0001836833FALSE00018368332023-07-272023-07-270001836833us-gaap:CommonStockMember2023-07-272023-07-270001836833us-gaap:WarrantMember2023-07-272023-07-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 27, 2023

Planet Labs PBC

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 001-40166 | | 85-4299396 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

645 Harrison Street, Floor 4 San Francisco, California | | 94107 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (415) 829-3313

N/A

(Former Name or Former Address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

Class A common stock, $0.0001 par value per share | | PL | | New York Stock Exchange |

Warrants, each warrant exercisable for one share of common stock, each at an exercise price of $11.50 per share | | PLWS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On July 27, 2023, Planet Labs PBC (the “Company”) committed to a plan to reduce its global headcount by approximately 117 employees, which represents approximately 10% of the Company’s total number of employees prior to the reduction (the “headcount reduction”). This action was taken to increase the Company’s focus on its high priority growth opportunities and operational efficiency, which the Company believes will further support its long-term strategy and path to profitability.

As a result of the headcount reduction, the Company currently estimates that it will incur non-recurring charges of approximately $7 million to $8 million in aggregate pre-tax costs in connection with the reduction, consisting of one-time severance and other termination benefit costs. The Company expects that the majority of these charges will be incurred in the third quarter of fiscal 2024, and that the headcount reductions, including related cash payments, will be substantially complete by the end of the fiscal year ending January 31, 2024. The foregoing amounts do not include any non-cash charges associated with stock-based compensation. The timing and cost estimates related to the headcount reduction plan are subject to a number of assumptions and actual results may differ materially from those expected and disclosed above. The Company intends to exclude the charges associated with the headcount reduction from its non-GAAP financial metrics, including Adjusted EBITDA.

Item 7.01 Regulation FD Disclosure.

On August 1, 2023, the Company posted a blog on the Company’s website at www.planet.com/pulse, which included an e-mail sent from William Marshall, the Company’s CEO, to the Company’s employees regarding the headcount reduction described above. A copy of the blog is attached as Exhibit 99.1.

The information in this Item 7.01, including the information contained in Exhibit 99.1, of this Current Report on Form 8-K is furnished herewith and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Forward-looking Statements

Except for the historical information contained herein, the matters set forth in this Current Report on Form 8-K are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding estimated costs and benefits related to the headcount reduction plan and other actions, including whether the headcount reduction, or any other actions, will help the Company achieve its long-term strategy or profitability, the expected timing of actions, costs and intended benefits related to the headcount reduction plan and other actions, and the fact that the Company intends to exclude certain charges from its non-GAAP financial measures. Forward-looking statements are based on the Company’s

management’s beliefs, as well as assumptions made by, and information currently available to them. Because such statements are based on expectations as to future events and results and are not statements of fact, actual results may differ materially from those projected. Factors which may cause actual results to differ materially from current expectations include, but are not limited to, the risk that costs may be greater than expected and that benefits may be lower than expected; that there may be unanticipated charges not currently contemplated that may occur as a result of the headcount reduction plan; that the headcount reduction may adversely affect the Company’s ability to attract and retain qualified personnel and that the implementation of the reduction may be distracting to employees and management; that the headcount reduction plan may negatively impact the Company’s business operations and reputation; that the headcount reduction plan may not generate the intended benefits to the extent or on the timeline as expected; and other risk factors and other disclosures about the Company and its business included in the Company’s periodic reports, proxy statements, and other disclosure materials filed from time to time with the Securities and Exchange Commission (SEC) which are available online at www.sec.gov, and on the Company’s website at www.planet.com. All forward-looking statements reflect the Company’s beliefs and assumptions only as of the date such statements are made. The Company undertakes no obligation to update forward-looking statements to reflect future events or circumstances.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Exhibit Description |

| |

| 99.1 | | |

104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | Planet Labs PBC |

| | | |

Date: August 1, 2023 | By: | | /s/ Ashley Johnson |

| | | Ashley Johnson Chief Financial and Operating Officer |

Planet CEO Will Marshall sent the following note to Planet employees today.

--

Planeteers,

I have some important and tough news to share. For reasons I’ll get to here, we’re reducing the size of our team and saying goodbye to 117 talented Planeteers.

If your role is impacted, you will have received a calendar invite titled “Transition Discussion” within the last hour setting up a meeting with a leader from your division.

In this note, I’ll explain why we’re doing this and what comes next, and we’ll talk in more detail at an upcoming All Hands. At the outset, I want to be clear that I am responsible for the decisions that led us here. I know this has significant effects on the lives of our team and their families, and for that I am sorry. We do not make these changes lightly.

