The Company has prepared this Management Proposal

and Manual for Attendance (the “Proposal”), in compliance with good corporate governance and transparency practices,

in order to guide and clarify to all its Shareholders about the matters that will be deliberated, making its Investor Relations Officer

available to clarify any additional questions.

The proposals of the Administration on the items

of the Meeting, as well as the information on each of the matters, are detailed in item 3 of this Proposal.

São Paulo (SP, Brazil), November 8, 2022.

As shown below, the Company will admit the shareholders'

participation by: (i) voting via the electronic system during the Meeting; or (ii) sending the distance votting bullet, which is available

on the Company's Investor Relations website (https://ri.assai.com.br) and on the websites of CVM (www.cvm.com.br) and B3 (www.b3.com.br)

and may be forwarded through their respective custody agents (if they provide this type of service), Itaú Corretora de Valores

S.A. which is the Company's bookkeeping agent (“Share Registry Agent”) or directly to the Company by e-mail (“Distance

Voting Bulletin”), as indicated below.

The Shareholder who participates in the Meeting

through the digital platform will be considered present and subscriber of the minutes and the book of presence of the shareholders.

The Meeting will be held exclusively digitally.

Shareholders who wish to participate in the Meeting through the digital platform must access the website https://www.tenmeetings.com.br/assembleia/portal/?id=0C2B71E221F1,

complete their registration and attach all documents necessary for their qualification for participation and/or voting at the Meeting,

as indicate below, with at least 2 (two) days prior to the date designated for the Meeting, that is, on December 5, 2022. After the approval

of the registration by the Company, the Shareholder will receive his login and individual password to access the platform though the e-mail

used for registration.

In the case of a attorney-in-fact/representative,

he/she must register with his/her data at the same email address indicated above. After receiving the registration confirmation email,

they must, through the link sent to the email informed in the registration, indicate each Shareholder that will represent and attach the

documents indicated below. The attorney-in-fact will receive an individual e-mail about the qualification status of each Shareholder registered

in his register and will provide, if necessary, the completion of documents. The attorney-in-fact who may represent more than one shareholder

may only vote at the Meeting for Shareholders whose qualification has been confirmed by the Company.

The following documents must be sent by the

shareholders and/or by their attorney-in-fact through the digital plataform indicated above:

The Company will not require certified copies

or firm recognition of documents issued and signed in Brazil or annotation, legalization and registration in the Registration of Securities

and documents in Brazil of those signed outside the country.

Furthermore, the Company will not require the

sworn translation of documents that were originally drawn up in Portuguese, French, English or Spanish or that are accompanied by their

translation in those same languages; required in other cases.

The following identity documents will be accepted,

provided that with photo and current: RG, RNE, CNH, passport or officially recognized professional class cards.

After the regularity of the representation documents

sent under the terms above is verified, they will be forwarded after the qualification to be confirmed by the Company by e-mail, for each

shareholder (or their respective attorney-in-fact, as the case may be) who has made the regular registration, guidelines for accessing

the digital platform, including, but not limited to, login and individual password, which will authorize only a single access to the Meeting.

Such information and guidance will be forwarded

exclusively to the e-mail address informed in the registration.

If the shareholder (or his respective attorney-in-fact,

as the case may be) has not received the aforementioned guidelines, he should contact the Company, by e-mail adm.societario@assai.com.br,

with a copy to ri@assai.com.br and up to 2 (two) hours before the Meeting start time, so that the guidelines are forwarded to you.

In case of need for additional documents and/or

additional clarifications in relation to the documents sent for registration purposes, the Company will contact the shareholder (or its

respective attorney-in-fact, as the case may be) to request such additional documents and/or additional clarifications in a timely manner

that allows the sending of information and guidelines for access to the digital platform within the period referred to above.

The accredited Shareholders undertake to: (i)

use the individual invitations solely and exclusively for the remote monitoring of the Meeting; (ii) not to transfer or disclose, in whole

or in part, the individual invitations to any third party, shareholder or not, the invitation being non-transferable; and (iii) not to

record or reproduce, in whole or in part, nor to transfer, to any third party, shareholder or not, the content or any information transmitted

by virtual means during the Meeting.

Access to the General Meeting's electronic system

will be restricted to Shareholders who are accredited until December 10, 2022 and enter the digital plan until the moment of the opening.

On the date of the Meeting, the link to access the digital platform will be available from 30 (thirty) minutes before the start time of

the Meeting, and the registration of the Shareholder's presence via the electronic system will only be done through the access via link,

as instructed here.

Access to the digital platform must occur exclusively

by computer, and the Company recommends that shareholders do tests and become familiar with the digital platform in advance, and access

it at least 30 (thirty) minutes before the beginning of the Meeting in order to to avoid possible operational problems with its use on

the day of the Meeting.

The Company shall not be liable for problems

connecting the Shareholders or their representatives, or any other situation that is not under its control. Shareholders who do not receive

the link to participate or have any other questions should contact the Investor Relations Department and/or Corporate Legal Department

by e-mails ri@assai.com.br and societario@assai.com.br.

Shareholders who have an interest in exercising

their right to vote, through the Distance Voting Bulletin, pursuant to CVM Resolution 81, shall (a) complete the Distance Voting Bulletin,

according to the guidelines contained therein; and (b) send it (i) directly to the Company by e-mail; (ii) the Share Registry Agent or

(iii) to his/her respective custody agent (if he or she provides this type of service), following instructions:

The Company made the Distance Voting Bulletin

on the Company's website (http://ri.assai.com.br), the CVM (www.cvm.gov.br) and the B3 (www.b3.com.br).

In all cases, for the Distance Voting Bulletin

to take effect, December 5, 2022 (i.e. 7 (seven) days before the date of the Meeting), shall be the last day for receipt by one of the

above forms, and not the last day for its submission. If the Distance Voting Bulletin is received after December 5, 2022, votes will not

be counted.

The Company’s Administration submit to

the Meeting the proposals described bellow.

The Company's Related Party Transactions

Policy currently in force states that such transactions are always subject to prior review by an evaluation committee, created specifically

to evaluate each case with members from different areas. Transactions with an amount of less than R$25,000,000.00 (twenty-five million

reais) are subject to prior review by the evaluation committee and the Corporate Governance and Sustainability Committee, as well as formal

approval by the Board of Directors.

To improve its corporate governance practices,

the Company's Management proposes to create an additional level of approval for certain transactions to be approved by the shareholders

gathered in a general meeting. Thus, it is proposed to include in article 8 of the Company's Bylaws, as a competence of the General Assembly,

the approval of transactions with related parties, whose value, individually or aggregated over a fiscal year exceeds R$100,000,000.00

(one hundred million reais), updated annually by the variation of the Consumer Price Index (IPCA), calculated and disclosed by the Brazilian

Institute of Geography and Statistics - IBGE, provided that the shareholders interested in the transaction must refrain from voting.

In consultation carried out by the Company,

the Company's controlling shareholder declared that he will vote in favor of this resolution.

The Management proposes the consolidation

of the Bylaws to reflect the amendment of item I above, as well as to reflect, in Article 4 of the Bylaws, the capital increases approved

by the Board of Directors on May 9, 2022, July 25, 2022 and October 20, 2022.

Pursuant to CVM Resolution 81, the origin

and justification of the amendment to the Company's proposed Bylaws and the analysis of its legal effects and the Consolidated Bylaws

with the outstanding amendments are, respectively, in Annexes 1 and 2 of this Proposal.

