2024 Revenue of $501 Million

2024 GAAP Earnings Per Share of $0.66,

Non-GAAP Earnings Per Share of $1.63

Proto Labs, Inc. ("Protolabs" or the "Company") (NYSE: PRLB),

the world’s leading provider of digital manufacturing services,

today announced financial results for the fourth quarter and full

year ended December 31, 2024.

Fourth Quarter 2024 Financial

Highlights:

- Revenue was $121.8 million, a 2.6% decrease compared to revenue

of $125.0 million in the fourth quarter of 2023.

- Revenue fulfilled through the Protolabs Network was $26.5

million, a 17.9% increase compared to the fourth quarter of

2023.

- Net loss was $(0.4) million, or $(0.02) per diluted share,

compared to $7.0 million, or $0.27 per diluted share, in the fourth

quarter of 2023.

- Non-GAAP net income was $9.4 million, or $0.38 per diluted

share, compared to $11.8 million, or $0.46 per diluted share, in

the fourth quarter of 2023. See “Non-GAAP Financial Measures”

below.

Full Year 2024 Financial

Highlights:

- Revenue was $500.9 million, a 0.6% decrease compared to revenue

of $503.9 million in 2023.

- Revenue fulfilled through the Protolabs Network was $100.4

million, a 21.6% increase compared to 2023.

- Net income was $16.6 million, or $0.66 per diluted share,

compared to $17.2 million, or $0.66 per diluted share, in

2023.

- Non-GAAP net income was $41.2 million, or $1.63 per diluted

share, compared to $41.6 million, or $1.59 per diluted share, in

2023. See “Non-GAAP Financial Measures” below.

- Gross margin was 44.6% of revenue, compared to 44.1% of revenue

in 2023.

- Non-GAAP gross margin was 45.2% of revenue, compared to 44.7%

of revenue in 2023. See "Non-GAAP Financial Measures" below.

- Cash flow from operations was $77.8 million in 2024, up from

$73.3 million in 2023.

“2024 was a transformational year for Protolabs, and we

delivered strong financial results, including expanded gross

margins, increased earnings per share, and grew our

industry-leading cash flow,” said Rob Bodor, President and Chief

Executive Officer. “During 2024, we continued the evolution of

Protolabs beyond prototyping into production, and we reorganized

our internal structure, creating regional go-to-market teams and a

new global operations organization. Go-to-market teams are

refocused to ensure the best possible customer experience from

prototype to production, while the operations organization

efficiently brings our global fulfillment capabilities to every

customer.”

“Our transformation is gaining traction. In 2024, the number of

customers using our combined Factory and Network offer grew by 50%

and revenue per customer increased over 2023,” continued Bodor. “In

2025, our objective is to deliver revenue growth. We are making

pointed investments to drive growth, including: additional

marketing to build our brand as a production manufacturer,

allocating resources to improve our sales enablement tools and

processes, and continuing to expand our production manufacturing

capabilities.”

Dan Schumacher, Chief Financial Officer, commented: “We

delivered solid fourth quarter and fiscal year 2024 cash flow and

returned capital to shareholders while transforming the Company for

future growth. The margin profile of Protolabs’ combined Factory

and Network model is unparalleled in the digital manufacturing

services space, and we will continue to invest across the business

which we believe will drive growth in 2025 and sustain our

industry-leading cash flow and profitability advantages.”

Additional Full Year 2024

Highlights:

- Customer contact information

- Protolabs served 51,552 customer contacts during the year.

- Revenue per customer contact increased 3.1% year-over-year to

$9,716.

- EBITDA was $55.7 million. See “Non-GAAP Financial Measures”

below.

- Adjusted EBITDA was $78.3 million, or 15.6% of revenue,

compared to $83.2 million, or 16.5% of revenue, in 2023. See

“Non-GAAP Financial Measures” below.

- Cash and investments balance was $120.9 million as of December

31, 2024.

First Quarter 2025

Outlook

In the first quarter of 2025, the Company expects to generate

revenue between $120 million and $128 million.

The Company expects first quarter 2025 diluted net income per

share between $0.08 and $0.16, and non-GAAP diluted net income per

share between $0.26 and $0.34. See "Non-GAAP Financial Measures"

below.

New Stock Repurchase

Program

On February 4, 2025, Protolabs' board of directors approved a

new $100 million stock repurchase program.

