Reliance, Inc. (NYSE: RS) today reported its financial results for

the third quarter ended September 30, 2024.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in

millions, except tons which are in thousands, average selling price

per ton sold and per share amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Sequential Quarter |

|

Nine Months Ended September 30, |

|

Year-Over-Year |

|

|

|

|

Year-Over-Year |

| |

|

Q3 2024* |

|

Q2 2024 |

|

% Change |

|

2024 |

|

2023 |

|

% Change |

|

Q3 2023 |

|

% Change |

| Income Statement

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

3,420.3 |

|

|

$ |

3,643.3 |

|

|

(6.1 |

%) |

|

$ |

10,708.4 |

|

|

$ |

11,468.6 |

|

|

(6.6 |

%) |

|

$ |

3,623.0 |

|

|

(5.6 |

%) |

| Gross profit1 |

|

$ |

1,006.3 |

|

|

$ |

1,086.0 |

|

|

(7.3 |

%) |

|

$ |

3,220.5 |

|

|

$ |

3,525.7 |

|

|

(8.7 |

%) |

|

$ |

1,077.0 |

|

|

(6.6 |

%) |

| Gross profit

margin1 |

|

|

29.4% |

|

|

|

29.8% |

|

|

(0.4 |

%) |

|

|

30.1% |

|

|

|

30.7% |

|

|

(0.6 |

%) |

|

|

29.7% |

|

|

(0.3 |

%) |

| Non-GAAP gross profit

margin1,2 |

|

|

29.4% |

|

|

|

29.8% |

|

|

(0.4 |

%) |

|

|

30.1% |

|

|

|

30.7% |

|

|

(0.6 |

%) |

|

|

29.7% |

|

|

(0.3 |

%) |

| LIFO income |

|

$ |

(50.0 |

) |

|

$ |

(50.0 |

) |

|

|

|

$ |

(150.0 |

) |

|

$ |

(105.0 |

) |

|

|

|

$ |

(45.0 |

) |

|

|

| LIFO income as a % of net

sales |

|

|

(1.5% |

) |

|

|

(1.4% |

) |

|

(0.1 |

%) |

|

|

(1.4% |

) |

|

|

(0.9% |

) |

|

(0.5 |

%) |

|

|

(1.2% |

) |

|

(0.3 |

%) |

| LIFO income per diluted share,

net of tax |

|

$ |

(0.68 |

) |

|

$ |

(0.66 |

) |

|

|

|

$ |

(1.98 |

) |

|

$ |

(1.33 |

) |

|

|

|

$ |

(0.57 |

) |

|

|

| Non-GAAP pretax expense

(income) adjustments² |

|

$ |

2.5 |

|

|

$ |

(1.6 |

) |

|

|

|

$ |

5.8 |

|

|

$ |

(3.8 |

) |

|

|

|

$ |

1.0 |

|

|

|

| Pretax income |

|

$ |

260.5 |

|

|

$ |

349.7 |

|

|

(25.5 |

%) |

|

$ |

1,006.4 |

|

|

$ |

1,407.4 |

|

|

(28.5 |

%) |

|

$ |

388.0 |

|

|

(32.9 |

%) |

| Non-GAAP pretax income2 |

|

$ |

263.0 |

|

|

$ |

348.1 |

|

|

(24.4 |

%) |

|

$ |

1,012.2 |

|

|

$ |

1,403.6 |

|

|

(27.9 |

%) |

|

$ |

389.0 |

|

|

(32.4 |

%) |

| Pretax income margin |

|

|

7.6% |

|

|

|

9.6% |

|

|

(2.0 |

%) |

|

|

9.4% |

|

|

|

12.3% |

|

|

(2.9 |

%) |

|

|

10.7% |

|

|

(3.1 |

%) |

| Net income attributable to

Reliance |

|

$ |

199.2 |

|

|

$ |

267.8 |

|

|

(25.6 |

%) |

|

$ |

769.9 |

|

|

$ |

1,063.2 |

|

|

(27.6 |

%) |

|

$ |

295.0 |

|

|

(32.5 |

%) |

| Diluted EPS |

|

$ |

3.61 |

|

|

$ |

4.67 |

|

|

(22.7 |

%) |

|

$ |

13.55 |

|

|

$ |

17.92 |

|

|

(24.4 |

%) |

|

$ |

4.99 |

|

|

(27.7 |

%) |

| Non-GAAP diluted EPS2 |

|

$ |

3.64 |

|

|

$ |

4.65 |

|

|

(21.7 |

%) |

|

$ |

13.63 |

|

|

$ |

17.87 |

|

|

(23.7 |

%) |

|

$ |

5.00 |

|

|

(27.2 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance Sheet and Cash

Flow Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash provided by

operations |

|

$ |

463.9 |

|

|

$ |

366.3 |

|

|

26.6 |

% |

|

$ |

956.5 |

|

|

$ |

1,145.7 |

|

|

(16.5 |

%) |

|

$ |

466.0 |

|

|

(0.5 |

%) |

| Free cash flow3 |

|

$ |

351.1 |

|

|

$ |

268.1 |

|

|

31.0 |

% |

|

$ |

636.8 |

|

|

$ |

787.1 |

|

|

(19.1 |

%) |

|

$ |

340.5 |

|

|

3.1 |

% |

| Net debt-to-total

capital4 |

|

|

11.5% |

|

|

|

9.4% |

|

|

|

|

|

11.5% |

|

|

|

2.1% |

|

|

|

|

|

2.1% |

|

|

|

| Net debt-to-EBITDA2,5 |

|

|

0.6x |

|

|

|

0.5x |

|

|

|

|

|

0.6x |

|

|

|

0.1x |

|

|

|

|

|

0.1x |

|

|

|

| Total debt-to-EBITDA2,5 |

|

|

0.8x |

|

|

|

0.7x |

|

|

|

|

|

0.8x |

|

|

|

0.5x |

|

|

|

|

|

0.5x |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital Allocation

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisitions, net |

|

$ |

20.2 |

|

|

$ |

292.8 |

|

|

|

|

$ |

366.7 |

|

|

$ |

24.1 |

|

|

|

|

$ |

— |

|

|

|

| Capital expenditures |

|

$ |

112.8 |

|

|

$ |

98.2 |

|

|

|

|

$ |

319.7 |

|

|

$ |

358.6 |

|

|

|

|

$ |

125.5 |

|

|

|

| Dividends |

|

$ |

60.6 |

|

|

$ |

62.6 |

|

|

|

|

$ |

188.5 |

|

|

$ |

179.3 |

|

|

|

|

$ |

58.7 |

|

|

|

| Share repurchases |

|

$ |

432.0 |

|

|

$ |

519.3 |

|

|

|

|

$ |

951.3 |

|

|

$ |

239.2 |

|

|

|

|

$ |

126.4 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Key Business

Metrics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tons sold |

|

|

1,521.4 |

|

|

|

1,553.5 |

|

|

(2.1 |

%) |

|

|

4,568.9 |

|

|

|

4,425.0 |

|

|

3.3 |

% |

|

|

1,420.8 |

|

|

7.1 |

% |

| Tons sold (same-store) |

|

|

1,465.2 |

|

|

|

1,489.6 |

|

|

(1.6 |

%) |

|

|

4,431.2 |

|

|

|

4,412.6 |

|

|

0.4 |

% |

|

|

1,413.6 |

|

|

3.7 |

% |

| Average selling price per ton

sold |

|

