Sale of Mortgage Lending Platforms Completed NEW YORK, May 14

/PRNewswire-FirstCall/ -- New York Mortgage Trust, Inc. (NYSE:NTR),

a self-advised real estate investment trust (REIT) engaged in the

investment in and management of high credit quality residential

adjustable rate mortgage (ARM) loans and mortgage-backed securities

(MBS), today reported results for its first quarter ended March 31,

2007. Highlights: - Completed the sale of its wholesale mortgage

lending platform assets to Tribeca Lending Corp. on February 22,

2007, and the sale of its retail mortgage lending platform assets

to IndyMac Bank, F.S.B. on March 31, 2007. - The sale of the retail

mortgage lending platform and the sale of the wholesale mortgage

lending platform resulted in gross proceeds of approximately $14.0

million and a net gain of approximately $5.2 million. -

Consolidated net loss of $4.7 million, or $0.26 per share, for the

quarter ended March 31, 2007, as compared to a net loss of $9.5

million, or $0.53 per share, for the immediate preceding quarter

ended December 31, 2006 and $1.8 million, or $0.10 per share, for

the quarter ended March 31, 2006. - Total headcount reduced to 35

as of March 31, 2007, from 616 as of December 31, 2006. Headcount

reductions are attributable to exit from lending business and are

expected to decline further as remaining loans held for sale are

liquidated. Results are divided into Discontinued Operations and

Continuing Operations. Discontinued Operations pertain to our

retail and wholesale mortgage lending platforms. Discontinued

Operations (Mortgage Lending): - Loss from Discontinued Operations

of $3.8 million for the quarter ended March 31, 2007, as compared

to a loss of $2.9 million for the quarter ended March 31, 2006.

Included in the loss for the quarter ended March 31, 2007 is a $5.2

million gain from the sale of its retail mortgage lending platform.

- Loan losses due to early payment defaults and loan repurchases in

its Discontinued Operations of $3.2 million in the quarter ended

March 31, 2007, as compared to no losses in the same period in

2006. - Mortgage loans held for sale in our Discontinued Operations

decreased to $59.7 million at March 31, 2007, from $106.9 million

at December 31, 2006. Continuing Operations (Investment Portfolio):

- Loss from its Continuing Operations of $0.9 million for the

quarter ended March 31, 2007, as compared to net income in its

Continuing Operations of $1.1 million for the same period in 2006.

