0001713445False00017134452024-05-022024-05-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________

FORM 8-K

_________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 2, 2024

_________________________________________

Reddit, Inc.

(Exact name of registrant as specified in its charter)

_________________________________________

| | | | | | | | |

| Delaware | 001-41983 | 45-2546501 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

303 2nd Street, South Tower, 5th Floor

San Francisco, California 94107

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (415) 494-8016

_________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Class A common stock, $0.0001 par value per share | | RDDT | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Item 2.02 Results of Operations and Financial Condition.

On May 7, 2024, Reddit, Inc. ("Reddit") issued a press release and a letter to shareholders announcing its financial results for the three months ended March 31, 2024. In the press release and letter, Reddit also announced that it would be holding a conference call on May 7, 2024 at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern Time to discuss its financial results for the three months ended March 31, 2024. Reddit will also solicit questions from the Reddit community in its investor relations subreddit r/RDDT at https://www.reddit.com/r/RDDT/ on Tuesday, May 7, 2024, and post responses following the earnings call at Reddit’s Investor Relations website at https://investor.redditinc.com and r/RDDT at https://www.reddit.com/r/RDDT/. A copy of the press release and letter to shareholders are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

The information furnished pursuant to Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Reddit uses the investor relations page on its website https://investor.redditinc.com, as well as the subreddits r/RDDT and r/reddit, available at https://www.reddit.com/r/RDDT/ and https://www.reddit.com/r/reddit/ respectively, as means of disclosing material non-public information and for complying with its disclosure obligation under Regulation FD.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 2, 2024, the Board of Directors of Reddit (the “Board”) appointed Sarah Farrell, Managing Partner of Waygrove Partnership, to the Board. Ms. Farrell was appointed to a newly created vacancy on the Board resulting from an increase in the size of the Board from seven to eight directors. Ms. Farrell has been appointed to the Audit Committee of the Board, effective May 2, 2024. Ms. Farrell is an independent director under the applicable listing rules of the New York Stock Exchange.

As a result of her appointment to the Board, Ms. Farrell will participate in Reddit’s amended and restated non-employee director compensation program (the “Program”), the terms of which are described in Reddit’s prospectus, dated March 20, 2024, filed with the Securities and Exchange Commission in accordance with Rule 424(b) of the Securities Act of 1933, as amended, on March 21, 2024. Pursuant to the Program, Ms. Farrell will receive (i) an annual cash retainer of $60,000 for service on the Board, paid quarterly in arrears, prorated for the portion of each calendar quarter served, (ii) an annual cash retainer of $12,500 for service on the Audit Committee of the Board, paid quarterly in arrears, prorated for the portion of each calendar quarter served, and (iii) commencing in 2025, an annual award of restricted stock units (“RSUs”) under Reddit’s 2024 Incentive Award Plan (the “2024 Plan”) granted on each date of the annual meeting of the Company’s stockholders, provided she continues serving on the Board following such meeting, with a target value of $250,000, which will vest on the earlier of the first anniversary of the grant date or the next annual meeting of Reddit’s stockholders, subject to her continued service on the Board. The number of RSUs subject to each annual equity award will be determined by dividing the target value of the award by the average closing trading price of Reddit’s Class A common stock over the 60 consecutive trading days ending with the trading day immediately preceding the grant date.

Additionally, the Board has approved an award of RSUs for Ms. Farrell, to be granted on May 30, 2024, under the 2024 Plan with a target value of $250,000, which will vest on the earlier of the first anniversary of the grant date or the 2025 annual meeting of Reddit’s stockholders, subject to her continued service on the Board. The number of RSUs subject to the award will be determined by dividing the target value of the award by the average closing trading price of Reddit’s Class A common stock from March 21, 2024 through May 20, 2024.

Reddit will also enter into an indemnification agreement with Ms. Farrell in substantially the same form entered into with the other directors of Reddit.

There are no arrangements or understandings between Ms. Farrell, on the one hand, and any other persons, on the other hand, pursuant to which Ms. Farrell was selected as a director. Ms. Farrell has no family relationship with any director or executive officer of Reddit, and is not a party to any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

A copy of the press release announcing this appointment is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)The following exhibits are being filed herewith:

| | | | | | | | |

Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| REDDIT, INC. |

| | |

Date: May 7, 2024 | By: | /s/ Steven Huffman |

| | Steven Huffman |

| | President and Chief Executive Officer |

Exhibit 99.1

Reddit Announces First Quarter 2024 Results

Record user traffic, Daily Active Uniques (“DAUq”) increased 37% to 82.7 million

Revenue increased 48% to $243.0 million, nearly doubling growth rate from prior quarter

Net loss driven by IPO expenses, first profitable Q1 on an Adjusted EBITDA basis

Operating cash flow of $32.1 million and positive free cash flow of $29.2 million

SAN FRANCISCO, Calif. – May 7, 2024 – Reddit, Inc. (NYSE: RDDT) today announced financial results for the quarter ended March 31, 2024. Reddit’s complete financial results and management commentary can be found in its shareholder letter on Reddit’s Investor Relations website at https://investor.redditinc.com and investor relations subreddit r/RDDT at https://www.reddit.com/r/RDDT/.

“It was a strong start to the year and a milestone quarter for Reddit and our communities as we debuted as a public company,” said Steve Huffman, Co-Founder and CEO of Reddit. “We see this as the beginning of a new chapter as we work towards building the next generation of Reddit.”

•DAUq increased 37% year-over-year to 82.7 million

•Weekly Active Uniques (“WAUq”) increased 40% year-over-year to 306.2 million

•Revenue increased 48% year-over-year to $243.0 million, Ad Revenue increased 39% year-over-year to $222.7 million

•Gross margin was 88.6%, an improvement of 500 basis points from the prior year

•Net loss was $575.1 million, as compared to $60.9 million in the prior year. Stock-based compensation expense and related taxes were $595.5 million, as compared to $13.2 million in the prior year, driven by IPO charges

•Adjusted EBITDA was $10.0 million, as compared to $(50.2) million in the prior year

•Operating cash flow was $32.1 million, an improvement of $28.0 million from the prior year

•Free Cash Flow was $29.2 million. Capital expenditures were $2.9 million

First Quarter 2024 Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | | | |

| (in millions, except percentages; unaudited) | 2024 | | 2023 | | % Change | | | | | | |

| Revenue | $ | 243.0 | | | $ | 163.7 | | | 48% | | | | | | |

| U.S. | $ | 199.8 | | | $ | 130.6 | | | 53% | | | | | | |

| International | $ | 43.2 | | | $ | 33.1 | | | 30% | | | | | | |

| | | | | | | | | | | |

| GAAP gross margin | 88.6 | % | | 83.6 | % | | | | | | | | |

| Non-GAAP gross margin* | 88.7 | % | | 83.7 | % | | | | | | | | |

| | | | | | | | | | | |

| Net income (loss) | $ | (575.1) | | | $ | (60.9) | | | NM | | | | | | |

| Adjusted EBITDA* | $ | 10.0 | | | $ | (50.2) | | | NM | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Net cash provided by operating activities | $ | 32.1 | | | $ | 4.1 | | | NM | | | | | | |

| Free Cash Flow* | $ | 29.2 | | | $ | 3.7 | | | NM | | | | | | |

Cash, cash equivalents, and marketable securities | $ | 1,670.4 | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

NM - not meaningful

*The definitions of non-GAAP gross margin, Adjusted EBITDA, and Free Cash Flow can be found in the Use of Non-GAAP Financial Measures section of this release. A reconciliation of non-GAAP financial measures to the most directly comparable U.S. GAAP measure can be found on pages 10-12.

Financial Outlook

The guidance provided below is based on Reddit’s current estimates and is not a guarantee of future performance. This guidance is subject to significant risks and uncertainties that could cause actual results to differ materially, including the risk factors discussed in Reddit’s reports on file with the Securities and Exchange Commission. Reddit undertakes no duty to update any forward-looking statements or estimates, except as required by applicable law.

As we look ahead, we will share our internal thoughts on revenue and Adjusted EBITDA for the second quarter.

In the second quarter of 2024, we estimate:

•Revenue in the range of $240 million to $255 million

•Adjusted EBITDA in the range of $0 to $15 million

Board of Directors Update

We are pleased to announce that Sarah Farrell, co-founder and Managing Partner of Waygrove Partnership, has joined Reddit’s Board of Directors. Sarah has served as a board observer since 2021 and will fill a new seat, increasing our Board to eight directors.

“Sarah’s expertise in finance and investing has been invaluable as we’ve made the transition to a public company,” said Steve Huffman, Co-Founder and CEO of Reddit. “This appointment is a testament to Sarah’s contributions, and I look forward to her continued impact on Reddit’s mission.”

“As a long-time Reddit user, I am excited to continue to partner with Steve and Reddit's leadership as the company enters a new era of growth in the public markets,” said Sarah Farrell. “In a world where content is increasingly AI and influencer generated, Reddit remains one of the few uniquely human places on the internet.”

Previously, Sarah was a Partner at Inclusive Capital Partners and held investment and private equity roles at ValueAct Capital, The Blackstone Group, and J.P. Morgan. Sarah served on the boards of Verra Mobility Corporation, Kolmac Outpatient Recovery Centers, and Lindblad Expeditions Holdings, Inc. Sarah lives in San Francisco with her family and enjoys spending time in r/goldenretrievers, r/watercolor, and r/dramatichouseplants.

Earnings Conference Call Information and Community Update

Reddit will host a conference call to discuss the results for the first quarter of 2024 on May 7, 2024, at 2:00 p.m. PT / 5:00 p.m. ET. A live webcast of the call can be accessed on Reddit’s Investor Relations website at https://investor.redditinc.com and investor relations subreddit r/RDDT at https://www.reddit.com/r/RDDT/. A replay of the webcast and transcript will be available following the conclusion of the conference call on the same websites.

Reddit will solicit questions from the community in the investor relations subreddit r/RDDT at https://www.reddit.com/r/RDDT/ on Tuesday, May 7, 2024, and post responses following the earnings call at Reddit’s Investor Relations website at https://investor.redditinc.com and r/RDDT at https://www.reddit.com/r/RDDT/.

Reddit uses the investor relations page on its website https://investor.redditinc.com, as well as the subreddits r/RDDT and r/reddit, available at https://www.reddit.com/r/RDDT/ and https://www.reddit.com/r/reddit/, respectively, as means of disclosing material non-public information and for complying with its disclosure obligation under Regulation FD.

About Reddit

Reddit is a network of more than 100,000 active communities where people can dive into anything through experiences built around their interests, hobbies and passions. Reddit users submit, vote, and comment on content, stories, and discussions about the topics they care about the most. From pets to parenting, there’s a community for everybody on Reddit and with more than 82 million daily active uniques, it is home to the most open and authentic conversations on the internet. For more information, visit www.redditinc.com.

| | | | | |

Investor Relations Jesse Rose ir@reddit.com | Media Relations Gina Antonini press@reddit.com |

Forward Looking Statements

This letter contains forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Reddit's future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as "may," "will," "should," "expects," "plans," "anticipates," "going to," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these words or other similar terms or expressions that concern Reddit's expectations, strategy, priorities, plans or intentions. Forward-looking statements in this release include, but are not limited to, statements regarding Reddit’s priorities, future financial and operating performance, including headcount strategy, breakeven performance objective, capitalization of training data, evolution of AI, international growth strategies to increase content consumption and improve local user experience, consumer product strategy with respect to growth and engagement, GAAP and non-GAAP guidance, strategies, and expectations of growth. Reddit's expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected, including those more fully described under the caption “Risk Factors” and elsewhere in documents that Reddit files with the Securities and Exchange Commission (the “SEC”) from time to time, including Reddit’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, which is being filed with the SEC at or around the date hereof. The forward-looking statements in this release are based on information available to Reddit as of the date hereof, and Reddit undertakes no obligation to update any forward-looking statements, except as required by law.

A Note About Metrics

We define a daily active unique (“DAUq”) as a user whom we can identify with a unique identifier who has visited a page on the Reddit website, www.reddit.com, or opened a Reddit application at least once during a 24-hour period. Average DAUq for a particular period is calculated by adding the number of DAUq on each day of that period and dividing that sum by the number of days in that period.

We define a weekly active unique (“WAUq”) as a user whom we can identify with a unique identifier who has visited a page on the Reddit website, www.reddit.com, or opened a Reddit application at least once during a trailing seven-day period. Average quarterly WAUq for a particular period is calculated by adding the number of WAUq on each day of that period and dividing that sum by the number of days in that period.

We define average revenue per unique (“ARPU”) as quarterly revenue in a given geography divided by the average DAUq in that geography. For the purposes of calculating ARPU, advertising revenue in a given geography is based on the geographic location in which advertising impressions are delivered, as this approximates revenue based on user activity, while other revenue in a given geography is based on the billing address of the customer.

Use of Non-GAAP Financial Measures

We use certain non-GAAP financial measures to supplement our consolidated financial statements, which are presented in accordance with U.S. GAAP, to evaluate our core operating performance. These non-GAAP financial measures include Adjusted EBITDA, Free Cash Flow, non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expense, non-GAAP research and development expense, non-GAAP sales and marketing expense, and non-GAAP general and administrative expense. We use these non-GAAP financial measures to facilitate reviews of our operational performance and as a basis for strategic planning. By excluding certain items that are non-recurring or not reflective of the performance of our normal course of business, we believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance. Accordingly, we believe these non-GAAP financial measures are useful to investors and others because they allow investors to supplement their understanding of our financial trends and evaluate our ongoing and future performance in the same manner as management. However, there are a number of limitations related to the use of non-GAAP financial measures as they

reflect the exercise of judgment by our management about which expenses are excluded or included in determining these non-GAAP measures. These non-GAAP measures should be considered in addition to, not as a substitute for or in isolation from, our financial results prepared in accordance with U.S. GAAP. Other companies, including companies in our industry, may calculate these non-GAAP financial measures differently or not at all, which reduces their usefulness as comparative measures.