Annex 1

Report Detailing the Origin and Justification

of Proposed Amendments

Below is a comparative table between the version

currently in force and the proposed changes in the Company's Bylaws.

| Current Writing |

Proposed Writing |

Comparative Writing |

Economic or Legal Effects |

| ARTICLE 4 - The Company's capital stock is R$1,253,048,594.57 (one billion, two hundred and fifty-three million, fourty-eight thousand, fice hundred ninety-four reais and fifty-seven cents), fully subscribed and paid-up, divided into 1,346,914,232 (one billion, three hundred and forty-six million, nine hundred and fourteen thousand, two hundred and thirty-two) common shares, all nominative, registered and without par value. |

ARTICLE 4 - The Company's capital stock is R$1,261,646,786.96 (one billion, two hundred and sixty-one million, six hundred amd fourty-six thousand, seven hundred eighty-six reais and ninety-six cents), fully subscribed and paid-up, divided into 1,348,983,474 (one billion, three hundred and forty-eight million, nine hundred and eighty-three thousand, four hundred and seventy-four) common shares, all nominative, registered and without par value. |

ARTICLE 4 - The Company's capital stock is R$1,253,048,594.57 (one billion, two hundred and fifty-three million, fourty-eight thousand, fice hundred ninety-four reais and fifty-seven cents)R$1,261,646,786.96 (one billion, two hundred and sixty-one million, six hundred amd fourty-six thousand, seven hundred eighty-six reais and ninety-six cents), fully subscribed and paid-up, divided into 1,346,914,232 (one billion, three hundred and forty-six million, nine hundred and fourteen thousand, two hundred and thirty-two)1,348,983,474 (one billion, three hundred and forty-eight million, nine hundred and eighty-three thousand, four hundred and seventy-four) common shares, all nominative, registered and without par value |

Reflect the capital increases approved by the

Board of Directors on May 9, 2022, July 25, 2022 and October 20, 2022, as a result of the exercise of stock options.

There are no economic consequences. |

|

ARTICLE 8 - Without prejudice to the

provisions in article 123, sole paragraph, of Law 6,404/76, the General Assembly shall be convened, installed and presided over by the

Chairman of the Board of Directors, or in his absence, by the Vice-Chairman of the Board of Directors or, in their absence, by an Officer

appointed by the Chairman of the Board of Directors, and shall have the following attributions, without prejudice to the other duties

set forth by law

i.

reform the Bylaws;

ii.

elect or dismiss, at any time, the members of the Board

of Directors (and of the Fiscal Council, when installed) of the Company, as well as define the number of positions in the Board of Directors

(and of the Fiscal Council, when installed);

iii.

designate the Chairman and Vice-Chairman of the Board of Directors;

iv.

take, annually, the management accounts and deliberate about the financial statements presented by them, the destination of the net profit

of the fiscal year;

v.

approve the issuance of shares, subscription warrants,

debentures convertible into shares of its own issuance or any securities, securities or other rights or interests that are exchangeable

or convertible into shares of its own issuance, without prejudice to the powers of the Board of Directors set forth in Article 5 and Article

17(g);

vi.

deliberate about the evaluation of assets with which the shareholder contributes for the formation of the capital stock;

vii.

resolve on the transformation, merger, incorporation

(including merger of shares) and spin-off of the Company, or any other form of restructuring of the Company;

viii.

eliberate about the Company's dissolution and liquidation

and elect and dismiss liquidator(s);

ix.

examine and approve the liquidator(s) accounts; and

x.

defining the annual global remuneration of the members

of the Board of Directors, Executive Board and Fiscal Council, if installed.

(non-existing)

(non-existing) |

ARTICLE 8 - Without prejudice to the

provisions in article 123, sole paragraph, of Law 6,404/76, the General Assembly shall be convened, installed and presided over by the

Chairman of the Board of Directors, or in his absence, by the Vice-Chairman of the Board of Directors or, in their absence, by an Officer

appointed by the Chairman of the Board of Directors, and shall have the following attributions, without prejudice to the other duties

set forth by law

i.

reform the Bylaws;

ii.

elect or dismiss, at any time, the members of the Board

of Directors (and of the Fiscal Council, when installed) of the Company, as well as define the number of positions in the Board of Directors

(and of the Fiscal Council, when installed);

iii.

designate the Chairman and Vice-Chairman of the Board of Directors;

iv.

take, annually, the management accounts and deliberate about the financial statements presented by them, the destination of the net profit

of the fiscal year;

v.

approve the issuance of shares, subscription warrants,

debentures convertible into shares of its own issuance or any securities, securities or other rights or interests that are exchangeable

or convertible into shares of its own issuance, without prejudice to the powers of the Board of Directors set forth in Article 5 and Article

17(g);

vi.

deliberate about the evaluation of assets with which the shareholder contributes for the formation of the capital stock;

vii.

resolve on the transformation, merger, incorporation

(including merger of shares) and spin-off of the Company, or any other form of restructuring of the Company;

viii.

eliberate about the Company's dissolution and liquidation

and elect and dismiss liquidator(s);

ix.

examine and approve the liquidator(s) accounts; and

x.

defining the annual global remuneration of the members

of the Board of Directors, Executive Board and Fiscal Council, if installed.

xi.

approve the signing of transactions with related parties, as defined in the applicable accounting standards, whose value, individual or

aggregate over a fiscal year, is higher than R$100,000,000.00 (one hundred million reais), being observed that shareholders representing

related parties to the transaction shall refrain from voting.

Sole Paragraph - The value mentioned

in item (xi) of Article 8 will be corrected annually from January 1, 2023, due to the positive variation, occurred in the previous year,

of the National Broad Consumer Price Index - IPCA, calculated and disclosed by the Brazilian Institute of Geography and Statistics - IBGE,

or another index that will replace it.

|

ARTICLE 8 - Without prejudice to the

provisions in article 123, sole paragraph, of Law 6,404/76, the General Assembly shall be convened, installed and presided over by the

Chairman of the Board of Directors, or in his absence, by the Vice-Chairman of the Board of Directors or, in their absence, by an Officer

appointed by the Chairman of the Board of Directors, and shall have the following attributions, without prejudice to the other duties

set forth by law

i.

reform the Bylaws;

ii.

elect or dismiss, at any time, the members of the Board

of Directors (and of the Fiscal Council, when installed) of the Company, as well as define the number of positions in the Board of Directors

(and of the Fiscal Council, when installed);

iii.

designate the Chairman and Vice-Chairman of the Board of Directors;

iv.

take, annually, the management accounts and deliberate about the financial statements presented by them, the destination of the net profit

of the fiscal year;

v.

approve the issuance of shares, subscription warrants,

debentures convertible into shares of its own issuance or any securities, securities or other rights or interests that are exchangeable

or convertible into shares of its own issuance, without prejudice to the powers of the Board of Directors set forth in Article 5 and Article

17(g);

vi.

deliberate about the evaluation of assets with which the shareholder contributes for the formation of the capital stock;

vii.

resolve on the transformation, merger, incorporation

(including merger of shares) and spin-off of the Company, or any other form of restructuring of the Company;

viii.

eliberate about the Company's dissolution and liquidation

and elect and dismiss liquidator(s);

ix.

examine and approve the liquidator(s) accounts; and

x.

defining the annual global remuneration of the members

of the Board of Directors, Executive Board and Fiscal Council, if installed.;

and

xii.

approve the execution of transactions

with related parties, as defined in the applicable accounting rules, the individual or aggregate amount of which throughout a fiscal year

exceeds one hundred million reais (R$100,000,000.00), observed that the shareholders representing related parties in the transaction shall

abstain from voting.