$ |

2,246 |

|

|

$ |

2,348 |

|

|

(4.3 |

%) |

|

$ |

2,345 |

|

|

$ |

2,602 |

|

|

(9.9 |

%) |

|

$ |

2,552 |

|

|

(12.0 |

%) |

| Average selling price per ton

sold (same-store) |

|

$ |

2,266 |

|

|

$ |

2,376 |

|

|

(4.6 |

%) |

|

$ |

2,365 |

|

|

$ |

2,604 |

|

|

(9.2 |

%) |

|

$ |

2,557 |

|

|

(11.4 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * Q3 2024

includes one more shipping day compared to the same 2023

period. |

| Please refer to

the footnotes at the end of this press release for additional

information. |

| |

Management Commentary “Our businesses

continued to execute well through challenging market conditions in

the third quarter, once again outperforming the industry in

shipments while maintaining a gross profit margin within our

sustainable range, which we refer to as smart, profitable growth,”

said Karla Lewis, President and Chief Executive Officer of

Reliance. “Although metals pricing declined more than anticipated,

the inherent resilience of our business model servicing diverse end

markets with expansive value-added processing capabilities and

quick-turn orders, as well as increased volume, helped mitigate the

impact of lower pricing levels to our gross profit margin and

supported non-GAAP earnings per diluted share of $3.64, in-line

with our guidance.”

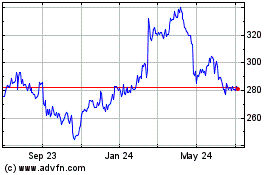

Mrs. Lewis continued, “In the third quarter, we generated $463.9

million of cash flow from operations, underpinned by strong

profitability and our effective working capital management through

cyclical markets. Our consistently strong cash flow continues to

fuel execution of all key pillars of our capital allocation

strategy. We invested $112.8 million in capital expenditures, the

majority of which was directed towards growth activities, and

closed our fourth acquisition of 2024. We repurchased $432.0

million of our common stock, reducing our outstanding shares by

nearly 3% during the quarter, as we opportunistically repurchased

our shares amid the broader pullback in equity prices across the

metals space. In addition, we paid $60.6 million in dividends,

highlighting our commitment to our valued stockholders. While

near-term uncertainty is contributing to headwinds in demand and

pricing, our resilient business model and positive long-range view

support our confidence in our ability to continue executing our

strategic growth and stockholder return priorities.”

End Market CommentaryReliance provides a

diverse range of metal products and value-added processing services

to a wide range of end markets, generally in small quantities on an

as-needed basis. The Company’s tons sold in the third quarter of

2024 increased 7.1% compared to the prior year quarter, above

management’s expectations of up 4.5% to 6.5%. On a same-store

basis, the Company’s tons sold increased 3.7% compared to the prior

year quarter and decreased 1.6% compared to the second quarter of

2024, reflecting somewhat better than normal seasonal trends due to

its strategic growth efforts.

Demand in non-residential construction (including

infrastructure), Reliance’s largest end market, improved compared

to the third quarter of 2023. Reliance continues to service new

construction projects in diverse sectors, including public

infrastructure, manufacturing, data centers and energy

infrastructure. The Company expects non-residential construction

demand to remain relatively stable in the fourth quarter, subject

to normal seasonality.

Demand across the broader manufacturing sectors Reliance serves

strengthened compared to the third quarter of 2023 primarily due to

relative strength in industrial machinery, military, shipbuilding,

and rail. Weaker demand in consumer products and heavy equipment

partially offset the stronger demand seen in other manufacturing

sectors. Reliance anticipates that demand for its products across

the broader manufacturing sector will experience a customary

seasonal slowdown in the fourth quarter of 2024.

Demand in commercial aerospace remained stable compared to the

third quarter of 2023. Reliance anticipates fairly consistent

demand in the fourth quarter of 2024, subject to the impact on

build rates, supply chain disruption and pricing attributable to

the ongoing Boeing labor stoppage. Strong demand in the military

and space related portions of Reliance’s aerospace business is

expected to continue in the fourth quarter of 2024.

Demand for the toll processing services Reliance provides to the

automotive market increased compared to the third quarter of 2023.

The Company expects demand for automotive toll processing to remain

stable in the fourth quarter of 2024, subject to normal

seasonality.

Demand in the semiconductor market declined compared to the

third quarter of 2023. The Company anticipates demand will remain

under pressure in the fourth quarter of 2024 due to excess

inventory in the supply chain. Reliance’s long-term outlook for the

semiconductor market remains positive.

