New joint venture acquisitions in May and July

and previously announced acquisition in Q2 add nine communities to

Sonida’s owned senior living portfolio

Newly acquired assets continue to strengthen

Sonida’s portfolio quality with the addition of newer vintage,

high-quality real estate at significant discounts to replacement

cost

Sonida also enters into management agreements

on two new assets on behalf of a REIT partner

In Q2 2024, Company raised approximately $18.9

million in net proceeds through its at-the-market (ATM) equity

offering program to fund acquisitions

Company added to the Russell 3000® effective

July 1, 2024

Sonida Senior Living, Inc. (“Sonida” or the “Company”) (NYSE:

SNDA), a leading owner, operator and investor in communities and

services for seniors, today announced that in late May and early

July 2024, the Company executed two separate joint venture

investments acquiring eight senior living communities strategically

located in attractive submarkets within the Company’s geographic

footprint, creating further density in Texas and the Midwest and

allowing management to leverage market knowledge and create

operating efficiencies. The transactions include 790 units with

Independent Living, Assisted Living and Memory Care offerings.

Combined with the previously announced May 9, 2024 acquisition of a

100-unit Assisted Living and Memory Care senior living community in

Macedonia, Ohio, Sonida has added nine senior living communities to

its portfolio year-to-date, bringing its total owned senior living

portfolio to 70 communities. These acquisitions are consistent with

the Company’s acquisition framework of acquiring high-quality,

newer assets to which Sonida’s operating platform can add

significant value. Including the Company’s two new management

contracts, Sonida’s operating portfolio is comprised of 82

communities.

“These successful closings are the most recent wins in a

comprehensive strategy to judiciously grow Sonida’s portfolio

through creative deal structuring, expand its best-in-class

operating platform and ultimately achieve attractive returns upon

asset stabilization,” said Brandon Ribar, President and Chief

Executive Officer. “The acquired assets consist of exceptional

private-pay communities, with newer vintage construction and/or

material renovations within the last 10 years and are in

mid-to-large metropolitan areas with favorable growth prospects. We

continue to leverage our sourcing channels which enable us to

identify compelling investment opportunities and drive long-term

inorganic growth and value creation for our shareholders.”

Joint Venture Acquisition #1 (Sonida

51% Owner)

The first transaction, with joint venture partner Palatine

Capital Partners, includes the recapitalization of four senior

living communities in major metropolitan markets: San Antonio, TX

(2), Austin, TX (1) and Atlanta, GA (1). This brings the total

number of Texas owned properties to 19 and represents Sonida’s

entrance into Atlanta, a high-growth market that complements the

existing portfolio and further strengthens Sonida’s Southeast

presence.

The four assets are in strong submarkets and were built or

redeveloped an average of seven years ago but have not yet

stabilized since COVID. With 326 units and a wide variety of

amenities, the communities provide a tremendous opportunity for

Sonida, who will also operate the communities on behalf of the

joint venture for a market fee, bringing its best-in-class

operating platform to drive the portfolio’s recovery.

The assets were recapitalized at an implied valuation of $34.7

million, or $107,300 per unit. The transaction was financed with

approximately $21.8 million of mortgage debt from the existing

lenders, who collaboratively worked through favorable modifications

to the existing financing to allow the joint venture sufficient

duration and flexibility to stabilize the portfolio. At

stabilization, the investment is expected to deliver double-digit

Net Operating Income (“NOI”) yields by leveraging Sonida’s deep

local sales and marketing expertise as well as its proven labor

management processes.

Sonida, as a 51% owner in the joint venture, contributed $6.4

million in initial cash equity to the transaction.

Joint Venture Acquisition #2 (Sonida

33% Owner)

The second transaction, with joint venture partner KZ Family

Ventures, includes four senior living communities with 464 units in

the Cincinnati, OH (1), Cleveland, OH (1), Kansas City, MO (1) and

Louisville, KY (1) markets, bringing the total number of Ohio

properties to 13 (including Sonida’s previously announced second

quarter acquisition in Macedonia, OH). Although the first

Sonida-owned community in Kentucky, the Louisville asset

complements Sonida’s regional cluster in southern Indiana and

Cincinnati.

The upscale, highly amenitized assets were all recently

constructed with an average age of five years old but have not

stabilized due to under-management and leadership turnover. The

joint venture acquired the portfolio for $64.0 million, or less

than $140,000 per unit and closed on an all-cash basis with the

intent to assume moderate leverage post-close. At stabilization,

the transaction is expected to deliver double-digit NOI yields

through both occupancy and margin improvement. Sonida will operate

the assets on behalf of the joint venture for a market fee,

leveraging its deep regional support team in its Midwest

division.

Sonida, as a 33% owner in the joint venture, contributed $22.3

million in initial cash equity to close the transaction. Upon the

joint venture assuming moderate leverage post-close, a majority

portion of that outlay will be returned to the Company, providing

further capital for future Sonida acquisitions.