A reconciliation is provided in the Appendix for each historical non-GAAP financial measure to the most directly comparable financial measure stated in accordance with U.S. GAAP. Reddit encourages investors to review the related U.S. GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable U.S. GAAP financial measures, and not to rely on any single financial measure to evaluate Reddit’s business. We have not provided a reconciliation to the forward-looking GAAP equivalent measures for our non-GAAP guidance due to uncertainty regarding, and the potential variability of, reconciling items. Therefore, a reconciliation of these non-GAAP guidance measures to their corresponding GAAP guidance measures is not available without unreasonable effort.

Adjusted EBITDA is defined as net income (loss) excluding interest (income) expense, net, income tax expense (benefit), depreciation and amortization, stock-based compensation expense and related taxes, other (income) expense, net, and certain other non-recurring or non-cash items impacting net income (loss) that we do not consider indicative of our ongoing business performance. Other (income) expense, net consists primarily of realized gains and losses on sales of marketable securities, foreign currency transaction gains and losses, and other income and expense that are not indicative of our core operating performance. We consider the exclusion of certain non-recurring or non-cash items in calculating Adjusted EBITDA to provide a useful measure for investors and others to evaluate our operating results in the same manner as management.

Free Cash Flow represents net cash provided by (used in) operating activities less purchases of property and equipment. We believe that Free Cash Flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash. Once our business needs and obligations are met, cash can be used to maintain a strong balance sheet and invest in future growth. Additionally, we believe that Free Cash Flow is an important measure since we use third-party infrastructure partners to host our services and therefore we do not incur significant capital expenditures to support revenue generating activities.

Non-GAAP gross profit is defined as gross profit excluding stock-based compensation and related taxes, depreciation, and amortization expenses. Non-GAAP gross margin is defined as non-GAAP gross profit divided by revenue. We believe that these non-GAAP financial measures are useful to investors as they exclude expenses that are not reflective of our operational performance during the period and could mask underlying trends in our business.

Non-GAAP operating expenses represents operating expenses excluding stock-based compensation and related taxes, depreciation and amortization, and certain other non-recurring or non-cash items impacting operating expenses that we do not consider indicative of our ongoing business performance. Non-GAAP research and development expense, non-GAAP sales and marketing expense, and non-GAAP general and administrative expense represent their respective operating expense line items excluding stock-based compensation and related taxes, depreciation, amortization, and certain other non-recurring or non-cash items. Similar to non-GAAP gross profit and non-GAAP gross margin, we consider non-GAAP operating expense, non-GAAP research and development expense, non-GAAP sales and marketing expense, and non-GAAP general and administrative expense to be useful measures as they exclude expenses that are not reflective of our operational performance and could mask underlying trends in our business.

| | |

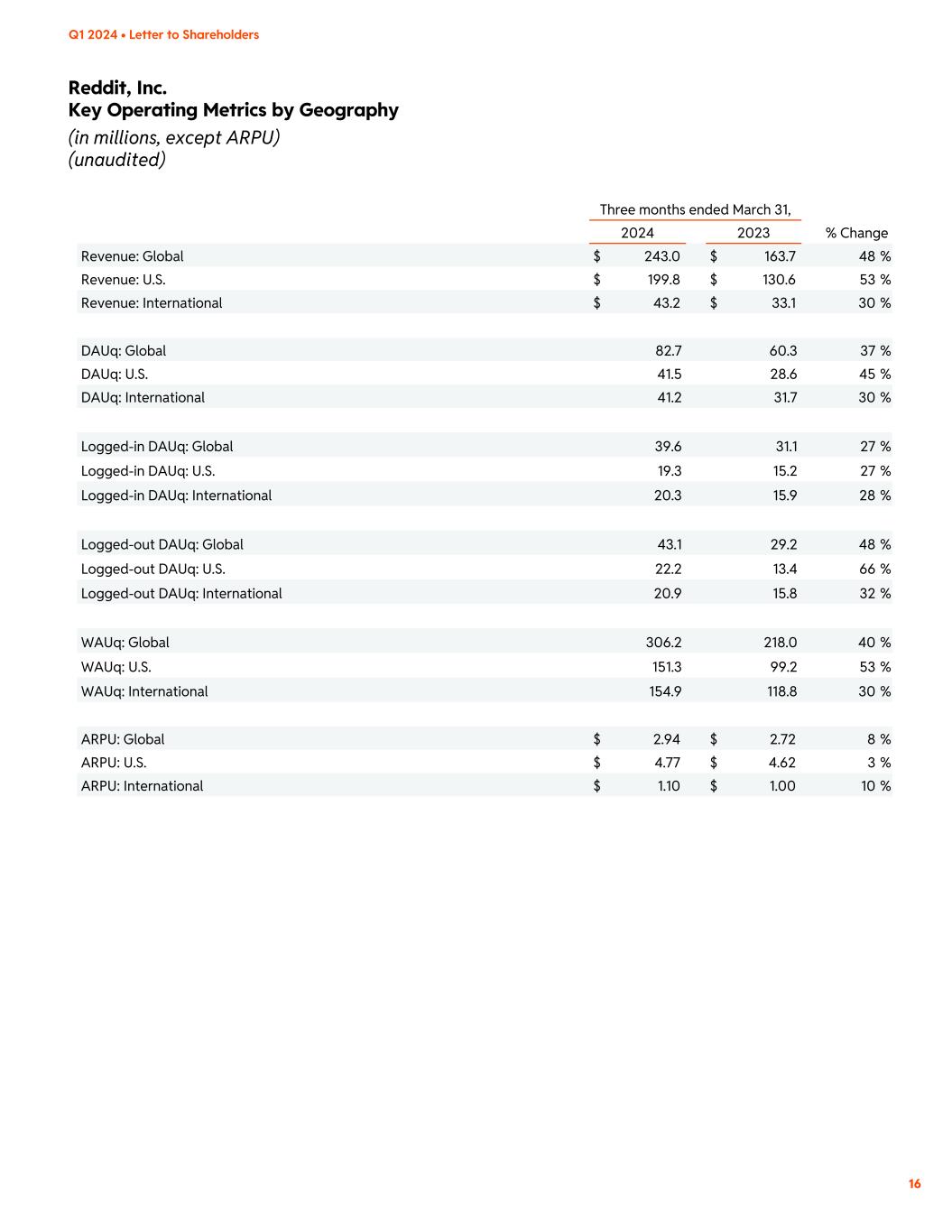

Reddit, Inc. Key Operating Metrics by Geography (in millions, except ARPU) (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | | | |

| 2024 | | 2023 | | % Change | | | | | | |

| Revenue: Global | $ | 243.0 | | | $ | 163.7 | | | 48 | % | | | | | | |

| Revenue: U.S. | $ | 199.8 | | | $ | 130.6 | | | 53 | % | | | | | | |

| Revenue: International | $ | 43.2 | | | $ | 33.1 | | | 30 | % | | | | | | |

| | | | | | | | | | | |

| DAUq: Global | 82.7 | | 60.3 | | 37 | % | | | | | | |

| DAUq: U.S. | 41.5 | | 28.6 | | 45 | % | | | | | | |

| DAUq: International | 41.2 | | 31.7 | | 30 | % | | | | | | |

| | | | | | | | | | | |

Logged-in DAUq: Global | 39.6 | | 31.1 | | 27 | % | | | | | | |

Logged-in DAUq: U.S. | 19.3 | | 15.2 | | 27 | % | | | | | | |

Logged-in DAUq: International | 20.3 | | 15.9 | | 28 | % | | | | | | |

| | | | | | | | | | | |

Logged-out DAUq: Global | 43.1 | | 29.2 | | 48 | % | | | | | | |

Logged-out DAUq: U.S. | 22.2 | | 13.4 | | 66 | % | | | | | | |

Logged-out DAUq: International | 20.9 | | 15.8 | | 32 | % | | | | | | |

| | | | | | | | | | | |

WAUq: Global | 306.2 | | 218.0 | | 40 | % | | | | | | |

WAUq: U.S. | 151.3 | | 99.2 | | 53 | % | | | | | | |

WAUq: International | 154.9 | | 118.8 | | 30 | % | | | | | | |

| | | | | | | | | | | |

| ARPU: Global | $ | 2.94 | | | $ | 2.72 | | | 8 | % | | | | | | |

| ARPU: U.S. | $ | 4.77 | | | $ | 4.62 | | | 3 | % | | | | | | |

| ARPU: International | $ | 1.10 | | | $ | 1.00 | | | 10 | % | | | | | | |

| | |

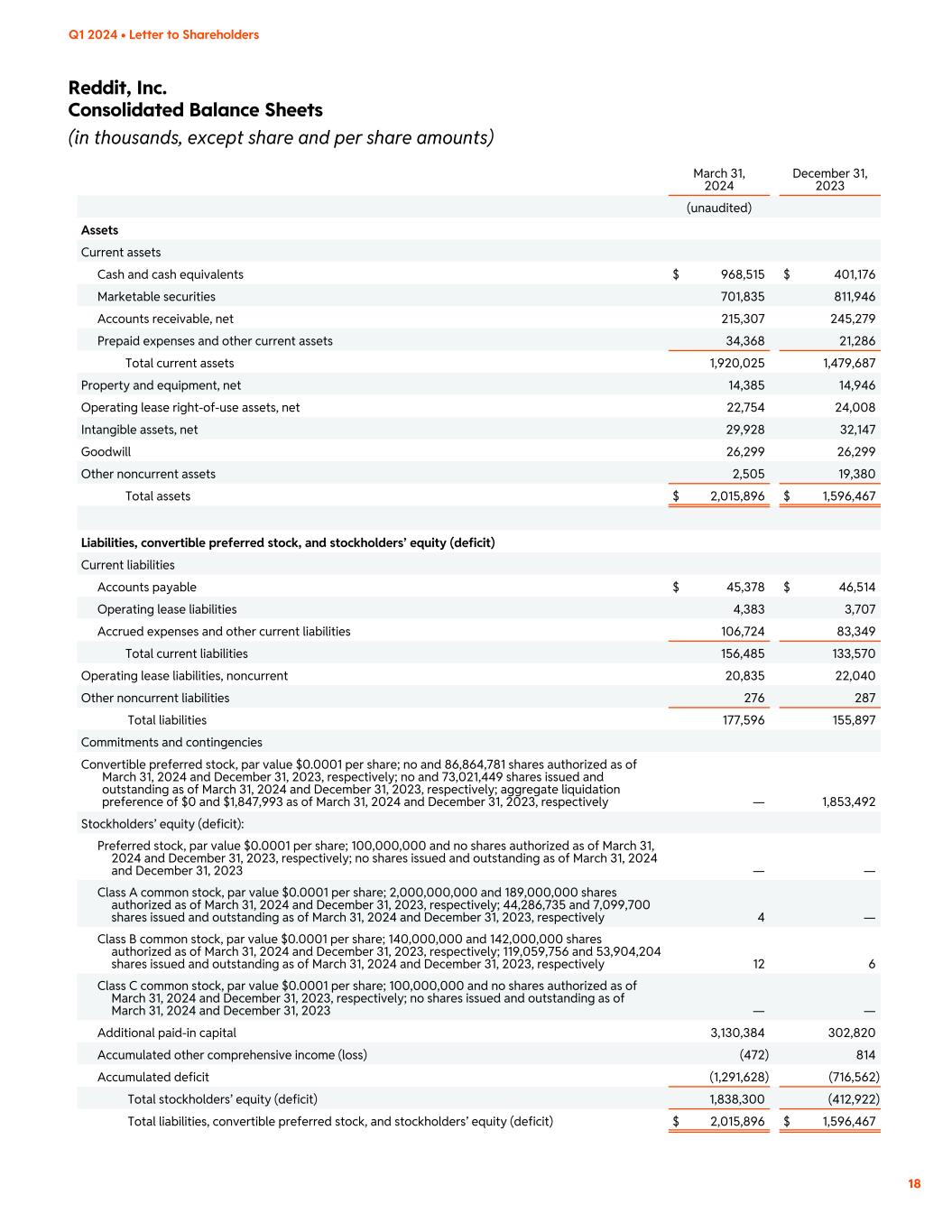

Reddit, Inc. Consolidated Balance Sheets (in thousands, except share and per share amounts)

|

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| (unaudited) | | |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 968,515 | | | $ | 401,176 | |

| Marketable securities | 701,835 | | | 811,946 | |

| Accounts receivable, net | 215,307 | | | 245,279 | |

| Prepaid expenses and other current assets | 34,368 | | | 21,286 | |

| Total current assets | 1,920,025 | | | 1,479,687 | |

| Property and equipment, net | 14,385 | | | 14,946 | |

| Operating lease right-of-use assets, net | 22,754 | | | 24,008 | |

| Intangible assets, net | 29,928 | | | 32,147 | |

| Goodwill | 26,299 | | | 26,299 | |

| Other noncurrent assets | 2,505 | | | 19,380 | |

| Total assets | $ | 2,015,896 | | | $ | 1,596,467 | |

| | | |

| Liabilities, convertible preferred stock, and stockholders’ equity (deficit) | | | |

| Current liabilities | | | |

| Accounts payable | $ | 45,378 | | | $ | 46,514 | |

| Operating lease liabilities | 4,383 | | | 3,707 | |

| Accrued expenses and other current liabilities | 106,724 | | | 83,349 | |

| Total current liabilities | 156,485 | | | 133,570 | |

| Operating lease liabilities, noncurrent | 20,835 | | | 22,040 | |

| Other noncurrent liabilities | 276 | | | 287 | |

| Total liabilities | 177,596 | | | 155,897 | |

| Commitments and contingencies | | | |

| Convertible preferred stock, par value $0.0001 per share; no and 86,864,781 shares authorized as of March 31, 2024 and December 31, 2023, respectively; no and 73,021,449 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively; aggregate liquidation preference of $0 and $1,847,993 as of March 31, 2024 and December 31, 2023, respectively | — | | | 1,853,492 | |

| Stockholders’ equity (deficit): | | | |

Preferred stock, par value $0.0001 per share; 100,000,000 and no shares authorized as of March 31, 2024 and December 31, 2023, respectively; no shares issued and outstanding as of March 31, 2024 and December 31, 2023 | — | | | — | |

| Class A common stock, par value $0.0001 per share; 2,000,000,000 and 189,000,000 shares authorized as of March 31, 2024 and December 31, 2023, respectively; 44,286,735 and 7,099,700 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | 4 | | | — | |

| Class B common stock, par value $0.0001 per share; 140,000,000 and 142,000,000 shares authorized as of March 31, 2024 and December 31, 2023, respectively; 119,059,756 and 53,904,204 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | 12 | | | 6 | |