Balance Sheet & Cash FlowAs previously

announced on September 10, 2024, Reliance amended and restated

its existing $1.5 billion unsecured revolving credit agreement for

a new five-year term.

Reliance is positioned to continue operating from a position of

financial strength and to continue executing its flexible and

opportunistic capital allocation strategy which is focused on both

growth and stockholder returns. During the third quarter, Reliance

invested $112.8 million in capital expenditures, $23 million for an

acquisition, and returned $492.6 million to its stockholders

through dividends and opportunistic share repurchases.

At September 30, 2024, Reliance had cash and cash equivalents of

$314.6 million and total outstanding debt of $1.28 billion, with

$125.0 million outstanding and approximately $1.37 billion

available for borrowing under its amended and restated $1.5 billion

unsecured revolving credit facility.

Reliance generated cash flow from operations of $463.9 million

in the third quarter of 2024.

Stockholder Return ActivityOn October 22, 2024,

the Company’s Board of Directors declared a quarterly cash dividend

of $1.10 per share of common stock, payable on December 6, 2024 to

stockholders of record as of November 22, 2024. Reliance has paid

regular quarterly cash dividends for 65 consecutive years without

reduction or suspension.

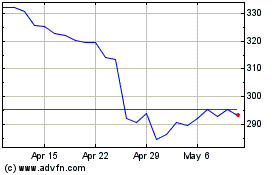

In the third quarter of 2024, Reliance repurchased approximately

1.5 million shares of its common stock at an average cost of

$281.37 per share, for a total of $432.0 million. On October 22,

2024, the Board of Directors approved an amendment of Reliance’s

share repurchase plan, replenishing the repurchase authorization to

$1.5 billion without a set expiration date. From 2019 through

September 30, 2024, Reliance has repurchased approximately 15.1

million shares of its common stock at an average cost of $183.37

per share for a total of $2.77 billion.

AcquisitionEffective August 16, 2024, with cash

on hand, Reliance completed its acquisition of certain toll

processing assets of the FerrouSouth division of Ferragon

Corporation (“FerrouSouth”), a premier toll processing operation

headquartered in Iuka, Mississippi. Net sales for the FerrouSouth

toll processing operations for the year ended December 31, 2023

were approximately $15 million.

Business Outlook Given the significant

uncertainty currently surrounding economic policy in the U.S.,

Reliance anticipates underlying demand will weaken temporarily

across the majority of the end markets it serves in the fourth

quarter of 2024, recovering as we move into 2025. Due to normal

seasonal trends and heightened macroeconomic and political

uncertainty, the Company estimates its tons sold will be down 6.0%

to 8.0% in the fourth quarter of 2024 compared to the third quarter

of 2024 and up 4.0% to 6.0% from the fourth quarter of 2023 with

0.5% to 2.5% attributable to same store growth. Reliance expects

its average selling price per ton sold for the fourth quarter of

2024 to be down 1.5% to 3.5% compared to the third quarter of 2024

with continued pricing pressure across carbon steel products.

Reliance anticipates its FIFO gross profit margin to stabilize in

the fourth quarter of 2024, reflecting better alignment of

replacement costs and inventory costs on hand. Based on these

expectations, the Company anticipates non-GAAP earnings per diluted

share in the range of $2.65 to $2.85 for the fourth quarter of

2024.

Conference Call DetailsA conference call and

simultaneous webcast to discuss Reliance’s third quarter 2024

financial results and business outlook will be held on Thursday,

October 24, 2024 at 11:00 a.m. Eastern Time / 8:00 a.m. Pacific

Time. To listen to the live call by telephone, please dial (877)

407-0792 (U.S. and Canada) or (201) 689-8263 (International)

approximately 10 minutes prior to the start time and use conference

ID: 13749249. The call will also be broadcast live over the

Internet hosted on the Investors section of the Company's website

at investor.reliance.com.

For those unable to participate during the live broadcast, a

replay of the call will also be available beginning that same day

at 2:00 p.m. Eastern Time until 11:59 p.m. Eastern Time on November

7, 2024, by dialing (844) 512-2921 (U.S. and Canada) or (412)

317-6671 (International) and entering the conference ID: 13749249.

The webcast will remain posted on the Investors section of

Reliance’s website at reliance.com for 90 days.

About Reliance, Inc.Founded in 1939, Reliance,

Inc. (NYSE: RS) is a leading global diversified metal solutions

provider and the largest metals service center company in North

America. Through a network of more than 320 locations in 41 states

and 12 countries outside of the United States, Reliance provides

value-added metals processing services and distributes a full-line

of over 100,000 metal products to more than 125,000 customers in a

broad range of industries. Reliance focuses on small orders with

quick turnaround and value-added processing services. In 2023,

Reliance’s average order size was $3,210, approximately 51% of

orders included value-added processing and approximately 40% of

orders were delivered within 24 hours. Reliance, Inc.’s press

releases and additional information are available on the Company’s

website at reliance.com.

Forward-Looking StatementsThis press release

contains certain statements that are, or may be deemed to be,

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements may include, but are not limited to, discussions of

Reliance’s industry and end markets, business strategies,

acquisitions, and expectations concerning the Company’s future

growth and profitability and its ability to generate industry

leading returns for its stockholders, as well as future demand and

metals pricing and the Company’s results of operations, margins,

profitability, taxes, liquidity, macroeconomic conditions,

including inflation and the possibility of an economic recession or

slowdown, litigation matters and capital resources. In some cases,

you can identify forward-looking statements by terminology such as

“may,” “will,” “should,” “could,” “would,” “expect,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,”

“preliminary,” “range,” “intend” and “continue,” the negative of

these terms, and similar expressions.

