- Successfully completed MAP to Growth operating improvement

program with annualized savings exceeding target by $30

million

- Fourth-quarter net sales increased 19.6% to $1.74 billion

- Fourth-quarter diluted EPS increased 42.9% to $1.20 and

adjusted diluted EPS increased 13.3% to $1.28

- Fiscal 2021 full-year sales increased 10.9% to $6.11

billion

- Fiscal 2021 full-year diluted EPS increased 65.4% to $3.87 and

adjusted diluted EPS increased 35.5% to $4.16

- Record cash from operations of $766.2 million for the full year

driven by margin improvements and good working capital

management

- Supply chain challenges and margin pressure expected to persist

during the fiscal 2022 first-half

RPM International Inc. (NYSE: RPM), a world leader in specialty

coatings, sealants and building materials, today reported financial

results for its fiscal 2021 fourth quarter and year ended May 31,

2021.

“As we conclude a fiscal year unlike any other, I am extremely

grateful for the perseverance of our associates around the world.

Through their efforts, we were able to generate very strong

fourth-quarter and full-year financial results. For the full fiscal

year, consolidated sales increased nearly 11% to $6.1 billion, net

income increased 65% to $502.6 million, and cash flow climbed

nearly 40% to a record $766.2 million,” stated RPM chairman and CEO

Frank C. Sullivan.

“Also at year end, we brought our MAP to Growth operating

improvement program to a successful conclusion. Over the course of

the three-year initiative, we reduced our global manufacturing

footprint by 28 facilities, created a lasting culture of

manufacturing excellence and continuous improvement, consolidated

material spending across our operating companies, negotiated

improved payment terms that helped us to reduce working capital,

consolidated 46 accounting locations, migrated 75% of our

organization to one of four group-level ERP platforms and returned

$1.1 billion of capital to shareholders,” Sullivan continued.

“These actions generated $320 million in annualized cost

savings, which exceeded our original target by $30 million. We also

significantly improved our profit margin profile and cash

generation, as reflected in the cumulative total return generated

by RPM that has exceeded our peer group average over the last three

years,” stated Sullivan. “The operational disciplines we developed

will continue to generate improvements in our profitability, cash

flow and return on investment metrics. Perhaps more significantly,

we maintained our entrepreneurial, growth-focused culture as

evidenced by the fact that our revenues grew at or above our

industry averages throughout the MAP to Growth program. Our ability

to achieve these accomplishments during the disruptions caused by

the global pandemic and unprecedented supply chain challenges is a

testament to the dedication and resilience of the RPM associates

worldwide.”

“While we have officially concluded our 2020 MAP to Growth

operating improvement plan and achieved our primary objectives, we

still expect to generate more than $50 million in incremental MAP

to Growth savings in fiscal 2022. RPM has always been exceptional

at growing the top line. Now, thanks to MAP to Growth, we are a

much more efficient business as well,” stated Sullivan. “Our next

step is to leverage the lessons learned from MAP to Growth to chart

a course for 2025. Over the next six to 12 months, we will be

working on a ‘MAP 2.0’ program in conjunction with our operating

leaders. We remain committed to achieving our long-term goal of a

16% EBIT (earnings before interest and taxes) margin. We will share

more information about this program over the coming quarters.”

Fourth-Quarter Consolidated Results

Fiscal 2021 fourth-quarter net sales were $1.74 billion, an

increase of 19.6% compared to the $1.46 billion reported in the

year-ago period. Fourth-quarter net income increased 42.8% to

$156.1 million compared to net income of $109.3 million in the

prior-year period. Diluted earnings per share (EPS) were $1.20, an

increase of 42.9% compared to diluted EPS of $0.84 in the year-ago

quarter. Income before income taxes (IBT) was $204.3 million

compared to $146.9 million reported in the same period last fiscal

year. RPM’s consolidated EBIT increased 26.6% to $215.0 million

compared to $169.8 million reported in the fiscal 2020 fourth

quarter.

The fourth quarter included restructuring and other items that

are not indicative of ongoing operations of $21.2 million during

fiscal 2021 and $43.8 million in fiscal 2020. Excluding these

items, RPM’s adjusted EBIT was $236.2 million compared to $213.6

million during the year-ago period, which was an increase of 10.6%.

The company has excluded the impact of gains and losses from

marketable securities from adjusted EPS, as their inherent

volatility is outside of management’s control and cannot be

predicted with any level of certainty. These investments resulted

in a net after-tax gain of $11.8 million for the fourth quarter of

fiscal 2021 and a net after-tax loss of $1.9 million during the

same quarter last year. Excluding the restructuring and other

adjustments, as well as investment gains and losses, fiscal 2021

fourth-quarter adjusted diluted EPS increased 13.3% to $1.28

compared to $1.13 in the fiscal 2020 fourth quarter.

“Because of an unusual comparison in our non-operating segment,

our fourth-quarter operating performance was actually better than

indicated by our consolidated adjusted EBIT growth of 10.6%. It’s

important to note that last year’s fourth quarter was impacted by

the pandemic’s onset, which created the extraordinary situation

where our non-operating segment reported a profit due to lower

medical expenses, incentive reversals and other factors. On the

other hand, during this year’s fourth quarter, we experienced

higher insurance costs due to property claims and business

interruptions created by hurricanes and winter storm Uri, as well

as higher incentives tied to improved performance,” stated

Sullivan. “Excluding the impact of our non-operating segment from

both years, our four operating segments generated impressive sales

growth of 19.6% and adjusted EBIT growth of 27.5% as they overcame

margin pressures and supply availability challenges.”

