- Net income of $6.0 million and diluted

earnings per share of $0.63 -

- 30+ day contractual delinquencies of 6.9% as

of June 30, 2023, an improvement of 30 basis points compared to

March 31, 2023 -

- Continued early indications of improved

credit performance in the second quarter -

Regional Management Corp. (NYSE: RM), a diversified consumer

finance company, today announced results for the second quarter

ended June 30, 2023.

“We are pleased with our second quarter results, which exceeded

our expectations on both the top and bottom lines,” said Robert W.

Beck, President and Chief Executive Officer of Regional Management

Corp. “We produced $6.0 million of net income and $0.63 of diluted

earnings per share. Loan demand remained strong in the quarter,

allowing us to generate high-quality portfolio growth and

near-record quarterly revenue while simultaneously maintaining a

conservative credit posture. We also continued to closely manage

our expenses while investing in our business, driving our

annualized operating expense ratio down to 13.6% in the quarter.

Our focus on portfolio quality, expense management, and strong

execution of our core business has enabled us to deliver

consistent, predictable, and superior results quarter after

quarter.”

“Our portfolio’s early-stage delinquencies continue to benefit

from several quarters of tightened underwriting criteria,” added

Mr. Beck. “Overall, we ended the quarter with a 30+ day delinquency

rate of 6.9%, a sequential improvement of 30 basis points from the

first quarter. Looking ahead, while we have been encouraged by

recent economic data indicating a strong labor market, moderating

inflation, and real wage growth, we continue to be comfortable

prioritizing higher credit quality over more rapid portfolio

growth. However, we remain prepared to lean back into growth when

justified by the economic conditions and the overall performance of

our portfolio. As always, we look forward to continuing our

delivery of controlled growth and profitability, sustainable

returns, and long-term value to our shareholders.”

Second Quarter 2023 Highlights

- Net income for the second quarter of 2023 was $6.0 million and

diluted earnings per share was $0.63.

- Net finance receivables as of June 30, 2023 were $1.7 billion,

an increase of $163.3 million, or 10.7%, from the prior-year

period.

- Large loan net finance receivables of $1.2 billion increased

$178.5 million, or 16.8%, from the prior-year period and

represented 73.3% of the total loan portfolio, compared to 69.4% in

the prior-year period.

- Small loan net finance receivables were $444.6 million, a

decrease of 2.3% from the prior-year period.

- Total loan originations were $399.0 million in the second

quarter of 2023, a decrease of $27.3 million, or 6.4%, from the

prior-year period.

- Total revenue for the second quarter of 2023 was $133.5

million, an increase of $10.6 million, or 8.6%, from the prior-year

period.

- Interest and fee income increased $8.3 million, or 7.6%,

primarily due to higher average net finance receivables.

- Insurance income, net increased $1.0 million, or 9.6%, driven

by portfolio growth.

- Provision for credit losses for the second quarter of 2023 was

$52.6 million, an increase of $7.2 million, or 15.8%, from the

prior-year period.

- Annualized net credit losses as a percentage of average net

finance receivables for the second quarter of 2023 were 13.1%,

compared to 10.0% in the prior-year period.

- The provision for credit losses for the second quarter of 2023

included a reserve reduction of $2.4 million primarily due to

changes in estimated future macroeconomic impacts on credit losses,

partially offset by portfolio growth during the quarter.

- Allowance for credit losses was $181.4 million as of June 30,

2023, or 10.7% of net finance receivables.

- As of June 30, 2023, 30+ day contractual delinquencies totaled

$116.3 million, or 6.9% of net finance receivables, an improvement

of 30 basis points compared to March 31, 2023. The 30+ day

contractual delinquency compares favorably to the company’s $181.4

million allowance for credit losses as of June 30, 2023.

- General and administrative expenses for the second quarter of

2023 were $56.9 million, an increase of $2.8 million, or 5.1%, from

the prior-year period.

- The operating expense ratio (annualized general and

administrative expenses as a percentage of average net finance

receivables) for the second quarter of 2023 was 13.6%, a 110 basis

point improvement compared to the prior-year period.

Third Quarter 2023 Dividend

The company’s Board of Directors has declared a dividend of

$0.30 per common share for the third quarter of 2023. The dividend

will be paid on September 14, 2023 to shareholders of record as of

the close of business on August 23, 2023. The declaration and

payment of any future dividend is subject to the discretion of the

Board of Directors and will depend on a variety of factors,

including the company’s financial condition and results of

operations.