These forward-looking statements are based on management's

estimates, projections and assumptions as of today’s date that may

not prove to be accurate. Forward-looking statements involve known

and unknown risks and uncertainties and are not guarantees of

future performance. Actual outcomes and results may differ

materially from what is expressed or forecasted in these

forward-looking statements as a result of various important

factors, including, but not limited to, actions taken by Reliance,

as well as developments beyond its control, including, but not

limited to, the possibility that the expected benefits of

acquisitions may not materialize as expected, the impacts of labor

constraints and supply chain disruptions, changes in domestic and

worldwide political and economic conditions such as inflation and

the possibility of an economic recession that could materially

impact the Company, its customers and suppliers, metals pricing,

and demand for the Company’s products and services. Deteriorations

in economic conditions as a result of inflation, economic

recession, slowing growth, outbreaks of infectious disease,

conflicts such as the war in Ukraine and the evolving events in

Israel and Gaza or otherwise, could lead to a decline in demand for

the Company’s products and services and negatively impact its

business, and may also impact financial markets and corporate

credit markets which could adversely impact the Company’s access to

financing, or the terms of any financing. The Company cannot at

this time predict all of the impacts of inflation, product price

fluctuations, economic recession, outbreaks of infectious disease

or the war in Ukraine and the Israel-Gaza conflict and related

economic effects, but these factors, individually or in any

combination, could have a material adverse effect on the Company’s

business, financial position, results of operations and cash

flows.

The statements contained in this press release speak only as of

the date hereof, and Reliance disclaims any and all obligations to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or for any other

reason, except as may be required by law. Important risks and

uncertainties about Reliance’s business can be found in “Item 1A.

Risk Factors” of the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023 and in other documents Reliance files

or furnishes with the United States Securities and Exchange

Commission.

CONTACT: (213)

576-2428investor@reliance.com

or Addo Investor Relations(310) 829-5400

(Tables to follow)

| Third

Quarter 2024 Major Commodity Metrics |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons Sold (tons in thousands; % change) |

|

Average Selling Price per Ton Sold (% change) |

|

|

|

Q3 2024 |

|

Q2 2024 |

|

Sequential Quarter Change |

|

Q3 2023 |

|

Year-Over-Year Change |

|

Sequential Quarter Change |

|

Year-Over-Year Change |

|

Carbon steel |

|

|

1,246.9 |

|

|

|

1,274.3 |

|

|

|

(2.2 |

%) |

|

|

1,150.6 |

|

|

|

8.4 |

% |

|

|

(6.4 |

%) |

|

|

(14.2 |

%) |

| Aluminum |

|

|

80.2 |

|

|

|

81.3 |

|

|

|

(1.4 |

%) |

|

|

78.2 |

|

|

|

2.6 |

% |

|

|

(0.4 |

%) |

|

|

(5.0 |

%) |

| Stainless steel |

|

|

73.2 |

|

|

|

73.6 |

|

|

|

(0.5 |

%) |

|

|

69.9 |

|

|

|

4.7 |

% |

|

|

(0.9 |

%) |

|

|

(11.9 |

%) |

| Alloy |

|

|

30.2 |

|

|

|

32.5 |

|

|

|

(7.1 |

%) |

|

|

31.2 |

|

|

|

(3.2 |

%) |

|

|

0.5 |

% |

|

|

(7.7 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Sales ($'s in millions; % change) |

|

|

|

|

|

|

| |

|

Q3 2024 |

|

Q2 2024 |

|

Sequential Quarter Change |

|

Q3 2023 |

|

Year-Over-Year Change |

|

|

|

|

|

|

| Carbon steel |

|

$ |

1,856.2 |

|

|

$ |

2,025.7 |

|

|

|

(8.4 |

%) |

|

$ |

1,996.9 |

|

|

|

(7.0 |

%) |

|

|

|

|

|

|

| Aluminum |

|

$ |

576.3 |

|

|

$ |

587.8 |

|

|

|

(2.0 |

%) |

|

$ |

592.6 |

|

|

|

(2.8 |

%) |

|

|

|

|

|

|

| Stainless steel |

|

$ |

513.9 |

|

|

$ |

521.8 |

|

|

|

(1.5 |

%) |

|

$ |

557.5 |

|

|

|

(7.8 |

%) |

|

|

|

|

|

|

| Alloy |

|

$ |

155.9 |

|

|

$ |

166.8 |

|

|

|

(6.5 |

%) |

|

$ |

174.4 |

|

|

|

(10.6 |

%) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-to-Date (9 Months) 2024 Major Commodity

Metrics |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons Sold (tons in thousands; % change) |

|

AverageSelling Price per Ton Sold (%

change) |

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

Year-Over-Year Change |

|

Year-Over-Year Change |

|

|

|

|

|

|

|

|

|

| Carbon steel |

|

|

3,736.0 |

|

|

|

3,588.3 |

|

|

|

4.1 |

% |

|

|

(9.6 |

%) |

|

|

|

|

|

|

|

|

|

| Aluminum |

|

|

243.3 |

|

|

|

247.4 |

|

|

|

(1.7 |

%) |

|

|

(5.9 |

%) |

|

|

|

|

|

|

|

|

|

| Stainless steel |

|

|

222.3 |

|

|

|

218.4 |

|

|

|

1.8 |

% |

|

|

(13.8 |

%) |

|

|

|

|

|

|

|

|

|

| Alloy |

|

|

95.7 |

|

|

|

102.0 |

|

|

|

(6.2 |

%) |

|

|

(4.6 |

%) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Sales ($'s in millions; % change) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2024 |

|

|

2023 |

|

|

Year-Over-Year Change |

|

|

|

|

|

|

|

|

|

|

|

|

| Carbon steel |

|

$ |

5,894.8 |

|

|

$ |

6,266.6 |

|

|

|

(5.9 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

| Aluminum |

|

$ |

1,760.2 |

|

|

$ |

1,902.5 |

|

|

|

(7.5 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

| Stainless steel |

|

$ |

1,595.6 |

|

|

$ |

1,818.8 |

|

|

|

(12.3 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

| Alloy |

|

$ |

494.6 |

|

|

$ |

552.6 |

|

|

|

(10.5 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Sales by Product ($'s as a % of total sales) |

