0001784851FALSE00017848512024-05-072024-05-070001784851us-gaap:CommonStockMember2024-05-072024-05-070001784851us-gaap:WarrantMember2024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date Earliest Event Reported): May 7, 2024

___________________________________

SHAPEWAYS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-39092 (Commission File Number) | 87-2876494 (I.R.S. Employer Identification Number) |

| | |

12163 Globe St. Livonia, MI | | 48150 |

(Address of principal executive offices) | | (Zip Code) |

| | |

(734) 422-6060 |

(Registrant's telephone number, including area code) |

| | |

| | |

| | |

| | |

___________________________________

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, par value $0.0001 | SHPW | The NASDAQ Stock Market LLC |

| Warrants to purchase Common Stock | SHPWW | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Exchange Act.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

As previously disclosed, Shapeways Holdings, Inc. (the “Company”) has been working with advisors while considering strategic alternatives, and is actively taking steps to sell a material portion of the Company’s assets. In the course of market checks conducted by the Company’s advisors and preliminary discussions with potential purchasers, the Company has received indications of interest to acquire either its manufacturing business or software business, but not both together.

Based on that feedback, the Shapeways Board of Directors formed an independent Special Committee to oversee the divestment or liquidation of the software business. The Special Committee engaged outside advisors and pursued a competitive process to sell those assets, which resulted in the Company accepting a management-led proposal to purchase the software business.

As a result of that process, on May 7, 2024, the Company issued a press release announcing it had entered into an asset purchase agreement in connection with the sale of its software business to OTTO dms, Inc., an entity wholly-owned by Greg Kress and Greg Rothman, which is expected to close on or around May 20, 2024, subject to customary closing conditions. Mr. Kress is the Company’s chief executive officer, and Mr. Rothman is the executive of the Company’s software business unit. The transaction is limited to the sale of the Company’s OTTO and MFG assets, and does not affect its proprietary, internal-use software, “InShape,” which enables the Company to fully digitize the end-to-end manufacturing workflow and is used by its internal manufacturing locations and external supply chain partners.

Following the closing of the transaction, Mr. Kress will remain the full-time chief executive officer of Shapeways Holdings, Inc. and Mr. Rothman is expected to lead the newly independent, privately-held software business after the transaction closes. The transaction was approved by the Special Committee, Audit Committee, and Board of Directors.

The press release announcing the transaction is attached as Exhibit 99.1 hereto and is incorporated by reference herein.

The Company is continuing to pursue strategic alternatives for the core manufacturing business, and is engaged in ongoing discussions with potential acquirers. There can be no assurance that any of these discussions will result in any transaction.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| Shapeways Holdings, Inc. |

| | |

Dated: May 7, 2024 | By: | /s/ Alberto Recchi |

| Name: | Alberto Recchi |

| Title: | Chief Financial Officer |

| | |

SHAPEWAYS ANNOUNCES DEFINITIVE AGREEMENT TO SELL SOFTWARE ASSETS

New York, NY, May 7, 2024 – Shapeways Holdings, Inc. (NASDAQ: SHPW) (“Shapeways” or the “Company”), a leader in the large and fast-growing digital manufacturing industry, today announced that it has entered into an asset purchase agreement in connection with the sale of its software business to OTTO dms, Inc., an entity wholly-owned by Shapeways’ Chief Executive Officer, Greg Kress and the Executive of Shapeways’ software business unit, Greg Rothman.

As previously disclosed, the Company has been working with advisors while considering strategic alternatives, and is actively taking steps to sell a material portion of the Company’s assets. In the course of market checks conducted by the Company’s advisors and preliminary discussions with potential purchasers, the Company has received indications of interest to acquire either its manufacturing business or software business, but not both together.

Based on that feedback, the Shapeways Board of Directors formed an independent Special Committee to oversee the divestment or liquidation of the Company’s software business. The Special Committee engaged outside advisors and pursued a competitive process to sell the Company’s software assets, which resulted in the Company accepting a management-led proposal to purchase the software business.

The transaction is expected to close on or around May 20, 2024, subject to customary closing conditions. The transaction is limited to the sale of the Company’s OTTO and MFG assets, and does not affect its proprietary, internal-use software, “InShape,” which enables the Company to fully digitize the end-to-end manufacturing workflow and is used by its internal manufacturing locations and external supply chain partners.

