t

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________________________

Form 11-K

_________________________________________________________

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35832

_________________________________________________________

| | | | | |

| A. | Full title of plan and the address of the plan, if different from that of the issuer named below: |

Science Applications International Corporation Retirement Plan

| | | | | |

| B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

Science Applications International Corporation

12010 Sunset Hills Road

Reston, VA 20190

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION RETIREMENT PLAN

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| | |

| | 1 |

| | |

| FINANCIAL STATEMENTS | | |

| | 2 |

| | 3 |

| | 4 |

| | |

| SUPPLEMENTAL SCHEDULE | | |

| | 9 |

| | |

| | 10 |

| | |

| | 11 |

NOTE: All other schedules required by Section 29 CFR 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable.

Report of Independent Registered Public Accounting Firm

Benefit Plans Committee

Science Applications International Corporation Retirement Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Science Applications International Corporation Retirement Plan (the “Plan”) as of December 31, 2021 and 2020, and the related statements of changes in net assets available for benefits for the years then ended, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The Schedule of Assets (Held at Year End) as of December 31, 2021 (collectively referred to as the supplemental information) has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Mayer Hoffman McCann P.C.

We have served as the Plan's auditor since 2013.

San Diego, California

June 22, 2022

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION RETIREMENT PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

| | | | | | | | | | | | | | | | | | | | |

| | | | December 31, | | December 31, |

| | | | 2021 | | 2020 |

| | | | (in thousands) |

| ASSETS: | | | |

| Investments: | | | |

| Mutual funds | $ | 1,452,848 | | | $ | 1,433,296 | |

| Science Applications International Corporation common stock | 96,734 | | | 109,413 | |

| Common collective trusts | 3,484,938 | | | 2,993,179 | |

| Self-directed brokerage fund | 90,682 | | | 75,026 | |

| | Total investments | 5,125,202 | | | 4,610,914 | |

| Receivables: | | | |

| Notes receivable from participants | 29,078 | | | 29,852 | |

| Employer contributions | 21,267 | | | 19,868 | |

| Participant contributions | 1 | | | — | |

| | Total receivables | 50,346 | | | 49,720 | |

| Total assets | 5,175,548 | | | 4,660,634 | |

| LIABILITIES: | | | |

| Excess contributions due to participants | 1 | | | — | |

| NET ASSETS AVAILABLE FOR BENEFITS | $ | 5,175,547 | | | $ | 4,660,634 | |

See accompanying notes to financial statements.

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION RETIREMENT PLAN

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

| | | | | | | | | | | | | | | | | | | | |

| | | | Year Ended |

| | | | December 31, | | December 31, |

| | | | 2021 | | 2020 |

| | | | (in thousands) |

| INVESTMENT INCOME: | | | |

| Net appreciation in fair value of investments | $ | 477,654 | | | $ | 555,591 | |

| Interest and dividends | 93,221 | | | 61,956 | |

| | Total investment income | 570,875 | | | 617,547 | |

| | | | | | |

| INTEREST INCOME ON NOTES RECEIVABLE FROM PARTICIPANTS | 1,495 | | | 1,733 | |

| | | | | | |

| CONTRIBUTIONS: | | | |

| Participants | 205,405 | | | 194,649 | |

| Employer | 78,755 | | | 74,329 | |

| Participant rollovers | 50,310 | | | 42,134 | |

| | Total contributions | 334,470 | | | 311,112 | |

| | | | | | |

| DEDUCTIONS: | | | |

| Distributions paid to participants | 413,915 | | | 355,360 | |

| Administrative expenses | 2,305 | | | 1,931 | |

| | Total deductions | 416,220 | | | 357,291 | |

| | | |

| INCREASE IN NET ASSETS AVAILABLE FOR BENEFITS BEFORE TRANSFERS | 490,620 | | | 573,101 | |

| | | | | | |

| NET TRANSFERS FROM OTHER PLANS | 24,293 | | | 1,071,593 | |

| | | | | | |

| INCREASE IN NET ASSETS AVAILABLE FOR BENEFITS | 514,913 | | | 1,644,694 | |

| | | | | | |

| NET ASSETS AVAILABLE FOR BENEFITS: | | | |

| Beginning of year | 4,660,634 | | | 3,015,940 | |

| End of year | $ | 5,175,547 | | | $ | 4,660,634 | |

See accompanying notes to financial statements.

