MSCI Inc. (“MSCI” or the “Company”) (NYSE: MSCI), a leading

provider of critical decision support tools and services for the

global investment community, today announced its financial results

for the three months ended March 31, 2024 (“first quarter

2024”).

Financial and Operational Highlights for First Quarter

2024 (Note: Unless otherwise noted, percentage and other

changes are relative to the three months ended March 31, 2023

(“first quarter 2023”) and Run Rate percentage changes are relative

to March 31, 2023).

- Operating revenues of $680.0 million, up 14.8%; Organic

operating revenue growth of 10.3%

- Recurring subscription revenues up 15.2%; Asset-based fees

up 12.9%

- Operating margin of 49.9%; Adjusted EBITDA margin of

56.4%

- Diluted EPS of $3.22, up 8.4%; Adjusted EPS of $3.52, up

12.1%

- Organic recurring subscription Run Rate growth of 8.7%;

Retention Rate of 92.8%

- Approximately $126.8 million in dividends were paid to

shareholders in first quarter 2024; Cash dividend of $1.60 per

share declared by MSCI Board of Directors for second quarter

2024

Three Months Ended

Mar. 31,

Mar. 31,

In thousands, except per share data

(unaudited)

2024

2023

% Change

Operating revenues

$

679,965

$

592,218

14.8

%

Operating income

$

339,382

$

314,602

7.9

%

Operating margin %

49.9

%

53.1

%

Net income

$

255,954

$

238,728

7.2

%

Diluted EPS

$

3.22

$

2.97

8.4

%

Adjusted EPS

$

3.52

$

3.14

12.1

%

Adjusted EBITDA

$

383,573

$

344,729

11.3

%

Adjusted EBITDA margin %

56.4

%

58.2

%

“MSCI’s first-quarter financial results affirm that we can

deliver solid earnings amid continued operating environment

challenges. Record AUM balances in MSCI-linked index products drove

strong revenue growth from asset-based fees, which helped offset

lower subscription revenue. This highlights the underlying strength

and stability of our all-weather franchise,” said Henry A.

Fernandez, Chairman and CEO of MSCI.

“Our operating metrics showed resilience in our new recurring

sales, especially in Analytics, which was our highest first quarter

in a decade. Elevated cancels reflected a concentration of unusual

client events, including a large merger among our banking clients.

We are managing through these pressures and do not expect this

level of cancels to continue,” Fernandez added.

“We are encouraged by our deep client engagement across

segments, which is enabling us to accelerate product innovation.

Our long-term strategy and recent acquisitions have positioned us

well to benefit from secular trends that are reshaping our

industry, such as portfolio indexation and customization, the

growth of private assets and the global sustainability revolution.

All of this supports our conviction that we can maintain attractive

profitability and growth in 2024 and beyond.”

First Quarter Consolidated

Results

Operating Revenues:

Operating revenues were $680.0 million, up 14.8%. Organic operating

revenue growth was 10.3%. The $87.7 million increase was the result

of a $67.8 million increase in recurring subscription revenues; a

$17.1 million increase in asset-based fees and a $2.8 million

increase in non-recurring revenues.

Run Rate and Retention Rate:

Total Run Rate at March 31, 2024 was $2,726.5 million, up 14.6%.

Recurring subscription Run Rate increased by $262.4 million, and

asset-based fees Run Rate increased by $84.9 million. Organic

recurring subscription Run Rate growth was 8.7%. Retention Rate in

first quarter 2024 was 92.8%, compared to 95.2% in first quarter

2023. Approximately $7.0 million of the cancels related to one

client event related to the merger of our banking clients, which

impacted Index, ESG and Climate, and Analytics. The majority of

first quarter 2024 cancels were due to corporate events including

organizations closing, shutting funds, restructuring or downsizing.

Approximately 85% of MSCI’s subscription Run Rate as of March 31,

2024 was with clients subscribing to multiple products, and these

clients had a 93.1% or higher Retention Rate in first quarter

2024.

Expenses: Total operating

expenses were $340.6 million, up 22.7%, including $35.1 million

associated with Private Capital Solutions; formerly known as The

Burgiss Group, LLC ("Burgiss")), Carbon Markets (formerly known as

Trove Research Ltd ("Trove")) and Fabric RQ Inc. ("Fabric").

