SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Amendment No. 1

Filed by the Registrant

o

Filed by a Party other

than the Registrant þ

Check the appropriate box:

| þ |

Preliminary Proxy Statement |

| o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o |

Definitive Proxy Statement |

| o |

Definitive Additional Materials |

| o |

Soliciting Material Under Rule 14a-12 |

Putnam Municipal Opportunities Trust

(Name of Registrant as Specified In Its Charter)

Saba Capital Management, L.P.

Boaz R. Weinstein

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (check the appropriate box):

| þ |

No fee required. |

| |

|

| o |

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act |

| Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| |

|

|

| |

|

|

| o |

Fee paid previously with preliminary materials. |

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the |

| filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

|

|

| |

|

|

| |

4) |

Date Filed: |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED [●], 2023

Putnam Municipal Opportunities Trust

__________________________

PROXY STATEMENT

OF

|

| Saba Capital Management, L.P. |

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GOLD

PROXY CARD TODAY

This proxy statement (this “Proxy

Statement”) and the enclosed GOLD proxy card are being furnished by Saba Capital Management, L.P. (“Saba

Capital”) and Boaz R. Weinstein (“Mr. Weinstein,” and together with Saba Capital, “Saba,”

“we,” “us” or the “Participants”), in connection with the solicitation of proxies from the

shareholders of Putnam Municipal Opportunities Trust, a Massachusetts business trust and closed-end management investment

company registered under the Investment Company Act of 1940, as amended (the “Fund”).

Upon consummation of an anticipated stock and cash transaction where Putnam

Investment Management, LLC, the current investment manager of the Fund (“Putnam Management”), and Putnam Investments Limited

(“PIL”), the Fund’s subadviser, would each become an indirect wholly-owned subsidiary of Franklin Resources, Inc. (“Franklin

Templeton,” and such transaction, the “Transaction”), the current investment management contract between the Fund and

Putnam Management and the related sub-advisory contract with PIL will automatically terminate pursuant to the Investment Company Act of

1940, as amended (the “40 Act”). In connection therewith, the Board of Trustees of the Fund (the “Board”) has

scheduled a special meeting of shareholders of the Fund for the purpose of considering and voting on the proposals to approve a new investment

management contract with Putnam Management allowing it to continue to serve as the investment manager to the Fund, as well as a new sub-advisory

contract with PIL allowing PIL to continue to serve as subadviser to the Fund.

As discussed in detail in the “Reasons for this

Proxy Solicitation” section, Franklin Templeton has, in our view, a poor corporate governance track record, particularly with respect

to the closed-end funds it and its subsidiaries manage. For this reason, Saba believes that the Fund is in need of a new manager not affiliated

with Franklin Templeton.

We are therefore seeking your support at the upcoming

special meeting of shareholders of the Fund, including any adjournments or postponements thereof (the “Special Meeting”),

that is scheduled to be held on October 6, 2023 at [11:00 a.m.], Boston time, at 100 Federal Street, Boston, MA 02110.

This

Proxy Statement and the enclosed GOLD proxy card are first being furnished to the Fund’s

shareholders on or about [●], 2023.

Saba is seeking your support at the Special

Meeting with respect to the following proposals (each a “Proposal” and collectively the “Proposals”) and to consider and act upon

any other business that may properly come before the Special Meeting.

| Proposal |

|

Our Recommendation |

| |

|

|

|

|

| |

1. |

To approve a new management

contract with Putnam Management (the “New Investment Management Contract”). |

|

AGAINST |

| |

2. |

To approve a new sub-advisory

contract between Putnam Management and PIL (the “New Sub-Advisory Contract,” and together with the New Investment Management

Contract, the “New Contracts”). |

|

AGAINST |

| |

|

To transact such other business as may properly come before the Special Meeting. |

|

|

Based on the Fund’s preliminary proxy

statement for the Special Meeting, filed on July 7, 2023 (the “Fund’s Proxy Statement”), the New Contracts each

require approval by holders of common stock shares of beneficial interest, no par value (the “Common Shares”) and

preferred shares of the Fund (the “Preferred Shares”), voting together as a single class.

Through this Proxy Statement and enclosed GOLD

proxy card, we are soliciting proxies in opposition to the Fund’s proposals to approve the New Contracts.

We strongly oppose the approval of the New Contracts and urge shareholders to vote “AGAINST”

the Proposals. Please refer to the information set forth under the section of this Proxy Statement titled “Reasons for this

Proxy Solicitation” for a more detailed explanation of our rationale for opposing the approval of the New Contracts.

The Fund has set the record date for determining

shareholders entitled to notice of and to vote at the Special Meeting (the “Record Date”) as July 10, 2023. Shareholders of

record at the close of business on the Record Date will be entitled to vote at the Special Meeting. As of the close of business on

the Record Date, the Participants may be deemed to “beneficially own” (such term as used in Schedule 14A within the

meaning of Rule 13d-3 or Rule 16a-1 under the Securities Exchange Act of 1934 (the “Exchange

Act”)), in the aggregate, 13,042 Common Shares, as further described in Annex I. There were [●] Common Shares

and [●] Preferred Shares outstanding as of the Record Date according to the Fund’s Proxy Statement.

We urge you to sign, date and return the GOLD

proxy card “AGAINST” each of the Proposals. By returning the GOLD proxy card, you are authorizing

Saba to vote on your behalf, and if you do not indicate how you would like to vote, your vote will be counted “AGAINST”

each of the Proposals.