Sole Paragraph

- The value mentioned in item (xi) of Article 8 will be corrected annually from January 1, 2023, due to the positive variation, occurred

in the previous year, of the National Broad Consumer Price Index - IPCA, calculated and disclosed by the Brazilian Institute of Geography

and Statistics - IBGE, or another index that will replace it.

|

Enhancement of the Company's corporate governance

practices, with the inclusion of the need for approval of certain material transactions with related parties by the Company's shareholders

in a general meeting.

No economic consequences. |

Annex 2

Consolidated Bylaws, reflecting the proposed amendments

Consolidated Bylaws

CONSOLIDATED BYLAWS

SENDAS DISTRIBUIDORA S.A.

Brazilian taxpayers’ registry

No. 06.057.223/0001-71

Board of trade registry No. 33.300.272.909

CHAPTER I

NAME, HEADQUARTERS, OBJECT AND DURATION

ARTICLE 1 - SENDAS DISTRIBUIDORA

S.A. (“Company”) is a joint stock company, headquartered at Avenida Ayrton Senna, 6000, Lote 2, Pal 48959, Anexo A, Jacarepaguá,

CEP 22775-005, in the city and state of Rio de Janeiro, Federative Republic of Brazil, which hereinafter shall be governed by these Bylaws,

by Law 6404 of December 15, 1976 (“Law 6404/76”), as amended, and other legal provisions in effect.

Sole Paragraph - With the Company's

admission to the New Market of B3 S.A. - Brasil, Bolsa, Balcão (“New Market” and “B3”, respectively), the

Company, its shareholders, including controlling shareholders, managers and fiscal council members, when installed, are subject to the

provisions of the New Market Regulation.

ARTICLE 2 - The Company's business

purpose is the commercialization of manufactured products, semi-manufactured or “in natura”, domestic or foreign, of all and

any kind and species, nature or quality.

Paragraph 1 - The Company may

also perform the following activities:

| (a) | the industrialization, processing,

manipulation, transformation, export, import and representation of products, food or non-food, for its own account or for the account

of third parties; |

| (b) | international trade, including

coffee; |

| (c) | import, distribution and marketing

of cosmetic products for hygiene and toiletries, perfumery, sanitizing and household products, and food supplements; |

| (d) | the general commerce of drugs

and medications, pharmaceutical and homeopathic specialties; chemical products, accessories, dental articles, surgical instruments and

devices; the manufacturing of chemical products and pharmaceutical specialties, and may be specialized as Drugstores or Allopathic Pharmacies,

Drugstores or Homeopathic Pharmacies, or Manipulation Pharmacies for each specialty; |

| (e) | the trade of petroleum products

and derivatives, fuel supply of any kind, and may also provide technical assistance services, service workshops, repairs, washing, lubrication,

sale of accessories and other related services for any vehicles in general; |

| (f) | the commerce of products, drugs

and veterinary medications in general; veterinary office, clinic and hospital and “pet shop” with bath and grooming services;

|

| (g) | the rental of any recorded

media; |

| (h) | rendering services of photographic,

cinematographic and similar studios; |

| (i) | practice and management of

real estate operations, buying, promoting subdivisions and development, renting and selling of own and third party real estate; |

| (j) | acting as a distributor, agent

and representative of traders and industrialists established inside or outside the country and in this capacity, on behalf of the principals

or for its own account, acquiring, retaining, owning and making any operations and transactions of its own interest or of the principals;

|

| (k) | the provision of data processing

services; |

| (l) | the operation of building and

construction in all its forms, for its own account or for the account of third parties, the purchase and sale of building materials, and

the installation and maintenance of air conditioning systems, freight elevators and freight elevators; |

| (m) | application of household sanitizing

products; |

| (n) | the municipal, state and interstate

highway transportation of cargo in general for its own products and for third parties, and may also store, deposit, load, store and guard

third parties' own goods of any kind, as well as subcontract the services foreseen in this item; |

| (o) | the operation of communication,

publicity and advertising services in general, including bars, snack bars and restaurants, and may extend to other compatible or related

branches, in compliance with the legal restrictions; |

| (p) | the purchase, sale and distribution

of books, magazines, newspapers, periodicals and the like; |

| (q) | the performance of studies,

analysis, planning and market research; |

| (r) | to carry out tests for launching

new products, packages and brands; |

| (s) | the elaboration of strategies

and analyses of the sectorial behavior of sales, special promotions and advertising; |

| (t) | the rendering of services of

administration of food, meal, pharmacy, fuel and transportation voucher cards and other cards that result from activities related to its

corporate objective; |

| (u) | the leasing and sub-leasing

of own or third-party movable property; |

| (v) | the rendering of services in

the management area; |

| (w) | representation of other domestic

or foreign companies and participation as a partner or shareholder in the capital stock of other companies, whatever their form or purpose,

and in commercial undertakings of any nature; |

| (x) | agency, brokerage or intermediation

of securities and tickets; |

| (y) | services related to collections,

receipts or payments in general, of securities, bills or carnets, foreign exchange, taxes and on behalf of third parties, including those

made by electronic means, automatic or by attendance machines; provision of collection, receipt or payment position; issuance of carnets,

compensation forms, forms and documents in general; |

| (z) | rendering of parking, lodging

and guarding services for vehicles; |

| (aa) | importing beverages, wines

and vinegars; |

| (bb) | snack bars, tea houses, juice

houses and similar establishments; |

| (cc) | trade in seeds and seedlings;

|

| (dd) | trade in telecommunications

products; and; e |

| (ee) | import, distribution and commercialization

of toys, metal pans, household ladders, baby strollers, party articles, school articles, tires, household appliances, bicycles, monoblock

plastic chairs and lamp. |

Paragraph 2 - The Company may

render sureties or guarantees in businesses of its interest, forbidding those of mere favor.

ARTICLE 3 - The Company's duration

is indeterminate.

CHAPTER II SHARE CAPITAL AND SHARES

ARTICLE

4 - The Company's capital stock is R$1,253,048,594.57 (one billion, two hundred and fifty-three million,

fourty-eight thousand, fice hundred ninety-four reais and fifty-seven cents)R$1,261,646,786.96

(one billion, two hundred and sixty-one

million, six hundred amd fourty-six

thousand, seven hundred

eighty-six reais

and ninety-six cents), fully

subscribed and paid-up, divided into 1,346,914,232 (one billion, three hundred and forty-six million,

nine hundred and fourteen thousand, two hundred and thirty-two)1,348,983,474 (one billion,

three hundred and forty-eight million, nine hundred and eighty-three thousand, four hundred and seventy-four) common shares, all

nominative, registered and without par value

Paragraph 1 - The shares representing

the capital stock are indivisible with respect to the Company and each common share entitles its holder to one vote at the General Meetings.

Paragraph 2 - The shares shall

be in book-entry form and shall be kept in deposit accounts on behalf of their holders, at the authorized financial institution designated

by the Company, without the issuance of certificates.

Paragraph 3 - The cost of services

of transfer of ownership of book-entry shares charged by the depositary financial institution may be passed on to the shareholder, as

authorized by Article 35, paragraph 3 of Law 6,404/76, in compliance with the maximum limits determined by the Brazilian Securities and

Exchange Commission.

Paragraph 4 - The Company may

not issue preferred shares and founder's shares.

ARTICLE 5 - The Company is authorized

to increase its capital stock by resolution of the Board of Directors and regardless of statutory reform, up to the limit of 2,000,000,000

(two billion) common shares.