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION RETIREMENT PLAN

NOTES TO FINANCIAL STATEMENTS

1. DESCRIPTION OF THE PLAN

The following brief description of the Science Applications International Corporation Retirement Plan (the “Plan”) is for general information purposes only. Participants should refer to the Plan document and the Summary Plan Description for complete information regarding the Plan. Within these financial statements, Science Applications International Corporation (the “Company”) refers to the sponsoring employer.

General—The Plan is a defined contribution plan sponsored by the Company and is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The Plan is a 401(k) plan with profit-sharing and employee stock ownership plan (“ESOP”) features. Both employee and Company contributions to the Plan are held in a qualified retirement trust fund. The Science Applications International Corporation Benefit Plans Committee is the Plan’s named fiduciary for purposes of Section 402(a) of ERISA.

Investment Funds—As of December 31, 2021, the Plan held investments in 7 mutual funds, 20 common collective trust funds, a self-directed brokerage fund, and 2 Company stock funds: the SAIC Common Stock Fund and the SAIC Closed Stock Fund (collectively, the “Stock Funds”). All amounts in the Stock Funds are invested in Science Applications International Corporation common stock, except for estimated cash reserves, which are invested in the Vanguard Federal Money Market Fund and are primarily used to provide future benefit distributions and facilitate investment exchanges.

Eligibility—Employees of the Company are eligible to participate in the Plan. Employees must be in an eligible fringe benefit package to be eligible to receive Company matching 401(k) contributions. Generally, employees may make elective contributions and receive Company matching 401(k) contributions upon commencing employment.

Participant Contributions—The Plan permits participants to contribute up to 75% of their eligible compensation to the Plan, subject to statutory limitations. Participants may also contribute amounts representing rollovers from other qualified plans. Participant contributions are invested according to participant direction into any of the available investment funds of the Plan. Participant contributions and rollovers to the SAIC Common Stock Fund are limited to a maximum of 50% of the employee deferral or rollover, as applicable.

Employer Contributions—The Company may make matching 401(k) contributions. Eligible participants may receive Company matching 401(k) contributions based on a percentage (up to a maximum match percentage of 4%), depending on the fringe benefit package, which are invested per participant direction. Company contributions to the Plan for the Plan years ended December 31, 2021 and 2020 were made in cash. The Company, at its discretion, may also make additional contributions to the Plan for the benefit of non-highly compensated participants in order to comply with Section 401(k) (3) of the Internal Revenue Code ("IRC"); however, the Company made no such additional contributions for the Plan years ended December 31, 2021 and 2020.

Participant Accounts—In accordance with Plan provisions, individual accounts are maintained for each Plan participant. Each participant’s account is credited with the participant’s contributions, and if eligible, allocations of Company contributions. Allocations are based on participant eligible compensation, as defined in the Plan document. Participant accounts also reflect changes from investment income and losses and from distributions. The benefit to which a participant is entitled is the vested balance of his or her account.

Plan Amendments and Termination—Effective January 1, 2020, the Plan was amended to merge the Engility Master Savings Plan ("MSP") into the Plan and to adopt certain other provisions regarding vesting of MSP balances and timing of Company contributions. This was in connection with the Company's acquisition of Engility Corporation during the year ended December 31, 2019.

Effective February 20, 2020, the Plan was amended to authorize special disaster distributions to eligible participants who are residents of Puerto Rico.

Effective December 1, 2021, the Plan was amended to merge the Halfaker & Associates LLC 401(k) Plan ("Halfaker Plan") into the Plan and to adopt certain other provisions regarding vesting of Halfaker Plan balances. This was in connection with the Company's acquisition of Halfaker & Associates LLC during the year ended December 31, 2021. Final regulations on hardship distributions promulgated under Section 401(k) of the IRC were also adopted.

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION RETIREMENT PLAN

NOTES TO FINANCIAL STATEMENTS

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions and to terminate the Plan at any time subject to the provisions of ERISA.

Vesting and Forfeitures—Participants’ elective deferrals, rollover contributions and Company contributions together with associated earnings vest immediately. Company contributions included in participants' balances in the MSP and Halfaker Plan that were merged into the Plan will continue to vest according the vesting schedules in those plans prior to the mergers, vesting ratably over periods of 3 and 5 years, respectively. Forfeitures are used to offset Company contributions or certain eligible Plan expenses. Forfeitures amounted to approximately $682,000 and $791,000 for the years ended December 31, 2021 and 2020, respectively.