According to the Fund’s Amended and

Restated Agreement and Declaration of Trust (the “Charter”) and the Fund’s Proxy Statement, approval of the New

Contracts each requires the affirmative vote of a “majority of the outstanding voting securities” of the Fund, which is

defined under the 40 Act to be the lesser of (a) more than 50% of the outstanding shares of the Fund, or (b) 67% or more of the

shares of the Fund present (in person or by proxy) at the Special Meeting if more than 50% of the outstanding shares of the Fund are

present at the Special Meeting in person or by proxy.

Saba intends to deliver this Proxy Statement and

the accompanying form of GOLD proxy card to holders of at least the percentage of the Fund’s voting shares

required under applicable law to oppose each of the Proposals at the Special Meeting and otherwise intends to solicit proxies or

votes from shareholders of the Fund in opposition to the passage of the Proposals. This proxy solicitation is being made by Saba

and not on behalf of the Board or management of the Fund or any other third party. We are not aware of any other matters to be

brought before the Special Meeting other than as described herein. Should other matters be brought before the Special Meeting, the

persons named as proxies in the enclosed GOLD proxy card will vote on such matters in their discretion to the extent

allowed by Rule 14a-4(c)(3) under the Exchange Act.

If you have already voted using the Fund’s

[●] proxy card, you have every right to change your vote by completing and mailing the enclosed GOLD proxy card in the enclosed

pre-paid envelope or by voting via Internet or by telephone by following the instructions on the GOLD proxy card. Importantly,

only the latest validly executed proxy that you submit will be counted. In addition, any proxy may be revoked at any time prior to its

exercise at the Special Meeting by following the instructions under “Can I change my vote or revoke my proxy?” in the

Questions and Answers section.

For instructions on how to vote, including the quorum

and voting requirements for the Fund and other information about the proxy materials, see the Questions and Answers section.

|

We urge you to promptly sign,

date and return your GOLD proxy card. |

If you have any questions or require any assistance

with voting your shares, please contact our proxy solicitor, InvestorCom, toll free at (877) 972-0090 or collect at (203) 972-9300.

| REASONS FOR THIS PROXY SOLICITATION |

Saba is committed to improving the Fund for the

benefit of all shareholders and, to this end, is opposing the approval of the New Contracts, which, if approved, would re-install

Putnam Management and PIL, subsidiaries of Franklin Templeton, as the investment manager and subadviser of the Fund, respectively.

Franklin Templeton has a poor corporate governance track record as described below, particularly with respect to the closed-end

funds it and its subsidiaries manage. While Saba would be happy to work with the Board to explore alternative options in the event

the Proposals do not pass, Saba does not currently have any plan to propose a replacement manager or any other plans or proposals in

connection therewith.

Franklin Templeton’s Poor Corporate Governance

Track Record

Legg Mason Partners Fund Advisor, LLC

(“Legg Mason”), an indirect wholly-owned subsidiary of Franklin Templeton, is the investment manager of ClearBridge

Energy Midstream Opportunity Fund (“EMO”), ClearBridge MLP and Midstream Fund Inc. (“CEM”) and ClearBridge

MLP and Midstream Total Return Fund Inc. (“CTR” and together with EMO and CEM, the “ClearBridge funds”), all of which

have, in Saba's view, significant corporate governance failures.

So that shareholders are aware, on August 14, 2020, soon after Franklin

Templeton’s acquisition of Legg Mason, the ClearBridge funds elected to be subject to the Maryland Control Share Acquisition Act

(see EMO and CEM’s annual report filed with the SEC each on January 29, 2021 and CTR’s annual report filed on February 1,

2021) which purports to strip >10% shareholders of their >10% voting rights.

Further, the ClearBridge funds also issued super voting shares that significantly diluted common stockholders (see page 3, Saba’s DEFC14A, File No. 811-22546, February 28, 2023).

Yet further, the ClearBridge funds (who are, again,

managed by a Franklin Templeton subsidiary) employ a majority of the outstanding voting standard in contested elections, which can have

the effect of ensuring that incumbent directors “hold over” and stay on the board even if shareholder proposed candidates

receive more votes than them (i.e. in the event no candidates received a majority of the outstanding).

It is this poor corporate governance track record that, in Saba’s

view, warrants a new manager, one not affiliated with Franklin Templeton.

For the foregoing reasons, we urge you to join us and

vote “AGAINST” each of the Proposals on the GOLD proxy card today.

| PROPOSAL

1: APPROVAL OF THE NEW INVESTMENT MANAGEMENT CONTRACT |

The Fund’s current investment management

contract with Putnam Management will automatically terminate following the consummation of the Transaction because the 40 Act requires management contracts to terminate automatically

upon an “assignment” of the contract, which includes a “change of control” affecting an investment company’s

investment adviser (including any subadviser). Therefore, the Fund is

seeking to put in place the New Investment Management Contract with Putnam Management allowing it to continue to serve as the

investment manager to the Fund.

We oppose the approval of the New Investment

Management Contract as we believe it is not in the best interests of the Fund and its shareholders to allow the Fund to be managed

by an investment manager controlled by Franklin Templeton, due to, in our view, Franklin Templeton’s poor track record of

corporate governance and respecting shareholder rights, as described in the “Reasons for this Proxy Solicitation”

section. If the New Investment Management Contract fails to receive the requisite approval by the shareholders, Putnam Management

will no longer serve as the investment manager to the Fund leaving room for an alternative investment manager not controlled by

Franklin Templeton.