Paragraph 1 - The Company's authorized

capital limit may only be modified by resolution of the General Meeting.

Paragraph 2 - The Company, within

the limit of authorized capital and in accordance with the plan approved by the General Meeting, may grant stock options to its managers

or employees, or to natural persons providing services to it.

ARTICLE 6 - Issues of shares,

subscription bonus or debentures convertible into shares up to the limit of the authorized capital may be approved by the Board of Directors,

with exclusion or reduction of the term for exercise of the preemptive right, as provided for in Article 172 of Law 6,404/76.

Sole Paragraph - With the exception

of the provision in the caption sentence of this Article, the shareholders shall have preference, in proportion to their respective shareholdings,

for subscription of the Company's capital increases, the exercise of this right being governed by the applicable legislation.

CHAPTER III GENERAL MEETING

ARTICLE 7 - The General Assembly

is the shareholders' meeting, which may be attended by themselves or by representatives constituted pursuant to the Law, in order to deliberate

on matters of the Company's interest.

ARTICLE 8 - Without prejudice

to the provisions in article 123, sole paragraph, of Law 6,404/76, the General Assembly shall be convened, installed and presided over

by the Chairman of the Board of Directors, or in his absence, by the Vice-Chairman of the Board of Directors or, in their absence, by

an Officer appointed by the Chairman of the Board of Directors, and shall have the following

attributions, without prejudice to the other duties set forth by law

| ii. | elect or dismiss, at any time,

the members of the Board of Directors (and of the Fiscal Council, when installed) of the Company, as well as define the number of positions

in the Board of Directors (and of the Fiscal Council, when installed); |

| iii. | designate the Chairman and

Vice-Chairman of the Board of Directors; |

| iv. | take, annually, the management

accounts and deliberate about the financial statements presented by them, the destination of the net profit of the fiscal year; |

| v. | approve the issuance of shares,

subscription warrants, debentures convertible into shares of its own issuance or any securities, securities or other rights or interests

that are exchangeable or convertible into shares of its own issuance, without prejudice to the powers of the Board of Directors set forth

in Article 5 and Article 17(g); |

| vi. | deliberate about the evaluation

of assets with which the shareholder contributes for the formation of the capital stock; |

| vii. | resolve on the transformation,

merger, incorporation (including merger of shares) and spin-off of the Company, or any other form of restructuring of the Company; |

| viii. | eliberate about the Company's

dissolution and liquidation and elect and dismiss liquidator(s); |

| ix. | examine and approve the liquidator(s)

accounts; and |

| x. | defining the annual global

remuneration of the members of the Board of Directors, Executive Board and Fiscal Council, if installed.;

and |

| xi. | approve the execution of transactions

with related parties, as defined in the applicable accounting rules, the individual or aggregate amount of which throughout a fiscal year

exceeds one hundred million reais (R$100,000,000.00), observed that the shareholders representing related parties in the transaction shall

abstain from voting. |

Sole Paragraph

- The value mentioned in item (xi) of Article 8 will be corrected annually from January 1, 2023, due to the positive variation, occurred

in the previous year, of the National Broad Consumer Price Index - IPCA, calculated and disclosed by the Brazilian Institute of Geography

and Statistics - IBGE, or another index that will replace it.

ARTICLE 9 - For any resolution

of the General Assembly, the approval of shareholders representing, at least, the majority of votes of those present shall be necessary,

blank votes not being counted, save the exceptions foreseen by law and applicable regulations.

ARTICLE 10 - The Ordinary General

Assembly shall have the attributions established by law and shall be held within the first four-month period subsequent to the closing

of the fiscal year.

Sole Paragraph - Whenever necessary

the General Assembly may be installed on an extraordinary basis, and may be held concomitantly with the Ordinary General Assembly.

CHAPTER IV ADMINISTRATION

ARTICLE 11 - The Board of Directors

and the Executive Board shall be in charge of the Company's management.

Paragraph 1 - The managers' investiture

is conditioned to the execution of instrument of investiture, which shall contemplate their subjection to the arbitration clause referred

to in Article 42.

Paragraph 2 - The term of office

of the members of the Board of Directors and Executive Officers shall extend until the investiture of their respective successors.

Paragraph 3 - Minutes shall be

drawn up in a proper book of the meetings of the Board of Directors and the Board of Executive Officers, which shall be signed by the

members of the Board of Directors and the Executive Officers present, as the case may be.

Section I Board of Directors

ARTICLE 12 - The Board of Directors

is formed by at least three (3) and at most nine (9) members, elected and dismissible by the General Assembly, with a unified term of

office of two (2) years, reelection being allowed.

Paragraph 1 - Except in the case

of election of the members of the Board of Directors by means of the multiple vote procedure, in the event of vacancy in the position

of Board Member, it shall be incumbent upon the Board of Directors to elect a substitute to fill the position on a definitive basis until

the end of the respective term of office. In the event of simultaneous vacancy of most of the positions, the General Meeting shall be

convened to hold a new election.

Paragraph 2 - At least two (2)

or twenty percent (20%), whichever is higher, of the members of the Board of Directors shall be independent members, as per the definition

in the Novo Mercado Listing Rules. 6,404/76, in the event of controlling shareholder.

Paragraph 3 - When, as a result

of the calculation of the percentage referred to in the paragraph above, the result generates a fraction number, the Company shall proceed

with the rounding up to the immediately superior whole number.

ARTICLE 13 - The Board of Directors

shall have one (1) Chairman and one (1) Vice Chairman, elected by the General Assembly.

Paragraph 1 - The positions of

Chairman of the Board of Directors and Chief Executive Officer or main executive of the Company may not be accumulated by the same person.

Paragraph 2 - In the event of

vacancy of the Chairman's position or impediment of the Chairman, the Vice Chairman shall automatically take over such position, remaining

until the end of the respective term of office or, should a General Meeting be convened for the election of a new Chairman, until his

respective investiture.

Paragraph 3 - In the event of

vacancy of any Vice Chairman position, the Board of Directors shall elect his deputy pursuant to Article 12, paragraph 1 herein.

Paragraph 4 - In the event of

Chairman's absence or temporary impairment, the Board of Directors' meetings shall be chaired by the Chairman.

ARTICLE 14 - The Board of Directors

shall meet, ordinarily, at least six times a year, to review the Company's financial and other results and to review and monitor the annual

investment plan, and extraordinarily, at any time, whenever necessary.

Paragraph 1 - It is incumbent

upon the Chairman or, in the Chairman's absence, the Vice-Chairman to call the meetings of the Board of Directors, on his own initiative

or at the written request of any board member.

Paragraph 2 - The Board of Directors'

meeting calls shall be made by electronic means or letter, at least seven (7) days prior to the date of each meeting, specifying time

and place for the first and, if applicable, second call, and including the agenda. Any proposal and all documentation necessary and related

to the agenda must be made available to the Directors. The call may be waived whenever all of the acting Directors are present at the

meeting, or by prior written agreement of the absent Directors.

Paragraph 3 - The minimum “quorum”

required for the instatement of the Board of Directors' meetings is the presence of at least half of its acting members, at first call,

and of any number of Board members, at second call, considering present, including those represented as authorized herein.

ARTICLE 15 - The meetings of the

Board of Directors shall be presided over by its Chairman and in his absence, by the Vice-Chairman of the Board of Directors.