Notes Receivable from Participants—Participants may borrow up to 50% of their vested account balance, up to a maximum of $50,000. Loan repayment periods may not exceed 60 months except for loans used to acquire a principal residence, in which case the repayment period may not exceed 30 years. If a participant defaults on a loan, it becomes a deemed distribution from the Plan to the participant. The loans bear interest at a rate commensurate with local prevailing rates as determined monthly by the Plan administrator. Principal and interest are collected ratably through payroll deductions.

Distributions to Participants—For vested account balances less than $1,000, participants receive their vested account balance in a single lump sum following termination of employment with the Company. For vested account balances between $1,000 and $5,000, a participant’s vested account balance is automatically rolled over into an Individual Retirement Account. For vested account balances that exceed $5,000, balances are not distributed unless the participant elects to take a distribution following the participant’s termination of employment with the Company. Regardless of the existing account balance, distributions are made when participants die or become permanently disabled while employed by the Company. After attaining the age of 59-1/2, a participant may make withdrawals even if still employed by the Company. Participants may make withdrawals from the Plan prior to attaining the age of 59-1/2 from their rollover account or if the participant incurs a financial hardship, as specified by the Plan document. Former employees, regardless of their age, may elect to receive up to two distributions in any given Plan year, of all or a portion of their account balance.

Tax Status—The Internal Revenue Service (“IRS”) has determined and informed the Company by a letter dated February 28, 2014, that the Plan was designed in accordance with the applicable requirements of the IRC. Although the Plan has been amended since receiving the determination letter, the Company and the Plan’s tax counsel believe that the Plan is designed, and is currently being operated, in compliance with the applicable requirements of the IRC and, therefore, believe that the Plan is qualified, and the related trust is tax-exempt. Accordingly, no provision for income taxes has been included in the Plan’s financial statements. Management recognizes tax liabilities for uncertainty in income taxes when it is more likely than not that a tax position would not be sustained upon examination by and settlement with the IRS. The Plan is subject to routine audits by taxing jurisdictions, and the Company's tax returns for its fiscal years 2016 through 2019 (generally corresponding to Plan years 2015 through 2018) are currently under audit by the IRS. Management believes it is no longer subject to income tax examinations for Plan years prior to 2015.

Related-Party Transactions—Certain Plan investments are managed by The Vanguard Group, the Plan’s record-keeper; therefore, transactions with these investments qualify as party-in-interest transactions. Fees paid to the record-keeper were approximately $2,150,000 and $1,760,000 for the years ended December 31, 2021 and 2020, respectively. There were no amounts payable to the Plan’s record-keeper as of December 31, 2021 and 2020. Members of the Science Applications International Corporation Benefit Plans Committee also participate in the Plan and qualify as parties-in-interest.

Science Applications International Corporation is the sponsoring employer as of December 31, 2021 and 2020. At December 31, 2021 and 2020, the following Science Applications International Corporation shares were held by the Plan:

| | | | | | | | | | | | | | | | | | | | | | | |

| 2021 | | 2020 |

| Number of Shares | | Cost Basis | | Number of Shares | | Cost Basis |

| (in thousands) |

| Science Applications International Corporation common stock | 1,161 | | $61,797 | | | 1,156 | | $56,076 | |

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION RETIREMENT PLAN

NOTES TO FINANCIAL STATEMENTS

Transfers from Other Plans—In connection with the mergers of the Halfaker Plan and the MSP into the Plan, the undistributed participant account balances were transferred into the Plan. Net transfers from other plans reported in the statements of changes in net assets are summarized as follows:

| | | | | | | | | | | |

| Year ended |

| December 31, 2021 | | December 31, 2020 |

| (in thousands) |

| Halfaker Plan | $ | 24,293 | | | $ | — | |

| MSP | — | | | 1,071,593 | |

| Net transfers from other plans | $ | 24,293 | | | $ | 1,071,593 | |

COVID-19 Impact—In March 2020, the World Health Organization (“WHO”) categorized Coronavirus Disease 2019 (“COVID-19”) as a pandemic. Following the WHO’s declaration, the United States government passed the “Coronavirus Aid, Relief, and Economic Security (CARES) Act” on March 27, 2020. The CARES Act provides for various forms of relief for qualifying Plan participants including penalty-free distributions, increased limits for plan loans, suspension of loan payments for up to one year, and delaying required minimum distributions. The Plan has implemented these changes.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting—The Plan’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

Investment Valuation and Income Recognition—Investments held by the Plan are carried at fair value. Valuation and income recognition policies are as follows:

Investment in Mutual Funds—The Plan’s investments in mutual funds are stated at fair value based on quoted market prices.

Investment in Common Collective Trusts—The Plan's investments in common collective trusts are carried at net asset value (“NAV”) per unit, which is determined by the trustee using the fair value of the underlying investments.

