UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange Act of 1934

For the month of August 2024

Commission File Number: 001-35135

Sequans Communications S.A.

(Translation of Registrant’s name into English)

15-55 boulevard Charles de Gaulle

92700 Colombes, France

Telephone : +33 1 70 72 16 00

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F R Form 40-F £

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes £ NoR

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes £ NoR

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

The information in this report furnished on Form 6-K shall be incorporated by reference into each of the following Registration Statements under the Securities Act of 1933, as amended, of the registrant: Form S-8 (File Nos. 333-187611, 333-194903, 333-203539, 333-211011, 333-214444, 333-215911, 333-219430, 333-226458, 333-233473, 333-239968, 333-259914 and 333-266481) and Form F-3 (File Nos. 333-255865 and 333-271884).

EXPLANATORY NOTE

On August 23, 2024, Sequans Communications S.A. (“Sequans” or the “Company”) entered into an asset purchase agreement (the “Agreement”) to sell its 4G technology portfolio to Qualcomm Technologies, Inc. (“QTI” or the “Purchaser”), a subsidiary of Qualcomm Incorporated, for $200 million, in an all-cash transaction. Sequans will retain full rights to use the acquired technology commercially, via a perpetual, license, allowing Sequans to continue developing its 4G business.

Under the terms of the Agreement, QTI will acquire Sequans’ 4G technology, specifically LTE-M/NB-IoT and LTE Cat 1bis products technology, marketed by Sequans as Monarch 2 and Calliope 2. Sequans will retain the ownership of all its 5G technology, trademarks, domain names and patents and a 4G license which includes the right to sell, support, maintain and enhance these existing products on a royalty-free basis. The Company also has the right to develop new generations of 4G products using the acquired technology, subject to payment of royalties to QTI under certain circumstances. This transaction will not affect Sequans’ existing business and its contractual obligations or operations with customers, suppliers and industry partners. QTI will assume certain liabilities arising out of, or relating to, the ownership and use of the purchased assets and hired employees, from and after the closing. Sequans will retain all other liabilities, other than the expressly assumed liabilities.

In connection with the sale of the 4G technology portfolio, Sequans will license, royalty-free to QTI its complete patent portfolio and its Taurus 5G technology, granting QTI the rights to develop, manufacture and sell QTI products based on this technology. Also, in connection with this transaction, approximately 74 employees of Sequans’ engineering team are expected to transfer to QTI. Sequans and QTI will enter into a transition services agreement at closing pursuant to which Sequans and QTI will provide reciprocal technical services to ensure a smooth transition of the transaction, along with facilities and IT support.

The Agreement contains representations, warranties and covenants of the Company and Purchaser that are customary for a transaction of this nature, including among others, covenants regarding the conduct of the Company’s business before closing, prohibiting the Company from engaging in certain kinds of activities during such period without the consent of Purchaser, the use of commercially reasonable efforts to cause the conditions to the transaction to be satisfied, a one year post-closing employee non-solicitation, and no liquidation of Sequans prior to distribution of the escrow fund. The Company has agreed to an exclusive dealing covenant restricting its ability to solicit alternative proposals from third parties and to provide non-public information to third parties regarding alternative proposals. In addition, the Company has agreed to indemnify the Purchaser for certain damages, subject to certain caps.

The Agreement contains certain termination rights for each of the Company and Purchaser, including if (i) the closing has not occurred on or prior to October 31, 2024 and (ii) any non-appealable final judgment permanently prohibits completion of the transactions. Either party can terminate the Agreement upon a breach of any representation, warranty, covenant, or obligation made by the other party (subject to certain procedures and materiality exceptions).