Paragraph 1 - The Board of Directors'

resolutions shall be taken by the favorable vote of the majority of its members present, pursuant to the provisions of Article 14, paragraph

3 herein. The members of the Board of Directors may participate in the meetings of the Board of Directors by means of conference call,

videoconference or by any other means of electronic communication, which allows the identification of the member and simultaneous communication

with all other persons attending the meeting. In this case, the members of the board of directors shall be considered present at the meeting

and must subsequently sign the corresponding minutes.

Paragraph 2 - In the event of

absence or temporary impediment not resulting from a conflict of interest of any member of the Board of Directors, the absent member of

the Board of Directors may appoint, in writing, among the other members of the Board of Directors, the one who shall replace him/her.

In this case, the director replacing the temporarily absent or impeded director as provided above shall, in addition to his own vote,

cast the vote of the replaced director.

ARTICLE 16 - The Board of Directors

shall approve any amendments to the Internal Regulations and shall elect an Executive Secretary, who shall be in charge of performing

the duties defined in the Internal Regulations, as well as issuing certificates and attesting, before third parties, the authenticity

of the deliberations taken by the Board of Directors.

ARTICLE 17 - In addition to the

powers established by law, the Board of Directors shall be responsible for

| (a) | to set the general direction

of the Company's business; |

| (b) | approving or altering the Company's

investment plan; |

| (c) | electing and dismissing the

Company's Officers, establishing their attributions and appointments; |

| (d) | deciding on the individual

compensation of the Board of Directors and the Executive Officer; |

| (e) | inspecting the management of

the Executive Officers, examining, at any time, the Company's books and papers, requesting information on contracts signed or about to

be signed and any other acts; |

| (f) | to call a General Meeting of

Stockholders; |

| (g) | expressing an opinion on the

Management report, the Executive Board's accounts and the Company's financial statements; |

| (h) | deciding on the issue of shares,

subscription warrants or debentures convertible into shares up to the limit of authorized capital, setting the respective price and conditions

of payment; |

| (i) | choosing and dismissing the

independent auditors, with due regard for the recommendation of the Audit Committee; |

| (j) | issuing an opinion on any proposal

by the Executive Board to the General Meeting; |

| (k) | authorizing the acquisition

of shares of the Company itself, for the purpose of cancellation or holding in treasury, with due regard for applicable regulations; |

| (l) | developing, jointly with the

Executive Board, and approving a plan for the participation of employees and managers in the Company's results and the granting of additional

benefits to employees and managers linked to the Company's results (“Profit Sharing Plan”); |

| (m) | establish the amount of the

employees' and managers' participation in the Company's results, observing the pertinent legal provisions, the Bylaws and the Profit Sharing

Plan in effect. The amounts spent or accrued in each fiscal year as participation of employees and managers in the results, and also in

relation to the granting of stock options for the Company, shall be limited to 15% (fifteen percent) of the result of each fiscal year,

after the deductions of Article 189 of Law no. 6,404/76, with due regard for the legal provisions in force. 6,404/76, observing that the

participation of employees and managers in the results may not exceed the annual compensation of the managers or 0.1 (one tenth) of the

profits, whichever is smaller, under the terms of Paragraph 1 of Article 152 and Article 190 of Law 6,404/76; |

| (n) | establishing the limit of shares

to be issued under the Company's Stock Option Plan previously approved by the General Meeting, with due regard for the limit of authorized

capital and the limit provided for in item “m” above; |

| (o) | establishing Committees, which

will be responsible for elaborating proposals or making recommendations to the Board of Directors, defining their respective attributions

in accordance with the provisions of these Bylaws and setting the compensation of their members; |

| (p) | resolving on the acquisition,

disposal, creation of liens, encumbrance on any assets, including real estate, of the Company or the making of any other investment by

the Company in an individual or aggregate amount over a fiscal year that exceeds the amount in Reais equivalent to US$ 20,000,000.00 (twenty

million U.S. dollars) or exceeds the amount corresponding to 1% (one percent) of the Company's net equity at the time, as determined in

its most recent balance sheet or quarterly financial statement, whichever amount is greater; |

| (q) | to decide on (i) any financial

operation involving the Company, including the granting or taking of loans, in an amount exceeding, per transaction, ½ (half) of

the EBITDA (Earnings before Interest, Income Taxes, Depreciation and Amortization), as determined in the consolidated financial statements

for the fiscal year prior to the respective operation, and (ii) any issue of debentures that are not convertible into shares; |

| (r) | to resolve on any association

of the Company with third parties that involves individual or aggregate investment over a fiscal year that exceeds the amount in Reais

equivalent to US$ 20,000,000.00 (twenty million U.S. dollars) or exceeds the amount corresponding to 1% (one percent) of the Company's net equity at the time,

as determined in its most recent balance sheet or quarterly financial statements, whichever amount is greater; |

| (s) | preparing and disclosing a

grounded opinion, favorable or against the acceptance of any public offer for the acquisition of shares that have as their object the

shares issued by the Company, under the terms of the Novo Mercado Regulations; e |

| (t) | to decide on any alteration

to the Company's dividend distribution policy. |

Sole Paragraph - In the case of

decisions to be made by the corporate bodies of companies that are controlled by the Company, or in which the Company elects members of

the Board of Directors or the Executive Board, it will be incumbent upon the Board of Directors to guide the vote of the Company's managers,

in the case of decisions taken at a general meeting, partners' meeting or equivalent body, or the vote of the managers elected or nominated

by the Company for the management bodies of such companies, when the resolution falls under items (p), (q) and (r) of this Article, calculating

the parameters referred to therein based on the most recent balance sheet or quarterly financial statements of the controlled or invested

companies.

Section II Audit Committee and

Other Auxiliary Management Bodies

ARTICLE 18 - The Audit Committee,

an advisory body attached to the Board of Directors, is composed of at least three (3) members, at least one (1) of whom is an independent

board member, and at least one (1) must have recognized experience in corporate accounting matters.

Paragraph 1 - The same member

of the Audit Committee may accumulate both characteristics referred to in the caput.

Paragraph 2 - The members of the

Audit Committee must be elected by the Board of Directors and meet the applicable independence requirements provided for in the rules

of the Brazilian Securities and Exchange Commission and the Novo Mercado Regulation.

Paragraph 3 - The activities of

the Coordinator of the Audit Committee are defined in its internal regulation, approved by the Board of Directors.

ARTICLE 19 - The members of the

Audit Committee shall be elected by the Board of Directors for a term of office of two (2) years, reappointment for successive terms of office being allowed, in compliance with

the terms of the Board of Directors' internal regulation.

Paragraph 1 - During the course

of their mandates, the members of the Audit Committee may only be replaced in the following cases:

| (b) | unjustified absence to three

(3) consecutive meetings or six (6) alternate meetings per year; or |

| (c) | reasoned decision by the Board

of Directors. |

Paragraph 2 - In the event of

vacancy in the office of Audit Committee member, it shall be incumbent upon the Board of Directors to elect the person who shall complete

the term of office of the replaced member.

Paragraph 3 - It is incumbent

upon the Audit Committee, among other matters:

| (a) | to opine on the hiring and

dismissal of independent audit services; |

| (b) | evaluate the management report,

the financial statements, interim statements and the Company's quarterly information, making the recommendations deemed necessary to the

Board of Directors; |

| (c) | to monitor the activities of

the Company's internal audit and internal controls area; |

| (d) | evaluating and monitoring the

Company's risk exposures; |

| (e) | evaluating, monitoring and

recommending to management the correction or improvement of the Company's internal policies, including the policy of transactions between

related parties; and |

| (f) | have means for receiving and

treating information about the noncompliance with legal provisions and norms applicable to the Company, in addition to internal regulations

and codes, including the forecast of specific procedures for protecting the supplier and the confidentiality of the information. |

ARTICLE 21 - The Board of Directors

may constitute other Committees, with the composition it determines, which shall have the function of receiving and analyzing information,

elaborating proposals or making recommendations to the Board of Directors, in their specific areas of operation, as may be established

in their internal regulations, to be approved by the Board of Directors.

