Delivers Record Quarterly Revenue of $53.8

Million

Announced Completion of Acquisition of

Sinergise

Planet Labs PBC (NYSE: PL) (“Planet” or the “Company”), a

leading provider of daily data and insights about Earth, today

announced financial results for its fiscal second quarter for the

period ended July 31, 2023 that demonstrated continued growth and

momentum of its unique data subscription business.

“This quarter was one of increasing focus and operational

efficiency. Revenue for the second quarter of fiscal 2024 was in

line with our expectations, while gross margin and Adjusted EBITDA

outperformed for the quarter,” said Will Marshall, Planet’s

Co-Founder, Chief Executive Officer and Chairperson. “We completed

the acquisition of Sinergise, aligned our teams and resources

behind our top priorities, and made significant progress on the

development of our next generation satellite fleets. We continue to

feel the market tailwinds and the pull from customers for the

insights that our solutions enable.”

Ashley Johnson, Planet’s Chief Financial and Operating Officer,

added, “We recently announced a restructuring of our teams to align

resources behind our high priority growth opportunities and

reinforce our path to profitability. We are sharpening our focus

and getting more efficient as a Company, which we believe will

support growth in our core markets and healthy bottom line

performance going forward. Our balance sheet is strong with $367.8

million of cash, cash equivalents, and short-term investments as of

the end of the quarter and no debt.”

Fiscal Second Quarter 2024 Financial and Key Metric

Highlights:

- Second quarter revenue increased 11% year-over-year to $53.8

million.

- Percent of Recurring Annual Contract Value (ACV) for the second

quarter was 92%.

- End of Period (EoP) Customer Count increased 10% year-over-year

to 944 customers.

- Second quarter gross margin was 49%, compared to 48% in the

second quarter of fiscal year 2023. Second quarter Non-GAAP Gross

Margin(1) was 52%, compared to 52% in the second quarter of fiscal

year 2023.

- Ended the quarter with $367.8 million in cash, cash equivalents

and short-term investments.

(1) Please see “Planet’s Use of Non-GAAP Financial Measures”

below for a discussion on how Planet calculates the non-GAAP

financial measures presented herein. In addition, reconciliations

to the most directly comparable U.S. GAAP financial measures are

provided in the tables at the end of this release.

Recent Business Highlights:

Growing Customer and Partner

Relationships

- United States Space Force (USSF): Planet closed an

expansion opportunity with the United States Space Force's AFRL to

support their MicroSatellite Military Utility Program (MSMU). This

12-month extension will enable support of Coalition partner

military training exercises around the globe utilizing responsive

commercial space capabilities. AFRL has been leveraging SkySat,

SkySat Video, and AI-based Vessel Detection to supplement the U.S.

Department of Defense’s commercial satellite capabilities.

- US Government Agency: Planet recently received a new

seven-figure annual contract value (“ACV”) award from a US

Government agency for high-resolution SkySat tasking capabilities.

The award was won through one of Planet's partners.

- Ministry of Foreign Affairs in Asia: Planet recently won

a new contract with a Ministry of Foreign Affairs in Asia. The

contract has a seven-figure ACV. The Ministry of Foreign Affairs is

a new customer for Planet and the contract was won through one of

Planet’s partners in the region.

- UK Rural Payments Agency: Planet and Earth-i announced

that they have been awarded a seven-figure ACV, multi-year contract

to deliver environmental monitoring for the UK’s Rural Payments

Agency. The UK Government will use Planet’s data to support its

Environmental Land Management Scheme. The data allows for

country-wide detection of a wider range of biophysical parameters

than ever before in support of increasing the UK’s natural

capital.

- Multiple Canadian Provincial Governments: Planet

expanded contracts with existing customers across multiple Canadian

provincial governments. Planet’s data and solutions will be used to

support critical disaster response efforts during the Canadian fire

season, to monitor impacts of climate change on ecosystems, and to

support land rights across the region.

New Technologies and

Products

- Sinergise Acquisition: In August, Planet completed its

previously announced acquisition of the business of Holding

Sinergise d.o.o. (“Sinergise”), a leading developer platform for

Earth observation (EO) data. The purchase of the Sinergise

business, based in Ljubljana, Slovenia, accelerates the advancement

of Planet’s Earth Data Platform and ability to efficiently deliver

EO data to customers, which Planet expects will support accelerated

time to value for customers.