Investment in Common Stock—Investments in shares of Science Applications International Corporation common stock, which are publicly traded on the New York Stock Exchange, are recorded at their last quoted market price on the last business day of the respective plan year.

Self-Directed Brokerage Fund—The Plan’s investments in the self-directed brokerage fund are stated at fair value based on quoted market prices.

Investment Gains and Losses—Realized gains and losses on sales of investments are calculated as the difference between the fair value of the investments upon sale and the fair value of the investments at purchase. Unrealized appreciation or depreciation is calculated as the difference between the fair value of the investments at the end of the year and the fair value of the investments at the beginning of the year or on the date of purchase if purchased during the year. Interest income is recorded as earned, and dividends are recorded on the ex-dividend date.

Investment Risks and Uncertainties—The Plan invests in various investment securities which, in general, are exposed to various risks, such as interest rate risk, credit risk, and overall market volatility. Due to the level of risk associated with investment securities, it is reasonably possible that changes in the values of certain investment securities will occur in the near term and such changes could materially affect the amounts reported in the statement of net assets available for benefits and statement of changes in net assets available for benefits.

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION RETIREMENT PLAN

NOTES TO FINANCIAL STATEMENTS

Notes Receivable from Participants—Notes receivable from participants are carried at the aggregate unpaid principal balance, plus accrued, unpaid interest of loans outstanding.

Benefits Payable—Benefit payments to participants are recorded upon distribution. There were no benefits payable to participants who had elected to withdraw from the Plan but had not yet been paid as of December 31, 2021 and 2020.

Use of Estimates—The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements, and the reported amounts of additions and deductions during the reporting periods. Actual results may differ from those estimates.

Administrative Expenses—Administrative expenses of the Plan are paid by the Plan sponsor or Plan participants as provided in the Plan document.

3. FAIR VALUE MEASUREMENTS

Accounting guidance has been issued that establishes a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The three levels of the fair value hierarchy are described below:

Level 1 Unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

Level 2 Inputs to the valuation methodology include: quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in inactive markets; inputs other than quoted prices that are observable for the asset or liability; and inputs that are derived principally from or corroborated by observable market data by correlation or other means. If the asset or liability has a specified (contractual) term, the Level 2 inputs must be observable for substantially the full term of the asset or liability.

Level 3 Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

The following table sets forth the Plan’s investments at fair value and by level, as applicable, as of December 31, 2021 and 2020:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| | 2021 | | 2020 | | 2021 | | 2020 | | 2021 | | 2020 | | 2021 | | 2020 |

| | (in thousands) |

| Mutual funds | | $ | 1,452,848 | | | $ | 1,433,296 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 1,452,848 | | | $ | 1,433,296 | |

| Common stock | | 96,734 | | | 109,413 | | | — | | | — | | | — | | | — | | | 96,734 | | | 109,413 | |

| Self-directed brokerage fund | | 90,682 | | | 75,026 | | | — | | | — | | | — | | | — | | | 90,682 | | | 75,026 | |

| Subtotal | | $ | 1,640,264 | | | $ | 1,617,735 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 1,640,264 | | | $ | 1,617,735 | |

| Common collective trusts—measured at NAV | | | | | | | | | | 3,484,938 | | | 2,993,179 | |

| Total | | | | | | | | | | | | | | $ | 5,125,202 | | | $ | 4,610,914 | |

Common collective trusts are measured at fair value using NAV as a practical expedient and have not been categorized in the fair value hierarchy. The fair value amounts presented in the table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statements of Net Assets Available for Benefits. The Plan has no unfunded commitments to the common collective trusts, and there are no redemption restrictions.

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION RETIREMENT PLAN

NOTES TO FINANCIAL STATEMENTS

4. SUBSEQUENT EVENTS

In preparing the accompanying financial statements, management of the Plan has evaluated all subsequent events and transactions for potential recognition or disclosure through June 22, 2022, the date the financial statements were available for issuance.

