UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

OR

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38472

PERMROCK ROYALTY TRUST

(Exact name of registrant as specified in the

Amended and Restated Trust Agreement of PermRock

Royalty Trust)

| Delaware |

82-6725102 |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.) |

| |

|

|

Argent Trust Company, Trustee

3838 Oak Lawn Ave.

Suite 1720

Dallas, Texas |

75219 |

| (Address of principal executive offices) |

(Zip Code) |

(855) 588-7839

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units of Beneficial Interest |

|

PRT |

|

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such

shorter period that the registrant was required to submit such files). Yes ☐

No ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| Emerging growth company |

☒ |

|

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 14, 2023, 12,165,732 trust units representing beneficial

interests in PermRock Royalty Trust were outstanding.

TABLE OF CONTENTS

Glossary of Terms

| Bbl |

Barrel (of oil). |

| |

|

| Boe |

One barrel of crude oil equivalent. |

| |

|

| differential |

The difference between a benchmark price of oil and natural gas, such as the NYMEX crude oil spot, and the wellhead price received. |

| |

|

| distributable income |

An amount paid to Trust unitholders equal to the net profits income received by the Trust during a given period plus interest, less the expenses and payment of liabilities of the Trust, adjusted by any changes in cash reserves. |

| |

|

| GAAP |

United States generally accepted accounting principles. |

| |

|

| MBbl |

One thousand barrels of crude oil or condensate. |

| |

|

| MBoe |

One thousand barrels of crude oil equivalent. |

| |

|

| Mcf |

One thousand cubic feet (of natural gas). |

| |

|

| MMcf |

One million cubic feet (of natural gas). |

| |

|

| natural gas liquids (NGL) |

Those hydrocarbons that are separated from the gas as liquids through the process of absorption, condensation, or other methods in gas processing or cycling plants. |

| |

|

| net acres |

The sum of the fractional working interests owned by a given operator in gross acres. |

| |

|

| net profits |

Gross profits received by Boaz Energy from the sale of production from the Underlying Properties, less applicable costs, as provided in the Conveyance. |

| |

|

| net profits income |

Net profits multiplied by the net profits percentage of 80%, which is paid to the Trust by Boaz Energy. “Net profits income” is referred to as “royalty income” for tax reporting purposes. |

| |

|

| Net Profits Interest |

An interest in an oil and natural gas property measured by net profits from the sale of production, rather than a specific portion of production. An 80% net profits interest was conveyed to the Trust entitling the Trust to receive 80% of the net profits from the Underlying Properties. |

| |

|

| NYMEX |

The New York Mercantile Exchange is a commodity futures exchange that quotes prices for transactions which are the prices paid for various commodities, including oil and natural gas, throughout the world. |

| |

|

| Trust units |

Trust units representing beneficial interests in the Trust. |

| |

|

| Underlying Properties |

The interest in certain oil and natural gas properties from which the Net Profits Interest was conveyed by Boaz Energy. The Underlying Properties include working interests in oil and natural gas producing properties located in the Permian Basin in Texas. |

| |

|

| working interest |

An operating interest in an oil and natural gas property that provides the owner a specified share of production that is subject to all production expense and development costs. |

PART I. FINANCIAL

INFORMATION

| ITEM 1. | Financial Statements |

The condensed financial statements included herein are presented

without audit, pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”). Certain information

and footnote disclosures normally included in annual financial statements have been condensed or omitted pursuant to such rules and regulations,

and Argent Trust Company, as Trustee (the “Trustee”), believes that the disclosures are adequate to make the information presented

not misleading. These condensed interim financial statements and notes thereto should be read in conjunction with the audited financial

statements and notes thereto included in the Trust’s 2022 Annual Report on Form 10-K (“2022 Annual Report”). In the

opinion of the Trustee, all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of the assets,

liabilities and Trust corpus of PermRock Royalty Trust at June 30, 2023, and December 31, 2022, and the distributable income and changes

in Trust corpus for the three- and six-month periods ended June 30, 2023, and June 30, 2022, have been included. Distributable income

for such interim periods is not necessarily indicative of distributable income for the full year.

PERMROCK ROYALTY TRUST

CONDENSED STATEMENTS OF ASSETS, LIABILITIES

AND TRUST CORPUS

| | |

June

30, 2023 (unaudited) | | |

December

31, 2022 | |

| ASSETS | |

| | | |

| | |

| Cash and short-term investments | |

$ | 1,496,158 | | |

$ | 1,981,938 | |

| Net Profits Interest (1) | |

| 78,689,996 | | |

| 80,041,113 | |

| TOTAL ASSETS | |

$ | 80,186,154 | | |

$ | 82,023,051 | |

| LIABILITIES AND TRUST CORPUS | |

| | | |

| | |

| Distribution payable to unitholders | |

$ | 496,158 | | |

$ | 981,938 | |

| Cash reserves (2) | |

| 1,000,000 | | |

| 1,000,000 | |

| Trust corpus | |

| 78,689,996 | | |

| 80,041,113 | |

| TOTAL LIABILITIES AND TRUST CORPUS | |

$ | 80,186,154 | | |

$ | 82,023,051 | |

| (1) | | See Note 2 to condensed financial statements for further discussion of the Net Profits Interest. |

| (2) | | The Trustee is authorized to retain cash from distributions received by the Trust in an amount

not to exceed $1.0 million to be used in the event that cash on hand is not sufficient to pay ordinary course administrative expenses

and to provide for future liabilities of the Trust.

|

The accompanying notes to condensed financial statements

are an integral part of these financial statements.

PERMROCK ROYALTY TRUST

CONDENSED STATEMENTS OF DISTRIBUTABLE INCOME

(UNAUDITED)

| | |

Three Months

Ended June 30, | | |

Six Months

Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net profits income | |

$ | 1,573,745 | | |

$ | 3,497,371 | | |

$ | 3,940,422 | | |

$ | 6,284,707 | |

| Interest income | |

| 14,773 | | |

| 960 | | |

| 28,500 | | |

| 997 | |

| Total revenue | |

| 1,588,518 | | |

| 3,498,331 | | |

| 3,968,922 | | |

| 6,285,704 | |

| Expenditures – general and administrative | |

| (351,427 | ) | |

| (294,050 | ) | |

| (528,545 | ) | |

| (554,534 | ) |

| Cash reserves (1) | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Distributable income | |

$ | 1,237,091 | | |

$ | 3,204,281 | | |

$ | 3,440,377 | | |

$ | 5,731,170 | |

| Distributable income per unit (2) | |

$ | 0.101686 | | |

$ | 0.263384 | | |

$ | 0.282792 | | |

$ | 0.471091 | |

| (1) | The Trustee is authorized to retain cash from distributions received by the Trust in an amount not to exceed $1.0 million to be used

in the event that cash on hand is not sufficient to pay ordinary course administrative expenses and to provide for future liabilities

of the Trust.

|

| (2) | Based on 12,165,732 Trust units issued and outstanding as of August 14, 2023. |

The accompanying notes to condensed financial statements

are an integral part of these financial statements.

PERMROCK ROYALTY TRUST

CONDENSED STATEMENTS OF CHANGES IN TRUST

CORPUS (UNAUDITED)

| | |

Three

Months Ended

June 30, | | |

Six

Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Trust corpus, beginning of period | |

$ | 79,246,703 | | |

$ | 82,854,589 | | |

$ | 80,041,113 | | |

$ | 83,821,848 | |

| Amortization of Net Profits Interest | |

| (556,707 | ) | |

| (933,819 | ) | |

| (1,351,117 | ) | |

| (1,901,078 | ) |

| Distributable income | |

$ | 1,237,091 | | |

$ | 3,204,281 | | |

$ | 3,440,377 | | |

$ | 5,731,170 | |

| Distributions declared | |

| (1,237,091 | ) | |

| (3,204,281 | ) | |

| (3,440,377 | ) | |

| (5,731,170 | ) |

| Trust corpus, end of period | |

$ | 78,689,996 | | |

$ | 81,920,770 | | |

$ | 78,689,996 | | |

$ | 81,920,770 | |

The accompanying notes to condensed financial statements

are an integral part of these financial statements.

PERMROCK ROYALTY TRUST

NOTES TO CONDENSED FINANCIAL STATEMENTS

(Unaudited)

PermRock Royalty Trust (the “Trust”) is a Delaware statutory

trust formed on November 22, 2017, under the Delaware Statutory Trust Act pursuant to a trust agreement dated November 22, 2017, as amended

and restated on May 4, 2018, by and among Boaz Energy II, LLC (“Boaz Energy”), as trustor, Simmons Bank, as trustee, and Wilmington

Trust, National Association, as Delaware Trustee (the “Delaware Trustee”) (such amended and restated trust agreement, as amended

to date, the “Trust Agreement”).

In accordance with the successor trustee provisions of the Trust Agreement, Argent Trust

Company, as successor trustee of the Trust, is subject to all terms and conditions of the Trust Agreement. The defined term “Trustee”

as used herein shall refer to Simmons Bank (which maintains its offices at 2200 West 7th Street, Suite 210, P.O. Box 470727, Fort Worth,

Texas 76147) for periods prior to December 30, 2022, and shall refer to Argent Trust Company (which maintains its offices at 3838 Oak

Lawn Ave., Suite 1720, Dallas, Texas 75219) for periods on and after December 30, 2022.

The Trust was created to acquire and hold the Net Profits Interest for the benefit of

the Trust unitholders. In connection with the closing of the initial public offering of Trust units, on May 4, 2018, Boaz Energy conveyed

the Net Profits Interest to the Trust in exchange for Trust units pursuant to a conveyance agreement between Boaz Energy, the Trustee

and the Delaware Trustee (the “Conveyance”). The Net Profits Interest represents an interest in the Underlying Properties.

The Net Profits Interest entitles the Trust to receive 80% of the net profits from the

sale of oil and natural gas production from the Underlying Properties. The Net Profits Interest is passive in nature and neither the

Trust nor the Trustee has any control over, or responsibility for, costs relating to the operation of the Underlying Properties. The

Trust has and will continue to make monthly cash distributions of all of its monthly cash receipts, after deduction of fees and expenses

for the administration of the Trust and any cash reserves, to holders of its Trust units as of the applicable record date on or before

the 10th business day after the record date. Distributions generally relate to sales from a one-month period.

The Trustee may deposit funds awaiting distribution in an account with an FDIC-insured

or national bank, including the Trustee, if the interest paid to the Trust at least equals amounts paid by the Trustee on similar deposits,

and make other short-term investments with the funds distributed to the Trust.

In May 2018, Boaz Energy completed an initial public offering

of 6,250,000 of the 12,165,732 total Trust units outstanding, retaining ownership of 5,915,732 Trust units. As of June 30, 2023, Boaz

Energy owned 5,171,032 Trust units of the 12,165,732 Trust units issued and outstanding.

| 2. | Trust Significant Accounting Policies |

The Trust uses the modified cash basis of accounting to report Trust

receipts of the Net Profits Interest and payments of expenses incurred. The Net Profits Interest represents the right to receive revenues

(primarily oil and natural gas sales), less direct operating expenses, overhead expenses, lease operating expenses, severance and ad valorem

taxes and development expenses of the Underlying Properties, multiplied by 80%, less any payments made or plus any payments received in

connection with the settlement of certain hedge contracts. Cash distributions of the Trust are made based on the amount of cash received

by the Trust pursuant to terms of the Conveyance creating the Net Profits Interest.

The financial statements of the Trust, as prepared on a modified

cash basis, reflect the Trust’s assets, liabilities, Trust corpus, earnings and distributions as follows:

| • | Income from the Net Profits Interest is recorded when distributions are received by the Trust; |

| • | Distributions to Trust unitholders are recorded when declared by the Trust; |

| • | Trust general and administrative expenses (which includes the Trustee’s fees as well as accounting, printing, engineering, legal,

tax advisory and other professional fees) are recorded when paid; cash reserves for Trust expenses may be established by the Trustee for

certain expenditures that would not be recorded as contingent liabilities under United States generally accepted accounting principles

(“GAAP”); |

| • | Amortization of the investment in the Net Profits Interest is calculated on a unit-of-production basis and is charged directly to

Trust corpus, and such amortization does not affect distributions from the Trust; and |

| • | The Trust’s investment in the Net Profits Interest is periodically assessed to determine whether its aggregate value has been

impaired below its total capitalized cost basis. In general, neither the Trustee nor Boaz

Energy view temporarily low prices as an indication of impairment. The markets for crude oil and natural

gas have a history of significant price volatility and though prices will occasionally drop significantly, industry prices over the

long term will continue to be driven by market supply and demand. If events and circumstances indicate

the carrying value may not be recoverable, the Trustee

would use the estimated undiscounted future net cash flows from the Net

Profits Interest to evaluate the recoverability of the Trust assets. If the undiscounted future net cash flows from the Net Profits Interest

are less than the Net Profits Interest carrying value, the Trust would recognize an impairment

loss for the difference between the Net Profits Interest carrying value and the estimated fair value of

the Net Profits Interest. The determination as to whether the Net Profits Interest is impaired is based on the best information available

to the Trustee at the time of the evaluation, including information provided by Boaz Energy such as estimates of future production and

development and operating expenses. Any impairment would be charged directly to the Trust corpus. |

The financial statements of the Trust are prepared on a modified

cash basis of accounting, which is considered to be the most meaningful basis of preparation for a royalty trust because monthly distributions

to the Trust unitholders are based on net cash receipts. Although this basis of accounting is permitted for royalty trusts by the SEC,

the financial statements of the Trust differ from financial statements prepared in accordance with GAAP because net profits income is

not accrued in the month of production, expenses are not recognized when incurred, cash reserves may be established for certain contingencies,

and overpayments received do not need to be paid back and are instead taken from future payments that would not be recorded in GAAP financial

statements. This comprehensive basis of accounting other than GAAP corresponds to the accounting permitted for royalty trusts by the SEC

as specified by Staff Accounting Bulletin Topic 12:E, Financial Statements of Royalty Trusts.

| b. | Interim Financial Statements. |

The accompanying unaudited financial statements have been prepared

by the Trust in accordance with the accounting policies stated in the audited financial statements and notes of the Trust thereto included

in the Trust’s 2022 Annual Report and reflect all adjustments that are, in the opinion of the Trustee, necessary to state fairly

the information in the Trust’s unaudited interim financial statements.

The preparation of financial statements requires the Trust to make

estimates and assumptions that affect the reported amounts of assets and liabilities and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from those estimates. Estimated future cash flows used to determine amortization

and potential impairment of the investment in the Net Profits Interest are subject to change.

| d. | Risks and Uncertainties. |

The Trust’s revenue and distributions are substantially dependent

upon the prevailing and future prices for oil and natural gas, each of which depends on numerous factors beyond the Trust’s control

such as economic conditions, the global political environment, regulatory developments and competition from other energy sources. Oil

and natural gas prices historically have been volatile and may be subject to significant fluctuations in the future.

Contingencies related to the Underlying Properties that are unfavorably

resolved would generally be expected to result in reductions to cash receipts to the Trust in respect of the Net Profits Interest with

corresponding reductions to cash distributions to Trust unitholders. Please see the discussion of litigation in Note 8 to condensed financial

statements.

Tax counsel advised the Trust at the time of formation that for

U.S. federal income tax purposes, the Trust is treated as a grantor trust and will not be subject to federal income tax at the trust level.

Trust unitholders will be treated for such purposes as owning a direct interest in the assets of the Trust, and each Trust unitholder

is taxed directly on its pro rata share of the income and any gain, if sold, attributable to the assets of the Trust and is entitled to

claim its pro rata share of deductions and expenses attributable to the assets of the Trust. Each Trust unitholder should consult his

or her own tax advisor regarding income tax requirements, if any, applicable to such unitholder’s ownership of Trust units.

Pursuant to the Trust Agreement, as of May 31, 2019, the Trustee

began retaining cash from the distributions the Trust receives to be used by the Trust in the event that its cash on hand (including available

cash reserves) is not sufficient to pay ordinary course administrative expenses as they become due. The Trustee is authorized to retain

cash reserves (i) in an amount not to exceed $1.0 million at any one time and (ii) in such amounts as the Trustee in its discretion deems

appropriate to pay for future liabilities of the Trust, but not less than $25,000 per month or more than $100,000 per month. Cash reserves

held by the Trustee for administrative expenses totaled $1,000,000 as of June 30, 2023, and December 31, 2022.

Boaz Energy is entitled under the Conveyance to reserve up to $3.0

million from the net profits for certain future taxes and development or operating expenses. As of December 31, 2022, the balance

of funds held back to cover certain future capital expenses

was $1,478,157 net to the Trust. As of June 30, 2023, the balance of funds held back to cover future capital expenses was $446,157 net

to the Trust.

| 5. | Distributions to Unitholders |

The Trust makes monthly cash distributions of the net amount, if

any, of its monthly cash receipts, after deduction of fees and expenses for the administration of the Trust and cash reserves to holders

of its Trust units as of the applicable record date on or before the 10th business day after the record date.

Based on 12,165,732 Trust units outstanding at each date listed

below, the per unit distributions during the quarter ended June 30, 2023, were as follows:

| Record Date | |

Payment Date | |

Distribution

per Unit | |

| April 28, 2023 | |

May 12, 2023 | |

$ | 0.03088820 | |

| May 31, 2023 | |

June 14, 2023 | |

| 0.03001314 | |

| June 30, 2023 | |

July 17, 2023 | |

| 0.04078418 | |

| | |

| |

$ | 0.10168552 | |

| 6. | Related Party Transactions |

Trustee Administrative Fee. Under the terms of the Trust

Agreement, the Trust pays an annual administrative fee to the Trustee and the Delaware Trustee. The Delaware Trustee’s annual fee

is $4,000. For 2023, the Trustee’s annual administrative fee is approximately $200,357, which is divided into twelve equal monthly

payments throughout the year. The Trustee’s annual administrative fee increased at a rate of 3% per year for the first three years

of the Trust’s existence, increased at a rate of 2% in 2021 and 2022, and increased at a rate of 1% in 2023. The Trustee’s

annual administrative fee will continue to increase at a rate of 1% per year until the 20th anniversary of the Trust’s formation

and then remain flat thereafter. These costs of the Trust, which are included in administration expenses, are deducted by the Trust before

distributions are made to Trust unitholders.

Agreements with Boaz Energy. On May 4, 2018, the Trust entered

into a registration rights agreement for the benefit of Boaz Energy and certain of its affiliates and transferees, pursuant to which

the Trust agreed to register the offering of the Trust units held by Boaz Energy and certain of its affiliates and permitted transferees

upon request by Boaz Energy. The Trust filed a Registration Statement on Form S-3 on April 28, 2022 (the “Registration Statement”)

seeking the registration of 5,801,675 Trust units held by Boaz Energy. The SEC confirmed the effectiveness of the Registration Statement

on May 9, 2022. As of June 30, 2023, Boaz Energy owned 5,171,032 Trust units of the 12,165,732 Trust units issued and outstanding.

Boaz Energy has advised the Trustee that the estimate for Boaz Energy’s

2023 capital budget for the Underlying Properties is $5.2 million, of which approximately $2.8 million had been expended as of June 30,

2023. Based on current oil and gas prices, Boaz anticipates continuing to participate in Crane and Glasscock counties non-operated

drilling and waterflood conformance work in Crane, Terry, Schleicher and Stonewall counties, as well as drilling one new operated well

in each of Crane and Coke counties sometime in 2023. The majority of capital spent in 2023 to date has been on a well deepening

in the Abo Area. The $5.2 million estimate is subject to change based on, among other things, changes in the price of oil and natural

gas, Boaz Energy’s actual capital requirements, the pace of regulatory approvals and the mix of projects.

| 8. | Settlements and Litigation |

On October 1, 2018, a lawsuit styled Thaleia L. Marston, Trustee

of the Marston Trust v. Blackbeard Operating, LLC, et.al, No. 18-10-24761 – CVW in the 143rd District Court in Ward County,

Texas (the “2018 Litigation”) was filed, naming, among others, Boaz Energy and the Trust as defendants. The plaintiff is a

lessor under two leases operated by Blackbeard Operating LLC. The Underlying Properties include the interests of Boaz Energy in some of

the minerals covered by those leases. The litigation sought surface use damages and alleged violations of the terms of the leases, among

other things. The court had set a two-day bench trial to commence May 18, 2022, but on May 10, 2022, the court granted motions for summary

judgment effectively disposing of the plaintiff’s claims. At a status conference conducted on May 12, 2022, the plaintiff confirmed

the court’s rulings disposed of all the plaintiff’s claims. The court held a hearing regarding attorneys’ fees in June

2022. On May 12, 2023, the court entered its final judgment, incorporating its prior order granting the defendants’ motion for summary

judgment and granting defendants’ motion for attorneys’ fees. On June 12, 2023, the plaintiff filed a notice of appeal, notifying

all parties of its intent to appeal the judgment to the Eighth Court of Appeals in El Paso County, Texas.

On July 21, 2023, the Trust declared a cash distribution of $0.039689

per Trust unit based upon production during the month of May 2023.

| | | |

Underlying

Sales Volumes | |

Average

Price | |

| | | |

Oil

(Bbls) | |

Gas

(Mcf) | | |

Oil

(per Bbl) | | |

Gas

(per Mcf) | |

| | May | | |

27,186 | |

| 39,445 | | |

$ | 69.59 | | |

$ | 2.27 | |

| | | | |

| |

| | | |

| | | |

| | |

| ITEM 2. | Trustee’s Discussion and Analysis of Financial Condition and

Results of Operations |

Introduction

The following discussion and analysis is intended to help the reader

understand the Trust’s financial condition, results of operations, liquidity and capital resources. This discussion and analysis

should be read in conjunction with the Trust’s unaudited condensed financial statements and the accompanying notes included in this

Quarterly Report on Form 10-Q (“Quarterly Report”) and the Trust’s audited financial statements and the accompanying

notes included in the Trust’s 2022 Annual Report.

Cautionary Statement Regarding Forward Looking Statements

Certain information included in this Quarterly Report contains,

and other materials filed or to be filed by the Trust with the SEC (as well as information included in oral statements or other written

statements made or to be made by the Trust) may contain or include, forward-looking statements within the meaning of Section 21E of the

Exchange Act and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”). Such forward-looking statements

generally are accompanied by words such as “may,” “will,” “estimate,” “expect,” “predict,”

“project,” “anticipate,” “goal,” “should,” “assume,” “believe,”

“plan,” “intend,” or other words that convey the uncertainty of future events or outcomes. All statements other

than statements of historical fact included in this Quarterly Report are forward-looking statements, including without limitation statements

under this “Trustee’s Discussion and Analysis of Financial Conditions and Results of Operations” and all statements

regarding Boaz Energy and Argent Trust Company’s (as Trustee of the Trust) expectations, beliefs and plans regarding the following:

(i) Boaz Energy’s capital projects, timing and estimated costs, and the resulting impact of those activities on the computation

of the Net Profits Interest; (ii) outside operators’ capital projects and the resulting impact of those activities on the Net Profits

Interest; (iii) implementation or continued use of waterflood projects and workovers and the location of waterflood projects and workovers;

(iv) Boaz Energy’s estimated capital expenditures; (v) the timing of capital expenditures and capital reserve amounts; (vi) the

expected timing of litigation proceedings; (vii) the impact of current litigation matters on the Trust; (viii) Boaz Energy’s staffing

levels or future reductions in staffing on the Underlying Properties; (ix) shut in of wells on the Underlying Properties; and (x) distributions

to Trust unitholders. Such statements are based on certain assumptions of the Trustee, and certain assumptions of information provided

to the Trust by Boaz Energy, the owner of the Underlying Properties; are based on an assessment of, and are subject to, a variety of factors

deemed relevant by the Trustee and Boaz Energy; and involve risks and uncertainties. Certain factors could affect the future results of

the energy industry in general, and Boaz Energy and the Trust in particular, and could cause actual results to differ materially from

those projected in such forward-looking statements. Those factors include, without limitation, the following:

| • | the effect of changes in commodity prices or alternative fuel prices; |

| • | the effects of armed conflict between Russia and Ukraine on global oil and gas markets; |

| • | political and economic conditions in or affecting other oil and natural gas producing regions or countries; |

| • | uncertainties in estimating production and oil and natural gas reserves of the Underlying Properties; |

| • | risks associated with the drilling and operation of oil and natural gas wells; |

| • | the cost of developing the Underlying Properties; |

| • | the ability to maintain anticipated production levels; |

| • | the amount of future direct operating expenses, development expenses and other capital expenditures; |

| • | availability and terms of capital to fund capital expenditures; |

| • | risks associated with Boaz Energy and its ability to transfer operation of the Underlying Properties to third parties without the

approval of Trust unitholders; |

| • | the performance of such third parties contracted by Boaz Energy and their ability or willingness to provide sufficient facilities

and services to Boaz Energy on commercially reasonable terms; |

| • | the effect of existing and future laws and regulatory actions; |

| • | the actions of the Organizations of Petroleum Exporting Countries (“OPEC”); |

| • | conditions in the capital markets; |

| • | competition from others in the energy industry; |

| • | uncertainty in whether development projects will be pursued; |

| • | severe or unseasonable weather that may adversely affect production; |

| • | adequacy of Boaz Energy’s insurance coverage; |

| • | costs to comply with current and future governmental regulation of the oil and natural gas industry, including environmental, health

and safety laws and regulations, and regulations with respect to hydraulic fracturing and the disposal of produced water; |

| • | the effect of existing and future laws and regulatory actions, including real estate, bankruptcy and tax legislation and the ability

to accurately interpret the impact of such laws; |

| • | general economic conditions affecting the Permian Basin; |

| • | risks associated with title deficiencies that may arise with respect to the Underlying Properties and Boaz Energy’s ability

to cure any such defects; |

| • | actions by Boaz Energy, including such that result in conflicts of interest, that adversely affect the Trust; |

| • | the ability to successfully estimate the impact of litigation matters, and certain accounting and tax matters; |

| • | the cost of inflation; and |

| • | the risk factors discussed in Part I of the Trust’s 2022 Annual Report. |

You should not place undue reliance on any forward-looking statements.

All forward-looking statements speak as of the date of this Quarterly Report. The Trust does not undertake any obligation to release publicly

any revisions to the forward-looking statements to reflect events or circumstances after the date of this Quarterly Report or to reflect

the occurrence of unanticipated events, unless required by applicable law.

Boaz Energy Information

As a holder of a net profits interest, the Trust relies on Boaz

Energy for information regarding Boaz Energy and its affiliates; the Underlying Properties, including the operations, acreage, well and

completion count, working interests, production volumes, sales revenues, capital expenditures, operating expenses, reserves, drilling

plans, drilling results and leasehold terms related to the Underlying Properties; and factors and circumstances that have or may affect

the foregoing.

Overview

PermRock Royalty Trust, a Delaware statutory trust formed in November

2017 by Boaz Energy, completed its initial public offering in May 2018. The Trust’s main asset and source of income is the Net Profits

Interest, which entitles the Trust to receive 80% of the net profits from oil and natural gas production from the Underlying Properties.

The Net Profits Interest is passive in nature and neither the Trust nor the Trustee has any management control over or responsibility

for costs relating to the operation of the Underlying Properties.

The Trust is required to make monthly cash distributions of substantially

all of its monthly cash receipts, after deduction of fees and expenses for the administration of the Trust and any cash reserves, to holders

of its Trust units as of the applicable record date on or before the 10th business day after the record date. The Net Profits Interest

is entitled to a share of the profits from and after January 1, 2018, attributable to production occurring on or after such date. The

Trust is not subject to any pre-set termination provisions based on a maximum volume of oil or natural gas to be produced or the passage

of time. The amount of Trust revenues and cash distributions to Trust unitholders depends on, among other things:

| • | production and development costs; |

| • | potential reductions or suspensions of production; and |

| • | the amount and timing of Trust administrative expenses. |

Boaz Energy typically receives payment for oil production 30 to

60 days after it is produced and for natural gas production 60 to 90 days after it is produced.

Properties. The Underlying Properties consist of four operating

areas in the Permian Basin in Texas, aggregating 31,783 gross (22,731 net) acres. The Permian Clearfork area consists of 2,434 net acres

on the Central Basin Platform of the Permian Basin in Hockley and Terry Counties, Texas. The Permian Abo area consists of 1,667 net acres

on the Central Basin Platform of the Permian Basin in Terry and Cochran Counties, Texas. The Permian Shelf area consists of 14,727 net

acres on the Eastern Shelf of the Permian Basin in Glasscock, Schleicher, Stonewall and Coke Counties, Texas. The Permian Platform area

consists of 3,903 net acres on the Central Basin Platform of the Permian Basin in Ward, Crane, Terry and Ector Counties, Texas.

Outlook

Boaz Energy has advised the Trustee that the estimate for Boaz Energy’s

2023 capital budget for the Underlying Properties is $5.2 million, of which approximately $2.8 million had been expended as of June 30,

2023. Based on current oil and gas prices, Boaz anticipates continuing to participate in Crane and Glasscock counties non-operated

drilling and waterflood conformance work in Crane, Terry, Schleicher and Stonewall counties, as well as drilling one new operated well

in each of Crane and Coke counties sometime in 2023. The majority of capital spent in 2023 to date has been on a well deepening

in the Abo Area. The $5.2 million estimate is subject to change based on, among other things, changes in the price of oil and natural

gas, Boaz Energy’s actual capital requirements, the pace of regulatory approvals and the mix of projects.

RESULTS OF OPERATIONS

Distributable Income

Three Months Ended June 30, 2023

For the three months ended June 30, 2023, net profits income received

by the Trust was $1,573,745 compared to $3,497,371 for the same period of the prior year. This decrease in net profits income was primarily

due to a decrease in sales volumes and lower oil and gas prices. See “Computation of Income

from the Net Profits Interest Received by the Trust” below.

After considering interest income of $14,773 and

general and administrative expenditures of $351,427, distributable income for the three months ended June 30, 2023, was $1,237,091,

or $0.101686 per Trust unit. For the three months ended June 30, 2022, total distributable income was $3,204,281,

or $0.263384 per unit.

Interest income was higher for the quarter

ended June 30, 2023, as compared to the prior year, due to higher interest rates. General and administrative expenditures increased by

$57,377 for the three months ended June 30, 2023, as compared to the prior year, primarily due to the

timing of payments.

Pursuant to the Trust Agreement, as of May 31, 2019, the Trustee

is authorized to retain cash reserves for administrative expenses. The Trustee did not retain any cash reserves during the three months

ended June 30, 2023 or June 30, 2022. Total cash reserves were $1,000,000 as of June 30, 2023, and June 30, 2022.

Based on 12,165,732 Trust units outstanding at each date listed

below, the per unit distributions during the quarter ended June 30, 2023, were as follows:

| Record Date | |

Payment Date | |

Distribution

per Unit | |

| April 28, 2023 | |

May 12, 2023 | |

$ | 0.03088820 | |

| May 31, 2023 | |

June 14, 2023 | |

| 0.03001314 | |

| June 30, 2023 | |

July 17, 2023 | |

| 0.04078418 | |

| | |

| |

$ | 0.10168552 | |

Six Months Ended June 30, 2023

For the six months ended June 30, 2023, net profits income received

by the Trust was $3,940,422 compared to $6,284,707 for the same period of the prior year. This decrease in net profits income was primarily

due to a decrease in sales volumes and lower oil and gas prices. See “Computation of Income from the Net Profits Interest

Received by the Trust” below.

After considering interest income of $28,500 and general and administrative

expenditures of $528,545, distributable income for the six months ended June 30, 2023, was $3,440,377, or $0.282792 per Trust unit.

For the six months ended June 30, 2022, total distributable income was $35,731,170, or $0.471091 per Trust unit.

Interest income increased for the six months ended June 30, 2023,

as compared to the prior year, due to higher interest rates. General and administrative expenditures decreased by $25,989 for the six

months ended June 30, 2023, as compared to the prior year, primarily due to timing of payment of expenses.

Pursuant the terms of the Trust Agreement, the Trustee was authorized

to begin retaining cash reserves for administrative expenses in May of 2019. The Trustee did not retain any cash reserves during the six

months ended June 30, 2023, or June 30, 2022. Total cash reserves were $1,000,000 as of June 30, 2023, and December 31, 2022.

Computation of Income from the Net Profits Interest Received

by the Trust

The Net Profits Interest entitles the Trust to receive 80% of the

net profits attributable to Boaz Energy’s interest from the sale of oil and natural gas production from the Underlying Properties.

The Trust’s income from the Net Profits Interest consists of monthly net profits attributable to income from the Underlying Properties.

Because of the interval between the time of production and receipt of net profits income by the Trust, the Trust recognizes production

during the month in which the related net profits income is paid to the Trust. Net profits income for the three months ended June 30,

2023, was based on production during the months of February 2023 through April 2023. The table below outlines the computation of income

from the Net Profits Interest received by the Trust for the three and six months ended June 30, 2023, and June 30, 2022:

| | |

Three

Months Ended

June 30, 2023 | | |

Three

Months Ended

June 30, 2022 | | |

Six Months

Ended

June 30, 2023 | | |

Six Months

Ended

June 30, 2022 | |

| Underlying Properties sales volumes(1): | |

| | | |

| | | |

| | | |

| | |

| Oil (Bbl) | |

| 79,231 | | |

| 88,718 | | |

| 165,148 | | |

| 179,391 | |

| Natural gas (Mcf)(2) | |

| 91,933 | | |

| 104,345 | | |

| 196,219 | | |

| 207,609 | |

| Total sales (Boe) | |

| 94,553 | | |

| 106,108 | | |

| 197,851 | | |

| 213,991 | |

| Average realized sales price: | |

| | | |

| | | |

| | | |

| | |

| Oil (per Bbl) | |

$ | 73.80 | | |

$ | 100.34 | | |

$ | 75.36 | | |

$ | 88.23 | |

| Natural gas (per Mcf) | |

$ | 3.69 | | |

$ | 7.42 | | |

$ | 4.35 | | |

$ | 7.27 | |

| Calculation of net profits: | |

| | | |

| | | |

| | | |

| | |

| Gross profits: | |

| | | |

| | | |

| | | |

| | |

| Oil sales | |

$ | 5,847,488 | | |

$ | 8,929,298 | | |

$ | 12,444,930 | | |

$ | 15,822,314 | |

| Natural gas sales | |

| 339,048 | | |

| 774,687 | | |

| 853,776 | | |

| 1,512,234 | |

| Income from divestitures | |

| 0 | | |

| 1,090,387 | | |

| 0 | | |

| 1,090,387 | |

| Other revenue | |

| 27,002 | | |

| 25,626 | | |

| 49,665 | | |

| 55,042 | |

| Total gross profits | |

$ | 6,213,538 | | |

$ | 10,819,998 | | |

$ | 13,348,371 | | |

$ | 18,479,977 | |

| Costs: | |

| | | |

| | | |

| | | |

| | |

| Direct operating expenses | |

$ | 479,429 | | |

$ | 952,800 | | |

$ | 1,098,897 | | |

$ | 1,749,941 | |

| Lease operating expenses | |

| 1,546,342 | | |

| 1,623,623 | | |

| 3,678,054 | | |

| 3,170,724 | |

| Severance and ad valorem taxes | |

| 461,965 | | |

| 633,109 | | |

| 991,326 | | |

| 935,611 | |

| Development expenses | |

| 1,554,391 | | |

| 2,286,678 | | |

| 2,812,866 | | |

| 3,649,797 | |

| Other expenses | |

| 479,230 | | |

| 427,074 | | |

| 1,131,701 | | |

| 853,020 | |

| Total costs | |

$ | (4,521,357 | ) | |

$ | (5,923,284 | ) | |

$ | (9,712,844 | ) | |

$ | (10,359,093 | ) |

| Net profits | |

$ | 1,692,181 | | |

$ | 4,896,714 | | |

$ | 3,635,527 | | |

$ | 8,120,884 | |

| Percentage allocable to Net Profits Interest | |

| 80 | % | |

| 80 | % | |

| 80 | % | |

| 80 | % |

| Net profits income (before capital reserve) | |

$ | 1,353,745 | | |

$ | 3,917,371 | | |

$ | 2,908,422 | | |

$ | 6,496,707 | |

| Capital reserve (3) | |

| 220,000 | | |

| (420,000 | ) | |

| 1,032,000 | | |

| (212,000 | ) |

| Net Profits Interest audit fee | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Net profits income received by the Trust | |

$ | 1,573,745 | | |

$ | 3,497,371 | | |

$ | 3,940,422 | | |

$ | 6,284,707 | |

| (1) | Quarterly sales volumes are typically reported for a three-month period, and therefore sales volumes for the three months ended June

30, 2023, reflect production volumes for February 2023 through April 2023. Sales volumes for the six months ended June 30, 2023, reflect

production volumes for November 2022 through April 2023. |

| (2) | Sales volumes for natural gas include NGLs. |

| (3) | Boaz Energy is entitled under the Conveyance to reserve up to $3.0 million from the net profits for certain future taxes and expenses.

As of June 30, 2023, Boaz had reserved $446,157 net to the Trust for future capital expenses. |

Important factors used in calculating the Trust’s net profits

income include the volumes of oil and natural gas produced from the Underlying Properties and the realized prices received for the sale

of those minerals, including oil and natural gas liquids, as well as direct operating expenses, lease operating expenses, severance and

ad valorem taxes, development and other expenses and capital reserves.

Sales Volumes

Oil

Oil sales volumes decreased by 9,487 Bbls (10.7%) for the three

months ended June 30, 2023, as compared to the same period in 2022 and 14,243 Bbls (7.9%) for the six months ended June 30, 2023, as compared

to the same period in the prior year. Boaz Energy reports the decrease was primarily due to a decrease in demand and a natural decline

in the producing properties.

Natural Gas

Natural gas sales volumes decreased by 12,412 Mcf (11.9%) for the

three months ended June 30, 2023, as compared to the same period in 2022 and 11,390 Mcf (5.5%) for the six months ended June 30, 2023,

as compared to the same period in the prior year. Boaz Energy reports this decrease was primarily due to a decrease in demand and a natural

decline in the producing properties.

Sales Prices

Oil

The average realized oil price per Bbl decreased for the three and

six months ended June 30, 2023, as compared to the prior year periods primarily due to a decrease in the WTI benchmark oil price.

Natural Gas

The average realized natural gas price per Mcf decreased for the

three and six months ended June 30, 2023, as compared to the prior year periods primarily due to a decrease in the Henry Hub benchmark

price for natural gas.

Qualified De Minimis Sales

Boaz Energy informed the Trust that as of March 1, 2022, it had assigned

its deep interests in certain leases located in Stonewall County, Texas pursuant to a Qualified De Minimis Sale as contemplated by Section

3.02(c) of the Trust Agreement. Boaz Energy received $452,269 in consideration of the sale of its interest, which amount was received

in the second quarter of 2022 and included in calculating the Trust’s April 2022 distributions to unitholders.

Boaz Energy informed the Trust that as of May 25, 2022, it had assigned

its deep interests in certain leases located in Glasscock County, Texas pursuant to a Qualified De Minimis Sale as contemplated by Section

3.02(c) of the Trust Agreement. Boaz Energy received $638,118 in consideration of the sale of its interest, which amount was received

in the second quarter of 2022 and included in calculating the Trust’s June 2022 distributions to unitholders.

As of August 14, 2023, Boaz Energy has not provided notice to the

Trustee regarding a sale of any other of the Underlying Properties.

Costs

Direct Operating Expenses

Direct operating expenses decreased for the three and six months

ended June 30, 2023, as compared to the prior year periods primarily because of fewer projects to

return wells to production in 2023.

Lease Operating Expenses

Lease operating expenses decreased for the three months ended June 30, 2023, as compared

to the prior year period primarily because of fewer projects to return wells to production in 2023.

Lease operating expenses increased for the six months ended June 30, 2023, as compared to the prior

year period because of costs related to additional Permian Abo wells.

Severance and ad Valorem Taxes

Severance and ad valorem taxes

decreased for the three months ended June 30, 2023, as compared to the same period of the prior year, primarily because of lower valuation

of Underlying Properties due to lower pricing. Severance and ad valorem taxes increased for the six months ended June 30, 2023, as compared

to the same period of the prior year, primarily because of a tax refund received in the first quarter of 2022.

Development Expenses Related to the Underlying Properties

Development expenses related

to the Underlying Properties decreased for the three and six months ended June 30, 2023, as compared to the prior year period because

of fewer capital projects.

Other Expenses

Other expenses increased for the three and six months ended June 30, 2023, as compared to the

prior year period, primarily due to annual adjustments in overhead rates.

Capital Reserve

As of June 30, 2023, Boaz Energy had reserved $446,157 net to the

Trust for future capital expenses.

LIQUIDITY AND CAPITAL RESOURCES

The Trust’s principal sources of liquidity and capital are

cash flow generated from the Net Profits Interest, the amounts held by the Trustee as cash reserves to pay future liabilities, and borrowings,

if any to fund administrative expenses. The Trust’s primary uses of cash are distributions to Trust unitholders, payment of Trust

administrative expenses, including, if applicable, any reserves established by the Trustee for future liabilities.

Administrative expenses include the Trustee and Delaware Trustee

fees, accounting, engineering, legal, tax advisory and other professional fees, and tax reporting and distribution expenses. The Trust

is also responsible for paying other expenses incurred as a result of being a publicly traded entity, including costs associated with

annual, quarterly and current reports to the SEC, New York Stock Exchange listing fees, independent auditor fees and registrar and transfer

agent fees. If the Trustee determines that cash on hand and cash to be received in respect of the Net Profits Interest are, or will be,

insufficient to cover the Trust’s liabilities and expenses, the Trustee may cause the Trust to borrow funds to pay liabilities of

the Trust.

As authorized under the Trust Agreement, the Trustee is authorized

to retain cash from the distributions the Trust receives (i) in an amount not to exceed $1.0 million at any one time to be used by the

Trust in the event that its cash on hand (including available cash reserves) is not sufficient to pay ordinary course administrative expenses

as they become due and (ii) in such amounts as the Trustee in its discretion deems appropriate to pay for future liabilities of the Trust,

but not less than $25,000 or more than $100,000 per month. Cash reserves previously retained and currently held by the Trustee for future

administrative expenses total $1,000,000 as of June 30, 2023.

Boaz Energy Capital Expenditure Budget

Boaz Energy has advised the Trustee that the estimate for Boaz Energy’s

2023 capital budget for the Underlying Properties is $5.2 million, of which approximately $2.8 million had been expended as of June 30,

2023. Based on current oil and gas prices, Boaz anticipates continuing to participate in Crane and Glasscock counties non-operated

drilling and waterflood conformance work in Crane, Terry, Schleicher and Stonewall counties, as well as drilling one new operated well

in each of Crane and Coke counties sometime in 2023. The majority of capital spent in 2023 to date has been on a well deepening

in the Abo Area. The $5.2 million estimate is subject to change based on, among other things, changes in the price of oil and natural

gas, Boaz Energy’s actual capital requirements, the pace of regulatory approvals and the mix of projects.

Distributions Declared After Quarter End

On July 21, 2023, the Trust declared a cash distribution of $0.039689

per Trust unit based upon production during the month of May 2023.

| | | |

Underlying Sales Volumes | |

Average Price | |

| | | |

Oil

(Bbls) | |

Gas

(Mcf) | | |

Oil

(per Bbl) | | |

Gas

(per Mcf) | |

| | May | | |

27,186 | |

| 39,445 | | |

$ | 69.59 | | |

$ | 2.27 | |

Off-Balance Sheet Arrangements

As of June 30, 2023, the Trust had no off-balance sheet arrangements.

New Accounting Pronouncements

As the Trust’s financial statements are prepared on the modified

cash basis, most accounting pronouncements are not applicable to the Trust’s financial statements. No new accounting pronouncements

have been adopted or issued that would impact the financial statements of the Trust.

Critical Accounting Policies and Estimates

Refer to Note 2 to the unaudited condensed financial statements

contained in this Quarterly Report and the Trust’s 2022 Annual Report on Form 10-K, including the audited financial statements of

the Trust and notes thereto included therein, for a description of the Trust’s accounting policies and use of estimates.

| ITEM 3. | Quantitative and Qualitative Disclosures about Market Risk |

The Trust is a smaller reporting company as defined by Rule 12b-2

of the Exchange Act and is not required to provide the information required under this Item.

| ITEM 4. | Controls and Procedures |

The Trustee conducted an evaluation of the effectiveness of the

Trust’s disclosure controls and procedures pursuant to Exchange Act Rules 13a-15(a) and 15d-15(a) as of the end of the period covered

by this Quarterly Report. Based on this evaluation, the Trustee has concluded that the disclosure controls and procedures of the Trust

are effective as of June 30, 2023, that the information required to be disclosed by the Trust in its reports filed or submitted under

the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the SEC,

and such information is accumulated and communicated, as appropriate to allow timely decisions regarding required disclosure. In its evaluation

of disclosure controls and procedures, the Trustee has relied, to the extent considered reasonable, on information provided by Boaz Energy.

Due to the nature of the Trust as a passive entity and in light

of the contractual arrangements pursuant to which the Trust was created, including the provisions of the Trust Agreement and the Conveyance,

the Trustee’s disclosure controls and procedures related to the Trust necessarily rely on (A) information provided by Boaz Energy,

including information relating to results of operations, the costs and revenues attributable to the Trust’s interests under the

Conveyance and other operating and historical data, plans for future operating and capital expenditures, reserve information, information

relating to projected production, and other information relating to the status and results of operations of the Underlying Properties,

and (B) conclusions and reports regarding reserves by the Trust’s independent reserve engineers.

During the quarter ended June 30, 2023 there were no changes in

the Trust’s internal control over financial reporting that have materially affected, or are reasonably likely to materially affect,

the Trustee’s internal control over financial reporting. The Trustee notes for purposes of clarification that it has no authority

over, has not evaluated and makes no statement concerning, the internal control over financial reporting of Boaz Energy.

PART II. OTHER

INFORMATION

On October 1, 2018, a lawsuit styled Thaleia L. Marston, Trustee

of the Marston Trust v. Blackbeard Operating, LLC, et.al, No. 18-10-24761 – CVW in the 143rd District Court in Ward County,

Texas (the “2018 Litigation”) was filed, naming, among others, Boaz Energy and the Trust as defendants. The plaintiff is a

lessor under two leases operated by Blackbeard Operating LLC. The Underlying Properties include the interests of Boaz Energy in some of

the minerals covered by those leases. The litigation sought surface use damages and alleged violations of the terms of the leases, among

other things. The court had set a two-day bench trial to commence May 18, 2022, but on May 10, 2022, the court granted motions for summary

judgment effectively disposing of the plaintiff’s claims. At a status conference conducted on May 12, 2022, the plaintiff confirmed

the court’s rulings disposed of all the plaintiff’s claims. The only remaining issue is whether the court will award attorneys’

fees to the prevailing parties. The court held a hearing regarding attorneys’ fees in June 2022. On May 12, 2023, the court entered

its final judgment, incorporating its prior order granting the defendants’ motion for summary judgment and granting their motion

for attorneys’ fees. On June 12, 2023, the plaintiff filed a notice of appeal notifying all parties of its intent to appeal the

judgment to the Eighth Court of Appeals in El Paso County, Texas.

|

Exhibit

No. |

Description |

| 3.1 |

Certificate of Trust of PermRock Royalty Trust (incorporated by reference to Exhibit 3.3 to Registration Statement on Form S-1 (SEC File No. 333-224191) filed on April 6, 2018). |

| 3.2 |

Amended and Restated Trust Agreement of PermRock Royalty Trust, dated May 4, 2018, among Boaz Energy II, LLC, Wilmington Trust, National Association, as Delaware Trustee of PermRock Royalty Trust, and Simmons Bank, as Trustee of PermRock Royalty Trust (incorporated by reference to Exhibit 3.1 to Current Report on Form 8-K (SEC File No. 001-38472) filed on May 8, 2018). |

| 3.3 |

Amendment No. 1 to the Amended and Restated Trust Agreement of PermRock Royalty Trust, dated May 4, 2022 (incorporated by reference to Exhibit 4.1 to Current Report on form 8-K (SEC File No 001-38472) filed on May 6, 2022). |

| 31.1 |

Section 302 Certification.* |

| 32.1 |

Section 906 Certification.* |

The exhibits marked with the asterisk symbol (*) are filed or furnished

with this Quarterly Report on Form 10-Q.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

PERMROCK ROYALTY TRUST |

| |

By: Argent Trust Company, as Trustee

|

| |

By: /s/ Ron E. Hooper

Ron E. Hooper

SVP Royalty Trust Management |

Date: August 14, 2023

The registrant, PermRock Royalty Trust, has no principal executive

officer, principal financial officer, board of directors or persons performing similar functions. Accordingly, no additional signatures

are available, and none have been provided. In signing the report above, the Trustee does not imply that it has performed any such function

or that any such function exists pursuant to the terms of the Trust Agreement under which it serves.

EXHIBIT 31.1

CERTIFICATION

I, Ron E. Hooper, certify that:

1. I have reviewed this Quarterly Report

on Form 10-Q of PermRock Royalty Trust (the “registrant”), for which Argent Trust Company, acts as Trustee;

2. Based on my knowledge, this report does

not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of

the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial

statements, and other financial information included in this report, fairly present in all material respects the financial condition,

distributable income and changes in trust corpus of the registrant as of, and for, the periods presented in this report;

4. I am responsible for establishing and

maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal

control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)), or for causing such controls

and procedures to be established and maintained, for the registrant and have:

| |

a) |

designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under my supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to me by others within those entities, particularly during the period in which this report is being prepared; |

| |

b) |

designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under my supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes; |

| |

c) |

evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report my conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

d) |

disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

5. I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the registrant’s auditors:

| |

a) |

all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| |

b) |

any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

In giving the certifications in paragraphs

4 and 5 above, I have relied to the extent I consider reasonable on information provided to me by Boaz Energy II, LLC.

| |

|

|

|

|

|

|

| Date: August 14, 2023 |

|

|

|

By: |

|

/s/ Ron E. Hooper |

| |

|

|

|

|

|

Ron E. Hooper

SVP Royalty Trust Management

Argent Trust Company |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

EXHIBIT 32.1

CERTIFICATION

In connection with the Quarterly Report

of PermRock Royalty Trust (the “Trust”) on Form 10-Q for the quarterly period ended June 30, 2023, as filed with

the Securities and Exchange Commission on the date hereof (the “Report”), the undersigned, not in its individual capacity

but solely as the trustee of the Trust, certifies pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley

Act of 2002, that to its knowledge:

(1) The Report fully

complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended; and

(2) The information

contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Trust.

| |

|

|

|

|

|

|

| |

|

|

|

|

|

ARGENT TRUST COMPANY, TRUSTEE FOR PERMROCK ROYALTY TRUST |

| |

|

|

|

| Date: August 14, 2023 |

|

|

|

By: |

|

/s/ Ron E. Hooper |

| |

|

|

|

|

|

Ron E. Hooper

SVP Royalty Trust Management

Argent Trust Company |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

A signed original of this written statement

required by Section 906 has been provided to PermRock Royalty Trust and will be retained by PermRock Royalty Trust and furnished

to the Securities and Exchange Commission or its Staff upon request.

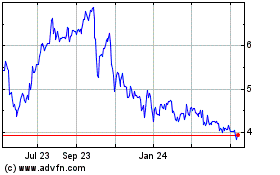

PermRock Royalty (NYSE:PRT)

Historical Stock Chart

From Nov 2024 to Dec 2024

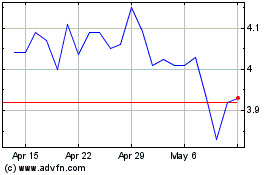

PermRock Royalty (NYSE:PRT)

Historical Stock Chart

From Dec 2023 to Dec 2024