Regis Corporation Announces Reverse Stock Split to Regain Compliance with Minimum Bid Price Requirements

November 17 2023 - 6:30AM

Business Wire

Regis Corporation (NYSE: RGS), a leader in the haircare

industry, today announced that it intends to effect a reverse stock

split of its outstanding common stock, par value $0.05 per share,

at a ratio of one-for-twenty, with an intended market effective

date of November 29, 2023.

The reverse stock split is primarily intended to bring the

Company into compliance with stock exchange minimum bid price

requirements, as the Company explores opportunities to remain

listed on a national securities exchange. The reverse stock split

is not expected to have a direct impact on the Company’s market

capitalization deficiency as previously reported in the Company’s

Current Report on Form 8-K filed on June 15, 2022, for which the

NYSE-established compliance period is scheduled to end on December

13, 2023.

Following the reverse stock split, the Company's common stock

will continue to trade under the symbol “RGS”. The new CUSIP number

for the Company’s common stock following the reverse stock split

will be 758932206. Upon the effectiveness of the reverse stock

split, every 20 shares of issued and outstanding common stock

before the open of trading on November 29, 2023 will be combined

into one issued and outstanding share of common stock, with no

change in par value per share. The Company’s common stock will open

for trading on NYSE on November 29, 2023 on a post-split basis.

The reverse stock split will reduce the number of shares of the

Company's outstanding common stock from approximately 45.6 million

shares to approximately 2.3 million shares. No fractional shares

will be issued as a result of the reverse stock split. Any

fractional shares that would result from the reverse stock split

will be cancelled in exchange for the payment of cash

consideration.

The reverse stock split will affect all issued and outstanding

shares of the Company’s common stock, as well as the number of

shares of common stock available for issuance under the Company’s

outstanding stock options and stock unit awards. The reverse stock

split will reduce the number of shares of common stock issuable

upon the exercise of stock options outstanding and the vesting of

stock unit awards outstanding immediately prior to the reverse

stock split and correspondingly increase the respective exercise

prices or other price dependent terms. The reverse stock split will

affect all shareholders uniformly and will not alter any

shareholder’s percentage interest in the Company’s equity, except

to the extent that the reverse stock split results in some

shareholders experiencing an adjustment of a fractional share as

described above.

Shareholders holding share certificates will receive information

from EQ Shareowner Services, the Company’s transfer agent,

regarding the process for exchanging their shares of common stock.

Shareholders with questions may contact our transfer agent by

calling 1-800-401-1957. Shareholders owning shares electronically

or via a broker, bank, trust or other nominee are expected to have

their positions automatically adjusted to reflect the reverse stock

split, subject to such broker’s particular processes, and will not

be required to take any action in connection with the reverse stock

split.

About Regis Corporation

Regis Corporation (NYSE:RGS) is a leader in the haircare

industry. As of September 30, 2023, the Company franchised or owned

4,811 locations. Regis’ franchised and corporate locations operate

under concepts such as Supercuts®, SmartStyle®, Cost Cutters®,

Roosters® and First Choice Haircutters®. For additional information

about the Company, please visit the Investor Information section of

the corporate website at www.regiscorp.com.

This press release contains or may contain “forward-looking

statements” within the meaning of the federal securities laws,

including statements concerning anticipated future events and

expectations that are not historical facts. These forward-looking

statements are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. The

forward-looking statements in this document reflect management's

best judgment at the time they are made, but all such statements

are subject to numerous risks and uncertainties, which could cause

actual results to differ materially from those expressed in or

implied by the statements herein. Such forward-looking statements

are often identified herein by use of words including, but not

limited to, “may,” “believe,” “project,” “forecast,” “expect,”

“estimate,” “anticipate,” “intend” and “plan.” In addition, the

following factors could affect the Company's actual results and

cause such results to differ materially from those expressed in

forward-looking statements. These factors include our ability to

remain listed on a national securities exchange, regain compliance

with the NYSE listing requirements, future compliance with such

requirements, potential future application of suspension and

delisting procedures and future quotation of our common stock, and

other potential factors that could affect future financial and

operating results as set forth under Item 1A of Part I of our Form

10-K and Item IA of Part II of our subsequent Form 10-Qs. We

undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. However, your attention is directed to

any further disclosures made in our subsequent annual and periodic

reports filed or furnished with the SEC on Forms 10-K, 10-Q and 8-K

and Proxy Statements on Schedule 14A.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231117711146/en/

Kersten Zupfer investorrelations@regiscorp.com

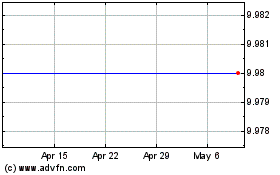

Regis (NYSE:RGS)

Historical Stock Chart

From Oct 2024 to Nov 2024

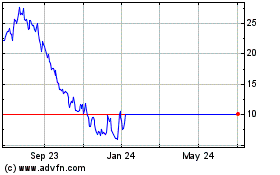

Regis (NYSE:RGS)

Historical Stock Chart

From Nov 2023 to Nov 2024