Three Hedge Funds Win Big in PG&E's Complex Restructuring

April 16 2019 - 2:41PM

Dow Jones News

By Matt Wirz

A sharp rebound in shares of PG&E Corp. has left three hedge

funds that own 10% of the stock sitting on a roughly $700 million

gain.

Abrams Capital Management LP, Knighthead Capital Management LLC

and Redwood Capital Management LLC bought about 45 million PG&E

shares in mid-January when the utility announced its plans to file

for bankruptcy and its stock dropped to around $6 from $24. The

stock has since recovered to around $23 as estimates of the

company's wildfire-related liabilities dropped and California's

government proposed new policies to address future wildfire

risk.

The funds are the biggest winners so far in PG&E's complex

restructuring, which has attracted some of the largest U.S. hedge

funds looking for bargains in the firm's 527 million shares and

approximately $18 billion of bonds. There have been few such large

distressed investing opportunities since oil prices collapsed in

2015, forcing many energy and mining companies to restructure.

While the funds' stakes have soared in value, profits from the

trade remain unrealized and a quick exit is unlikely given the

number of shares involved. The bankruptcy is likely to take one to

two more years to complete and the stock price could keep swinging

wildly over that period, hedge fund analysts say.

Timing the trade correctly has proven perilous. Funds including

the Baupost Group LLC and BlueMountain Capital Management LLC have

taken paper losses because they bought large equity stakes in

PG&E shares in 2018, after its stock began to fall on wildfire

worries but well before it bottomed out on the bankruptcy

filing.

The company sought bankruptcy protection because, unlike in most

states, California utilities can be found liable if their equipment

contributed to a fire, regardless of negligence.

The filing triggered PG&E's removal from widely followed

stock indexes, forcing mutual-fund managers who track the

benchmarks to dump their holdings. BlackRock Inc., for example,

sold 30 million of the company's shares in January, cutting its

stake by about 75%, according to data from S&P Global.

Boston-based Abrams initially bought 3.25 million PG&E

shares in late 2017 after fires north of San Francisco pushed its

stock down, then sold out in the summer of 2018, according to data

from S&P Global Market Intelligence. When the shares fell 70%

in early January, the firm dove in again, buying a 5% stake of 25

million shares in three days of frantic trading, Securities and

Exchange Commission filings show. The firm's founder David Abrams

worked at Baupost before starting his own fund, which focuses on a

small number of beaten-down companies.

Knighthead and Redwood started buying small stakes in 2017 and

2018 before purchasing about 9 million shares each in January and

February, according to SEC filings. The two funds own about 5% of

the company combined and have teamed up with Abrams to launch an

activist campaign to reform PG&E culturally and financially,

people familiar with the matter said.

The trio played a key role in the appointment of the company's

new chief executive in March and are now engaging with California's

government over proposed reforms to reduce wildfire risk and to

establish a liability-sharing framework for any future damage

claims, the people said.

California Gov. Gavin Newsom proposed some potential fixes last

week but has also clashed with hedge funds involved in PG&E's

restructuring, most recently over their proposed candidates for the

company's new board of directors.

Write to Matt Wirz at matthieu.wirz@wsj.com

(END) Dow Jones Newswires

April 16, 2019 14:26 ET (18:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

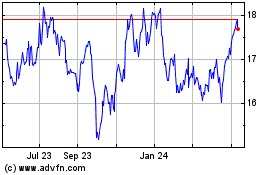

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2024 to May 2024

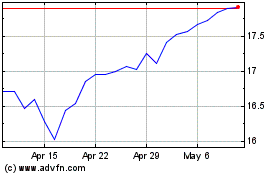

PG&E (NYSE:PCG)

Historical Stock Chart

From May 2023 to May 2024