Delivers S$100.7 Million in Full Year

Revenue, Growing 22.7% Over Previous Year

- Singapore marketplace revenue increased 19.9% to S$56.0

million

- Malaysia marketplace revenue increased 86.0% to

S$14.7million1

- On track to achieve 2022 guidance of 44.0% year-on-year revenue

growth and return to full year positive Adjusted EBITDA

PropertyGuru Group Limited (NYSE: PGRU) (“PropertyGuru” or “the

Company”), Southeast Asia’s leading2, property technology

(“PropTech”) company, today announced the Company’s financial

results for the full year ended December 31, 2021. The Company

ended 2021 with solid momentum, delivering strong operational and

financial performance as multiple key markets emerged from COVID-19

restrictions.

Management Commentary

Hari V. Krishnan, Chief Executive Officer and Managing

Director, PropertyGuru, said “2021 was a transformational year

for us as we took definitive steps to position PropertyGuru for its

next chapter of growth. In 2021, we completed our acquisition of

iProperty Malaysia and thinkofliving to strengthen our positions in

Malaysia and Thailand, welcomed REA Group as a strategic

shareholder, and listed on the New York Stock Exchange via our

business combination with Bridgetown 2.

“2021 results demonstrate our execution capability and the

strong growth our investments in technology and talent can deliver,

despite the uneven market recovery from pandemic-related lockdowns

in our region. We are only beginning to scratch the surface of our

US$8.1 billion3 addressable market in the region, as Southeast

Asia’s property market continues to expand driven by long-term

fundamentals of urbanization, digitalization and a rising middle

class. We are excited about the momentum we bring into 2022, and

the prospects for the years ahead.”

Joe Dische, Chief Financial Officer, PropertyGuru, said

“We are extremely pleased with our 2021 performance. Despite

challenging property market conditions, we delivered over S$100

million in revenue and a better than forecast Adjusted EBITDA

result. We are pleased to confirm that we are on track to achieve

our full year guidance for 2022, with expected year-on-year revenue

growth of 44.0% and a return to full year positive Adjusted EBITDA.

This outlook supports the confidence investors have placed in us

through the last few years and during our recent public

listing.”

Financial and Operational Overview for the Full Year Ended

December 31, 2021

Strong performance reflects the Company’s ability to navigate

pandemic challenges

- Total revenue increased by 22.7% to S$100.7 million, reflecting

the rising confidence in Southeast Asia’s property market.

PropertyGuru’s 2021 revenue exceeded its 2021 forecast of S$97.5

million.

- Overall marketplace revenues increased by 20.7% year-on-year,

primarily due to increased real estate market activity as movement

restrictions ease and Southeast Asia recovers from the pandemic:

- Singapore marketplace revenue increased 19.9% to S$56.0

million, with an Average Revenue Per Agent (“ARPA”) of S$3,279, a

total of 14,080 Agents and a renewal rate of 82%.

- Malaysia marketplace revenue increased 86.0% to S$14.7 million

primarily due to the inclusion of the results of the iProperty

business from August 3, 2021.

- Average revenue per listing in Vietnam increased 17% to

S$2.74.

- Adjusted EBITDA was a loss of S$10.9 million with increased

investments in hiring and marketing activities to position the

business to emerge strongly from the pandemic. This was

substantially better than the forecast of a loss of S$16.4 million

as revenue upsides flowed through to Adjusted EBITDA and costs were

tightly managed.

- Net loss increased to S$187.4 million, primarily due to an

accounting charge of S$124.1 million on preference share conversion

options, with the rise in valuation of the Company and other

non-cash items. As previously disclosed, the Company’s preference

shares have since been converted to ordinary shares, and such fair

value losses are not expected in future periods.

Information regarding our operating segments is presented

below.

