Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

March 14 2022 - 5:28PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For

the month of March, 2022

Commission

File Number 001-41129

Nu

Holdings Ltd.

(Exact

name of registrant as specified in its charter)

Nu

Holdings Ltd.

(Translation

of Registrant's name into English)

Campbells

Corporate Services Limited, Floor 4, Willow House, Cricket Square, KY1-9010 Grand Cayman, Cayman Islands

+1

345 949 2648

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F (X) Form 40-F

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No

(X)

Grand

Cayman, Cayman Islands, March 14, 2022 – Nu Holdings Ltd. ("Nu" or the "Company") hereby informs

its shareholders and the market, and in consideration of the new prudential rules for payment institutions issued by the Brazilian Central

Bank of Brazil ("BCB") last March 11th, 2022, the following:

| 1. | | we have a strong

capital position that is adequate to the requirements of the new regulatory framework. Given that the capital requirement has never been

considered a competitive advantage, this change does not have a significant impact on our business model or our ability to grow. |

| 2. | | the phased implementation

schedule of the capital requirement has been extended as compared to the proposal presented in Public Consultation Notice No. 78, dated

November 2020 ("ECP 78"), resulting in a lower capital requirement in 2023 and 2024 than our original expectations based on the ECP 78. |

| 3. | | our preliminary

estimates indicate, at the end of the implementation of the new standards in January 2025, a conglomerate-wide capital requirement between

10 to 15% higher than the level originally anticipated in ECP 78. |

| 4. | | these estimates

foresee an increase in the capital requirements applicable to our credit card business (bringing them in line with Basel III guidelines),

but keeping the capital requirements for our other businesses nearly unchanged. |

| 5. | | a more detailed

evaluation of the effects of the new regulatory framework depends on the edition of other rules by the BCB, such as the object of the

Public Consultation Notice ECP No. 80, on the calculation of the capital requirement of exposures to credit risk. |

We

will continue to monitor the new rules from BCB and will keep the market informed of any new developments.

Contacts:

Investor

Contact:

Guilherme

Lago

investors@nubank.com.br

Media

Contact:

Leila

Suwwan

press@nubank.com.br

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Nu Holdings Ltd. |

| |

|

| |

By: |

/s/ Guilherme

Lago |

| |

|

Guilherme

Lago

Chief Financial Officer |

Date: March

14, 2022

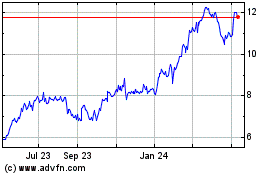

Nu (NYSE:NU)

Historical Stock Chart

From Jun 2024 to Jul 2024

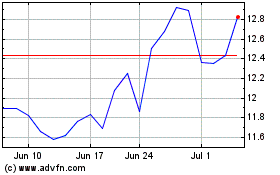

Nu (NYSE:NU)

Historical Stock Chart

From Jul 2023 to Jul 2024