How we got here

While Planet has always operated with a lean mentality, we transitioned into a new operating mode when we went public 18 months ago. This included building out teams that had been historically understaffed and taking on a range of new projects to expand our market opportunity.

Our business has scaled rapidly and continues to grow apace, but the expansion of projects has also increased cost and complexity, which slowed us down in some regards. Simultaneously, the macroeconomic environment has changed. For both of these reasons, we are making changes to prioritize our attention on the highest ROI opportunities for our business and mission, while reinforcing our path to profitability, consistent with what we shared on our prior earnings call.

Planet remains hyper relevant to the world: the sustainability transformation, the digital transformation, and the increasing global attention on peace and security will continue to be tailwinds for years to come. The AI revolution adds yet another. But, to seize these opportunities we need to focus and execute - and that leads us to the hard changes we’re making today.

Our process

We performed a deep assessment of our business and spending, looking at elements such as our fastest growth markets, our mission impact, our product and go to market efforts, and our operations. This led to decisions resulting in cuts to costs and teams. At the end of the day, our driving theme was focus for our business and our mission. The changes impact every division at Planet, globally.

I want to be clear that this action is not a reflection on personal or professional qualities. The contributions of the set of people whose roles are impacted today have been tremendous.

With this in mind, I want to thank all of the Planeteers who are leaving us. Thank you for bringing your talents and passion to Planet, and most of all for believing in and contributing to our mission. We appreciate everything you've done to help get Planet to where it is today.

How we’re handling departures

All departing employees will be eligible to receive a minimum of 14 weeks of pay from today, as well as a cash contribution toward continued healthcare, immigration support benefits, and career counseling for those who choose it. As noted above, if your role is impacted today, you will have received a calendar invite within the last hour setting up a meeting with you and a leader in your division.

The next few days will be hard as we navigate a lot of change at once. Thank you for your help supporting our departing Planeteers.

Going forward

The leadership team and I remain firmly convinced of the opportunity ahead of us. Our cash position is strong and we believe we are well positioned to compete and succeed in an uncertain economic environment. And our North Star remains unchanged: Planet’s differentiated data products, our investments toward an Earth Data Platform, and the immense potential for AI with our data, have immense value to the world.

I am sure many of you have questions. On Wednesday, each division lead will send an email detailing programmatic and organizational changes to their teams. Then we’ll regroup in a series of All Hands (covering various time zones) to talk more about these changes, take questions and focus on how we move forward. We’ll share more details on the All Hands soon.

I know this news is hard, so please take care of yourself and those around you.

Will

---

Forward-looking Statements

Except for the historical information contained herein, the matters set forth in this blog are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the Company’s ability to grow, current and future macroeconomic conditions, trends and tailwinds that will continue to drive demand for the Company’s products, the Company’s ability to successfully implement changes to its employee base and the Company’s ability to successfully execute on certain corporate opportunities. Forward-looking statements are based on the Company’s management’s beliefs, as well as assumptions made by, and information currently available to them. Because such statements are based on expectations as to future events and results and are not statements of fact, actual results may differ materially from those projected. Factors which may cause actual results to differ materially from current expectations include, but are not limited to the risk factors and other disclosures about the Company and its business included in the Company’s periodic reports, proxy statements, and other disclosure materials filed from time to time with the Securities and Exchange Commission (SEC) which are available online at www.sec.gov, and on the Company’s website at www.planet.com. All forward-looking statements reflect the Company’s beliefs and assumptions only as of the date such statements are made. The Company undertakes no obligation to update forward-looking statements to reflect future events or circumstances.

v3.23.2

Cover

|

Jul. 27, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 27, 2023

|

| Entity Registrant Name |

Planet Labs PBC

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40166

|

| Entity Tax Identification Number |

85-4299396

|

| Entity Address, Address Line One |

645 Harrison Street

|

| Entity Address, Address Line Two |

Floor 4

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94107

|

| City Area Code |

415

|

| Local Phone Number |

829-3313

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001836833

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, $0.0001 par value per share

|

| Trading Symbol |

PL

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one share of common stock, each at an exercise price of $11.50 per share

|

| Trading Symbol |

PLWS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

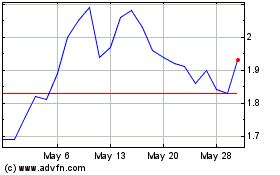

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2024 to Jul 2024

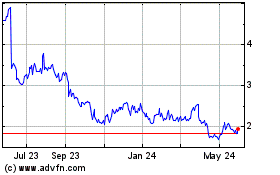

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jul 2023 to Jul 2024