only to the amortization from intangible assets acquired through acquisitions and excludes the amortization of software purchased by Stantec. For the quarter ended June 30, 2024, this amount is net of tax of $5.4 (2023 - $4.2). For the two quarters ended June 30, 2024 this amount is net of tax of $10.7 (2023 - $8.4).

note 3: For the quarter ended June 30, 2024, this amount is net of tax of $(0.4) (2023 - $(0.7)). For the two quarters ended June 30, 2024 this amount is net of tax of $(0.8) (2023- $(1.6)).

note 4: The add back of certain administrative and marketing costs and depreciation primarily related to acquisition and integration expenses associated with our acquisitions and restructuring costs. For the quarter ended June 30, 2024, this amount is net of tax of $3.2 (2023 - $2.5). For the two quarters ended June 30, 2024, this amount is net of tax of $5.1 (2023- $4.5).

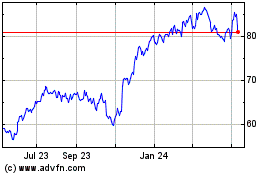

Stantec (NYSE:STN)

Historical Stock Chart

From Oct 2024 to Nov 2024

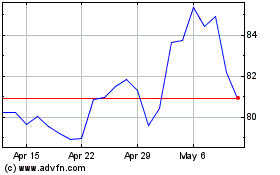

Stantec (NYSE:STN)

Historical Stock Chart

From Nov 2023 to Nov 2024