Full year ended December 31,

2021

Marketplaces

Fintech and data

services

Corporate*

Total

Singapore

Vietnam

Malaysia

Other Asia

(S$ in thousands except

percentages)

Revenue

55,953

18,769

14,670

8,467

2,852

100,711

Adjusted EBITDA

32,871

2,006

(10,388)

(1,283)

(3,891)

(30,184)

(10,869)

Adjusted EBITDA Margin (%)

58.7%

10.7%

(70.8%)

(15.2%)

(136.4%)

(10.8)%

Full year ended December 31,

2020

Marketplaces

Fintech and data

services

Corporate*

Total

Singapore

Vietnam

Malaysia

Other Asia

(S$ in thousands except

percentages)

Revenue

46,654

18,269

7,888

8,261

1,023

82,095

Adjusted EBITDA

32,541

4,198

(4,459)

(2,969)

(1,720)

(23,136)

4,455

Adjusted EBITDA Margin (%)

69.7%

23%

(56.5%)

(35.9%)

(168.1%)

5.4%

* Corporate consists of headquarters costs, which are not

allocated to the segments. Headquarters costs are costs of

PropertyGuru’s personnel that are based predominantly in its

Singapore headquarters and certain key personnel in Malaysia and

Thailand, and that service PropertyGuru’s group as a whole,

consisting of its executive officers and its group marketing,

technology, product, human resources, finance and operations teams,

as well as platform IT costs (hosting, licensing, domain fees),

workplace facilities costs, corporate public relations retainer

costs and professional fees such as audit, legal and consultant

fees.

Full Year 2022 Outlook

As previously announced, the Company confirmed that it is on

track to achieve its full year guidance for 2022. It expects to

deliver year-on-year revenue growth of 44.0%, reaffirmed by a

strong start to 2022 and driven by continued growth across all core

markets as the region emerges from the impact of COVID. The Company

also confirmed that it expects to return to full year positive

Adjusted EBITDA, as it realizes the full benefits of its increased

investments in people and marketing through the pandemic.

Strengthened Category Leadership Drives Long-Term Growth

Opportunities

As of December 31, 2021, PropertyGuru continued its Engagement

Market Share4 leadership in Singapore, Vietnam, Malaysia and

Thailand, while maintaining its position in Indonesia.

- Singapore: 79% – 4.6x the closest peer

- Vietnam: 71% – 2.5x the closest peer

- Malaysia: 95% – 19.8x the closest peer

- Thailand: 62% – 3.1x the closest peer

- Indonesia: 32% – 0.5x the closest peer

As of December 31, 2021, PropertyGuru’s platform connected more

than 38 million property seekers monthly5 to more than 57,000

agents in its digital marketplaces of more than 3.3 million

listings with organic traffic representing 82% of the traffic5.

About PropertyGuru Group

PropertyGuru Group is Southeast Asia’s leading2 property

technology company, and the preferred destination for over 38

million property seekers5 to find their dream home, every month.

PropertyGuru and its group companies empower property seekers with

more than 3.3 million real estate listings, in-depth insights, and

solutions that enable them to make confident property decisions

across Singapore, Malaysia, Thailand, Indonesia, and Vietnam.

PropertyGuru.com.sg was launched in 2007 and has helped to drive

the Singapore property market online and has made property search

transparent for the property seeker. Over the decade, the Group has

grown into a high-growth technology company with a robust portfolio

of leading property portals across its core markets company;

award-winning mobile apps; a high quality developer sales

enablement platform, FastKey; mortgage marketplace PropertyGuru

Finance; and a host of other property offerings including Awards,

events and publications across Asia.

For more information, please visit: PropertyGuruGroup.com;

PropertyGuru Group on LinkedIn.

Key Performance Metrics and Non-IFRS Financial

Measures

Engagement Market Share is the average monthly engagement for

websites owned by PropertyGuru as compared to average monthly

engagement for a basket of peers calculated over the relevant

period. Engagement is calculated as the number of visits to a

website during a period multiplied by the total amount of time

spent on that website for the same period, in each case based on

data from SimilarWeb. Engagement Market Share is based on the

prevailing SimilarWeb algorithm on the date the Company first filed

or furnished such information to the U.S. Securities and Exchange

Commission (“SEC”).

Number of agents in all Priority Markets except Vietnam is

calculated for a period as the sum of the number of agents with a

valid 12-month subscription package at the end of each month in a

period divided by the number of months in such period. In Vietnam,

number of agents is calculated as the number of agents who credit

money into their account within the relevant period. When counting

in aggregate across the PropertyGuru group, in markets where

PropertyGuru operates more than one property portal, an agent with

subscriptions to more than one portal is only counted once.

Number of real estate listings is calculated as the number of

listings created during the month for Vietnam and the average

number of monthly listings available in the period for other

markets.

This document also includes references to non-IFRS financial

measures, namely Adjusted EBITDA and Adjusted EBITDA Margin.

PropertyGuru uses these measures, collectively, to evaluate ongoing

operations and for internal planning and forecasting purposes.

