UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2015 (February 11, 2015)

| | | |

| Commission File Number | Registrant; State of Incorporation Address; and Telephone Number | I.R.S. Employer Identification No. |

| | | |

| 1-5324 | NORTHEAST UTILITIES (a Massachusetts voluntary association) 300 Cadwell Drive Springfield, Massachusetts 01104 Telephone number: (413) 785-5871 | 04-2147929 |

| 0-00404 | THE CONNECTICUT LIGHT AND POWER COMPANY (a Connecticut corporation) 107 Selden Street Berlin, Connecticut 06037-1616 Telephone: (860) 665-5000 | 06-0303850 |

| 1-2301 | NSTAR ELECTRIC COMPANY (a Massachusetts corporation) 800 Boylston Street Boston, Massachusetts 02199 Telephone number: (617) 424-2000 | 04-1278810 |

| 1-6392 | PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE (a New Hampshire corporation) Energy Park 780 North Commercial Street Manchester, New Hampshire 03101-1134 Telephone: (603) 669-4000 | 02-0181050 |

| 0-7624 | WESTERN MASSACHUSETTS ELECTRIC COMPANY (a Massachusetts corporation) 300 Cadwell Drive Springfield, Massachusetts 01104 Telephone number: (413) 785-5871 | 04-1961130 |

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 2

Financial Information

Item 2.02

Results of Operations and Financial Conditions.

On February 11, 2015, Northeast Utilities, doing business as Eversource Energy (“Eversource Energy”), issued a news release announcing its unaudited results of operations for the three and twelve month periods ended December 31, 2014, and related financial information for certain of its subsidiaries as of and for the same periods. A copy of the news release and related unaudited financial reports are attached as Exhibits 99.1 and 99.2, and are incorporated herein by reference thereto.

The information contained in this Item 2.02, including Exhibits 99.1 and 99.2, shall not be deemed “filed” with the Securities and Exchange Commission (“SEC”) nor incorporated by reference in any registration statement filed by Eversource Energy, The Connecticut Light and Power Company, NSTAR Electric Company, Public Service Company of New Hampshire or Western Massachusetts Electric Company under the Securities Act of 1933, as amended (the “Securities Act”), unless specified otherwise.

Section 7

-

Regulation FD

Item 7.01

Regulation FD Disclosure.

On February 12, 2015, Eversource Energy will make an investor presentation to the financial community discussing the company’s financial performance and outlook. Attached as Exhibit 99.3 and incorporated herein by reference are the slides to be used by Eversource Energy in the investor presentation, which will be simultaneously webcast to the public.

The information contained in this Item 7.01, including Exhibit 99.3, shall not be deemed “filed” with the SEC nor incorporated by reference into any registration statement filed by Eversource Energy, The Connecticut Light and Power Company, NSTAR Electric Company, Public Service Company of New Hampshire or Western Massachusetts Electric Company under the Securities Act, unless specified otherwise.

Section 9

-

Financial Statements and Exhibits

Item 9.01

Financial Statements and Exhibits.

| | |

| Exhibit Number | Description |

| Exhibit 99.1 | News Release of Eversource Energy, dated February 11, 2015. |

| Exhibit 99.2 | Unaudited Consolidated Statements of Income for the years ended December 31, 2014, 2013 and 2012 and Unaudited Consolidated Statements of Income for the three months ended December 31, 2014 and 2013. |

| Exhibit 99.3 | Investor presentation, February 12, 2015. |

[The remainder of this page left blank intentionally.]

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

| | |

| | NORTHEAST UTILITIES THE CONNECTICUT LIGHT AND POWER COMPANY NSTAR ELECTRIC COMPANY PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE WESTERN MASSACHUSETTS ELECTRIC COMPANY (Registrants) |

|

February 11, 2015 |

By: /S/ JAY S. BUTH Jay S. Buth Vice President, Controller and Chief Accounting Officer |

3

EXHIBIT INDEX

| | |

| Exhibit Number | Description |

| Exhibit 99.1 | News Release of Eversource Energy, dated February 11, 2015. |

| Exhibit 99.2 | Unaudited Consolidated Statements of Income for the years ended December 31, 2014, 2013 and 2012 and Unaudited Consolidated Statements of Income for the three months ended December 31, 2014 and 2013. |

| Exhibit 99.3 | Investor presentation, February 12, 2015. |

EXHIBIT 99.1

![[newsrelease002.gif]](newsrelease002.gif)

Eversource Energy Reports Year-End 2014 Results

(HARTFORD, Conn. and BOSTON, Mass. – February 11, 2015) Northeast Utilities (NYSE: NU), which last week began operating as Eversource Energy, today reported full-year 2014 earnings of

$819.5 million, or $2.58 per share, compared with full-year 2013 earnings of $786 million, or $2.49 per share. Excluding integration costs, Eversource earned $841.6 million, or $2.65 per share, in 2014, compared with $799.8 million, or $2.53 per share1, in 2013.

In the fourth quarter of 2014, Eversource Energy earned $221.6 million, or $0.69 per share, compared with $177.4 million, or $0.56 per share, in the fourth quarter of 2013. Fourth-quarter results include after-tax integration costs of $8.7 million in 2014 and $3.2 million in 2013. Excluding those costs, Eversource earned $230.3 million, or $0.72 per share, in the fourth quarter of 2014, compared with $180.6 million, or $0.57 per share1, in the fourth quarter of 2013. The very strong fourth quarter results were driven by improved transmission segment earnings and significantly lower operation and maintenance costs.

Thomas J. May, Eversource Energy chairman, president and chief executive officer, said, “Operationally and financially, we had a very strong finish to 2014, which provides us with considerable momentum heading into 2015 as we continue to address and resolve the most difficult energy supply challenges facing New England.”

May highlighted a number of accomplishments in 2014:

·

Strong electric service reliability and the company’s best overall system performance on record;

·

Significant improvement in the company’s customer service metrics;

·

More than 10,600 new natural gas heating customers at Eversource Energy’s natural gas utilities;

·

Strong execution of approximately $723 million of electric transmission projects, including completion of most of the company’s section of the Interstate Reliability Project in northeastern Connecticut;

·

Announcement of the Access Northeast proposal with Spectra Energy to significantly enhance New England’s access to natural gas supplies; and

·

Further improvement of top-tier industry credit ratings.

2015 and Long-Term Earnings Guidance

Also today, Eversource Energy projected 2015 earnings per share of between $2.75 per share and $2.90 per share and long-term annual earnings per share growth through 2018 of between 6 percent and 8 percent, using 2014 earnings per share as the base.

Electric Transmission

Eversource Energy’s transmission segment earned $295.4 million for the full year of 2014, compared with

$287 million for the full year of 2013, and $88.6 million for the fourth quarter of 2014, compared with $71.6 million for the fourth quarter of 2013. The earnings improvement for the fourth quarter of 2014 in part reflects continued investment in the Eversource transmission system. Full-year results include a net charge of $22.4 million, or $0.07 per share, recorded in 2014 to reflect refunds associated with a Federal Energy Regulatory Commission (FERC) decision lowering the return on equity for all of New England’s electric transmission owners. The FERC decision was retroactive to October 2011.

Electric Distribution and Generation

Eversource Energy’s electric distribution and generation segment earned $462.4 million for the full year of 2014, compared with $427.0 million for the full year of 2013. Full year 2014 results benefited from higher revenues and lower operation and maintenance costs, partially offset by higher depreciation and property tax expense. In the fourth quarter of 2014, the electric distribution and generation segment earned

$113.3 million, compared with earnings of $79.5 million in the fourth quarter of 2013.

Earnings of Electric Utility Subsidiaries (net of preferred dividends)

The Connecticut Light and Power Company earned $282.2 million in 2014, compared with earnings of $273.9 million in 2013. Improved results primarily reflect lower operation and maintenance costs, partially offset by the aforementioned transmission charge, a 1.6 percent decline in retail sales, and higher depreciation and property tax expense.

NSTAR Electric Company earned $301.1 million in 2014, compared with earnings of $266.4 million in 2013. Improved results primarily reflect lower operation and maintenance costs and higher transmission earnings.

Public Service Company of New Hampshire earned $113.9 million in 2014, compared with $111.4 million in 2013. Improved 2014 results were due primarily to higher transmission earnings resulting from a higher level of investment.

Western Massachusetts Electric Company (WMECO) earned $57.8 million in 2014, compared with

$60.4 million in 2013. WMECO’s 2014 results declined largely due to lower transmission earnings due to the FERC ruling on New England transmission ROEs.

Natural Gas Distribution

Eversource Energy’s natural gas distribution segment, which includes Yankee Gas Services Company and NSTAR Gas Company, earned $72.3 million in 2014, compared with earnings of $60.9 million for the full year 2013, and $28.1 million in the fourth quarter of 2014, compared with $26.8 million in the fourth quarter of 2013. Improved full-year results reflect higher revenues due to customer additions and a much colder first quarter in 2014, compared with 2013. Higher fourth quarter 2014 results, compared with 2013, reflect customer growth and lower operation and maintenance costs, partially offset by milder weather in 2014.

Eversource Energy parent and other companies

Eversource Energy parent and other companies earned $11.5 million in 2014, compared with earnings of $24.9 million for the full year of 2013. Both figures exclude after-tax integration costs, which totaled $22.1 million in 2014 and $13.8 million in 2013. In the fourth quarter of 2014, Eversource parent and other companies earned $0.3 million, excluding $8.7 million of after-tax integration costs, compared with earnings of $2.7 million in the fourth quarter of 2013, excluding $3.2 million of after-tax integration-related costs. Lower full-year results primarily reflect a higher effective tax rate in 2014.

The following table reconciles earnings per share for the fourth quarter and year ended December 31, 2014 and 2013.

| | | | |

| | | Fourth Quarter | Full Year |

| 2013 | Reported EPS | $0.56 | $2.49 |

| | 2013 integration costs | $0.01 | $0.04 |

| | 2013 EPS before merger costs | $0.57 | $2.53 |

| | Higher transmission earnings in 2014 | $0.05 | $0.02 |

| | Higher electric distribution revenues in 2014 | $0.02 | $0.02 |

| | Higher firm natural gas sales in 2014 | $0.00 | $0.05 |

| | Lower non-tracked O&M in 2014 | $0.14 | $0.23 |

| | Higher property tax, depreciation in 2014 | ($0.05) | ($0.09) |

| | Higher non-tracked interest expense in 2014 | $0.00 | ($0.03) |

| | Other, primarily higher effective tax rate in 2014 | ($0.01) | ($0.08) |

| | 2014 EPS before integration-related costs | $0.72 | $2.65 |

| | 2014 integration costs | ($0.03) | ($0.07) |

| 2014 | Reported EPS | $0.69 | $2.58 |

Financial results for the fourth quarter and year ended December 31, 2014 and 2013 are noted below:

Three months ended:

| | | | | |

| (in millions, except EPS) | December 31, 2014 | December 31, 2013 | Increase/ (Decrease) |

2014 EPS1 |

| Electric Distribution/Generation | $113.3 | $79.5 | $33.8 | $0.35 |

| Natural Gas Distribution | $28.1 | $26.8 | $1.3 | $0.09 |

| Electric Transmission | $88.6 | $71.6 | $17.0 | $0.28 |

| Eversource Parent and Other Companies, ex. integration costs |

$0.3 |

$2.7 |

($2.4) |

$0.00 |

| Earnings, ex. integration costs | $230.3 | $180.6 | $49.7 | $0.72 |

| Integration costs | ($8.7) | ($3.2) | ($5.5) | ($0.03) |

| Reported Earnings | $221.6 | $177.4 | $44.2 | $0.69 |

| | | | | |

| (in millions, except EPS) | December 31, 2014 | December 31, 2013 | Increase/ (Decrease) |

2014 EPS1 |

| Electric Distribution/Generation | $462.4 | $427.0 | $35.4 | $1.45 |

| Natural Gas Distribution | $72.3 | $60.9 | $11.4 | $0.23 |

| Electric Transmission | $295.4 | $287.0 | $8.4 | $0.93 |

| Eversource Parent and Other Companies, ex. integration costs |

$11.5 | $24.9 |

($13.4) |

$0.04 |

| Earnings, ex. integration costs | $841.6 | $799.8 | $41.8 | $2.65 |

| Integration costs | ($22.1) | ($13.8) | ($8.3) | ($0.07) |

| Reported Earnings | $819.5 | $786.0 | $33.5 | $2.58 |

| | | | | |

| | December 31, 2014 | December 31, 2013 | % Change Actual | % Change Weather Norm. |

| Electric Distribution | | | | |

| Gwh for three months ended | 13,004 | 13,377 | (2.8%) | (1.2%) |

| Gwh for 12 months ended | 54,442 | 55,331 | (1.6%) | (1.0%) |

| | | | | |

| Natural Gas Distribution | | | | |

| Firm volumes in mmcf for three months ended |

27,855 |

29,268 |

(4.8%) |

1.1% |

| Firm volumes in mmcf for 12 months ended |

99,500 |

94,083 |

5.8% |

2.9% |

The company has approximately 317 million common shares outstanding. It operates New England’s largest energy delivery system, serving approximately 3.6 million customers in Connecticut, Massachusetts and New Hampshire.

CONTACT:

Jeffrey R. Kotkin

(860) 665-5154

# # # #

|

| Note: Eversource Energy will webcast a conference call with senior management on February 12, 2015, beginning at 9 a.m. Eastern Time. The webcast and accompanying slides can be accessed through Eversource Energy’s website at www.eversource.com. |

1 All per share amounts in this news release are reported on a diluted basis. The only common equity securities that are publicly traded are common shares of NU parent. The earnings and EPS of each business do not represent a direct legal interest in the assets and liabilities allocated to such business, but rather represent a direct interest in NU's assets and liabilities as a whole. EPS by business is a non-GAAP (not determined using generally accepted accounting principles) measure that is calculated by dividing the net income or loss attributable to controlling interests of each business by the weighted average diluted NU parent common shares outstanding for the period. In addition, fourth quarter and full year 2014 and 2013 earnings and EPS excluding certain integration costs related to the April 10, 2012 closing of the merger between NU and NSTAR are non-GAAP financial measures. Management uses these non-GAAP financial measures to evaluate earnings results and to provide details of earnings results by business and to more fully compare and explain our fourth quarter and full year 2014 and 2013 results without including the impact of the non-recurring integration costs. Management believes that this measurement is useful to investors to evaluate the actual and projected financial performance and contribution of Eversource Energy’s businesses. Non-GAAP financial measures should not be considered as alternatives to Eversource consolidated net income attributable to controlling interests or EPS determined in accordance with GAAP as indicators of Eversource’s operating performance.

This news release includes statements concerning Eversource Energy’s expectations, beliefs, plans, objectives, goals, strategies, assumptions of future events, future financial performance or growth and other statements that are not historical facts. These statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, readers can identify these forward-looking statements through the use of words or phrases such as “estimate, “expect,” “anticipate,” “intend,” “plan,” “project,” “believe,” “forecast,” “should,” “could,” and other similar expressions. Forward-looking statements involve risks and uncertainties that may cause actual results or outcomes to differ materially from those included in the forward-looking statements. Factors that may cause actual results to differ materially from those included in the forward-looking statements include, but are not limited to, cyber breaches, acts of war or terrorism, or grid disturbances; actions or inaction of local, state and federal regulatory and taxing bodies; changes in business and economic conditions, including their impact on interest rates, bad debt expense and demand for Eversource’s

products and services; fluctuations in weather patterns; changes in laws, regulations or regulatory policy; changes in levels or timing of capital expenditures; disruptions in the capital markets or other events that make Eversource’s access to necessary capital more difficult or costly; developments in legal or public policy doctrines; technological developments; changes in accounting standards and financial reporting regulations; actions of rating agencies; and other presently unknown or unforeseen factors. Other risk factors are detailed from time to time in the company’s reports filed with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which such statement is made, and Eversource Energy undertakes no obligation to update the information contained in any forward-looking statements to reflect developments or circumstances occurring after the statement is made or to reflect the occurrence of unanticipated events.

###

EXHIBIT 99.2

| | | | | | | | | | | | | | | | | |

| NORTHEAST UTILITIES AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF INCOME |

| (Unaudited) |

| | | | | | | | | | | |

| | For the Three Months Ended December 31, |

| (Thousands of Dollars, Except Share Information) | 2014 | | 2013 |

| | | | | | |

Operating Revenues | $ | 1,881,120 | | $ | 1,777,729 |

| | | | | | | | |

Operating Expenses: | | | | | |

| | Purchased Power, Fuel and Transmission | | 702,557 | | | 600,962 |

| | Operations and Maintenance | | 358,574 | | | 425,026 |

| | Depreciation | | 158,433 | | | 147,142 |

| | Amortization of Regulatory Assets/(Liabilities), Net | | (21,122) | | | 27,653 |

| | Energy Efficiency Programs | | 112,898 | | | 95,910 |

| | Taxes Other Than Income Taxes | | 139,519 | | | 120,384 |

| | | Total Operating Expenses | | 1,450,859 | | | 1,417,077 |

Operating Income | | 430,261 | | | 360,652 |

| | | | | | | | |

Interest Expense: | | | | | |

| | Interest on Long-Term Debt | | 84,925 | | | 84,766 |

| | Other Interest | | 4,973 | | | 3,351 |

| | | Interest Expense | | 89,898 | | | 88,117 |

Other Income, Net | | 5,565 | | | 8,239 |

| Income Before Income Tax Expense | | 345,928 | | | 280,774 |

Income Tax Expense | | 122,440 | | | 101,498 |

| Net Income | | 223,488 | | | 179,276 |

Net Income Attributable to Noncontrolling Interests | | 1,879 | | | 1,879 |

| Net Income Attributable to Controlling Interest | $ | 221,609 | | $ | 177,397 |

| | | | | | | | |

| Basic and Diluted Earnings Per Common Share | $ | 0.69 | | $ | 0.56 |

| | | | | | | | |

| Weighted Average Common Shares Outstanding: | | | | | |

| | Basic | | 316,721,275 | | | 315,647,036 |

| | Diluted | | 318,109,809 | | | 316,637,990 |

|

| The data contained in this report is preliminary and is unaudited. This report is being submitted for the sole purpose of providing information to present shareholders about Northeast Utilities and Subsidiaries and is not a representation, prospectus, or intended for use in connection with any purchase or sale of securities. |

| | | | | | | | | | | |

NORTHEAST UTILITIES AND SUBSIDIARIES |

CONSOLIDATED STATEMENTS OF INCOME |

(Unaudited) |

| | | | | | | | | | | |

| | | | For the Years Ended December 31, |

| (Thousands of Dollars, Except Share Information) | 2014 | | 2013 | | 2012 |

| | | | | | | | | | | |

Operating Revenues | $ | 7,741,856 | | $ | 7,301,204 | | $ | 6,273,787 |

| | | | | | | | | | | |

Operating Expenses: | | | | | | | | |

| | Purchased Power, Fuel and Transmission | | 3,021,550 | | | 2,482,954 | | | 2,084,364 |

| | Operations and Maintenance | | 1,427,589 | | | 1,514,986 | | | 1,583,070 |

| | Depreciation | | 614,657 | | | 610,777 | | | 519,010 |

| | Amortization of Regulatory Assets, Net | | 10,704 | | | 206,322 | | | 79,762 |

| | Amortization of Rate Reduction Bonds | | - | | | 42,581 | | | 142,019 |

| | Energy Efficiency Programs | | 473,127 | | | 401,919 | | | 313,149 |

| | Taxes Other Than Income Taxes | | 561,380 | | | 512,230 | | | 434,207 |

| | | Total Operating Expenses | | 6,109,007 | | | 5,771,769 | | | 5,155,581 |

Operating Income | | 1,632,849 | | | 1,529,435 | | | 1,118,206 |

| | | | | | | | | | | |

Interest Expense: | | | | | | | | |

| | Interest on Long-Term Debt | | 345,001 | | | 340,970 | | | 316,987 |

| | Interest on Rate Reduction Bonds | | - | | | 422 | | | 6,168 |

| | Other Interest | | 17,105 | | | (2,693) | | | 6,790 |

| | | Interest Expense | | 362,106 | | | 338,699 | | | 329,945 |

Other Income, Net | | 24,619 | | | 29,894 | | | 19,742 |

Income Before Income Tax Expense | | 1,295,362 | | | 1,220,630 | | | 808,003 |

Income Tax Expense | | 468,297 | | | 426,941 | | | 274,926 |

Net Income | | 827,065 | | | 793,689 | | | 533,077 |

Net Income Attributable to Noncontrolling Interests | | 7,519 | | | 7,682 | | | 7,132 |

Net Income Attributable to Controlling Interest | $ | 819,546 | | $ | 786,007 | | $ | 525,945 |

| | | | | | | | | | | |

Basic Earnings Per Common Share | $ | 2.59 | | $ | 2.49 | | $ | 1.90 |

| | | | | | | | | | | |

Diluted Earnings Per Common Share | $ | 2.58 | | $ | 2.49 | | $ | 1.89 |

| | | | | | | | | | | |

Weighted Average Common Shares Outstanding: | | | | | | | | |

| | Basic | | 316,136,748 | | | 315,311,387 | | | 277,209,819 |

| | Diluted | | 317,417,414 | | | 316,211,160 | | | 277,993,631 |

| | | | | | | | | | | |

The data contained in this report is preliminary and is unaudited. This report is being submitted for the sole purpose of providing information to present shareholders about Northeast Utilities and Subsidiaries and is not a representation, prospectus, or intended for use in connection with any purchase or sale of securities. |

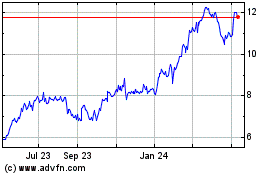

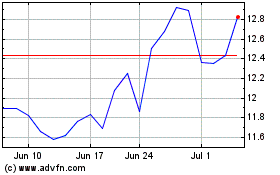

Nu (NYSE:NU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nu (NYSE:NU)

Historical Stock Chart

From Jul 2023 to Jul 2024