Sole Paragraph - The members of the Committees

created by the Board of Directors will have the same duties and responsibilities as those of the managers.

Section III The Board of Executive

Officers

ARTICLE 22 - The Board of Executive

Officers shall comprise at least 3 (three) and at most 8 (eight) members, shareholders or not, resident in the country, elected and dismissible

by the Board of Directors, 1 (one) of whom shall necessarily be appointed as Chief Executive Officer and 1 (one) as Investor Relations

Officer, and there may also be 1 (one) Chief Financial Officer, 1 (one) Chief Commercial Officer, 1 (one) Chief Operating Officer and

the other Executive Vice-Presidents and Officers without special designation, and overlapping of these positions is allowed.

Sole Paragraph - The term of management

of the members of the Board of Executive Officers is two (2) years, reelection being allowed.

ARTICLE 23 - The Officers shall

carry out the general duties set forth in these ByLaws and those assigned to them by the Board of Directors, keeping mutual collaboration

and aiding each other in the exercise of their positions and duties.

Paragraph 1 - The specific duties

and titles of each one of the Executive Officers shall be defined by the Board of Directors.

Paragraph 2 - In the cases of

temporary or definite vacancy, absence, leave of absence, impediment or removal, the Officers shall replace one another as follows:

| (a) | in case of absence or temporary

impediment that does not arise from a situation of conflict of interest of the Chief Executive Officer, he shall appoint a person to replace

him; and, in case of vacancy, the Board of Directors shall elect a replacement within up to thirty (30) days, who shall complete the term

of office of the replaced Chief Executive Office; |

| (b) | in case of absence or temporary

impediment of the other Officers, they shall be replaced by the Chief Executive Officer and, in case of vacancy, the Board of Directors

shall elect a substitute within thirty (30) days, who shall complete the term of office of the replaced Officer. |

ARTICLE 24 - The Board of Directors

shall meet when convened by the Chief Executive Officer, or also when convened by half of the acting Officers.

Sole Paragraph - The minimum quorum

for the installation of the Board of Directors' meetings is of at least one third (1/3) of its acting members, and its deliberations shall

be made by majority vote of those present. In the event of a tie in the deliberations of matters subject to the approval of the Board

of Executive Officers, such matter shall be submitted to the approval of the Board of Directors.

ARTICLE 25 - In addition to the

duties and responsibilities which may be assigned by the General Assembly and by the Board of Directors, it is incumbent upon the Executive

Board, without prejudice to other legal attributions:

| (i) | to manage the corporate business

and enforce these Bylaws; |

| (ii) | to comply with the corporate

purpose; |

| (iii) | approving plans, programs and

general operating, management and control norms in the interest of the Company's development, observing the guidelines established by

the Board of Directors; |

| (iv) | preparing and submitting to

the Annual General Meeting a report on the Company's business activities, instructing them with the Balance Sheet and Financial Statements

legally required for each fiscal year, as well as the respective opinions of the Audit Committee, when applicable; |

| (v) | directing all the Company's

activities, giving them the guidelines set by the Board of Directors and appropriate to the achievement of its objectives; |

| (vi) | proposing to the Board of Directors

the investment plans and programs; |

| (vii) | authorizing the opening and

closing of branches, agencies, branches, warehouses and/or the establishment of delegations, offices and representations anywhere in Brazil

or abroad; |

| (viii) | expressing an opinion on the

matters on which the Board of Directors may request specific appraisal; and |

| (ix) | developing, jointly with the

Board of Directors, and executing the Profit Sharing Plan. |

ARTICLE 26 - It is the Chief Executive

Officer's duty, especially

| (a) | to plan, coordinate, direct

and manage all of the Company's activities, exercising executive and decision-making functions, except for those activities that must

be performed with a report to the Board of Directors or its committees; |

| (b) | to exercise general supervision

over all the Company's business, coordinating and guiding the activities of the other Executive Officers; |

| (c) | convening and installing the

meetings of the Executive Board; |

| (d) | coordinating and conducting

the process of approving the annual/multi-annual budget and the investment and expansion plan with the Board of Directors; and |

| (e) | suggesting appointments and

respective candidates for positions in the Company's Executive Board and submitting such suggestion to the approval of the Board of Directors.

|

ARTICLE 27 - In addition to the

duties conferred by the Board of Directors and other duties conferred by applicable law or regulation, the Investor Relations Officer

shall be especially responsible for

| (a) | to represent the Company separately

before the Brazilian and foreign Securities and Exchange Commission (“CVM”), other controlling entities and other institutions

of the financial and capital markets; |

| (b) | to provide information to the

investing public, the CVM, the stock exchanges on which the Company has its securities admitted for trading and other bodies related to

the activities developed in the capital markets, pursuant to applicable legislation, in Brazil and/or abroad; and |

| (c) | to take measures to keep the

registration as publicly-held company updated before CVM. |

ARTICLE 28 - It is incumbent upon

the Chief Financial Officer, in addition to the duties conferred by the Board of Directors, to:

| (a) | to exercise the management

of the Company's administrative services, financial operations and risks; |

| (b) | participating in the formulation

and execution of the Company's strategies and business plans; and |

| (c) | managing human resources, administering

material resources and outsourced services of its competence area. |

ARTICLE 29 - In addition to the

duties conferred by the Board of Directors, the Chief Commercial Officer shall be especially in charge of:

| (a) | to act in the definition of

the Company's strategic planning; |

| (b) | to define and execute the marketing

and sales plan; |

| (c) | to manage the quality of sales;

|

| (d) | participating in the definition

of human resources policies; and |

| (e) | communicating primarily to

disseminate information to the public of interest to the Company. |

ARTICLE 30 - It is incumbent upon

the Chief Operating Officer, in addition to the duties conferred upon him by the Board of Directors, to:

| (a) | to establish trade guidelines

and operations; |

| (b) | to coordinate human resources

and manage material and financial resources; |

| (c) | to direct trade operations;

|

| (d) | to participate in marketing

activities; |

| (e) | establish branch offices and

commercial representations; and |

| (f) | to communicate in seminars,

lectures, interviews and in contacts and commercial negotiations with clients and distributors. |

ARTICLE 31 - It is incumbent upon

the other Officers to assist the Chief Executive Officer in all the tasks he shall assign them, carry out the activities related to the

duties granted to them by the Board of Directors and practice all the acts necessary for the regular operation of the Company, provided

they are authorized by the Board of Directors.

ARTICLE 32 - The Officers shall

represent the Company actively and passively, in and out of court and before third parties, practicing and signing all acts binding the

Company.

Paragraph 1 - In the acts of appointing

attorneys-in-fact, the Company shall be represented by two (2) Officers, jointly. The powers of attorney on behalf of the Company shall

contain validity term, except those for judicial purposes, in addition to the description of powers granted, which may encompass any and

all acts, including those of banking nature.

