SCHWAB CAPITAL TRUST

Laudus Small-Cap MarketMasters Fund

TM

Supplement dated March 13, 2013 to the

Prospectus dated February 28, 2013

This

supplement provides new and additional information beyond that contained in

the prospectus and should be read in

conjunction with the prospectus.

On February 28, 2013, the Board of Trustees (the “Board”) of Schwab Capital Trust

approved the termination of Neuberger Berman Management LLC (“Neuberger”) as investment manager to the Laudus Small-Cap MarketMasters Fund (the “Fund”). To replace Neuberger, the Board approved the hiring of BMO Asset Management

Corp. as an additional new investment manager to the Fund. Accordingly, the following changes have been made to the Fund’s prospectus:

The information under “Investment managers” on page 3 of the Fund’s prospectus is hereby deleted and replaced with the following:

The fund has four investment managers: Mellon Capital Management Corp., BMO Asset Management Corp., TAMRO Capital Partners LLC, and

Wellington Management Company, LLP. The table below shows investment managers that are (or are expected to be) responsible for managing more than 30% of the fund’s assets, and the individuals serving as portfolio managers for those investment

managers.

|

|

|

|

|

Investment manager and address

|

|

Year founded/assets under management (as of 12/31/12)

|

|

TAMRO Capital Partners LLC

1701 Duke Street

Suite 250

Alexandria, VA 22314

|

|

Founded

: 2000

Successor

Founded: 2007

$1.866 billion

|

|

|

|

|

Portfolio Manager(s)

|

|

Employment experience

|

|

Philip D. Tasho, CFA, Partner

|

|

Began investment career in 1980. Co-founded TAMRO in 2000. From 1995 to 2000, Chairman, Chief Executive Officer and Chief Investment officer of Riggs Investment Management Co.

(RIMCO).

|

|

Timothy A. Holland, CFA,

Partner, Co-Portfolio Manager

|

|

Began investment career in 2000. Joined TAMRO in 2005 as an equity analyst. Promoted to co-portfolio manager in 2010. From 1993 to 2000 worked in Financial services public

relations.

|

For more information on the fund’s other investment managers, please see the “Fund management” and

“Additional information about the funds” sections of the prospectus.

The second paragraph and related table under “More

about the fund’s investment managers and principal risks” in the “Fund details” section on page 9 of the Fund’s prospectus are hereby deleted and replaced with the following:

The following table identifies the fund’s investment managers as of March 11, 2013, their areas of focus, and approximate asset allocation.

|

|

|

|

|

|

|

|

|

Investment manager

|

|

Investment style

|

|

|

Approximate allocation

of net assets (%)

|

|

|

Mellon Capital Management Corp.

|

|

Small-cap blend

|

|

|

9.76

|

%

|

|

BMO Asset Management Corp.

|

|

Small-cap growth

|

|

|

0.00

|

%*

|

|

TAMRO Capital Partners LLC

|

|

Small-cap blend

|

|

|

49.64

|

%

|

|

Wellington Management Company, LLP

|

|

Small-cap value

|

|

|

29.61

|

%

|

|

Cash and other assets

|

|

—

|

|

|

10.99

|

%

|

|

|

*

|

BMO Asset Management Corp. will begin managing fund assets on or around March 14, 2013.

|

The seventh paragraph, relating to Neuberger, under “More about the fund’s investment managers

and principal risks” in the “Fund details” section on page 9 of the Fund’s prospectus is hereby deleted and the following is inserted:

BMO Asset Management Corp

.

(“BMO AM”)

. Using a bottom-up, fundamental approach, BMO AM seeks to invest in stocks exhibiting strong and improving growth characteristics. BMO AM will

adhere to its investment philosophy based on the premise that a portfolio of small-cap stocks with improving business fundamentals, and explainable and sustainable catalysts for growth, is expected to provide superior returns to the Russell 2000

Growth Index over time.

The fourth paragraph under “Fund management” on page 18 of the Fund’s prospectus is hereby deleted

and replaced with the following:

A discussion regarding the basis for the Board of Trustees’ approval of each fund’s investment

advisory agreement and sub-advisory agreements (except for the sub-advisory agreement with BMO AM) is available in the funds’ 2012 annual report, which covers the period of 11/1/11 through 10/31/12. A discussion regarding the basis for the

approval of the sub-advisory agreement between CSIM and BMO AM will be available in the funds’ 2013 semi-annual report.

