PGIM Global High Yield Fund, Inc. (NYSE: GHY), (the “Fund”), a

diversified, closed-end management investment company, announced

today its unaudited investment results for the quarter ended July

31, 2020.

As of July 31, 2020

As of April 30, 2020

As of

July 31,

2019

Net Assets

$634,169,633

$552,885,411

$680,904,116

Loan Outstanding

$224,000,000

$179,000,000

$284,000,000

Shares Outstanding

40,923,879

40,923,879

40,923,879

Net Asset Value (“NAV”) Per Share (a)

$15.50

$13.51

$16.64

Market Price Per Share (b)

$13.18

$11.73

$14.52

Premium / (Discount) to NAV (c)

(15.0)%

(13.2)%

(12.7)%

Undistributed / (Overdistributed) Net

Investment Income (d)

$3,042,733

$1,158,418

$5,569,839

Undistributed / (Overdistributed) Net

Investment Income Per Share (e)

$0.07

$0.03

$0.14

Quarter Ended

July 31,

2020

Quarter Ended

April

30, 2020

Quarter Ended

July 31,

2019

Quarterly

Earnings

Net Investment Income

$9,269,657

$10,377,176

$12,103,555

Net Realized and Unrealized Gain

(Loss)

$84,905,587

($123,952,384)

$12,441,715

Net Increase / (Decrease) in Net Assets

From Operations

$94,175,244

($113,575,208)

$24,545,270

Quarterly Earnings

Per Common Share Outstanding

Net Investment Income

$0.23

$0.25

$0.30

Net Realized and Unrealized Gain /

(Loss)

$2.07

($3.03)

$0.30

Net Increase / (Decrease) in Net Assets

From Operations

$2.30

($2.78)

$0.60

This financial data is unaudited. Amounts do not reflect

adjustments for Generally Accepted Accounting Principles, including

those relating to amortization of premiums on securities held, and

may be updated periodically.

Notes: (a)

Net Asset Value (“NAV”) Per Share is total

assets less total liabilities divided by the number of shares

outstanding.

(b)

Market Price Per Share is the closing

price on the New York Stock Exchange.

(c)

Premium / (Discount) to NAV is the %

difference between the market price and the NAV price.

(d)

Overdistributed amounts may be funded by

capital gains on portfolio securities or through return of

stockholders’ capital. Undistributed / (Overdistributed) Net

Investment Income (“UNII”) (“ONII”) represents the balance to date

of a fund’s net investment income less its distributions. Includes

prior year UNII of $3,042,733 for the fiscal year ended July 31,

2020 and the UNII of $5,569,839 for the fiscal year ended July 31,

2019.

(e)

The UNII information provided treats

amounts relating to foreign currency transactions as net realized

and unrealized gain (loss). However, these amounts are treated as

net investment income (loss) for federal income tax purposes. In

accordance with federal income tax treatment, the UNII balances

would have been $3,042,733/$0.07 per share, $6,638,138/$0.16 per

share, and $12,568,881/$0.31 per share, as of the current quarter,

prior quarter, and year ago quarter, respectively. While not

required to do so, the Fund may attempt to hedge its foreign

currency exposure, which may offset all or a portion of the foreign

currency exposure included in the table above. As of the date of

this press release, the Fund believes that it has significantly

hedged its foreign currency exposure.

The Fund files its annual and semiannual stockholders reports on

Form N-CSR with the Securities and Exchange Commission (the

“Commission”), which includes its complete schedule of investments.

The Fund also files Form N-PORT with the Commission within 60 days

of the end of each fiscal quarter, including the Fund’s complete

schedule of investments as of its first and third fiscal quarters.

The Fund’s schedule of portfolio holdings is also available on the

Fund’s website as of the end of each month no sooner than 15 days

after the end of the month. The Fund’s filings on Form N-PORT and

stockholder reports on Form N-CSR are available on the Commission’s

website at sec.gov. To obtain additional information or to make

other inquiries pertaining to the Fund, stockholders can call (800)

451-6788 (toll-free).

About PGIM and Prudential Financial, Inc.

PGIM, the global asset management business of Prudential

Financial, Inc. (NYSE: PRU), ranks among the top 10 largest asset

managers in the world1 with more than $1.4 trillion in assets under

management as of June 30, 2020. With offices in 16 countries,

PGIM’s businesses offer a range of investment solutions for retail

and institutional investors around the world across a broad range

of asset classes, including public fixed income, private fixed

income, fundamental equity, quantitative equity, real estate and

alternatives. For more information about PGIM, visit pgim.com.

Prudential’s additional businesses offer a variety of products

and services, including life insurance, annuities and

retirement-related services. For more information about Prudential,

please visit news.prudential.com.

Data and commentary provided in this press release are for

informational purposes only. PGIM Investments LLC, the Investment

Manager of the Fund, and its affiliates do not engage in selling

shares of the Fund. The Fund is subadvised by PGIM Fixed Income, a

business unit of PGIM, Inc. and an affiliate of the investment

manager.

The Fund invests in high yield (“junk”) bonds, which are

subject to greater credit and market risks, including greater risk

of default; derivative securities, which may carry market,

credit, and liquidity risks; foreign securities, which are

subject to currency fluctuation and political uncertainty; and

emerging markets securities, which are subject to greater

volatility and price declines. Fixed income investments are

subject to interest rate risk, where their value will decline as

interest rates rise. There are fees and expenses involved with

investing in these Funds. Diversification does not assure a profit

or protect against a loss in declining markets. There is no

guarantee that dividends or distributions will be paid.

An investment in a closed-end fund’s common stock may be

speculative in that it involves a high degree of risk, should not

constitute a complete investment program, and may result in loss of

principal. Each closed-end fund will have its own unique investment

strategy, risks, charges and expenses that need to be considered

before investing.

This material is being provided for informational or educational

purposes only and does not take into account the investment

objectives or financial situation of any client or prospective

clients. The information is not intended as investment advice and

is not a recommendation. Clients seeking information regarding

their particular investment needs should contact their financial

professional.

PGIM Fixed Income is a unit of PGIM, Inc., which is a registered

investment advisor and Prudential Financial company. © 2020

Prudential Financial, Inc. and its related entities. PGIM and the

PGIM logo are service marks of Prudential Financial, Inc. and its

related entities, registered in many jurisdictions worldwide.

Investment products are not insured by the FDIC or any federal

government agency, may lose value, and are not a deposit of or

guaranteed by any bank or any bank affiliate.

1Pensions & Investments Top Money Managers list, June 1,

2020; based on Prudential Financial, Inc. (PFI) total worldwide

assets under management as of March 31, 2020.

1014200-00008-00 Expiration: 2/28/2022

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200903005834/en/

MEDIA: Kylie Scott (973)-367-6873

kylie.scott@pgim.com

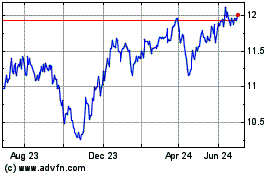

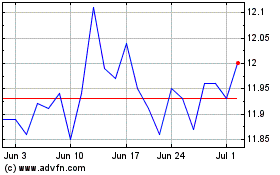

PGIM Global High Yield (NYSE:GHY)

Historical Stock Chart

From Oct 2024 to Nov 2024

PGIM Global High Yield (NYSE:GHY)

Historical Stock Chart

From Nov 2023 to Nov 2024