Fourth-Quarter Segment Sales and Earnings

Construction Products Group net sales were a record $629.4

million during the fiscal 2021 fourth quarter, which was an

increase of 33.2% compared to fiscal 2020 fourth-quarter net sales

of $472.4 million. The sales increase was driven by organic growth

of 28.4% and foreign currency translation tailwinds of 4.8%.

Segment IBT was $107.2 million compared to $70.3 million a year

ago. EBIT was $108.9 million, an increase of 50.4% versus EBIT of

$72.4 million in the fiscal 2020 fourth quarter. The segment

incurred $1.5 million in restructuring expenses during the fourth

quarter of fiscal 2021 and $5.0 million in restructuring and other

items not indicative of ongoing operations during the same period

of fiscal 2020. Excluding these charges, fiscal 2021 fourth-quarter

adjusted EBIT was a record $110.4 million compared to adjusted EBIT

of $77.3 million reported during the year-ago period, representing

an increase of 42.7%.

“Construction, maintenance and repair activity accelerated

during the quarter in the U.S. and even more so in international

markets, which had been more heavily constrained, as the impact of

the pandemic eased. Our Construction Products Group capitalized on

this trend and generated record results,” stated Sullivan. “Leading

the way in North America were our businesses that provide

commercial roofing materials and concrete admixtures and repair

products, as well as our European businesses, all of which

generated record sales. Demand for our Nudura insulated concrete

forms remained at elevated levels as a result of their relatively

low installed cost, in addition to their environmental and

structural benefits as compared to traditional building methods.

The bottom line was boosted by volume leveraging, savings from our

MAP to Growth program and higher selling prices.”

Performance Coatings Group net sales were $283.3 million during

the fiscal 2021 fourth quarter, which was an increase of 20.5%

compared to the $235.1 million reported a year ago. Organic sales

increased 12.9% and acquisitions contributed 2.9%. Foreign currency

translation increased sales by 4.7%. Segment IBT was $26.0 million

compared to $18.7 million reported a year ago. EBIT was $25.9

million, an increase of 38.2% compared to $18.7 million in the

fiscal 2020 fourth quarter. The segment reported fourth-quarter

restructuring expenses and acquisition-related costs of $5.1

million in fiscal 2021 as compared to $4.9 million in fiscal 2020.

Adjusted EBIT, which excludes these charges, was $31.0 million

during the fourth quarter of fiscal 2021 compared to adjusted EBIT

of $23.7 million during the year-ago period, representing an

increase of 31.2%.

“Our Performance Coatings Group also benefited from the release

of pent-up demand for the construction, maintenance and repair of

structures in the U.S. and abroad, which it leveraged into strong

year-over-year growth,” stated Sullivan. “This segment had been

particularly challenged through the pandemic because of its greater

exposure to international markets and the oil and gas industry, as

well as a greater reliance on facility access to apply its

products. Points of strength in the segment were its businesses

providing commercial flooring systems and North American bridge and

highway products, as well as a recovery in its international

businesses. Segment earnings increased due to higher sales volumes,

the MAP to Growth program and pricing, which helped to offset raw

material inflation.”

Consumer Group reported record net sales of $628.9 million

during the fourth quarter of fiscal 2021, an increase of 2.0%

compared to net sales of $616.2 million reported in the fourth

quarter of fiscal 2020. Organic sales decreased 3.8%, while

acquisitions contributed 3.8% to sales. Foreign currency

translation increased sales by 2.0%. Consumer Group IBT was $91.0

million compared to $74.6 million in the prior-year period. EBIT

was $91.0 million, an increase of 21.9% compared to $74.7 million

in the fiscal 2020 fourth quarter. The segment incurred

restructuring-related expenses of $2.6 million during the fiscal

2021 fourth quarter and $29.8 million during the year-ago period.

Excluding these charges, fiscal 2021 fourth-quarter adjusted EBIT

was $93.6 million, a decrease of 10.4% compared to adjusted EBIT of

$104.5 million reported during the prior-year period.

“During the first three quarters of this fiscal year, our

Consumer Group’s sales and earnings have grown rapidly as it served

the extraordinary demand for DIY home improvement products by

consumers who were homebound during the pandemic. As more Americans

became vaccinated and were no longer confined to their homes, DIY

home improvement activity began to slow towards the end of the

fourth quarter from its torrid pace since spring of 2020, though

the pace of sales remained higher than pre-pandemic levels. In

international markets, many of which still have stay-at-home orders

in place, sales growth remained quite strong,” stated Sullivan.

“Helping to partially offset the cost pressures were selling price

increases and savings from our MAP to Growth program, some of which

were invested in advertising programs to promote new products.”

The Specialty Products Group reported record net sales of $202.8

million during the fourth quarter of fiscal 2021, which increased

49.9% compared to net sales of $135.2 million in the fiscal 2020

fourth quarter. Organic sales increased 46.2%, while acquisitions

contributed 0.7% to sales. Foreign currency translation increased

sales by 3.0%. Segment IBT was $34.8 million compared with $2.9

million in the prior-year period. EBIT was $34.9 million, an

increase of 1,079.6% compared to $3.0 million in the fiscal 2020

fourth quarter. The segment reported $1.4 million of restructuring

and other items that are not indicative of ongoing operations in

the fourth quarter of fiscal 2021 and $4.4 million in the

comparable prior-year period. Adjusted EBIT, which excludes these

items, was a record $36.3 million in the fiscal 2021 fourth

quarter, an increase of 395.0% compared to adjusted EBIT of $7.3

million in the fiscal 2020 fourth quarter.