|

|

|

|

|

|

| |

|

|

|

Nine Months Ended |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

|

|

|

|

|

|

|

Q3 2024 |

|

Q2 2024 |

|

Q3 2023 |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

| Carbon steel plate |

|

|

12 |

% |

|

|

12 |

% |

|

|

12 |

% |

|

|

12 |

% |

|

|

12 |

% |

|

|

|

|

|

|

| Carbon steel structurals |

|

|

12 |

% |

|

|

11 |

% |

|

|

11 |

% |

|

|

11 |

% |

|

|

11 |

% |

|

|

|

|

|

|

| Carbon steel tubing |

|

|

9 |

% |

|

|

10 |

% |

|

|

10 |

% |

|

|

10 |

% |

|

|

10 |

% |

|

|

|

|

|

|

| Hot-rolled steel sheet &

coil |

|

|

8 |

% |

|

|

9 |

% |

|

|

9 |

% |

|

|

8 |

% |

|

|

9 |

% |

|

|

|

|

|

|

| Carbon steel bar |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

|

|

|

|

| Galvanized steel sheet &

coil |

|

|

5 |

% |

|

|

5 |

% |

|

|

4 |

% |

|

|

5 |

% |

|

|

4 |

% |

|

|

|

|

|

|

| Cold-rolled steel sheet &

coil |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

|

|

|

|

|

Carbon steel |

|

|

53 |

% |

|

|

54 |

% |

|

|

53 |

% |

|

|

53 |

% |

|

|

53 |

% |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aluminum bar & tube |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

|

|

|

|

| Heat-treated aluminum

plate |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

|

|

|

|

| Common alloy aluminum sheet

& coil |

|

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

|

|

|

|

| Common alloy aluminum

plate |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

|

|

|

|

| Heat-treated aluminum sheet

& coil |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

|

|

|

|

|

Aluminum |

|

|

16 |

% |

|

|

16 |

% |

|

|

16 |

% |

|

|

16 |

% |

|

|

16 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stainless steel bar &

tube |

|

|

7 |

% |

|

|

7 |

% |

|

|

7 |

% |

|

|

7 |

% |

|

|

7 |

% |

|

|

|

|

|

|

| Stainless steel sheet &

coil |

|

|

5 |

% |

|

|

5 |

% |

|

|

6 |

% |

|

|

5 |

% |

|

|

6 |

% |

|

|

|

|

|

|

| Stainless steel plate |

|

|

3 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

|

|

|

|

|

Stainless steel |

|

|

15 |

% |

|

|

14 |

% |

|

|

15 |

% |

|

|

14 |

% |

|

|

15 |

% |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Alloy bar & rod |

|

|

3 |

% |

|

|

3 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

|

|

|

|

| Alloy tube |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

|

|

|

|

|

Alloy |

|

|

4 |

% |

|

|

4 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Miscellaneous |

|

|

6 |

% |

|

|

6 |

% |

|

|

5 |

% |

|

|

6 |

% |

|

|

5 |

% |

|

|

|

|

|

|

| Toll processing &

logistics |

|

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

|

|

|

|

| Copper & brass |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

|

|

|

|

|

Other |

|

|

12 |

% |

|

|

12 |

% |

|

|

11 |

% |

|

|

12 |

% |

|

|

11 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

RELIANCE, INC. |

|

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME |

|

(in millions, except number of shares which are reflected

in thousands and per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

September 30, |

|

September 30, |

| |

|

2024 |

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net sales |

|

$ |

3,420.3 |

|

$ |

3,623.0 |

|

|

$ |

10,708.4 |

|

|

$ |

11,468.6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales (exclusive of depreciation and amortization shown

below) |

|

|

2,414.0 |

|

|

2,546.0 |

|

|

|

7,487.9 |

|

|

|

7,942.9 |

|

|

Warehouse, delivery, selling, general and administrative

(“SG&A”) |

|

|

665.0 |

|

|

626.9 |

|

|

|

2,004.2 |

|

|

|

1,928.8 |

|

|

Depreciation and amortization |

|

|

67.9 |

|

|

60.6 |

|

|

|

198.1 |

|

|

|

182.5 |

|

| |

|

|

3,146.9 |

|

|

3,233.5 |

|

|

|

9,690.2 |

|

|

|

10,054.2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

273.4 |

|

|

389.5 |

|

|

|

1,018.2 |

|

|

|

1,414.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other (income) expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

