false000108499100010849912022-11-142022-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 29, 2024 NATURAL GAS SERVICES GROUP, INC.

(Exact Name of Registrant as Specified in Charter) | | | | | | | | | | | | | | |

Colorado | | 1-31398 | | 75-2811855 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

404 Veterans Airpark Lane, Suite 300

Midland, TX 79705

(Address of Principal Executive Offices)

(432) 262-2700

(Registrant's Telephone Number, Including Area Code)

N/A

(Former Name or Former Address if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c)).

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, Par Value $0.01 | | NGS | | NYSE |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 29, 2024, the Company entered into an employment agreement (the “Employment Agreement”) with Justin C. Jacobs, age 49, pursuant to which Mr. Jacobs was appointed Chief Executive Officer of the Company, effective February 12, 2024, at which time Stephen C. Taylor, the Company’s Interim Chief Executive Officer, will retire although he will provide certain transition services pursuant to his previously announced retirement agreement. Both Messrs. Jacobs and Taylor will continue to serve on the Company’s Board of Directors with Mr. Taylor continuing as Chairman of the Board.

The following is a summary of the material features of the Employment Agreement and is qualified in its entirety by reference to the full text of it, a copy of which is filed as Exhibit 10.1 to this Report.

Base Salary. Mr. Jacobs’s initial annual base salary is $525,000 (“Base Salary”) and will be reviewed at least annually by the Company’s Compensation Committee (“Committee”). The Company does not have any obligation to increase or decrease the Base Salary.

Signing Bonus. In connection with the execution of the Employment Agreement, the Company will pay Mr. Jacobs a cash signing bonus of $30,000 and grant Mr. Jacobs a performance stock unit (“PSU”) award valued at $100,000. The PSU will vest based on total shareholder return metrics to be set by the Compensation Committee. The PSU vesting is also subject to Mr. Jacobs’s continuous employment with the Company and other customary provisions to be set forth in an award agreement under the Company’s 2019 Equity Incentive Plan.

Annual Cash Bonus. Mr. Jacobs will have the opportunity to earn incentive compensation in the form of an annual cash bonus based on performance thresholds and metrics established by the Compensation Committee (“Annual Bonus”). For 2024, the target amount is 100% of his Base Salary, pro-rated for the number of days employed in 2024.

Annual Equity Compensation. During his employment, Mr. Jacobs will be eligible to participate in the Company’s 2019 Equity Incentive Plan, or any successor plan. For calendar year 2024, Mr. Jacobs will receive a restricted stock unit (“RSU”) award valued at 100% of Base Salary and a PSU award valued at 100% of Base Salary, both awards subject to proration as provided in the Employment Agreement. The RSU vests in three equal annual installments beginning on the first anniversary of the effective date of the Employment Agreement. The PSU will vest based on total shareholder return metrics to be set by the Compensation Committee. Both of the RSU and PSU award are subject to Mr. Jacobs’s continuous employment with the Company and other customary provisions to be set forth in an award agreement under the Company’s 2019 Equity Incentive Plan.

Benefits. The Company will provide Mr. Jacobs retirement and other employee benefits as are customarily provided to similarly situated executives of the Company, including paid vacation, coverage under the Company’s medical plan and reimbursement for all reasonable business expenses in accordance with the Company’s expense reimbursement policy.

Term and Termination. Mr. Jacob’s employment is at-will. The Company or Mr. Jacobs may terminate the Agreement at any time upon written notice.

Effect of Termination; Severance.

Except with respect to a change of control in the Company, if Mr. Jacobs’s employment is terminated by the Company (A) without cause (as defined in the Employment Agreement) or (B) if Mr. Jacobs terminates his employment with good reason (as defined in the Employment Agreement), the Employment Agreement provides that he will receive (i) payment in a lump sum of accrued but unpaid salary and vacation time, (ii) any earned but unpaid bonus for any completed calendar year preceding the date of termination, (iii) unreimbursed business expenses and (iv) any such other benefits (including equity compensation) to which he may be entitled to under any employee benefit plan as of the date of termination (collectively, the “Accrued Amounts”). In addition, provided Mr. Jacobs executes a mutually agreed release of all claims in favor of the Company (the “Release”) he will receive a severance payment of (I) a prorated amount of the Annual Bonus that would be earned as calculated using the “target” thresholds and bonus formula set by the Compensation Committee for the year in which termination of employment occurs, such proration based on the number of days worked in the current year; (II) one (1) times his Base Salary and Annual Bonus at target for the year in which termination occurs; (III) accelerated vesting for all unvested RSUs; and (IV) a pro rata number of shares or other compensation underlying the unvested PSUs based on the target award that would otherwise have vested at the end of the performance period as set forth in the award agreement. In addition, the Company will pay COBRA continuation coverage for up to twelve (12) months following his termination.

In connection with a change of control of the Company, Mr. Jacobs will be entitled to the Accrued Amounts plus, provided he executes the Release, the same severance amounts described in subparts (I) – (IV) in the paragraph above, except the amount under subpart (II) shall be two (2) times his Base Salary and Annual Bonus at target during the year of termination. In addition, the Company will pay COBRA continuation coverage for up to twelve (12) months following his termination.

