NEW YORK, July 30 /CNW/ -- NYSE - OPY NEW YORK, July 30 /CNW/ -

Expressed in thousands of Three Months ended Six Months ended

dollars, except per share June 30, June 30, amounts 2010 2009 2010

2009

-------------------------------------------------------------------------

(unaudited) Revenue $256,996 $250,724 $503,171 $455,989 Expenses

$240,850 $237,748 $471,165 $445,835 Profit before taxes $16,146

$12,976 $32,006 $10,154 Net profit attributable to Oppenheimer

Holdings Inc. $9,202 $7,130 $18,370 $5,116 Basic earnings (loss)

per share $0.69 $0.55 $1.38 $0.39 Diluted earnings (loss) per share

$0.66 $0.54 $1.32 $0.38 Book value per share at June 30 $35.34

$33.12 - - Business Review Oppenheimer Holdings Inc. reported a net

profit of $9.2 million or $0.69 per share for the second quarter of

2010 compared to a net profit of $7.1 million or $0.55 per share in

the second quarter of 2009. Revenue for the second quarter of 2010

was $257.0 million, compared to revenue of $250.7 million in the

second quarter of 2009, an increase of 2.5%. Client assets

entrusted to the Company and under management totaled approximately

$66.9 billion while client assets under fee-based programs offered

by the asset management groups totaled approximately $14.7 billion

at June 30, 2010 ($55.3 billion and $13.6 billion, respectively, at

June 30, 2009). Net profit for the six months ended June 30, 2010

was $18.4 million or $1.38 per share compared to $5.1 million or

$0.39 per share in the same period of 2009. Revenue for the six

months ended June 30, 2010 was $503.2 million, an increase of 10.3%

compared to $456.0 million in the same period of 2009. The U.S.

economy grew for the third consecutive quarter, albeit at a slower

rate than previous quarters. Labor markets are slowly improving

and, while U.S. consumer confidence has declined in recent weeks,

spending continues to increase. Credit charge-offs seem to have

topped out for this cycle, but the recovery has slowed as a result

of concerns over availability of credit, continuing sluggishness in

the housing recovery, and concerns surrounding the impact on the

credit markets of the European debt crisis. Although European

policymakers have announced stress tests for European banks and aid

to some European sovereign credits, markets continue to see

significant risks to global recovery. The effects of these concerns

have resulted in the lowest interest rates for U.S government debt

in a generation and a weak stock market as investors seek safety in

an uncertain environment. Overall, the Company's revenue improved

in the second quarter of 2010 compared to the second quarter of

2009, boosted by stronger investment banking revenue, higher asset

management advisory fees as well as higher interest income.

Commission income and principal transactions revenue declined in

the second quarter of 2010 compared to the same period in 2009 as

the stock market stalled in early May and declined thereafter due

to a decline in consumer confidence and other factors. Net interest

revenue for the Company, as well as fees derived from money market

funds and FDIC-insured deposits of clients, continue to be

significantly and adversely affected by the low interest rate

environment. In commenting on the Company's results, Albert

Lowenthal, Chairman remarked, "We are pleased with Oppenheimer's

sustained return to profitability and growth. The Company continues

to pursue opportunities for prudently expanding its business.

