New York Mortgage Trust Declares Fourth Quarter 2006 Common Stock Dividend

December 18 2006 - 6:44PM

PR Newswire (US)

NEW YORK, Dec. 18 /PRNewswire-FirstCall/ -- New York Mortgage

Trust, Inc. (NYSE:NTR), announced today that its Board of Directors

declared a cash dividend of $0.05 per share on shares of its common

stock for the quarter ended December 31, 2006. The dividend is

payable on January 26, 2007, to stockholders of record as of

January 5, 2007. About New York Mortgage Trust New York Mortgage

Trust, Inc., a real estate investment trust (REIT), is engaged in

the origination of and investment in residential mortgage loans

throughout the United States. The Company, through its wholly owned

taxable REIT subsidiary, The New York Mortgage Company, LLC

("NYMC"), originates a broad spectrum of residential loan products

with a focus on high credit quality, or prime, loans. In addition

to prime loans, NYMC also originates jumbo loans, alternative-A

loans, sub-prime loans and home equity or second mortgage loans

through its retail and wholesale origination branch network. The

Company's REIT portfolio is comprised of securitized, high credit

quality, adjustable and hybrid ARM loans, the majority of which,

over time, will be originated by NYMC. As a REIT, the Company is

not subject to federal income tax provided that it distributes at

least 90% of its REIT income to shareholders. This news release

contains forward-looking statements that predict or describe future

events or trends. The matters described in these forward- looking

statements are subject to known and unknown risks, uncertainties

and other unpredictable factors, many of which are beyond the

Company's control. The Company faces many risks that could cause

its actual performance to differ materially from the results

predicted by its forward- looking statements, including, without

limitation, the possibilities that a rise in interest rates may

cause a decline in the market value of the Company's assets, a

decrease in the demand for mortgage loans may have a negative

effect on the Company's volume of closed loan originations,

prepayment rates may change, borrowings to finance the purchase of

assets may not be available on favorable terms, the Company may not

be able to maintain its qualification as a REIT for federal tax

purposes, the Company may experience the risks associated with

investing in real estate, including changes in business conditions

and the general economy, and the Company's hedging strategies may

not be effective. The reports that the Company files with the

Securities and Exchange Commission contain a fuller description of

these and many other risks to which the Company is subject. Because

of those risks, the Company's actual results, performance or

achievements may differ materially from the results, performance or

achievements contemplated by its forward-looking statements. The

information set forth in this news release represents management's

current expectations and intentions. The Company assumes no

responsibility to issue updates to the forward-looking matters

discussed in this news release. DATASOURCE: New York Mortgage

Trust, Inc. CONTACT: A. Bradley Howe, Senior Vice President and

General Counsel of New York Mortgage Trust, Inc., +1-212-634-9401,

; or Joe Calabrese, General, +1-212-827-3772, or Julie Tu,

Analysts, +1-212-827-3776, both of Financial Relations Board

Copyright

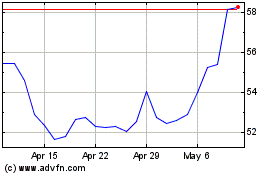

Nutrien (NYSE:NTR)

Historical Stock Chart

From May 2024 to Jun 2024

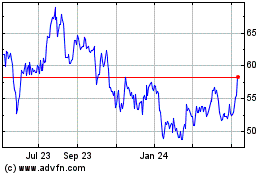

Nutrien (NYSE:NTR)

Historical Stock Chart

From Jun 2023 to Jun 2024