The table

relating to the Fund’s current investment managers in the “Fund management” section beginning on page 18 of the Fund’s prospectus is hereby deleted and replaced with the following:

Laudus Small-Cap MarketMasters Fund

TM

|

|

|

|

|

|

|

|

|

Investment manager and address

|

|

Year founded/

assets under

management

(as of 12/31/12)

|

|

Portfolio manager(s)

|

|

Employment experience

|

|

TAMRO Capital Partners LLC

1701 Duke Street

Suite 250

Alexandria, VA 22314

|

|

Founded: 2000

Successor

Founded: 2007

$1.866 billion

|

|

Philip D. Tasho, CFA, Partner.

|

|

Began investment career

in 1980. Co-founded

TAMRO in 2000. From

1995 to 2000, Chairman,

Chief Executive Officer

and Chief Investment

Officer of Riggs

Investment

Management

Co. (RIMCO).

|

|

|

|

|

|

Timothy A. Holland, CFA,

Partner, Co-Portfolio Manager.

|

|

Began investment career

in 2000. Joined TAMRO

in 2005 as an equity

analyst. Promoted to co-

portfolio manager in

2010. From 1993 to 2000

worked in

financial

services public relations.

|

|

|

|

|

|

|

|

|

|

Investment manager and address

|

|

Year founded/

assets under

management

(as of 12/31/12)

|

|

Portfolio manager(s)

|

|

Employment experience

|

|

Mellon Capital Management Corp.

50 Fremont St., Suite 3900

San Francisco, CA 94105

|

|

Founded: 1983

$259.1 billion

|

|

Karen Q. Wong, CFA Managing

Director, Head of Equity

Portfolio Management.

|

|

Ms. Wong is a managing

director of equity index

strategies with Mellon

Capital, where she has

been employed since

2000. She received an

MBA from San

Francisco

State University in

Finance, and a BS from

San Francisco State

University in Accounting

and Statistics.

|

|

BMO Asset Management Corp.

115 South LaSalle Street,

Chicago, IL 60603

|

|

Founded: 1973

$32.6 billion

|

|

Patrick M. Gundlach, Managing

Director and Portfolio

Manager.

|

|

Mr. Gundlach joined

BMO AM in 2004. He

began his investment

career in 2002.

|

|

|

|

|

|

Kenneth S. Salmon, Managing

Director and Portfolio

Manager.

|

|

Mr. Salmon joined BMO

AM in 2000. He began

his investment career in

1986.

|

|

Wellington Management

Company, LLP

280 Congress Street

Boston, MA 02210

|

|

Founded: 1933

$758 billion

|

|

Timothy J. McCormack, CFA,

Senior Vice President and

Equity Portfolio Manager.

|

|

Began his investment

career in 1991. Joined

Wellington Management

as an investment

professional in 2000. Has

served as portfolio

manager for the fund

since

2012.

|

|

|

|

|

|

Shaun F. Pederson, Senior Vice

President and Equity Portfolio

Manager.

|

|

Began his investment

career in 1991. Joined

Wellington Management

as an investment

professional in 2004. Has

been involved in

portfolio management

and

securities analysis for

the fund since 2012.

|

Additional information about the portfolio managers’ compensation, other accounts managed by the portfolio managers

and the portfolio managers’ ownership of securities in the fund is available in the fund’s SAI.

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE

Charles Schwab & Co., Inc. Member

SIPC

REG73229-00 (03/13)

©

2013 All Rights Reserved

SCHWAB CAPITAL TRUST

Laudus Small-Cap MarketMasters Fund

TM

Supplement dated March 13, 2013 to the

Statement of Additional Information (“SAI”) dated February 28, 2013

This

supplement provides new and additional information beyond that contained in the SAI

and should be read in conjunction

with the SAI.

On February 28, 2013, the Board of Trustees (the “Board”) of Schwab Capital Trust approved the termination

of Neuberger Berman Management LLC (“Neuberger”) as investment manager to the Laudus Small-Cap MarketMasters Fund (the “Fund”). To replace Neuberger, the Board approved the hiring of BMO Asset Management Corp. as an additional

new investment manager to the Fund. Accordingly, the following changes have been made to the Fund’s SAI:

The tenth paragraph relating

to Neuberger under “Advisory Agreement” in the “Investment Advisory and other Services” section beginning on page 33 of the Fund’s SAI is hereby deleted and the following is inserted:

BMO Asset Management Corp. (“BMO AM”)

serves as sub-adviser to the Laudus Small-Cap MarketMasters Fund.