Class C common stock, par value $0.0001 per share; 100,000,000 and no shares authorized as of March 31, 2024 and December 31, 2023, respectively; no shares issued and outstanding as of March 31, 2024 and December 31, 2023 | — | | | — | |

| Additional paid-in capital | 3,130,384 | | | 302,820 | |

| Accumulated other comprehensive income (loss) | (472) | | | 814 | |

| Accumulated deficit | (1,291,628) | | | (716,562) | |

| Total stockholders’ equity (deficit) | 1,838,300 | | | (412,922) | |

| Total liabilities, convertible preferred stock, and stockholders’ equity (deficit) | $ | 2,015,896 | | | $ | 1,596,467 | |

| | |

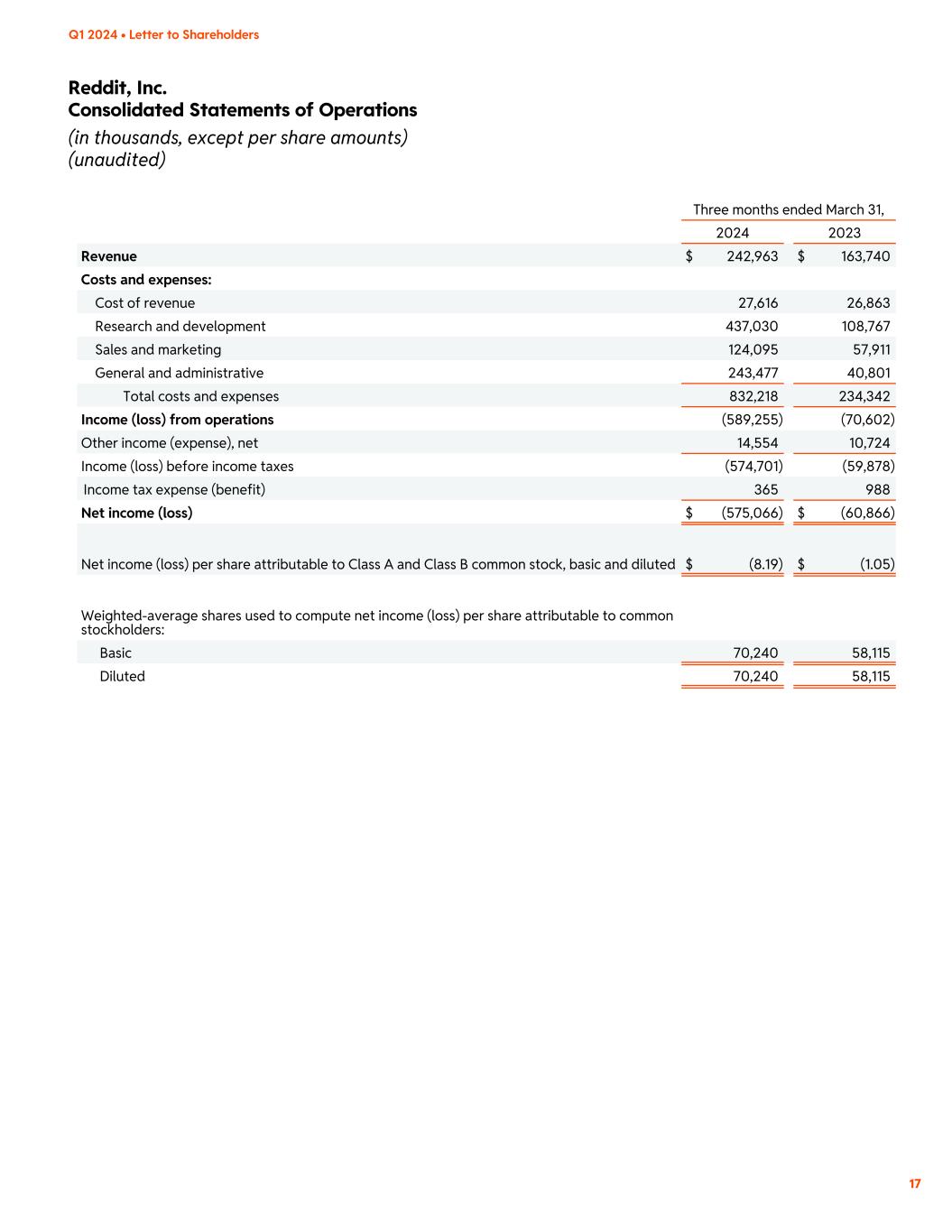

Reddit, Inc. Consolidated Statements of Operations (in thousands, except per share amounts) (unaudited) |

| | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

| 2024 | | 2023 | | | | |

| | | | | |

| Revenue | $ | 242,963 | | | $ | 163,740 | | | | | |

| Costs and expenses: | | | | | | | |

| Cost of revenue | 27,616 | | | 26,863 | | | | | |

| Research and development | 437,030 | | | 108,767 | | | | | |

| Sales and marketing | 124,095 | | | 57,911 | | | | | |

| General and administrative | 243,477 | | | 40,801 | | | | | |

| Total costs and expenses | 832,218 | | | 234,342 | | | | | |

| Income (loss) from operations | (589,255) | | | (70,602) | | | | | |

| Other income (expense), net | 14,554 | | | 10,724 | | | | | |

| Income (loss) before income taxes | (574,701) | | | (59,878) | | | | | |

| Income tax expense (benefit) | 365 | | | 988 | | | | | |

| Net income (loss) | $ | (575,066) | | | $ | (60,866) | | | | | |

| Net income (loss) per share attributable to Class A and Class B common stock, basic and diluted | $ | (8.19) | | | $ | (1.05) | | | | | |

| Weighted-average shares used to compute net income (loss) per share attributable to common stockholders: | | | | | | | |

| Basic | 70,240 | | | 58,115 | | | | | |

| Diluted | 70,240 | | | 58,115 | | | | | |

| | |

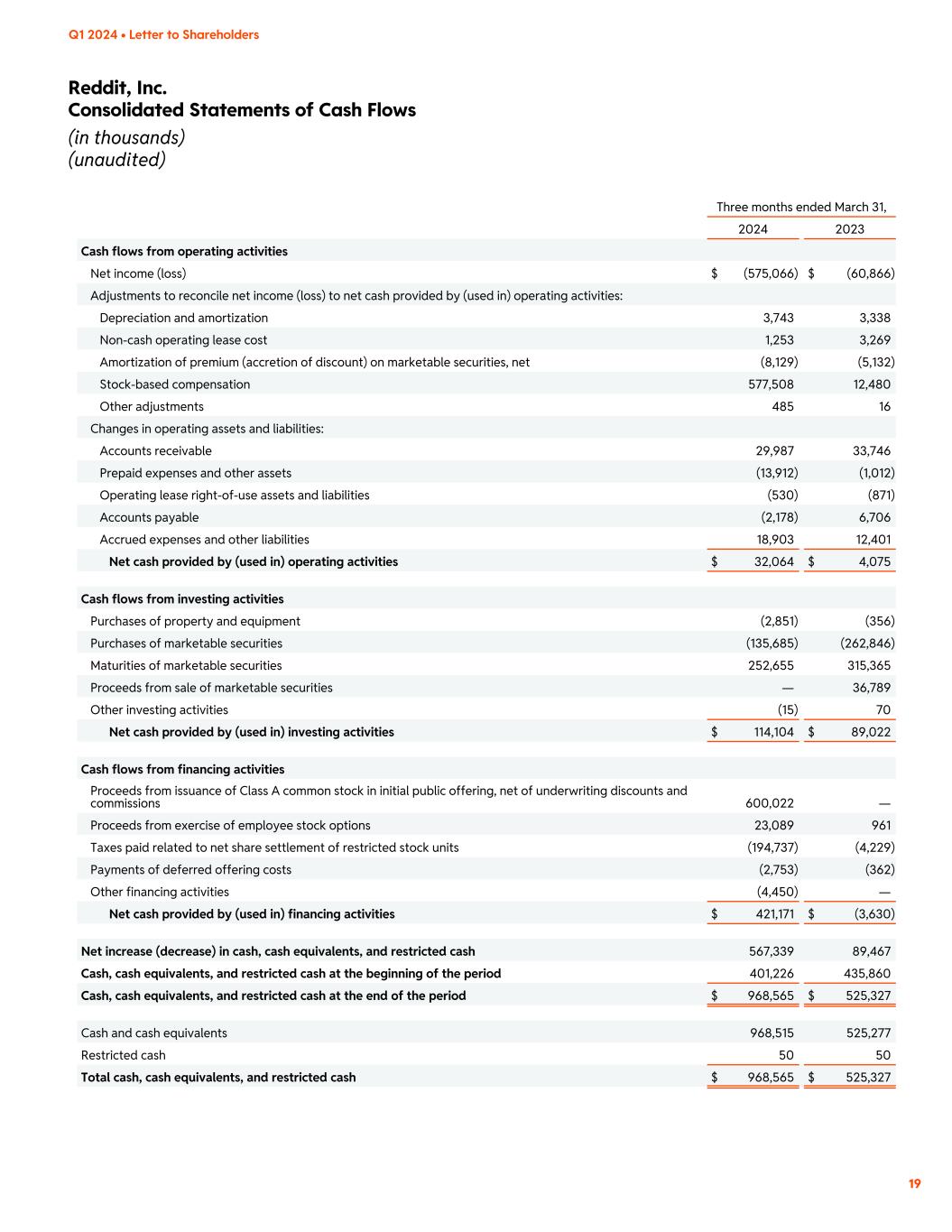

Reddit, Inc. Consolidated Statements of Cash Flows (in thousands) (unaudited) |

| | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

| 2024 | | 2023 | | | | |

| | | | | |

| Cash flows from operating activities | | | | | | | |

| Net income (loss) | $ | (575,066) | | | $ | (60,866) | | | | | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | | | | |

| Depreciation and amortization | 3,743 | | | 3,338 | | | | | |

| | | | | | | |

| | | | | | | |

| Non-cash operating lease cost | 1,253 | | | 3,269 | | | | | |

| Amortization of premium (accretion of discount) on marketable securities, net | (8,129) | | | (5,132) | | | | | |

| Stock-based compensation | 577,508 | | | 12,480 | | | | | |

| | | | | | | |

| | | | | | | |

| Other adjustments | 485 | | | 16 | | | | | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable | 29,987 | | | 33,746 | | | | | |

| Prepaid expenses and other assets | (13,912) | | | (1,012) | | | | | |

| Operating lease right-of-use assets and liabilities | (530) | | | (871) | | | | | |

| Accounts payable | (2,178) | | | 6,706 | | | | | |

| Accrued expenses and other liabilities | 18,903 | | | 12,401 | | | | | |

| Net cash provided by (used in) operating activities | $ | 32,064 | | | $ | 4,075 | | | | | |

| | | | | | | |

| Cash flows from investing activities | | | | | | | |

| Purchases of property and equipment | (2,851) | | | (356) | | | | | |

| | | | | | | |

| Purchases of marketable securities | (135,685) | | | (262,846) | | | | | |

| Maturities of marketable securities | 252,655 | | | 315,365 | | | | | |

| Proceeds from sale of marketable securities | — | | | 36,789 | | | | | |

| | | | | | | |

| Other investing activities | (15) | | | 70 | | | | | |

| Net cash provided by (used in) investing activities | $ | 114,104 | | | $ | 89,022 | | | | | |

| | | | | | | |

| Cash flows from financing activities | | | | | | | |

| Proceeds from issuance of Class A common stock in initial public offering, net of underwriting discounts and commissions | 600,022 | | | — | | | | | |

| Proceeds from exercise of employee stock options | 23,089 | | | 961 | | | | | |

| | | | | | | |

| Taxes paid related to net share settlement of restricted stock units | (194,737) | | | (4,229) | | | | | |

| Payments of deferred offering costs | (2,753) | | | (362) | | | | | |

| Other financing activities | (4,450) | | | — | | | | | |

| Net cash provided by (used in) financing activities | $ | 421,171 | | | $ | (3,630) | | | | | |

| | | | | | | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 567,339 | | | 89,467 | | | | | |

| Cash, cash equivalents, and restricted cash at the beginning of the period | 401,226 | | | 435,860 | | | | | |

| Cash, cash equivalents, and restricted cash at the end of the period | $ | 968,565 | | | $ | 525,327 | | | | | |

| | | | | | | |

| Cash and cash equivalents | 968,515 | | | 525,277 | | | | | |

| Restricted cash | 50 | | | 50 | | | | | |

| Total cash, cash equivalents, and restricted cash | $ | 968,565 | | | $ | 525,327 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | |

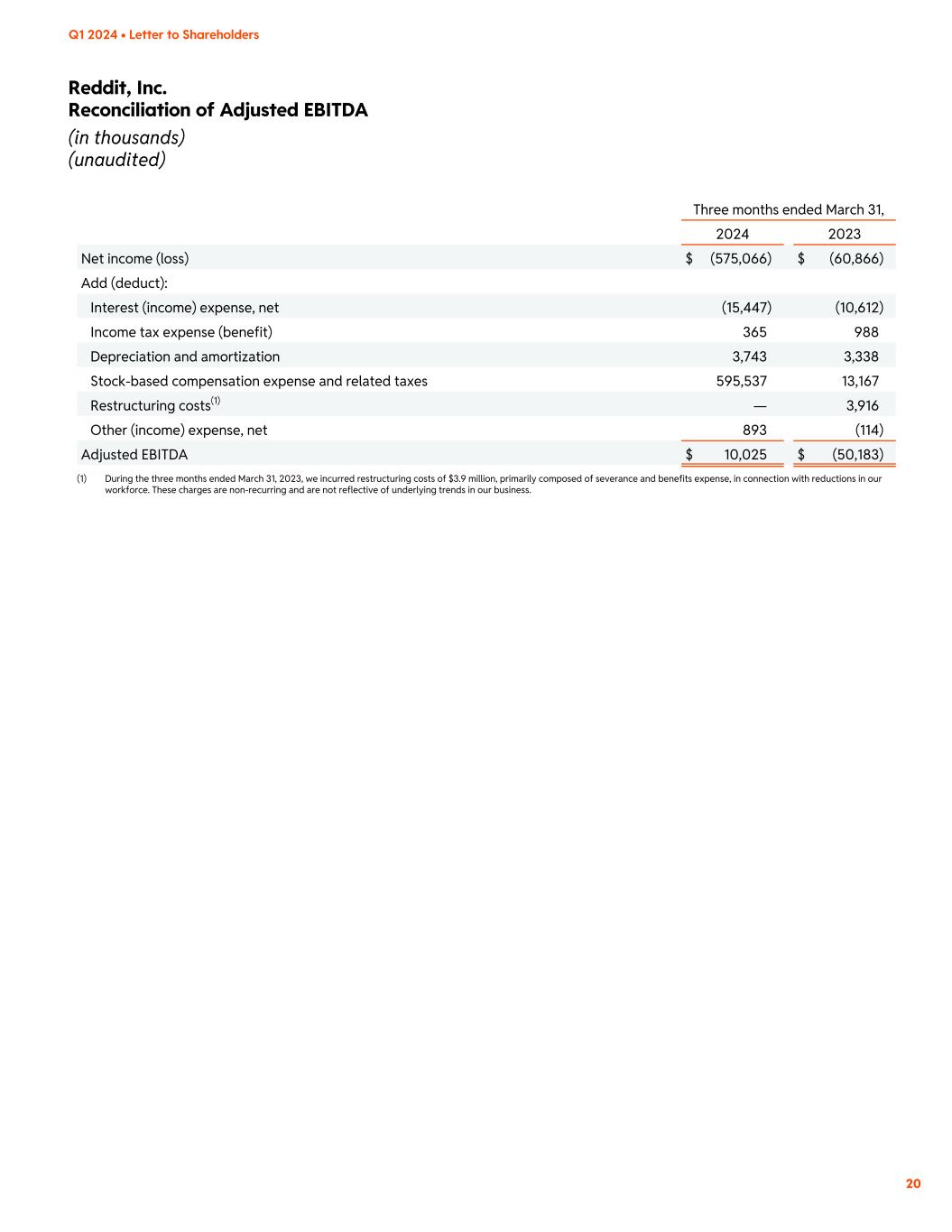

Reddit, Inc. Reconciliation of Adjusted EBITDA (in thousands) (unaudited) |

| | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

| 2024 | | 2023 | | | | |

| Net income (loss) | $ | (575,066) | | | $ | (60,866) | | | | | |

| Add (deduct): | | | | | | | |

| Interest (income) expense, net | (15,447) | | | (10,612) | | | | | |

| Income tax expense (benefit) | 365 | | | 988 | | | | | |

| Depreciation and amortization | 3,743 | | | 3,338 | | | | | |

| Stock-based compensation expense and related taxes | 595,537 | | | 13,167 | | | | | |

Restructuring costs(1) | — | | | 3,916 | | | | | |

| Other (income) expense, net | 893 | | | (114) | | | | | |

| Adjusted EBITDA | $ | 10,025 | | | $ | (50,183) | | | | | |

| | | | | | | |

| | | | | | | |

(1)During the three months ended March 31, 2023, we incurred restructuring costs of $3.9 million, primarily composed of severance and benefits expense, in connection with reductions in our workforce. These charges are non-recurring and are not reflective of underlying trends in our business.

| | |

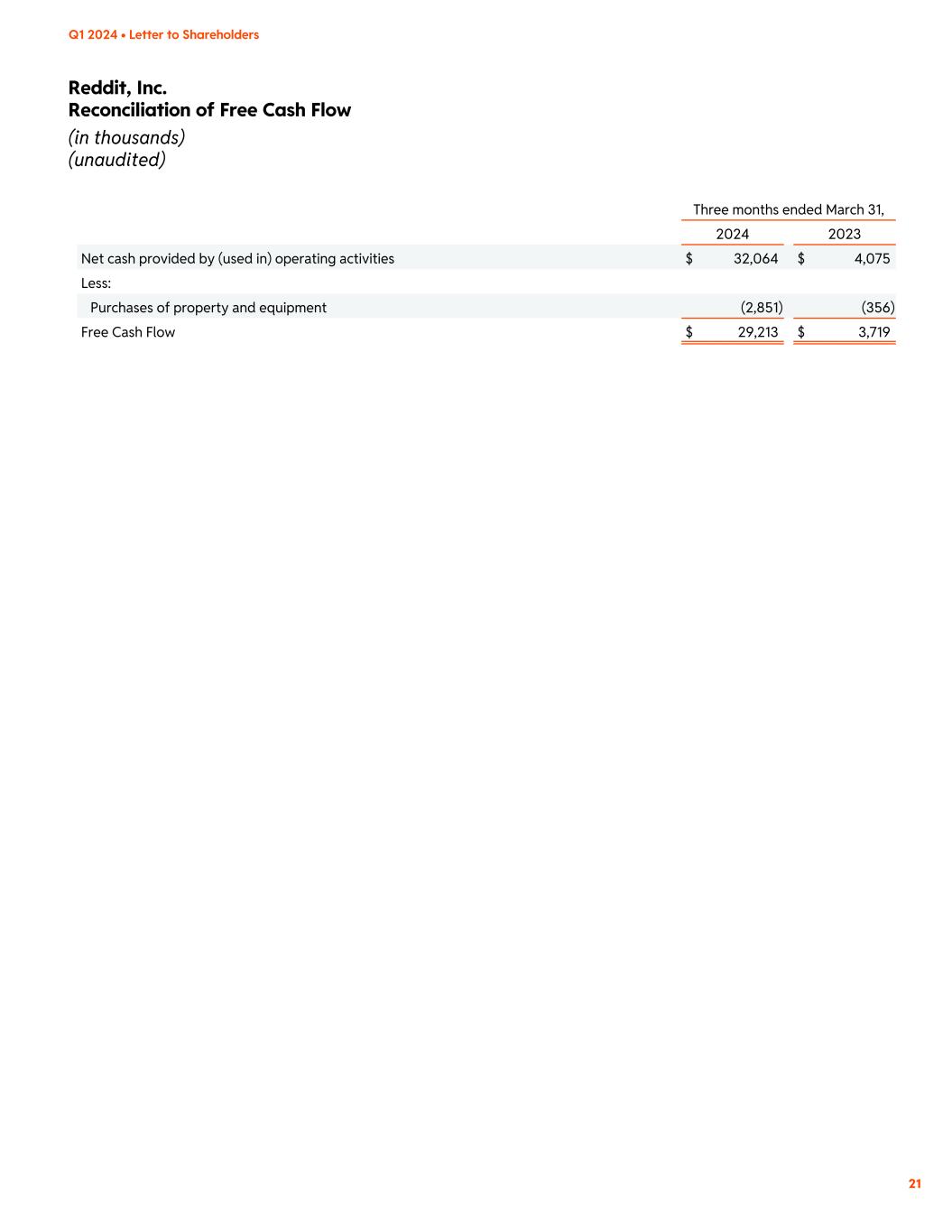

Reddit, Inc. Reconciliation of Free Cash Flow (in thousands) (unaudited) |

| | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

| 2024 | | 2023 | | | | |

| Net cash provided by (used in) operating activities | $ | 32,064 | | | $ | 4,075 | | | | | |

| Less: | | | | | | | |

| Purchases of property and equipment | (2,851) | | | (356) | | | | | |

| Free Cash Flow | $ | 29,213 | | | $ | 3,719 | | | | | |

| | |

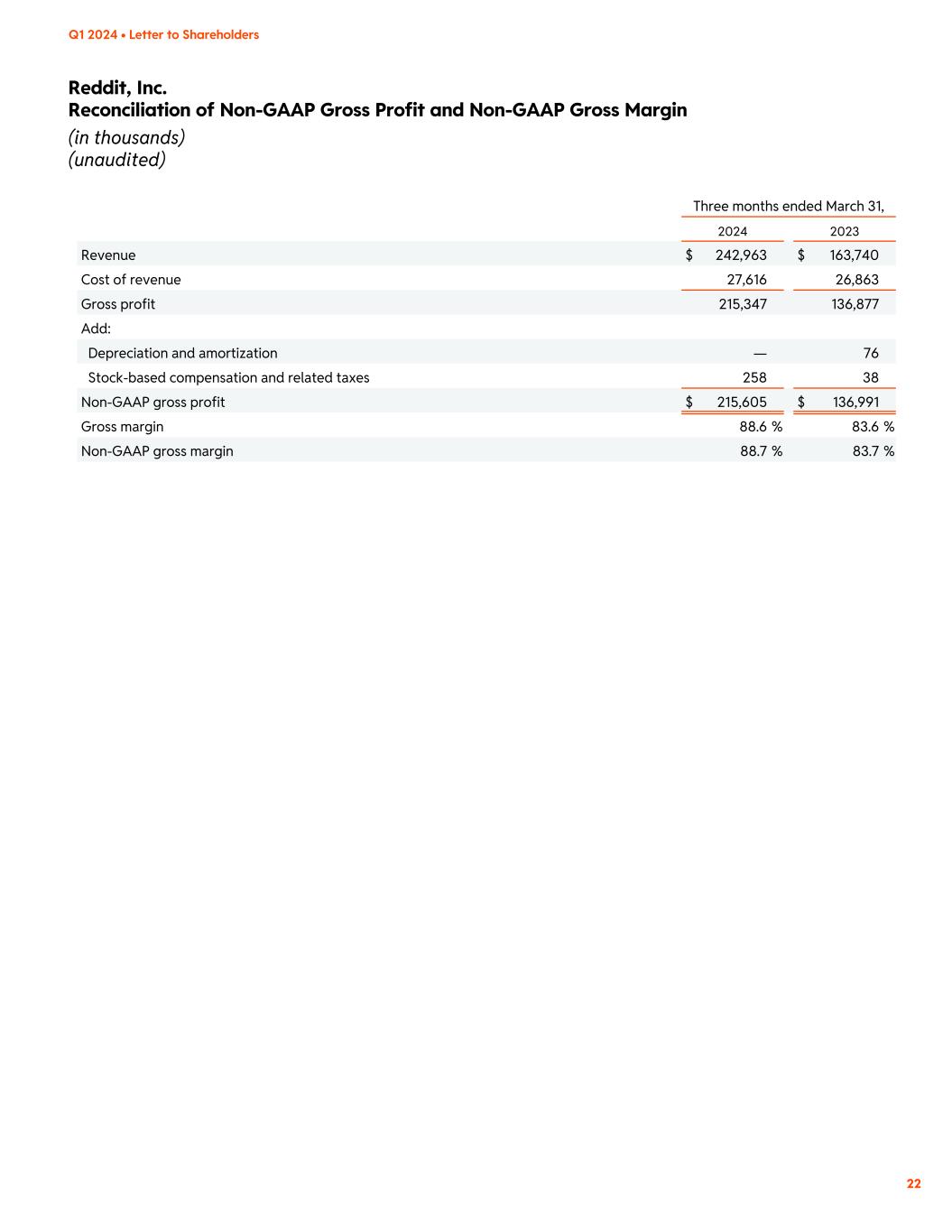

Reddit, Inc. Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin (in thousands) (unaudited) |

| | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

| 2024 | | 2023 | | | | |

| Revenue | $ | 242,963 | | | $ | 163,740 | | | | | |

| Cost of revenue | 27,616 | | | 26,863 | | | | | |

| Gross profit | 215,347 | | | 136,877 | | | | | |

| Add: | | | | | | | |

| Depreciation and amortization | — | | | 76 | | | | | |

| Stock-based compensation and related taxes | 258 | | | 38 | | | | | |

| Non-GAAP gross profit | $ | 215,605 | | | $ | 136,991 | | | | | |

| Gross margin | 88.6 | % | | 83.6 | % | | | | |

| Non-GAAP gross margin | 88.7 | % | | 83.7 | % | | | | |

Q1 2024 Letter to Shareholders Exhibit 99.2

Financial highlights Revenue was $243.0 million, an increase of 48% year-over-year Gross margin was 88.6%, as compared to 83.6% in the first quarter of 2023, an improvement of 500 basis points Net loss was $575.1 million, as compared to $60.9 million in the prior year. Stock-based compensation expense and related taxes were $595.5 million, as compared to $13.2 million in the prior year, driven by IPO charges Adjusted EBITDA¹ was $10.0 million, as compared to $(50.2) million in the first quarter of 2023, an improvement of $60.2 million, and represents Reddit’s first profitable Q1 on an Adjusted EBITDA basis Operating cash flow was $32.1 million, as compared to $4.1 million in the first quarter of 2023, an improvement of $28.0 million Free cash flow² was $29.2 million, as compared to $3.7 million in the first quarter of 2023, an improvement of $25.5 million Cash, cash equivalents, and marketable securities were $1.67 billion as of March 31, 2024 Business highlights Daily Active Uniques (“DAUq”) averaged 82.7 million in the first quarter 2024, an all-time high and an increase of 37% year-over-year. We added over 22 million DAUq from the first quarter of 2023 Logged-in users grew 27% year-over-year and Logged-out users grew 48% year-over-year We saw user growth across geographies. U.S. DAUq grew 45% year-over-year and International DAUq grew 30% year-over-year We made a number of product improvements including the continued roll out of our new web platform, Shreddit, improving on-platform search features, and new home feed machine learning (“ML”) models to drive more personalization and engagement We launched early use cases of machine translation to break the language barrier, translating highly visited posts into French, which is accelerating user growth Total revenue growth of 48% year-over-year was driven by advertising revenue growth of 39% year-over-year and growth in other revenue, which includes revenue from data licensing agreements, of over 450% year-over-year Average revenue per unique (“ARPU”) was $2.94, up 8% year-over-year We continued to scale and diversify our advertising business across channels, verticals, and geographies with over 50% year-over-year growth in our Scaled channel, which includes Mid-Market and SMB advertisers, and over 50% year-over-year growth in verticals such as financial services, pharma, and CPG Advertising Revenue growth was mainly driven by increased impressions from ad inventory optimizations and Logged-in DAUq growth We signed new partnerships in our emerging data licensing business as we continue to strategically explore opportunities to license data on our platform We continued building our suite of full-funnel solutions to expand advertiser capabilities and improve efficiency. We doubled click volume and click-through-rate grew over 40% year-over-year in the first quarter of 2024 2 Q1 2024 highlights Q1 2024 • Letter to Shareholders