PropertyGuru believes that non-IFRS information, when taken

collectively, may be helpful to investors because it provides

consistency and comparability with past financial performance and

may assist in comparisons with other companies to the extent that

such other companies use similar non-IFRS measures to supplement

their IFRS or GAAP results. These non-IFRS measures are presented

for supplemental informational purposes only and should not be

considered a substitute for financial information presented in

accordance with IFRS, and may be different from similarly titled

non-IFRS measures used by other companies. Accordingly, non-IFRS

measures have limitations as analytical tools, and should not be

considered in isolation or as substitutes for analysis of other

IFRS financial measures, such as net loss and loss before income

tax.

Adjusted EBITDA is a non-IFRS financial measure defined as net

loss for year/period plus changes in fair value of preferred shares

and embedded derivatives, finance cost, depreciation and

amortization, income tax expense, impairments when the impairment

is the result of an isolated, non-recurring event, share grant and

option expenses, loss on disposal of plant and equipment and

intangible assets, currency translation loss, fair value loss on

contingent consideration, business acquisition transaction and

integration cost and cost of proposed listing. Adjusted EBITDA

Margin is defined as Adjusted EBITDA as a percentage of revenue.

The table below reconciles Adjusted EBITDA and Adjusted EBITDA.

A reconciliation of Adjusted EBITDA to Net loss is provided as

follows:

2021

2020

2019

$’000

$’000

$’000

Adjusted EBITDA as above

19,315

27,591

35,663

Headquarters cost

(30,184)

(23,136)

(23,150)

Changes in fair value of preferred shares

and embedded derivatives

(124,146)

16,364

(16,516)

Finance costs – net

(13,453)

(15,964)

(11,707)

Depreciation and mortization expense

(14,032)

(9,554)

(7,720)

Impairment

(8)

(806)

-

Share grant and option expenses

(10,470)

(6,660)

(3,204)

Others gains/(losses) – net

(815)

(1,684)

(1,875)

Business acquisition transaction and

integration cost

(7,883)

-

-

Legal and professional expenses incurred

for IPO

(6,070)

-

-

Cost of proposed listing

-

-

(6,227)

Tax credit / (expense)

333

(559)

(3,779)

Net loss

(187,413)

(14,408)

(38,515)

Headquarters costs are costs of personnel that are based

predominantly in its Singapore headquarters and certain key

personnel in Malaysia and Thailand, and that service the group as a

whole, consisting of its executive officers and its group

marketing, technology, product, human resources, finance and

operations teams, as well as platform IT costs (hosting, licensing,

domain fees), workplace facilities costs, corporate public

relations retainer costs and professional fees such as audit, legal

and consultant fees.

Management uses Adjusted EBITDA as a measure to assess the

performance of the segments. This excludes the effects of

significant items of income and expenditure which may have an

impact on the quality of earnings such as changes in fair value of

preferred shares and embedded derivatives, finance cost,

depreciation and amortization, income tax expense, impairments when

the impairment is the result of an isolated, non–recurring event,

share grant and option expenses, loss on disposal of plant and

equipment and intangible assets, currency translation loss,

business acquisition transaction and integration cost and legal and

professional expenses incurred for IPO.

Forward-Looking Statements

Forward-looking statements in this press release, which are not

historical facts, are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1955. These

statements include statements regarding our future results of

operations and financial position, planned products and services,

business strategy and plans, objectives of management for future

operations of PropertyGuru, market size and growth opportunities,

competitive position and technological and market trends and

involve known and unknown risks that are difficult to predict. As a

result, our actual results, performance or achievements may differ

materially from those expressed or implied by these forward-looking

statements. In some cases, you can identify forward-looking

statements because they contain words such as “may,” “will,”

“shall,” “should,” “expects,” “plans,” “anticipates,” “could,”

“intends,” “target,” “projects,” “contemplates,” “believes,”