- Global Forest Carbon Dataset: Planet announced plans to

release its global Forest Carbon Planetary Variable. This

groundbreaking dataset aims to provide insights into forest change

and carbon capture at nearly the individual tree level. By

leveraging advanced deep learning models, Planet’s Forest Carbon

product is designed to provide exceptional resolution, accuracy,

and frequency to a variety of stakeholders in forested ecosystems -

from voluntary carbon market participants and service providers to

entities dependent on forests in their supply chains to

jurisdictions and regulators needing quality global insights into

changes in forest area and carbon stocks.

Global Sustainability and

Impact

- Maui Fire Response: Planet contributed its data to a

publicly available damage assessment solution as part of its

collaboration with Microsoft’s AI for Good Lab and the Red Cross.

Additionally, Planet’s data was leveraged by the United States Air

Force Civil Air Patrol Geospatial Team as part of their damage

assessment conducted at the request of the Federal Emergency

Management Agency (“FEMA”).

- NICFI Program: Planet’s NICFI Satellite Data Program

continues to make available data of all the world’s equatorial

tropical forests to governments, UN agencies, NGOs, scientists, and

others. For instance, The Nature Conservancy and Wageningen

University have recently been leveraging Planet’s high spatial and

temporal resolution Basemaps to map roads, selective logging, and

woody vines for improved carbon sequestration strategies. More

examples from the quarterly update can be found at

planet.com/pulse.

Financial Outlook

For the third quarter of fiscal year 2024, ending October 31,

2023, Planet expects revenue to be in the range of approximately

$54 million to $56 million, representing approximately 11%

year-over-year growth at the midpoint. Non-GAAP Gross Margin is

expected to be in the range of approximately 50% to 52%. Adjusted

EBITDA loss is expected to be in the range of approximately ($15)

million and ($13) million. Capital Expenditures as a Percentage of

Revenue is expected to be in the range of approximately 22% to 25%

for the quarter.

For fiscal year 2024, ending January 31, 2024, Planet expects

revenue to be in the range of approximately $216 million to $223

million, representing approximately 15% year-over-year growth at

the midpoint. Non-GAAP Gross Margin is expected to be in the range

of approximately 52% to 54%. Adjusted EBITDA loss is expected to be

in the range of approximately ($63) million and ($55) million.

Capital Expenditures as a Percentage of Revenue is expected to be

in the range of approximately 22% to 23% for the full fiscal year

2024.

Planet intends to exclude the charges associated with its recent

headcount reduction from its non-GAAP financial metrics, including

Adjusted EBITDA, and the outlook above reflects such exclusion.

Planet has not reconciled its Non-GAAP financial outlook to the

most directly comparable GAAP measures because certain reconciling

items, such as stock-based compensation expenses and depreciation

and amortization are uncertain or out of Planet’s control and

cannot be reasonably predicted. The actual amount of these expenses

during the third quarter of fiscal year 2024 and fiscal year 2024

will have a significant impact on Planet’s future GAAP financial

results. Accordingly, a reconciliation of Planet’s Non-GAAP outlook

to the most comparable GAAP measures is not available without

unreasonable efforts.

The foregoing forward-looking statements reflect Planet’s

expectations as of today's date. Given the number of risk factors,

uncertainties and assumptions discussed below, actual results may

differ materially.

Webcast and Conference Call Information

Planet will host a conference call at 5:00 p.m. ET / 2:00 p.m.

PT today, September 7, 2023. The webcast can be accessed at

www.planet.com/investors/. A replay will be available approximately

2 hours following the event. If you would prefer to register for

the conference call, please go to the following link:

https://www.netroadshow.com/events/login?show=8c514e2f&confId=53475.

You will then receive your access details via email.

Additionally, a supplemental presentation has been made

available on Planet’s investor relations page.

About Planet Labs PBC

Planet is a leading provider of global, daily satellite imagery

and geospatial solutions. Planet is driven by a mission to image

the world every day, and make change visible, accessible and

actionable. Founded in 2010 by three NASA scientists, Planet

designs, builds, and operates the largest Earth observation fleet

of imaging satellites. Planet provides mission-critical data,

advanced insights, and software solutions to over 900 customers,

comprising the world’s leading agriculture, forestry, intelligence,

education and finance companies and government agencies, enabling

users to simply and effectively derive unique value from satellite

imagery. Planet is a public benefit corporation listed on the New

York Stock Exchange as PL. To learn more visit www.planet.com and

follow us on Twitter.

