* Consolidated net loss of $0.21 per share for the quarter ended

September 30, 2006 as compared to a net income of $0.01 per share

for the immediate preceding quarter ended June 30, 2006 and net

income of $0.16 per share for the quarter ended September 30, 2005.

NEW YORK, Nov. 7 /PRNewswire-FirstCall/ -- New York Mortgage Trust,

Inc. (NYSE:NTR), a self-advised residential mortgage finance

company organized as a real estate investment trust ("REIT") for

federal income tax purposes, today reported results for the quarter

ended September 30, 2006. Comparison of the Quarters Ended

September 30, 2006 and 2005 * Quarterly loan origination volume of

$602.8 million for the quarter ended September 30, 2006 as compared

to $741.8 million for the immediate preceding quarter ended June

30, 2006 and $1.0 billion for the quarter ended September 30, 2005.

* Consolidated net loss of $3.9 million for the quarter ended

September 30, 2006 as compared to a net income of $178,000 for the

immediate preceding quarter ended June 30, 2006 and net income of

$2.9 million for the quarter ended September 30, 2005. * REIT

(Mortgage Portfolio Management segment) earnings of $1.2 million

for the quarter ended September 30, 2006 as compared to net income

of $2.4 million for the immediately preceding quarter ended June

30, 2006 and net income of $3.8 million for the quarter ended

September 30, 2005. Third Quarter Results For the quarter ended

September 30, 2006, the Company's Mortgage Portfolio Management

segment (REIT operations exclusive of its taxable REIT

subsidiaries) reported net revenues of $1.5 million and a net

income of $1.2 million, or $0.07 per share. The Company's Mortgage

Lending segment (the Company's wholly owned taxable REIT

subsidiaries or "TRS") reported net revenues of $2.4 million

(including $4.0 million in loan losses) and a net loss of $5.1

million for the quarter ended September 30, 2006. On a consolidated

basis, the Company reported net loss of $3.9 million for the

quarter ended September 30, 2006. Comments from Management Steven

B. Schnall, Chairman, President and Co-Chief Executive Officer,

commented, "The deterioration in third quarter operating results is

attributable to continued pressure in both our Mortgage Portfolio

Management and our Mortgage Lending segments. The decline in

earnings in our Mortgage Portfolio Management segment was largely

the result of the persistence of a flat to inverted yield curve and

decreasing net interest spreads due to hedge maturities and, to a

lesser extent, high prepayment rates associated with the re-pricing

of adjustable rate mortgage loans held in our $1.2 billion loan

portfolio. Specifically, our net interest margin declined to 16

basis points, as compared to 78 basis points from the immediately

preceding second quarter of 2006. Additionally, on a positive note,

the net duration gap between the average lives of our assets and

our liabilities declined slightly to approximately six months and

the credit characteristics of our portfolio remains very strong,

with total loan delinquencies of 1.03% of portfolio, loan

delinquencies greater than 90 days representing only 0.41% of

portfolio value and credit losses since inception of only $52,000."

Mr. Schnall added, "Our Mortgage Lending segment also experienced

significant earnings pressure primarily as the result of a 19%

decrease in our mortgage origination volume from the second quarter

of 2006 (as compared to a 14% nationwide decline in mortgage

originations for the same period -- as reported by the Mortgage

Bankers Association) as well as continued pricing pressure on

premiums earned on loans sold to third parties. Our third quarter

earnings were further affected by atypical, and largely

non-recurring, loan losses due primarily to early payment defaults

incurred on sub-prime loans made during the early part of 2006. Of

note, though, is that we have largely discontinued making sub-prime

loans other than in cases where the loans are either prior-approved

by loan purchasers or simply brokered to third parties -- both of

which serve to dramatically reduce our risk going forward.

