Form 8-K - Current report

December 05 2024 - 12:59PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 5, 2024 |

SABINE ROYALTY TRUST

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Texas |

001-08424 |

75-6297143 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Argent Trust Company 3838 Oak Lawn Ave Suite 1720 |

|

Dallas, Texas |

|

75219-4518 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 855 588-7839 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Units of Beneficial Interest |

|

SBR |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On December 5, 2024, the Registrant issued a press release announcing its monthly cash distribution to unitholders of record on December 16, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

This Report on Form 8-K is being furnished pursuant to Item 2.02, Results of Operations and Financial Condition. The information furnished is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

SABINE ROYALTY TRUST |

|

|

|

|

|

|

|

By: ARGENT TRUST COMPANY, TRUSTEE |

|

|

|

|

|

Date: |

December 5, 2024 |

|

By: |

/s/ NANCY WILLIS |

|

|

|

|

Nancy Willis Director of Royalty Trust Services |

Exhibit 99.1

Sabine Royalty Trust

News Release

SABINE ROYALTY TRUST ANNOUNCES

MONTHLY CASH DISTRIBUTION FOR DECEMBER 2024

Dallas, Texas, December 5, 2024 – Argent Trust Company, as Trustee of the Sabine Royalty Trust (NYSE: SBR), today declared a cash distribution to the holders of its units of beneficial interest of $0.311170 per unit, payable on December 30, 2024, to unit holders of record on December 16, 2024. Sabine’s cash distribution history, current and prior year financial reports and tax information booklets, a link to filings made with the Securities and Exchange Commission and more can be found on its website, which has recently been updated with a new look, at http://www.sbr-sabine.com/. Additionally, printed reports can be requested and are mailed free of charge.

This distribution reflects primarily the oil production for September 2024 and the gas production for August 2024, which is considered current production. Preliminary production volumes are approximately 68,183 barrels of oil and 1,536,640 Mcf of gas. Preliminary prices are approximately $71.76 per barrel of oil and $1.39 per Mcf of gas.

This month’s distribution is lower than the previous month’s primarily due to a decrease in oil and gas production, as well as a decrease in the pricing of both oil and natural gas.

The table below compares this month’s production and prices to the previous month’s:

|

|

|

|

|

|

|

|

|

|

|

|

|

Net to Trust Sales |

|

|

|

|

Volumes (a) |

|

Average Price (a) |

|

|

Oil (bbls) |

|

Gas (Mcf) |

|

Oil (per bbl) |

|

Gas (per Mcf) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Month |

|

68,183 |

|

1,536,640 |

|

$71.76 |

|

$1.39 |

|

|

|

|

|

|

|

|

|

Prior Month |

|

70,299 |

|

1,898,789 |

|

$76.90 |

|

$1.78 |

|

|

|

|

|

|

|

|

|

(a)Sales volumes are recorded in the month the Trust receives and identifies the related royalty income. Because of this, sales volumes and pricing may fluctuate from month to month based on the timing of cash receipts.

Revenues are only distributed after they are received, verified, and posted. Most energy companies normally issue payment of royalties on or about the 25th of every month, and depending on mail delivery, a varying amount of royalties are not received until after the revenue posting on the last business day of the month. The revenues received after that date will be posted within 30 days of receipt.

Due to the timing of the end of the month of November, approximately $1,526,000 of revenue received will be posted in the following month of December, in addition to normal cash receipts received during December. Since the close of business in November and prior to this press release, approximately $290,000 in revenue has been received.

Approximately $1,624,000 for 2024 Ad Valorem taxes was deducted from this month’s distribution as compared to $990,000 this time last year. The trustee has been advised that some of the tax renditions have been delayed somewhat this year, so the amounts to be deducted in the January 2025 and February 2025 distributions may be different relative to the same time periods last year. Ad Valorem tax payments are normal expenditures at this time of year.

The 2023 Annual Report with Form 10-K and the January 1, 2024 Reserve Summary are available on the Sabine website at http://www.sbr-sabine.com/.

Forward-looking Statements

Any statements in this press release about future events or conditions, and other statements containing the words “estimates,” “believes,” “anticipates,” “plans,” “expects,” “will,” “may,” “intends” and similar expressions, other than historical facts, constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Factors or risks that could cause the Trust’s actual results to differ materially from the results the Trustee anticipates include, but are not limited to the factors described in Part I, Item 1A, “Risk Factors” of the Trust’s Annual Report on Form 10-K for the year ended December 31, 2023, and Part II, Item 1A, “Risk Factors” of subsequently filed Quarterly Reports on Form 10-Q.

Actual results may differ materially from those indicated by such forward-looking statements. In addition, the forward-looking statements included in this press release represent the Trustee’s views as of the date hereof. The Trustee anticipates that subsequent events and developments may cause its views to change. However, while the Trustee may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Trustee’s views as of any date subsequent to the date hereof.

* * *

Contact: Nancy Willis – Director of Royalty Trust Services

Argent Trust Company

Toll Free (855) 588-7839

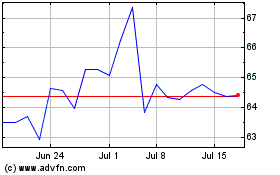

Sabine Royalty (NYSE:SBR)

Historical Stock Chart

From Nov 2024 to Dec 2024

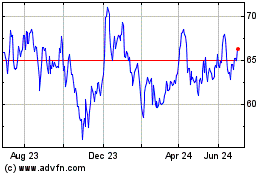

Sabine Royalty (NYSE:SBR)

Historical Stock Chart

From Dec 2023 to Dec 2024