In the event of a termination of employment in the case of death or disability, Mr. Jacobs will be entitled to the Accrued Amounts plus (i) a prorated amount of cash bonus that would be earned as calculated using the “target” thresholds and bonus formula set by the Compensation Committee for the year in which termination of employment occurs and (ii) a pro rata number of shares or other compensation underlying the unvested PSUs based on the target award that would otherwise have vested at the end of the performance period as set forth in the award agreement.

In the event of a termination of employment (i) by the Company for cause or (ii) by Mr. Jacobs without good reason, Mr. Jacobs will be entitled to the Accrued Amounts but will not be entitled to any severance.

Clawbacks. Mr. Jacobs’s incentive compensation is subject to the Company’s Clawback Policy which is consistent with requirements of the New York Stock Exchange.

Non-Compete and Other Agreements.

In connection with the Employment Agreement, Mr. Jacobs also executed a Non-Compete Agreement and Proprietary Rights Agreement that contain customary non-compete, confidentiality and non-solicitation provisions, along with proprietary rights ownership of work product in favor of the Company.

The non-compete provision prohibit Mr. Jacobs from engaging in competitive activity in a defined geographic area for a period of either (i) 12 months immediately following the termination of his employment connection with a termination by Mr. Jacobs for Good Reason or by the Company without Cause, or (ii) 24 months immediately following the termination of employment with the Company in connection with a termination by Mr. Jacobs without Good Reason or by the Company with Cause. The non-solicitation provisions prohibit Mr. Jacobs from soliciting for employment any employee of the Company or any person who was an employee of the Company. This prohibition applies while Mr. Jacobs is employed by the Company and for the same applicable period of time as the non-compete provision after termination of his employment.

Prior to Mr. Jacobs’ employment with the Company, most recently he was a Managing Director and a member of the management committee of Mill Road Capital Management LLC, where we worked since 2005. Mill Road Capital Management is an investment firm focused on investments in small, publicly traded companies. From 1999 to 2004, Mr. Jacobs was employed at LiveWire Capital, an investment and management group backed primarily by The Blackstone Group and Thomas Lee Partners that focused on operationally intensive buyouts of middle market companies. While employed at LiveWire, he held various operational positions in numerous portfolio companies, including interim Chief Operating Officer, in addition to investment responsibilities. Before joining LiveWire, Mr. Jacobs was an investment professional in the private equity group at The Blackstone Group from 1996 to 1999. Mr. Jacobs is currently a member of the Board of Directors of Swiss Water Decaffeinated Coffee, Inc. He previously served as a member of the Boards of Directors of several public companies, including Ecology and Environment, Inc., Galaxy Nutritional Foods, Inc., National Technical Systems, Inc., and School Specialty, Inc., as well as numerous private companies, including Lignetics, Inc., Mother’s Market & Kitchen, Inc., PRT Growing Services LTD and Rubios Restaurants, Inc. Mr. Jacobs holds a B.S. from the McIntire School of Commerce at the University of Virginia with concentrations in accounting and finance.

Item 8.01 Other Events

On February 1, 2024, the Company issued a press release announcing the appointment of Mr. Jacobs as its Chief Executive Officer. A copy of this press release is filed herewith as Exhibit 99.1 and is hereby incorporated by reference.

The press release filed herewith as Exhibit 99.1 is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section, and it shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are included with this Current Report on Form 8-K:

| | | | | |

| Exhibit No. | Description |

| Employment Agreement between Justin C. Jacobs and Natural Gas Services Group, Inc. dated January 29, 2024. |

| Employee Non-Compete Agreement between Justin C. Jacobs and Natural Gas Services Group, Inc. dated January 29, 2024. |

| Employee Proprietary Rights Agreement between Justin C. Jacobs and Natural Gas Services Group, Inc. dated January 29, 2024. |

| Press Release dated February 1, 2024 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | NATURAL GAS SERVICES GROUP, INC. |

| | | | | |

| | | | | |

| Date: | | By: | | /s/ Stephen C. Taylor |

| February 1, 2024 | | | | Stephen C. Taylor |

| | | | | Interim Chief Executive Officer |

Execution Copy

EMPLOYMENT AGREEMENT

This Employment Agreement (the “Agreement”) is made and entered into as of January 29, 2024 (the “Agreement Date”), by and between Justin C. Jacobs (the “Executive”) and Natural Gas Services Group, Inc., a Colorado corporation (the “Company”).

RECITALS

WHEREAS, the Company desires to employ the Executive on the terms and conditions set forth herein; and

WHEREAS, the Executive desires to be employed by the Company on such terms and conditions.

NOW, THEREFORE, in consideration of the mutual covenants, promises, and obligations set forth herein, the parties agree as follows:

1.Term. The Executive's term of employment hereunder is at-will and shall commence on February 12, 2024 and continue until terminated under Section 5 of this Agreement. The period during which the Executive is employed by the Company hereunder is hereinafter referred to as the “Employment Term.”

2.Position and Duties.

1.1Position. During the Employment Term, the Executive shall serve as the Chief Executive Officer of the Company, reporting to the Board of Directors of the Company (the “Board”). In such position, the Executive shall have such duties, authority, and responsibilities as are consistent with the Executive's position.

1.2Duties. During the Employment Term, the Executive shall devote substantially all of the Executive's business time and attention to the performance of the Executive's duties hereunder and will not engage in any other business, profession, or occupation for compensation or otherwise which would conflict or interfere with the performance of such services either directly or indirectly without the prior written consent of the Board. Prior to execution of this Agreement, Executive has disclosed in writing to the Company any such conflicts that exist at the time of execution.

