PG&E Shares Jump After California Clears Company in 2017 Blaze -- Update

January 24 2019 - 7:49PM

Dow Jones News

By Katherine Blunt

PG&E Corp. shares surged after California fire investigators

said the utility didn't cause the deadliest in a series of 2017

state wildfires.

California fire investigators said the Tubbs Fire, which killed

22 people and destroyed nearly 37,000 acres mainly in Napa and

Sonoma counties, was caused by a private electrical system near a

residential structure, ending speculation that PG&E might have

been liable for the blaze.

Shares in PG&E, which said last week that it was planning to

seek bankruptcy protection by month's end in response to

wildfire-related liability costs, rose Thursday by 75% to close at

$13.95.

The California Department of Forestry and Fire Protection said

it found no evidence of violations of state law related to the

cause of the Tubbs Fire. It has previously found that PG&E

equipment helped spark 18 other wildfires during a spate of deadly

fires that hit the state in 2017.

State officials have yet to determine whether PG&E equipment

helped cause the Camp Fire, the state's deadliest fire to date,

which killed 86 people last year. PG&E has disclosed that a

high-voltage line malfunctioned in the region where the Camp Fire

began, failing some 15 minutes before the start of the blaze was

reported in November.

Even after Thursday's jump, the company's shares are still down

41% this month and on track for their worst monthly decline since

November, when PG&E fell 43%.

PG&E has said it could face as much as $30 billion in

potential liability costs related to the 2017 and 2018 wildfires.

That estimate, however, included the possibility it could be found

liable for the Tubbs Fire. A company spokeswoman didn't immediately

offer a revised estimate and said its liability costs could still

exceed that number.

"Regardless of today's announcement, PG&E still faces

extensive litigation, significant potential liabilities and a

deteriorating financial situation, which was further impaired by

the recent credit agency downgrades to below investment grade," the

company said in a written statement.

PG&E faces substantial challenges in grappling with the

fallout from the spate of wildfires, which have called into

question the safety of its electric grid and the effectiveness of

its risk-mitigation practices. The California Public Utilities

Commission has expanded an existing probe into the company's safety

practices and is considering whether the company should be broken

up.

PG&E is shaking up its board of directors as part of a plan

to improve its safety practices. The company has said it also plans

to invest billions of dollars to reduce fire risk within its

70,000-mile service territory by installing weather stations and

cameras and enhancing inspections and tree-trimming practices,

among other things.

BlueMountain Capital Management LLC, a hedge fund that recently

raised its stake in PG&E, has questioned the utility's plan to

seek bankruptcy protection, arguing that the company isn't yet

insolvent and that its ultimate liabilities from fires remain

unclear. On Thursday, the hedge fund said it would mount an effort

to replace PG&E's 10-member board during its meeting in May and

encouraged other shareholders to support a proxy fight.

"The news from Cal Fire that PG&E did not cause the

devastating 2017 Tubbs fire is yet another example of why the

company shouldn't be rushing to file for bankruptcy, which would be

totally unnecessary and bad for all stakeholders," BlueMountain

Capital said in a written statement.

PG&E said earlier this month that it faced about 50 lawsuits

related to the Camp Fire on behalf of 2,000 individual plaintiffs,

and more than 700 lawsuits on behalf of at least 3,600 plaintiffs

in connection with the 2017 fires.

California Gov. Gavin Newsom said Thursday that he had discussed

the findings of the state investigation with PG&E executives.

He expressed worries that the findings might complicate efforts by

fire victims to seek compensation for damages.

"It's made it more challenging and that's a concern I have," he

said. "It's certainly a concern that plaintiffs' attorneys

have."

Mike Danko, a California trial lawyer who represents victims of

the Tubbs Fire and other wildfires, said the Tubbs blaze accounts

for a substantial percentage of the litigation resulting from the

2017 fires. He said his group, the Northern California Fire

Lawyers, is representing about 150 cases related to that fire.

California's findings will make it more challenging to recoup

damages under the state's principle of inverse condemnation, which

renders utilities liable for property damage caused by their

equipment even if they aren't found negligent, he said. But he

expected the litigation to continue.

"We won't be giving up," Mr. Danko said. "But it has become a

more difficult case than the other cases."

--Alejandro Lazo and Becky Yerak contributed to this

article.

Write to Katherine Blunt at Katherine.Blunt@wsj.com

(END) Dow Jones Newswires

January 24, 2019 19:34 ET (00:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

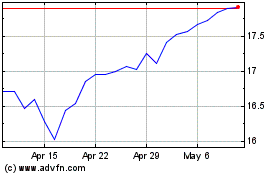

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2024 to May 2024

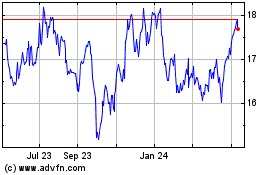

PG&E (NYSE:PCG)

Historical Stock Chart

From May 2023 to May 2024