Under the stock repurchase program, shares of the Company’s

common stock may be repurchased periodically, including in the open

market or privately negotiated transactions. The actual timing,

manner, number, and value of shares repurchased under the program

will be determined by management at its discretion and will depend

on several factors, including the market price of Protolabs’ common

stock, general market and economic conditions, applicable

requirements, and other business considerations. The stock

repurchase program does not obligate the Company to acquire any

particular amount of shares of the Company’s common stock. The new

program is open-ended and remains in effect until the total

authorized amount is expended or until further action by the board

of directors.

Non-GAAP Financial Measures

The Company has included non-GAAP revenue growth by region and

by service line that excludes the impact of changes in foreign

currency exchange rates (collectively, “non-GAAP revenue growth”).

Management believes these metrics, when viewed in conjunction with

the comparable GAAP metrics, are useful in evaluating the

underlying business trends and ongoing operating performance of the

Company.

The Company has included earnings before interest, taxes,

depreciation and amortization (“EBITDA”) and EBITDA, adjusted for

stock-based compensation expense, unrealized (gain) loss on foreign

currency and costs related to exit and disposal activities

(collectively, “Adjusted EBITDA”), in this press release to provide

investors with additional information regarding the Company’s

financial results. The Company has also included earnings before

interest, taxes, depreciation and amortization margin (“EBITDA

margin”) and EBITDA margin, adjusted for stock-based compensation

expense, unrealized (gain) loss on foreign currency and costs

related to exit and disposal activities (collectively, “Adjusted

EBITDA margin”), in this press release to provide investors with

additional information regarding the Company’s financial

results.

The Company has included non-GAAP gross margin, adjusted for

stock-based compensation expense and amortization expense, in this

press release to provide investors with additional information

regarding the Company’s financial results.

The Company has included non-GAAP operating margin, adjusted for

stock-based compensation expense, amortization expense and costs

related to exit and disposal activities (collectively, “non-GAAP

operating margin”), in this press release to provide investors with

additional information regarding the Company’s financial

results.

The Company has included non-GAAP net income, adjusted for

stock-based compensation expense, amortization expense, unrealized

(gain) loss on foreign currency and costs related to exit and

disposal activities (collectively, “non-GAAP net income”), in this

press release to provide investors with additional information

regarding the Company’s financial results.

The Company has provided below reconciliations of GAAP to

non-GAAP net income, non-GAAP gross margin, non-GAAP operating

margin, non-GAAP revenue growth by region and by service, and

Adjusted EBITDA and Adjusted EBITDA margin, the most directly

comparable measures calculated and presented in accordance with

GAAP. These non-GAAP measures are used by the Company’s management

and board of directors to understand and evaluate operating

performance and trends, provide useful measures for

period-to-period comparisons of the Company’s business, and in

determining executive and senior management incentive compensation.

Accordingly, the Company believes that these non-GAAP measures

provide useful information to investors and others in understanding

and evaluating operating results in the same manner as our

management and board of directors. These non-GAAP financial

measures should not be considered a substitute for, or superior to,

financial measures calculated in accordance with GAAP. These

non-GAAP financial measures exclude significant expenses and income

that are required by GAAP to be recorded in our condensed

consolidated financial statements and are subject to inherent

limitations. Investors should review the reconciliations of

non-GAAP financial measures to the comparable GAAP financial

measures that are included in this press release.

Conference Call

The Company has scheduled a conference call to discuss its

fourth quarter and full year 2024 financial results and first

quarter 2025 outlook today, February 7, 2025 at 8:30 a.m. EST. To

access the call in the U.S. please dial 877-709-8150 or outside the

U.S. dial 201-689-8354 at least five minutes prior to the 8:30 a.m.

EST start time. No participant code is required. A simultaneous

webcast of the call and accompanying presentation will be available

via the investor relations section of the Protolabs website and the

following link: https://edge.media-server.com/mmc/p/b94yu8yp/. A

replay will be available for 14 days following the call on the

investor relations section of the Protolabs website.

About Protolabs

Protolabs is the fastest and most comprehensive manufacturing

service from prototyping to production. Our digital factories

produce low-volume parts in days while Protolabs Network unlocks

advanced capabilities and volume pricing through its highly vetted

manufacturing partners. The result? One digital manufacturing

source for product developers, engineers, and supply chain teams

across the globe. See what's next at protolabs.com.