Operating Management

Contracts

On June 1, Sonida commenced management on two additional

properties located in Minnesota and Wisconsin for one of its REIT

partners. The Company intends to apply its proven systems for

near-term occupancy recovery. The management contracts have a

5-year term with extension options at the owner’s election. In Q3

2024, Sonida expects to assume management of one additional

community owned by the same REIT partner.

Capital Markets Update

Sonida disclosed that on April 1, 2024, it filed a prospectus

supplement with the U.S. Securities and Exchange Commission under

which it may offer and sell from time to time and at its

discretion, shares of its common stock having an aggregate offering

price of up to $75 million pursuant to an at-the-market (ATM)

securities offering program. Shares are offered pursuant to an at

the market sales issuance agreement between the Company and Mizuho

Securities USA LLC, who acts as the sole sales agent.

In Q2 2024, the Company utilized its ATM to sell 667,502 shares

of common stock at a weighted average price of $29.08 per share,

representing a total of approximately $19.4 million of gross

proceeds and approximately $18.9 million of net proceeds to the

Company since implementing the program.

The net proceeds were used to fund and execute on the

above-mentioned transactions, as well as working capital and other

general corporate purposes.

Sonida Added to Russell 3000®

Index

The Company has been added to the broad-market Russell 3000®

Index at the conclusion of the 2024 Russell Indexes annual

reconstitution, effective July 1, 2024.

The annual Russell U.S. Indexes reconstitution captures the

4,000 largest U.S. stocks as of Tuesday, April 30th, ranking them

by total market capitalization. Membership in the U.S. all-cap

Russell 3000® Index, which remains in place for one year, means

automatic inclusion in the large-cap Russell 1000® Index or

small-cap Russell 2000® Index, as well as the appropriate growth

and value style indexes. FTSE Russell, a prominent global index

provider, determines membership for its Russell indexes primarily

by objective, market-capitalization rankings, and style

attributes.

“Being included in the Russell Index is an important milestone

for Sonida and reflects the significant progress we continue to

make transforming the Company. Our inclusion will expand investor

awareness and broaden our shareholder base,” said Kevin Detz, Chief

Financial Officer of Sonida. “This marker coincides with an

exciting time for Sonida. With a strong foundation of operational

discipline and recent balance sheet and liquidity advancements, the

Company has meaningfully positioned itself for strategic expansion

and continued momentum, as we focus on continued shareholder value

creation for the remainder of 2024 and beyond.”

Safe Harbor

The forward-looking statements in this press release, including,

but not limited to, statements relating to the Company’s

acquisitions, are subject to certain risks and uncertainties that

could cause the Company’s actual results and financial condition to

differ materially, including, but not limited to the Company’s

ability to recognize the anticipated benefits of such acquisitions;

the impact of such acquisitions on the Company’s business; any

legal proceedings that may be brought related to such acquisitions;

and other risks and factors identified from time to time in the

Company’s reports filed with the SEC, including the Company’s

ability to generate sufficient cash flows from operations,

additional proceeds from debt financings or refinancings, and

proceeds from the sale of assets to satisfy its short-and long-term

debt obligations and to make capital improvements to the Company’s

communities; increases in market interest rates that increase the

cost of certain of the Company’s debt obligations; increased

competition for, or a shortage of, skilled workers, including due

to general labor market conditions, along with wage pressures

resulting from such increased competition, low unemployment levels,

use of contract labor, minimum wage increases and/or changes in

overtime laws; the Company’s ability to obtain additional capital

on terms acceptable to it; the Company’s ability to extend or

refinance its existing debt as such debt matures; the Company’s

compliance with its debt agreements, including certain financial

covenants and the risk of cross-default in the event such

non-compliance occurs; the Company’s ability to complete

acquisitions and dispositions upon favorable terms or at all; the

risk of oversupply and increased competition in the markets which

the Company operates; the Company’s ability to improve and maintain

controls over financial reporting and remediate the identified

material weakness discussed in its recent Quarterly and Annual

Reports filed with the SEC; the cost and difficulty of complying

with applicable licensure, legislative oversight, or regulatory

changes; risks associated with current global economic conditions

and general economic factors such as inflation, the consumer price

index, commodity costs, fuel and other energy costs, competition in

the labor market, costs of salaries, wages, benefits, and

insurance, interest rates, and tax rates; and changes in accounting

principles and interpretations.

About Sonida

Dallas-based Sonida Senior Living, Inc. is a leading owner,

operator and investor in independent living, assisted living and

memory care communities and services for senior adults. The Company

provides compassionate, resident-centric services and care as well

as engaging programming of 82 housing communities in 19 states with

an aggregate capacity of approximately 8,000+ residents, including

70 communities which the Company owns and 12 communities that the

Company manages on behalf of third parties.

For more information, visit www.sonidaseniorliving.com or

connect with the Company on Facebook, Twitter or LinkedIn.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240702384450/en/

Investor Relations Jason Finkelstein Ignition Investor

Relations ir@sonidaliving.com

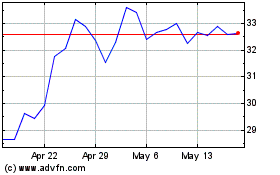

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Jan 2024 to Jan 2025