BMO AM is a registered investment adviser and a wholly-owned subsidiary of BMO Financial Corp., a financial services company headquartered in Chicago,

Illinois, and an indirect wholly-owned subsidiary of the Bank of Montreal, a Canadian bank holding company. As of December 31, 2012, BMO AM had approximately $32.6 billion in assets under management. BMO AM has managed investments for

individuals and institutions since 1973. Its principal address is located at 115 South LaSalle Street, Chicago, IL 60603.

The information

relating to Neuberger under “Sub-Adviser Portfolio Manager Disclosure” beginning on page 50 of the Fund’s SAI is hereby deleted and the following is inserted:

BMO AM sub-advises the Laudus Small-Cap MarketMasters Fund (the “Fund”)

Other Accounts.

The portfolio managers are also responsible for the day-to-day management of other accounts, as indicated in the following

table. The information below is provided as of December 31, 2012. There are no accounts with respect to which the advisory fee is based on the performance of the account.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Registered Investment

Companies

|

|

|

Other Pooled Investment Vehicles

|

|

Other Accounts

|

|

|

|

Number of

Accounts

|

|

|

Total Assets

|

|

|

Number of

Accounts

|

|

Total Assets

|

|

Number of

Accounts

|

|

|

Total Assets

|

|

|

Patrick M. Gundlach

|

|

2

|

|

$

|

808.6 million

|

|

|

0

|

|

$0

|

|

107

|

|

$

|

337.2 million

|

|

|

Kenneth S. Salmon

|

|

2

|

|

$

|

808.6 million

|

|

|

0

|

|

$0

|

|

107

|

|

$

|

337.2 million

|

|

Material Conflicts of Interest

.

A conflict of interest may arise as a result of a portfolio manager being

responsible for multiple accounts, including the Fund, which may have different investment guidelines and objectives. In addition to the Fund, these accounts may include other mutual funds managed on an advisory or sub-advisory basis, separate

accounts, and collective trust accounts. An investment opportunity may be suitable for the Fund as well as for any of the other managed accounts. However, the investment may not be available in sufficient quantity for all of the accounts to

participate fully. In addition, there may be limited opportunity to sell an investment held by the Fund and the other accounts. The other accounts may have similar investment objectives or strategies as the Fund, they may track the same benchmarks

or indexes as the Fund tracks, and they may sell securities that are eligible to be held, sold or purchased by the Fund. A portfolio manager may be responsible for accounts that have different advisory fee schedules, which may create the incentive

for the portfolio manager to favor one account over another in terms of access to investment opportunities. A portfolio manager also may manage accounts whose investment objectives and policies differ from those of the Fund, which may cause the

portfolio manager to effect trading in one account that may have an adverse effect on the value of the holdings within another account, including the Fund.

To address and manage these potential conflicts of interest, BMO AM has adopted compliance policies and procedures to allocate investment opportunities and to ensure that each of its clients is treated on

a fair and equitable basis. Such

policies and procedures include, but are not limited to, trade allocation and trade aggregation policies, cross trading policies, portfolio manager assignment practices, and oversight by

investment management, and/or compliance departments.

Compensation

. Compensation for BMO AM’s portfolio managers consists

of base salary, which is monitored to ensure competitiveness in the external marketplace. In addition to base salary, portfolio managers have a portion of their compensation tied to the investment performance of client accounts. The formula for each

professional varies according to their level of portfolio responsibility and seniority. Investment professionals may also receive bonuses of restricted share units or other units linked to the performance of BMO Financial Group.

Ownership of Fund Shares.

As of December 31, 2012, neither portfolio managers owned any shares of the Fund.

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE

Charles Schwab & Co., Inc. Member

SIPC

REG73230-00 (03/13)

©

2013 All Rights Reserved

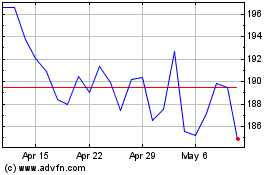

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Jun 2024 to Jul 2024

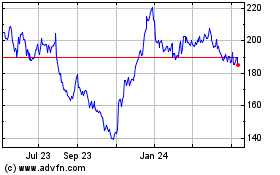

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Jul 2023 to Jul 2024