Rule 15a-4 under the 40 Act provides a temporary

exemption to the approval requirements of an investment management agreement, in the event that a prior advisory contract is

terminated, which allows the Board (including a majority of the independent trustees) to approve an interim investment management

contract. Such an interim contract is required to be approved within ten business days after the date that the termination of the

prior advisory contract becomes effective, with the compensation received under the interim contract to be no greater than the

compensation the adviser would have received under the previous contract. The Board would then have 150 days to obtain shareholder

approval for that new investment management contract at a subsequent meeting of shareholders (which is the subject of

this proxy solicitation). The Board has approved an interim management contract between the Fund and Putnam Management, with terms

identical to the existing investment management contract, which will allow Putnam Management to continue as the Fund’s

investment manager after consummation of the Transaction for up to 150 days without shareholder approval. Although the failure to

approve a permanent investment management agreement could potentially require the Fund to become internally managed, we believe any

reasonably designed process to select a new manager would identify a number of suitable, alternative advisers willing to advise the

Fund on attractive terms.

Although a change in investment manager may

result in some amount of lost time or incremental expenses being borne by the Fund, as can be incidental to a change in investment

manager due to the time and expense that may be incurred by the Fund and its Board as they seek a replacement, or could lead to the

appointment of an alternative adviser which may assess a higher (or lower) advisory fee, we believe these potential costs are far

outweighed by the potential benefits of replacing the existing investment manager. For these reasons, we recommend voting

“AGAINST” Proposal 1. The Participants intend to vote all of their Common Shares “AGAINST”

Proposal 1.

Vote Required. According to the Charter

and the Fund’s Proxy Statement, approval of the New Investment Management Contract requires the affirmative vote of a “majority

of the outstanding voting securities” of the Fund, which is defined under the 40 Act to be the lesser of (a) more than 50% of the

outstanding shares of the Fund, or (b) 67% or more of the shares of the Fund present (in person or by proxy) at the Special Meeting if

more than 50% of the outstanding shares of the Fund are present at the meeting in person or by proxy.

Abstentions and broker

non-votes, if any, will have the same effect as votes “against” Proposal 1. However, because Saba has initiated a contested

proxy solicitation, there will be no “routine” matters at the Special Meeting for any broker accounts that are provided with

proxy materials by Saba. As a result, there will be no broker non-votes by such banks, brokers or other nominees with respect to such

accounts.

|

We Recommend a Vote AGAINST Proposal 1 on

the GOLD proxy card.

|

| PROPOSAL 2: APPROVAL OF A NEW SUB-ADVISORY CONTRACT BETWEEN PUTNAM MANAGEMENT AND PIL |

Under the 40 Act, the Fund’s current sub-advisory

contract between Putnam Management and PIL will automatically terminate following the consummation of the Transaction. Therefore, Putnam

Management is seeking to put in place the New Sub-Advisory Contract with PIL, allowing PIL to continue to serve as subadviser to the Fund.

According to the Fund’s Proxy Statement, it may not be necessary for shareholders to approve the New Sub-Advisory Contract. However,

the Board has determined to seek shareholder approval of the New Sub-Advisory Contract.

We oppose the approval of the New Sub-Advisory

Contract as we believe it is not in the best interests of the Fund and its shareholders to allow the Fund to be served by a

subadviser controlled by Franklin Templeton, due to, in our view, Franklin Templeton’s poor track record of corporate

governance and respecting shareholder rights, as described in the “Reasons for this Proxy Solicitation” section. If the

New Sub-Advisory Contract fails to receive the requisite approval by the shareholders, PIL will no longer serve as the subadviser to

the Fund leaving room for an alternative sub-advisor not controlled by Franklin Templeton.

Rule 15a-4 under the 40 Act provides a temporary

exemption to the approval requirements of a management agreement, including a sub-advisory contract, in the event that a prior

advisory contract is terminated, which allows the Board (including a majority of the independent trustees) to approve an interim

sub-advisory contract. Such an interim contract is required to be approved within ten business days after the date that the

termination of the prior sub-advisory contract becomes effective, with the compensation received under the interim contract to be no

greater than the compensation the sub-adviser would have received under the previous contract. The Board would then have 150 days to

obtain shareholder approval for that new sub-advisory contract at a subsequent meeting of shareholders (which is the subject of

this proxy solicitation). The Board has approved an interim sub-advisory contract between Putnam Management and PIL, with terms

identical to the existing sub-advisory contract, which will allow PIL to continue providing its services to the Fund after

consummation of the Transaction for up to 150 days without shareholder approval. Although the failure to approve a permanent

sub-advisory contract could potentially require the Fund to be managed without a subadviser, we believe any reasonably designed

process to select a new subadviser would identify a number of suitable, alternative subadvisers willing to serve the Fund on

attractive terms.

Although a change in subadviser may result in

some amount of lost time or incremental expenses being borne by the Fund, as can be incidental to a change in subadviser, due to the

time and expense that may be incurred by the Fund and its Board as they seek a replacement, or could lead to the appointment of an

alternative sub-adviser which may assess a higher (or lower) sub-advisory fee, we believe these potential costs are far outweighed

by the potential benefits of replacing the existing subadviser. For these reasons, we recommend voting “AGAINST”

Proposal 2. The Participants intend to vote all of their Common Shares “AGAINST” Proposal 2.