- Investment portfolio's net interest margin for the quarter ended

March 31, 2007 averaged 2 basis points, down from 71 basis points

in the quarter ended March 31, 2006 and 9 basis points for the

quarter ended December 31, 2006. - Average invested portfolio

assets of $1.0 billion for the quarter ended March 31, 2007, as

compared to $1.5 billion for the same period in 2006 and $1.1

billion for the quarter ended December 31, 2006. Comments from

Management David Akre, Vice Chairman and Co-Chief Executive Officer

of New York Mortgage Trust, commented, "As expected, our 2007 first

quarter financial and operating results reflect an important

transition period for our organization. During the quarter we

focused on completing the sale of our retail and wholesale mortgage

lending platforms. By exiting and monetizing the value of these

businesses, we have the opportunity to ultimately eliminate our

taxable REIT subsidiary's operating losses, thus stabilizing book

value." Mr. Akre added, "Over the coming months, with respect to

our discontinued operations, we will concentrate on selling the

remaining mortgage loans held for sale and managing early payment

defaults and repurchase requests related to mortgage loans

previously sold. Simultaneously, as this transition frees up

capital, we will recommit this capital to our existing portfolio

strategy. Our portfolio strategy consists of securitizing

high-credit quality mortgage loans and managing a short duration

interest-rate spread position. Despite an industry-wide relaxation

of credit standards in the past 18 months, our disciplined approach

has resulted in only $57,000 in credit losses to date in our

portfolio." Steve Mumma, Co-Chief Executive Officer, President and

Chief Financial Officer of New York Mortgage Trust, stated "Our

financial results for the quarter ended March 31, 2007 reflect the

challenging market conditions facing many mortgage originators as

well as the continued pressure on our portfolio net interest

margins. The Company was successful in exiting the mortgage

business as of March 31, 2007, which will allow us to focus on

rebuilding our portfolio of high credit quality mortgage assets in

the coming quarter. "During the first quarter, the decline in

earnings was primarily due to a decrease in gain on sale revenues,

an increase in loan losses and a decrease in net interest income

from our investment portfolio. For the first quarter 2007, we

repurchased a total of $5.5 million mortgage loans that were

originated in either 2005 or 2006 and we have approximately $14

million of additional repurchase requests pending, against which

the Company has taken a reserve of $1.7 million. Proceeds from the

origination platform assets sales are expected to cover any

repurchase requests and we continue to believe that, for us, a

majority of the EPD impact will be substantially behind us by the

end of the third quarter." Mortgage Portfolio Activity As of March

31, 2007, the Company's portfolio of high credit quality investment

securities totaled $447.1 million and had a weighted average

purchase price of $100.29. Approximately 20.1% of the securities

purchased are backed by 3/1 hybrid adjustable rate mortgages, 42.6%

are backed by 5/1 hybrid adjustable rate mortgages and the

remaining 37.3% are comprised of short reset floating rate

securities. In addition, loans held in securitization trusts

totaled $540.5 million and had an average purchase price of $100.65

and total delinquencies of 1.61%. Approximately 32.5% of investment

securities and loans held in securitized trusts have interest rate

resets of less than 6 months. As of March 31, 2007, the investment

securities and the loans held in securitization trusts are financed

by $434.9 million of reverse repurchase agreements and $501.9

million of collateralized debt obligations. The following table

summarizes the Company's investment portfolio of residential

mortgage-backed securities and loans owned at March 31, 2007,

classified by relevant categories: Par Value Coupon Carrying Value

Yield Agency REMIC floaters $149,668,983 6.68% $150,045,030 6.58%

Private label floaters 13,985,137 6.12% 13,970,848 6.18% Private

label ARMs 264,893,255 4.80% 263,133,216 5.73% NYMT retained

securities 20,801,701 5.74% 19,913,519 7.48% Loans held in

securitization trusts 540,549,448 5.56% 544,045,978 6.12%

Total/Weighted Average $989,898,524 5.54% $991,108,591 6.11% - The

Company's investment portfolio continues to be comprised

exclusively of high credit quality prime adjustable rate mortgages

and agency securities, 98% rated either "AA" or "AAA". - The loans

held in securitization trusts had 60-days' plus delinquencies of

1.43% or 7 loans and total delinquencies of 1.61% or 9 loans as of

March 31, 2007 and total losses since inception of $57,000. -

Approximately 1/3 of the investment portfolio resetting within six

months. NOTE: Mortgage origination data will be available in the

Company's Quarterly Report on Form 10-Q. Strategic Update Mr. Akre

commented, "We announced in October of 2006, that we were reviewing

our strategic alternatives. That process brought about our exit

from the mortgage lending business. We are now continuing that

process as it relates to the REIT, in order to maximize shareholder

value." Dividend Declaration On Monday, March 12, 2007, the

Company's Board of Directors declared a cash dividend of $0.05 per

share on shares of its common stock for the quarter ending March

31, 2007. The dividend was paid on April 26, 2007 to stockholders

of record as of April 9, 2007. The Company reevaluates the dividend

policy each quarter and makes adjustments as necessary. Investors

are advised that the Company's earnings projections are based on a

number of operational, financial and market assumptions, and if

such assumptions do not materialize, the Company may not be able to

maintain its dividend policy. In addition to such assumptions, the

Company's dividend policy is subject to its Board of Directors

approval and ongoing review, which includes, but is not limited to,

considerations such as the Company's financial condition, earnings

projections and business prospects. The dividend policy does not

constitute an obligation to pay dividends, which only occurs when

the Board of Directors declares a dividend. First quarter 2007

financial and operating data can be viewed in the Company's

Quarterly Report on Form 10-Q, which is expected to be filed

Tuesday, May 15, 2007. Conference Call On Tuesday, May 15, 2007 at

9:00 a.m. Eastern Time, New York Mortgage Trust's executive

management will host a conference call and audio webcast

highlighting the Company's first quarter 2007 financial results.

The conference call dial-in number is 303-205-0033. A live audio

webcast of the conference call can be accessed via the Internet, on

a listen-only basis, at http://www.earnings.com/ or at the Investor

Relations section of the Company's website at

http://www.nymtrust.com/. Please allow extra time, prior to the

call, to visit the site and download the necessary software to

listen to the Internet broadcast. The online archive of the webcast

will be available for approximately 90 days. About New York

Mortgage Trust New York Mortgage Trust, Inc., a self-advised real

estate investment trust (REIT), is engaged in the investment in and

management of high credit quality residential adjustable rate

mortgage (ARM) loans and mortgage-backed securities (MBS). As of

March 31, 2007, the Company has exited the mortgage lending

business. The Company's portfolio is comprised of securitized, high

credit quality, adjustable and hybrid ARM loans, and purchased MBS.