“For the second quarter in a row, our Specialty Products Group

generated the highest organic growth among our four operating

segments. Its results have improved sequentially over the past

three quarters with excellent top- and bottom-line results by

nearly all of its businesses, including cleaning chemicals and

restoration equipment as well as coatings for recreational

watercraft, food, pharmaceuticals, wood and other OEM

applications,” Sullivan stated. “Its record results were driven by

recent management changes, increased business development

initiatives and improving market conditions.”

Full-Year Consolidated Results

Fiscal 2021 full-year net sales were $6.11 billion, an increase

of 10.9% compared to $5.51 billion during fiscal 2020. Organic

sales increased 8.1%, while acquisitions added 1.8%. Foreign

currency translation increased sales by 1.0%. Net income was $502.6

million, an increase of 65.1% compared to $304.4 million in fiscal

2020. Diluted EPS increased 65.4% to $3.87 versus $2.34 a year ago.

IBT was $668.4 million compared to $407.8 million reported in

fiscal 2020. EBIT was $709.4 million, an increase of 42.2% versus

the $499.0 million reported last year.

Fiscal 2021 and 2020 included restructuring and other items that

are not indicative of ongoing operations of $75.2 million and

$121.3 million, respectively. Excluding those items in both years,

RPM’s adjusted EBIT was up 26.5% to $784.6 million compared to

adjusted EBIT of $620.3 million last year. Investments resulted in

a net after-tax gain of $31.2 million during fiscal 2021 and a net

after-tax gain of $1.1 million last year. Excluding the

restructuring and other items, as well as investment gains,

adjusted diluted EPS for fiscal 2021 increased 35.5% to $4.16

compared to $3.07 in fiscal 2020.

Full-Year Segment Sales and Earnings

Construction Products Group fiscal 2021 full-year sales were

$2.08 billion, an increase of 10.4% compared to $1.88 billion

during fiscal 2020. Sales grew organically by 9.5% and foreign

currency translation added 0.9%. IBT was $291.8 million versus

year-ago IBT of $209.7 million. Segment EBIT was $299.8 million, an

increase of 37.6% over EBIT of $217.9 million in fiscal 2020. The

segment incurred restructuring and other items not indicative of

ongoing operations of $9.9 million during fiscal 2021 and $14.2

million during fiscal 2020. Excluding these items, fiscal 2021

adjusted EBIT increased 33.4% to $309.7 million from $232.1 million

reported for fiscal 2020.

Performance Coatings Group fiscal 2021 full-year sales declined

by 4.8% to $1.03 billion from $1.08 billion during fiscal 2020.

Organic sales decreased 6.8%, while acquisitions added 0.7%.

Foreign currency translation increased sales by 1.3%. IBT was $90.7

million versus year-ago IBT of $102.3 million. Segment EBIT was

$90.6 million, a decrease of 11.5% from EBIT of $102.3 million

during fiscal 2020. The segment reported restructuring expense and

acquisition-related costs of $13.5 million in fiscal 2021 and $19.4

million in fiscal 2020. Adjusted EBIT, which excludes these

charges, decreased 14.5% to $104.1 million during fiscal 2021 from

adjusted EBIT of $121.8 million during the prior year.

In the Consumer Group, fiscal 2021 sales were up 18.0% to $2.30

billion from $1.95 billion during fiscal 2020. Organic sales

increased 13.3%, while acquisitions added 3.8%. Foreign currency

increased sales by 0.9%. IBT was $354.8 million compared to

year-ago IBT of $198.0 million. Consumer Group fiscal 2021 EBIT was

$355.0 million, an increase of 79.0% compared to $198.3 million

reported a year ago. The segment incurred restructuring expenses

and acquisition-related costs of $13.7 million during fiscal 2021

and $54.7 million during fiscal 2020. Excluding these charges,

fiscal 2021 adjusted EBIT was $368.7 million, an increase of 45.8%

over adjusted EBIT of $253.0 million reported during the prior

period.

Specialty Products Group fiscal 2021 sales were $706.0 million

compared to $601.0 million a year ago, representing an increase of

17.5%. Organic sales increased 13.9%. Acquisitions added 2.3% and

foreign currency translation increased sales by 1.3%. IBT was

$108.2 million versus year-ago IBT of $57.9 million. Fiscal 2021

EBIT in the segment was $108.5 million, an increase of 87.1% versus

$58.0 million a year ago. The segment reported restructuring

expense and other items that are not indicative of ongoing

operations of $6.7 million in fiscal 2021 and $18.7 million in

fiscal 2020. Adjusted EBIT, which excludes these items, was $115.2

million in fiscal 2021, an increase of 50.3% versus $76.7 million

in fiscal 2020.

Cash Flow and Financial Position

For fiscal 2021, cash from operations was a record $766.2

million compared to $549.9 million during fiscal 2020. Capital

expenditures during fiscal 2021 of $157.2 million compare to $147.8

million in fiscal 2020. Total debt at the end of fiscal 2021 was

$2.38 billion compared to $2.54 billion a year ago. Per the terms

of RPM’s bank agreements, the company’s calculated net leverage

ratio was 2.17 on May 31, 2021, which was an improvement as

compared to 2.89 a year ago. RPM’s total liquidity at May 31, 2021

was $1.46 billion, and included $246.7 million of cash and $1.21

billion in committed available credit.

“Our cash flow was excellent and reached a record, increasing

nearly 40% over last year’s record cash flow, primarily due to good

working capital management and margin improvement initiatives. All

working capital metrics improved during the year. As a result of

our strong cash flow, we reinstituted our stock buyback program,

completed multiple acquisitions and are investing more aggressively

to support the growth of our businesses,” stated Sullivan.

