Hedge Fund BlueMountain Nominates New Board for PG&E -- Update

March 01 2019 - 2:27PM

Dow Jones News

By Becky Yerak

BlueMountain Capital Management LLC, the hedge fund seeking to

replace the board at bankrupt PG&E Corp., said Friday it has

nominated 13 candidates for the California utility's board.

The San Francisco-based utility, which is struggling with

billions of dollars in potential liabilities from its role in

sparking California wildfires, is expected to hold its annual

shareholder meeting in May.

BlueMountain said Friday that its proposed board has the

experience to handle the safety, risk management, governance and

transparency matters that must be top priorities for PG&E.

The nominee slate of the New York-based investment firm includes

Phil Angelides, a former California state treasurer who served as

chairman of the U.S. Financial Crisis Inquiry Commission, which

investigated the 2008 financial meltdown; Kenneth Feinberg, who was

appointed by the U.S. government to oversee the Sept. 11 victims'

compensation fund and to help oversee the British Petroleum

Deepwater Horizon oil spill fund; and Christopher Hart, former

chairman of the National Transportation Safety Board.

The hedge fund in January had protested PG&E's board's

decision to file for bankruptcy, calling it a "costly and

unnecessary" move, and said at the time that it planned to nominate

a new board at the next annual shareholder meeting.

BlueMountain said Friday that it interviewed more than 60

potential candidates. It has said that PG&E stock, currently

trading at $18 a share, could be worth more than $50 a share with

the right corporate governance.

PG&E has said it plans to make changes to its board, with a

goal of ensuring that most of its directors will be new,

independent directors by the time of the annual meeting. On Friday,

PG&E said it "appreciates the constructive dialogue that it has

had with shareholders and other stakeholders throughout this

process" and that it expects to continue talks with BlueMountain

and others regarding the composition of the board.

Facing an estimated $30 billion worth of liabilities for death,

injury and property damage stemming from years of wildfires,

PG&E sought bankruptcy protection aiming for a resolution that

will appease thousands of injured people and save the utility.

In his state-of-the-state address earlier this month, Gov. Gavin

Newsom said California has hired lawyers and financial advisers to

tackle the public-safety and utility-service issues at stake in

PG&E's bankruptcy.

BlueMountain owns about 11 million of PG&E's 528 million

shares.

The hedge fund's proposed board for PG&E also includes five

utility executives: Fred Buckman, chief executive of

electric-transmission-system operator Powerlink Transmission Co.;

Donald Chappel, former chief financial officer for natural-gas

pipeline operator Williams Cos.; David Crane, former NRG Energy

Inc. CEO; Tanuja Dehne, former NRG chief administrative officer;

and Dick Rosenblum, a former executive at utility Southern

California Edison.

In addition to Mr. Angelides, the proposed slate includes five

other California residents: Alvaro Aguirre, chairman of

industrial-staffing business EmployBridge and a former

planning-commission chairman of Tiburon, Calif.; Marjorie Bowen, a

former Houlihan Lokey investment banker who also has served on a

utility board; Mark Lerdal, executive chairman of Leaf Clean Energy

Co. and a former KKR Financial managing director; Barbara Lloyd,

California's former chief deputy treasurer and a former managing

director for KPMG's infrastructure advisory group; and Jeffrey

Ubben, founder and CEO of investment firm ValueAct Capital.

Write to Becky Yerak at becky.yerak@wsj.com

(END) Dow Jones Newswires

March 01, 2019 14:12 ET (19:12 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

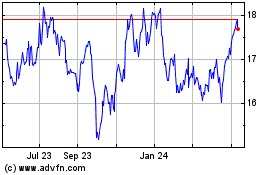

PG&E (NYSE:PCG)

Historical Stock Chart

From Jun 2024 to Jul 2024

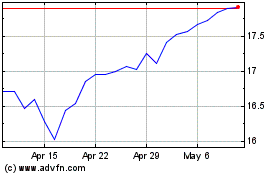

PG&E (NYSE:PCG)

Historical Stock Chart

From Jul 2023 to Jul 2024