Historically at least 98% of the portfolio has been rated "AA" or

"AAA". As a REIT, the Company is not subject to federal income tax

provided that it distributes at least 90% of its REIT income to

stockholders. Certain statements contained in this press release

may be deemed to be forward-looking statements that predict or

describe future events or trends. The matters described in these

forward-looking statements are subject to known and unknown risks,

uncertainties and other unpredictable factors, many of which are

beyond the Company's control. The Company faces many risks that

could cause its actual performance to differ materially from the

results predicted by its forward-looking statements, including,

without limitation, that a rise in interest rates may cause a

decline in the market value of the Company's assets, prepayment

rates that may change, borrowings to finance the purchase of assets

may not be available on favorable terms, the Company may not be

able to maintain its qualification as a REIT for federal tax

purposes, the Company may experience the risks associated with

investing in mortgage loans, including changes in loan

delinquencies, and the Company's hedging strategies may not be

effective. The reports that the Company files with the Securities

and Exchange Commission contain a fuller description of these and

many other risks to which the Company is subject. Because of those

risks, the Company's actual results, performance or achievements

may differ materially from the results, performance or achievements

contemplated by its forward- looking statements. The information

set forth in this news release represents management's current

expectations and intentions. The Company assumes no responsibility

to issue updates to the forward-looking matters discussed in this

press release. NEW YORK MORTGAGE TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (amounts in thousands, except

per share data) (unaudited) For the three Months Ended March 31,

2007 2006 REVENUE: Interest income: Investment securities and loans

held in securitization trusts $13,713 $17,584 Interest expense:

Investment securities and loans held in securitization trusts

13,084 14,079 Net interest income investment securities and loans

held in securitization trusts 629 3,505 Subordinated debentures 882

885 Net interest (expense) income (253) 2,620 OTHER EXPENSE: Loss

on sale of securities and related hedges - (969) Total other

expense - (969) EXPENSES: Salaries and benefits 345 250 Marketing

and promotion 23 8 Data processing and communications 37 56

Professional fees 100 94 Depreciation and amortization 68 67 Other

74 87 Total expenses 647 562 (LOSS) INCOME FROM CONTINUING

OPERATIONS (900) 1,089 LOSS FROM DISCONTINUED OPERATION-NET OF TAX

(3,841) (2,885) NET LOSS $(4,741) $(1,796) Basic loss per share

$(0.26) $(0.10) Weighted average shares outstanding-basic 18,078

17,967 NEW YORK MORTGAGE TRUST, INC. AND SUBSIDIARIES CONSOLIDATED

BALANCE SHEETS (dollar amounts in thousands) March 31, 2007

December 31, (unaudited) 2006 ASSETS Cash and cash equivalents

$1,734 $969 Restricted cash 2,979 3,151 Investment securities -

available for sale 447,063 488,962 Accounts and accrued interest

receivable 18,272 5,189 Mortgage loans held in securitization

trusts 544,046 588,160 Prepaid and other assets 20,544 20,951

Derivative assets 1,300 2,632 Assets related to discontinued

operations 126,641 212,894 TOTAL ASSETS $1,162,579 $1,322,908

LIABILITIES AND STOCKHOLDERS' EQUITY LIABILITIES: Financing

arrangements, portfolio investments $434,894 $815,313

Collateralized debt obligations 501,853 197,447 Accounts payable

and accrued expenses 6,569 5,871 Subordinated debentures 45,000

45,000 Derivative liabilities 183 - Liabilities related to

discontinued operation 108,960 187,705 Total liabilities 1,097,459

1,251,336 COMMITMENTS AND CONTINGENCIES STOCKHOLDERS' EQUITY:

Common stock, $0.01 par value, 400,000,000 shares authorized,

18,162,749 shares issued and 18,100,531 outstanding at March 31,

2007 and 18,325,187 shares issued and 18,077,880 outstanding at

December 31, 2006 182 183 Additional paid-in capital 98,888 99,509

Accumulated other comprehensive loss (5,470) (4,381) Accumulated

deficit (28,480) (23,739) Total stockholders' equity 65,120 71,572

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $1,162,579 $1,322,908

DATASOURCE: New York Mortgage Trust, Inc. CONTACT: Steven R. Mumma,

Co-CEO, President, Chief Financial Officer, New York Mortgage

Trust, Inc., +1-212-634-2411, ; or Joe Calabrese, General,

+1-212-827-3772, or Julie Tu, Analysts, +1-212-827-3776 Web site:

http://www.nymtrust.com/

Copyright

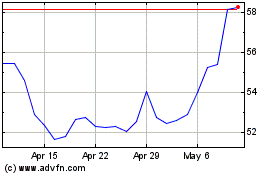

Nutrien (NYSE:NTR)

Historical Stock Chart

From May 2024 to Jun 2024

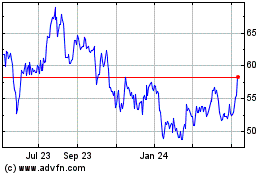

Nutrien (NYSE:NTR)

Historical Stock Chart

From Jun 2023 to Jun 2024