Additionally, on a positive note, both our loan application and

funding volumes for October 2006 have taken a slight positive turn

as compared to September 2006 results." A breakdown of the

Company's loan originations by payment stream for the quarter ended

September 30, 2006 follows: MORTGAGE LOAN ORIGINATION SUMMARY For

the Third Quarter Ended September 30, 2006 (Dollar amounts in

thousands) Number of Loans Par Amount % of Total Payment Stream

Fixed Rate FHA/VA 82 $12,882 2.1% Conventional Conforming 1,577

270,379 44.9% Conventional Jumbo 132 80,705 13.4% Total Fixed Rate

1,791 363,966 60.4% ARMs FHA/VA 3 1,271 0.2% Conventional 794

237,572 39.4% Total ARMs 797 238,843 39.6% Total 2,588 $602,809

100.0% Loan Purpose Conventional 2,503 $588,656 97.7% FHA/VA 85

14,153 2.3% Total 2,588 $602,809 100.0% Documentation Type Full

Documentation 1,285 $288,726 47.9% Stated Income 545 141,503 23.5%

Stated Income/Stated Assets 323 73,166 12.1% No Documentation 266

63,481 10.5% No Ratio 116 27,091 4.5% Stated Asset 4 578 0.1% Other

49 8,264 1.4% Total 2,588 $602,809 100.0% A breakdown by credit

quality of the Company's loan originations for third quarter 2006

follows: Aggregate Weighted Principal Weighted Average Balance

Percentage Average Average Number of ($ in Of Total Interest

Principal Loans millions) Principal Rate Balance LTV FICO ARM 794

$237.6 39.4% 7.27% $299,209 72.8 704 Fixed- rate 1,709 351.1 58.2%

7.48% 205,433 75.6 711 Subtotal -non-FHA 2,503 588.7 97.6% 7.39%

235,180 74.5 708 FHA - ARM 3 1.2 0.2% 6.06% 423,701 96.1 681 FHA -

fixed-rate 82 12.9 2.2% 6.61% 157,096 95.7 652 Subtotal - FHA 85

14.1 2.4% 6.56% 166,506 95.7 654 Total ARM 797 238.8 39.6% 7.27%

299,678 72.9 704 Total fixed -rate 1,791 364.0 60.4% 7.45% 203,220

76.4 709 Total Origi- nations 2,588 $602.8 100.0% 7.38% $232,925

75.0 707 Purchase mortgages 1,594 $352.6 58.5% 7.47% $221,215 79.0

718 Refinancings 909 236.1 39.1% 7.28% 259,670 67.8 693 Subtotal-

non-FHA 2,503 588.7 97.6% 7.39% 235,180 74.5 708 FHA - purchase 70

11.9 2.0% 6.50% 170,453 96.5 664 FHA - refinancings 15 2.2 0.4%

6.84% 148,087 91.4 604 Subtotal - FHA 85 14.1 2.4% 6.56% 166,506

95.7 654 Total purchase 1,664 364.5 60.5% 7.44% 219,079 79.5 716

Total refinancings 924 238.3 39.5% 7.27% 257,858 68.0 692 Total

Origi- nations 2,588 $602.8 100.0% 7.38% $232,925 75.0 707 Note:

FHA originations are Streamlined Refinance mortgages with low

average balances. All FHA loans are and will continue to be sold or

brokered to third party investors. Investment Activity As of

September 30, 2006, the Company's portfolio of investment

securities totaled $524.0 million and had a weighted average

purchase price of 100.31. Approximately 41% of the securities

purchased have rate resets in less than six months, 8% reset in six

to 24 months and the remaining 51% reset in less than five years.

In addition, loans held in securitization trusts totaled $628.6

million and had an average origination value (purchase price) of

100.66. Approximately 26% of loans held in the portfolio have

interest rate resets of less than 6 months, 9% have resets between

6 months and 24 months and the remaining 65% have resets less than

48 months. The investment securities and the loans held in

securitization trusts are financed in part with debt totaling $1.1

billion at September 30, 2006. The net interest margin on the

Company's mortgage portfolio investments for the quarter ended

September 30, 2006 averaged 16 basis points, down from 78 basis

points in the quarter ended June 30, 2006. This decrease in spreads

is primarily due to hedge maturities and, to a lesser extent, to

the re- pricing of adjustable rate mortgage loans held in our

portfolio. The following table summarizes the Company's investment

portfolio of residential mortgage-backed securities and loans owned

at September 30, 2006, classified by relevant categories: Par Value

Coupon Carrying Value Yield Agency REMIC floaters $178,388,984

6.68% $178,990,895 6.56% Private label floaters 27,573,587 6.11%

27,499,840 6.28% Private label ARMs 296,201,236 4.81% 293,237,365

6.03% NYMT retained securities 25,111,629 5.65% 24,240,627 7.91%

Loans held in securitization trusts 624,525,836 5.31% 628,624,669

6.00% Total/Weighted Average $1,151,801,272 5.42% $1,152,593,396

6.14% Conference Call On Wednesday, November 8, 2006 at 10:00 a.m.