The transaction is expected to close by mid October 2024, subject to customary closing conditions, French regulatory approval and the acceptance of employment offers by certain key employees and at least 90% of the identified employees. If French regulatory approval is the only remaining closing condition, the termination date shall be automatically extended from October 31, 2024 to December 31, 2024. Upon closing of the transaction, the Monarch 2 license executed in June 2024 between Sequans and QTI shall terminate, and the $15 million license fee paid to the Company in June 2024 will be credited against the $200 million purchase price. The remaining $185 million cash consideration will be paid by QTI upon closing, of which $10 million will be paid directly into an escrow fund to cover indemnification obligations. The balance of the escrow fund, if any, will be released at the end of the 12-month warranty period. The proceeds from this transaction will be used to repay outstanding debt and for general operating purposes.

Forward Looking Statements

This document contains certain statements that are, or may be deemed to be, forward-looking statements with respect to the financial condition, results of operations and business of Sequans following completion of the transaction. These forward-looking statements include, but are not limited to, statements regarding the satisfaction of conditions to the completion of the proposed transaction and the expected completion of the proposed transaction, the timing and benefits thereof, as well as other statements that are not historical fact. These forward-looking statements can be identified by the fact that they do not relate to historical or current facts. Forward-looking statements also often use words such as “anticipate,” “target,” “continue,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “goal,” “believe,” “hope,” “aims,” “continue,” “could,” “project,” “should,” “will” or other words of similar meaning. These statements are based on assumptions and assessments made by Sequans in light of its experience and perception of historical trends, current conditions, future developments and other factors they believe appropriate. By their nature, forward-looking statements involve risk and uncertainty, because they relate to events and depend on circumstances that will occur in the future and the factors described in the context of such forward-looking statements in this announcement could cause actual results and developments to differ materially from those expressed in or implied by such forward-looking statements. Although it is believed that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to be correct and you are therefore cautioned not to place undue reliance on these forward-looking statements which speak only as at the date of this announcement.

Forward-looking statements are not guarantees of future performance. Such forward-looking statements involve known and unknown risks and uncertainties that could significantly affect expected results and are based on certain key assumptions. Such risks and uncertainties include, but are not limited to, the potential failure to satisfy conditions to the completion of the proposed transaction due to the failure to obtain necessary regulatory or other approvals; the outcome of legal proceedings that may be instituted against Sequans and/or others relating to the transaction; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; significant or unexpected costs, charges or expenses resulting from the proposed transaction; and negative effects of this announcement or the consummation of the proposed transaction on the market price of Sequans’ ADS and ordinary shares. Many factors could cause actual results to differ materially from those projected or implied in any forward-looking statements. Among the factors that could cause actual results to differ materially from those described in the forward-looking statements are changes in the global, political, economic, business and competitive environments, market and regulatory forces. If any one or more of these risks or uncertainties materializes or if any one or more of the assumptions prove incorrect, actual results may differ materially from those expected, estimated or projected. Such forward looking statements should therefore be construed in the light of such factors. A more complete description of these and other material risks can be found in Sequans’ filings with the SEC, including its annual report on Form 20-F for the year ended December 31, 2023, subsequent filings on Form 6-K and other documents that may be filed from time to time with the SEC. Due to such uncertainties and risks, readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this announcement. Sequans undertakes no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by applicable law.

EXHIBIT INDEX

The following exhibit is filed as part of this Form 6-K: | | | | | |

Exhibit | Description |

| |

| 99.1 | Press release dated August 23, 2024. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | | |

| | SEQUANS COMMUNICATIONS S.A. (Registrant) | |

| Date: August 23, 2024 | By: | /s/ Deborah Choate | |

| | | Deborah Choate | |

| | | Chief Financial Officer | |

| |

Qualcomm Contacts:

Clare Conley, Corporate Communications

Phone: 1-858-845-5959

Email: corpcomm@qualcomm.com

Mauricio Lopez-Hodoyan, Investor Relations

Phone: 1-858-658-4813

Email: ir@qualcomm.com

Sequans Contacts:

Linda Bouvet (France), Media Relations

Phone : +33 1 70 72 16 00

media@sequans.com

Kim Rogers (USA), Investor Relations

Phone: 1-385-831-7337

ir@sequans.com

Qualcomm and Sequans Reach Agreement on Sale of 4G IoT Technology

•Strengthens Qualcomm’s Industrial IoT portfolio, offering low-power solutions for reliable, optimized cellular connectivity for IoT applications