Dear fellow shareholders, 3 Q1 2024 • Letter to Shareholders We believe that great companies are built in the public markets, and we are proud to have made the transition this quarter. Our IPO was an important moment for the company. I want to say thank you to our employees, users, and investors who all made it possible. I also want to say welcome to our new investors, particularly to our new user-investors. For users to be able to own some of Reddit has long been a dream of mine. It’s an exciting time. Reddit is one of the largest places for authentic human connection and conversation online, and we are seeing more and more people discover and appreciate this. We believe Reddit is more important than ever before, both as an alternative to traditional social media, and as we enter the AI era. People need a place where they can truly be themselves, and as more content on the internet is written by machines, Reddit is a source for authentic conversation, unique perspectives, earnest advice, honest reviews, and answers to questions about every topic imaginable. We are happy with our progress this quarter. We grew users across the platform, including logged-in and logged-out and the U.S. and abroad. We were cash flow positive and had our first profitable Q1 on an Adjusted EBITDA basis, which as an ads business is typically our smallest quarter from a revenue standpoint. Our management target is to grow revenue twice as fast as total adjusted costs, but this quarter we grew revenue five times faster. The most reliable way to grow is to make Reddit better. As such, our primary focus this year is to continue to make Reddit faster, safer, and easier to use. It sounds simple, but the details matter. Anyone who has used Reddit has encountered rough edges that we aim to smooth. We believe our investments in ML and AI will continue to improve relevance, engagement, and moderation. When we say relevance, we are referring to our ability to help users find communities they will love, which in turn increases engagement across the platform. For moderation, our testing of large language models has dramatically reduced the time required for communities to enforce their own rules. We are also using machine translation to unlock our mostly-English language corpus for the rest of the world. We believe this will drive growth in the near term, and over time will also allow users from all over the world to connect regardless of the languages they speak.

As we look to the future, we see huge opportunities for on-platform search and our user economy. Historically, the value of Reddit to our users has been in conversation about recent topics, but with improvements to search, we can unlock the huge amount of latent value in past content, including questions, reviews, and advice that we have. The user economy refers to a family of features that includes both our developer platform, which enables third-party developers to expand what the Reddit platform can be used for, and monetization primitives that can unlock the entrepreneurial energy we see across Reddit today. Overall, this was a strong start to the year for Reddit and we are executing better than ever. We see so much opportunity, and could not be more excited about our future. Community Highlight: Reddit’s IPO and the Community AM(A)A: Reddit management hosted an “Ask Me (Almost) Anything” on r/RDDT to address questions from the community during the IPO Pledge 1%: We reserved 1% of our Class A common stock to fund community initiatives and bring our users’ ideas to life Earnings Calls: We will solicit questions from the community on r/RDDT to address during and after our earnings call IPO Participation: Users and moderators had an opportunity to participate in the IPO through a Directed Share Program r/RDDT: We launched a dedicated investor relations community, r/RDDT, to share investor news and updates as a public company 4 Steve Huffman Co-Founder & Chief Executive Officer We are committed to including the community in our journey as a public company Q1 2024 • Letter to Shareholders

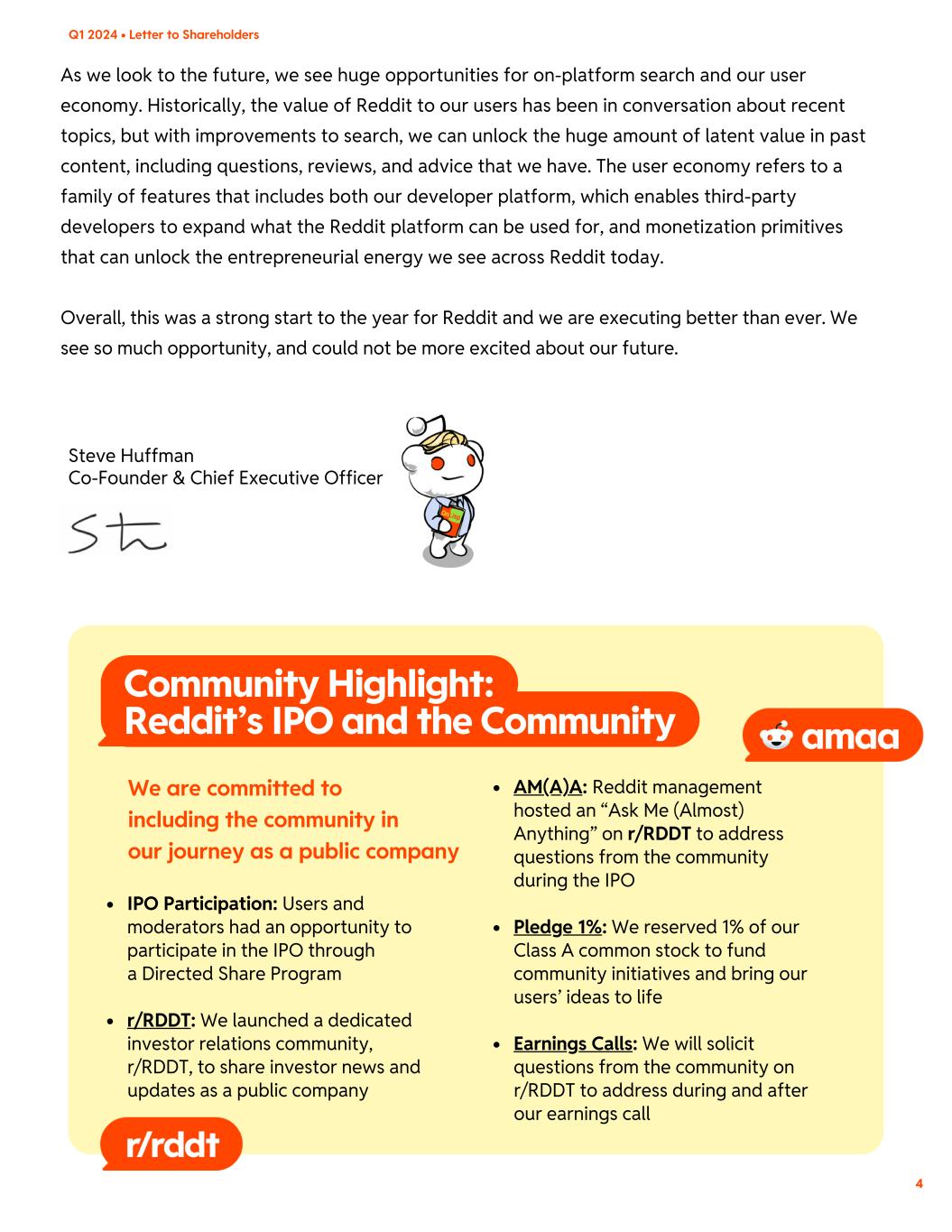

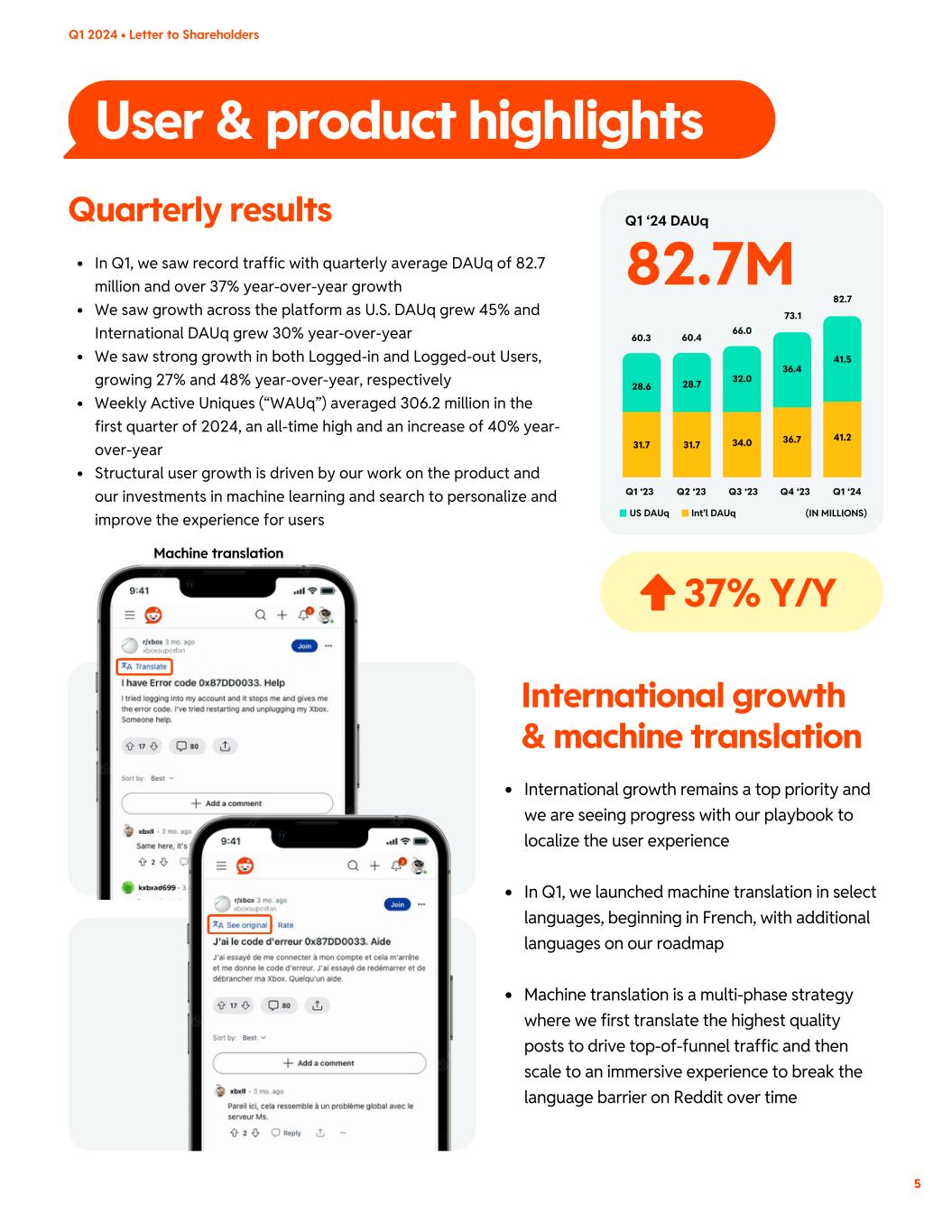

User & product highlights International growth & machine translation International growth remains a top priority and we are seeing progress with our playbook to localize the user experience In Q1, we launched machine translation in select languages, beginning in French, with additional languages on our roadmap Machine translation is a multi-phase strategy where we first translate the highest quality posts to drive top-of-funnel traffic and then scale to an immersive experience to break the language barrier on Reddit over time 5 In Q1, we saw record traffic with quarterly average DAUq of 82.7 million and over 37% year-over-year growth We saw growth across the platform as U.S. DAUq grew 45% and International DAUq grew 30% year-over-year We saw strong growth in both Logged-in and Logged-out Users, growing 27% and 48% year-over-year, respectively Weekly Active Uniques (“WAUq”) averaged 306.2 million in the first quarter of 2024, an all-time high and an increase of 40% year- over-year Structural user growth is driven by our work on the product and our investments in machine learning and search to personalize and improve the experience for users Quarterly results Q1 2024 • Letter to Shareholders 37% Y/Y 41.5 Q1 ‘23 Q2 ‘23 Q4 ‘23Q3 ‘23 Q1 ‘24 (IN MILLIONS)US DAUq Int’l DAUq 28.6 28.7 32.0 36.4 41.2 31.7 31.7 34.0 36.7 82.7 60.3 60.4 66.0 73.1 Q1 ‘24 DAUq 82.7M Machine translation

