Nuveen Announces Updates to Closed-End Fund Portfolio Management Teams

March 26 2019 - 8:30AM

Business Wire

Portfolio manager responsibilities for four closed-end funds for

which Nuveen Asset Management (NAM) serves as a subadviser have

been updated. Kevin Lorenz has been added to the existing portfolio

management teams for each of the funds below. There will be no

impact on the investment approach, investment strategies or any of

the fund’s investment objectives or policies.

Information on the portfolio management transition is outlined

in the table below.

Portfolio Current Portfolio

Management Team Ticker Fund Name

Management Team Effective 3/26/2019 JGH Nuveen

Global High Income Fund Anders Persson Kevin Lorenz Michael Ainge

Anders Persson Tim Palmer Michael Ainge

Tim Palmer JHD Nuveen High Income December 2019

Target Anders Persson Kevin Lorenz Term Fund Michael Ainge Anders

Persson Tim Palmer Michael Ainge

Tim Palmer JHY Nuveen High Income 2020 Target Term Fund

Anders Persson Kevin Lorenz Michael Ainge Anders Persson Tim Palmer

Michael Ainge Tim Palmer

JHB Nuveen High Income November 2021 Target Anders Persson Kevin

Lorenz Term Fund Michael Ainge Anders Persson Tim Palmer Michael

Ainge Tim Palmer JHAA

Nuveen High Income 2023 Target Term Fund Anders Persson Kevin

Lorenz Michael Ainge Anders Persson Tim Palmer Michael Ainge

Tim Palmer

Kevin Lorenz is responsible for managing Nuveen’s high yield

bond portfolios as part of the Nuveen Asset Management (NAM) and

TIAA Investments organizations. Previously, he served as a director

with TIAA Investments’ Private Placements Team, investing in both

high-grade and high yield securities. He joined the TIAA

organization in 1987 as a generalist focusing on the private

placement market. Kevin holds a BS in accounting from Rider

University and an MBA in finance from Indiana University. He is a

member of the New York Society of Security Analysts.

Tim Palmer and Nuveen have mutually agreed to transition his

role and he will be leaving the firm later this year. He will

continue to have portfolio management responsibilities for these

funds until July 31, 2019 to provide continuity during this

transition.

For more general closed-end fund information and education,

please visit Nuveen’s closed-end fund website.

About Nuveen

Nuveen, the investment manager of TIAA, offers a comprehensive

range of outcome-focused investment solutions designed to secure

the long-term financial goals of institutional and individual

investors. Nuveen has $930 billion in assets under management as of

12/31/18 and operations in 16 countries. Its affiliates offer deep

expertise across a comprehensive range of traditional and

alternative investments through a wide array of vehicles and

customized strategies. For more information, please visit

www.nuveen.com.

Nuveen Securities, LLC, member FINRA and SIPC.

The information contained on the Nuveen website is not a part of

this press release.

794831-INV-AN-03/21

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190326005525/en/

Kristyna Munoz312-917-8343Kristyna.Munoz@nuveen.com

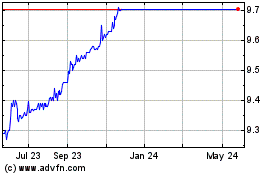

Nuveen Corporate Income ... (NYSE:JHAA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Nuveen Corporate Income ... (NYSE:JHAA)

Historical Stock Chart

From Nov 2023 to Nov 2024