New York Mortgage Trust, Inc. Announces Recent Developments and De-listing from NYSE

September 05 2007 - 4:41PM

PR Newswire (US)

NEW YORK, Sept. 5 /PRNewswire-FirstCall/ -- New York Mortgage

Trust, Inc. (NYSE:NTR), a self-advised real estate investment trust

(REIT) engaged in the investment in and management of high credit

quality residential adjustable rate mortgage (ARM) loans and

mortgage-backed securities (MBS), today seeks to update the

marketplace about recent developments that have occurred since the

Company reported its second quarter 2007 operating results on

August 6, 2007, and highlight certain aspects of the Company's

balance sheet. The Company feels this update is important given the

unprecedented marketplace events that have occurred since the

Company reported its second quarter results. The following

developments have occurred since the Company reported its second

quarter 2007 results: -- De-listing from NYSE; Application to

Another National Securities Exchange - the Company was notified on

September 5, 2007, by the NYSE Regulation, Inc., that trading of

the Company's common stock on the NYSE will be suspended prior to

the market opening on Tuesday, September 11, 2007, and that the

NYSE will take action to de-list the Company's common stock; the

Company has filed an application to list its common stock on

another national securities exchange with details to follow; --

Loan repurchase settlements - as of September 5, 2007, the Company

had settled approximately 77%, based on outstanding principal

balance, of all loan repurchase requests that were outstanding when

the second quarter 2007 operating results were reported; --

Additional loan repurchase requests - as of September 5, 2007,

since the Company reported its second quarter results it had

received one new loan repurchase request relating to a single loan

with an original principal balance of $178,000; -- Liquidity - the

Company entered into a $100 million six-month term repurchase

agreement; and -- Balance Sheet - The Company has only $34 million

of non-Agency MBS, 94% of which are "AAA" rated. Trading on NYSE to

be suspended pending de-listing; application filed to list on

another national securities exchange On September 5, 2007, the NYSE

Regulation, Inc. notified the Company that trading of the Company's

common stock on the NYSE will be suspended prior to the market

opening on Tuesday, September 11, 2007, and that the NYSE will take

action to de-list the Company's common stock. The NYSE's decision

to suspend trading in the Company's common stock was reached in

view of the fact that the Company has fallen below the NYSE's

continued listing standard regarding average global market

capitalization over a consecutive 30 trading day period of not less

than $25 million, which is the minimum threshold for continued

listing. The Company has applied to list its common stock on

another national securities exchange. The Company expects to

complete the new listing process in late September or early

October; however, no assurance can be given that the Company's

common stock will be approved for listing on another national

securities exchange. Details with respect to trading in the

Company's common stock beginning Tuesday, September 11, 2007 are to

be announced by the OTC Bulletin Board on Monday, September 10,

2007. Loan Repurchase Request Settlements Since the Company

reported its second quarter 2007 operating results, it has

continued to negotiate settlements pertaining to loan repurchase

requests for loans originated by its discontinued mortgage lending

business. As of September 5, 2007, the Company has settled

approximately 77% of all repurchase requests that were outstanding

as of August 6, 2007, the date on which second quarter 2007

operating results were reported. Since August 6, 2007, the Company

has received one new loan repurchase request for a single loan with

a $178,000 original principal balance. Liquidity On August 21,

2007, the Company entered into a $100 million six-month term

repurchase agreement that will allow the Company to finance a

portion of its $337 million Agency MBS portfolio. Balance Sheet As

of September 5, 2007, the Company's balance sheet had the following

composition: -- $471 million of securitized loans permanently

financed with collateralized debt obligations (CDO). The CDO debt,

resulting from the Company's in-house loan securitization strategy,

is 100% non recourse to the Company and does not subject the

Company to margin calls; -- $337 million in Agency backed REMIC

floaters; -- $34 million in non-Agency MBS, 94% of which are rated

"AAA". About New York Mortgage Trust New York Mortgage Trust, Inc.

(NYSE:NTR), a self-advised real estate investment trust (REIT)

engaged in the investment in and management of high credit quality

residential adjustable rate mortgage (ARM) loans and mortgage-

backed securities (MBS). As of March 31, 2007, the Company exited

the mortgage lending business. The Company's portfolio is comprised

of securitized, high credit quality, adjustable and hybrid ARM

loans, and purchased MBS. Historically at least 98% of the

portfolio has been rated "AA" or "AAA". As a REIT, the Company is

not subject to federal income tax provided that it distributes at

least 90% of its REIT income to stockholders. Certain statements

contained in this press release may be deemed to be forward-looking

statements that predict or describe future events or trends. The

matters described in these forward-looking statements are subject

to known and unknown risks, uncertainties and other unpredictable

factors, many of which are beyond the Company's control. The

Company faces many risks that could cause its actual performance to

differ materially from the results predicted by its forward-looking

statements, including, without limitation, that a rise in interest

rates may cause a decline in the market value of the Company's

assets, prepayment rates that may change, borrowings to finance the

purchase of assets may not be available or may not be available on

favorable terms, the Company may not be able to maintain its

qualification as a REIT for federal tax purposes, the Company may

experience the risks associated with investing in mortgage loans,

including changes in loan delinquencies, and the Company's hedging

strategies may not be effective. The reports that the Company files

with the Securities and Exchange Commission contain a fuller

description of these and many other risks to which the Company is

subject. Because of those risks, the Company's actual results,

performance or achievements may differ materially from the results,

performance or achievements contemplated by its forward- looking

statements. The information set forth in this news release

represents management's current expectations and intentions. The

Company assumes no responsibility to issue updates to the

forward-looking matters discussed in this press release.

DATASOURCE: New York Mortgage Trust, Inc. CONTACT: Steven R. Mumma,

Co-CEO, President, Chief Financial Officer, of New York Mortgage

Trust, Inc., +1-212-792-0107, ; or Joe Calabrese, General,

+1-212-827-3772, or Julie Tu, Analysts, +1-212-827-3776, both of

Financial Relations Board, for New York Mortgage Trust, Inc.

Copyright

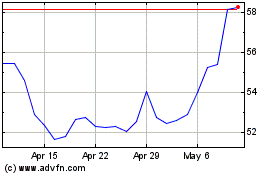

Nutrien (NYSE:NTR)

Historical Stock Chart

From May 2024 to Jun 2024

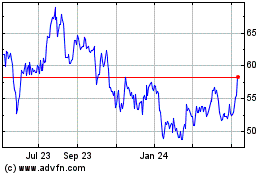

Nutrien (NYSE:NTR)

Historical Stock Chart

From Jun 2023 to Jun 2024