Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

August 31 2023 - 6:54AM

Edgar (US Regulatory)

FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

Commission File Number: 1-15270

For the month of August 2023

NOMURA HOLDINGS, INC.

(Translation of registrant’s name into English)

13-1, Nihonbashi 1-chome

Chuo-ku, Tokyo 103-8645

Japan

(Address of

principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F X Form

40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

Information furnished on this form:

EXHIBIT

Exhibit

Number

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

NOMURA HOLDINGS, INC. |

|

|

|

|

| Date: August 31, 2023 |

|

|

|

By: |

|

/s/ Yoshifumi Kishida |

|

|

|

|

|

|

Yoshifumi Kishida |

|

|

|

|

|

|

Senior Managing Director |

Nomura Issues 7th and 8th Series of Unsecured Straight Bonds with No Negative

Pledge or Other Financial Covenants

Tokyo, August 31, 2023—Nomura Holdings, Inc. today announced that it has

determined the terms of its 7th and 8th series of unsecured straight bonds with no negative pledge or other financial covenants in the total principal amount of 50 billion yen. Terms of the issue are as outlined below.

Nomura is subject to the Japanese Total Loss-Absorbing Capacity (TLAC) standard. The bonds are expected to qualify as TLAC-eligible debt.

7th Series of Nomura Holdings, Inc. Unsecured Straight Bonds with no negative pledge or other financial covenants

|

|

|

|

|

| 1. |

|

Amount of Issue |

|

30 billion yen |

| 2. |

|

Denomination of each Bond |

|

100 million yen |

| 3. |

|

Issue Price |

|

100% of the principal amount |

| 4. |

|

Interest Rate |

|

0.680% per annum |

| 5. |

|

Offering Period |

|

August 31, 2023 |

| 6. |

|

Payment Date |

|

September 6, 2023 |

| 7. |

|

Interest Payment Dates |

|

March 6 and September 6 each year |

| 8. |

|

Maturity Date |

|

September 4, 2026 |

| 9. |

|

Redemption Price |

|

100% of the principal amount |

| 10. |

|

Security or Guarantee |

|

The bonds are not secured by any pledge, mortgage or other charge on any assets or revenues of the Company or of others, nor are they guaranteed. There are no assets reserved

as security for the bonds. |

| 11. |

|

Place for Application |

|

Head office and domestic branch offices of the Underwriter described in the item 13 |

| 12. |

|

Book-entry Transfer Institution |

|

Japan Securities Depository Center, Inc. |

| 13. |

|

Underwriters |

|

Nomura Securities

Co., Ltd. SMBC Nikko Securities Inc. Barclays Securities

Japan Limited BNP Paribas Securities (Japan) Limited

Crédit Agricole Securities Asia B.V., Tokyo Branch HSBC

Securities (Japan) Co., Ltd. Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

Mizuho Securities Co., Ltd. Natixis Japan Securities Co.,

Ltd. Societe Generale Securities Japan Limited |

| 14. |

|

Fiscal Agent |

|

Resona Bank, Limited. |

| 15. |

|

Rating |

|

The bonds have been given a rating of “A” from Rating and Investment Information, Inc. and

“AA-” from Japan Credit Rating Agency, Ltd. |

The purpose of this press release is

to make a general public announcement concerning the public offering for the 7th and 8th series of unsecured straight bonds (with no negative pledge or other financial covenants) outside the United States. This press release has not been prepared

for the purpose of, and does not constitute, an offer of, or solicitation of an offer to buy or subscribe for, securities of Nomura Holdings, Inc. The above-referenced securities will not be or have not been registered under the U.S. Securities Act

of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements thereunder.

1

8th Series of Nomura Holdings, Inc. Unsecured Straight Bonds with no negative pledge or other financial

covenants

|

|

|

|

|

| 1. |

|

Amount of Issue |

|

20 billion yen |

| 2. |

|

Denomination of each Bond |

|

100 million yen |

| 3. |

|

Issue Price |

|

100% of the principal amount |

| 4. |

|

Interest Rate |

|

0.959% per annum |

| 5. |

|

Offering Period |

|

August 31, 2023 |

| 6. |

|

Payment Date |

|

September 6, 2023 |

| 7. |

|

Interest Payment Dates |

|

March 6 and September 6 each year |

| 8. |

|

Maturity Date |

|

September 6, 2028 |

| 9. |

|

Redemption Price |

|

100% of the principal amount |

| 10. |

|

Security or Guarantee |

|

The bonds are not secured by any pledge, mortgage or other charge on any assets or revenues of the Company or

of others, nor are they guaranteed. There are no assets reserved as security for the bonds. |

| 11. |

|

Place for Application |

|

Head office and domestic branch offices of the Underwriter described in the item 13 |

| 12. |

|

Book-entry Transfer

Institution |

|

Japan Securities Depository Center, Inc. |

| 13. |

|

Underwriters |

|

Nomura Securities Co., Ltd.

SMBC Nikko Securities Inc. Barclays Securities Japan Limited

BNP Paribas Securities (Japan) Limited Crédit Agricole

Securities Asia B.V., Tokyo Branch HSBC Securities (Japan) Co., Ltd.

Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. Mizuho

Securities Co., Ltd. Natixis Japan Securities Co., Ltd.

Societe Generale Securities Japan Limited |

| 14. |

|

Fiscal Agent |

|

Resona Bank, Limited. |

| 15. |

|

Rating |

|

The bonds have been given a rating of “A” from Rating and Investment Information, Inc. and

“AA-” from Japan Credit Rating Agency, Ltd. |

The purpose of this press release is

to make a general public announcement concerning the public offering for the 7th and 8th series of unsecured straight bond (with no negative pledge or other financial covenants) outside the United States. This press release has not been prepared for

the purpose of, and does not constitute, an offer of, or solicitation of an offer to buy or subscribe for, securities of Nomura Holdings, Inc. The above-referenced securities will not be or have not been registered under the U.S. Securities Act of

1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements thereunder.

2

For further information please contact:

|

|

|

|

|

| Name |

|

Company |

|

Telephone |

| Kenji Yamashita |

|

Nomura Holdings, Inc. Group Corporate

Communications Dept. |

|

81-3-3278-0591 |

Nomura

Nomura is a global

financial services group with an integrated network spanning approximately 30 countries and regions. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its three

business divisions: Retail, Investment Management, and Wholesale (Global Markets and Investment Banking). Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered

thought leadership. For further information about Nomura, visit www.nomura.com.

The purpose of this press release is

to make a general public announcement concerning the public offering for the 7th and 8th series of unsecured straight bond (with no negative pledge or other financial covenants) outside the United States. This press release has not been prepared for

the purpose of, and does not constitute, an offer of, or solicitation of an offer to buy or subscribe for, securities of Nomura Holdings, Inc. The above-referenced securities will not be or have not been registered under the U.S. Securities Act of

1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements thereunder.

3

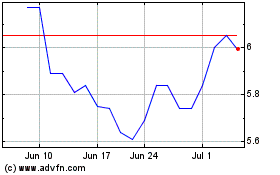

Nomura (NYSE:NMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nomura (NYSE:NMR)

Historical Stock Chart

From Jul 2023 to Jul 2024