Vote Required. According to the Charter

and the Fund’s Proxy Statement, approval of the New Sub-Advisory Contract requires the affirmative vote of a “majority of

the outstanding voting securities” of the Fund, which is defined under the 40 Act to be the lesser of (a) more than 50% of the outstanding

shares of the Fund, or (b) 67% or more of the shares of the Fund present (in person or by proxy) at the Special Meeting if more than 50%

of the outstanding shares of the Fund are present at the meeting in person or by proxy.

Abstentions and broker non-votes, if any, will have the same effect as

votes “against” Proposal 2. However, because Saba has initiated a contested proxy solicitation, there will be no

“routine” matters at the Special Meeting for any broker accounts that are provided with proxy materials by Saba. As a

result, there will be no broker non-votes by such banks, brokers or other nominees with respect to such accounts.

|

We Recommend a Vote AGAINST Proposal 2

on the GOLD proxy card.

|

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE SPECIAL MEETING |

Who is entitled to vote?

Only holders of Common Shares and Preferred Shares

(together with the Common Shares, the “Shares”) at the close of business on the Record Date are entitled to notice of and

to vote at the Special Meeting. Shareholders who sold their Shares before the Record Date (or acquire them without voting rights after

the Record Date) may not vote such Shares. Shareholders of record on the Record Date will retain their voting rights in connection with

the Special Meeting even if they sell such Shares after the Record Date (unless they also transfer their voting rights as of the Record

Date).

How do I vote my Shares?

Shares held in record name. If your Shares are

registered in your own name, please vote today by signing, dating and returning the enclosed GOLD proxy card in the postage-paid

envelope provided. Execution and delivery of a proxy by a record holder of Shares will be presumed to be a proxy with respect to all Shares

held by such record holder unless the proxy specifies otherwise.

Shares beneficially owned or held in “street”

name. If you hold your Shares in “street” name with a broker, bank, dealer, trust company or other nominee, only that

nominee can exercise the right to vote with respect to the Shares that you beneficially own through such nominee and only upon receipt

of your specific instructions. Accordingly, it is critical that you promptly give instructions to your broker, bank, dealer, trust

company or other nominee to vote AGAINST each of the Proposals. Please follow the instructions to vote provided on the enclosed

GOLD voting instruction form. If your broker, bank, dealer, trust company or other nominee provides for proxy instructions

to be delivered to them by telephone or Internet, instructions will be included on the enclosed GOLD voting instruction

form. We urge you to confirm in writing your instructions to the person responsible for your account and provide a copy of those instructions

by emailing them to Saba@investor-com.com or mailing them to Saba Capital Management, L.P., c/o InvestorCom, 19 Old

Kings Highway S., Suite 130, Darien, CT 06820, so that we will be aware of all instructions given and can attempt to ensure that such

instructions are followed.

Note: Shares represented by properly executed

GOLD proxy cards will be voted at the Special Meeting as marked and, in the absence of specific instructions, “AGAINST”

each of the Proposals.

How should I vote

on the Proposals?

We recommend that you vote your Shares on the

GOLD proxy card as follows:

“AGAINST”

the Proposal to approve the New Investment Management Contract (Proposal 1).

“AGAINST”

the Proposal to approve the New Sub-Advisory Contract (Proposal 2).

How

many Shares must be present to hold the Special Meeting?

According to

the Charter, 30% of Shares entitled to vote on a particular matter shall constitute a quorum for the transaction of business on that matter

at the Special Meeting. Abstentions and broker non-votes, if any, are treated as votes present for purposes of determining a quorum. Because

Saba has initiated a contested proxy solicitation, there will be no “routine” matters at the Special Meeting for any broker

accounts that are provided with proxy materials by Saba. As a result, there will be no broker non-votes by such banks, brokers or other

nominees with respect to such accounts. For more information on broker non-votes, see “What are “broker non-votes”

and what effect do they have on the Proposals?” below.

What vote is needed

to approve the Proposals?

Proposals 1 and 2 – Approval of

the New Contracts. According to the Charter and the Fund’s Proxy Statement, approval of the New Contracts each requires

the affirmative vote of a “majority of the outstanding voting securities” of the Fund, which is defined under the 40 Act

to be the lesser of (a) more than 50% of the outstanding Shares, or (b) 67% or more of the shares of the Fund present (in person or

by proxy) at the Special Meeting if more than 50% of the outstanding Shares are present at the meeting in person or by proxy.

Abstentions and broker non-votes, if any, will have the same effect as votes “against” each of the Proposals because

they represent shares entitled to vote. However, because Saba has initiated a contested proxy solicitation, there will be no

“routine” matters at the Special Meeting for any broker accounts that are provided with proxy materials by Saba. As a

result, there will be no broker non-votes by such banks, brokers or other nominees with respect to such accounts.

What are “broker non-votes”

and what effect do they have on the Proposals?

Generally, broker

non-votes occur when shares held by a broker, bank or other nominee in “street name” for a beneficial owner are not voted

with respect to a particular proposal because the broker, bank or other nominee has not received voting instructions from the beneficial

owner and lacks discretionary voting power to vote those shares with respect to that particular proposal. If your shares are held in the

name of a brokerage firm, and the brokerage firm has not received voting instructions from you, as the beneficial owner of such shares

with respect to that proposal, the brokerage firm cannot vote such shares on that proposal unless it is a “routine” matter.