Paragraph 2 - For the acts involving

acquisition, encumbrance or disposal of assets, including real estate, as well as the acts of appointing attorneys-in-fact for such practices,

the Company shall be represented, mandatorily, by 2 (two) Officers, 2 (two) attorneys-in-fact or 1 (one) Officer and 1 (one) attorney-in-fact,

jointly, and 1 (one) of them must be the Chief Executive Officer or an attorney-in-fact appointed by 2 (two) Officers, and one of them

must be the Chief Executive Officer.

Paragraph 3 - The Company shall

be deemed bound when represented:

| (a) | jointly by 2 (two) Executive

Officers; |

| (b) | jointly by 1 (one) Officer

and one (1) attorney-in-fact, appointed pursuant to these Bylaws; |

| (c) | jointly by 2 (two) attorneys-in-fact,

appointed under the terms of these By-Laws; or |

| (d) | individually, by an attorney-in-fact

or by an Officer, in special cases, when so designated in the respective power of attorney and according to the extent of the powers contained

therein. |

CHAPTER V

FISCAL COUNCIL

ARTICLE 33 - The Company shall

have a non-permanent Fiscal Council, composed of 3 (three) to 5 (five) effective members and an equal number of deputy members.

Paragraph 1 - The Fiscal Council

shall only be installed upon request of the Company's shareholder(s), in compliance with the applicable legislation.

Paragraph 2 - The Fiscal Council,

if installed, shall approve its internal regulation, which shall set forth the general rules of its operation, structure, organization

and activities.

Paragraph 3 - The term of office

of the Fiscal Council's members, whether effective or deputy, shall be conditioned to the previous signature of the instrument of investiture,

which shall contemplate their submission to the arbitration clause referred to in Article 42.

CHAPTER VI FISCAL YEAR AND FINANCIAL

STATEMENTS

ARTICLE 34 - The fiscal year shall

end in December 31 of each year, when the balance sheet shall be drawn up and the financial statements required by the legislation in

force shall be prepared.

ARTICLE 35 - The Company may,

at the Board of Directors' discretion, draw up quarterly or half-yearly balance sheets.

CHAPTER VII ALLOCATION OF PROFITS

ARTICLE 36 - Once the balance

sheet is drawn up, the following rules shall be complied with as to the distribution of the result ascertained:

| (i) | from the result of the fiscal

year shall be deducted, before any participation, the accumulated losses and the provision for Income Tax; |

| (ii) | fter deduction of the portions

described in item (a) above, the amount to be distributed as participation of the employees and managers in the Company's results will

be deducted, as determined by the Board of Directors in compliance with the Profit Sharing Plan, under the terms and limits of items “l”

and “m” of Article 17 of these Bylaws; |

(c) the remaining profits will

be allocated as follows:

| (a) | five percent (5%) to the legal

reserve fund until it reaches twenty percent (20%) of the capital stock; |

| (b) | amounts intended for the constitution

of a contingency reserve, if deliberated by the General Assembly; |

| (c) | twenty-five percent (25%) for

the payment of the mandatory dividend, according to Paragraph 1 below; and |

| (d) | the profit not allocated to

the reserve referred to in Paragraph 2 of this Article, nor retained pursuant to Article 196 of Law 6,404/76, shall be distributed as

additional dividend. |

Paragraph 1 - The mandatory dividend

shall be calculated and paid according to the following rules:

| (a) | the calculation basis of the

dividend will be the net profit of the fiscal year minus the amounts destined to the constitution of the legal reserve and of reserves

for contingencies, and increased by the reversal of the reserves of contingencies formed in previous fiscal years; |

| (b) | the payment of the dividend

determined under the terms of the previous item may be limited to the amount of the net profit of the fiscal year that has been realized

under the terms of the law, provided that the difference is registered as a reserve of profits to be realized; and |

| (c) | the profits recorded in the

unrealized profit reserve, when realized and if not absorbed by losses in subsequent fiscal years, shall be added to the first dividend

declared after the realization. |

Paragraph 2 - A Reserve for Expansion

is hereby created, the purpose of which shall be to secure funds to finance additional fixed and current capital investments and shall

be formed with up to 100% of the net income

remaining after the allocations referred to in items (i), (ii) and (iii) of item (c) of the caput, and the total of this reserve may not

exceed the Company's capital stock.

Paragraph 3 - The Board of Directors

may approve the preparation of half-yearly, quarterly or shorter balance sheets and declare dividends or interest on own capital to the

account of the profit calculated in such balance sheets, in compliance with the legal limits, as well as declare interim dividends to

the account of retained earnings or reserves. The dividends or interest on own capital thus declared shall constitute advance payment

of the mandatory dividend.

Paragraph 4 - The Company may

pay or credit interest as remuneration on own capital calculated on the Net Equity accounts, in compliance with the rate and limits defined

by law.

ARTICLE 37 - The amount of dividends

shall be made available to the shareholders within 60 (sixty) days as of the date they are attributed, and may be monetarily restated,

as determined by the Board of Directors, in compliance with the pertinent legal provisions.

CHAPTER VIII SETTLEMENT

ARTICLE 38 - The Company shall

go into liquidation in the legal cases, and it shall be incumbent upon the General Assembly to establish the liquidation mode, elect the

liquidator and the Fiscal Council that shall operate during the liquidation, determining their remuneration.

CHAPTER IX ALIENATION OF SHAREHOLDING

CONTROL

ARTICLE 39 - The direct or indirect

disposal of the Company's control, whether by means of a single operation or successive operations, shall be contracted under the condition

that the acquirer of control undertakes to make a public offering for acquisition of shares having as their object the shares issued by

the Company held by the other shareholders, pursuant to the conditions and terms foreseen in the legislation and regulations in force

and in the New Market Regulation, so as to ensure them equal treatment to that given to the seller.

CHAPTER X ACQUISITION OF RELEVANT STAKE IN THE

COMPANY

ARTICLE 40 - Any person, shareholder

or Group of Shareholders, who acquires or becomes the holder, by means of a single operation or successive operations (“Acquiring

Shareholder”): (a) of a direct or indirect interest equal to or greater than twenty-five percent (25%) of the total shares issued

by the Company, excluding treasury shares; or (b) any other shareholders' rights, including usufruct or trust, over shares issued by the

Company representing a percentage equal to or higher than twenty-five percent (25%) of the total shares issued by the Company, excluding

treasury shares (“Relevant Holding”), shall conduct a public offering for the acquisition of all shares issued by the Company

or request registration with the CVM and B3, as the case may be, within no more than thirty (30) days from the date of the last transaction

that resulted in the attainment of the Relevant Shareholding, with the following minimum requirements, pursuant to the provisions of the

applicable regulations of the CVM, the regulations of B3 and the terms of this Article (“POS”):

| (a) | be directed indistinctly to

all shareholders of the Company for the acquisition of all shares issued by the Company; |

| (b) | the price offered must correspond

to at least the highest value among: (i) the Economic Value ascertained in an appraisal report; (ii) the highest price paid by the Acquiring

Shareholder in the twelve (12) months preceding the achievement of the Relevant Shareholding; and (iii) 125% of the weighted average unit

price of the shares issued by the Company during the period of one hundred and twenty (120) trading sessions prior to the holding of the

Tender Offer; and |

| (c) | be carried out at auction to

be held at B3. |

Paragraph 1 - The conduction of

the Tender Offer referred to in the caput of the Article herein shall not exclude the possibility for another person or shareholder to

conduct a competing Tender Offer, pursuant to the applicable regulation.

Paragraph 2 - The obligations

set forth in Article 254-A of Law 6,404/76 and in Article 39 herein do not exclude the performance by the Acquiring Shareholder of the

obligations set forth in the Article herein.