3.Place of Performance. The principal place of Executive's employment shall be the Company's principal executive office, currently located in Midland, Texas.

4.Compensation.

1.1Base Salary. The Company shall pay the Executive an annual rate of base salary of $525,000 in periodic installments in accordance with the Company's customary payroll practices and applicable wage payment laws, but no less frequently than monthly. The Executive's base salary shall be reviewed at least annually by the Compensation Committee of the Board (the “Compensation Committee”) during the Employment Term. The Executive's annual base salary, as in effect from time to time, is hereinafter referred to as “Base Salary.”

1.2Annual Bonus.

(a)For each calendar year ending during the Employment Term, the Executive shall be eligible to receive an annual bonus (the “Annual Bonus”) in accordance with the Company’s Annual Incentive Bonus Plan (the “Bonus Plan”), or any successor plan applicable to the Company’s executive officers. The terms of the Annual Bonus shall be determined by the Compensation Committee and approved by the Compensation Committee or the Independent Members of the Board.

(b)Except as otherwise provided in Section 5, (i) the Annual Bonus will be subject to the terms of the Bonus Plan under which it is granted and (ii) in order to be eligible to receive an Annual Bonus, the Executive must be employed by the Company on the last day of the applicable calendar year. For calendar year 2024, Executive’s cash bonus at “Target” as established by the Compensation Committee, shall be 100% of Base Salary and shall be prorated for the number of days employed in 2024.

(c)The Annual Bonus shall be paid in cash unless the Executive otherwise agrees.

1.3Equity Awards. The Executive shall be eligible to participate in the Company’s 2019 Equity Incentive Plan, or any successor plan (the “Equity Plan”), subject to the terms of such Equity Plan and such other terms determined by the Board or the Compensation Committee, in its discretion, and reflected in the applicable award agreement accompanying each award under the Equity Plan (each an “Award Agreement”). For calendar year 2024, Executive will receive, on the Agreement Date (also referred to herein as the “Award Date”) a restricted stock unit (“RSU”) award valued at 100% of Base Salary and a performance stock unit (“PSU”) award valued at 100% of Base Salary, both awards prorated for the number of days remaining in 2024 from the Award Date.

(a)RSU Award. The number of RSUs awarded will be determined by dividing the value of the RSU award by the closing sale price of one share of the Company’s common stock as reported on the New York Stock Exchange on the Award Date and then prorated by multiplying the number of days remaining in 2024 from the Award Date divided by 365 (the “2024 RSU Award”). The 2024 RSU Award will vest in one-third annual installments beginning on the first anniversary of the Award Date and be subject to such other terms as set forth in the Award Agreement.

(b)PSU Award. The opportunity to earn a number of PSUs awarded for 2024 (the “2024 PSU Award”) will be determined by dividing the value of the PSU award by the closing sale price of one share of the Company’s common stock as reported on the New York Stock Exchange on the Award Date and then prorated by multiplying the number of days remaining in 2024 from the Award Date divided by 365. The 2024 PSU Award shall be set forth in an Award Agreement, and the number of shares underlying the award shall vest in the amounts set forth in the Award Agreement.

1.4Signing Bonus. The Executive will also receive the following:

(a)A one-time cash bonus of $30,000 in the first regular payroll after reporting for full time employment.

(b)A one-time PSU grant of $100,000, calculated in a similar method to the 2024 PSU Award (with no pro ration) and shall be set forth in an Award Agreement in the form substantially similar to the agreement attached hereto as Exhibit A, and the number of shares underlying the award shall vest in the amounts set forth in the Award Agreement.

1.5Fringe Benefits and Perquisites. During the Employment Term, the Executive shall be entitled to fringe benefits and perquisites consistent with those provided to similarly situated executives of the Company.

1.6Employee Benefits. During the Employment Term, the Executive shall be entitled to participate in all employee benefit plans, practices, and programs maintained by the Company, as in effect from time to time (collectively, “Employee Benefit Plans”), on a basis which is no less favorable than is provided to other similarly situated executives of the Company, to the extent consistent with applicable law and the terms of the applicable Employee Benefit Plans. The Company reserves the right to amend or terminate any Employee Benefit Plans at any time in its sole discretion, subject to the terms of such Employee Benefit Plan and applicable law.

1.7Vacation; Paid Time Off. During the Employment Term, the Executive shall be entitled to four weeks of paid vacation days per calendar year (prorated for partial years) in accordance with the

Company's vacation policies, as in effect from time to time. The Executive shall receive other paid time off in accordance with the Company's policies for executive officers as such policies may exist from time to time and as required by applicable law. In compliance with Company policy, vacation shall be taken during the year that it is awarded and shall not be carried-over or accrued beyond the current year.

1.8Business Expenses. The Executive shall be entitled to reimbursement for all reasonable and necessary out-of-pocket business, entertainment, and travel expenses incurred by the Executive in connection with the performance of the Executive's duties hereunder in accordance with the Company's expense reimbursement policies and procedures.

1.9Indemnification. The Company shall indemnify and hold the Executive harmless to the fullest extent permitted by law, subject to applicable law and the Company's Bylaws, for acts and omissions in the Executive's capacity as an officer and employee of the Company.