Forward-Looking Statements

Statements contained in this press release regarding matters

that are not historical or current facts are “forward-looking

statements” within the meaning of The Private Securities Litigation

Reform Act of 1995. These statements involve known and unknown

risks, uncertainties and other factors which may cause the results

of Protolabs to be materially different than those expressed or

implied in such statements. Certain of these risk factors and

others are described in the “Risk Factors” section within reports

filed with the SEC. Other unknown or unpredictable factors also

could have material adverse effects on Protolabs’ future results.

The forward-looking statements included in this press release are

made only as of the date hereof. Protolabs cannot guarantee future

results, levels of activity, performance or achievements.

Accordingly, you should not place undue reliance on these

forward-looking statements. Finally, Protolabs expressly disclaims

any intent or obligation to update any forward-looking statements

to reflect subsequent events or circumstances.

Proto Labs, Inc.

Condensed Consolidated Balance

Sheets

(In thousands)

December 31,

2024

December 31,

2023

(Unaudited)

Assets

Current assets

Cash and cash equivalents

$

89,071

$

83,790

Short-term marketable securities

14,019

19,013

Accounts receivable, net

66,504

72,848

Inventory

12,305

13,657

Income taxes receivable

2,906

2,228

Prepaid expenses and other current

assets

10,049

9,124

Total current assets

194,854

200,660

Property and equipment, net

227,263

253,655

Goodwill

273,991

273,991

Other intangible assets, net

21,422

25,584

Long-term marketable securities

17,773

8,019

Operating lease assets

2,993

4,628

Finance lease assets

692

960

Other long-term assets

4,524

4,856

Total assets

$

743,512

$

772,353

Liabilities and shareholders'

equity

Current liabilities

Accounts payable

$

15,504

$

15,636

Accrued compensation

16,550

15,292

Accrued liabilities and other

19,621

16,872

Current operating lease liabilities

1,287

1,585

Current finance lease liabilities

309

296

Total current liabilities

53,271

49,681

Long-term operating lease liabilities

1,633

3,008

Long-term finance lease liabilities

287

595

Long-term deferred tax liabilities

13,565

18,742

Other long-term liabilities

4,605

5,032

Shareholders' equity

670,151

695,295

Total liabilities and shareholders'

equity

$

743,512

$

772,353

Proto Labs, Inc.

Condensed Consolidated

Statements of Operations

(In thousands, except share

and per share amounts)

(Unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Revenue

Injection Molding

$

45,641

$

51,486

$

194,215

$

203,941

CNC Machining

52,389

48,905

206,887

198,222

3D Printing

19,467

20,339

83,767

84,291

Sheet Metal

4,047

4,062

15,265

16,540

Other Revenue

206

256

756

883

Total Revenue

121,750

125,048

500,890

503,877

Cost of revenue

69,793

69,236

277,690

281,884

Gross profit

51,957

55,812

223,200

221,993

Operating expenses

Marketing and sales

23,003

21,825

92,073

87,688

Research and development

9,698

9,488

41,298

40,135

General and administrative

15,166

16,075

64,333

65,788

Costs related to exit and disposal

activities

5,585

29

5,585

215

Total operating expenses

53,452

47,417

203,289

193,826

(Loss) income from operations

(1,495

)

8,395

19,911

28,167

Other income (loss), net

1,213

1,543

4,761

(215

)

(Loss) income before income taxes

(282

)

9,938

24,672

27,952

Provision for income taxes

122

2,948

8,079

10,732

Net (loss) income

$

(404

)

$

6,990

$

16,593

$

17,220

Net (loss) income per share:

Basic

$

(0.02

)

$

0.27

$

0.66

$

0.66

Diluted

$

(0.02

)

$

0.27

$

0.66

$

0.66

Shares used to compute net income per

share:

Basic

24,474,051

25,820,802

25,096,117

26,186,533

Diluted

24,474,051

25,889,004

25,212,178

26,223,498

Proto Labs, Inc.