Paragraph 3 - The Acquiring Shareholder

shall be bound to meet the occasional ordinary requests or requirements from CVM and B3 relative to the Tender Offer, within the maximum

terms determined in the applicable regulation.

Paragraph 4 - The obligation to

carry out the Tender Offer as set forth in the Article 40 herein shall not apply in the event of a person, shareholder or Group of Shareholders

becomes the holder of shares issued by the Company should the relevant interest be reached due to: (a) of corporate operations of merger,

incorporation or incorporation of shares involving the Company, (b) in case of acquisition, via private capital increase or subscription of shares held in a primary

offering by those who have the preemptive right or also, in case of acquisition, via private capital increase or subscription of shares

held in a primary offering, due to the amount has not been fully subscribed by those who have the preemptive right or that has not had

a sufficient number of interested parties in the respective distribution; and (c) in the cases of public offerings of distribution of

shares (including public offerings of restricted efforts).

Paragraph 5 - For the purpose

of calculation of the Relevant Shareholding percentage, involuntary shareholding increases resulting from cancellation of treasury shares,

share buybacks or reduction of the Company's capital stock with the cancellation of shares shall not be computed.

Paragraph 6 - For the purposes

of the provisions of this Article 40, the following terms shall have the meanings defined hereunder:

“Group of Shareholders” means

the group of persons: (i) bound by voting agreement (including, without limitation, any natural or legal person, investment fund, condominium,

securities portfolio, universality of rights, or other form of organization, resident, domiciled or headquartered in Brazil or abroad),

either directly or through controlled companies, controllers or under common control; or (ii) among which there is a control relationship;

or (iii) under common control; or (iv) acting representing a common interest. Examples of persons representing a common interest include:

(a) a person holding, directly or indirectly, an equity interest equal to or greater than fifteen percent (15%) of the capital stock of

the other person; and (b) two persons having a third common investor that holds, directly or indirectly, an equity interest equal to or

greater than fifteen percent (15%) of the capital stock of each of the two persons. Any joint ventures, investment funds or clubs, foundations,

associations, trusts, condominiums, cooperatives, consortiums, securities portfolios, universality of rights, or any other forms of organization

or undertaking, constituted in Brazil or abroad, will be considered part of a same Group of Shareholders, whenever two or more among such

entities are: (c) administered or managed by the same legal entity or by parties related to the same legal entity; or (d) have in common

the majority of their managers, being certain that, in the case of investment funds with a common manager, only those whose decision on

the exercise of votes in General Meetings, under the terms of the respective regulations, is the responsibility of the manager, on a discretionary

basis, shall be considered as members of a Shareholders Group.

“Economic Value” means the

value of the Company and its shares that may be determined by a first class financial institution with operations in Brazil, by using

the discounted cash flow method.

ARTICLE 41 - The Public Tender

Offer referred to in Article 40 above may be dismissed by the General Assembly, subject to the terms below.

Paragraph 1 - The General Meeting

shall be installed at first call with the attendance of shareholders representing, at least, two thirds (2/3) of total outstanding shares.

Paragraph 2 - Should the quorum

of paragraph 1 not be reached, the General Meeting may be installed on second call, with the presence of any number of shareholders holding

outstanding shares.

Paragraph 3 - The deliberation

on the exemption of the public offer of shares must occur by the majority of votes of the holders of outstanding shares present in the

General Meeting, excluding the Acquiring Shareholder's votes.

CHAPTER XI FINAL PROVISIONS

ARTICLE 42 - The Company, its

shareholders, managers, members of the Fiscal Council, effective and substitute, if any, undertake to solve by means of arbitration, before

the Market Arbitration Chamber, pursuant to its regulation, any controversy that may arise among them, related to or arising from their

condition as issuer, shareholders, managers, and members of the Fiscal Council, especially arising from the provisions contained in Law

no. 6. 385, of December 7, 1976, Law 6,404/76, the Company's Bylaws, the rules edited by the National Monetary Council, by the Central

Bank of Brazil and by the Securities and Exchange Commission, as well as the other rules applicable to the operation of the capital markets

in general, besides those contained in the Novo Mercado Regulations, in the other regulations of B3 and in the Novo Mercado Participation

Agreement.

ARTICLE 43 -The Company shall

indemnify and hold harmless its managers, members of statutory committees, fiscal councilors and other employees exercising management

position or function in the Company, in the event of any damage or loss effectively suffered by such persons by virtue of the regular

exercise of their functions in the Company, even if the beneficiary no longer exercises the position or function for which he/she was

elected or exercised in the Company and/or any of its controlled or affiliated companies (“Beneficiaries”).

Paragraph 1 - The indemnity shall

only be due after the use and only in supplemental character to eventual coverage of civil liability insurance granted by the Company

and/or any of its controlled or affiliated companies (“D&O Insurance”). The payments to be made by the Company shall correspond

to the exceeding amount covered by D&O Insurance and observed the limits set forth in

the indemnity agreement to be entered into between the Company and the Beneficiary, as referred to in Paragraph 4 below (“Indemnity

Agreement”).

Paragraph 2 - The Indemnity Agreement

may provide for exception situations in which the Company makes advances to the Beneficiaries, provided that the payment of such advances

is previously approved by the Board of Directors and the D&O Insurance is activated prior to the payment of the advance by the Company.

Paragraph 3 - Without prejudice

to other situations set forth in the Indemnity Agreement, acts performed out of the exercise of the Beneficiaries' duties, in disagreement

with the applicable laws, regulations or administrative decisions, the Bylaws and the policies and codes, performed out of the normal

course of business, with bad faith, malice, serious fault or fraud, in their own interest or of third parties or detrimental to the corporate

interest, shall not be subject to indemnity. In case any Beneficiary is condemned, by final and unappealable court decision, or a definitive

decision of any regulator or governmental body having jurisdiction, due to an act not subject to indemnity, he/she shall reimburse the

Company for all costs and expenses effectively paid or, as the case may be, anticipated to the Beneficiary, as a result of the obligation

assumed pursuant to the caput of this Article, under the terms of the Indemnity Agreement.

Paragraph 4 - The indemnity conditions

object of this article shall guarantee the independence of decisions and ensure the Company's best interest and shall be determined in

the Indemnity Agreement to be approved by the Board of Directors and entered into between the Company and each one of the Beneficiaries.

ARTICLE 44 - The US dollar amounts

mentioned in these By-Laws shall be used exclusively as reference base of monetary restatement and shall be converted into Brazilian Reais

by the closing sales rate of the US dollar, disclosed by the Brazilian Central Bank.

ARTICLE 45 - The omitted cases

shall be solved according to the legislation and regulation in force, including the New Market Regulation.

***

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 08, 2022

Sendas Distribuidora S.A.

By: /s/ Daniela Sabbag Papa

Name: Daniela Sabbag Papa

Title: Chief Financial Officer

By: /s/ Gabrielle Helú

Name: Gabrielle Helú

Title: Investor Relations Officer

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These

statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances,

industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates",

"expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking

statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies

and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or

results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject

to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements

are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors.

Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

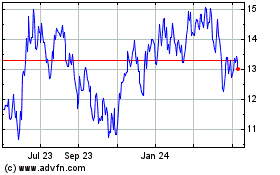

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Aug 2024 to Sep 2024

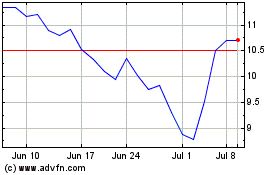

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Sep 2023 to Sep 2024