Improved investment banking results offset lower returns from

trading and investment, while investor transaction activity was

significantly affected by concerns over market direction, the

impact of financial regulation on markets and liquidity, and a

preoccupation with the oil spill along the U.S. Gulf coast. We are

not satisfied with our return on capital for our shareholders in

the current environment. Continued economic expansion and an

eventual move to a higher interest rate environment should permit

higher levels of profitability. The Company remains well positioned

to attract clients and experienced professionals across its

platform in the weeks and months ahead." Highlights of the

Company's results for the three and six months ended June 30, 2010

follow: Revenue and Expenses Revenue - Second Quarter 2010

----------------------------- - Commission revenue was $139.6

million for the second quarter of 2010, a decrease of 2.2% compared

to $142.7 million in the second quarter of 2009. Weak investor

sentiment and volatile markets in the 2010 period contributed to

the decline. - Principal transactions revenue was $16.8 million in

the second quarter of 2010 compared to $30.2 million in the second

quarter of 2009, a decrease of 44.4%. The decrease stems from lower

income from firm investments (a net loss of $144,000 for the second

quarter of 2010 compared to income of $6.4 million for the second

quarter of 2009), and lower fixed income trading revenue ($17.3

million in the second quarter of 2010 compared to $23.5 million in

the second quarter of 2009). The net loss from firm investments

included realized and unrealized gains of approximately $2.2

million which arose from the conversion of the Company's Chicago

Board Options Exchange membership into 80,000 shares by way of an

IPO that closed on June 14, 2010. The Company sold 20,000 shares in

June 2010. - Interest revenue was $11.2 million in the second

quarter of 2010, an increase of 29.2% compared to $8.7 million in

the second quarter of 2009. The increase is primarily attributable

to interest earned on reverse repurchase agreements held by the

government trading desk which began operations in June 2009. -

Investment banking revenue was $36.3 million in the second quarter

of 2010, an increase of 65.8% compared to $21.9 million in the

second quarter of 2009 with increased revenue from equity issuance

of $5.2 million and fee income related to private placements of

$10.8 million, offset by a decrease of $4.3 million in advisory

services. - Advisory fees were $44.0 million in the second quarter

of 2010, an increase of 23.9% compared to $35.5 million in the

second quarter of 2009. Asset management fees increased by $14.1

million in the second quarter of 2010 compared to the same period

in 2009 as a result of an increase in the value of assets under

management of 47.8% during the period. Asset management fees are

calculated based on client assets under management at the end of

the prior quarter which totaled $17.0 billion at March 31, 2010

($11.5 billion at March 31, 2009). This increase was offset by a

decrease of $4.2 million in fees from money market funds as a

result of waivers of $5.7 million on fees that otherwise would have

been due from money market funds ($1.8 million in the second

quarter of 2009). - Other revenue was $9.1 million in the second

quarter of 2010, a decrease of 22.2% compared to $11.7 million in

the second quarter of 2009 primarily as a result of a $6.2 million

decrease in the mark-to- market value of Company-owned life

insurance policies that relate to our employee deferred

compensation programs. This decline was offset by increased fees

generated from Oppenheimer Multifamily Housing & Healthcare

Finance, Inc. ("OMHHF") (formerly called Evanston Financial

Corporation) in the amount of $3.6 million. Revenue - Year-to-date

2010 --------------------------- - Commission revenue was $277.8

million for the six months ended June 30, 2010, an increase of 4.2%

compared to $266.5 million in the same period of 2009. - Principal

transactions revenue was $37.0 million in the six months ended June

30, 2010 compared to $54.9 million in the same period of 2009, a

decrease of 32.7%. The decrease stems from lower income from firm

investments (a net loss of $413,000 for the six months ended June

30, 2010 compared to income of $5.6 million for the same period of

2009 and lower fixed income trading revenue ($36.1 million in the

six months ended June 30, 2010 compared to $46.7 million in the

same period of 2009). These declines were partially offset by an

increase in U.S. government trading income which amounted to $3.3

million in the six months ended June 30, 2010 compared to $1.6

million for the same period of 2009. - Interest revenue was $20.8

million in the six months ended June 30, 2010, an increase of 28.3%

compared to $16.2 million in the same period of 2009. The increase