Business Outlook

“As mentioned last quarter, a number of macroeconomic factors

are creating inflationary and supply pressures on some of our

product categories. Due to the lag impact resulting from our FIFO

accounting methodology, we expect that our fiscal 2022 first-half

performance will be significantly impacted by inflation throughout

our P&L, which is currently averaging in the upper-teens. We

continue to work to offset these increased costs with incremental

MAP to Growth savings and commensurate selling price increases,

which we will continue to implement as necessary. More importantly,

the limited availability of certain key raw material components is

negatively impacting our ability to meet demand. Our largest such

challenge for the first half of fiscal 2022 will be in our Consumer

Group,” stated Sullivan. “Several factors are compressing margins

in the segment. First, selling price negotiations took place last

spring and material costs have rapidly escalated further since

then. Second, insufficient supply of raw materials, several of

which are severely constrained due to trucking shortages or force

majeure being declared by suppliers, has led to intermittent plant

shutdowns and low productivity. Lastly, the Consumer Group has

outsourced production in several cases to improve service levels at

the expense of margins. In response to these first-half margin

challenges, the Consumer Group is cutting costs and working with

customers to secure additional price increases. We expect that our

other three segments will successfully manage supply challenges to

continue their robust top- and bottom-line momentum from the latest

quarter into the first half of fiscal 2022.”

“Turning now to our first-quarter guidance, we expect

consolidated sales to increase in the low- to mid-single digits

compared to the fiscal 2021 first quarter, when sales grew 9%

creating a difficult year-over-year comparison. Additionally,

supply constraints have slowed production in some product

categories. In spite of these factors, our revenue growth is

expected to continue in three of our four segments,” stated

Sullivan. “We anticipate our Construction Products Group and

Performance Coatings Group to experience sales increases in the

high-single or low-double digits. The Specialty Products Group is

expected to generate double-digit sales increases. These sales

projections are based on the assumption that global economies

continue to improve. Sales in our Consumer Group are expected to

decline double digits as it continues to face difficult comparisons

to the prior year when organic growth was up 34%. However, the

Consumer Group’s fiscal 2022 first-quarter sales are expected to be

above the pre-pandemic record, indicating that we have expanded the

user base for our products since then.”

“We expect our first-quarter adjusted EBIT to grow in three of

our four segments, with the exception again being our Consumer

Group. Based on the anticipated decline in this one segment, our

first-quarter consolidated adjusted EBIT is expected to decrease

25% to 30% versus a difficult prior-year comparison, when adjusted

EBIT in last year’s first quarter was up nearly 40%,” stated

Sullivan.

“Moving to the second quarter of fiscal 2022, we expect good

performance again, with the exception of the Consumer Group, where

we anticipate similar challenges as discussed earlier to result in

a significant decline in adjusted EBIT against difficult prior-year

comparisons when sales were up 21% and adjusted EBIT was up 66%,”

stated Sullivan. “We anticipate that the second-quarter decline in

Consumer will be mostly offset by the combined EBIT growth in our

three other segments, leading to consolidated adjusted EBIT being

roughly flat versus another difficult prior-year comparison, when

consolidated adjusted EBIT was up nearly 30%.”

“After we work through the temporary supply chain challenges, we

expect to emerge with a Consumer Group that has broader

distribution and a larger user base than it had before the

pandemic,” stated Sullivan. “For our other three segments, good

results are expected to continue due to recent strategic changes in

our Specialty Products Group continuing to bear fruit and the catch

up of deferred maintenance driving additional business at our

Construction Products Group and Performance Coatings Group.”

Webcast and Conference Call Information

Management will host a conference call to discuss these results

beginning at 10:00 a.m. EDT today. The call can be accessed via

webcast at www.RPMinc.com/Investors/Presentations-Webcasts/ or by

dialing 833-323-0996 or 236-712-2462 for international callers.

Participants are asked to call the assigned number approximately 10

minutes before the conference call begins. The call, which will

last approximately one hour, will be open to the public, but only

financial analysts will be permitted to ask questions. The media

and all other participants will be in a listen-only mode.

For those unable to listen to the live call, a replay will be

available from approximately 1:00 p.m. EDT on July 26, 2021 until

11:59 p.m. EDT on August 2, 2021. The replay can be accessed by

dialing 800-585-8367 or 416-621-4642 for international callers. The

access code is 3685703. The call also will be available for replay

and as a written transcript via the RPM website at

www.RPMinc.com.

About RPM

RPM International Inc. owns subsidiaries that are world leaders

in specialty coatings, sealants, building materials and related

services. The company operates across four reportable segments:

consumer, construction products, performance coatings and specialty

products. RPM has a diverse portfolio with hundreds of

market-leading brands, including Rust-Oleum, DAP, Zinsser,

Varathane, Day-Glo, Legend Brands, Stonhard, Carboline, Tremco and

Dryvit. From homes and workplaces, to infrastructure and precious

landmarks, RPM’s brands are trusted by consumers and professionals

alike to help build a better world. The company employs

approximately 15,500 individuals worldwide. Visit www.RPMinc.com to

learn more.

For more information, contact Russell L. Gordon, vice president

and chief financial officer, at 330-273-5090 or

rgordon@rpminc.com.