10.9 |

|

|

9.7 |

|

|

|

30.3 |

|

|

|

30.3 |

|

|

Other expense (income), net |

|

|

2.0 |

|

|

(8.2 |

) |

|

|

(18.5 |

) |

|

|

(23.3 |

) |

| Income before income

taxes |

|

|

260.5 |

|

|

388.0 |

|

|

|

1,006.4 |

|

|

|

1,407.4 |

|

| Income tax provision |

|

|

60.6 |

|

|

92.0 |

|

|

|

234.4 |

|

|

|

340.7 |

|

| Net income |

|

|

199.9 |

|

|

296.0 |

|

|

|

772.0 |

|

|

|

1,066.7 |

|

|

Less: net income attributable to noncontrolling interests |

|

|

0.7 |

|

|

1.0 |

|

|

|

2.1 |

|

|

|

3.5 |

|

| Net income attributable to

Reliance |

|

$ |

199.2 |

|

$ |

295.0 |

|

|

$ |

769.9 |

|

|

$ |

1,063.2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share

attributable to Reliance stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

3.64 |

|

$ |

5.05 |

|

|

$ |

13.68 |

|

|

$ |

18.13 |

|

|

Diluted |

|

$ |

3.61 |

|

$ |

4.99 |

|

|

$ |

13.55 |

|

|

$ |

17.92 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in computing

earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

54,691 |

|

|

58,427 |

|

|

|

56,297 |

|

|

|

58,648 |

|

|

Diluted |

|

|

55,182 |

|

|

59,124 |

|

|

|

56,813 |

|

|

|

59,333 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends per share |

|

$ |

1.10 |

|

$ |

1.00 |

|

|

$ |

3.30 |

|

|

$ |

3.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RELIANCE, INC. |

|

UNAUDITED CONSOLIDATED BALANCE SHEETS |

|

(in millions, except number of shares

which are reflected in thousands and par

value) |

|

|

|

|

|

|

|

|

|

|

| |

|

September 30, |

|

December 31, |

| |

|

2024 |

|

2023* |

|

ASSETS |

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

314.6 |

|

|

$ |

1,080.2 |

|

|

Accounts receivable, less allowance for credit losses of $26.6 at

September 30, 2024 and $24.9 at December 31, 2023 |

|

|

1,566.7 |

|

|

|

1,472.4 |

|

|

Inventories |

|

|

2,205.8 |

|

|

|

2,043.2 |

|

|

Prepaid expenses and other current assets |

|

|

123.5 |

|

|

|

140.4 |

|

|

Income taxes receivable |

|

|

1.9 |

|

|

|

35.6 |

|

|

Total current assets |

|

|

4,212.5 |

|

|

|

4,771.8 |

|

| Property, plant and

equipment: |

|

|

|

|

|

|

|

Land |

|

|

294.3 |

|

|

|

281.7 |

|

|

Buildings |

|

|

1,648.1 |

|

|

|

1,510.9 |

|

|

Machinery and equipment |

|

|

2,902.1 |

|

|

|

2,700.4 |

|

|

Accumulated depreciation |

|

|

(2,341.5 |

) |

|

|

(2,244.6 |

) |

|

Property, plant and equipment, net |

|

|

2,503.0 |

|

|

|

2,248.4 |

|

| Operating lease right-of-use

assets |

|

|

271.0 |

|

|

|

231.6 |

|

| Goodwill |

|

|

2,170.9 |

|

|

|

2,111.1 |

|

| Intangible assets, net |

|

|

1,031.5 |

|

|

|

981.1 |

|

| Cash surrender value of life

insurance policies, net |

|

|

29.8 |

|

|

|

43.8 |

|

| Other long-term assets |

|

|

82.1 |

|

|

|

92.5 |

|

|

Total assets |

|

$ |

10,300.8 |

|

|

$ |

10,480.3 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

| |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

440.9 |

|

|

$ |

410.3 |

|

|

Accrued expenses |

|

|

132.8 |

|

|

|

118.5 |

|

|

Accrued compensation and retirement benefits |

|

|

194.1 |

|

|

|

213.9 |

|

|

Accrued insurance costs |

|

|

45.1 |

|

|

|

44.4 |

|

|

Current maturities of long-term debt |

|

|

399.5 |

|

|

|

0.3 |

|

|

Current maturities of operating lease liabilities |

|

|

60.1 |

|

|

|

56.2 |

|

|

Total current liabilities |

|

|

1,272.5 |

|

|

|

843.6 |

|

| Long-term debt |

|

|

867.8 |

|

|

|

1,141.9 |

|

| Operating lease

liabilities |

|

|

210.8 |

|

|

|

178.9 |

|

| Long-term retirement

benefits |

|

|

29.1 |

|

|

|

25.1 |

|

| Other long-term

liabilities |

|

|

57.6 |

|

|

|

64.0 |

|

| Deferred income taxes |

|

|

501.8 |

|

|

|

494.0 |

|

|

Total liabilities |

|

|

2,939.6 |

|

|

|

2,747.5 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

Preferred stock, $0.001 par value: 5,000 shares authorized; none

issued or outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock and additional paid-in capital, $0.001 par value and