is primarily attributable to interest earned on reverse repurchase

agreements held by the government trading desk which began

operations in June 2009. - Investment banking revenue was $61.5

million in the six months ended June 30, 2010, an increase of

101.7% compared to $30.5 million in the same period of 2009 with

increased revenue from equity issuance of $15.0 million and fee

income associated with private placements of $11.2 million. -

Advisory fees were $86.8 million in the six months ended June 30,

2010, an increase of 21.8% compared to $71.3 million in the same

period of 2009. Asset management fees increased by $25.6 million in

the six months ended June 30, 2010 compared to the same period in

2009 as a result of an increase in the value of assets under

management during the period. This increase was offset by a

decrease of $9.7 million in fees from money market funds as a

result of waivers of $11.8 million in the six months ended June 30,

2010 on fees that otherwise would have been due from money market

funds ($2.4 million during the six months ended June 30, 2009). -

Other revenue was $19.4 million in the six months ended June 30,

2010, an increase of 16.8% compared to $16.6 million in the same

period of 2009 primarily as a result of a $6.0 million increase in

fees generated from OMHHF in the six months ended June 30, 2010

compared to the same period on 2009. Expenses - Second Quarter 2010

------------------------------ - Compensation and related expenses

decreased 2.1% in the second quarter of 2010 to $164.3 million

compared to $167.9 million in the second quarter of 2009. Decreases

in share-based compensation expense and deferred compensation

expense of $3.9 million and $5.2 million, respectively, were

partially offset by increases in salary and related expenses in the

second quarter of 2010 compared to the same period in 2009. -

Clearing and exchange fees increased 16.2% to $7.8 million in the

second quarter of 2010 compared to $6.7 million in the same period

of 2009 partly due to trade execution costs related to the

government trading business. - Communications and technology

expenses increased 12.2% to $16.3 million in the second quarter of

2010 from $14.5 million in the same period of 2009 due primarily to

increases of $435,000 and $495,000, respectively, in IT-related and

telecommunications expenses in the second quarter of 2010 compared

to the same quarter of 2009. - Occupancy and equipment costs of

$18.3 million in the second quarter of 2010 were flat compared to

$18.3 million in the second quarter of 2009. - Interest expenses

increased 26.7% to $6.4 million in the second quarter of 2010 from

$5.0 million in the same period in 2009 primarily due to interest

expense incurred on positions and repurchase agreements held by the

government trading desk which began operations in June 2009. -

Other expenses increased 10.0% to $27.8 million in the second

quarter of 2010 from $25.3 million in the same period in 2009

primarily due to an increase in legal costs of approximately $2.4

million as a result of increased client litigation and arbitration

activity as well as legal costs to resolve regulatory matters.

Expenses - Year-to-date 2010 ---------------------------- -

Compensation and related expenses increased 4.5% in the six months

ended June 30, 2010 to $322.5 million compared to $308.6 million in

the same period of 2009. Decreases in share-based compensation

expense and deferred compensation expense of $7.2 million and $2.6

million, respectively, were partially offset by increases in salary

and related expenses in the six months ended June 30, 2010 compared

to the same period in 2009. - Clearing and exchange fees increased

15.3% to $14.4 million in the six months ended June 30, 2010

compared to $12.5 million in the same period of 2009 partly due to

trade execution costs related to the government trading business. -

Communications and technology expenses decreased 4.5% to $32.7

million in the six months ended June 30, 2010 from $34.3 million in

the same period of 2009 due primarily to lower market data costs in

the six months ended June 30, 2010 compared to the same period of

2009. - Occupancy and equipment costs of $36.7 million in the six

months ended June 30, 2010 were flat compared to $36.5 million in

the same period of 2009. - Interest expenses increased 10.4% to

$11.7 million in the six months ended June 30, 2010 from $10.6

million in the same period in 2009 primarily due to interest

expense incurred on positions and repurchase agreements held by the

government trading desk which began operations in June 2009. -

Other expenses increased 22.4% to $53.1 million in the six months

ended June 30, 2010 from $43.4 million in the same period in 2009

primarily due to an increase in legal costs of approximately $6.9

million as a result of increased client litigation and arbitration

activity as well as legal costs to resolve regulatory matters.

