Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 26 2024 - 8:26AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

———————————

FORM 6-K

———————————

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of July 2024

Commission File Number: 001-31798

———————————

SHINHAN FINANCIAL GROUP CO., LTD.

(Translation of registrant's name into English)

———————————

20, Sejong-daero 9-gil, Jung-gu, Seoul 04513, Korea

(Address of principal executive offices)

———————————

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F Form 40-F

Corporate Value-up Plan of Shinhan Financial Group

On July 26, 2024, the board of directors of Shinhan Financial Group made a resolution to establish “2024 Shinhan Financial Group Value-up Plan”.

Value-up Plan Establishment Progress

1. Through the Board of Directors (BOD)’s resolution on “Establishment on Shinhan Financial Group (SFG) Mid-term Strategy” on 11 Aug, 2022, SFG have set mid-term financial target including Return on Equity (ROE) 10.5%, Return on Total Capital Equity (ROTCE) 12.0%, and Common Equity Tier 1 (CET1) Ratio 12.0%.

2. Through the disclosure dated 8 Feb, 2024 on the “cash and dividend decision”, SFG temporarily increased CET1 Ratio target to 13% considering changes in regulations, and announced that SFG will re-evaluate mid-term financial target after reviewing the effect of changes in regulations.

3. As a result, SFG management presented and discussed the mid-term financial target at the BOD on 9 May, 2024, and based on the above discussion, SFG established the “2024 Shinhan Financial Group Value-up Plan” through additional BOD discussion on 16 July 2024 and BOD resolution on 26 July, 2024.

Key Summary of Value-up Plan

1. SFG evaluates that not only an increase in ROE and Shareholder Return Ratio is required, but also an improvement of the Tangible Book Value Per Share (TBPS) through reducing relatively larger amount of shares in comparison to other domestic major financial groups is important in order to enhance the current under-valued corporate valuation.

2. SFG selected the following core targets for enhancement of the corporate valuation to achieve by 2027.

- Based on CET1 Ratio 13% or above, achieving ROE 10% and ROTCE 11.5%

- Increasing Shareholder Return Ratio to 50% level

- Improving TBPS through reducing the number of shares below 500 million by 2024, and down to

450 million by 2027.

3. SFG plans to set-up and implement the following measures of performance in order to achieve the key indicators in item 2 above.

- Establishing the ROE enhancement plan in addition to making efforts to increase efficiency of the cost

of equity(COE) and create expectations on growth

- Establishing and Operating the ROTCE–ROC Value Chain

- Promoting the shareholder return policy with consistency and speed, while executing a flexible growth

and shareholder return policy at each PBR stage.

4. SFG will continuously communicate regarding the performance evaluation of, or any potential changes to, this Value-up Plan based on discussion and reporting/resolution at the BOD.

Please refer to attached PDF file for further details.

The English version of the Plan can also be viewed from the company’s website at www.shinhangroup.com

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shinhan Financial Group Co., Ltd. |

|

|

|

|

(Registrant) |

|

|

|

|

Date: July 26, 2024 |

|

|

|

By: |

|

/s/ CHUN Sang-yung |

|

|

|

|

|

|

|

|

|

|

Name: CHUN Sang-yung |

|

|

|

|

Title: Chief Financial Officer |

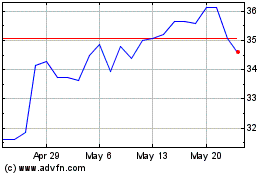

Shinhan Financial (NYSE:SHG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Shinhan Financial (NYSE:SHG)

Historical Stock Chart

From Dec 2023 to Dec 2024