1.10Clawback Provisions. Any amounts payable under this Agreement (other than Sections 4.1 and 4.4(a)) are subject to any policy (whether in existence as of the Agreement Date or later adopted) established by the Company providing for clawback or recovery of amounts that were paid to the Executive. The Company will make any determination for clawback or recovery in its sole discretion and in accordance with any applicable law or regulation.

5.Termination of Employment. In addition to the rights of the parties set forth herein, the Employment Term and the Executive's employment hereunder may be terminated after the Agreement Date by either the Company or the Executive at any time and for any reason or for no particular reason; provided that, unless otherwise provided herein, either party shall be required to give the other party at least thirty (30) days advance written notice of any termination of the Executive's employment. Upon termination of the Executive's employment during the Employment Term, the Executive shall be entitled to the compensation and benefits described in this Section 5 and shall have no further rights to any compensation or any other benefits from the Company or any of its affiliates.

1.1By Company For Cause or By Executive Without Good Reason.

(a)The Executive's employment hereunder may be terminated by the Company for Cause or by the Executive without Good Reason and the Executive shall be entitled to receive:

(i)any accrued but unpaid Base Salary and accrued but unused vacation/paid time off which shall be paid within six calendar days following the date of the Executive's termination, or at the next regular pay period following the date of the Executive’s resignation;

(ii)any earned but unpaid Annual Bonus with respect to any completed calendar year immediately preceding the date of the Executive's termination, which shall be paid on the otherwise applicable payment date except to the extent payment is otherwise deferred pursuant to any applicable deferred compensation arrangement; provided that, if the Executive's employment is terminated by the Company for Cause, then the Executive understands and acknowledges that any such earned but unpaid Annual Bonus shall be forfeited;

(iii)reimbursement for unreimbursed business expenses properly incurred by the Executive, which shall be subject to and paid in accordance with the Company's expense reimbursement policy; and

(iv)such employee benefits (including equity compensation), if any, to which the Executive may be entitled under the Company's employee benefit plans as of the date of the Executive's termination; provided that, in no event shall the Executive be entitled to any payments in the nature of severance or termination payments except as specifically provided herein.

Items 5.1(a)(i) through 5.1(a)(iv) are referred to herein collectively as the “Accrued Amounts.”

(b)For purposes of this Agreement, “Cause” shall mean:

(i)the Executive's willful failure to perform the Executive's duties (other than any such failure resulting from incapacity due to physical or mental illness);

(ii)the Executive's willful failure to comply with any valid and legal directive of the Board;

(iii)the Executive's engagement in dishonesty, illegal conduct, or misconduct, which is, in each case, injurious to the Company or its affiliates, as reasonably determined by the Board;

(iv)the Executive's embezzlement, misappropriation, or fraud, whether or not related to the Executive's employment with the Company;

(v)the Executive's conviction of or plea of guilty or nolo contendere to a crime that constitutes a felony (or state law equivalent) or a crime that constitutes a misdemeanor involving moral turpitude;

(vi)the Executive's material violation of the Company's written policies or codes of conduct, including written policies related to discrimination, harassment, performance of illegal or unethical activities, and ethical misconduct;

(vii)the Executive's material breach of any material obligation under this Agreement or any other written agreement between the Executive and the Company; or

(viii)the Executive's engagement in conduct that brings or is reasonably likely to bring the Company negative publicity or into public disgrace, embarrassment, or disrepute.

For purposes of this provision, none of the Executive's acts or failures to act shall be considered “willful” unless the Executive (i) acts in bad faith or without reasonable belief that the action was in the best interests of the Company, or (ii) fails to act in bad faith or without reasonable belief that the failure to act was in the best interests of the Company. The Executive's actions, or failures to act, based upon authority given pursuant to a resolution duly adopted by the Board or upon the advice of counsel for the Company shall be conclusively presumed to be in good faith and in the best interests of the Company.

Except for a failure, breach, or refusal which, by its nature, cannot reasonably be expected to be cured, the Executive shall have 10 business days from the delivery of written notice by the Company within which to cure any acts constituting Cause.

(c)For purposes of this Agreement, “Good Reason” shall mean the occurrence of any of the following, in each case during the Employment Term without the Executive's prior written consent:

(i)a material diminution in the Executive’s duties, responsibilities, or authority (including without limitation a change in reporting directly to the Company’s Board of Directors or failure by the Company to properly nominate the Executive for election to the Board in the Company’s annual proxy materials whenever the Executive’s term is expiring);

(ii)a material reduction in the Executive's Base Salary, other than a general reduction in Base Salary that affects all similarly situated executives in substantially the same proportions, or a material reduction in the Target Levels (as a percent of Base Salary) for the Annual Bonus, RSU, or PSU awards as stated in this Agreement, other than a general reduction in such amounts that affects all similarly situated executives in substantially the same proportions;

(iii)a relocation of the Executive's principal place of employment by more than 100 miles; or

(iv)any material breach by the Company of any material provision of this Agreement.

To terminate the Executive's employment for Good Reason, the Executive must provide written notice to the Company of the existence of the circumstances providing grounds for termination for Good Reason within 30 days of the initial existence of such grounds and the Company must have at least 30 days from the date on which such notice is provided to cure such circumstances. If the Executive does not terminate the Executive's employment for Good Reason within 60 days after the first occurrence of the applicable grounds, then the Executive will be deemed to have waived the Executive's right to terminate for Good Reason with respect to such grounds.