Planet’s Use of Non-GAAP Financial Measures

This press release includes Non-GAAP Gross Profit, Non-GAAP

Gross Margin, certain Non-GAAP Expenses described further below,

Non-GAAP Loss from Operations, Non-GAAP Net Loss, Non-GAAP Net Loss

per Diluted Share and Adjusted EBITDA which are non-GAAP

performance measures that the Company uses to supplement its

results presented in accordance with U.S. GAAP. The Company

believes these non-GAAP financial measures are useful in evaluating

its operating performance, as they are similar to measures reported

by the Company’s public competitors and are regularly used by

analysts, institutional investors, and other interested parties in

analyzing operating performance and prospects. Further, the Company

believes such non-GAAP measures are helpful in highlighting trends

in the Company’s operating results because they exclude certain

items that are not indicative of the Company’s core operating

performance. In addition, the Company includes these non-GAAP

financial measures because they are used by management to evaluate

the Company’s core operating performance and trends and to make

strategic decisions regarding the allocation of capital and new

investments.

Non-GAAP financial measures have limitations as analytical tools

and should not be considered in isolation from, as a substitute

for, or superior to, measures of financial performance prepared in

accordance with U.S. GAAP. The non-GAAP financial measures

presented are not based on any standardized methodology prescribed

by U.S. GAAP and are not necessarily comparable to similarly-titled

measures presented by other companies, which may have different

definitions from the Company. Further, the non-GAAP financial

measures presented exclude stock-based compensation expenses, which

has recently been, and will continue to be for the foreseeable

future, a significant recurring expense for the Company’s business

and an important part of its compensation strategy.

Planet calculates these non-GAAP financial measures as

follows:

Non-GAAP Gross Profit and Non-GAAP Gross

Margin: The Company defines and calculates Non-GAAP Gross

Profit as gross profit adjusted for stock-based compensation,

amortization of acquired intangible assets classified as cost of

revenue, and other expenses that are considered unrelated to our

underlying business performance and Non-GAAP Gross Margin as

Non-GAAP Gross Profit divided by revenue.

Non-GAAP Expenses: The Company

defines and calculates Non-GAAP cost of revenue, Non-GAAP research

and development expenses, Non-GAAP sales and marketing expenses,

and Non-GAAP general and administrative expenses as, in each case,

the corresponding U.S. GAAP financial measure (cost of revenue,

research and development expenses, sales and marketing expenses,

and general and administrative expenses) adjusted for stock-based

compensation expenses, amortization of acquired intangible assets

and other expenses that are considered unrelated to our underlying

business performance, that are classified within each of the

corresponding U.S. GAAP financial measures.

Non-GAAP Loss from Operations: The

Company defines and calculates Non-GAAP Loss from Operations as

loss from operations adjusted for stock-based compensation

expenses, amortization of acquired intangible assets and other

expenses that are considered unrelated to our underlying business

performance.

Non-GAAP Net Loss and Non-GAAP Net Loss

per Diluted Share: The Company defines and calculates

Non-GAAP Net Loss as net loss adjusted for stock-based compensation

expenses, amortization of acquired intangible assets, and other

expenses that are considered unrelated to our underlying business

performance and the tax effects of the adjustments. The Company

defines and calculates Non-GAAP Net Loss per Diluted Share as

Non-GAAP Net Loss divided by diluted weighted-average common shares

outstanding.

Adjusted EBITDA: The Company

defines and calculates Adjusted EBITDA as net income (loss) before

the impact of interest income and expense, income tax expense and

depreciation and amortization, and further adjusted for the

following items: stock-based compensation, change in fair value of

warrant liabilities, gain or loss on the extinguishment of debt and

non-operating income, expenses such as foreign currency exchange

gain or loss, and other expenses that are considered unrelated to

our underlying business performance.

Other Key Metrics

ACV and EoP ACV Book of Business:

In connection with the calculation of several of the key

operational and business metrics we utilize, the Company calculates

Annual Contract Value (“ACV”) for contracts of one year or greater

as the total amount of value that a customer has contracted to pay

for the most recent 12 month period for the contract. For

short-term contracts (contracts less than 12 months), ACV is equal

to total contract value.