Condensed Consolidated

Statements of Cash Flows

(In thousands)

(Unaudited)

Twelve Months Ended

December 31,

2024

2023

Operating activities

Net income

$

16,593

$

17,220

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

35,808

37,528

Stock-based compensation expense

16,999

15,989

Deferred taxes

(5,153

)

(7,656

)

Interest on finance lease obligations

33

1,055

Loss on impairment of equipment

256

—

Loss on foreign currency translation

—

3,906

Impairments related to exit and closure of

Germany and Japan businesses

2,333

—

Gain on disposal of property and

equipment

(13

)

(498

)

Other

1

154

Changes in operating assets and

liabilities

10,972

5,576

Net cash provided by operating

activities

77,829

73,274

Investing activities

Purchases of property, equipment and other

capital assets

(9,169

)

(28,116

)

Proceeds from sales of property, equipment

and other capital assets

34

699

Purchases of marketable securities

(25,070

)

—

Purchases of other assets and

investments

—

(1,000

)

Proceeds from sales of marketable

securities

1,416

—

Proceeds from call redemptions and

maturities of marketable securities

19,209

23,865

Net cash used in investing activities

(13,580

)

(4,552

)

Financing activities

Proceeds from exercises of stock options

and employee stock purchases

4,019

3,835

Purchases of shares withheld for tax

obligations

(1,995

)

(1,436

)

Repurchases of common stock

(60,278

)

(43,951

)

Principal repayments of finance lease

obligations

(296

)

(306

)

Net cash used in financing activities

(58,550

)

(41,858

)

Effect of exchange rate changes on cash

and cash equivalents

(418

)

368

Net increase in cash and cash

equivalents

5,281

27,232

Cash and cash equivalents, beginning of

period

83,790

56,558

Cash and cash equivalents, end of

period

$

89,071

$

83,790

Proto Labs, Inc.

Reconciliation of GAAP to

Non-GAAP Net Income per Share

(In thousands, except share

and per share amounts)

(Unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Non-GAAP net income, adjusted for

stock-based compensation expense, amortization expense, unrealized

(gain) loss on foreign currency and costs related to exit and

disposal activities

GAAP net (loss) income

$

(404

)

$

6,990

$

16,593

$

17,220

Add back:

Stock-based compensation expense

4,283

4,178

16,999

15,989

Amortization expense

911

1,457

3,707

5,928

Unrealized (gain) loss on foreign

currency

(324

)

(211

)

(1

)

(125

)

Costs related to exit and disposal

activities

5,585

29

5,585

4,122

Total adjustments 1

10,455

5,453

26,290

25,914

Income tax benefits on adjustments 2

(649

)

(609

)

(1,715

)

(1,540

)

Non-GAAP net income

$

9,402

$

11,834

$

41,168

$

41,594

Non-GAAP net income per share:

Basic

$

0.38

$

0.46

$

1.64

$

1.59

Diluted

$

0.38

$

0.46

$

1.63

$

1.59

Shares used to compute non-GAAP net income

per share:

Basic

24,474,051

25,820,802

25,096,117

26,186,533

Diluted

24,689,181

25,889,004

25,212,178

26,223,498

1

Stock-based compensation expense,

amortization expense, unrealized (gain) loss on foreign currency

and costs related to exit and disposal activities were included in

the following GAAP consolidated statement of operations

categories:

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Cost of revenue

$

876

$

794

$

3,304

$

3,210

Marketing and sales

734

916

3,112

3,424

Research and development

690

669

2,721

2,557

General and administrative

2,894

3,256

11,569

12,727

Costs related to exit and disposal

activities

5,585

29

5,585

215

Total operating expenses

9,903

4,870

22,987

18,923

Other income (loss), net

(324

)

(211

)

(1

)

3,781

Total adjustments

$

10,455

$

5,453

$

26,290

$

25,914

2

For the three and twelve months ended

December 31, 2024 and 2023, income tax effects were calculated

using the effective tax rate for the relevant jurisdictions. The

Company's non-GAAP tax rates differ from its GAAP tax rates due

primarily to the mix of activity incurred in domestic and foreign

tax jurisdictions and removing effective tax rate benefits from

stock-based compensation activity in the quarter.

Proto Labs, Inc.

Reconciliation of GAAP to

Non-GAAP Gross Margin

(In thousands)

(Unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Revenue

$

121,750

$

125,048

$

500,890

$

503,877

Gross profit

51,957

55,812

223,200

221,993

GAAP gross margin

42.7

%

44.6

%

44.6

%

44.1

%

Add back:

Stock-based compensation expense

534

452

1,935

1,840

Amortization expense

342

342

1,369

1,370

Total adjustments

876

794

3,304

3,210

Non-GAAP gross profit

$

52,833

$

56,606

$

226,504

$

225,203

Non-GAAP gross margin

43.4

%

45.3

%

45.2

%

44.7

%

Proto Labs, Inc.