1.2Termination by Company Without Cause or Termination by Executive for Good Reason. The Employment Term and the Executive's employment hereunder may be terminated by the Executive for Good Reason or by the Company without Cause. In the event of such termination, the Executive shall be entitled to receive the Accrued Amounts and subject to the Executive's compliance with Section 6 of this Agreement and the Executive's execution, within 21 days following receipt, of a release of claims in favor of the Company, its affiliates and their respective officers and directors in a form provided by the Company (the “Release”), the Executive shall be entitled to receive the following:

(a)equal installment payments payable in accordance with the Company's normal payroll practices, but no less frequently than monthly, which are in the aggregate equal to 12 months of the Executive's Base Salary and Annual Bonus at target for the year in which the date of the Executive's termination occurs, which shall begin upon the lapse of any and all legal revocation period relating to the Release and continue until the 1st anniversary of the Executive's date of termination;

(b)any Annual Bonus that would be earned as calculated using the “target” thresholds and bonus formula set by the Compensation Committee for the year in which termination of employment occurs, calculated on a prorated basis by taking the number of days from January 1 of that year to the termination date divided by 365, payable in equal installment payments payable in accordance with the Company's normal payroll practices, but no less frequently than monthly, which shall begin upon the lapse of any and all legal revocation period relating to the Release and continue until the 1st anniversary of the Executive's date of termination;

(c)all RSUs awarded to the Executive that remain unvested shall automatically vest as of the date of termination;

(d)Executive will be entitled to receive a pro rata number of shares or other compensation underlying the unvested PSUs based on the Target Award that would otherwise have vested at the end of the Performance Period as set forth in the Award Agreement. The timing of settlement of the vested award shall be as set forth in the Award Agreement.;

(e)Any unpaid and owing amounts, including salary and including accrued vacation not taken in the current vacation year; and

(f)If the Executive timely and properly elects health continuation coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”), the Company shall reimburse the Executive for the monthly COBRA premium paid by the Executive for the Executive and the Executive’s dependents. Such reimbursement shall be paid to the Executive no later than the 15th day of the month immediately following the month in which the Executive timely remits the premium payment and proof thereof. The Executive shall be eligible to receive such reimbursement until the earliest of: (i) the 12-month anniversary of the date of the Executive’s termination; (ii) the date the Executive is no longer eligible to receive COBRA continuation coverage; or (iii) the date on which the Executive becomes eligible to receive health insurance coverage from another employer or other source. Notwithstanding the foregoing, if the Company's making payments under this Section 5.2(f) would violate the nondiscrimination rules applicable to non-grandfathered, insured group health

plans under the Affordable Care Act (the “ACA”), or result in the imposition of penalties under the ACA and the related regulations and guidance promulgated thereunder, the parties agree to reform this Section 5.2(f) in a manner as is necessary to comply with the ACA.

1.3Change of Control. If within 18 months following the occurrence of a Change in Control (as defined in the Equity Plan) the Executive’s employment by the Company is terminated according to Section 5.2, the Executive shall receive all of the benefits listed in Section 5.2 as well as the following:

(a)An additional year of Base Salary plus Annual Bonus at target, calculated and paid in the same manner as described in Section 5.2(a); and

(b)all unvested PSU awards to the Executive shall vest to the extent that such PSUs would otherwise have vested in accordance the applicable Award Agreement under the assumption that the end of the Performance Period (as defined in the Award Agreement) is the date of the closing of such Change in Control; provided, however that the minimum number of unvested PSUs that shall vest will be not less than the Target Award. The timing of settlement of the vested award shall be as set forth in the Award Agreement.

1.4Death or Disability.

(a)The Executive’s employment hereunder shall terminate automatically upon the Executive’s death during the Employment Term, and the Company may terminate the Executive’s employment on account of the Executive’s Disability.

(b)If the Executive’s employment is terminated during the Employment Term on account of the Executive’s death or Disability, the Executive (or the Executive’s estate and/or beneficiaries, as the case may be) shall be entitled to receive the Accrued Amounts in accordance with Section 5.1. as well as the amounts and/or benefits under Sections 5.2(b), 5.2(d), and 5.2(e).

(c)For purposes of this Agreement, “Disability” shall mean the Executive’s inability, due to physical or mental incapacity, to perform the essential functions of the Executive’s job, with or without reasonable accommodation, for one hundred twenty (120) consecutive days. Any question as to the existence of the Executive’s Disability as to which the Executive and the Company cannot agree shall be determined in writing by a qualified independent physician mutually acceptable to the Executive and the Company. The determination of Disability made in writing to the Company and the Executive shall be final and conclusive for all purposes of this Agreement. During the 120-day period noted above, any material diminution in the Executive’s duties, responsibilities, or authority shall not be considered a Good Reason event under Section 5.1(c).

1.5Settlement of RSUs and PSUs. In connection with the vesting of any RSUs or PSUs pursuant to this Section 5, the timing of the issuance of Company shares or payment of other consideration shall be subject to the settlement provisions of the applicable Award Agreement and the Equity Plan.

1.6Notice of Termination. Any termination of the Executive’s employment hereunder by the Company or by the Executive during the Employment Term (other than termination pursuant to Section 5.3(a) on account of the Executive's death) shall be communicated by written notice of termination (“Notice of Termination”) to the other party hereto in accordance with Section 17. The Notice of Termination shall specify:

(a)the termination provision of this Agreement relied upon;

(b)if notice of termination is provided by the Company, then a written notice of termination is to be sent to the Executive at any time and with or without reason; and

(c)if notice of termination is provided by the Executive, then the Executive understands and agrees as a courtesy to send a 30-day written termination notice prior to his intended last day of employment to the Company’s Board of Directors.