•Expands and accelerates Qualcomm’s leadership position in digital transformation at the edge

•Sequans retains license of the 4G IoT technology for its ongoing use and will continue to serve its IoT markets with a strengthened balance sheet

•Sequans maintains full ownership of its 5G technology

PARIS, France and SAN DIEGO – August 23, 2024 – Qualcomm Incorporated, (NASDAQ: QCOM), a global leader in high-performance at low-power solutions, through its subsidiary, Qualcomm Technologies, Inc. (“Qualcomm”), and Sequans Communications S.A. (NYSE: SQNS), a supplier of 4G and 5G semiconductor solutions for the Internet of Things (IoT), today announced that they have entered into a definitive agreement for Qualcomm to buy Sequans’ 4G IoT technologies. The acquisition includes certain employees, assets and licenses. The transaction is subject to customary closing conditions, including French regulatory approval.

Qualcomm is revolutionizing industries, redefining business models, and enhancing user experiences through its cutting-edge IoT solutions. Qualcomm® IoT technologies and solutions utilize the real-world connected intelligent edge to offer end-to-end, ready-to-deploy solutions so customers can digitally transform their businesses to optimize their operations, monetize massive amounts of data, innovate in new ways, and drive cost savings.

Sequans is a designer, developer, and supplier of cellular semiconductor solutions for massive and critical IoT markets. The addition of Sequans’ 4G IoT technologies to Qualcomm’s advanced end-to-end IoT solutions will strengthen Qualcomm’s Industrial IoT portfolio and provides a unique opportunity to build a leadership position in this space.

“Digital transformation is being driven by high-performance processing and intelligence at the edge, positioning Qualcomm for growth in one of the largest addressable opportunities,” said Nakul Duggal, group general manager, automotive, industrial and embedded IoT, and cloud computing, Qualcomm Technologies, Inc. “This acquisition of Sequans’ 4G IoT technology adds to Qualcomm’s broad portfolio, further strengthening our offerings across enterprise customers of low-power solutions for reliable, optimized cellular connectivity for Industrial IoT applications.”

Sequans will retain full rights to continue to use the technology commercially, via a perpetual license agreement, supporting the company’s ability to expand its 4G business and develop its 5G portfolio.

“We are excited to announce this important transaction with Qualcomm. This agreement underscores the value of our 4G IoT technology and provides us with significant capital to continue to further invest in our IoT business ambitions,” said Georges Karam, CEO of Sequans. “We are dedicated to pushing the boundaries of innovation and providing cutting-edge 4G/5G semiconductor solutions that meet the advancing needs of AI-powered Internet of Things applications. This transaction is expected to provide us the resources and flexibility to enhance our product offerings and expand our market presence.”

About Qualcomm

Qualcomm relentlessly innovates to deliver intelligent computing everywhere, helping the world tackle some of its most important challenges. Our proven solutions drive transformation across major industries, and our Snapdragon® branded platforms power extraordinary consumer experiences. Building on our nearly 40-year leadership in setting industry standards and creating era-defining technology breakthroughs, we deliver leading edge AI, high-performance, low-power computing, and unrivaled connectivity. Together with our ecosystem partners, we enable next-generation digital transformation to enrich lives, improve businesses, and advance societies. At Qualcomm, we are engineering human progress.

Qualcomm Incorporated includes our licensing business, QTL, and the vast majority of our patent portfolio. Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, operates, along with its subsidiaries, substantially all of our engineering and research and development functions and substantially all of our products and services businesses, including our QCT semiconductor business. Snapdragon and Qualcomm branded products are products of Qualcomm Technologies, Inc. and/or its subsidiaries. Qualcomm patented technologies are licensed by Qualcomm Incorporated.