Reconciliation of GAAP to

Non-GAAP Operating Margin

(In thousands)

(Unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Revenue

$

121,750

$

125,048

$

500,890

$

503,877

(Loss) income from operations

(1,495

)

8,395

19,911

28,167

GAAP operating margin

(1.2

%)

6.7

%

4.0

%

5.6

%

Add back:

Stock-based compensation expense

4,283

4,178

16,999

15,989

Amortization expense

911

1,457

3,707

5,928

Costs related to exit and disposal

activities

5,585

29

5,585

215

Total adjustments

10,779

5,664

26,291

22,132

Non-GAAP income from operations

$

9,284

$

14,059

$

46,202

$

50,299

Non-GAAP operating margin

7.6

%

11.2

%

9.2

%

10.0

%

Proto Labs, Inc.

Reconciliation of GAAP Net

(Loss) Income to EBITDA and Adjusted EBITDA

(In thousands)

(Unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Revenue

$

121,750

$

125,048

$

500,890

$

503,877

GAAP net (loss) income

(404

)

6,990

16,593

17,220

GAAP net (loss) income margin

(0.3

%)

5.6

%

3.3

%

3.4

%

Add back:

Amortization expense

$

911

$

1,457

$

3,707

$

5,928

Depreciation expense

7,913

7,858

32,101

31,600

Interest income, net

(1,225

)

(951

)

(4,749

)

(2,234

)

Provision for income taxes

122

2,948

8,079

10,732

EBITDA

7,317

18,302

55,731

63,246

EBITDA Margin

6.0

%

14.6

%

11.1

%

12.6

%

Add back:

Stock-based compensation expense

4,283

4,178

16,999

15,989

Unrealized (gain) loss on foreign

currency

(324

)

(211

)

(1

)

(125

)

Costs related to exit and disposal

activities

5,585

29

5,585

4,122

Total adjustments

9,544

3,996

22,583

19,986

Adjusted EBITDA

$

16,861

$

22,298

$

78,314

$

83,232

Adjusted EBITDA Margin

13.8

%

17.8

%

15.6

%

16.5

%

Proto Labs, Inc.

Comparison of GAAP to Non-GAAP

Revenue Growth by Region

(In thousands)

(Unaudited)

Three Months Ended

December 31, 2024

Three Months Ended

December 31, 2023

%

Change2

% Change

Organic3

GAAP

Foreign

Currency1

Non-GAAP

GAAP

Revenues

United States

$

96,599

$

—

$

96,599

$

98,814

(2.2

%)

(2.2

%)

Europe

25,151

(519

)

24,632

26,234

(4.1

%)

(6.1

%)

Total revenue

$

121,750

$

(519

)

$

121,231

$

125,048

(2.6

%)

(3.1

%)

Twelve Months Ended

December 31, 2024

Twelve Months Ended

December 31, 2023

%

Change2

% Change

Organic3

GAAP

Foreign

Currency1

Non-GAAP

GAAP

Revenues

United States

$

396,192

$

—

$

396,192

$

396,821

(0.2

%)

(0.2

%)

Europe

104,698

(1,876

)

102,822

107,056

(2.2

%)

(4.0

%)

Total revenue

$

500,890

$

(1,876

)

$

499,014

$

503,877

(0.6

%)

(1.0

%)

1

Revenue for the three and twelve months

ended December 31, 2024 has been recalculated using 2023 foreign

currency exchange rates in effect during comparable periods to

provide information useful in evaluating the underlying business

trends excluding the impact of changes in foreign currency exchange

rates.

2

This column presents the percentage change

from GAAP revenue for the three and twelve months ended December

31, 2023 to GAAP revenue for the three and twelve months ended

December 31, 2024.

3

This column presents the percentage change

from GAAP revenue for the three and twelve months ended December

31, 2023 to non-GAAP revenue for the three and twelve months ended

December 31, 2024 (as recalculated using the foreign currency

exchange rates in effect during the three and twelve months ended

December 31, 2023) in order to provide a constant-currency

comparison.

Proto Labs, Inc.