1.7Resignation of All Other Positions. Upon termination of the Executive’s employment hereunder for any reason, the Executive shall be deemed to have resigned from all positions that the Executive holds as an officer or member of the Board (or a committee thereof) of the Company or any of its affiliates.

6.Confidential Information and Restrictive Covenants. As a condition of the Executive’s employment with the Company, the Executive shall enter into and abide by the Company’s Employee Non-Compete Agreement and Proprietary Rights Agreement.

7.Arbitration/Prevailing Party Recovery of Attorney’s Fees. Any dispute, controversy, or claim arising out of or related to the Executive’s employment by the Company, or termination of employment, including but not limited to claims arising under or related to this Agreement or any breach of this Agreement, and any alleged violation of federal, state, or local statute, regulation, common law, or public policy, shall be submitted to and decided by binding arbitration. Arbitration shall be administered exclusively by the American Arbitration Association and shall be conducted in the county of the Company’s principal executive office consistent with the rules of the American Arbitration Association in effect at the time the arbitration is commenced. Any arbitral award determination shall be final and binding upon the parties. The Parties agree that the prevailing party of the Arbitration shall recover its or his attorney’s fees.

8.Governing Law, Jurisdiction, and Venue. This Agreement, for all purposes, shall be construed in accordance with the laws of Texas without regard to conflicts of law principles. Any action or proceeding by either of the parties to enforce this Agreement shall be brought only in a state or federal court located in the state and county of the Company’s principal executive office. The parties hereby irrevocably submit to the exclusive jurisdiction of such courts and waive the defense of inconvenient forum to the maintenance of any such action or proceeding in such venue.

9.Stock Ownership Requirements. During the Employment Term, the Executive shall be expected to comply with the Company’s stock ownership guidelines, as same may be amended from time to time by the Company.

10.Entire Agreement. Unless specifically provided herein, this Agreement, together with the Employee Non-Compete Agreement and Proprietary Rights Agreement, contains all of the understandings and representations between the Executive and the Company pertaining to the subject matter hereof and supersedes all prior and contemporaneous understandings, agreements, representations and warranties, both written and oral, with respect to such subject matter.

11.Modification and Waiver. No provision of this Agreement may be amended or modified unless such amendment or modification is agreed to in writing and signed by the Executive and by the Chairperson of the Compensation Committee of the Board. No waiver by either of the parties of any breach by the other party hereto of any condition or provision of this Agreement to be performed by the other party hereto shall be deemed a waiver of any similar or dissimilar provision or condition at the same or any prior or subsequent time.

12.Severability. Should any provisions of this Agreement be held to be invalid, illegal, or unenforceable in any respect, such invalidity, illegality, or unenforceability shall not affect any other provisions hereof, and if such provision or provisions are not modified as provided above, this Agreement shall be construed as if such invalid, illegal, or unenforceable provisions had not been set forth herein.

13.Captions. Captions and headings of the sections and paragraphs of this Agreement are intended solely for convenience and no provision of this Agreement is to be construed by reference to the caption or heading of any section or paragraph.

14.Counterparts. This Agreement may be executed in separate counterparts, each of which shall be deemed an original, but all of which taken together shall constitute one and the same instrument.

15.Section 409A.

1.1General Compliance. This Agreement is intended to comply with Section 409A of the Code and the treasury regulations promulgated thereunder (“Section 409A”) or an exemption thereunder and shall be construed and administered in accordance with such intent.

1.2Notwithstanding any other provision of this Agreement, payments provided under this Agreement may only be made upon an event and in a manner that complies with Section 409A or an applicable exemption. Any nonqualified deferred compensation payments under this Agreement that may be excluded from Section 409A either as “separation pay” due to an involuntary separation from service or as a “short-term deferral” shall be excluded from Section 409A to the maximum extent possible. For purposes of Section 409A, each installment payment provided under this Agreement shall be treated as a separate payment and any right to a series of installment payments under this Agreement shall be treated as a right to a series of separate payments. Any payments to be made under this Agreement upon a termination of employment shall only be made upon a “separation from service” under Section 409A. Notwithstanding any provision of this Agreement to the contrary, in no event shall the timing of Executive’s execution of a release, directly or indirectly, result in Executive designating the calendar year of payment of any deferred compensation subject to Section 409A, and if a payment subject to Section 409A is subject to execution of a release and could be made in more than one taxable year, payment of such an amount shall be made in the later taxable year. Notwithstanding the foregoing, the Company makes no representations that the payments and benefits provided under this Agreement comply with Section 409A, and in no event shall the Company be liable for all or any portion of any taxes, penalties, interest, or other expenses that may be incurred by the Executive on account of non-compliance with Section 409A.

1.3Specified Employees. Notwithstanding any other provision of this Agreement, if any payment or benefit provided to the Executive in connection with the Executive’s termination of employment is determined to constitute “nonqualified deferred compensation” within the meaning of Section 409A and the Executive is determined to be a “specified employee” as defined in Section 409A(a)(2)(b)(i), then such payment or benefit shall not be paid until the first payroll date to occur following the six-month anniversary of the date of the Executive’s termination or, if earlier, on the Executive’s death (the “Specified Employee Payment Date”). The aggregate of any payments that would otherwise have been paid before the Specified Employee Payment Date shall be paid to the Executive in a lump sum on the Specified Employee Payment Date and thereafter, any remaining payments shall be paid without delay in accordance with their original schedule.