******

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION RETIREMENT PLAN

SUPPLEMENTAL SCHEDULE

FORM 5500, SCHEDULE H, PART IV, LINE 4i—SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2021

| | | | | | | | | | | | | | | | | | | | | | | |

| | | EIN: 30-6419427 | | Plan #001 |

| Identity of Issue, Borrower, Lessor, or Similar Party | | Description of Investment Including Maturity Date, Rate of Interest and Collateral | | Cost | | Current Value |

| | | | | (in thousands) |

| * | Science Applications International Corporation common stock | | Company Stock | | ** | | $ | 96,734 | |

| * | Dodge & Cox Stock Fund | | Mutual Fund | | ** | | 243,750 |

| T. Rowe Price Institutional Mid Cap Equity Growth Fund | | Mutual Fund | | ** | | 187,644 |

| * | Vanguard FTSE All-World ex-US Index: Institutional Shares | | Mutual Fund | | ** | | 178,597 |

| * | Vanguard Federal Money Market Fund | | Mutual Fund | | ** | | 259,679 |

| * | Vanguard International Growth Fund Admiral Shares | | Mutual Fund | | ** | | 177,361 |

| * | Vanguard PRIMECAP Fund Admiral Shares | | Mutual Fund | | ** | | 362,546 |

| * | Vanguard Short-Term Bond Index Fund Institutional | | Mutual Fund | | ** | | 43,271 |

| Columbia Trust Emerging Markets Equity Fund; Founders Cl | | Common Collective Trust | | ** | | 50,835 |

| Loomis Sayles Core Plus Fixed Income Trust Class C | | Common Collective Trust | | ** | | 93,225 |

| T. Rowe Price U.S. Mid Cap-Value Equity Trust; D Class | | Common Collective Trust | | ** | | 55,023 |

| * | Vanguard Institutional 500 Index Trust | | Common Collective Trust | | ** | | 714,849 |

| * | Vanguard Institutional Extended Market Index Trust | | Common Collective Trust | | ** | | 265,349 |

| * | Vanguard Institutional Total Bond Market Index Trust | | Common Collective Trust | | ** | | 234,047 |

| * | Vanguard Target Retirement 2015 Trust Plus | | Common Collective Trust | | ** | | 61,192 |

| * | Vanguard Target Retirement 2020 Trust Plus | | Common Collective Trust | | ** | | 217,153 |

| * | Vanguard Target Retirement 2025 Trust Plus | | Common Collective Trust | | ** | | 364,583 |

| * | Vanguard Target Retirement 2030 Trust Plus | | Common Collective Trust | | ** | | 370,986 |

| * | Vanguard Target Retirement 2035 Trust Plus | | Common Collective Trust | | ** | | 245,399 |

| * | Vanguard Target Retirement 2040 Trust Plus | | Common Collective Trust | | ** | | 199,211 |

| * | Vanguard Target Retirement 2045 Trust Plus | | Common Collective Trust | | ** | | 162,699 |

| * | Vanguard Target Retirement 2050 Trust Plus | | Common Collective Trust | | ** | | 119,056 |

| * | Vanguard Target Retirement 2055 Trust Plus | | Common Collective Trust | | ** | | 56,682 |

| * | Vanguard Target Retirement 2060 Trust Plus | | Common Collective Trust | | ** | | 27,060 |

| * | Vanguard Target Retirement 2065 Trust Plus | | Common Collective Trust | | ** | | 7,930 |

| * | Vanguard Target Retirement Income Trust Plus | | Common Collective Trust | | ** | | 79,507 |

| Wellington Trust Small Cap 2000 | | Common Collective Trust | | ** | | 135,858 |

| Wellington Trust TIPS | | Common Collective Trust | | ** | | 24,294 |

| Self-Directed Brokerage Fund | | Various | | ** | | 90,682 |

| * | Notes Receivable from Participants | | Loans/Interest rates from 4.25% to 9.25%; maturities from January 2022 to November 2051 | | ** | | 29,078 |

| | | | | | | |

| * | Indicates party-in-interest to the Plan | | | | | | |

| ** | Not applicable - Historical cost information is not required to be presented, as all investments are participant-directed. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Science Applications International Corporation Benefit Plans Committee has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

By: Science Applications International Corporation Benefit Plans Committee

| | | | | | | | | | | |

| Date: June 22, 2022 | | | /s/ Paul C. Lehrer |

| | | Paul C. Lehrer |

| | | Authorized Official |

| | | Science Applications International Corporation |

Exhibit Index

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | |

| | |

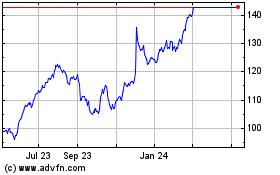

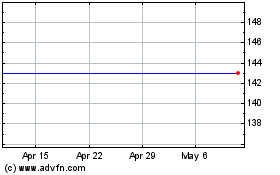

Science Applications (NYSE:SAIC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Science Applications (NYSE:SAIC)

Historical Stock Chart

From Sep 2023 to Sep 2024