Comparison of GAAP to Non-GAAP

Revenue Growth by Service Line

(In thousands)

(Unaudited)

Three Months Ended

December 31, 2024

Three Months Ended

December 31, 2023

%

Change2

% Change

Organic3

GAAP

Foreign

Currency1

Non-GAAP

GAAP

Revenues

Injection Molding

$

45,641

$

(265

)

$

45,376

$

51,486

(11.4

)%

(11.9

)%

CNC Machining

52,389

(140

)

52,249

48,905

7.1

6.8

3D Printing

19,467

(112

)

19,355

20,339

(4.3

)

(4.8

)

Sheet Metal

4,047

(1

)

4,046

4,062

(0.4

)

(0.4

)

Other Revenue

206

(1

)

205

256

(19.5

)

(19.9

)

Total Revenue

$

121,750

$

(519

)

$

121,231

$

125,048

(2.6

%)

(3.1

%)

Twelve Months Ended

December 31, 2024

Twelve Months Ended

December 31, 2023

%

Change2

% Change

Organic3

GAAP

Foreign

Currency1

Non-GAAP

GAAP

Revenues

Injection Molding

$

194,215

$

(931

)

$

193,284

$

203,941

(4.8

)%

(5.2

)%

CNC Machining

206,887

(518

)

206,369

198,222

4.4

4.1

3D Printing

83,767

(427

)

83,340

84,291

(0.6

)

(1.1

)

Sheet Metal

15,265

8

15,273

16,540

(7.7

)

(7.7

)

Other Revenue

756

(8

)

748

883

(14.4

)

(15.3

)

Total Revenue

$

500,890

$

(1,876

)

$

499,014

$

503,877

(0.6

%)

(1.0

%)

1

Revenue for the three and twelve months

ended December 31, 2024 has been recalculated using 2023 foreign

currency exchange rates in effect during comparable periods to

provide information useful in evaluating the underlying business

trends excluding the impact of changes in foreign currency exchange

rates.

2

This column presents the percentage change

from GAAP revenue for the three and twelve months ended December

31, 2023 to GAAP revenue for the three and twelve months ended

December 31, 2024.

3

This column presents the percentage change

from GAAP revenue for the three and twelve months ended December

31, 2023 to non-GAAP revenue for the three and twelve months ended

December 31, 2024 (as recalculated using the foreign currency

exchange rates in effect during the three and twelve months ended

December 31, 2023) in order to provide a constant-currency

comparison.

Proto Labs, Inc.

Customer Contact

Information

(In thousands, except customer

contacts and per customer contact amounts)

(Unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Revenue

$

121,750

$

125,048

$

500,890

$

503,877

Customer contacts

21,558

21,879

51,552

53,464

Revenue per customer contact1

$

5,648

$

5,715

$

9,716

$

9,425

1

Revenue per customer contact is calculated

using the revenue recognized during the respective period divided

by the actual number of customer contacts served during the same

period. Customer contacts are product developers, engineers,

procurement and supply chain professionals and other individuals

who place an order, and that order is shipped and invoiced during

the period. The Company believes revenue per customer contact is

useful to investors in evaluating the underlying business trends

and ongoing operating performance of the Company.

Proto Labs, Inc.

Reconciliation of GAAP to

Non-GAAP Guidance

(In thousands, except per

share and per share amounts)

(Unaudited)

Q1 2025 Outlook

Low

High

GAAP diluted net income per share

$

0.08

$

0.16

Add back:

Stock-based compensation expense

0.15

0.15

Amortization expense

0.03

0.03

Unrealized (gain) loss on foreign

currency

0.00

0.00

Total adjustments

0.18

0.18

Non-GAAP diluted net income per share

$

0.26

$

0.34

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250207157663/en/

Investor Relations Contacts: Protolabs Ryan Johnsrud,

612-225-4873 Manager – Investor Relations and FP&A

ryan.johnsrud@protolabs.com

Gateway Group, Inc. 949-574-3860 PRLB@gateway-grp.com

Media Contact: Protolabs Brent Renneke, 763-479-7704

Marketing Communications Manager brent.renneke@protolabs.com

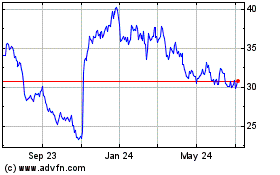

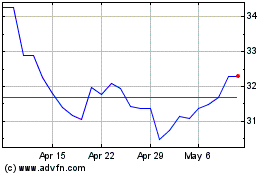

Proto Labs (NYSE:PRLB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Proto Labs (NYSE:PRLB)

Historical Stock Chart

From Feb 2024 to Feb 2025