Legal challenge looms in the race to control key component used

in electric-car batteries

By Scott Patterson

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 22, 2018).

A Chilean court is expected to rule in the coming week on a

lawsuit aimed at derailing a deal critics say could create a cartel

for lithium, a key component in batteries used in electric vehicles

and smartphones.

The legal challenge is the latest twist in a nearly yearlong

effort by China's Tianqi Lithium Corp. to acquire a large stake in

Chile's biggest lithium producer, Sociedad Quimica y Minera de

Chile SA, or SQM.

The battle has opened another front in a global scramble to

control the ingredients that make up lithium-ion batteries, the

power packs for much of the world's gadgets and electric cars.

Tianqi agreed in May to buy a 24% stake in SQM from Canadian

mining giant Nutrien Ltd. for $4.1 billion. The sale, following

months of negotiations, was required by regulators in China and

India as a condition for approving the merger of two big Canadian

miners that created Nutrien.

SQM is the world's second-biggest lithium miner by production.

Tianqi also operates a big lithium mine in Australia with chemicals

giant Albemarle Corp., the world's No. 1 producer of lithium based

in Charlotte, N.C.

The SQM deal has won regulatory approval in Chile and other

jurisdictions. Chile's competition regulator gave the agreement a

green light after imposing restrictions on Tianqi, such as

forbidding Tianqi-nominated directors to share SQM's commercially

sensitive information.

Earlier this month, a group of companies controlled by SQM's

biggest shareholder, the Chilean tycoon Julio Ponce Lerou who also

is the son-in-law of the late Chilean dictator Augusto Pinochet,

challenged the deal's approval process in the country's

Constitutional Court.

Mr. Lerou has argued a Tianqi-SQM combination could result in

the leaking of SQM trade secrets to Tianqi partner and SQM rival

Albemarle. Outside critics say the deal also could create an

OPEC-like lithium cartel that might be able to influence pricing

and access to the metal at a time when demand is soaring.

"The biggest concern I have is about those few companies having

monopolistic tendencies," said Jon Hykawy, president of Stormcrow

Capital Ltd., a Toronto research firm that focuses on battery

minerals. There is a risk that "these guys are going to charge what

they want to charge," he said.

A court hearing is set for Monday, Oct 22, with a decision

expected shortly after. If the court throws out the suit, it would

pave the way for the sale of the SQM stake to close in the fourth

quarter. If the court agrees to review the suit, the deal would be

delayed for an indefinite period.

Tianqi and Nutrien say the deal won't be anticompetitive, citing

limitations imposed by Chile's competition regulator, such as

restricting Tianqi from placing its own employees on SQM's

board.

"We look forward to vigorously defending our position before the

Constitutional Court," a Tianqi spokesman said. Albemarle declined

to comment.

SQM itself opposes the sale of the stake. In a statement, it

said the agreement with Chile's competition regulator doesn't

"effectively resolve the risks that it intends to mitigate."

Nutrien expects the court to strike down the lawsuit, company

spokesman Richard Downey said. He said Mr. Ponce is "attempting to

manipulate the legal system" in Chile.

A lawyer for Mr. Ponce didn't respond to requests for

comment.

Lithium, once best known as a treatment for depression, was long

a niche metal. The industry built around mining it out of the

ground was small and low profile.

Demand skyrocketed with the rise of the lithium-ion batteries,

raising scrutiny over who controls the world's supplies. Chile

boasts nearly half of the world's known lithium reserves, according

to the U.S. Geological Survey, and has the lowest cost of

production.

The deal at the center of the suit -- and the separate joint

venture between Tianqi and Albemarle -- draws together three

companies that control about two-thirds of the world's lithium

production, based on 2017 output, according to Benchmark Mineral

Intelligence.

With demand soaring, lithium has joined other once-obscure

metals, like cobalt, as an object of a global scramble. China has

moved ahead in the world-wide race to control cobalt, locking up

access to much of the metal in Congo.

In a similar way, companies are racing to lock up supplies of

lithium. Japan's SoftBank Group this year paid nearly $80 million

for a roughly 10% stake in Canada's Nemaska Lithium Inc. The

trading arm of Toyota Group, parent of Toyota Motor Corp., said it

was taking a 15% stake in Australian lithium producer Orocobre Ltd.

for about $225 million. Tesla Inc. has signed a three-year supply

agreement to secure lithium from an Australian operation partly

owned by SQM.

The biggest deal by far -- and the most disputed -- is Tianqi's

proposed investment in SQM.

The Chilean development agency overseeing the Salar de Atacama

region where most of the country's lithium is produced filed an

objection to the deal with the country's competition regulator

earlier this year. It argued the deal would "gravely distort market

competition." Despite those concerns, Chile's competition regulator

approved the deal.

Write to Scott Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

October 22, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

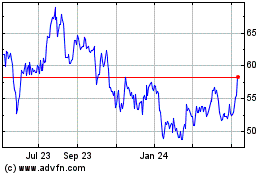

Nutrien (NYSE:NTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

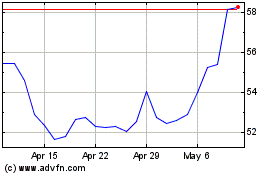

Nutrien (NYSE:NTR)

Historical Stock Chart

From Jul 2023 to Jul 2024