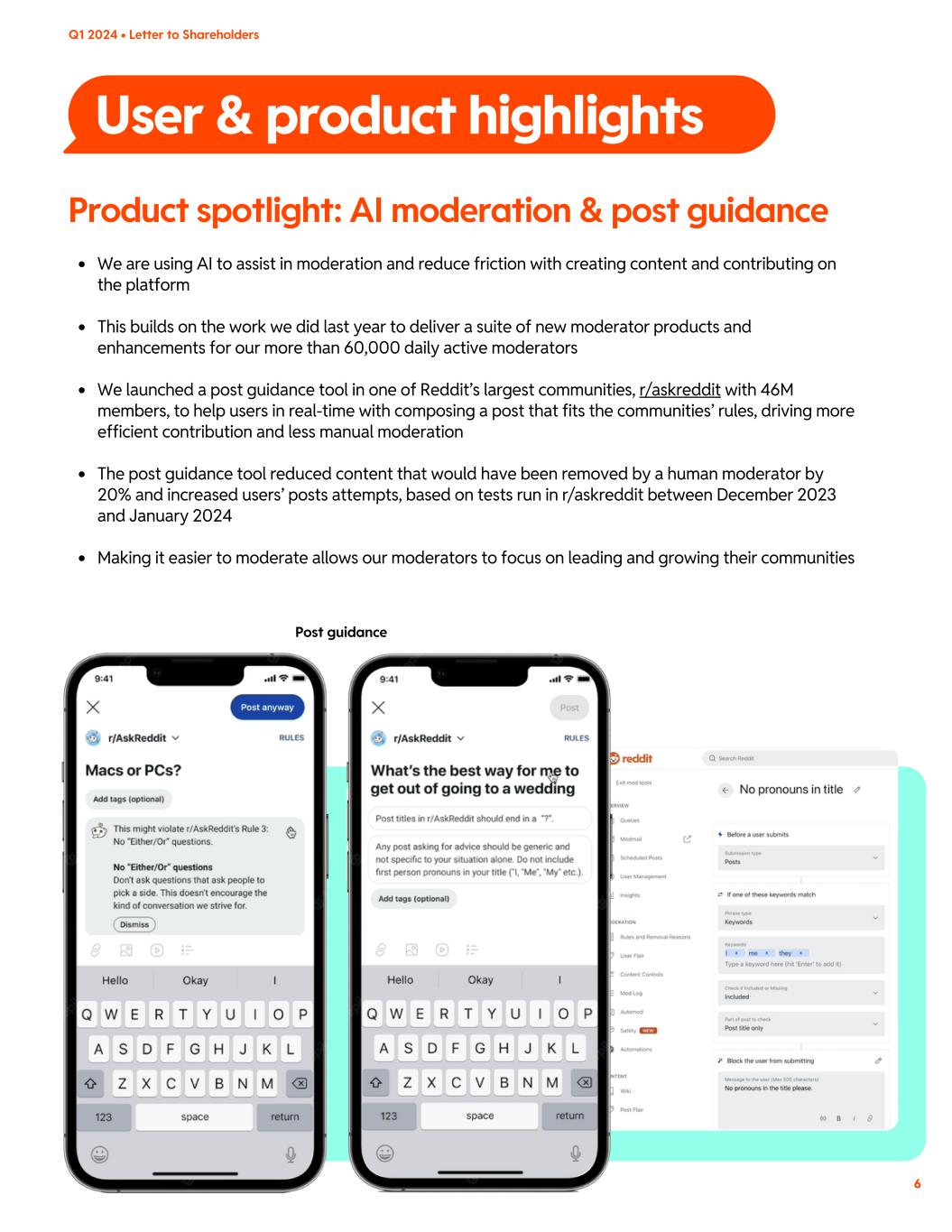

6 We are using AI to assist in moderation and reduce friction with creating content and contributing on the platform This builds on the work we did last year to deliver a suite of new moderator products and enhancements for our more than 60,000 daily active moderators We launched a post guidance tool in one of Reddit’s largest communities, r/askreddit with 46M members, to help users in real-time with composing a post that fits the communities’ rules, driving more efficient contribution and less manual moderation The post guidance tool reduced content that would have been removed by a human moderator by 20% and increased users’ posts attempts, based on tests run in r/askreddit between December 2023 and January 2024 Making it easier to moderate allows our moderators to focus on leading and growing their communities Product spotlight: AI moderation & post guidance Post guidance Q1 2024 • Letter to Shareholders User & product highlights

7 Total revenue in Q1 grew 48% year-over-year to $243.0 million, the fastest year-over-year growth since Q1'22 and the third consecutive quarter of accelerating revenue growth Advertising revenue grew 39% year-over-year, and other revenue of $20.3M increased over 450% year-over-year, primarily driven by new data licensing agreements signed in the first quarter U.S. revenue grew 53% year-over-year and International revenue grew 30% year-over-year. International revenue represented 18% of total revenue in the first quarter Advertising Revenue growth was primarily driven by increases in impressions delivered as we continued to attract new users and deepen engagement on the platform, which offset a year- over-year decline in advertising pricing Our full suite of solutions across the marketing funnel continued to position us well for a broad set of advertisers. Our performance advertising business drove more than half of our growth in the quarter, with the mid-funnel growing high double-digits year-over-year We experienced growth across channels, verticals, and geographies Channels: we saw revenue growth across our managed channels, our Scaled business (Mid- Market and SMB) grew over 50% year-over-year Verticals: We saw positive growth in the Tech vertical and experienced broad strength with financial services, pharma, and CPG customers, which each grew over 50% year-over-year Geographies: we continued to see strong growth in our EMEA markets, including with both large and mid-sized customers Reddit’s human-generated and authentic data is uniquely valuable and plays an important role in new and emerging technologies Our data licensing business and strategy continue to evolve as the size of the landscape and opportunity are still nascent In the first quarter, we signed new data licensing agreements across the data landscape with social listening and enterprise-scale technology companies, including the previously announced partnerships with Google and Cision, among others Advertising & monetization highlights Quarterly results Advertiser diversification Data licensing update Q1 2024 • Letter to Shareholders

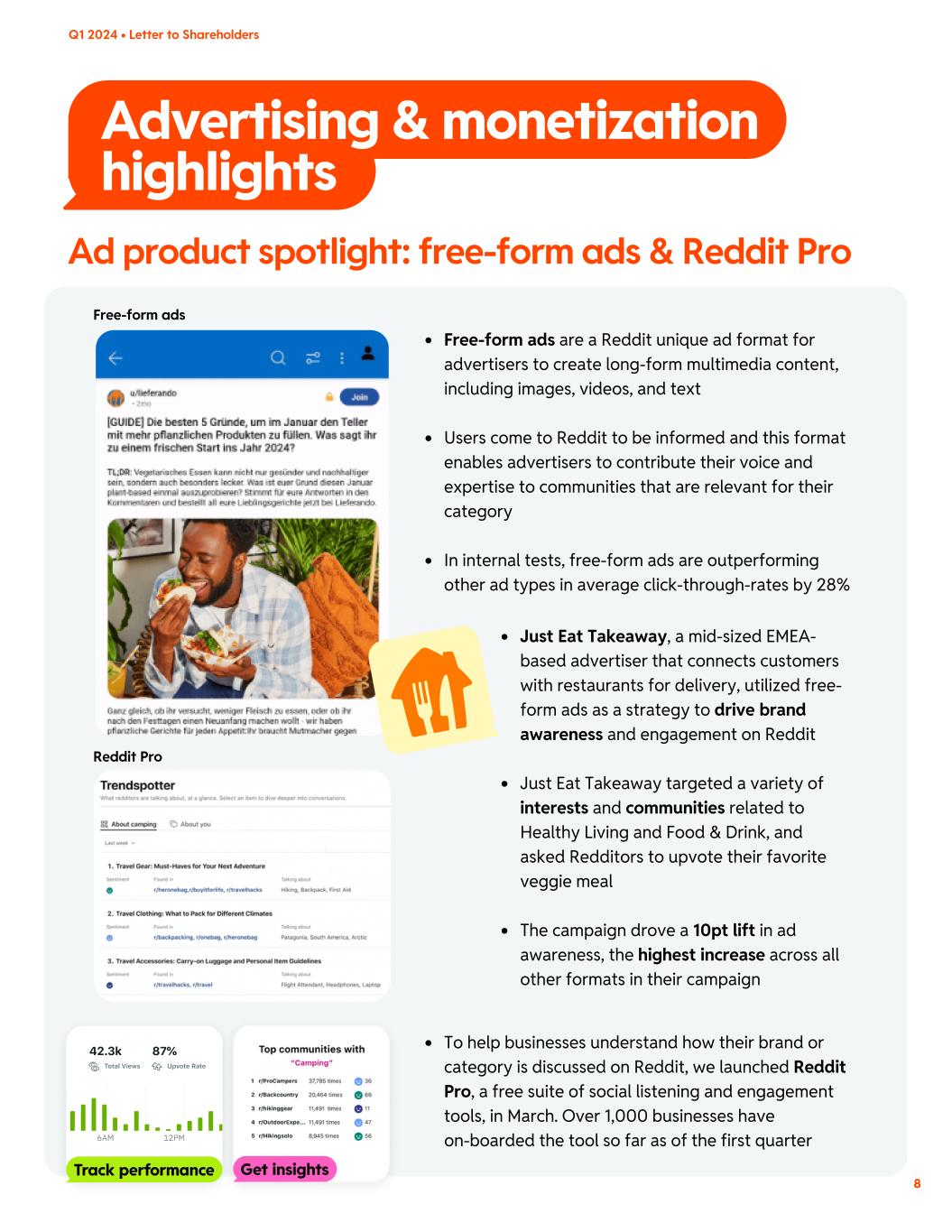

Advertising & monetization highlights Free-form ads are a Reddit unique ad format for advertisers to create long-form multimedia content, including images, videos, and text Users come to Reddit to be informed and this format enables advertisers to contribute their voice and expertise to communities that are relevant for their category In internal tests, free-form ads are outperforming other ad types in average click-through-rates by 28% Just Eat Takeaway, a mid-sized EMEA- based advertiser that connects customers with restaurants for delivery, utilized free- form ads as a strategy to drive brand awareness and engagement on Reddit Just Eat Takeaway targeted a variety of interests and communities related to Healthy Living and Food & Drink, and asked Redditors to upvote their favorite veggie meal The campaign drove a 10pt lift in ad awareness, the highest increase across all other formats in their campaign To help businesses understand how their brand or category is discussed on Reddit, we launched Reddit Pro, a free suite of social listening and engagement tools, in March. Over 1,000 businesses have on-boarded the tool so far as of the first quarter 8 Ad product spotlight: free-form ads & Reddit Pro Free-form ads Q1 2024 • Letter to Shareholders Reddit Pro

Financial highlights $243M Q1 ‘24 REVENUE 48% Y/Y 8% Y/Y 9 $2.94 Q1 ‘24 Average Revenue per Unique (ARPU) (IN MILLIONS) $207.5 $3.14 $249.8 $3.42 $243.0 $2.94 $163.7 $2.72 $183.0 $3.03 Our first quarter results featured strong revenue growth and expanding margins on a year-over-year basis, which drove positive cash flow and profitability on an Adjusted EBITDA basis. Revenue Total revenue was $243.0 million, an increase of 48% from $163.7 million in the first quarter of 2023, primarily driven by an increase in impressions, partially offset by a decrease in ad pricing. In addition, other revenues increased as a result of data licensing agreements executed in 2024. ARPU ARPU was $2.94, an increase of 8% from $2.72 in the first quarter of 2023. Cost of Revenue Cost of revenue was $27.6 million, an increase of 3% from $26.9 million in the first quarter of 2023, primarily driven by increased hosting usage to support user growth on our platform and an increase in advertising measurement and other services, partially offset by hosting cost efficiencies and lower hosting prices. Gross Profit and Non-GAAP Gross Profit Gross profit was $215.3 million, or a gross margin of 88.6%, as compared to $136.9 million, or a gross margin of 83.6%, in the first quarter of 2023. Non-GAAP gross profit³ (which excludes stock-based compensation and related taxes, depreciation, and amortization expenses) was $215.6 million, or a non-GAAP gross margin of 88.7%, as compared to $137.0 million, or a non-GAAP gross margin of 83.7%, in the first quarter of 2023. Q2 ‘23 Q3 ‘23 Q4 ‘23 Q1 ‘24Q1 ‘23 88.6% Q1 ‘24 GROSS MARGIN 83.6% 84.2% 87.3% 88.4% 88.6% (AS A % OF TOTAL REVENUE) GAAP GROSS MARGIN TOTAL REVENUE Q2 ‘23 Q3 ‘23 Q4 ‘23 Q1 ‘24Q1 ‘23 Q2 ‘23 Q3 ‘23 Q4 ‘23 Q1 ‘24Q1 ‘23 $5.27 $4.77$4.62 $5.21 $5.51 $1.14 $1.10$1.00 $1.06 $1.34 UNITED STATES ARPU INTERNATIONAL ARPU First quarter 2024 Q1 2024 • Letter to Shareholders

