Filing by Certain Investment Companies of Rule 482 Advertising in Accordance With Rule 497 and the Note to Rule 482(e) (497ad)

February 01 2023 - 6:06AM

Edgar (US Regulatory)

RiverNorth

CAPITAL AND INCOME Fund, INC.*

Announces FINAL RESULTS OF Rights Offering

West Palm Beach, FL– January 31, 2023

– RiverNorth Capital and Income Fund, Inc. (NYSE: RSF) (the “Fund”) today announced the final results of its transferable

rights offering (the “Offering”). The Fund will issue a total of 1,047,000 new shares of common stock as a result of the Offering,

which closed on January 27, 2023 (the “Expiration Date”).

The subscription price of $15.84 per share in the

Offering was established on the Expiration Date based on a formula equal to 90% of the reported net asset value per share of common stock.

Gross proceeds received by the Fund, before any expenses of the Offering, are expected to total approximately $16.6 million.

The Offering was oversubscribed and the over-subscription

requests exceeded the over-subscription shares available. Accordingly, the shares issued as part of the over-subscription privilege of

the Offering will be allocated pro-rata among record date stockholders who submitted over-subscription requests based on the number of

rights originally issued to them by the Fund.

This press release shall not constitute an offer to

sell or constitute a solicitation of an offer to buy.

| * | Formerly known as RiverNorth Specialty Finance Corporation. |

RiverNorth Capital and Income Fund, Inc.

The investment objective of the Fund is to seek a

high level of current income. The Fund had approximately $57.2 million of net assets and 3.3 million shares of common stock outstanding

as of December 31, 2022.

The Fund is a closed-end fund and does not continuously

issue stock for sale as open-end mutual funds do. The Fund now trades in the secondary market. Investors wishing to buy or sell stock

need to place orders through an intermediary or broker. The share price of a closed-end fund is based on the market value.

Risk is inherent in all investing. Investing in any

investment company security involves risk, including the risk that you may receive little or no return on your investment or even that

you may lose part or all of your investment. Therefore, before investing in the shares of common stock, you should consider the risks

as well as the other information in the prospectus, annual report and semi-annual report.

Past performance is no guarantee of future results.

See the Prospectus for a more detailed description

of Fund risks.

The profitability of specialty finance and other financial

companies is largely dependent upon the availability and cost of capital funds and may fluctuate significantly in response to changes

in interest rates, as well as changes in general economic conditions. If the borrower of Alternative Credit (as defined below) in which

the Fund invests is unable to make its payments on a loan, the Fund may be greatly limited in its ability to recover any outstanding principal

and interest under such loan, as (among other reasons) the Fund may not have direct recourse against the borrower or may otherwise be

limited in its ability to directly enforce its rights under the loan, whether through the borrower or the platform through which such

loan was originated, the loan may be unsecured or under collateralized, and/or it may be impracticable to commence a legal proceeding

against the defaulting borrower. Substantially all of the Alternative Credit in which the Fund invests will not be guaranteed or insured

by a third party. In addition, the Alternative Credit Instruments in which the Fund may invest will not be backed by any governmental

authority. Prospective borrowers supply a variety of information regarding the purpose of the loan, income, occupation and employment

status (as applicable) to the lending platforms. As a general matter, platforms do not verify the majority of this information, which

may be incomplete, inaccurate, false or misleading. Prospective borrowers may misrepresent any of the information they provide to the

platforms, including their intentions for the use of the loan proceeds. Alternative Credit Instruments are generally not rated by the

nationally recognized statistical rating organizations (“NRSROs”). Such unrated instruments, however, are considered to be

comparable in quality to securities falling into any of the ratings categories used by such NRSROs to classify "junk" bonds

(i.e., below investment grade securities). Accordingly, the Fund’s unrated Alternative Credit Instrument investments constitute

highly risky and speculative investments similar to investments in “junk” bonds, notwithstanding that the Fund is not permitted

to invest in loans that are of subprime quality at the time of investment. Although the Fund is not permitted to invest in loans that

are of subprime quality at the time of investment, an investment in the Fund’s Shares should be considered speculative and involving

a high degree of risk, including the risk of loss of investment. There can be no assurance that payments due on underlying loans, including

Alternative Credit, will be made.

Diversification does not ensure a profit or a guarantee

against loss.

The Fund’s investment objectives, risks,

charges and expenses must be considered carefully before investing. The Fund’s prospectus and most recent periodic reports contain

this and other important information about the investment company and may be obtained by visiting rivernorth.com/literature or by calling

844.569.4750. Read the Prospectus carefully before investing.

RiverNorth Capital Management, LLC

RiverNorth is an investment management firm founded

in 2000 that specializes in opportunistic strategies in niche markets where the potential to exploit inefficiencies is greatest. RiverNorth

is the manager to multiple registered and private funds.

Investor Contact

Chris Lakumb, CFA, CAIA

312.445.2336

clakumb@rivernorth.com

Not FDIC Insured | May Lose Value | No Bank Guarantee

RiverNorth® is a registered trademark of RiverNorth Capital Management,

LLC.

Marketing services provided by ALPS Distributors Inc. ALPS and RiverNorth

are not affiliated.

©2000-2023 RiverNorth Capital Management, LLC. All rights reserved.

RVN001645

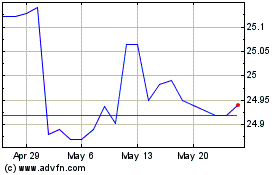

RiverNorth Capital and I... (NYSE:RMPL-)

Historical Stock Chart

From Oct 2024 to Nov 2024

RiverNorth Capital and I... (NYSE:RMPL-)

Historical Stock Chart

From Nov 2023 to Nov 2024