The Company also calculates EoP ACV Book of Business in

connection with the calculation of several of the key operational

and business metrics we utilize. The Company defines EoP ACV Book

of Business as the sum of the ACV of all contracts that are active

on the last day of the period pursuant to the effective dates and

end dates of such contracts. Active contracts exclude any contract

that has been canceled, expired prior to the last day of the period

without renewing, or for any other reason is not expected to

generate revenue in the subsequent period. For contracts ending on

the last day of the period, the ACV is either updated to reflect

the ACV of the renewed contract or, if the contract has not yet

renewed or extended, the ACV is excluded from the EoP ACV Book of

Business. The Company does not annualize short-term contracts in

calculating EoP ACV Book of Business. The Company calculates the

ACV of usage-based contracts based on the committed contracted

revenue or the revenue achieved on the usage-based contract in the

prior 12-month period.

Percent of Recurring ACV: The

Company defines Percent of Recurring ACV as the dollar value of all

data subscription contracts and the committed portion of

usage-based contracts divided by the total dollar value of all

contracts in its ACV Book of Business at a specific point in time.

The Company defines ACV Book of Business as the sum of the ACV of

all contracts that are active on the last day of the period

pursuant to the effective dates and end dates of such contracts.

The Company believes Percent of Recurring ACV is a useful metric

for investors and management to track as it helps to illustrate how

much of its revenue comes from customers that have the potential to

renew their contracts over multiple years rather than being

one-time in nature. In calculating Percent of Recurring ACV,

management applies judgment as to which customers have an active

contract at a period end for the purpose of determining ACV Book of

Business, which is used as part of the calculation of Percent of

Recurring ACV.

EoP Customer Count: The Company

defines EoP Customer Count as the total count of all existing

customers at the end of the period. It defines existing customers

as customers with an active contract with the Company at the end of

the reported period. For the purpose of this metric, the Company

defines a customer as a distinct entity that uses its data or

services. The Company sells directly to customers, as well as

indirectly through its partner network. If a partner does not

provide the end customer’s name, then the partner is reported as

the customer. Each customer, regardless of the number of active

opportunities with the Company, is counted only once. For example,

if a customer utilizes multiple products of the Company, the

Company only counts that customer once for purposes of EoP Customer

Count. A customer with multiple divisions, segments, or

subsidiaries are also counted as a single unique customer based on

the parent organization or parent account. The Company believes EoP

Customer Count is a useful metric for investors and management to

track as it is an important indicator of the broader adoption of

its platform and is a measure of its success in growing its market

presence and penetration. In calculating EoP Customer Count,

management applies judgment as to which customers are deemed to

have an active contract in a period, as well as whether a customer

is a distinct entity that uses the Company’s data or services.

Capital Expenditures as a Percentage of

Revenue: The Company defines capital expenditures as

purchases of property and equipment plus capitalized internally

developed software development costs, which are included in our

statements of cash flows from investing activities. The Company

defines Capital Expenditures as a Percentage of Revenue as the

total amount of capital expenditures divided by total revenue in

the reported period. Capital Expenditures as a Percentage of

Revenue is a performance measure that we use to evaluate the

appropriate level of capital expenditures needed to support demand

for the Company’s data services and related revenue, and to provide

a comparable view of the Company’s performance relative to other

earth observation companies, which may invest significantly greater

amounts in their satellites to deliver their data to customers. The

Company uses an agile space systems strategy, which means we invest

in a larger number of significantly lower cost satellites and

software infrastructure to automate the management of the

satellites and to deliver the Company’s data to clients. As a

result of the Company’s strategy and business model, the Company’s

capital expenditures may be more similar to software companies with

large data center infrastructure costs. Therefore, the Company

believes it is important to look at the level of capital

expenditure investments relative to revenue when evaluating the

Company’s performance relative to other earth observation companies

or to other software and data companies with significant data

center infrastructure investment requirements. The Company believes

Capital Expenditures as a Percentage of Revenue is a useful metric

for investors because it provides visibility to the level of

capital expenditures required to operate the Company and the

Company’s relative capital efficiency.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements generally relate to future

events or Planet's future financial or operating performance. In

some cases, you can identify forward looking statements because

they contain words such as “expect,” “estimate,” “project,”

“budget,” “forecast,” “target,” “anticipate,” “intend,” “develop,”

“evolve,” “plan,” “seek,” “may,” “will,” “could,” “can,” “should,”

“would,” “believes,” “predicts,” “potential,” “strategy,”