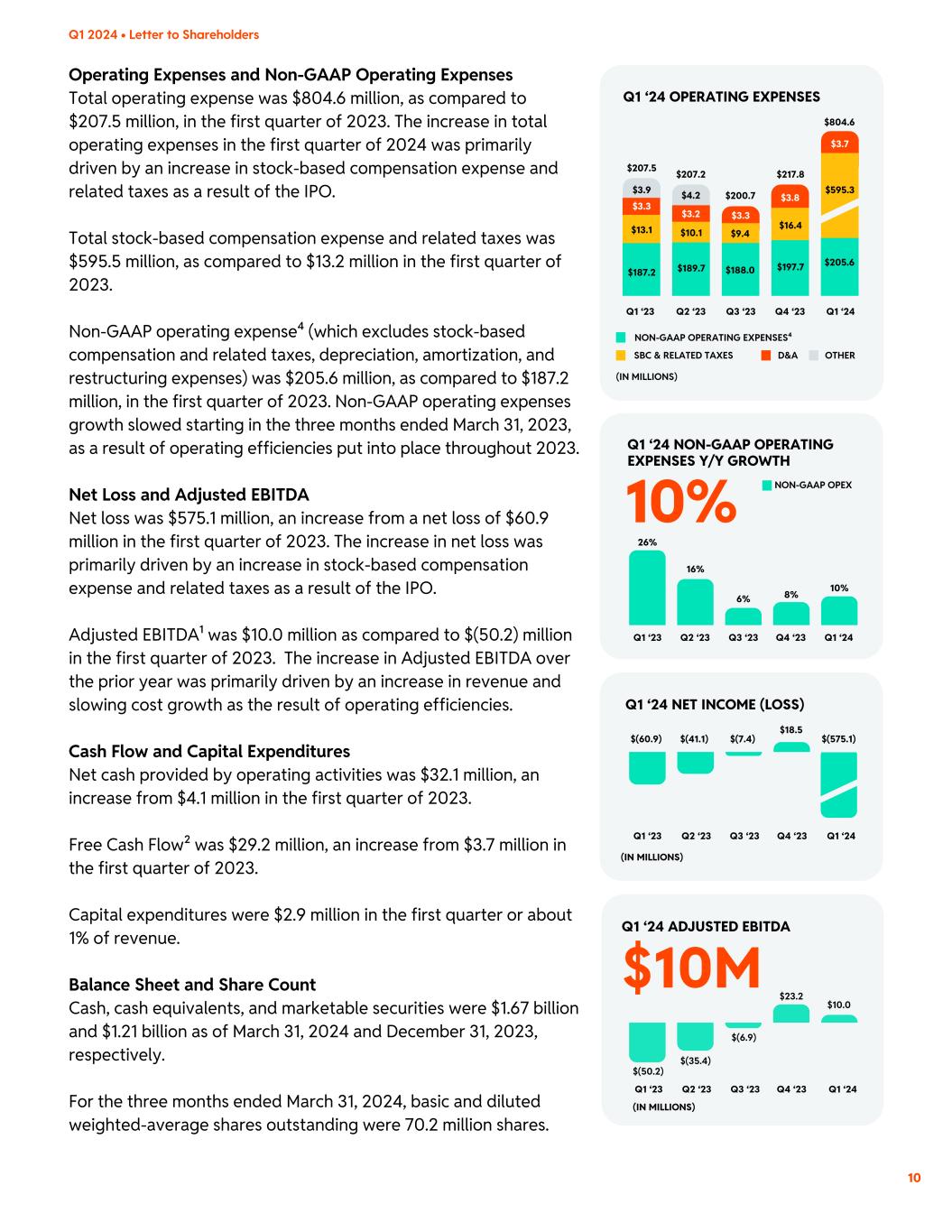

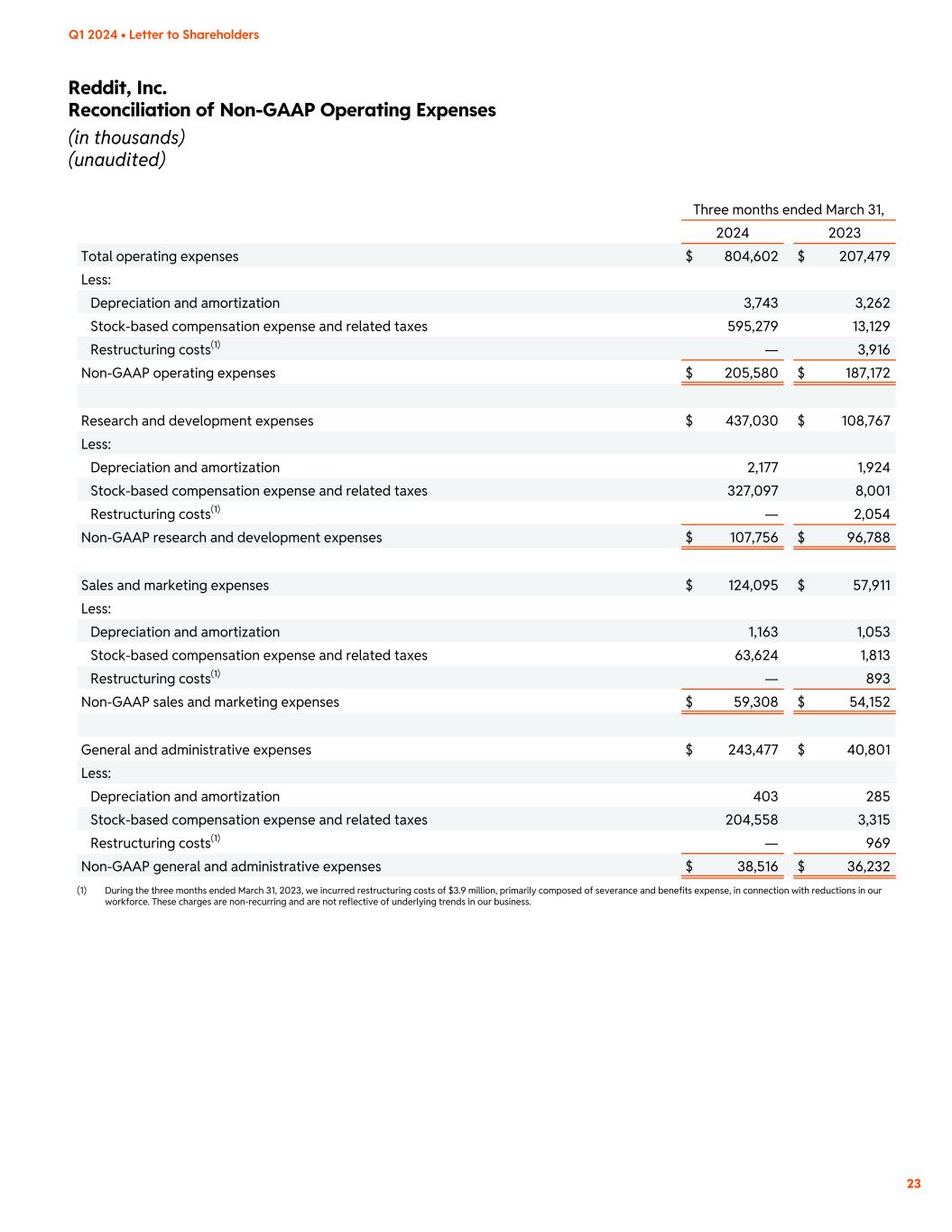

Operating Expenses and Non-GAAP Operating Expenses Total operating expense was $804.6 million, as compared to $207.5 million, in the first quarter of 2023. The increase in total operating expenses in the first quarter of 2024 was primarily driven by an increase in stock-based compensation expense and related taxes as a result of the IPO. Total stock-based compensation expense and related taxes was $595.5 million, as compared to $13.2 million in the first quarter of 2023. Non-GAAP operating expense⁴ (which excludes stock-based compensation and related taxes, depreciation, amortization, and restructuring expenses) was $205.6 million, as compared to $187.2 million, in the first quarter of 2023. Non-GAAP operating expenses growth slowed starting in the three months ended March 31, 2023, as a result of operating efficiencies put into place throughout 2023. Net Loss and Adjusted EBITDA Net loss was $575.1 million, an increase from a net loss of $60.9 million in the first quarter of 2023. The increase in net loss was primarily driven by an increase in stock-based compensation expense and related taxes as a result of the IPO. Adjusted EBITDA¹ was $10.0 million as compared to $(50.2) million in the first quarter of 2023. The increase in Adjusted EBITDA over the prior year was primarily driven by an increase in revenue and slowing cost growth as the result of operating efficiencies. Cash Flow and Capital Expenditures Net cash provided by operating activities was $32.1 million, an increase from $4.1 million in the first quarter of 2023. Free Cash Flow² was $29.2 million, an increase from $3.7 million in the first quarter of 2023. Capital expenditures were $2.9 million in the first quarter or about 1% of revenue. Balance Sheet and Share Count Cash, cash equivalents, and marketable securities were $1.67 billion and $1.21 billion as of March 31, 2024 and December 31, 2023, respectively. For the three months ended March 31, 2024, basic and diluted weighted-average shares outstanding were 70.2 million shares. Q1 ‘24 OPERATING EXPENSES 10 (IN MILLIONS) SBC & RELATED TAXES NON-GAAP OPERATING EXPENSES⁴ D&A $10M Q1 ‘24 ADJUSTED EBITDA $(35.4) $(6.9) $23.2 $10.0 $(50.2) (IN MILLIONS) Q2 ‘23 Q3 ‘23 Q4 ‘23 Q1 ‘24Q1 ‘23 Q2 ‘23 Q3 ‘23 Q4 ‘23 Q1 ‘24Q1 ‘23 OTHER Q1 ‘24 NON-GAAP OPERATING EXPENSES Y/Y GROWTH 26% Q2 ‘23 Q3 ‘23 Q4 ‘23 Q1 ‘24Q1 ‘23 10% 16% 6% 8% 10% NON-GAAP OPEX $187.2 $207.5 $207.2 $200.7 $217.8 $13.1 $3.3 $3.9 $3.2 $4.2 $3.3 $3.8 $3.7 $189.7 $10.1 $188.0 $9.4 $197.7 $16.4 $595.3 $205.6 $804.6 Q1 2024 • Letter to Shareholders (IN MILLIONS) Q1 ‘24 NET INCOME (LOSS) $(41.1) $(7.4) $18.5 $(575.1)$(60.9) Q2 ‘23 Q3 ‘23 Q4 ‘23 Q1 ‘24Q1 ‘23

Q2 ‘24 REVENUE $240M-$255M Q2 ‘24 ADJUSTED EBITDA $0M-$15M 11 The guidance provided below is based on Reddit’s current estimates and is not a guarantee of future performance. This guidance is subject to significant risks and uncertainties that could cause actual results to differ materially, including the risk factors discussed in Reddit’s reports on file with the Securities and Exchange Commission. Reddit undertakes no duty to update any forward-looking statements or estimates, except as required by applicable law. As we look ahead, we will share our internal thoughts on revenue and Adjusted EBITDA for the second quarter. In the second quarter of 2024, we estimate: Revenue in the range of $240 million to $255 million Adjusted EBITDA⁵ in the range of $0 to $15 million Financial outlook Q1 2024 • Letter to Shareholders

Reddit will host a conference call to discuss the results for the first quarter of 2024 on May 7, 2024, at 2:00 p.m. PT / 5:00 p.m. ET. A live webcast of the call can be accessed on Reddit’s Investor Relations website at https://investor.redditinc.com and investor relations subreddit r/RDDT at https://www.reddit.com/r/RDDT/. A replay of the webcast and transcript will be available following the conclusion of the conference call on the same websites. Reddit will solicit questions from the community in the investor relations subreddit r/RDDT at https://www.reddit.com/r/RDDT/ on Tuesday, May 7, 2024, and post responses following the earnings call at Reddit’s Investor Relations website at https://investor.redditinc.com and r/RDDT at https://www.reddit.com/r/RDDT/. 12 Steve Huffman Co-Founder & Chief Executive Officer Drew Vollero Chief Financial Officer Earnings conference call Q1 2024 • Letter to Shareholders

Appendix 13 Notes The definition of Adjusted EBITDA and a reconciliation of Net Income (Loss) to Adjusted EBITDA can be found on subsequent pages of this appendix 1. The definition of Free Cash Flow and a reconciliation of Free Cash Flow to net cash provided by (used in) operating activities can be found on subsequent pages of this appendix 2. A reconciliation of non-GAAP gross profit and non-GAAP gross margin can be found on a subsequent page of this appendix 3. The definition of non-GAAP operating expenses and a reconciliation of non-GAAP operating expenses to the comparable U.S. GAAP measure can be found on subsequent pages of this appendix 4. We have not provided a reconciliation to the forward-looking U.S. GAAP equivalent measures for our non-GAAP guidance due to uncertainty regarding, and the potential variability of, reconciling items. Therefore, a reconciliation of these non-GAAP guidance measures to their corresponding U.S. GAAP guidance measures is not available without unreasonable effort 5. About Reddit Reddit is a network of more than 100,000 active communities where people can dive into anything through experiences built around their interests, hobbies and passions. Reddit users submit, vote and comment on content, stories and discussions about the topics they care about the most. From pets to parenting, there’s a community for everybody on Reddit and with more than 82 million daily active uniques, it is home to the most open and authentic conversations on the internet. For more information, visit www.redditinc.com. Forward Looking Statements This letter contains forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Reddit's future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as "may," "will," "should," "expects," "plans," "anticipates," "going to," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these words or other similar terms or expressions that concern Reddit's expectations, strategy, priorities, plans or intentions. Forward-looking statements in this release include, but are not limited to, statements regarding Reddit’s priorities, future financial and operating performance, including headcount strategy, breakeven performance objective, capitalization of training data, evolution of AI, international growth strategies to increase content consumption and improve local user experience, consumer product strategy with respect to growth and engagement, GAAP and non-GAAP guidance, strategies, and expectations of growth. Reddit's expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected, including those more fully described under the caption “Risk Q1 2024 • Letter to Shareholders

Factors” and elsewhere in documents that Reddit files with the Securities and Exchange Commission (the “SEC”) from time to time, including Reddit’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, which is being filed with the SEC at or around the date hereof. The forward-looking statements in this release are based on information available to Reddit as of the date hereof, and Reddit undertakes no obligation to update any forward-looking statements, except as required by law. A Note About Metrics We define a daily active unique (“DAUq”) as a user whom we can identify with a unique identifier who has visited a page on the Reddit website, www.reddit.com, or opened a Reddit application at least once during a 24-hour period. Average DAUq for a particular period is calculated by adding the number of DAUq on each day of that period and dividing that sum by the number of days in that period. We define a weekly active unique (“WAUq”) as a user whom we can identify with a unique identifier who has visited a page on the Reddit website, www.reddit.com, or opened a Reddit application at least once during a trailing seven-day period. Average quarterly WAUq for a particular period is calculated by adding the number of WAUq on each day of that period and dividing that sum by the number of days in that period. We define average revenue per unique (“ARPU”) as quarterly revenue in a given geography divided by the average DAUq in that geography. For the purposes of calculating ARPU, advertising revenue in a given geography is based on the geographic location in which advertising impressions are delivered, as this approximates revenue based on user activity, while other revenue in a given geography is based on the billing address of the customer. Use of Non-GAAP Financial Measures We use certain non-GAAP financial measures to supplement our consolidated financial statements, which are presented in accordance with U.S. GAAP, to evaluate our core operating performance. These non- GAAP financial measures include Adjusted EBITDA, Free Cash Flow, non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expense, non-GAAP research and development expense, non-GAAP sales and marketing expense, and non-GAAP general and administrative expense. We use these non- GAAP financial measures to facilitate reviews of our operational performance and as a basis for strategic planning. By excluding certain items that are non-recurring or not reflective of the performance of our normal course of business, we believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance. Accordingly, we believe these non-GAAP financial measures are useful to investors and others because they allow investors to supplement their understanding of our financial trends and evaluate our ongoing and future performance in the same manner as management. However, there are a number of limitations related to the use of non-GAAP financial measures as they reflect the exercise of judgment by our management about which expenses are excluded or included in determining these non-GAAP measures. These non-GAAP measures should be considered in addition to, not as a substitute for or in isolation from, our financial results prepared in accordance with U.S. GAAP. Other companies, including companies in our industry, may calculate these non-GAAP financial measures differently or not at all, which reduces their usefulness as comparative measures. A reconciliation is provided in the Appendix for each historical non-GAAP financial measure to the most directly comparable financial measure stated in accordance with U.S. GAAP. Reddit encourages investors 14 Q1 2024 • Letter to Shareholders