About Sequans

Sequans Communications S.A. (NYSE: SQNS) is a leading semiconductor company specialized in wireless cellular technology for the Internet of Things (IoT). Our engineers design and develop innovative, secure, and scalable technologies that power the next generation of connected devices. We offer a wide range of solutions, including chips, modules, IP and services. Our Monarch® (NB-IoT/LTE-M), Calliope (LTE Cat-1/Cat-1bis), and Taurus (5G NR) platforms are optimized for IoT, delivering breakthroughs in wireless connectivity, power efficiency, security, and performance.

Established in 2003, Sequans is headquartered in France and has a global presence with offices in the United States, United Kingdom, Israel, Hong Kong, Singapore, Finland, Taiwan, and China.

Forward Looking Statements

This press release contains certain statements that are, or may be deemed to be, forward-looking statements with respect to the financial condition, results of operations and/or business of Sequans and Qualcomm following completion of the transaction. These forward-looking statements include, but are not limited to, statements regarding the satisfaction of conditions to the completion of the proposed transaction and the expected completion of the proposed transaction, the timing and benefits thereof, as well as other statements that are not historical fact. These forward-looking statements can be identified by the fact that they do not relate to historical or current facts. Forward-looking statements also often use words such as “anticipate,” “target,” “continue,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “goal,” “believe,” “hope,” “aims,” “continue,” “could,” “project,” “should,” “will” or other words of similar meaning. These statements are based on assumptions and assessments made by Sequans or Qualcomm, as applicable, in light of its experience and perception of historical trends, current conditions, future developments and other factors they believe appropriate. By their nature, forward-looking statements involve risk and uncertainty, because they relate to events and depend on circumstances that will occur in the future and the factors described in the context of such forward-looking statements in this announcement could cause actual results and developments to differ materially from those expressed in or implied by such forward-looking statements. Although it is believed that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such

expectations will prove to be correct and you are therefore cautioned not to place undue reliance on these forward-looking statements which speak only as at the date of this announcement.

Forward-looking statements are not guarantees of future performance. Such forward-looking statements involve known and unknown risks and uncertainties that could significantly affect expected results and are based on certain key assumptions. Such risks and uncertainties include, but are not limited to, the potential failure to satisfy conditions to the completion of the proposed transaction due to the failure to obtain necessary regulatory or other approvals; the outcome of legal proceedings that may be instituted against Sequans and/or others relating to the transaction; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; significant or unexpected costs, charges or expenses resulting from the proposed transaction; and negative effects of this announcement or the consummation of the proposed transaction on the market price of Sequans’ ADS and ordinary shares. Many factors could cause actual results to differ materially from those projected or implied in any forward-looking statements. Among the factors that could cause actual results to differ materially from those described in the forward-looking statements are changes in the global, political, economic, business and competitive environments, market and regulatory forces. If any one or more of these risks or uncertainties materializes or if any one or more of the assumptions prove incorrect, actual results may differ materially from those expected, estimated or projected. Such forward looking statements should therefore be construed in the light of such factors. A more complete description of these and other material risks can be found in Sequans’ filings with the SEC, including its annual report on Form 20-F for the year ended December 31, 2023, subsequent filings on Form 6-K and other documents that may be filed from time to time with the SEC, and in Qualcomm’s filings with the SEC, including its most recent Annual Report on Form 10-K and subsequent periodic reports on Form 10-Q and Form 8-K. Sequans’ and Qualcomm’s respective filings with the SEC are available at the SEC’s website at www.sec.gov. Due to such uncertainties and risks, readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this announcement. Neither Sequans nor Qualcomm undertakes any obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by applicable law.

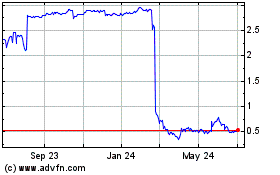

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Feb 2025 to Mar 2025

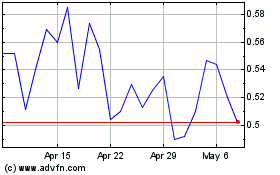

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Mar 2024 to Mar 2025