“opportunity,” “aim,” “conviction,” “continue,” “positioned” or the

negative of these words or other similar terms or expressions that

concern Planet's expectations, strategy, priorities, plans or

intentions. Forward-looking statements in this release include, but

are not limited to, statements regarding Planet’s financial

guidance and outlook, Planet’s path to profitability, Planet’s

expectations regarding the acquisition of Sinergise, Planet’s

expectations regarding future product performance, and Planet’s

expectations regarding market and customer trends. Planet’s

expectations and beliefs regarding these matters may not

materialize, and actual results in future periods are subject to

risks and uncertainties that could cause actual results to differ

materially from those projected, including risks related to the

macroeconomic environment and risks regarding our ability to

forecast our performance due to our limited operating history. The

forward-looking statements contained in this release are also

subject to other risks and uncertainties, including those more

fully described in Planet's filings with the Securities and

Exchange Commission (“SEC”), including our Annual Report on Form

10-K and any subsequent filings with the SEC the Company may make.

All forward-looking statements reflect the Company’s beliefs and

assumptions only as of the date of this press release. The Company

undertakes no obligation to update forward-looking statements to

reflect future events or circumstances, except as may be required

by law. The Company’s results for the quarter ended July 31, 2023

are not necessarily indicative of its operating results for any

future periods.

PLANET

CONSOLIDATED BALANCE SHEETS

(unaudited)

(In thousands)

July 31, 2023

January 31, 2023

Assets

Current assets

Cash and cash equivalents

$

118,808

$

181,892

Short-term investments

248,979

226,868

Accounts receivable, net

40,349

38,952

Prepaid expenses and other current

assets

19,725

27,943

Total current assets

427,861

475,655

Property and equipment, net

120,193

108,091

Capitalized internal-use software, net

12,992

11,417

Goodwill

112,750

112,748

Intangible assets, net

14,867

14,831

Restricted cash and cash equivalents,

non-current

5,707

5,657

Operating lease right-of-use assets

23,485

20,403

Other non-current assets

2,562

3,921

Total assets

$

720,417

$

752,723

Liabilities and Stockholders’

Equity

Current liabilities

Accounts payable

$

3,825

$

6,900

Accrued and other current liabilities

37,841

46,022

Deferred revenue

56,575

51,900

Liability from early exercise of stock

options

10,757

12,550

Operating lease liabilities, current

7,261

4,885

Total current liabilities

116,259

122,257

Deferred revenue

18,186

2,882

Deferred hosting costs

9,605

8,679

Public and private placement warrant

liabilities

9,499

16,670

Operating lease liabilities,

non-current

19,139

17,145

Contingent consideration

5,926

7,499

Other non-current liabilities

2,235

1,487

Total liabilities

180,849

176,619

Commitments and contingencies

Stockholders’ equity

Common stock

27

27

Additional paid-in capital

1,549,920

1,513,102

Accumulated other comprehensive income

1,336

2,271

Accumulated deficit

(1,011,715

)

(939,296

)

Total stockholders’ equity

539,568

576,104

Total liabilities and stockholders’

equity

$

720,417

$

752,723

PLANET

CONSOLIDATED STATEMENTS OF

OPERATIONS (unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

(In thousands, except share and per share

amounts)

2023

2022

2023

2022

Revenue

$

53,761

$

48,450

$

106,464

$

88,577

Cost of revenue

27,469

24,977

52,025

48,605

Gross profit

26,292

23,473

54,439

39,972

Operating expenses

Research and development

26,741

26,737

54,927

51,487

Sales and marketing

22,310

19,483

45,435

38,338

General and administrative

20,521

19,893

42,049

40,501

Total operating expenses

69,572

66,113

142,411

130,326

Loss from operations

(43,280

)

(42,640

)

(87,972

)

(90,354

)

Interest income

3,802

1,311

8,308

1,423

Change in fair value of warrant

liabilities

1,226

2,112

7,171

5,388

Other income (expense), net

859

(158

)

963

122

Total other income (expense), net

5,887

3,265

16,442

6,933

Loss before provision for income taxes

(37,393

)

(39,375

)

(71,530

)

(83,421

)

Provision for income taxes

582

154

889

468

Net loss

$

(37,975

)

$

(39,529

)

$

(72,419

)

$

(83,889

)

Basic and diluted net loss per share

attributable to common stockholders

$

(0.14

)

$

(0.15

)

$

(0.26

)

$

(0.32

)

Basic and diluted weighted-average common

shares outstanding used in computing net loss per share

attributable to common stockholders

275,053,198

266,212,489

273,723,006

265,168,341

PLANET

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE LOSS (unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