Under the rules and interpretations of the New York Stock Exchange, if you receive proxy materials from or on behalf of both Saba and

the Fund, brokers, banks and other nominees will not be permitted to exercise discretionary authority regarding any of the proposals to

be voted on at the Special Meeting, whether “routine” or not. Because Saba has initiated a contested proxy solicitation, there

will be no “routine” matters at the Special Meeting for any broker accounts that are provided with proxy materials by Saba.

As a result, there will be no broker non-votes by such banks, brokers or other nominees with respect to such accounts. If you do not submit

any voting instructions to your broker, bank or other nominee with respect to such accounts, your shares in such accounts will not be

counted in determining the outcome of the Proposals at the Special Meeting, nor will your shares be counted for purposes of determining

whether a quorum exists.

What should I do if I receive

a proxy card from the Fund?

You may receive

proxy solicitation materials from the Fund, including an opposition proxy statement and a [●] proxy card. We are not responsible

for the accuracy of any information contained in any proxy solicitation materials used by the Fund or any other statements that it may

otherwise make.

We recommend

that you discard any proxy card or solicitation materials that may be sent to you by the Fund. If you have already voted using the Fund’s

[●] proxy card, you have every right to change your vote by using the enclosed GOLD proxy card by signing, dating and returning

the enclosed GOLD proxy card in the postage-paid envelope provided. Only the latest validly executed proxy that you submit will

be counted; any proxy may be revoked at any time prior to its exercise at the Special Meeting by following the instructions below under

“Can I change my vote or revoke my proxy?”

If you have

any questions or require any assistance with voting your Shares, please contact our proxy solicitor, InvestorCom. Shareholders may call

toll free at (877) 972-0090 or collect at (203) 972-9300.

Can I change my vote

or revoke my proxy?

If you are the shareholder of record, you may

change your proxy instructions or revoke your proxy at any time before your proxy is voted at the Special Meeting. Proxies may be revoked

by any of the following actions:

| · | signing, dating and returning the enclosed GOLD

proxy card in the postage-paid envelope provided or signing, dating and returning a [●] proxy card (the latest dated proxy is the

only one that counts); |

| · | delivering a written revocation to the secretary

of the Fund; or |

| · | attending the Special Meeting and voting by ballot

in person (although attendance at the Special Meeting will not, by itself, revoke a proxy). |

If your Shares are held in a brokerage account by a

broker, bank or other nominee, you should follow the instructions provided by your broker, bank or other nominee. If you attend the Special

Meeting and you beneficially own Shares but are not the record owner, your mere attendance at the Special Meeting WILL NOT be sufficient

to revoke any previously submitted proxy card. You must have written authority from the record owner to vote your Shares held in its name

at the meeting in the form of a “legal proxy” issued in your name from the bank, broker or other nominee that holds your Shares.

If you have any questions or require any assistance with voting your Shares, please contact our proxy solicitor, InvestorCom, toll free

at (877) 972-0090 or collect at (203) 972-9300.

IF YOU HAVE ALREADY VOTED USING THE FUND’S

[●] PROXY CARD, WE URGE YOU TO REVOKE IT BY FOLLOWING THE INSTRUCTIONS ABOVE. Although a revocation is effective if delivered

to the Fund, we request that a copy of any revocation be mailed to Saba Capital Management, L.P., c/o InvestorCom, 19 Old Kings Highway

S., Suite 130, Darien, CT 06820, so that we will be aware of all revocations.

Who is making this

proxy solicitation and who is paying for it?

The solicitation of proxies

pursuant to this proxy solicitation is being made by the Participants. Proxies may be solicited by mail, facsimile, telephone, telegraph,

Internet, in person or by advertisements. Saba will solicit proxies from individuals, brokers, banks, bank nominees and other institutional

holders. Saba will request banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials

to the beneficial owners of the Shares they hold of record. Saba will reimburse these record holders for their reasonable out-of-pocket

expenses in so doing. It is anticipated that certain regular employees of Saba will also participate in the solicitation of proxies in

opposition of the Proposal. Such employees will receive no additional consideration if they assist in the solicitation of proxies.

Saba has retained

InvestorCom to provide solicitation and advisory services in connection with this solicitation. InvestorCom will be paid a fee not

to exceed $[●] based upon the campaign services provided. In addition, Saba will advance costs and reimburse InvestorCom for

reasonable out-of-pocket expenses and will indemnify InvestorCom against certain liabilities and expenses, including certain

liabilities under the federal securities laws. InvestorCom will solicit proxies from individuals, brokers, banks, bank nominees and

other institutional holders. It is anticipated that InvestorCom will employ approximately [●] persons to solicit the

Fund’s shareholders as part of this solicitation. InvestorCom does not believe that any of its owners, managers, officers,

employees, affiliates or controlling persons, if any, is a “participant” in this proxy solicitation.

The entire expense of soliciting

proxies is being borne by Saba. Costs of this proxy solicitation are currently estimated to be approximately $[●]. We estimate

that through the date hereof, Saba’s expenses in connection with the proxy solicitation are approximately $[●]. If successful

in its proxy solicitation, Saba may seek reimbursement of these costs from the Fund. For the avoidance of doubt, such reimbursement

is not guaranteed. In the event that Saba decides to seek reimbursement of its expenses, Saba does not intend to submit the matter to

a vote of the Fund’s shareholders. The members of the Board would be required to evaluate the requested reimbursement consistent

with their fiduciary duties to the Fund and its shareholders.

What is Householding of Proxy Materials?