Liquidity and Capital Resources

As of June 30, 2023, the company had net finance receivables of

$1.7 billion and debt of $1.3 billion. The debt consisted of:

- $105.4 million on the company’s $420 million senior revolving

credit facility,

- $50.2 million on the company’s aggregate $375 million revolving

warehouse credit facilities, and

- $1.2 billion through the company’s asset-backed

securitizations.

As of June 30, 2023, the company’s unused capacity to fund

future growth on its revolving credit facilities (subject to the

borrowing base) was $641 million, or 80.6%, and the company had

available liquidity of [$147.2 million], including unrestricted

cash on hand and immediate availability to draw down cash from its

revolving credit facilities. As of June 30, 2023, the company’s

fixed-rate debt as a percentage of total debt was 88%, with a

weighted-average coupon of 3.6% and a weighted-average revolving

duration of 1.6 years.

The company had a funded debt-to-equity ratio of 4.2 to 1.0 and

a stockholders’ equity ratio of 18.7%, each as of June 30, 2023. On

a non-GAAP basis, the company had a funded debt-to-tangible equity

ratio of 4.4 to 1.0, as of June 30, 2023. Please refer to the

reconciliations of non-GAAP measures to comparable GAAP measures

included at the end of this press release.

Conference Call Information

Regional Management Corp. will host a conference call and

webcast today at 5:00 PM ET to discuss these results.

The dial-in number for the conference call is (855) 327-6837

(toll-free) or (631) 891-4304 (direct). Please dial the number 10

minutes prior to the scheduled start time.

*** A supplemental slide presentation will be made available

on Regional’s website prior to the earnings call at

www.RegionalManagement.com. ***

In addition, a live webcast of the conference call will be

available on Regional’s website at www.RegionalManagement.com.

A webcast replay of the call will be available at

www.RegionalManagement.com for one year following the call.

About Regional Management Corp.

Regional Management Corp. (NYSE: RM) is a diversified consumer

finance company that provides attractive, easy-to-understand

installment loan products primarily to customers with limited

access to consumer credit from banks, thrifts, credit card

companies, and other lenders. Regional Management operates under

the name “Regional Finance” online and in branch locations in 19

states across the United States. Most of its loan products are

secured, and each is structured on a fixed-rate, fixed-term basis

with fully amortizing equal monthly installment payments, repayable

at any time without penalty. Regional Management sources loans

through its multiple channel platform, which includes branches,

centrally managed direct mail campaigns, digital partners, and its

consumer website. For more information, please visit

www.RegionalManagement.com.

Forward-Looking Statements

This press release may contain various “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are not statements

of historical fact but instead represent Regional Management

Corp.’s expectations or beliefs concerning future events.

Forward-looking statements include, without limitation, statements

concerning financial outlooks or future plans, objectives, goals,

projections, strategies, events, or performance, and underlying

assumptions and other statements related thereto. Words such as

“may,” “will,” “should,” “likely,” “anticipates,” “expects,”

“intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,”

and similar expressions may be used to identify these

forward-looking statements. Such forward-looking statements speak

only as of the date on which they were made and are about matters

that are inherently subject to risks and uncertainties, many of

which are outside of the control of Regional Management. As a

result, actual performance and results may differ materially from

those contemplated by these forward-looking statements. Therefore,

investors should not place undue reliance on forward-looking

statements.

Factors that could cause actual results or performance to differ

from the expectations expressed or implied in forward-looking

statements include, but are not limited to, the following: managing

growth effectively, implementing Regional Management’s growth

strategy, and opening new branches as planned; Regional

Management’s convenience check strategy; Regional Management’s

policies and procedures for underwriting, processing, and servicing

loans; Regional Management’s ability to collect on its loan

portfolio; Regional Management’s insurance operations; exposure to

credit risk and repayment risk, which risks may increase in light

of adverse or recessionary economic conditions; the implementation

of evolving underwriting models and processes, including as to the

effectiveness of Regional Management's custom scorecards; changes

in the competitive environment in which Regional Management

operates or a decrease in the demand for its products; the

geographic concentration of Regional Management’s loan portfolio;