(In thousands)

2023

2022

2023

2022

Net loss

$

(37,975

)

$

(39,529

)

$

(72,419

)

$

(83,889

)

Other comprehensive income (loss), net of

tax:

Foreign currency translation

adjustment

169

142

124

317

Change in fair value of available-for-sale

securities

(515

)

303

(1,059

)

303

Other comprehensive income (loss), net of

tax

(346

)

445

(935

)

620

Comprehensive loss

$

(38,321

)

$

(39,084

)

$

(73,354

)

$

(83,269

)

PLANET

CONSOLIDATED STATEMENTS OF

CASH FLOWS (unaudited)

Six Months Ended July

31,

(In thousands)

2023

2022

Operating activities

Net loss

$

(72,419

)

$

(83,889

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation and amortization

22,408

23,213

Stock-based compensation, net of

capitalized cost

32,013

40,403

Change in fair value of warrant

liabilities

(7,171

)

(5,388

)

Change in fair value of contingent

consideration

(527

)

—

Other

(2,747

)

485

Changes in operating assets and

liabilities

Accounts receivable

(1,588

)

18,595

Prepaid expenses and other assets

5,152

(4,432

)

Accounts payable, accrued and other

liabilities

(17,164

)

(1,866

)

Deferred revenue

19,957

(15,165

)

Deferred hosting costs

1,082

(760

)

Net cash used in operating activities

(21,004

)

(28,804

)

Investing activities

Purchases of property and equipment

(21,709

)

(6,509

)

Capitalized internal-use software

(1,998

)

(1,271

)

Maturities of available-for-sale

securities

106,762

—

Sales of available-for-sale securities

990

—

Purchases of available-for-sale

securities

(127,703

)

(195,113

)

Other

(644

)

(293

)

Net cash used in investing activities

(44,302

)

(203,186

)

Financing activities

Proceeds from the exercise of common stock

options

6,358

6,418

Class A common stock withheld to satisfy

employee tax withholding obligations

(4,753

)

(2,164

)

Payment of transaction costs related to

the Business Combination

—

(326

)

Other

(15

)

122

Net cash provided by financing

activities

1,590

4,050

Effect of exchange rate changes on cash

and cash equivalents, and restricted cash and cash equivalents

155

(1,118

)

Net decrease in cash and cash equivalents,

and restricted cash and cash equivalents

(63,561

)

(229,058

)

Cash and cash equivalents, and restricted

cash and cash equivalents at the beginning of the period

188,076

496,814

Cash and cash equivalents, and

restricted cash and cash equivalents at the end of the

period

$

124,515

$

267,756

PLANET

RECONCILIATION OF NET LOSS TO

ADJUSTED EBITDA (unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

(in thousands)

2023

2022

2023

2022

Net loss

$

(37,975

)

$

(39,529

)

$

(72,419

)

$

(83,889

)

Interest income

(3,802

)

(1,311

)

(8,308

)

(1,423

)

Income tax provision

582

154

889

468

Depreciation and amortization

12,160

11,588

22,408

23,213

Change in fair value of warrant

liabilities

(1,226

)

(2,112

)

(7,171

)

(5,388

)

Stock-based compensation

16,657

20,581

32,013

40,403

Other (income) expense, net

(859

)

158

(963

)

(122

)

Adjusted EBITDA

$

(14,463

)

$

(10,471

)

$

(33,551

)

$

(26,738

)

PLANET

RECONCILIATION OF U.S. GAAP TO

NON-GAAP FINANCIAL MEASURES (unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

(In thousands)

2023

2022

2023

2022

Reconciliation of cost of

revenue:

GAAP cost of revenue

$

27,469

$

24,977

$

52,025

$

48,605

Less: Stock-based compensation

1,063

1,357

1,968

2,676

Less: Amortization of acquired intangible

assets

439

366

878

797

Non-GAAP cost of revenue

$

25,967

$

23,254

$

49,179

$

45,132

Reconciliation of gross profit:

GAAP gross profit

$

26,292

$

23,473

$

54,439

$

39,972

Add: Stock-based compensation

1,063

1,357

1,968

2,676

Add: Amortization of acquired intangible

assets

439

366

878

797

Non-GAAP gross profit

$

27,794

$

25,196

$

57,285

$

43,445

GAAP gross margin

49

%

48

%

51

%

45

%

Non-GAAP gross margin

52

%

52

%

54

%

49

%

Reconciliation of operating

expenses:

GAAP research and development

$

26,741

$

26,737

$

54,927

$

51,487

Less: Stock-based compensation

6,929

8,503

12,899

16,732

Less: Amortization of acquired intangible

assets

—

—

—

—

Non-GAAP research and development

$

19,812

$

18,234

$

42,028

$

34,755

GAAP sales and marketing

$

22,310

$

19,483

$

45,435

$

38,338

Less: Stock-based compensation

3,121

3,757

6,201

7,394

Less: Amortization of acquired intangible

assets

202

153

403

305

Non-GAAP sales and marketing

$

18,987

$

15,573

$

38,831

$

30,639

GAAP general and administrative

$

20,521

$

19,893

$

42,049

$

40,501

Less: Stock-based compensation

5,544

6,964

10,945

13,601

Less: Amortization of acquired intangible

assets

80

80

161

160

Non-GAAP general and administrative

$

14,897

$

12,849

$

30,943

$

26,740

Reconciliation of loss from

operations

GAAP loss from operations

$

(43,280

)

$

(42,640

)

$

(87,972

)

$

(90,354

)

Add: Stock-based compensation

16,657

20,581

32,013

40,403

Add: Amortization of acquired intangible

assets

721

599

1,442

1,262

Non-GAAP loss from operations

$

(25,902

)

$

(21,460

)

$

(54,517

)

$

(48,689

)

PLANET

RECONCILIATION OF U.S. GAAP TO

NON-GAAP FINANCIAL MEASURES (unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

(In thousands, except share and per share

amounts)

2023

2022

2023

2022

Reconciliation of net loss

GAAP net loss

$

(37,975

)

$

(39,529

)

$

(72,419

)

$

(83,889

)

Add: Stock-based compensation

16,657

20,581

32,013

40,403

Add: Amortization of acquired intangible

assets

721

599

1,442

1,262

Income tax effect of non-GAAP

adjustments

—

—

—

—

Non-GAAP net loss

$

(20,597

)

$

(18,349

)

$

(38,964

)

$

(42,224

)

Reconciliation of net loss per share,

diluted

GAAP net loss

$

(37,975

)

$

(39,529

)

$

(72,419

)

$

(83,889

)

Non-GAAP net loss

$

(20,597

)

$

(18,349

)

$

(38,964

)

$

(42,224

)

GAAP net loss per share, basic and diluted

(1)

$

(0.14

)

$

(0.15

)

$

(0.26

)

$

(0.32

)

Add: Stock-based compensation

0.06

0.08

0.12

0.15

Add: Amortization of acquired intangible

assets

—

—

0.01

—

Income tax effect of non-GAAP

adjustments

—

—

—

—

Non-GAAP net loss per share, diluted (2)

(3)

$

(0.07

)

$

(0.07

)

$

(0.14

)

$

(0.16

)

Weighted-average shares used in computing

GAAP net loss per share, basic and diluted (1)

275,053,198

266,212,489

273,723,006

265,168,341

Weighted-average shares used in computing

Non-GAAP net loss per share, diluted (2)

275,053,198

266,212,489

273,723,006

265,168,341

(1) Basic and diluted GAAP net loss per

share was the same for each period presented as the inclusion of

all potential Class A common stock and Class B common stock

outstanding would have been anti-dilutive.

(2) Non-GAAP net loss per share, diluted

is calculated using weighted-average shares, adjusted for dilutive

potential shares assumed outstanding during the period. No

adjustment was made to weighted-average shares for each period

presented as the inclusion of all potential Class A common stock

and Class B common stock outstanding would have been

anti-dilutive.

(3) Totals may not sum due to rounding.

Figures are calculated based upon the respective underlying

non-rounded data.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230907397711/en/

Investor Contact

Chris Genualdi / Cleo Palmer-Poroner Planet Labs PBC

ir@planet.com

Press Contact

Trevor Hammond Planet Labs PBC comms@planet.com

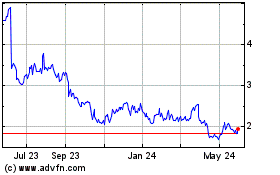

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Oct 2024 to Nov 2024

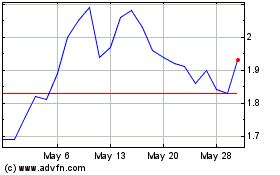

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Nov 2023 to Nov 2024