Following the closing of the transaction, Mr. Kress will remain the full-time Chief Executive Officer of Shapeways Holdings, Inc and Mr. Rothman is expected to lead the newly independent, privately-held software business after the transaction closes. The transaction was approved by the Special Committee, Audit Committee, and Board of Directors.

The Company is continuing to pursue strategic alternatives for the core manufacturing business, and is engaged in ongoing discussions with potential acquirers. There can be no assurance that any of these discussions will result in any transaction.

About Shapeways

Shapeways is a global leader in digital manufacturing, combining additive and traditional technologies with proprietary software solutions designed for other manufacturers and their customers, reducing costs, and improving supply chains. Partnering with hundreds of companies engaged in industrial applications like automotive, medical, and transportation, as well as aerospace and defense, Shapeways helps them scale their businesses, solve complex problems in product development, and achieve critical manufacturing milestones.

With access to a dozen additive technologies, six conventional manufacturing methods, and hundreds of materials and finishes, Shapeways ensures production of quality parts with the right technologies, at the right time, and at the right cost.

With ISO 9001-compliant manufacturing facilities in Livonia and Charlotte, Michigan, and Eindhoven, the Netherlands, Shapeways operates globally and has delivered more than 24 million parts to more than 1 million customers in more than 180 countries. For more information, visit www.shapeways.com.

Contact Information

Investor Relations

investors@shapeways.com

Media Relations

press@shapeways.com

Special Note Regarding Forward-Looking Statements

Certain statements included in this press release are not historical facts and are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect," "should," "would," "plan," "predict," "potential," "seem," "seek," "future," "outlook," and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. All statements, other than statements of present or historical fact included in this press release, regarding the proposed transaction and the anticipated timing of the closing thereof; the plans of the Company’s management; the sale or liquidation of some or all of the Company's assets via merger, business combination, or other strategic transaction, and the timing and/or impact of any such divestiture, liquidation or other potential transactions, are forward-looking statements. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including the risk that the proposed transaction will not be completed on the anticipated terms and/or timing; the risk that the closing conditions of the proposed transaction are not satisfied and the transaction is not consummated; the risk that exploration of strategic alternatives for the manufacturing business may not result in any definitive transaction and may create a distraction or uncertainty that may adversely affect the Company’s operating results, business, or investor perceptions; the effect of the announcement or pendency of the proposed transaction on Shapeways’ business, financial condition, and operating results; risks that the proposed transaction disrupts current plans and operations of Shapeways and the ability of Shapeways to retain key personnel; changes in domestic and foreign business, financial, geopolitical, legal, and market conditions; and those factors discussed under the heading "Risk Factors" in Shapeways’ most recent Form 10-K, most recent Form 10-Q, and other documents Shapeways has filed, or will file, with the Securities and Exchange Commission. If any of these risks materialize or the Company’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that the Company does not presently know, or that the Company currently believes are immaterial, that could also cause actual results to differ from those contained in forward-looking statements. In addition, forward-looking statements reflect the Company's expectations, plans, or forecasts of future events and views as of the date of this press release. The Company anticipates that subsequent events and developments will cause its assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company's assessments of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon forward-looking statements.

v3.24.1.u1

Cover

|

May 07, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 07, 2024

|

| Entity Registrant Name |

SHAPEWAYS HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39092

|

| Entity Tax Identification Number |

87-2876494

|

| Entity Address, Address Line One |

12163 Globe St.

|

| Entity Address, City or Town |

Livonia,

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48150

|

| City Area Code |

(734)

|

| Local Phone Number |

422-6060

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001784851

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001

|

| Trading Symbol |

SHPW

|

| Security Exchange Name |

NASDAQ

|

| Common Stock Warrants |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase Common Stock

|

| Trading Symbol |

SHPWW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

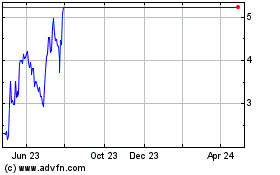

Shapeways (NYSE:SHPW)

Historical Stock Chart

From Jan 2025 to Feb 2025

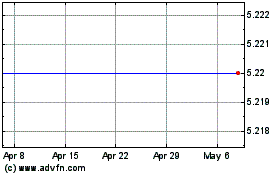

Shapeways (NYSE:SHPW)

Historical Stock Chart

From Feb 2024 to Feb 2025