the failure of third-party service providers, including those

providing information technology products; changes in economic

conditions in the markets Regional Management serves, including

levels of unemployment and bankruptcies; the ability to achieve

successful acquisitions and strategic alliances; the ability to

make technological improvements as quickly as competitors; security

breaches, cyber-attacks, failures in information systems, or

fraudulent activity; the ability to originate loans; reliance on

information technology resources and providers, including the risk

of prolonged system outages; changes in current revenue and expense

trends, including trends affecting delinquencies and credit losses;

any future public health crises (including the resurgence of

COVID-19), including the impact of such crisis on our operations

and financial condition; changes in operating and administrative

expenses; the departure, transition, or replacement of key

personnel; the ability to timely and effectively implement,

transition to, and maintain the necessary information technology

systems, infrastructure, processes, and controls to support

Regional Management’s operations and initiatives; changes in

interest rates; existing sources of liquidity may become

insufficient or access to these sources may become unexpectedly

restricted; exposure to financial risk due to asset-backed

securitization transactions; risks related to regulation and legal

proceedings, including changes in laws or regulations or in the

interpretation or enforcement of laws or regulations; changes in

accounting standards, rules, and interpretations and the failure of

related assumptions and estimates; the impact of changes in tax

laws and guidance, including the timing and amount of revenues that

may be recognized; risks related to the ownership of Regional

Management’s common stock, including volatility in the market price

of shares of Regional Management’s common stock; the timing and

amount of future cash dividend payments; and anti-takeover

provisions in Regional Management’s charter documents and

applicable state law.

The foregoing factors and others are discussed in greater detail

in Regional Management’s filings with the Securities and Exchange

Commission. Regional Management will not update or revise

forward-looking statements to reflect events or circumstances after

the date of this press release or to reflect the occurrence of

unanticipated events or the non-occurrence of anticipated events,

whether as a result of new information, future developments, or

otherwise, except as required by law. Regional Management is not

responsible for changes made to this document by wire services or

Internet services.

Regional Management Corp. and

Subsidiaries

Consolidated Statements of

Income

(Unaudited)

(dollars in thousands, except

per share amounts)

Better (Worse)

Better (Worse)

2Q 23

2Q 22

$

%

YTD 23

YTD 22

$

%

Revenue

Interest and fee income

$

118,083

$

109,771

$

8,312

7.6

%

$

238,490

$

217,402

$

21,088

9.7

%

Insurance income, net

11,203

10,220

983

9.6

%

22,162

20,764

1,398

6.7

%

Other income

4,198

2,880

1,318

45.8

%

8,210

5,553

2,657

47.8

%

Total revenue

133,484

122,871

10,613

8.6

%

268,862

243,719

25,143

10.3

%

Expenses

Provision for credit losses

52,551

45,400

(7,151

)

(15.8

)%

100,219

76,258

(23,961

)

(31.4

)%

Personnel

36,419

33,941

(2,478

)

(7.3

)%

75,016

69,595

(5,421

)

(7.8

)%

Occupancy

6,158

6,156

(2

)

0.0

%

12,446

11,964

(482

)

(4.0

)%

Marketing

3,844

4,108

264

6.4

%

7,223

7,199

(24

)

(0.3

)%

Other

10,475

9,916

(559

)

(5.6

)%

21,534

20,463

(1,071

)

(5.2

)%

Total general and administrative

56,896

54,121

(2,775

)

(5.1

)%

116,219

109,221

(6,998

)

(6.4

)%

Interest expense

16,224

7,564

(8,660

)

(114.5

)%

33,006

7,505

(25,501

)

(339.8

)%

Income before income taxes

7,813

15,786

(7,973

)

(50.5

)%

19,418

50,735

(31,317

)

(61.7

)%

Income taxes

1,790

3,804

2,014

52.9

%

4,706

11,970

7,264

60.7

%

Net income

$

6,023

$

11,982

$

(5,959

)

(49.7

)%

$

14,712

$

38,765

$

(24,053

)

(62.0

)%

Net income per common share:

Basic

$

0.64

$

1.29

$

(0.65

)

(50.4

)%

$

1.57

$

4.13

$

(2.56

)

(62.0

)%

Diluted

$

0.63

$

1.24

$

(0.61

)

(49.2

)%

$

1.53

$

3.94

$

(2.41

)

(61.2

)%

Weighted-average common shares

outstanding:

Basic

9,399

9,261

(138

)

(1.5

)%

9,363

9,396

33

0.4

%

Diluted

9,566

9,669

103

1.1

%

9,595

9,845

250

2.5

%

Return on average assets (annualized)

1.4

%

3.2

%

1.7

%

5.2

%

Return on average equity (annualized)

7.6

%

16.0

%

9.3

%

26.3

%

Regional Management Corp. and

Subsidiaries

Consolidated Balance

Sheets

(Unaudited)

(dollars in thousands, except

par value amounts)

Increase (Decrease)

2Q 23

2Q 22

$

%

Assets

Cash

$

10,330

$

7,928

$

2,402

30.3

%

Net finance receivables

1,688,937

1,525,659

163,278

10.7

%

Unearned insurance premiums

(49,059

)

(48,986

)

(73

)

(0.1

)%

Allowance for credit losses

(181,400

)

(167,500

)

(13,900

)

(8.3

)%

Net finance receivables, less unearned

insurance premiums and allowance for credit losses

1,458,478

1,309,173

149,305

11.4

%

Restricted cash

131,132

144,802

(13,670

)

(9.4

)%

Lease assets

34,996

28,555

6,441

22.6

%

Restricted available-for-sale

investments

20,298

—

20,298

100.0

%

Deferred tax assets, net

15,278

19,798

(4,520

)

(22.8

)%

Property and equipment

14,689

12,808

1,881

14.7

%

Intangible assets

13,949

10,312

3,637

35.3

%

Other assets

24,466

14,568

9,898

67.9

%

Total assets

$

1,723,616

$

1,547,944

$

175,672

11.3

%

Liabilities and Stockholders’

Equity

Liabilities:

Debt

$

1,344,855

$

1,194,570

$

150,285

12.6

%

Unamortized debt issuance costs

(6,923

)

(10,819

)

3,896

36.0

%

Net debt

1,337,932

1,183,751

154,181

13.0

%

Lease liabilities

37,150

31,117

6,033

19.4

%

Accounts payable and accrued expenses

27,032

34,492

(7,460

)

(21.6

)%

Total liabilities

1,402,114

1,249,360

152,754

12.2

%

Stockholders’ equity:

Preferred stock ($0.10 par value, 100,000

shares authorized, none issued or outstanding)

—

—

—

—

Common stock ($0.10 par value, 1,000,000

shares authorized, 14,636 shares issued and 9,829 shares

outstanding at June 30, 2023 and 14,390 shares issued and 9,584

shares outstanding at June 30, 2022)

1,464

1,439

25

1.7

%

Additional paid-in capital

116,202

108,345

7,857

7.3

%

Retained earnings

354,346

338,943

15,403

4.5

%

Accumulated other comprehensive loss

(367

)

—

(367

)

(100.0

)%

Treasury stock (4,807 shares at June 30,

2023 and 4,807 shares at June 30, 2022)

(150,143

)

(150,143

)

-

—

Total stockholders’ equity

321,502

298,584

22,918

7.7

%

Total liabilities and stockholders’

equity

$

1,723,616

$

1,547,944

$

175,672

11.3

%

Regional Management Corp. and

Subsidiaries

Selected Financial

Data

(Unaudited)

(dollars in thousands, except

per share amounts)

Net Finance Receivables by

Product

2Q 23

1Q 23

QoQ $ Inc (Dec)

QoQ % Inc (Dec)

2Q 22

YoY $ Inc (Dec)

YoY % Inc (Dec)

Small loans

$

444,590

$

456,313

$

(11,723

)

(2.6

)%

$

455,253

$

(10,663

)

(2.3

)%

Large loans

1,238,031

1,211,836

26,195

2.2

%

1,059,523

178,508

16.8

%

Retail loans

6,316

8,081

(1,765

)

(21.8

)%

10,883

(4,567

)

(42.0

)%

Total net finance receivables

$

1,688,937

$

1,676,230

$

12,707

0.8

%

$

1,525,659

$

163,278

10.7

%

Number of branches at period end

347

344

3

0.9

%

334

13

3.9

%

Net finance receivables per branch

$

4,867

$

4,873

$

(6

)

(0.1

)%

$

4,568

$

299

6.5

%

Averages and Yields

2Q 23

1Q 23

2Q 22

Average Net Finance

Receivables

Average Yield (1)