# # #

Use of Non-GAAP Financial Information

To supplement the financial information presented in accordance

with Generally Accepted Accounting Principles in the United States

(“GAAP”) in this earnings release, we use EBIT, adjusted EBIT and

adjusted earnings per share, which are all non-GAAP financial

measures. EBIT is defined as earnings (loss) before interest and

taxes, with adjusted EBIT and adjusted earnings per share provided

for the purpose of adjusting for one-off items impacting revenues

and/or expenses that are not considered by management to be

indicative of ongoing operations. We evaluate the profit

performance of our segments based on income before income taxes,

but also look to EBIT as a performance evaluation measure because

interest expense is essentially related to acquisitions, as opposed

to segment operations. For that reason, we believe EBIT is also

useful to investors as a metric in their investment decisions. EBIT

should not be considered an alternative to, or more meaningful

than, income before income taxes as determined in accordance with

GAAP, since EBIT omits the impact of interest and investment income

or expense in determining operating performance, which represent

items necessary to our continued operations, given our level of

indebtedness. Nonetheless, EBIT is a key measure expected by and

useful to our fixed income investors, rating agencies and the

banking community all of whom believe, and we concur, that this

measure is critical to the capital markets' analysis of our

segments' core operating performance. We also evaluate EBIT because

it is clear that movements in EBIT impact our ability to attract

financing. Our underwriters and bankers consistently require

inclusion of this measure in offering memoranda in conjunction with

any debt underwriting or bank financing. EBIT may not be indicative

of our historical operating results, nor is it meant to be

predictive of potential future results. See the financial statement

section of this earnings release for a reconciliation of EBIT and

adjusted EBIT to income before income taxes, and adjusted earnings

per share to earnings per share. We have not provided a

reconciliation of our first and second quarter fiscal 2022 adjusted

EBIT guidance because material terms that impact such measures are

not in our control and/or cannot be reasonably predicted, and

therefore a reconciliation of such measures is not available

without unreasonable effort.

Forward-Looking Statements

This press release contains “forward-looking statements”

relating to our business. These forward-looking statements, or

other statements made by us, are made based on our expectations and

beliefs concerning future events impacting us and are subject to

uncertainties and factors (including those specified below), which

are difficult to predict and, in many instances, are beyond our

control. As a result, our actual results could differ materially

from those expressed in or implied by any such forward-looking

statements. These uncertainties and factors include (a) global

markets and general economic conditions, including uncertainties

surrounding the volatility in financial markets, the availability

of capital and the effect of changes in interest rates; (b) the

prices, supply and availability of raw materials, including

assorted pigments, resins, solvents, and other natural gas- and

oil-based materials; packaging, including plastic and metal

containers; and transportation services, including fuel surcharges;

(c) continued growth in demand for our products; (d) legal,

environmental and litigation risks inherent in our construction and

chemicals businesses and risks related to the adequacy of our

insurance coverage for such matters; (e) the effect of changes in

interest rates; (f) the effect of fluctuations in currency exchange

rates upon our foreign operations; (g) the effect of non-currency

risks of investing in and conducting operations in foreign

countries, including those relating to domestic and international

political, social, economic and regulatory factors; (h) risks and

uncertainties associated with our ongoing acquisition and

divestiture activities; (i) the timing of and the realization of

anticipated cost savings from restructuring initiatives and the

ability to identify additional cost savings opportunities; (j)

risks related to the adequacy of our contingent liability reserves;

(k) risks relating to the Covid pandemic; (l) risks related to

adverse weather conditions or the impacts of climate change and

natural disasters; and (m) other risks detailed in our filings with

the Securities and Exchange Commission, including the risk factors

set forth in our Annual Report on Form 10-K for the year ended May

31, 2020, as the same may be updated from time to time. We do not

undertake any obligation to publicly update or revise any

forward-looking statements to reflect future events, information or

circumstances that arise after the date of this release.

CONSOLIDATED STATEMENTS OF INCOME IN THOUSANDS,

EXCEPT PER SHARE DATA (Unaudited)

Three Months Ended

Year Ended May 31, May 31, May 31,

May 31,

2021

2020

2021

2020

Net Sales

$

1,744,307

$

1,458,962

$

6,106,288

$

5,506,994

Cost of Sales

1,050,916

905,006

3,701,129

3,414,139

Gross Profit

693,391

553,956

2,405,159

2,092,855

Selling, General & Administrative Expenses

466,471

362,861

1,664,026

1,548,653

Restructuring Charges

5,826

14,344

18,106

33,108

Interest Expense

21,425

22,372

85,400

101,003

Investment (Income) Expense, Net

(10,716

)

615

(44,450

)

(9,739

)

Other Expense, Net

6,132

6,909

13,639

12,066

Income Before Income Taxes

204,253

146,855

668,438

407,764

Provision for Income Taxes

47,889

37,680

164,938

102,682

Net Income

156,364

109,175

503,500

305,082

Less: Net Income (Loss) Attributable to Noncontrolling Interests

217

(139

)

857

697

Net Income Attributable to RPM International Inc.