The SEC has adopted rules

that permit companies and intermediaries (such as brokers and banks) to satisfy the delivery requirements for proxy statements and annual

reports with respect to two or more shareholders sharing the same address by delivering a single proxy statement addressed to those shareholders.

Some banks and brokers with account holders who are shareholders of the Fund may be householding our proxy materials.

A single copy of

this Proxy Statement (and of the Fund’s Proxy Statement) will be delivered to multiple shareholders sharing an address unless contrary

instructions have been received from one or more of the affected shareholders. Once you have received notice from your bank or broker

that it will be householding communications to your address, householding will continue until you are notified otherwise or until you

revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement,

please notify your bank or broker and direct your request to the Fund at P.O. Box 219697, Kansas City, MO 64121-9697, or by calling toll free at

1-800-225-1581. Shareholders who currently receive multiple copies of this Proxy Statement at their address and would like to request

householding of their communications should contact their bank or broker.

Because Saba

has initiated a contested proxy solicitation, we understand that banks and brokers with account holders who are shareholders of the Fund

will not be householding our proxy materials.

Where can I find additional

information concerning the Fund?

Pursuant to Rule 14a-5(c) promulgated under the Exchange

Act, we have omitted from this Proxy Statement certain disclosure required by applicable law to be included in the Fund’s Proxy

Statement. We take no responsibility for the accuracy or completeness of any information that we expect to be contained in the Fund’s

Proxy Statement. Except as otherwise noted herein, the information in this Proxy Statement concerning the Fund has been taken from or

is based upon documents and records on file with the SEC and other publicly available information.

This Proxy

Statement and all other solicitation materials in connection with this proxy solicitation will be available on the internet, free of

charge, on the SEC’s website at https://www.edgar.sec.gov. The Edgar file number for the Fund is 811-07626.

We urge you to carefully consider the information contained

in this Proxy Statement and then support our efforts by signing, dating and returning the enclosed GOLD proxy card today.

Thank you for your support,

|

| |

| Saba Capital Management, L.P. |

| Boaz R. Weinstein |

| |

| [●], 2023 |

ANNEX I: INFORMATION

ON THE PARTICIPANTS

Beneficial Ownership and Other Information

This proxy solicitation is being made by the

Participants. As of the date of this Proxy Statement, the Participants may be deemed to “beneficially own” (such term as

used in Schedule 14A within the meaning of Rule 13d-3 or Rule 16a-1 under the Exchange Act for the purposes of this Annex I) 13,042

Common Shares in the aggregate. Of the 13,042 Common Shares owned in the aggregate by the Participants, such Common Shares may be

deemed to be beneficially owned as follows: (a) 13,042 Common Shares may be deemed to be beneficially owned by Saba Capital by

virtue of its status as the investment manager of various funds and accounts, such funds and accounts, the (“Saba

Entities”); and (b) 13,042 Common Shares may be deemed to be beneficially owned by Mr. Weinstein by virtue of his status

as the principal of Saba.

The principal business of Saba Capital is to serve

as investment manager to the Saba Entities. The principal business of Mr. Weinstein is investment management and serving as the principal

of Saba Capital. The principal business of the Saba Entities is to invest in securities.

The business address of each member of Saba and the

Saba Entities is 405 Lexington Avenue, 58th Floor, New York, New York 10174.

Unless otherwise noted as shares held in record name

by the Saba Entities, the Common Shares held by the Saba Entities are held in commingled margin accounts, which may extend margin credit

to such parties from time to time, subject to applicable federal margin regulations, stock exchange rules and credit policies. In such

instances, the positions held in the margin account are pledged as collateral security for the repayment of debit balances in the account.

The margin accounts bear interest at a rate based upon the broker’s call rate from time to time in effect. Because other securities

are held in the margin accounts, it is not possible to determine the amounts, if any, of margin used to purchase the Common Shares reported

herein since margin may have been attributed to such other securities and since margin used is not disclosed on an individual per-security

basis.

Disclaimer

Except as set forth in this Proxy Statement

(including the Appendices hereto), (i) during the past 10 years, no Participant in this solicitation has been convicted in a

criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no Participant and no associate or “Immediate

Family Member” (as defined in Item 22 of Schedule 14A under the Exchange Act (“Item 22”)) of any Participant, is a

record owner or direct or indirect beneficial owner of any securities of the Fund, any parent or subsidiary of the Fund, any

investment adviser, principal underwriter, or “Sponsoring Insurance Company” (as defined in Item 22) of the Fund, or in

any registered investment companies overseen or to be overseen by the Participant within the same “Family of Investment

Companies” (as defined in Item 22) that directly or indirectly controls, is controlled by or is under common control with an

investment adviser, principal underwriter, or Sponsoring Insurance Company, or affiliated person of the Fund; (iii) no Participant in this

solicitation directly or indirectly beneficially owns any securities of the Fund which are owned of record but not beneficially;

(iv) no Participant in this solicitation has purchased or sold any securities of the Fund or the Fund’s investment adviser

during the past two years, nor from either entity’s “Parents” or “Subsidiaries” (as defined in Item

22); (v) no Participant has any “family relationship” for the purposes of Item 22 whereby a family member is an

“Officer” (as defined in Item 22), director (or person nominated to become an Officer or director), employee, partner,

or copartner of the Fund, the Fund’s investment adviser and/or a principal underwriter of any of the foregoing, or any