“estimates,” “predicts,” “potential,” “goal,” “objective,” “seeks,”

or “continue” or the negative of these words or other similar terms

or expressions that concern our expectations, strategy, plans, or

intentions. Such forward-looking statements are necessarily based

upon estimates and assumptions that, while considered reasonable by

us and our management, are inherently uncertain. Factors that may

cause actual results to differ materially from current expectations

include, but are not limited to: changes in domestic and foreign

business, market, financial, political and legal conditions;

competitive pressures in and any disruption to the industry in

which PropertyGuru and its subsidiaries (the “Group”) operates; the

Group’s ability to achieve profitability despite a history of

losses; the Group’s ability to implement its growth strategies and

manage its growth; customers of the Group continuing to make

valuable contributions to its platform, the Group’s ability to meet

consumer expectations; the success of the Group’s new product or

service offerings; the Group’s ability to produce accurate

forecasts of its operating and financial results; the Group’s

ability to attract traffic to its websites; the Group’s ability to

assess property values accurately; the Group’s internal controls;

the war in Ukraine and escalating geopolitical tensions as a result

of Russia's invasion of Ukraine; fluctuations in foreign currency

exchange rates; the Group’s ability to raise capital; media

coverage of the Group; the Group’s ability to obtain insurance

coverage; changes in the regulatory environments (such as

anti-trust laws, foreign ownership restrictions and tax regimes) of

the countries in which the Group operates, general economic

conditions in the countries in which the Group operates, the

Group’s ability to attract and retain management and skilled

employees, the impact of the COVID-19 pandemic on the business of

the Group, the success of the Group’s strategic investments and

acquisitions, changes in the Group’s relationship with its current

customers, suppliers and service providers, disruptions to

information technology systems and networks, the Group’s ability to

grow and protect its brand and the Group’s reputation, the Group’s

ability to protect its intellectual property; changes in regulation

and other contingencies; the Group’s ability to achieve tax

efficiencies of its corporate structure and intercompany

arrangements; potential and future litigation that the Group may be

involved in; unanticipated losses, write-downs or write-offs,

restructuring and impairment or other charges, taxes or other

liabilities that may be incurred or required subsequent to, or in

connection with, the consummation of the Group’s completed business

combination and technological advancements in the Group’s industry;

and other risks discussed in our filings with the SEC.

All forward-looking statements attributable to us or persons

acting on our behalf are expressly qualified in their entirety by

the cautionary statements set forth above. We caution you not to

place undue reliance on any forward-looking statements, which are

made only as of the date of this press release. We do not undertake

or assume any obligation to update publicly any of these

forward-looking statements to reflect actual results, new

information or future events, changes in assumptions or changes in

other factors affecting forward-looking statements, except to the

extent required by applicable law. If we update one or more

forward-looking statements, no inference should be drawn that we

will make additional updates with respect to those or other

forward-looking statements. The inclusion of any statement in this

document does not constitute an admission by PropertyGuru or any

other person that the events or circumstances described in such

statement are material. Undue reliance should not be placed upon

the forward-looking statements.

Industry and Market Data

This document contains information, estimates and other

statistical data derived from third party sources and/or industry

or general publications, including estimated insights from

SimilarWeb and Google Analytics. Such information involves a number

of assumptions and limitations, and you are cautioned not to place

undue weight on such estimates. PropertyGuru has not independently

verified such third-party information, and makes no representation

as to the accuracy of such third-party information.

1 Includes results of the iProperty business from August 3,

2021. 2 In terms of Engagement Market Share based on SimilarWeb

data. 3 According to Frost & Sullivan. 4 Based on SimilarWeb

data between July 2021 and December 2021. 5 Based on Google

Analytics data between July 2021 and December 2021.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220414005457/en/

For inquiries regarding PropertyGuru, please contact:

Media PropertyGuru

Group Sheena Chopra +65 9247 5651

sheena@propertyguru.com.sg

Sard Verbinnen & Co Ron Low and Jay Qin – Asia Liz

Zale and Chloe Clifford – U.S. PropertyGuru-SVC@sardverb.com

Investor PropertyGuru

Group Investor Relations investors@propertyguru.com

The Blueshirt Group Gary Dvorchak

propertyguru@blueshirtgroup.com

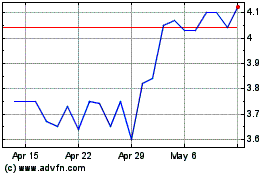

PropertyGuru (NYSE:PGRU)

Historical Stock Chart

From Oct 2024 to Nov 2024

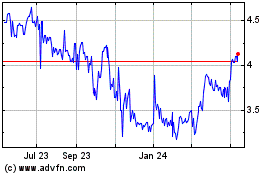

PropertyGuru (NYSE:PGRU)

Historical Stock Chart

From Nov 2023 to Nov 2024