1.4Reimbursements. To the extent required by Section 409A, each reimbursement or in-kind benefit provided under this Agreement shall be provided in accordance with the following, subject to proof thereof:

(a)the amount of expenses eligible for reimbursement, or in-kind benefits provided, during each calendar year cannot affect the expenses eligible for reimbursement, or in-kind benefits to be provided, in any other calendar year;

(b)any reimbursement of an eligible expense shall be paid to the Executive on or before the last day of the calendar year following the calendar year in which the expense was incurred; and

(c) any right to reimbursements or in-kind benefits under this Agreement shall not be subject to liquidation or exchange for another benefit.

16.Section 280G.

1.1Notwithstanding any other provision of this Agreement or any other plan, arrangement or agreement to the contrary, if any of the payments or benefits provided or to be provided by the

Company or its affiliates to the Executive or for the Executive’s benefit pursuant to the terms of this Agreement or otherwise as a result of a Change in Control (”Covered Payments”) constitute “parachute payments” within the meaning of Code Section 280G and would, but for this Section 16, be subject to the excise tax imposed under Code Section 4999 of the Code (or any successor provision thereto) or any similar tax imposed by state or local law or any interest or penalties with respect to such taxes (collectively, the ”Excise Tax”), then the Covered Payments shall be reduced (but not below zero) to the minimum extent necessary to ensure that no portion of the Covered Payments is subject to the Excise Tax.

1.2The Covered Payments shall be reduced in a manner that maximizes the Executive’s economic position. In applying this principle, the reduction shall be made in a manner consistent with the requirements of Section 409A, and where two economically equivalent amounts are subject to reduction but payable at different times, such amounts shall be reduced on a pro rata basis but not below zero.

1.3Any determination required under this Section 16 shall be made in writing in good faith by the accounting firm that was the Company’s independent auditor immediately before the Change in Control (the ”Accountants”), which shall provide detailed supporting calculations to the Company and the Executive as requested by the Company or the Executive. The Company and the Executive shall provide the Accountants with such information and documents as the Accountants may reasonably request in order to make a determination under this Section 16. For purposes of making the calculations and determinations required by this Section 16, the Accountants may rely on reasonable, good faith assumptions and approximations concerning the application of Code Sections 280G and 4999. The Accountants’ good faith determinations shall be final and binding on the Company and the Executive. The Company shall be responsible for all fees and expenses incurred by the Accountants in connection with the calculations required by this Section.16.

17.Cooperation. The parties agree that certain matters in which the Executive will be involved during the Employment Term may necessitate the Executive’s cooperation in the future. Accordingly, following the termination of the Executive’s employment for any reason, to the extent reasonably requested by the Board, the Executive shall cooperate with the Company in connection with matters arising out of the Executive’s service to the Company; provided that, the Company shall make reasonable efforts to minimize disruption of the Executive’s other activities. The Company shall reimburse the Executive for reasonable expenses incurred in connection with such cooperation and, to the extent that the Executive is required to spend substantial time on such matters, the Company shall compensate the Executive at an hourly rate based on the Executive’s Base Salary on the Termination Date.

18.Successors and Assigns. This Agreement is personal to the Executive and shall not be assigned by the Executive. Any purported assignment by the Executive shall be null and void from the initial date of the purported assignment. The Company may assign this Agreement to any successor or assign (whether direct or indirect, by purchase, merger, consolidation, or otherwise) to all or substantially all of the business or assets of the Company. This Agreement shall inure to the benefit of the Company and permitted successors and assigns.

19.Notice. Notices and all other communications provided for in this Agreement shall be given in writing by personal delivery, electronic delivery, or by registered mail to the parties at the addresses set forth below (or such other addresses as specified by the parties by like notice):

If to the Company:

Natural Gas Services Group, Inc.

404 Veterans Airpark Lane, Suite 300

Midland, TX 79705

Attention: Chief Financial Officer and Chairman of the Board

Email: At the current Company email addresses for such individuals

with a copy (which will not constitute notice hereunder) to:

Jones & Keller, P.C.

1675 Broadway, 26th Floor

Denver, CO 80202

Attention: David Thayer, Esq.

If to the Executive:

Justin C. Jacobs

[Redacted]

[Redacted]

Email: [Redacted]

with a copy (which will not constitute notice hereunder) to:

[Redacted]

[Redacted]

[Redacted]

[Redacted]

Attention: [Redacted]

Email: [Redacted]

20.Representations of the Executive. The Executive represents and warrants to the Company that:

The Executive's acceptance of employment with the Company and the performance of the Executive's duties hereunder will not conflict with or result in a violation of, a breach of, or a default under any contract, agreement, or understanding to which the Executive is a party or is otherwise bound.

The Executive's acceptance of employment with the Company and the performance of the Executive's duties hereunder will not violate any non-solicitation, non-competition, or other similar covenant or agreement of a prior employer or third-party.

21.Withholding. The Company shall have the right to withhold from any amount payable hereunder any Federal, state, local or foreign taxes in order for the Company to satisfy any withholding tax obligation it may have under any applicable law or regulation.

