UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 22, 2015

Simpson Manufacturing Co., Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 1-13429 | | 94-3196943 |

(State or other jurisdiction of incorporation) | | (Commission file number) | | (I.R.S. Employer Identification No.) |

5956 W. Las Positas Boulevard, Pleasanton, CA 94588

(Address of principal executive offices)

(Registrant’s telephone number, including area code): (925) 560-9000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-2) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240. 13e-4(c)) |

Item 8.01 Other Events.

On September 22, 2015, Simpson Manufacturing co., Inc. (the “Company”) issued a press release announcing its capital allocation program, including an accelerated share repurchase program. This press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

On September 14, 2015, the Company entered into a Master Confirmation and a Supplemental Confirmation for an accelerated share repurchase program (the “ASR Agreement”) with Wells Fargo Bank, National Association (“Wells Fargo”). Pursuant to the ASR Agreement, the Company will repurchase approximately $25 million of its common stock from Wells Fargo. It is expected that the total number of shares that will be repurchased will be determined based on the daily volume weighted average market price of the Company’s common stock during the term of the ASR Agreement, less a discount. On September 15, 2015, the Company paid an initial purchase price of $25 million to Wells Fargo and Wells Fargo delivered 498,700 shares of the Company’s common stock to the Company. At the completion of the program, the Company may be entitled to receive additional shares of its common stock from Wells Fargo, or, under certain circumstances, may be required to make a cash payment or, at the Company’s option, deliver shares to Wells Fargo. Final settlement of the ASR Agreement is expected to be completed by the end of the fourth quarter of 2015, although the settlement may be accelerated at Wells Fargo’s option to an earlier date after a specified minimum period.

The ASR Agreement contains the principal terms and provisions governing the accelerated share repurchase, including, but not limited to, the mechanism used to determine the number of shares that will be delivered, the required timing of delivery of the shares, the circumstances under which Wells Fargo is permitted to make adjustments to valuation and calculation periods. The ASR Agreement provides for various representations and warranties, covenants, and indemnification by the Company in favor of Wells Fargo. The ASR Agreement also provides that Wells Fargo can terminate or adjust the terms of the ASR Agreement following the occurrence of certain specified events, including major corporate transactions, market disruptions and other specified events involving the Company and/or its shares.

Wells Fargo and its affiliates have performed, and may in the future perform, various commercial banking, investment banking and other financial advisory services for the Company and its subsidiaries for which they have received, and will receive, customary fees and expenses.

Item 9.01 Financial Statements and Exhibits

Exhibit No. Description

Exhibit 99.1 Press Release dated September 22, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | Simpson Manufacturing Co., Inc. |

| | (Registrant) |

| | | |

| | | |

| | | |

DATE: | September 22, 2015 | By | /s/BRIAN J. MAGSTADT |

| | | Brian J. Magstadt |

| | | Chief Financial Officer |

Exhibit 99.1 Press Release dated September 22, 2015

SIMPSON MANUFACTURING CO., INC. ANNOUNCES

CAPITAL ALLOCATION PROGRAM AND SHARE REPURCHASES

Pleasanton, CA - Simpson Manufacturing Co., Inc. (the “Company”) announced today that it has purchased 395,091 shares of its Common Stock, for an average price of $34.63 per share, since August 2015, exclusive of the accelerated share repurchase described below. The total amount spent on such repurchases was approximately $13.7 million, which was part of the $50.0 million authorization from the Company’s Board of Directors in February 2015 for repurchases of Common Stock in 2015 (the “Authorization”). The total number of such repurchases this year under the Authorization was 649,710 shares at an average share price of $34.08 per share for a total of $22.2 million, leaving $27.8 million unspent under the Authorization and available to be utilized for the accelerated repurchase described below.

On September 14, 2015, the Company entered into a Master Confirmation and a Supplemental Confirmation for an accelerated share repurchase program (the “ASR Agreement”) with Wells Fargo Bank, National Association to repurchase approximately $25 million worth of Common Stock. The total number of shares that will be repurchased will be determined based on the daily volume weighted average market price of the Company’s common stock, less a discount.

This action does not change the Company’s overall growth strategy. The Company has a strong cash position and remains committed to seeking growth opportunities in the building products range where it can leverage its expertise in engineering, testing, manufacturing and distribution to invest in and grow its business. Those opportunities include internal improvements or acquisitions that fit within the Company’s strategic growth plan. Additionally, the Company has financial flexibility and is committed to providing returns to its shareholders. Considering the Company’s current strong cash position and balance sheet, the Company entered into the ASR Agreement as a means to repurchase shares under the remaining balance of the Authorization. Over the next three years, the Company currently plans to utilize future share repurchase authorizations and to consider future dividend increases, both of which will require approval by the Company’s Board of Directors.

Simpson Manufacturing Co., Inc., headquartered in Pleasanton, California, through its subsidiary, Simpson Strong-Tie Company Inc., designs, engineers and is a leading manufacturer of wood construction products, including connectors, truss plates, fastening systems, fasteners and shearwalls, and concrete construction products, including adhesives, specialty chemicals, mechanical anchors, powder actuated tools and reinforcing fiber materials. The Company's common stock trades on the New York Stock Exchange under the symbol "SSD."

This document contains forward-looking statements, based on numerous assumptions and subject to risks and uncertainties, such as statements above regarding the Company’s growth strategy, the Company’s growth opportunities, and the Company’s plans for share repurchases and dividends. Although the Company believes that the forward-looking statements are reasonable, it does not and cannot give any assurance that its beliefs and expectations will prove to be correct. Many factors could significantly affect the Company's operations and cause the Company's actual results to differ substantially from the Company's expectations. Those factors include, but are not limited to: (i) general economic and construction business conditions; (ii) customer acceptance of the Company's products; (iii) relationships with key customers; (iv) materials and manufacturing costs; (v) the financial condition of customers, competitors and suppliers; (vi) technological developments; (vii) increased competition; (viii) changes in capital and credit market conditions; (ix) governmental and business conditions in countries where the Company's products are manufactured and sold; (x) changes in trade regulations; (xi) the effect of acquisition activity; (xii) changes in the Company's plans, strategies, objectives, expectations or intentions; and (xiii) other risks and uncertainties indicated from time to time in the Company's filings with the U.S. Securities and Exchange Commission including most recently the Company's Annual Report on Form 10-K under the heading "Item 1A - Risk Factors." Actual results or outcomes might differ materially from results or outcomes suggested by any forward-looking statements in this document. The Company does not have an obligation to publicly update any forward-looking statements, whether as a result of the receipt of new information, the occurrence of future events or otherwise.

For further information, contact Tom Fitzmyers at (925) 560-9030.

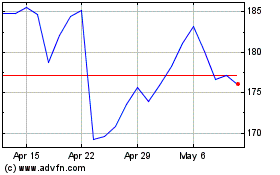

Simpson Manufacturing (NYSE:SSD)

Historical Stock Chart

From Aug 2024 to Sep 2024

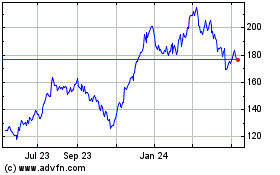

Simpson Manufacturing (NYSE:SSD)

Historical Stock Chart

From Sep 2023 to Sep 2024