Earnings Preview: PEG - Analyst Blog

October 22 2012 - 11:50AM

Zacks

Public Service Enterprise

Group Inc. (PEG), a regulated electric and natural gas

distributor, is expected to release its third quarter 2012 results

on November 1, 2012, before the bell. The Zacks Consensus Estimate

for the third quarter of 2012 is 71 cents per share (year-over-year

decrease of 14.46%) on revenues of $2,771 million (year-over-year

increase of 5.76%).

Second-quarter 2012, a Synopsis

Public Service Enterprise’s second-quarter 2012 operating earnings

per share (“EPS”) were 43 cents, 2 cents below the Zacks Consensus

Estimate of 45 cents and far below the year-ago figure of 59 cents

per share.

In the second quarter of 2012, GAAP EPS was 42 cents, down from 63

cents per share in the year-ago period. The variance between GAAP

and operating earnings was due to a gain of 1 cent on nuclear

decommissioning trust (“NDT”) Fund Related Activity and

mark-to-market loss of 2 cents at PSEG Power.

Revenue in the second quarter of 2012 was $2.1 billion, down from

the year-ago figure of $2.47 billion. The top line was also lower

than the Zacks Consensus Estimate by $295 million.

Residential electric sales were 3,052 million kilowatt Kwh while

Commercial & Industrial sales were 6,857 million Kwh in the

reported quarter. Total sales were 9,978 million Kwh.

Total operating expenses in the quarter under review were $1.67

billion, down 9.9% year over year. Lower operating expenses were

offset by a decline in revenue, resulting in an operating income of

$433 million, down 30.2% year over year.

Read our full coverage on this earnings report: PEG Misses on All

Counts

Guidance for 2012

Public Service Enterprise expects earnings in the range of $2.25 to

$2.50 per share for full year 2012. It indicated that fossil

operations helped in controlling costs and thereby mitigated the

impact of a warmer winter, lower demand and a decline in gas

prices. Going forward, on the basis of this operational excellence,

it expects to generate good results.

Zacks

Consensus

The analysts covered by Zacks expect Public Service Enterprise

Group to post third-quarter 2012 earnings of 71 cents per share,

lower than 83 cents delivered in the prior-year quarter. Currently,

the Zacks Consensus Estimate ranges between earnings of 66 cents

and 76 cents a share.

For 2012, the Zacks Consensus Estimate stands at $2.39 per share,

lower than its prior-year earnings of $2.74 per share. The current

Zacks Consensus Estimate ranges between $2.25 and $2.50 per

share.

Estimate Revisions

Trend

Agreement

We see a flat trend for estimates for the third quarter of 2012.

Among the 9 estimates, no estimate moved upward or downward over

the last 30 days. The flattish trend is also reflected for

full-year 2012.

Magnitude

The Zacks Consensus Estimate for the third quarter 2012 inched up

by a penny to 71 cents over the last 30 days. For full year 2012

the consensus estimate remained static at $2.39 for the last 30

days.

Surprise History

With respect to earnings surprises, Public Service Enterprise Group

has topped the Zacks Consensus Estimate in three out of the last

four quarters in the range of (4.44)% to 26.87%. The average

surprise over the last four quarter remained a positive 6.46%. The

earnings miss in the last quarter was the lowest at (4.44)%.

Our Recommendation

Public Service Enterprise Group has a solid portfolio of regulated

and non-regulated utility assets that offer a stable earnings base

and substantial long-term growth potential. Going forward, we

believe that the low-cost nuclear fleet, assumed rate relief and

added generating capacities will drive Public Service’s earnings

growth. Public Service has been pursuing growth opportunities in

the core U.S. market and increasing capital allocation in projects

that provide good risk-adjusted returns.

Like its peer, Northeast Utilities (NU), the

company presently retains a short-term Zacks #2 Rank (Buy)

providing investors with a window of opportunity for short-term

gains.

However, over the longer run, we are concerned about the increasing

cost of coal, higher pension & financial costs, and power-price

volatility. Thus, we maintain our long-term Neutral recommendation

on the stock.

Based in Newark, New Jersey, Public Service Enterprise Group

Incorporated is a diversified utility holding company. Its

operations are mostly located in the Northeastern and Mid-Atlantic

parts of the U.S. Public Service Enterprise principally

operates through three key subsidiaries: Public Service Electric

and Gas Company (PSE&G), PSEG Power LLC (PSEG Power) and PSEG

Energy Holdings LLC (PSEG Energy).

NORTHEAST UTIL (NU): Free Stock Analysis Report

PUBLIC SV ENTRP (PEG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

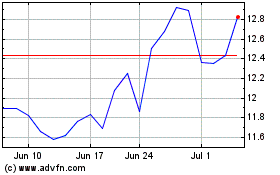

Nu (NYSE:NU)

Historical Stock Chart

From Aug 2024 to Sep 2024

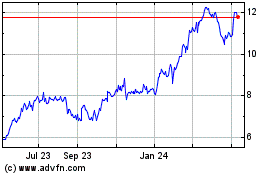

Nu (NYSE:NU)

Historical Stock Chart

From Sep 2023 to Sep 2024