Stockholders' Equity and Dividend Declaration - At June 30, 2010,

total equity was $473.5 million compared to $451.4 million at

December 31, 2009. - At June 30, 2010, book value per share was

$35.34 (compared to $33.12 at June 30, 2009) and tangible book

value per share was $22.18 (compared to $19.31 at June 30, 2009). -

The Company announced today a quarterly cash dividend in the amount

of $0.11 per share, payable on August 27, 2010 to holders of Class

A non-voting and Class B voting common stock of record on August

13, 2010. OPPENHEIMER HOLDINGS INC. SUMMARY STATEMENT OF OPERATIONS

(UNAUDITED) $ in thousands, except share and per share amounts

-------------------------------------------------------- Three

Months Ended Six Months Ended % % 06/30/10 06/30/09 Change 06/30/10

06/30/09 Change

-------------------------------------------------------- REVENUE

Commissions $139,582 $142,713 -2% $277,779 $266,509 4% Principal

transactions, net 16,778 30,201 -44% 36,957 54,942 -33% Interest

11,198 8,668 29% 20,776 16,190 28% Investment banking 36,336 21,909

66% 61,520 30,501 102% Advisory fees 43,984 35,511 24% 86,778

71,275 22% Other 9,118 11,722 -22% 19,361 16,572 17%

--------------------------- -------------------------- 256,996

250,724 2% 503,171 455,989 10% ---------------------------

-------------------------- EXPENSES Compensation & related

expenses 164,304 167,902 -2% 322,483 308,564 5% Clearing &

exchange fees 7,823 6,735 16% 14,385 12,473 15% Communications

& technology 16,300 14,530 12% 32,740 34,281 -5% Occupancy

& equipment costs 18,262 18,283 0% 36,722 36,516 1% Interest

6,389 5,043 27% 11,690 10,586 10% Other 27,772 25,255 10% 53,145

43,415 22% --------------------------- --------------------------

240,850 237,748 1% 471,165 445,835 6% ---------------------------

-------------------------- ---------------------------

-------------------------- Profit before income taxes 16,146 12,976

24% 32,006 10,154 215% Income tax provision 6,284 5,846 8% 12,780

5,038 154% --------------------------- --------------------------

--------------------------- -------------------------- Net profit

for the period 9,862 7,130 38% 19,226 5,116 276% Less net profit

attributable to non-controlling interest, net of tax 660 - n/a 856

- n/a --------------------------- -------------------------- Net

profit attributable to Oppenheimer Holdings Inc. $9,202 $7,130 29%

$18,370 $5,116 259% ---------------------------

-------------------------- ---------------------------

-------------------------- Profit per share attributable to

Oppenheimer Holdings Inc. Basic $0.69 $0.55 n/a $1.38 $0.39 Diluted

$0.66 $0.54 n/a $1.32 $0.38 Weighted avg. shares outstanding

13,349,551 13,069,014 13,323,410 13,070,547 Actual shares

outstanding 13,352,702 13,172,669 Company Information Oppenheimer,

through its principal subsidiaries, Oppenheimer & Co. Inc. (a

U.S. broker-dealer) and Oppenheimer Asset Management Inc., offers a

wide range of investment banking, securities, investment management

and wealth management services from 94 offices in 26 states and

through local broker-dealers in 4 foreign jurisdictions.

Oppenheimer employs over 3,600 people. The Company offers trust and

estate services through Oppenheimer Trust Company. OPY Credit Corp.

offers syndication as well as trading of issued corporate loans.

Oppenheimer Multifamily Housing & Healthcare Finance, Inc.

(formerly called Evanston Financial Corporation) is engaged in

mortgage brokerage and servicing. In addition, through Freedom

Investments, Inc. and the BUYandHOLD division of Freedom,

Oppenheimer offers online discount brokerage and dollar-based

investing services. Forward-Looking Statements This press release

includes certain "forward-looking statements" relating to

anticipated future performance. For a discussion of the factors

that could cause future performance to be different than

anticipated, reference is made to Factors Affecting

"Forward-Looking Statements" and Part 1A - Risk Factors in

Oppenheimer's Annual Report on Form 10-K for the year ended

December 31, 2009. A.G. Lowenthal, 212 668-8000; or E.K. Roberts,

416 322-1515

Copyright

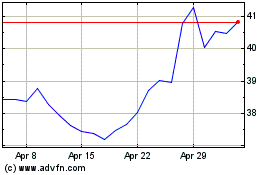

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jul 2023 to Jul 2024