Eastern time, New York Mortgage Trust's executive management will

host a conference call and audio webcast highlighting the Company's

third quarter financial results. The conference call dial-in number

is 303-262-2138. A live audio webcast of the conference call can be

accessed via the Internet, on a listen-only basis, at

http://www.earnings.com/ or at the Investor Relations section of

the Company's website at http://www.nymtrust.com/. Please allow

extra time, prior to the call, to visit the site and download the

necessary software to listen to the Internet broadcast. The online

archive of the webcast will be available for approximately 90 days.

About New York Mortgage Trust New York Mortgage Trust, Inc., a real

estate investment trust (REIT), is engaged in the origination of

and investment in residential mortgage loans throughout the United

States. The Company, through its wholly owned taxable REIT

subsidiary, The New York Mortgage Company, LLC ("NYMC"), originates

a broad spectrum of residential loan products with a focus on high

credit quality, or prime, loans. In addition to prime loans, NYMC

also originates jumbo loans, alternative-A loans, sub-prime loans

and home equity or second mortgage loans through its retail and

wholesale origination branch network. The Company's REIT portfolio

is comprised of securitized, high credit quality, adjustable and

hybrid ARM loans, the majority of which, over time, will be

originated by NYMC. As a REIT, the company is not subject to

federal income tax provided that it distributes at least 90% of its

REIT taxable income to its stockholders. This news release contains

forward-looking statements that predict or describe future events

or trends. The matters described in these forward- looking

statements are subject to known and unknown risks, uncertainties

and other unpredictable factors, many of which are beyond the

Company's control. The Company faces many risks that could cause

its actual performance to differ materially from the results

predicted by its forward- looking statements, including, without

limitation, the possibilities that a rise in interest rates may

cause a decline in the market value of the Company's assets, a

decrease in the demand for mortgage loans may have a negative

effect on the Company's volume of closed loan originations,

prepayment rates may change, borrowings to finance the purchase of

assets may not be available on favorable terms, the Company may not

be able to maintain its qualification as a REIT for federal tax

purposes, the Company may experience the risks associated with

investing in real estate, including changes in business conditions

and the general economy, and the Company's hedging strategies may

not be effective. The reports that the Company files with the

Securities and Exchange Commission contain a fuller description of

these and many other risks to which the Company is subject. Because

of those risks, the Company's actual results, performance or

achievements may differ materially from the results, performance or

achievements contemplated by its forward-looking statements. The

information set forth in this news release represents management's

current expectations and intentions. The Company assumes no

responsibility to issue updates to the forward-looking matters

discussed in this news release. NEW YORK MORTGAGE TRUST, INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (Dollar amounts

in thousands, except per share data) (unaudited) For the Nine

Months Ended For the Three Months Ended September 30, September 30,

2006 2005 2006 2005 REVENUE: Interest income: Investment securities

and loans held in securitization trusts $50,050 $40,523 $16,998

$13,442 Loans held for investment - 5,388 - 1,783 Loans held for

sale 12,155 10,573 3,880 4,473 Total interest income 62,205 56,484

20,878 19,698 Interest expense: Investment securities and loans

held in securitization trusts 42,320 30,090 15,882 10,751 Loans

held for investment - 3,911 - 1,366 Loans held for sale 9,284 7,284

3,337 3,441 Subordinated debentures 2,656 1,095 877 601 Total

interest expense 54,260 42,380 20,096 16,159 Net interest income

7,945 14,104 782 3,539 OTHER INCOME (EXPENSE): Gain on sales of

mortgage loans 14,362 21,634 4,311 8,985 Brokered loan fees 8,672

7,181 2,402 2,647 (Loss) gain on sale of current period securitized

loans (747) - - - (Loss) gain on sale of securities and related

hedges (529) 2,207 440 1,286 Loan losses (4,077) - (4,077) -

Miscellaneous income (expense) 310 195 43 91 Total other income

17,991 31,217 3,119 13,009 EXPENSES: Salaries and benefits 17,720

23,875 5,378 7,302 Brokered loan expenses 6,609 5,689 1,674 1,483

Occupancy and equipment 3,871 4,981 1,256 1,265 Marketing and

promotion 1,643 3,900 427 1,310 Data processing and communications

1,938 1,807 524 618 Office supplies and expenses 1,464 1,909 426

651 Professional fees 3,329 2,812 798 966 Travel and entertainment

409 707 126 261 Depreciation and amortization 1,625 1,069 539 302

Other 1,308 1,084 536 531 Total expenses 39,916 47,833 11,684

14,689 (LOSS) INCOME BEFORE INCOME TAX BENEFIT (13,980) (2,512)

(7,783) 1,859 Income tax benefit 8,494 5,880 3,915 1,000 NET (LOSS)

