Northeast Utilities Remains Neutral - Analyst Blog

April 17 2013 - 12:25PM

Zacks

We are maintaining our Neutral

recommendation on Northeast Utilities (NU). The

company currently has a Zacks Rank #2 (Buy).

Why the Reiteration?

The reiteration is primarily based on risks associated with

Northeast Utilities’ over-reliance on transmission and distribution

businesses, delay in several important projects, and stringent

regulations. However, we consider the company’s diversified asset

base and solid project pipeline as catalysts, which can mitigate

these negatives.

The performance of utility providers like Northeast Utilities

primarily depends on their ability to manage their transmission and

distribution businesses. Northeast Utilities’ regulated businesses

contributed substantially to its total earnings in 2012.

Transmission and distribution businesses sometimes face several

operational risks including breakdown and failure or damage of

equipments or processes, which affect the company’s operations and

increase operating costs.

On the positive side, Northeast Utilities completed its merger with

NSTAR in Apr 2012 and enjoyed related benefits in the fourth

quarter of 2012. The company’s quarterly revenues surpassed the

year-ago figure on the back of strong performance from its

transmission segment primarily driven by this merger. We believe

that the NSTAR-merger will allow Northeast Utilities to increase

its scale of operations and widen customer base.

As far as organic growth strategies are concerned, Northeast

Utilities invested $1.47 billion in 2012 under the infrastructure

spending program for its several expansion and development

projects. These initiatives will allow the company to increase its

transmission capacity, which will subsequently help to meet rising

demand. Later, this will provide the company attractive earnings

and cash flow over the couple of years.

Over the past two months, the Zacks Consensus Estimate for

first-quarter 2013 increased 1.6% to 65 cents per share. The Zacks

Consensus Estimate for full-year 2013 earnings currently stands at

$2.55 per share, up 12.06% year over year primarily attributable to

lower interest costs and operating and maintenance expenses.

Other Stocks to Consider

Other stocks from the industry that are presently performing better

include Brookfield Infrastructure Partners L.P.

(BIP), Empresa Nacional de Electricidad S.A. (EOC)

and Pike Electric Corporation (PIKE). All the

three stocks carry a Zacks Rank #1 (Strong Buy).

BROOKFIELD INFR (BIP): Free Stock Analysis Report

ENDESA-CHILE (EOC): Free Stock Analysis Report

NORTHEAST UTIL (NU): Free Stock Analysis Report

PIKE ELECTRIC (PIKE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

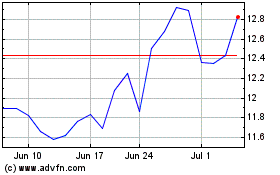

Nu (NYSE:NU)

Historical Stock Chart

From Jun 2024 to Jul 2024

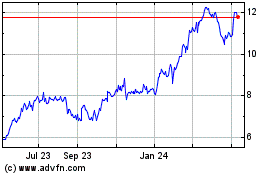

Nu (NYSE:NU)

Historical Stock Chart

From Jul 2023 to Jul 2024