Quaker Chemical Corporation - Value

November 17 2011 - 7:00PM

Zacks

The specialty chemical companies are right in the thick of the

global economy.

Quaker Chemical Corporation (KWR) saw record

volumes in the third quarter but raw material prices are biting.

Still, this Zacks #2 Rank (buy) has value. It is trading at just

11x forward estimates.

Quaker's chemical business is a barometer of the

global economy because while it is headquartered in Pennsylvania,

it has a presence in every major manufacturing country in the

world. It also has regional headquarters in the growth powerhouses

of Brazil and China.

The company produces process chemicals and

specialty chemicals for some of the key building block industries

such as primary metals and metalworking.

Quaker Beat By 34% in the Third Quarter

On Oct 25, Quaker Chemical reported its third

quarter results and surprised on the Zacks Consensus Estimate by 26

cents. Earnings per share were $1.03 compared to the consensus of

just 77 cents. It made just 55 cents in the year ago quarter.

This was the company's 11th consecutive earnings

surprise.

Sales jumped 32% to $182.3 million from $137.7

million in the year ago period. The product volumes were at an

all-time high, jumping 16% including acquisitions.

Raw material price increases are still hitting

hard. The company implemented price increases across the globe to

combat the costs and restore margins.

Outlook for the Fourth Quarter

Quaker has seen demand in some countries soften and

considers the global environment to be "challenging."

But in the fourth quarter, the company expects good

volumes, with some seasonality due to the holidays. The uncertainty

in Europe had, so far, not affected the company.

Zacks Consensus Estimates Rise But Growth

Slows

Since the third quarter results, the 2011 Zacks

Consensus Estimate rose 3 cents to $3.30 per share. That is

earnings growth of just 1.9% as the company earned $3.24 in

2010.

Further growth is expected in 2012 however, as the

Zacks Consensus rose to $3.66 from $3.64 in the last month. That is

earnings growth of 10.9%.

Still a Value Stock

Like a lot of stocks, Quaker sold off over the

summer but rebounded in the October rally.

But even with the recent rebound, the shares still

have attractive valuations.

In addition to a P/E well below 15, which is the

cut-off I use for value stocks, Quaker also has a price-to-book

ratio of 1.8. A P/B ratio under 3.0 is usually considered

"value."

Quaker also has a price-to-sales ratio of 0.7. A

P/S ratio under 1.0 usually indicates a company is undervalued.

The company also rewards shareholders with a

dividend, currently yielding 2.6%. It also has a solid 1-year

return on equity (ROE) of 18.4%.

Quaker continues to put together solid results

quarter after quarter. If chemical companies are the building

blocks of the global economy, then the economy isn't looking too

shabby right here.

This Week's Value Zacks Rank Buy Stocks

Railcar demand is defying the economic doom and

gloom. The Greenbrier Companies (GBX) recently delivered a

record number of new railcars in the fiscal fourth quarter and the

backlog grew. This Zacks #1 Rank (strong buy) is a strong value

stock, with a price-to-sales ratio of just 0.5. Read the full

article.

Macy's Inc. (M) recently reported yet

another earnings surprise and raised guidance, but a bigger

question still looms: what will happen this holiday season?

Investors in retail stocks are very jittery this year. This Zacks

#1 Rank (strong buy) is trading at just 11.3x forward estimates as

uncertainty lingers about the health of the American shopper. Read

the full article.

Looking for a value stock that also pays a nice

dividend? Plains All American Pipeline, L.P. (PAA) is a rare

combination of both value and income. This Zacks #1 Rank (strong

buy) is trading with a P/E of 13.9 yet it also has a dividend

yielding 6.2%. Read the full article.

TravelCenters of America LLC (TA) is

expected to see triple digit earnings growth in 2011. This Zacks #1

Rank (strong buy) has been profiting from strong fuel sales. Shares

are cheap, with a forward P/E of just 7.6. Read the full

article.

Tracey Ryniec is the Value Stock Strategist for

Zacks.com. She is also the Editor in charge of the market-beating

Zacks Value Trader service. You can follow her at

twitter.com/traceyryniec.

QUAKER CHEMICAL (KWR): Free Stock Analysis Report

Zacks Investment Research

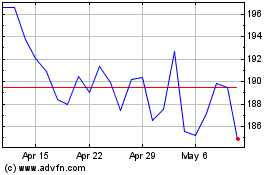

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Jun 2024 to Jul 2024

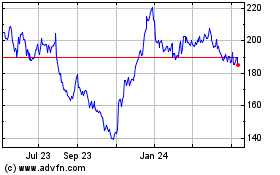

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Jul 2023 to Jul 2024