INCOME $(5,486) $3,368 $(3,868) $2,859 Basic (loss) income per

share $(0.31) $0.19 $(0.21) $0.16 Diluted (loss) income per share

$(0.31) $0.19 $(0.21) $0.16 Weighted average shares outstanding

-basic 17,975 17,855 18,025 17,958 Weighted average shares

outstanding -diluted 17,975 18,121 18,025 18,242 NEW YORK MORTGAGE

TRUST, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (Dollar

amounts in thousands) September 30, December 31, 2006 2005

(unaudited) ASSETS Cash and cash equivalents $6,879 $9,056

Restricted cash 1,979 5,468 Investment securities - available for

sale 523,969 716,482 Due from loan purchasers 132,950 121,813

Escrow deposits - pending loan closings 1,622 1,434 Accounts and

accrued interest receivable 9,256 14,866 Mortgage loans held for

sale 109,197 108,271 Mortgage loans held in securitization trusts

628,625 776,610 Mortgage loans held for investment - 4,060 Prepaid

and other assets 27,118 16,505 Derivative assets 3,402 9,846

Property and equipment, net 6,838 6,882 TOTAL ASSETS $1,451,835

$1,791,293 LIABILITIES AND STOCKHOLDERS' EQUITY LIABILITIES:

Financing arrangements, portfolio investments $886,956 $1,166,499

Financing arrangements, loans held for sale/for investment 208,285

225,186 Collateralized debt obligations 203,550 228,226 Due to loan

purchasers 11,677 1,652 Accounts payable and accrued expenses

14,736 22,794 Subordinated debentures 45,000 45,000 Derivative

liabilities 686 394 Other liabilities 202 584 Total liabilities

1,371,092 1,690,335 COMMITMENTS AND CONTINGENCIES STOCKHOLDERS'

EQUITY: Common stock, $0.01 par value, 400,000,000 shares

authorized, 18,327,371 shares issued and 18,077,160 outstanding at

September 30, 2006 and 18,258,221 shares issued and 17,984,843

outstanding at December 31, 2005 183 183 Additional paid-in capital

100,324 107,573 Accumulated other comprehensive (loss) income

(5,570) 1,910 Accumulated deficit (14,194) (8,708) Total

stockholders' equity 80,743 100,958 TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY $1,451,835 $1,791,293 NEW YORK MORTGAGE TRUST,

INC. AND SUBSIDIARIES SELECTED SEGMENT REPORTING (Dollar amounts in

thousands) For the Nine Months Ended September 30, 2006 Mortgage

Portfolio Mortgage Management Lending Segment Segment Total Total

revenue $7,149 $18,787 $25,936 Total expense 1,473 29,949 31,422

Net income (loss) $5,676 $(11,162) $(5,486) Total assets $1,163,802

$288,033 $1,451,835 For the Nine Months Ended September 30, 2005

Mortgage Portfolio Mortgage Management Lending Segment Segment

Total Total revenue $14,118 $31,203 $45,321 Total expense 2,527

39,426 41,953 Net income (loss) $11,591 $(8,223) $3,368 For the

Three Months Ended September 30, 2006 Mortgage Portfolio Mortgage

Management Lending Segment Segment Total Total revenue $1,504

$2,397 $3,901 Total expense 279 7,490 7,769 Net income (loss)

$1,225 $(5,093) $(3,868) For the Three Months Ended September 30,

2005 Mortgage Portfolio Mortgage Management Lending Segment Segment

Total Total revenue $4,394 $12,154 $16,548 Total expense 599 13,090

13,689 Net income (loss) $3,795 $(936) $2,859 DATASOURCE: New York

Mortgage Trust, Inc. CONTACT: Steven R. Mumma, Chief Financial

Officer, +1-212-634-2411, ; or Joe Calabrese, General,

+1-212-827-3772, or Julie Tu, Analysts, +1-212-827-3776, both of

Financial Relations Board Web site: http://www.nymtrust.com/

Copyright

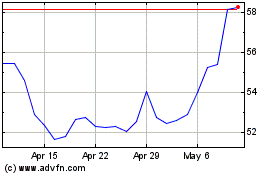

Nutrien (NYSE:NTR)

Historical Stock Chart

From May 2024 to Jun 2024

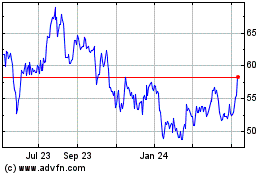

Nutrien (NYSE:NTR)

Historical Stock Chart

From Jun 2023 to Jun 2024