Average Net Finance

Receivables

Average Yield (1)

Average Net Finance

Receivables

Average Yield (1)

Small loans

$

443,601

34.5

%

$

467,851

35.0

%

$

437,226

35.8

%

Large loans

1,223,339

26.0

%

1,215,547

26.0

%

1,023,546

27.4

%

Retail loans

7,191

16.6

%

8,954

18.6

%

10,828

18.3

%

Total interest and fee yield

$

1,674,131

28.2

%

$

1,692,352

28.5

%

$

1,471,600

29.8

%

Total revenue yield

$

1,674,131

31.9

%

$

1,692,352

32.0

%

$

1,471,600

33.4

%

(1) Annualized interest and fee income as

a percentage of average net finance receivables.

Components of Increase in

Interest and Fee Income

2Q 23 Compared to 2Q

22

Increase (Decrease)

Volume

Rate

Volume & Rate

Total

Small loans

$

571

$

(1,409

)

$

(21

)

$

(859

)

Large loans

13,691

(3,617

)

(706

)

9,368

Retail loans

(166

)

(46

)

15

(197

)

Product mix

1,011

(901

)

(110

)

—

Total increase in interest and fee

income

$

15,107

$

(5,973

)

$

(822

)

$

8,312

Loans Originated (1)

2Q 23

1Q 23

QoQ $ Inc (Dec)

QoQ % Inc (Dec)

2Q 22

YoY $ Inc (Dec)

YoY % Inc (Dec)

Small loans

$

149,460

$

109,484

$

39,976

36.5

%

$

171,244

$

(21,784

)

(12.7

)%

Large loans

249,514

193,571

55,943

28.9

%

252,572

(3,058

)

(1.2

)%

Retail loans

—

146

(146

)

(100.0

)%

2,471

(2,471

)

(100.0

)%

Total loans originated

$

398,974

$

303,201

$

95,773

31.6

%

$

426,287

$

(27,313

)

(6.4

)%

(1) Represents the principal balance of

loan originations and refinancings.

Other Key Metrics

2Q 23

1Q 23

2Q 22

Net credit losses

$

54,951

$

42,668

$

36,700

Percentage of average net finance

receivables (annualized)

13.1

%

10.1

%

10.0

%

Provision for credit losses

$

52,551

$

47,668

$

45,400

Percentage of average net finance

receivables (annualized)

12.6

%

11.3

%

12.3

%

Percentage of total revenue

39.4

%

35.2

%

36.9

%

General and administrative expenses

$

56,896

$

59,323

$

54,121

Percentage of average net finance

receivables (annualized)

13.6

%

14.0

%

14.7

%

Percentage of total revenue

42.6

%

43.8

%

44.0

%

Same store results (1):

Net finance receivables at period-end

$

1,636,131

$

1,619,407

$

1,466,300

Net finance receivable growth rate

7.2

%

12.3

%

24.7

%

Number of branches in calculation

329

325

310

(1) Same store sales reflect the change in

year-over-year sales for the comparable branch base. The comparable

branch base includes those branches open for at least one year.

Contractual Delinquency by

Aging

2Q 23

1Q 23

2Q 22

Allowance for credit losses

$

181,400

10.7

%

$

183,800

11.0

%

$

167,500

11.0

%

Current

1,433,787

84.9

%

1,438,354

85.8

%

1,306,183

85.6

%

1 to 29 days past due

138,810

8.2

%

116,723

7.0

%

124,810

8.2

%

Delinquent accounts:

30 to 59 days

33,676

2.0

%

27,428

1.6

%

26,785

1.8

%

60 to 89 days

24,931

1.5

%

25,178

1.5

%

24,420

1.6

%

90 to 119 days

20,041

1.1

%

23,148

1.4

%

18,557

1.2

%

120 to 149 days

18,087

1.1

%

22,263

1.3

%

12,528

0.8

%

150 to 179 days

19,605

1.2

%

23,136

1.4

%

12,376

0.8

%

Total contractual delinquency

$

116,340

6.9

%

$

121,153

7.2

%

$

94,666

6.2

%

Total net finance receivables

$

1,688,937

100.0

%

$

1,676,230

100.0

%

$

1,525,659

100.0

%

1 day and over past due

$

255,150

15.1

%

$

237,876

14.2

%

$

219,476

14.4

%

Contractual Delinquency by

Product

2Q 23

1Q 23

2Q 22

Small loans

$

40,894

9.2

%

$

45,600

10.0

%

$

41,984

9.2

%

Large loans

74,637

6.0

%

74,606

6.2

%

51,763

4.9

%

Retail loans

809

12.8

%

947

11.7

%

919

8.4

%

Total contractual delinquency

$

116,340

6.9

%

$

121,153

7.2

%

$

94,666

6.2

%

Income Statement Quarterly

Trend

2Q 22

3Q 22

4Q 22

1Q 23

2Q 23

QoQ $ B(W)