Subsidiary or other potential affiliate of any of the foregoing; (vi) no part of the purchase price or market value of the

securities of the Fund owned by any Participant in this solicitation is represented by funds borrowed or otherwise obtained for the

purpose of acquiring or holding such securities; (vii) no Participant in this solicitation is, or within the past year was, a party

to any contract, arrangements or understandings with any person with respect to any securities of the Fund, including, but not

limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of

losses or profits, or the giving or withholding of proxies; (viii) no associate of any Participant in this solicitation owns

beneficially, directly or indirectly, any securities of the Fund; (ix) no Participant in this solicitation owns beneficially,

directly or indirectly, any securities of any parent or subsidiary of the Fund; (x) no Participant and no Immediate Family Member of

any Participant in this solicitation or any of his or its associates was a party to, or had a direct or indirect material

relationship in, any transaction or series of similar transactions since the beginning of the Fund’s last fiscal year, or is a

party to any currently proposed transaction, or series of similar transactions in which the amount involved exceeds $120,000 and for

which any of the following was or is a party: (a) the Fund or any of its subsidiaries; (b) an Officer of the Fund; (c) an investment

company, or a person that would be an investment company but for the exclusions provided by sections 3(c)(1) and 3(c)(7) of the 40

Act, having the same investment adviser, principal underwriter, or Sponsoring Insurance Company as the Fund or having an investment

adviser, principal underwriter, or Sponsoring Insurance Company that directly or indirectly controls, is controlled by or is under

common control with the investment adviser, principal underwriter, or Sponsoring Insurance Company of the Fund; (d) an investment

adviser, principal underwriter, Sponsoring Insurance Company, or affiliated person of the Fund; (e) any Officer or any person

directly or indirectly controlling, controlled by, or under common control with any investment adviser, principal underwriter,

Sponsoring Insurance Company, or affiliated person of the Fund; (f) an Officer of an investment adviser, principal underwriter, or

Sponsoring Insurance Company of the Fund; or (g) an Officer of a person directly or indirectly controlling, controlled by, or under

common control with an investment adviser, principal underwriter, or Sponsoring Insurance Company of the Fund; (xi) during the last

five years, no Participant and no Immediate Family Member of any Participant has had a position or office with: (a) the Fund; (b) an

investment company, or a person that would be an investment company but for the exclusions provided by Sections 3(c)(1) and 3(c)(7)

of the 40 Act, having the same investment adviser, principal underwriter, or Sponsoring Insurance Company as the Fund or having an

investment adviser, principal underwriter, or Sponsoring Insurance Company that directly or indirectly controls, is controlled by,

or is under common control with an investment adviser, principal underwriter, or Sponsoring Insurance Company of the Fund; or (c) an

investment adviser, principal underwriter, Sponsoring Insurance Company, or affiliated person (xii) no Participant in this

solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future

employment by the Fund or its affiliates, or with respect to any future transactions to which the Fund or any of its affiliates will

or may be a party; (xiii) no Participant in this solicitation has a substantial interest, direct or indirect, by securities holdings

or otherwise, in any matter to be acted on at the Special Meeting; (xiv) since the beginning of the last two completed fiscal years,

no Participant (and no Immediate Family Member of a Participant) has served on the board of directors or trustees of a company or

trust where an Officer of an investment adviser, principal underwriter, or Sponsoring Insurance Company of the Fund, or any person

directly or indirectly controlling, controlled by, or under common control with any of those, serves on the board of directors or

trustees; and (xv) no Participant has withheld information that is required to be disclosed under the following Items under

Regulation S-K under the Exchange Act: Item 401(f) with respect to involvement in certain legal proceedings, Item 401(g) with

respect to promoters and control persons and Item 405 with respect to beneficial ownership and required filings.

Transactions by the Participants with respect

to the Fund’s securities

The following tables set forth all transactions effected

during the past two years by Saba, by virtue of Saba Capital’s direct and indirect control of the Saba Entities, with respect to

securities of the Fund. The Common Shares reported herein are held in either cash accounts or margin accounts in the ordinary course of

business. Unless otherwise indicated, all transactions were effected on the open market.

Common Shares:

Saba Capital, in its capacity as investment manager of the Saba Entities

| Date |

Side |

Common Shares |

| 2/8/2022 |

Buy |

2,197* |

| 2/9/2022 |

Buy |

15,979* |

| 3/11/2022 |

Buy |

5,662* |

| 3/15/2022 |

Buy |

14,864* |

| 5/3/2022 |

Buy |

10,200* |

| 12/28/2022 |

Buy |

27,602* |

| 12/29/2022 |

Buy |

12,699* |

| 12/30/2022 |

Buy |

2,438* |

| 1/4/2023 |

Buy |

7,921* |

| 1/5/2023 |

Buy |

14,418* |

| 6/6/2023 |

Buy |

13,042 |

*

Represents a purchase to cover a short position entered into by Saba in 2020, with the counterparty being an unaffiliated third party

financial institution.

**

Saba does not currently have any short position in the Fund.

IMPORTANT

Tell your Board what you think! YOUR VOTE IS VERY IMPORTANT,

no matter how many or how few Shares you own. Please give us your vote “AGAINST” the Proposals by taking three steps:

| | ● | SIGNING the enclosed GOLD

proxy card, |

| | | |

| | ● | DATING the enclosed GOLD

proxy card, and |

| | | |

| ● | MAILING the enclosed GOLD proxy card TODAY in the envelope provided (no postage is required

if mailed in the United States). |

If any of your Shares are held in the name of a

broker, bank, bank nominee or other institution, only it can vote your Shares and only upon receipt of your specific instructions.

Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. You may also vote by

signing, dating and returning the enclosed GOLD voting instruction form in the postage-paid envelope provided, and to ensure

that your Shares are voted, you should also contact the person responsible for your account and give instructions for a GOLD

voting instruction form to be issued representing your shares.

By returning the GOLD proxy card, you

are authorizing Saba to vote on your behalf, and if you do not indicate how you would like to vote, your vote will be counted “AGAINST”

the Proposals.

After signing the enclosed GOLD proxy

card, DO NOT SIGN OR RETURN THE FUND’S [●] PROXY CARD UNLESS YOU INTEND TO CHANGE YOUR VOTE, because only your latest

dated proxy card will be counted.

If you have previously signed, dated and returned a

[●] proxy card to the Fund, you have every right to change your vote. Only your latest dated proxy card will count. You may revoke

any proxy card already sent to the Fund by signing, dating and mailing the enclosed GOLD proxy card in the postage-paid

envelope provided or by voting by telephone or Internet. Any proxy may be revoked at any time prior to the Special Meeting by delivering

a written notice of revocation or a later dated proxy for the Special Meeting to the secretary of the Fund or by voting in person at the

Special Meeting. Attendance at the Special Meeting will not in and of itself constitute a revocation.

If you have any questions concerning this Proxy Statement,

would like to request additional copies of this Proxy Statement, or need help voting your shares, please contact our proxy solicitor:

19 Old Kings Highway S., Suite 130

Darien, CT 06820

Shareholders Call Toll-Free at: (877) 972-0090

E-mail: Saba@investor-com.com

PRELIMINARY COPY SUBJECT TO COMPLETION

Form of GOLD Proxy Card

Putnam Municipal Opportunities Trust

Proxy Card for the Special Meeting of Shareholders

(the “Special Meeting”)

THIS PROXY SOLICITATION IS BEING MADE BY SABA CAPITAL

MANAGEMENT, L.P. (“SABA CAPITAL”) AND Boaz R. Weinstein

THE BOARD OF TRUSTEES (THE “BOARD”) OF

PUTNAM MUNICIPAL OPPORTUNITIES TRUST IS NOT SOLICITING THIS PROXY

The undersigned appoints Michael D’Angelo,

Paul Kazarian, Eleazer Klein, Pierre Weinstein and John Grau and each of them, attorneys and agents with full power of substitution

to vote all common shares of Putnam Municipal Opportunities Trust, a Massachusetts business trust and a closed-end management

investment company registered under the Investment Company Act of 1940, as amended (the “Fund”), that the undersigned

would be entitled to vote at the Special Meeting, including at any adjournments or postponements thereof, with all powers that the

undersigned would possess if personally present, upon and in respect of the instructions indicated herein, with discretionary

authority, subject to applicable law, as to any and all other matters that may properly come before the meeting or any adjournment,

postponement or substitution thereof that are unknown to us a reasonable time before this solicitation.

The undersigned hereby revokes any other proxy or proxies

heretofore given to vote or act with respect to said shares, and hereby ratifies and confirms all action the herein named attorneys and

proxies, their substitutes or any of them may lawfully take by virtue hereof. This proxy will be valid until the sooner of one year from

the date indicated on the reverse side and the completion of the Special Meeting (including any adjournments or postponements thereof).

If this proxy is signed, dated and returned, it

will be voted in accordance with your instructions. If you do not specify how the proxy should be voted, this proxy will be voted

“AGAINST” each of the Proposals. None of the matters currently intended to be acted upon pursuant to this proxy are

conditioned on the approval of other matters.

INSTRUCTIONS:

FILL IN VOTING BOXES “n” IN BLACK OR BLUE INK

We recommend that you vote

“AGAINST” Proposal 1 and Proposal 2:

Proposal 1 – To approve a new

management contract with Putnam Investment Management, LLC.

| FOR |

ABSTAIN |

AGAINST |

| q |

q |

q |

Proposal 2 – To approve a new sub-advisory

contract between Putnam Management, LLC and Putnam Investments Limited.

| FOR |

ABSTAIN |

AGAINST |

| q |

q |

q |

| |

|

|

| Signature (Capacity) |

|

Date |

| |

|

|

| Signature (Joint Owner) (Capacity/Title) |

|

Date |

| |

|

|

| NOTE: Please sign exactly as your name(s) appear(s) on stock certificates or on the label affixed hereto. When signing as attorney, executor, administrator or other fiduciary, please give full title as such. Joint owners must each sign personally. ALL HOLDERS MUST SIGN. If a corporation or partnership, please sign in full corporate or partnership name by an authorized officer and give full title as such. |

PLEASE SIGN, DATE AND PROMPTLY RETURN THIS PROXY

IN THE ENCLOSED RETURN ENVELOPE THAT IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES.

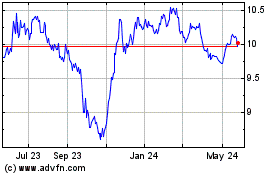

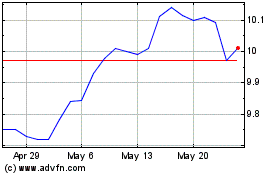

Putnam Muni Opportunity (NYSE:PMO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Putnam Muni Opportunity (NYSE:PMO)

Historical Stock Chart

From Nov 2023 to Nov 2024