22.Survival. Upon the expiration or other termination of this Agreement, the respective rights and obligations of the parties hereto shall survive such expiration or other termination to the extent necessary to carry out the intentions of the parties under this Agreement.

23.Acknowledgement of Full Understanding. THE EXECUTIVE ACKNOWLEDGES AND AGREES THAT THE EXECUTIVE HAS FULLY READ, UNDERSTANDS AND VOLUNTARILY ENTERS INTO THIS AGREEMENT. THE EXECUTIVE ACKNOWLEDGES AND AGREES THAT THE EXECUTIVE HAS HAD AN OPPORTUNITY TO ASK QUESTIONS AND CONSULT WITH AN ATTORNEY OF THE EXECUTIVE'S CHOICE BEFORE SIGNING THIS AGREEMENT.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the parties hereto have executed this Employment Agreement as of the date first above written.

NATURAL GAS SERVICES GROUP, INC.

By: /s/ Stephen C. Taylor

Name: Stephen C. Taylor

Title: Interim Chief Executive Officer

EXECUTIVE

/s/ Justin C. Jacobs

Justin C. Jacobs

Exhibit 10.2

Exhibit 10.3

Natural Gas Services Group, Inc. Announces

Justin Jacobs as Chief Executive Officer

Midland, Texas, February 1, 2024 (GLOBE NEWSWIRE) – Natural Gas Services Group, Inc. (NYSE: NGS), a leading provider of gas compression equipment, technology, and services to the energy industry, announced today the appointment of Justin Jacobs as Chief Executive Officer of NGS, effective February 12, 2024.

The appointment concludes an extensive and thorough search process undertaken by the Board of Directors over the past year. Stephen Taylor, who serves as Interim Chief Executive Officer, will remain Chairman of Board of NGS and will provide transition services for 6 months as per his retirement agreement.

“We are delighted to have Justin take an executive role at this important point in NGS’s history,” Mr. Taylor said. “In working with him for several years as an engaged shareholder in the company and then working very closely with him in his time as a director, I’m confident his expertise will help drive the continued upward trajectory of our performance. As one of the company’s largest shareholders, I am excited about the future of NGS.”

“NGS is a great company that has grown significantly over the past year with a huge opportunity ahead, particularly considering the company’s strong competitive position and industry tailwinds,” noted Mr. Jacobs. “Throughout my career, I have worked with companies as an investor, operator, and director to drive returns for shareholders. I look forward to working closely with Steve during his transition, NGS’s President and COO, Brian Tucker, and the outstanding operating team at the company. I believe the future for NGS is bright.”

Mr. Jacobs joins NGS from Mill Road Capital, an investment firm focused on investing in, and partnering with, small publicly traded companies in the U.S. and Canada. He was a Managing Director at Mill Road, a member of the management committee, and responsible for overseeing and managing the Firm’s governance investments. Mr. Jacobs joined the firm in 2005, prior to the formation of the first fund. He previously worked at LiveWire Capital, an investment and management group focused on operationally intensive buyouts. In addition to leading and executing investment opportunities, Mr. Jacobs held operational positions in numerous portfolio companies, including interim Chief Operating Officer. Prior to LiveWire, Mr. Jacobs was an investment professional in the private equity group at Blackstone, where he worked on transactions in a range of industries including oil refining. In addition to sitting on the Board of NGS, Mr. Jacobs is or has been a director for five public companies as well as numerous private for profit and not for profit boards.

About Natural Gas Services Group, Inc. (NGS)

NGS is a leading provider of gas compression equipment, technology, and services to the energy industry. The Company manufactures, fabricates, rents, sells, and maintains natural gas compressors for oil and natural gas production and plant facilities. NGS is headquartered in Midland, Texas, with fabrication facilities located in Tulsa, Oklahoma, and Midland, Texas, and service facilities located in major oil and natural gas producing basins in the U.S. Additional information can be found at www.ngsgi.com.

Cautionary Statements

This news release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that do not relate strictly to historical or current facts, including those relating to expectations regarding the Company's CEO hiring, are forward-looking and are subject to known and unknown risks and uncertainties that may cause actual results to differ materially from those expressed in such forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made, and the Company does not intend to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

For Additional Information:

Anna Delgado-Investor Relations

(432) 262-2700

ir@ngsgi.com

www.ngsgi.com

v3.24.0.1

Cover Page

|

Nov. 14, 2022 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 29, 2024

|

| Entity Registrant Name |

NATURAL GAS SERVICES GROUP, INC.

|

| Entity Incorporation, State or Country Code |

CO

|

| Entity File Number |

1-31398

|

| Entity Tax Identification Number |

75-2811855

|

| Entity Address, Address Line One |

404 Veterans Airpark Lane, Suite 300

|

| Entity Address, City or Town |

Midland

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

79705

|

| City Area Code |

432

|

| Local Phone Number |

262-2700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.01

|

| Trading Symbol |

NGS

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001084991

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

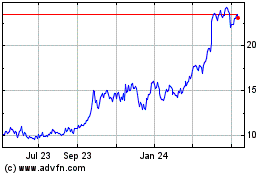

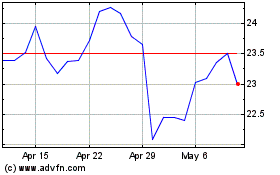

Natural Gas Services (NYSE:NGS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Natural Gas Services (NYSE:NGS)

Historical Stock Chart

From Jul 2023 to Jul 2024