YoY $ B(W)

Revenue

Interest and fee income

$

109,771

$

116,020

$

117,432

$

120,407

$

118,083

$

(2,324

)

$

8,312

Insurance income, net

10,220

11,987

10,751

10,959

11,203

244

983

Other income

2,880

3,445

3,833

4,012

4,198

186

1,318

Total revenue

122,871

131,452

132,016

135,378

133,484

(1,894

)

10,613

Expenses

Provision for credit losses

45,400

48,071

60,786

47,668

52,551

(4,883

)

(7,151

)

Personnel

33,941

36,979

34,669

38,597

36,419

2,178

(2,478

)

Occupancy

6,156

5,848

5,997

6,288

6,158

130

(2

)

Marketing

4,108

3,940

4,239

3,379

3,844

(465

)

264

Other

9,916

11,397

10,238

11,059

10,475

584

(559

)

Total general and administrative

54,121

58,164

55,143

59,323

56,896

2,427

(2,775

)

Interest expense

7,564

11,863

14,855

16,782

16,224

558

(8,660

)

Income before income taxes

15,786

13,354

1,232

11,605

7,813

(3,792

)

(7,973

)

Income taxes

3,804

3,286

(1,159

)

2,916

1,790

1,126

2,014

Net income

$

11,982

$

10,068

$

2,391

$

8,689

$

6,023

$

(2,666

)

$

(5,959

)

Net income per common share:

Basic

$

1.29

$

1.09

$

0.26

$

0.93

$

0.64

$

(0.29

)

$

(0.65

)

Diluted

$

1.24

$

1.06

$

0.25

$

0.90

$

0.63

$

(0.27

)

$

(0.61

)

Weighted-average shares outstanding:

Basic

9,261

9,195

9,199

9,325

9,399

(74

)

(138

)

Diluted

9,669

9,526

9,411

9,622

9,566

56

103

Balance Sheet Quarterly

Trend

2Q 22

3Q 22

4Q 22

1Q 23

2Q 23

QoQ $ Inc (Dec)

YoY $ Inc (Dec)

Total assets

$

1,547,944

$

1,606,550

$

1,724,987

$

1,701,114

$

1,723,616

$

22,502

$

175,672

Net finance receivables

$

1,525,659

$

1,607,598

$

1,699,393

$

1,676,230

$

1,688,937

$

12,707

$

163,278

Allowance for credit losses

$

167,500

$

179,800

$

178,800

$

183,800

$

181,400

$

(2,400

)

$

13,900

Debt

$

1,194,570

$

1,241,039

$

1,355,359

$

1,329,677

$

1,344,855

$

15,178

$

150,285

Other Key Metrics Quarterly

Trend

2Q 22

3Q 22

4Q 22

1Q 23

2Q 23

QoQ Inc (Dec)

YoY Inc (Dec)

Interest and fee yield (annualized)

29.8

%

29.6

%

28.5

%

28.5

%

28.2

%

(0.3

)%

(1.6

)%

Efficiency ratio (1)

44.0

%

44.2

%

41.8

%

43.8

%

42.6

%

(1.2

)%

(1.4

)%

Operating expense ratio (2)

14.7

%

14.9

%

13.4

%

14.0

%

13.6

%

(0.4

)%

(1.1

)%

30+ contractual delinquency

6.2

%

7.2

%

7.1

%

7.2

%

6.9

%

(0.3

)%

0.7

%

Net credit loss ratio (3)

10.0

%

9.1

%

15.0

%

10.1

%

13.1

%

3.0

%

3.1

%

Book value per share

$

31.15

$

32.18

$

32.41

$

33.06

$

32.71

$

(0.35

)

$

1.56

(1) General and administrative

expenses as a percentage of total revenue.