200,000 shares authorized Issued and outstanding shares—54,119 at

September 30, 2024 and 57,271 at December 31, 2023 |

|

|

0.1 |

|

|

|

0.1 |

|

|

Retained earnings |

|

|

7,433.5 |

|

|

|

7,798.9 |

|

|

Accumulated other comprehensive loss |

|

|

(83.1 |

) |

|

|

(76.7 |

) |

|

Total Reliance stockholders’ equity |

|

|

7,350.5 |

|

|

|

7,722.3 |

|

|

Noncontrolling interests |

|

|

10.7 |

|

|

|

10.5 |

|

|

Total equity |

|

|

7,361.2 |

|

|

|

7,732.8 |

|

|

Total liabilities and equity |

|

$ |

10,300.8 |

|

|

$ |

10,480.3 |

|

| |

|

|

|

|

|

|

| * Derived from audited

financial statements. |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

RELIANCE, INC. |

|

UNAUDITED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(in millions) |

|

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended |

| |

|

September 30, |

| |

|

2024 |

|

2023 |

| Operating

activities: |

|

|

|

|

|

|

|

Net income |

|

$ |

772.0 |

|

|

$ |

1,066.7 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

|

198.1 |

|

|

|

182.5 |

|

|

Stock-based compensation expense |

|

|

43.0 |

|

|

|

48.4 |

|

|

Other |

|

|

5.0 |

|

|

|

7.5 |

|

| Changes in operating assets

and liabilities (excluding effect of businesses acquired): |

|

|

|

|

|

|

|

Accounts receivable |

|

|

(51.9 |

) |

|

|

(102.0 |

) |

|

Inventories |

|

|

(52.3 |

) |

|

|

(113.5 |

) |

|

Prepaid expenses and other assets |

|

|

105.7 |

|

|

|

91.1 |

|

|

Accounts payable and other liabilities |

|

|

(63.1 |

) |

|

|

(35.0 |

) |

|

Net cash provided by operating activities |

|

|

956.5 |

|

|

|

1,145.7 |

|

|

|

|

|

|

|

|

|

| Investing

activities: |

|

|

|

|

|

|

|

Acquisitions, net of cash acquired |

|

|

(366.7 |

) |

|

|

(24.1 |

) |

|

Purchases of property, plant and equipment |

|

|

(319.7 |

) |

|

|

(358.6 |

) |

|

Other |

|

|

13.0 |

|

|

|

14.9 |

|

|

Net cash used in investing activities |

|

|

(673.4 |

) |

|

|

(367.8 |

) |

|

|

|

|

|

|

|

|

| Financing

activities: |

|

|

|

|

|

|

|

Net short-term debt repayments |

|

|

— |

|

|

|

(2.2 |

) |

|

Proceeds from long-term debt borrowings |

|

|

663.0 |

|

|

|

— |

|

|

Principal payments on long-term debt |

|

|

(538.0 |

) |

|

|

(505.7 |

) |

|

Cash dividends and dividend equivalents |

|

|

(188.5 |

) |

|

|

(179.3 |

) |

|

Share repurchases |

|

|

(951.3 |

) |

|

|

(239.2 |

) |

|

Taxes paid related to net share settlement of restricted stock

units |

|

|

(29.6 |

) |

|

|

(41.3 |

) |

|

Other |

|

|

(4.3 |

) |

|

|

(3.0 |

) |

|

Net cash used in financing activities |

|

|

(1,048.7 |

) |

|

|

(970.7 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

|

— |

|

|

|

(3.7 |

) |

| Decrease in cash and cash

equivalents |

|

|

(765.6 |

) |

|

|

(196.5 |

) |

| Cash and cash equivalents at

beginning of year |

|

|

1,080.2 |

|

|

|

1,173.4 |

|

| Cash and cash equivalents at

end of the period |

|

$ |

314.6 |

|

|

$ |

976.9 |

|

| |

|

|

|

|

|

|

| Supplemental cash flow

information: |

|

|

|

|

|

|

| Interest paid during the

period |

|

$ |

27.7 |

|

|

$ |

32.5 |

|

| Income taxes paid during the

period, net |

|

$ |

197.1 |

|

|

$ |

305.2 |

|

| |

|

|

|

|

|

|

|

RELIANCE, INC. |

|

NON-GAAP RECONCILIATION |

|

(in millions, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

Diluted EPS |

|

|

|

Three Months Ended |

|

Three Months Ended |

|

|

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

June 30, |

|

September 30, |

|

|

|

2024 |

|

2024 |

|

2023 |

|

2024 |

|

2024 |

|

2023 |

|

Net income attributable to Reliance |

|

$ |

199.2 |

|

|

$ |

267.8 |

|

|

$ |

295.0 |

|

|

$ |

3.61 |

|

|

$ |

4.67 |

|

|

$ |

4.99 |

|

| Restructuring charges |

|

|

2.1 |

|

|

|

0.4 |

|

|

|

1.0 |

|

|

|

0.03 |

|

|

|

0.01 |

|

|

|

0.02 |

|

| Non-recurring income of

acquisitions |

|

|

(1.6 |

) |

|

|

(2.0 |

) |

|

|

— |

|

|

|

(0.03 |

) |

|

|

(0.03 |

) |

|

|

— |

|

| Non-recurring settlement

charges |

|

|

0.5 |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

| Debt restructuring charge |

|

|

1.5 |

|

|

|

— |

|

|

|

— |

|

|

|

0.03 |

|

|

|

— |

|

|

|

— |

|

| Income tax (benefit) expense

related to above items |

|

|

(0.6 |

) |

|

|

0.4 |

|

|

|

(0.3 |

) |

|

|

(0.01 |

) |

|

|

— |

|

|

|

(0.01 |

) |

| Non-GAAP net income

attributable to Reliance |

|

$ |

201.1 |

|

|

$ |

266.6 |

|

|

$ |

295.7 |

|

|

$ |

3.64 |

|

|

$ |

4.65 |

|

|

$ |

5.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Net Income |

|

Diluted EPS |

|

|

|

| |

|

|

|

|

Nine Months Ended |

|

Nine Months Ended |

|

|

|

| |

|

|

|

|

September 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

|

| |

|

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

| Net income attributable to

Reliance |

|

|

|

|

$ |

769.9 |

|

|

$ |

1,063.2 |

|

|

$ |

13.55 |

|

|

$ |

17.92 |

|

|

|

|

| Restructuring charges |

|

|

|

|

|

2.8 |

|

|

|

1.0 |

|

|

|

0.04 |

|

|

|

0.02 |

|

|

|

|

| Non-recurring income of

acquisitions |

|

|

|

|

|

(3.6 |

) |

|

|

— |

|

|

|

(0.06 |

) |

|

|

— |

|

|

|

|

| Non-recurring settlement

charges |

|

|

|

|

|

5.1 |

|

|

|

— |

|

|

|

0.09 |

|

|

|

— |

|

|

|

|

| Debt restructuring charge |

|

|

|

|

|

1.5 |

|

|

|

— |

|

|

|

0.03 |

|

|

|

— |

|

|

|

|

| Gains related to sales of

non-core assets |

|

|

|

|

|

— |

|

|

|

(4.8 |

) |

|

|

— |

|

|

|

(0.08 |

) |

|

|

|

| Income tax (benefit) expense

related to above items |

|

|

|

|

|

(1.4 |

) |

|

|

0.9 |

|

|

|

(0.02 |

) |

|

|

0.01 |

|

|

|

|

| Non-GAAP net income

attributable to Reliance |

|

|

|

|

$ |

774.3 |

|

|

$ |

1,060.3 |

|

|

$ |

13.63 |

|

|

$ |

17.87 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

| |