15 to review the related U.S. GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable U.S. GAAP financial measures, and not to rely on any single financial measure to evaluate Reddit’s business. Adjusted EBITDA is defined as net income (loss) excluding interest (income) expense, net, income tax expense (benefit), depreciation and amortization, stock-based compensation expense and related taxes, other (income) expense, net, and certain other non-recurring or non-cash items impacting net income (loss) that we do not consider indicative of our ongoing business performance. Other (income) expense, net consists primarily of realized gains and losses on sales of marketable securities, foreign currency transaction gains and losses, and other income and expense that are not indicative of our core operating performance. We consider the exclusion of certain non-recurring or non-cash items in calculating Adjusted EBITDA to provide a useful measure for investors and others to evaluate our operating results in the same manner as management. Free Cash Flow represents net cash provided by (used in) operating activities less purchases of property and equipment. We believe that Free Cash Flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash. Once our business needs and obligations are met, cash can be used to maintain a strong balance sheet and invest in future growth. Additionally, we believe that Free Cash Flow is an important measure since we use third-party infrastructure partners to host our services and therefore we do not incur significant capital expenditures to support revenue generating activities. Non-GAAP gross profit is defined as gross profit excluding stock-based compensation and related taxes, depreciation, and amortization expenses. Non-GAAP gross margin is defined as non-GAAP gross profit divided by revenue. We believe that these non-GAAP financial measures are useful to investors as they exclude expenses that are not reflective of our operational performance during the period and could mask underlying trends in our business. Non-GAAP operating expenses represents operating expenses excluding stock-based compensation and related taxes, depreciation and amortization, and certain other non-recurring or non-cash items impacting operating expenses that we do not consider indicative of our ongoing business performance. Non-GAAP research and development expense, non-GAAP sales and marketing expense, and non- GAAP general and administrative expense represent their respective operating expense line items excluding stock-based compensation and related taxes, depreciation, amortization, and certain other non-recurring or non-cash items. Similar to non-GAAP gross profit and non-GAAP gross margin, we consider non-GAAP operating expense, non-GAAP research and development expense, non-GAAP sales and marketing expense, and non-GAAP general and administrative expense to be useful measures as they exclude expenses that are not reflective of our operational performance and could mask underlying trends in our business. Investor Relations Jesse Rose ir@reddit.com Media Relations Gina Antonini press@reddit.com Q1 2024 • Letter to Shareholders

Reddit, Inc. Key Operating Metrics by Geography (in millions, except ARPU) (unaudited) 16 Q1 2024 • Letter to Shareholders Three months ended March 31, 2024 2023 % Change Revenue: Global $ 243.0 $ 163.7 48 % Revenue: U.S. $ 199.8 $ 130.6 53 % Revenue: International $ 43.2 $ 33.1 30 % DAUq: Global 82.7 60.3 37 % DAUq: U.S. 41.5 28.6 45 % DAUq: International 41.2 31.7 30 % Logged-in DAUq: Global 39.6 31.1 27 % Logged-in DAUq: U.S. 19.3 15.2 27 % Logged-in DAUq: International 20.3 15.9 28 % Logged-out DAUq: Global 43.1 29.2 48 % Logged-out DAUq: U.S. 22.2 13.4 66 % Logged-out DAUq: International 20.9 15.8 32 % WAUq: Global 306.2 218.0 40 % WAUq: U.S. 151.3 99.2 53 % WAUq: International 154.9 118.8 30 % ARPU: Global $ 2.94 $ 2.72 8 % ARPU: U.S. $ 4.77 $ 4.62 3 % ARPU: International $ 1.10 $ 1.00 10 %

17 Q1 2024 • Letter to Shareholders Reddit, Inc. Consolidated Statements of Operations (in thousands, except per share amounts) (unaudited) Three months ended March 31, 2024 2023 Revenue $ 242,963 $ 163,740 Costs and expenses: Cost of revenue 27,616 26,863 Research and development 437,030 108,767 Sales and marketing 124,095 57,911 General and administrative 243,477 40,801 Total costs and expenses 832,218 234,342 Income (loss) from operations (589,255) (70,602) Other income (expense), net 14,554 10,724 Income (loss) before income taxes (574,701) (59,878) Income tax expense (benefit) 365 988 Net income (loss) $ (575,066) $ (60,866) Net income (loss) per share attributable to Class A and Class B common stock, basic and diluted $ (8.19) $ (1.05) Weighted-average shares used to compute net income (loss) per share attributable to common stockholders: Basic 70,240 58,115 Diluted 70,240 58,115

18 Q1 2024 • Letter to Shareholders Reddit, Inc. Consolidated Balance Sheets (in thousands, except share and per share amounts) March 31, 2024 December 31, 2023 (unaudited) Assets Current assets Cash and cash equivalents $ 968,515 $ 401,176 Marketable securities 701,835 811,946 Accounts receivable, net 215,307 245,279 Prepaid expenses and other current assets 34,368 21,286 Total current assets 1,920,025 1,479,687 Property and equipment, net 14,385 14,946 Operating lease right-of-use assets, net 22,754 24,008 Intangible assets, net 29,928 32,147 Goodwill 26,299 26,299 Other noncurrent assets 2,505 19,380 Total assets $ 2,015,896 $ 1,596,467 Liabilities, convertible preferred stock, and stockholders’ equity (deficit) Current liabilities Accounts payable $ 45,378 $ 46,514 Operating lease liabilities 4,383 3,707 Accrued expenses and other current liabilities 106,724 83,349 Total current liabilities 156,485 133,570 Operating lease liabilities, noncurrent 20,835 22,040 Other noncurrent liabilities 276 287 Total liabilities 177,596 155,897 Commitments and contingencies Convertible preferred stock, par value $0.0001 per share; no and 86,864,781 shares authorized as of March 31, 2024 and December 31, 2023, respectively; no and 73,021,449 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively; aggregate liquidation preference of $0 and $1,847,993 as of March 31, 2024 and December 31, 2023, respectively — 1,853,492 Stockholders’ equity (deficit): Preferred stock, par value $0.0001 per share; 100,000,000 and no shares authorized as of March 31, 2024 and December 31, 2023, respectively; no shares issued and outstanding as of March 31, 2024 and December 31, 2023 — — Class A common stock, par value $0.0001 per share; 2,000,000,000 and 189,000,000 shares authorized as of March 31, 2024 and December 31, 2023, respectively; 44,286,735 and 7,099,700 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively 4 — Class B common stock, par value $0.0001 per share; 140,000,000 and 142,000,000 shares authorized as of March 31, 2024 and December 31, 2023, respectively; 119,059,756 and 53,904,204 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively 12 6 Class C common stock, par value $0.0001 per share; 100,000,000 and no shares authorized as of March 31, 2024 and December 31, 2023, respectively; no shares issued and outstanding as of March 31, 2024 and December 31, 2023 — — Additional paid-in capital 3,130,384 302,820 Accumulated other comprehensive income (loss) (472) 814 Accumulated deficit (1,291,628) (716,562) Total stockholders’ equity (deficit) 1,838,300 (412,922) Total liabilities, convertible preferred stock, and stockholders’ equity (deficit) $ 2,015,896 $ 1,596,467

19 Q1 2024 • Letter to Shareholders Reddit, Inc. Consolidated Statements of Cash Flows (in thousands) (unaudited) Three months ended March 31, 2024 2023 Cash flows from operating activities Net income (loss) $ (575,066) $ (60,866) Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: Depreciation and amortization 3,743 3,338 Non-cash operating lease cost 1,253 3,269 Amortization of premium (accretion of discount) on marketable securities, net (8,129) (5,132) Stock-based compensation 577,508 12,480 Other adjustments 485 16 Changes in operating assets and liabilities: Accounts receivable 29,987 33,746 Prepaid expenses and other assets (13,912) (1,012) Operating lease right-of-use assets and liabilities (530) (871) Accounts payable (2,178) 6,706 Accrued expenses and other liabilities 18,903 12,401 Net cash provided by (used in) operating activities $ 32,064 $ 4,075 Cash flows from investing activities Purchases of property and equipment (2,851) (356) Purchases of marketable securities (135,685) (262,846) Maturities of marketable securities 252,655 315,365 Proceeds from sale of marketable securities — 36,789 Other investing activities (15) 70 Net cash provided by (used in) investing activities $ 114,104 $ 89,022 Cash flows from financing activities Proceeds from issuance of Class A common stock in initial public offering, net of underwriting discounts and commissions 600,022 — Proceeds from exercise of employee stock options 23,089 961 Taxes paid related to net share settlement of restricted stock units (194,737) (4,229) Payments of deferred offering costs (2,753) (362) Other financing activities (4,450) — Net cash provided by (used in) financing activities $ 421,171 $ (3,630) Net increase (decrease) in cash, cash equivalents, and restricted cash 567,339 89,467 Cash, cash equivalents, and restricted cash at the beginning of the period 401,226 435,860 Cash, cash equivalents, and restricted cash at the end of the period $ 968,565 $ 525,327 Cash and cash equivalents 968,515 525,277 Restricted cash 50 50 Total cash, cash equivalents, and restricted cash $ 968,565 $ 525,327

20 Q1 2024 • Letter to Shareholders Reddit, Inc. Reconciliation of Adjusted EBITDA (in thousands) (unaudited) Three months ended March 31, 2024 2023 Net income (loss) $ (575,066) $ (60,866) Add (deduct): Interest (income) expense, net (15,447) (10,612) Income tax expense (benefit) 365 988 Depreciation and amortization 3,743 3,338 Stock-based compensation expense and related taxes 595,537 13,167 Restructuring costs(1) — 3,916 Other (income) expense, net 893 (114) Adjusted EBITDA $ 10,025 $ (50,183) (1) During the three months ended March 31, 2023, we incurred restructuring costs of $3.9 million, primarily composed of severance and benefits expense, in connection with reductions in our workforce. These charges are non-recurring and are not reflective of underlying trends in our business.

21 Q1 2024 • Letter to Shareholders Reddit, Inc. Reconciliation of Free Cash Flow (in thousands) (unaudited) Three months ended March 31, 2024 2023 Net cash provided by (used in) operating activities $ 32,064 $ 4,075 Less: Purchases of property and equipment (2,851) (356) Free Cash Flow $ 29,213 $ 3,719

22 Q1 2024 • Letter to Shareholders Reddit, Inc. Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin (in thousands) (unaudited) Three months ended March 31, 2024 2023 Revenue $ 242,963 $ 163,740 Cost of revenue 27,616 26,863 Gross profit 215,347 136,877 Add: Depreciation and amortization — 76 Stock-based compensation and related taxes 258 38 Non-GAAP gross profit $ 215,605 $ 136,991 Gross margin 88.6 % 83.6 % Non-GAAP gross margin 88.7 % 83.7 %

23 Q1 2024 • Letter to Shareholders Reddit, Inc. Reconciliation of Non-GAAP Operating Expenses (in thousands) (unaudited) Three months ended March 31, 2024 2023 Total operating expenses $ 804,602 $ 207,479 Less: Depreciation and amortization 3,743 3,262 Stock-based compensation expense and related taxes 595,279 13,129 Restructuring costs(1) — 3,916 Non-GAAP operating expenses $ 205,580 $ 187,172 Research and development expenses $ 437,030 $ 108,767 Less: Depreciation and amortization 2,177 1,924 Stock-based compensation expense and related taxes 327,097 8,001 Restructuring costs(1) — 2,054 Non-GAAP research and development expenses $ 107,756 $ 96,788 Sales and marketing expenses $ 124,095 $ 57,911 Less: Depreciation and amortization 1,163 1,053 Stock-based compensation expense and related taxes 63,624 1,813 Restructuring costs(1) — 893 Non-GAAP sales and marketing expenses $ 59,308 $ 54,152 General and administrative expenses $ 243,477 $ 40,801 Less: Depreciation and amortization 403 285 Stock-based compensation expense and related taxes 204,558 3,315 Restructuring costs(1) — 969 Non-GAAP general and administrative expenses $ 38,516 $ 36,232 (1) During the three months ended March 31, 2023, we incurred restructuring costs of $3.9 million, primarily composed of severance and benefits expense, in connection with reductions in our workforce. These charges are non-recurring and are not reflective of underlying trends in our business.

v3.24.1.u1

Cover

|

May 02, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 02, 2024

|

| Entity Registrant Name |

Reddit, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-41983

|

| Entity Tax Identification Number |

45-2546501

|

| Entity Address, Address Line One |

303 2nd Street

|

| Entity Address, Address Line Two |

South Tower

|

| Entity Address, Address Line Three |

5th Floor

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94107

|

| City Area Code |

415

|

| Local Phone Number |

494-8016

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.0001 par value per share

|

| Trading Symbol |

RDDT

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

true

|

| Entity Central Index Key |

0001713445

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |