Earnings Preview: Northeast Utilities - Analyst Blog

October 26 2012 - 2:04PM

Zacks

Northeast Utilities (NU), a public utility

holding company, is scheduled to report its third-quarter 2012

financial results on October 29, 2012.

Second-Quarter Recap

Northeast’s second-quarter 2012 pro-forma earnings per share were

45 cents, which is in line with the Zacks Consensus Estimate, but

surpassed the year-ago earnings by a penny. The rise in earnings

was due to continued investments in the company’s electric

transmission systems, but partially offset by lower retail sales

from each of its business segments and higher miscellaneous

costs.

In second-quarter 2012, GAAP earnings per share were 15 cents

compared with 44 cents reported in the year-ago quarter.

The variance between pro forma and GAAP earnings resulted from

after-tax charges of 30 cents related to the merger of Northeast

and NSTAR.

In second-quarter 2012, Northeast reported operating revenue of

$1,629.0 million, up 55.4% from the year-ago figure of $1,048.0

million. Quarterly revenue beats the Zacks Consensus Estimate of

$1,503.0 million.

Zacks Consensus

The Zacks Consensus Estimate for third-quarter 2012 is 65 cents per

share, up from 51 cents per share reported in the prior-year

quarter. Currently, the Zacks Consensus Estimate for the company’s

earnings per share range between 62 cents and 70 cents.

For full-year 2012, the Zacks Consensus Estimate stands at $2.28

per share, lower than the prior-year earnings of $2.38 per share.

The current Zacks Consensus Estimate for full-year 2012 ranges from

$2.25 to $2.35 per share.

Estimate Revisions Trend

Agreement

For third-quarter 2012, we have observed that 2 estimates have

moved upwards while no downward revisions were witnessed in the

last 7 days. However, we have noticed 2 upward and 1 downward

movements in the last 30 days.

For full-year 2012, there were no estimate revisions in the last 7

days. As far as last 30 days estimates revisions are concerned, 3

estimates moved upwards whereas 2 estimates went downwards.

Magnitude

In the last 7 days, the Zacks Consensus Estimate for third-quarter

2012 earnings remained unchanged at 65 cents per share. However,

quarterly earnings estimate decreased by a penny to 65 cents from

66 cents in the last 30 days.

For full-year 2012, earnings per share as per the Zacks Consensus

Estimate remained unchanged at $2.28 in the last 7 days and

decreased by a cent to $2.28 from $2.29 in the last 30 days.

Surprise History

With respect to earnings surprises, Northeast Utilities has topped

the Zacks Consensus Estimate in two quarters out of the last four

quarters. Over the last four quarters, the surprise ranges from

-17.65% to 7.25% with an average of -5.89%.

Our Recommendation

Northeast Utilities strongly follows organic as well as inorganic

growth strategy. As a result of merger with NSTAR, the company has

become one of the leading utility providers in the U.S. This merged

entity continues to get benefit from increased scale of operations

and a wide customer base, which subsequently enables it to achieve

higher end of earnings growth in the near future.

As far as organic growth projects are concerned, the company

intends to invest $1.7 billion under its full-year 2012

infrastructure spending programs for expansion and development of

several major projects. We believe these projects will provide

Northeast attractive earnings and cash flow growth over the coming

couple of years.

However, we are skeptical about strict regulations, over-dependence

on transmission and distribution businesses, and risks associated

with delay and cancellation of several key projects.

Northeast Utilities currently has short-term Zacks #3 Rank (Hold

rating).

Hartford, Connecticut and Boston, Massachusetts-based Northeast

Utilities is a public utility holding company, which provides

energy delivery services to residential, commercial and industrial

customers in Connecticut, New Hampshire and Massachusetts. The

company engages in the purchase, delivery, and sale of

electricity.

With a market capitalization of $12.15 billion, Northeast has

6,063 full time employees. The company’s closest peer is

NiSource Inc. (NI).

NISOURCE INC (NI): Free Stock Analysis Report

NORTHEAST UTIL (NU): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

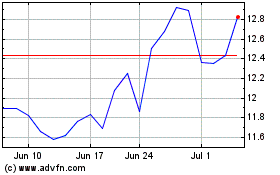

Nu (NYSE:NU)

Historical Stock Chart

From Jul 2024 to Aug 2024

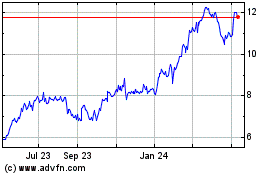

Nu (NYSE:NU)

Historical Stock Chart

From Aug 2023 to Aug 2024