Stockholders

$

156,147

$

109,314

$

502,643

$

304,385

Earnings per share of common stock attributable to

RPM International Inc. Stockholders: Basic

$

1.21

$

0.85

$

3.89

$

2.35

Diluted

$

1.20

$

0.84

$

3.87

$

2.34

Average shares of common stock outstanding - basic

127,977

128,155

128,334

128,468

Average shares of common stock outstanding - diluted

129,728

129,623

128,927

129,974

SUPPLEMENTAL SEGMENT INFORMATION IN THOUSANDS

(Unaudited)

Three Months Ended Year Ended

May 31, May 31, May 31, May 31,

2021

2020

2021

2020

Net Sales: CPG Segment

$

629,386

$

472,408

$

2,076,565

$

1,880,105

PCG Segment

283,311

235,063

1,028,456

1,080,701

Consumer Segment

628,859

616,246

2,295,277

1,945,220

SPG Segment

202,751

135,245

705,990

600,968

Total

$

1,744,307

$

1,458,962

$

6,106,288

$

5,506,994

Income Before Income Taxes: CPG Segment Income Before

Income Taxes (a)

$

107,160

$

70,339

$

291,773

$

209,663

Interest (Expense), Net (b)

(1,705

)

(2,033

)

(8,030

)

(8,265

)

EBIT (c)

108,865

72,372

299,803

217,928

MAP to Growth related initiatives (d)

1,512

5,992

10,158

14,702

Acquisition-related costs (e)

-

-

-

548

Adjustment to Exit Flowcrete China (g)

-

(1,039

)

(305

)

(1,039

)

Adjusted EBIT

$

110,377

$

77,325

$

309,656

$

232,139

PCG Segment Income Before Income Taxes (a)

$

25,968

$

18,728

$

90,687

$

102,345

Interest Income (Expense), Net (b)

76

(2

)

128

18

EBIT (c)

25,892

18,730

90,559

102,327

MAP to Growth related initiatives (d)

4,586

4,854

12,949

19,247

Acquisition-related costs (e)

546

66

546

184

Adjusted EBIT

$

31,024

$

23,650

$

104,054

$

121,758

Consumer Segment Income Before Income Taxes (a)

$

90,976

$

74,612

$

354,789

$

198,024

Interest (Expense), Net (b)

(56

)

(54

)

(242

)

(272

)

EBIT (c)

91,032

74,666

355,031

198,296

MAP to Growth related initiatives (d)

2,551

29,799

12,527

54,695

Acquisition-related costs (e)

-

-

1,178

-

Adjusted EBIT

$

93,583

$

104,465

$

368,736

$

252,991

SPG Segment Income Before Income Taxes (a)

$

34,827

$

2,901

$

108,242

$

57,933

Interest (Expense), Net (b)

(65

)

(57

)

(284

)

(62

)

EBIT (c)

34,892

2,958

108,526

57,995

MAP to Growth related initiatives (d)

1,400

4,371

6,732

18,485

Acquisition-related costs (e)

-

-

-

187

Unusual executive costs, net of insurance proceeds (f)

(10

)

-

(10

)

-

Adjusted EBIT

$

36,282

$

7,329

$

115,248

$

76,667

TOTAL OPERATIONS Income Before Income Taxes (a)

$

258,931

$

166,580

$

845,491

$

567,965

Interest (Expense), Net (b)

(1,750

)

(2,146

)

(8,428

)

(8,581

)

EBIT (c)

260,681

168,726

853,919

576,546

MAP to Growth related initiatives (d)

10,049

45,016

42,366

107,129

Acquisition-related costs (e)

546

66

1,724

919

Unusual executive costs, net of insurance proceeds (f)

(10

)

-

(10

)

-

Adjustment to Exit Flowcrete China (g)

-

(1,039

)

(305

)

(1,039

)

Adjusted EBIT

$

271,266

$

212,769

$

897,694

$

683,555

Corporate/Other (Loss) Before Income Taxes (a)

$

(54,678

)

$

(19,725

)

$

(177,053

)

$

(160,201

)

Interest (Expense), Net (b)

(8,959

)

(20,841

)

(32,522

)

(82,683

)

EBIT (c)

(45,719

)

1,116

(144,531

)

(77,518

)

MAP to Growth related initiatives (d)

10,377

1,420

30,406

15,960

Unusual executive costs, net of insurance proceeds (f)

272

(1,696

)

(996

)

(1,696

)

Settlement for SEC Investigation & Enforcement Action (h)

-

-

2,000

-

Adjusted EBIT

$

(35,070

)

$

840

$

(113,121

)

$

(63,254

)

TOTAL CONSOLIDATED Income Before Income Taxes

(a)

$

204,253

$

146,855

$

668,438

$

407,764

Interest (Expense)

(21,425

)

(22,372

)

(85,400

)

(101,003

)

Investment Income (Expense), Net

10,716

(615

)

44,450

9,739

EBIT (c)

214,962

169,842

709,388

499,028

MAP to Growth related initiatives (d)

20,426

46,436

72,772

123,089

Acquisition-related costs (e)

546

66

1,724

919

Unusual executive costs, net of insurance proceeds (f)

262

(1,696

)

(1,006

)

(1,696

)

Adjustment to Exit Flowcrete China (g)

-

(1,039

)

(305

)

(1,039

)

Settlement for SEC Investigation & Enforcement Action

(h)

-

-

2,000

-

Adjusted EBIT

$

236,196

$

213,609

$

784,573

$

620,301

(a)

The presentation includes a reconciliation

of Income (Loss) Before Income Taxes, a measure defined by

Generally Accepted Accounting Principles in the United States

(GAAP), to EBIT and Adjusted EBIT.

(b)

Interest Income (Expense), Net includes

the combination of Interest Income (Expense) and Investment Income

(Expense), Net.

