RH Announces Chairman & CEO Gary Friedman Purchased $10 Million of RH Stock in the Open Market

June 27 2024 - 6:00AM

Business Wire

RH announced today that Chairman & CEO Gary Friedman

completed the purchase of $10 million of RH stock at an average

price per share of $216.10 representing 46,274 shares.

With this purchase, Mr. Friedman beneficially owns as of June

26, 2024, 5,051,337 shares, or 25.1% of the outstanding shares of

RH common stock, based on 18,445,222 shares outstanding as of June

7, 2024, as reported in RH’s first quarter fiscal 2024 Form 10-Q.

This represents an increase in Mr. Friedman’s beneficial ownership

by 0.2%. Mr. Friedman's beneficial ownership is determined for

these purposes in accordance with the rules and regulations of the

SEC and includes 1,700,000 shares of common stock issuable upon the

exercise of options that were exercisable within 60 days of June

26, 2024. As of June 26, 2024, 583,334 of these options were

subject to selling restrictions.

ABOUT RH

RH (NYSE: RH) is a curator of design, taste and style in the

luxury lifestyle market. The company offers collections through its

retail galleries, sourcebooks and online at RH.com,

RHContemporary.com, RHModern.com, RHBabyandChild.com, RHTEEN.com,

and Waterworks.com

FORWARD LOOKING STATEMENTS

This release contains forward-looking statements within the

meaning of the federal securities laws. These statements include,

but are not limited to, those relating to purchases of our common

stock by our Chairman & CEO and any assumptions or implications

of such statements, such as that our common stock may be

undervalued. You can identify forward-looking statements by the

fact that they do not relate strictly to historical or current

facts. We cannot assure you that future developments affecting us

will be those that we have anticipated. Important risks and

uncertainties that could cause actual results to differ materially

from our expectations include, among others, risks related to civil

unrest; risks related to general economic conditions and the

housing market as well as the impact of economic conditions on

consumer confidence and spending; changes in customer demand for

our products; our ability to anticipate consumer preferences and

buying trends; consumer spending based on weather and other

conditions beyond our control; risks related to the number of new

business initiatives we are undertaking; our ability to obtain our

products in a timely fashion or in the quantities required; risks

related to our sourcing and supply chain including our dependence

on imported products produced by foreign manufacturers and risks

related to importation of such products, as well as those risks and

uncertainties disclosed under the sections entitled “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” in RH’s most recent Form 10-K and Forms

10-Q filed with the Securities and Exchange Commission, and similar

disclosures in subsequent reports filed with the SEC, which are

available on our investor relations website at ir.rh.com and on the

SEC website at www.sec.gov. Any forward-looking statement made by

us in this press release speaks only as of the date on which we

make it. We undertake no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except as may be required by any

applicable securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240627604569/en/

PRESS truthgroup@RH.com

INVESTOR RELATIONS Allison Malkin,

203.682.8225, allison.malkin@icrinc.com

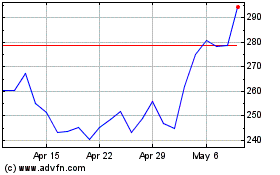

RH (NYSE:RH)

Historical Stock Chart

From Nov 2024 to Dec 2024

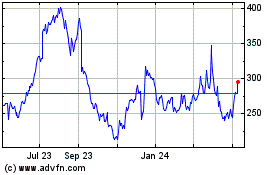

RH (NYSE:RH)

Historical Stock Chart

From Dec 2023 to Dec 2024