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

|

| |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

| Pretax income |

|

$ |

260.5 |

|

|

$ |

349.7 |

|

|

$ |

388.0 |

|

|

$ |

1,006.4 |

|

|

$ |

1,407.4 |

|

|

|

|

| Restructuring charges |

|

|

2.1 |

|

|

|

0.4 |

|

|

|

1.0 |

|

|

|

2.8 |

|

|

|

1.0 |

|

|

|

|

| Non-recurring income of

acquisitions |

|

|

(1.6 |

) |

|

|

(2.0 |

) |

|

|

— |

|

|

|

(3.6 |

) |

|

|

— |

|

|

|

|

| Non-recurring settlement

charges |

|

|

0.5 |

|

|

|

— |

|

|

|

— |

|

|

|

5.1 |

|

|

|

— |

|

|

|

|

| Debt restructuring charge |

|

|

1.5 |

|

|

|

— |

|

|

|

— |

|

|

|

1.5 |

|

|

|

— |

|

|

|

|

| Gains related to sales of

non-core assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4.8 |

) |

|

|

|

| Non-GAAP pretax income |

|

$ |

263.0 |

|

|

$ |

348.1 |

|

|

$ |

389.0 |

|

|

$ |

1,012.2 |

|

|

$ |

1,403.6 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

| |

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

|

| |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

| Gross profit - LIFO |

|

$ |

1,006.3 |

|

|

$ |

1,086.0 |

|

|

$ |

1,077.0 |

|

|

$ |

3,220.5 |

|

|

$ |

3,525.7 |

|

|

|

|

| Amortization of inventory

step-down |

|

|

(1.6 |

) |

|

|

(2.0 |

) |

|

|

— |

|

|

|

(3.6 |

) |

|

|

— |

|

|

|

|

| Restructuring charges |

|

|

1.7 |

|

|

|

— |

|

|

|

— |

|

|

|

1.7 |

|

|

|

— |

|

|

|

|

| Non-GAAP gross profit |

|

|

1,006.4 |

|

|

|

1,084.0 |

|

|

|

1,077.0 |

|

|

|

3,218.6 |

|

|

|

3,525.7 |

|

|

|

|

| LIFO income |

|

|

(50.0 |

) |

|

|

(50.0 |

) |

|

|

(45.0 |

) |

|

|

(150.0 |

) |

|

|

(105.0 |

) |

|

|

|

| Non-GAAP gross profit -

FIFO |

|

$ |

956.4 |

|

|

$ |

1,034.0 |

|

|

$ |

1,032.0 |

|

|

$ |

3,068.6 |

|

|

$ |

3,420.7 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit margin -

LIFO |

|

|

29.4 |

% |

|

|

29.8 |

% |

|

|

29.7 |

% |

|

|

30.1 |

% |

|

|

30.7 |

% |

|

|

|

| Amortization of inventory

step-down as a % of sales |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

| Restructuring charges as a %

of sales |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

| Non-GAAP gross profit

margin |

|

|

29.4 |

% |

|

|

29.8 |

% |

|

|

29.7 |

% |

|

|

30.1 |

% |

|

|

30.7 |

% |

|

|

|

| LIFO income as a % of

sales |

|

|

(1.5 |

%) |

|

|

(1.4 |

%) |

|

|

(1.2 |

%) |

|

|

(1.4 |

%) |

|

|

(0.9 |

%) |

|

|

|

| Non-GAAP gross profit margin -

FIFO |

|

|

27.9 |

% |

|

|

28.4 |

% |

|

|

28.5 |

% |

|

|

28.7 |

% |

|

|

29.8 |

% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

September 30, |

|

June 30, |

|

September 30, |

|

|

|

|

|

|

|

| |

|

2024 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

| Total debt |

|

$ |

1,276.4 |

|

|

$ |

1,151.4 |

|

|

$ |

1,151.7 |

|

|

|

|

|

|

|

|

|

|

| Less: unamortized debt

discount and debt issuance costs |

|

|

(9.1 |

) |

|

|

(7.8 |

) |

|

|

(9.8 |

) |

|

|

|

|

|

|

|

|

|

| Carrying amount of debt |

|

|

1,267.3 |

|

|

|

1,143.6 |

|

|

|

1,141.9 |

|

|

|

|

|

|

|

|

|

|

| Less: cash and cash

equivalents |

|

|

(314.6 |

) |

|

|

(350.8 |

) |

|

|

(976.9 |

) |

|

|

|

|

|

|

|

|

|

| Net debt |

|

$ |

952.7 |

|

|

$ |

792.8 |

|

|

$ |

165.0 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Twelve Months Ended |

|

|

|

|

|

|

|

|

|

| |

|

September 30, |

|

June 30, |

|

September 30, |

|

|

|

|

|

|

|

|

|

| |

|

2024 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

1,045.4 |

|

|

$ |

1,141.5 |

|

|

$ |

1,418.0 |

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

261.0 |

|

|

|

253.7 |

|

|

|

243.9 |

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

40.1 |

|

|

|

38.9 |

|

|

|

45.8 |

|

|

|

|

|

|

|

|

|

|

| Income taxes |

|

|

294.3 |

|

|

|

325.7 |

|

|

|

436.0 |

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

$ |

1,640.8 |

|

|

$ |

1,759.8 |

|

|

$ |

2,143.7 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net debt-to-EBITDA |

|

|

0.6x |

|

|

0.5x |

|

|

0.1x |

|

|

|

|

|

|

|

|

|

| Total debt-to-EBITDA |

|

|

0.8x |

|

|

0.7x |

|

|

0.5x |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reliance, Inc.’s presentation of non-GAAP pretax income, net income

and EPS over certain time periods is an attempt to provide

meaningful comparisons to the Company's historical performance for

its existing and future stockholders. Adjustments include

restructuring charges, non-recurring income of its acquisitions,

non-recurring settlement charges, non-recurring expenses related to

the amendment of its credit agreement, and gains on sales of

non-core property, plant, and equipment, which make comparisons of

the Company’s operating results between periods difficult using

GAAP measures. Reliance, Inc.’s presentation of gross profit margin

- FIFO, which is calculated as gross profit plus LIFO expense (or

minus LIFO income) divided by net sales, is presented in order to

provide a means of comparison amongst its competitors who may not

use the same inventory valuation method. Please see footnote 1

below for additional information on the Company’s gross profit and

gross profit margin. Reliance, Inc. presents net debt- and total

debt-to-EBITDA as a measurement of leverage utilized by management

to monitor its debt levels in relation to its operating cash flow

for which it utilizes EBITDA as a proxy. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Footnotes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Gross profit, calculated as net sales less cost of sales, and

gross profit margin, calculated as gross profit divided by net

sales, are non-GAAP financial measures as they exclude depreciation

and amortization expense associated with the corresponding sales.

About half of Reliance's orders are basic distribution with no