(c)

EBIT is defined as earnings (loss) before

interest and taxes, with Adjusted EBIT provided for the purpose of

adjusting for items impacting earnings that are not considered by

management to be indicative of ongoing operations. We evaluate the

profit performance of our segments based on income before income

taxes, but also look to EBIT, or adjusted EBIT, as a performance

evaluation measure because interest expense is essentially related

to acquisitions, as opposed to segment operations. For that reason,

we believe EBIT is also useful to investors as a metric in their

investment decisions. EBIT should not be considered an alternative

to, or more meaningful than, income before income taxes as

determined in accordance with GAAP, since EBIT omits the impact of

interest and investment income or expense in determining operating

performance, which represent items necessary to our continued

operations, given our level of indebtedness. Nonetheless, EBIT is a

key measure expected by and useful to our fixed income investors,

rating agencies and the banking community all of whom believe, and

we concur, that this measure is critical to the capital markets'

analysis of our segments' core operating performance. We also

evaluate EBIT because it is clear that movements in EBIT impact our

ability to attract financing. Our underwriters and bankers

consistently require inclusion of this measure in offering

memoranda in conjunction with any debt underwriting or bank

financing. EBIT may not be indicative of our historical operating

results, nor is it meant to be predictive of potential future

results.

(d)

Reflects restructuring and other charges,

all of which have been incurred in relation to our Margin

Acceleration Plan initiatives, as follows.

"Inventory-related charges," all of which

have been recorded in Cost of Goods Sold;

"Headcount reductions, closures of

facilities and related costs, and accelerated vesting of equity

awards," all of which have been recorded in Restructuring

Expense;

"Accelerated Expense - Other," "Receivable

writeoffs (recoveries)," "ERP consolidation plan," "Professional

Fees," "Unusual costs triggered by executive departures,"

"Divestitures," & "Discontinued Product Line," all of which

have been recorded in Selling, General & Administrative

Expenses.

(e)

Acquisition costs reflect amounts included

in gross profit for inventory step-ups.

(f)

Reflects unusual compensation costs, net

of insurance proceeds, recorded unrelated to our MAP to Growth

initiative, including stock and deferred compensation plan

arrangements.

(g)

In FY18, we added back a charge to exit

our Flowcrete China business. Included in that charge from FY18 was

an accrual for a contingent liability. During Q2 2021, the

contingent liability was resolved, and a favorable adjustment of ~

$0.3 million was recognized.

(h)

On December 22, 2020, the Court entered

its Final Judgment resolving the legacy "SEC Investigation &

Enforcement Action." We agreed to pay a civil monetary penalty of

$2.0 million under Section 21(d)(3) of the Exchange Act. The

settlement amount was accrued for in our consolidated financial

statements as of the period ending November 30, 2020, and paid

during our fiscal 3rd quarter ending February 28, 2021.

SUPPLEMENTAL INFORMATION RECONCILIATION OF

"REPORTED" TO "ADJUSTED" AMOUNTS (Unaudited)

Three

Months Ended Year Ended May 31, May 31,

May 31, May 31,

2021

2020

2021

2020

Reconciliation of Reported Earnings

per Diluted Share toAdjusted Earnings per Diluted Share (All

amounts presented after-tax): Reported Earnings per

Diluted Share

$

1.20

$

0.84

$

3.87

$

2.34

MAP to Growth related initiatives (d)

0.13

0.30

0.45

0.75

Acquisition-related costs (e)

-

-

0.01

0.01

Unusual executive costs, net of insurance proceeds (f)

-

(0.01

)

(0.01

)

(0.01

)

Adjustment to Exit Flowcrete China (g)

-

(0.01

)

-

(0.01

)

Settlement for SEC Investigation & Enforcement Action (h)

-

-

0.01

-

Discrete Tax Adjustments (i)

0.04

-

0.08

-

Investment returns (j)

(0.09

)

0.01

(0.25

)

(0.01

)

Adjusted Earnings per Diluted Share (k)

$

1.28

$

1.13

$

4.16

$

3.07

(d)

Reflects restructuring and other charges,

all of which have been incurred in relation to our Margin

Acceleration Plan initiatives, as follows.

"Inventory-related charges," all of which

have been recorded in Cost of Goods Sold;

"Headcount reductions, closures of

facilities and related costs, and accelerated vesting of equity

awards," all of which have been recorded in Restructuring

Expense;

"Accelerated Expense - Other," "Receivable

writeoffs (recoveries)," "ERP consolidation plan," "Professional

Fees," "Unusual costs triggered by executive departures,"

"Divestitures," & "Discontinued Product Line," all of which

have been recorded in Selling, General & Administrative

Expenses.

(e)

Acquisition costs reflect amounts included

in gross profit for inventory step-ups.

(f)

Reflects unusual compensation costs, net

of insurance proceeds, recorded unrelated to our MAP to Growth

initiative, including stock and deferred compensation plan

arrangements.

(g)

In FY18, we added back a charge to exit

our Flowcrete China business. Included in that charge from FY18 was

an accrual for a contingent liability. During Q2 2021, the

contingent liability was resolved, and a favorable adjustment of ~

$0.3 million was recognized.

(h)

On December 22, 2020, the Court entered

its Final Judgment resolving the legacy "SEC Investigation &

Enforcement Action." We agreed to pay a civil monetary penalty of

$2.0 million under Section 21(d)(3) of the Exchange Act. The

settlement amount was accrued for in our consolidated financial

statements as of the period ending November 30, 2020, and paid

during our fiscal 3rd quarter ending February 28, 2021.

(i)

Includes income tax charges for an

increase to our deferred income tax liability for withholding taxes

on additional unremitted foreign earnings not considered

permanently reinvested and for income tax charges related to

certain foreign legal entity restructurings.

(j)

Investment returns include realized net

gains and losses on sales of investments and unrealized net gains

and losses on equity securities, which are adjusted due to their

inherent volatility. Management does not consider these gains and

losses, which cannot be predicted with any level of certainty, to

be reflective of the Company's core business operations.

(k)

Adjusted EPS is provided for the purpose

of adjusting diluted earnings per share for items impacting

earnings that are not considered by management to be indicative of

ongoing operations.