(2) Annualized general and administrative

expenses as a percentage of average net finance receivables.

(3) Annualized net credit losses as a

percentage of average net finance receivables.

Averages and Yields

YTD 23

YTD 22

Average Net Finance

Receivables

Average Yield

(Annualized)

Average Net Finance

Receivables

Average Yield

(Annualized)

Small loans

$

455,659

34.8

%

$

439,070

35.9

%

Large loans

1,219,464

26.0

%

1,003,326

27.4

%

Retail loans

8,068

17.7

%

10,725

18.3

%

Total interest and fee yield

$

1,683,191

28.3

%

$

1,453,121

29.9

%

Total revenue yield

$

1,683,191

31.9

%

$

1,453,121

33.5

%

(1) Annualized interest and fee income as

a percentage of average net finance receivables.

Components of Increase in

Interest and Fee Income

YTD 23 Compared to YTD

22

Increase (Decrease)

Volume

Rate

Volume & Rate

Total

Small loans

$

2,977

$

(2,421

)

$

(92

)

$

464

Large loans

29,648

(7,204

)

(1,552

)

20,892

Retail loans

(244

)

(33

)

9

(268

)

Product mix

2,040

(1,852

)

(188

)

—

Total increase in interest and fee

income

$

34,421

$

(11,510

)

$

(1,823

)

$

21,088

Loans Originated (1)

YTD 23

YTD 22

YTD $ Inc (Dec)

YTD % Inc (Dec)

Small loans

$

258,944

$

308,375

$

(49,431

)

(16.0

)%

Large loans

443,085

438,851

4,234

1.0

%

Retail loans

146

5,061

(4,915

)

(97.1

)%

Total loans originated

$

702,175

$

752,287

$

(50,112

)

(6.7

)%

(1) Represents the principal balance of

loan originations and refinancings.

Other Key Metrics

YTD 23

YTD 22

Net credit losses

$

97,619

$

68,058

Percentage of average net finance

receivables (annualized)

11.6

%

9.4

%

Provision for credit losses

$

100,219

$

76,258

Percentage of average net finance

receivables (annualized)

11.9

%

10.5

%

Percentage of total revenue

37.3

%

31.3

%

General and administrative expenses

$

116,219

$

109,221

Percentage of average net finance

receivables (annualized)

13.8

%

15.0

%

Percentage of total revenue

43.2

%

44.8

%

Non-GAAP Financial Measures

In addition to financial measures presented in accordance with

generally accepted accounting principles (“GAAP”), this press

release contains certain non-GAAP financial measures. The company’s

management utilizes non-GAAP measures as additional metrics to aid

in, and enhance, its understanding of the company’s financial

results. Tangible equity and the funded debt-to-tangible equity

ratio are non-GAAP measures that adjust GAAP measures to exclude

intangible assets. Management uses these equity measures to

evaluate and manage the company’s capital and leverage position.

The company also believes that these equity measures are commonly

used in the financial services industry and provide useful

information to users of the company’s financial statements in the

evaluation of its capital and leverage position.

This non-GAAP financial information should be considered in

addition to, not as a substitute for or superior to, measures of

financial performance prepared in accordance with GAAP. In

addition, the company’s non-GAAP measures may not be comparable to

similarly titled non-GAAP measures of other companies. The

following tables provide a reconciliation of GAAP measures to

non-GAAP measures.

2Q 23

Debt

$

1,344,855

Total stockholders' equity

321,502

Less: Intangible assets

13,949

Tangible equity (non-GAAP)

$

307,553

Funded debt-to-equity ratio

4.2

x

Funded debt-to-tangible equity ratio

(non-GAAP)

4.4

x

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230802337574/en/

Investor Relations Garrett Edson, (203) 682-8331

investor.relations@regionalmanagement.com

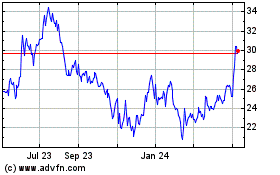

Regional Management (NYSE:RM)

Historical Stock Chart

From Oct 2024 to Nov 2024

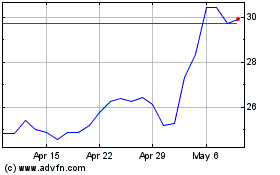

Regional Management (NYSE:RM)

Historical Stock Chart

From Nov 2023 to Nov 2024