CONSOLIDATED BALANCE SHEETS IN THOUSANDS (Unaudited)

May 31, 2021 May 31, 2020 Assets

Current Assets Cash and cash equivalents

$

246,704

$

233,416

Trade accounts receivable

1,336,728

1,193,804

Allowance for doubtful accounts

(55,922

)

(55,847

)

Net trade accounts receivable

1,280,806

1,137,957

Inventories

938,095

810,448

Prepaid expenses and other current assets

316,399

241,608

Total current assets

2,782,004

2,423,429

Property, Plant and Equipment, at Cost

1,967,482

1,755,190

Allowance for depreciation

(1,002,300

)

(905,504

)

Property, plant and equipment, net

965,182

849,686

Other Assets Goodwill

1,345,754

1,250,066

Other intangible assets, net of amortization

628,693

584,380

Operating lease right-of-use assets

300,827

284,491

Deferred income taxes, non-current

26,804

30,894

Other

203,705

208,008

Total other assets

2,505,783

2,357,839

Total Assets

$

6,252,969

$

5,630,954

Liabilities and Stockholders' Equity Current

Liabilities Accounts payable

$

717,176

$

535,311

Current portion of long-term debt

1,282

80,890

Accrued compensation and benefits

258,380

185,531

Accrued losses

29,054

20,021

Other accrued liabilities

325,522

271,827

Total current liabilities

1,331,414

1,093,580

Long-Term Liabilities Long-term debt, less current

maturities

2,378,544

2,458,290

Operating lease liabilities

257,415

244,691

Other long-term liabilities

436,176

510,175

Deferred income taxes

106,395

59,555

Total long-term liabilities

3,178,530

3,272,711

Total liabilities

4,509,944

4,366,291

Stockholders' Equity Preferred stock; none issued

-

-

Common stock (outstanding 129,573; 129,511)

1,295

1,295

Paid-in capital

1,055,400

1,014,428

Treasury stock, at cost

(653,006

)

(580,117

)

Accumulated other comprehensive (loss)

(514,884

)

(717,497

)

Retained earnings

1,852,259

1,544,336

Total RPM International Inc. stockholders' equity

1,741,064

1,262,445

Noncontrolling interest

1,961

2,218

Total equity

1,743,025

1,264,663

Total Liabilities and Stockholders' Equity

$

6,252,969

$

5,630,954

CONSOLIDATED STATEMENTS OF CASH FLOWS IN

THOUSANDS (Unaudited)

Year Ended May 31, May

31,

2021

2020

Cash Flows From Operating Activities: Net

income

$

503,500

$

305,082

Adjustments to reconcile net income to net cash provided by (used

for) operating activities: Depreciation and amortization

146,857

156,842

Restructuring charges, net of payments

(2,909

)

6,831

Fair value adjustments to contingent earnout obligations

(582

)

680

Deferred income taxes

20,188

(12,150

)

Stock-based compensation expense

40,926

19,789

Net (gain) on marketable securities

(38,774

)

(1,132

)

Other

(2,340

)

(77

)

Changes in assets and liabilities, net of effect from purchases and

sales of businesses: (Increase) decrease in receivables

(88,618

)

82,060

(Increase) decrease in inventory

(68,802

)

21,309

(Increase) decrease in prepaid expenses and other

(11,457

)

17,614

current and long-term assets Increase (decrease) in accounts

payable

151,388

(27,111

)

Increase (decrease) in accrued compensation and benefits

62,966

(6,198

)

Increase in accrued losses

8,510

487

Increase (decrease) in other accrued liabilities

43,010

(23,665

)

Other

2,293

9,558

Cash Provided By Operating Activities

766,156

549,919

Cash Flows From Investing Activities: Capital expenditures

(157,199

)

(147,756

)

Acquisition of businesses, net of cash acquired

(165,223

)

(65,102

)

Purchase of marketable securities

(121,669

)

(28,891

)

Proceeds from sales of marketable securities

112,298

31,337

Other

5,405

799

Cash (Used For) Investing Activities

(326,388

)

(209,613

)

Cash Flows From Financing Activities: Additions to long-term

and short-term debt

-

485,306

Reductions of long-term and short-term debt

(188,278

)

(471,035

)

Cash dividends

(194,720

)

(185,101

)

Repurchases of common stock

(49,956

)

(125,000

)

Shares of common stock returned for taxes

(22,826

)

(18,075

)

Payments of acquisition-related contingent consideration

(2,218

)

(606

)

Other

(1,621

)

(2,359

)

Cash (Used For) Financing Activities

(459,619

)

(316,870

)

Effect of Exchange Rate Changes on Cash and Cash

Equivalents

33,139

(13,188

)

Net Change in Cash and Cash Equivalents

13,288

10,248

Cash and Cash Equivalents at Beginning of Period

233,416

223,168

Cash and Cash Equivalents at End of Period

$

246,704

$

233,416

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210726005243/en/

Russell L. Gordon Vice President and Chief Financial Officer

330-273-5090 rgordon@rpminc.com

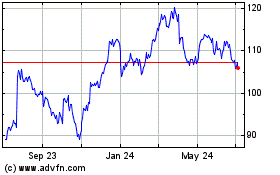

RPM (NYSE:RPM)

Historical Stock Chart

From Oct 2024 to Nov 2024

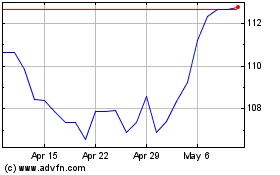

RPM (NYSE:RPM)

Historical Stock Chart

From Nov 2023 to Nov 2024