Adjusted EBITDA expenses were $296.4 million, up 19.8%,

primarily reflecting higher compensation and benefits costs related

to higher headcount as a result of business growth and the recent

acquisitions. Adjusted EBITDA expense includes $23.9 million of

expenses associated with Private Capital Solutions, Carbon Markets

and Fabric. Approximately $1.5 million in integration costs related

to the acquisition of the remaining interest in Burgiss and $9.7

million of acquired intangible asset amortization expenses related

to Private Capital Solutions, Carbon Markets and Fabric were

excluded from Adjusted EBITDA expenses.

Total operating expenses excluding the impact of foreign

currency exchange rate fluctuations (“ex-FX”) and adjusted EBITDA

expenses ex-FX increased 21.9% and 18.9%, respectively.

Operating Income: Operating

income was $339.4 million, up 7.9%. Operating income margin in

first quarter 2024 was 49.9%, compared to 53.1% in first quarter

2023.

Headcount: As of March 31,

2024, we had 5,858 employees reflecting a 20.9% increase, which was

primarily driven by our recent acquisitions. Approximately 32.8%

and 67.2% of employees are located in developed market and emerging

market locations, respectively.

Other Expense (Income), Net:

Other expense (income), net was $43.5 million, up 13.8% primarily

driven by lower interest income reflecting lower average cash

balances as well as loss on extinguishment related to unamortized

debt issuance costs associated with the prepayment of the Tranche A

Term Loans and the entry into the amended and restated credit

agreement (the "Credit Amendment"), partially offset by the impact

of favorable foreign currency exchange rate fluctuations.

Income Taxes: The effective

tax rate was 13.5% in first quarter 2024 compared to 13.6% in first

quarter 2023. A higher operating tax rate in the current period was

offset by favorable discrete items related to prior years, as well

as higher excess tax benefits recognized on share-based

compensation vested during the period.

Net Income: As a result of

the factors described above, net income was $256.0 million, up

7.2%.

Adjusted EBITDA: Adjusted

EBITDA was $383.6 million, up 11.3%. Adjusted EBITDA margin in

first quarter 2024 was 56.4%, compared to 58.2% in first quarter

2023.

Index Segment:

Table 1A: Results (unaudited)

Three Months Ended

Mar. 31,

Mar. 31,

In thousands

2024

2023

% Change

Operating revenues:

Recurring subscriptions

$

212,952

$

196,678

8.3

%

Asset-based fees

150,259

133,126

12.9

%

Non-recurring

10,661

9,578

11.3

%

Total operating revenues

373,872

339,382

10.2

%

Adjusted EBITDA expenses

96,112

85,700

12.1

%

Adjusted EBITDA

$

277,760

$

253,682

9.5

%

Adjusted EBITDA margin %

74.3

%

74.7

%

Index operating revenues were $373.9 million, up 10.2%. The

$34.5 million increase was primarily driven by $17.1 million in

higher asset-based fees and $16.3 million in higher recurring

subscription revenues.

Revenues from ETFs linked to MSCI equity indexes, driven by an

increase in average AUM, drove more than 70% of the increase in

revenues attributable to asset-based fees. The revenue increase was

also impacted by non-ETF indexed funds linked to MSCI indexes,

driven by an increase in average AUM. The increase was partially

offset by a decrease in average basis point fees for both ETFs

linked to MSCI equity indexes as well as non-ETF indexed linked

funds linked to MSCI indexes and a decrease in revenue from futures

and options contracts linked to MSCI indexes.

More than 90% of the growth in recurring subscription revenues

was driven by strong growth from market-cap weighted and custom

Index products and special packages.

Index Run Rate as of March 31, 2024, was $1.5 billion, up 12.0%.

The $159.3 million increase was comprised of an $84.9 million

increase in asset-based fees Run Rate and a $74.3 million increase

in recurring subscription Run Rate. The increase in asset-based

fees Run Rate primarily reflected higher AUM in ETFs linked to MSCI

equity indexes and non-ETF indexed funds linked to MSCI indexes.

The increase in recurring subscription Run Rate was primarily

driven by growth from market cap-weighted and custom Index products

and special packages. The increase reflected growth across all

regions.

Analytics Segment:

Table 1B: Results (unaudited)

Three Months Ended

Mar. 31,

Mar. 31,

In thousands

2024

2023

% Change

Operating revenues:

Recurring subscriptions

$

160,551

$

144,503

11.1

%

Non-recurring

3,415

2,567

33.0

%

Total operating revenues

163,966

147,070

11.5

%

Adjusted EBITDA expenses

91,754

86,290

6.3

%

Adjusted EBITDA

$

72,212

$

60,780

18.8

%

Adjusted EBITDA margin %

44.0

%

41.3

%

Analytics operating revenues were $164.0 million, up 11.5%. The

$16.9 million increase was primarily driven by growth from

recurring subscriptions related to both Multi-Asset Class and

Equity Analytics products. Organic operating revenue growth for

Analytics was 11.9%.

Analytics Run Rate as of March 31, 2024, was $662.1 million, up

6.5%. The increase of $40.5 million was driven by growth in both

Multi-Asset Class and Equity Analytics products, and reflected

growth across all regions and client segments. Organic recurring

subscription Run Rate growth for Analytics was 7.0%.

ESG and Climate Segment:

Table 1C: Results (unaudited)

Three Months Ended

Mar. 31,

Mar. 31,

In thousands

2024

2023

% Change

Operating revenues:

Recurring subscriptions

$

76,418

$

65,732

16.3

%

Non-recurring

1,466

1,326

10.6

%

Total operating revenues

77,884

67,058

16.1

%

Adjusted EBITDA expenses

56,793

49,182

15.5

%

Adjusted EBITDA

$

21,091

$

17,876

18.0

%

Adjusted EBITDA margin %

27.1

%

26.7

%

ESG and Climate operating revenues were $77.9 million, up 16.1%.

The $10.8 million increase was driven by growth in Ratings, Climate

and Screening products. Organic operating revenue growth for ESG

and Climate was 11.0%.

ESG and Climate Run Rate as of March 31, 2024, was $320.6

million, up 14.9%. The $41.7 million increase primarily reflects

strong growth from Ratings, Climate and Screening products with

contributions across all regions and client segments. Organic

recurring subscription Run Rate growth for ESG and Climate was

13.3%.

All Other – Private Assets

Segment:

Table 1D: Results (unaudited)

Three Months Ended

Mar. 31,

Mar. 31,

In thousands

2024

2023

% Change

Operating revenues:

Recurring subscriptions

$

63,134

$

38,334

64.7

%

Non-recurring

1,109

374

196.5

%

Total operating revenues

64,243

38,708

66.0

%

Adjusted EBITDA expenses

51,733

26,317

96.6

%

Adjusted EBITDA

$

12,510

$

12,391

1.0

%

Adjusted EBITDA margin %

19.5

%

32.0

%

All Other – Private Assets operating revenues, which reflect the

Real Assets and Private Capital Solutions operating segments, were

$64.2 million, up 66.0% and included $24.2 million of revenue from

Private Capital Solutions. The remaining growth in revenue was

primarily driven by growth from recurring subscriptions related to

Index Intel products and favorable foreign currency exchange rate

fluctuations, partially offset by a decrease in recurring

subscriptions related to our Property Intel product. Organic

operating revenue growth for All Other – Private Assets was

2.6%.

All Other – Private Assets Run Rate, which reflects the Real

Assets and Private Capital Solutions operating segments, was $254.4

million as of March 31, 2024, up 71.4%, and included $101.0 million

associated with Private Capital Solutions. The remaining growth in

the run rate was primarily driven by Index Intel, RCA and

Performance Insights products, partially offset by a decline in

Property Intel product. Organic recurring subscription Run Rate

growth for All Other – Private Assets was 3.5%.

Select Balance Sheet Items and Capital

Allocation

Cash Balances and Outstanding

Debt: Cash and cash equivalents was $519.3 million as of

March 31, 2024, including $3.8 million of restricted cash. MSCI

typically seeks to maintain minimum cash balances globally of

approximately $225.0 million to $275.0 million for general

operating purposes.

Total principal amounts of debt outstanding as of March 31,

2024, were $4.5 billion. The total debt to net income ratio (based

on trailing twelve months net income) was 3.9x. The total debt to

adjusted EBITDA ratio (based on trailing twelve months adjusted

EBITDA) was 2.9x.

MSCI seeks to maintain total debt to adjusted EBITDA in a target

range of 3.0x to 3.5x.

During the quarter, we amended and restated the credit agreement

governing our credit facilities (the “Credit Agreement”) to provide

for a new revolving credit facility (the “Revolving Credit

Facility”) with an aggregate of $1.25 billion of revolving loan

commitments, which may be drawn until January 2029. On the closing

of the Credit Agreement, we drew down $336.9 million on the

Revolving Credit Facility in order to prepay the term loans

outstanding under the prior term loan A facility.

Capex and Cash Flow: Capex

was $24.2 million, and net cash provided by operating activities

increased by 13.6% to $300.1 million, primarily reflecting higher

cash collections from customers partially offset by higher cash

expenses. Free cash flow for first quarter 2024 was up 13.7% to

$275.9 million.

Share Count and Share

Repurchases: Weighted average diluted shares outstanding

were 79.5 million in first quarter 2024, down 1.2% year-over-year.

Total shares outstanding as of March 31, 2024 were 79.2 million. As

of April 22, 2024, a total of approximately $0.8 billion remains

available on the outstanding share repurchase authorization.

Dividends: Approximately

$126.8 million in dividends were paid to shareholders in first

quarter 2024. On April 22, 2024, the MSCI Board of Directors

declared a cash dividend of $1.60 per share for second quarter

2024, payable on May 31, 2024 to shareholders of record as of the

close of trading on May 17, 2024.

Full-Year 2024 Guidance

MSCI’s guidance for the year ending December 31, 2024

(“Full-Year 2024”) is based on assumptions about a number of

factors, in particular related to macroeconomic factors and the

capital markets. These assumptions are subject to uncertainty, and

actual results for the year could differ materially from our

current guidance, including as a result of the uncertainties, risks

and assumptions discussed in the “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” sections of our Annual Report on Form 10-K, as updated

in quarterly reports on Form 10-Q and current reports on Form 8-K

filed or furnished with the SEC. See “Forward-Looking Statements”

below.

Guidance Item

Current Guidance for Full-Year

2024

Operating Expense

$1,300 to $1,340 million

Adjusted EBITDA Expense

$1,130 to $1,160 million

Interest Expense

(including amortization of financing

fees)(1)

$185 to $189 million

Depreciation & Amortization

Expense

$170 to $180 million

Effective Tax Rate

18% to 21%

Capital Expenditures

$95 to $105 million

Net Cash Provided by Operating

Activities

$1,330 to $1,380 million

Free Cash Flow

$1,225 to $1,285 million

(1) A portion of our annual interest expense is from our

variable rate indebtedness under our Revolving Credit Facility,

while the majority is from fixed rate senior unsecured notes.

Changes to the secured overnight funding rate (“SOFR”) and

indebtedness levels can cause our annual interest expense to

vary.

Conference Call Information

MSCI’s senior management will review the first quarter 2024

results on Tuesday, April 23, 2024 at 10:00 AM Eastern Time. To

listen to the live event via webcast, visit the events and

presentations section of MSCI’s Investor Relations website,

https://ir.msci.com/events-and-presentations, or via telephone,

dial 1-833-630-1956 within the United States. International callers

may dial 1-412-317-1837. Participants should ask the operator to be

joined into the MSCI call. The teleconference will also be webcast

with an accompanying slide presentation that can be accessed

through MSCI’s Investor Relations website.

About MSCI Inc.

MSCI is a leading provider of critical decision support tools

and services for the global investment community. With over 50

years of expertise in research, data and technology, we power

better investment decisions by enabling clients to understand and

analyze key drivers of risk and return and confidently build more

effective portfolios. We create industry-leading research-enhanced

solutions that clients use to gain insight into and improve

transparency across the investment process. To learn more, please

visit www.msci.com. MSCI#IR

Forward-Looking Statements

This earnings release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including without limitation, MSCI’s Full-Year 2024 guidance.

These forward-looking statements relate to future events or to

future financial performance and involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance or achievements to be materially

different from any future results, levels of activity, performance

or achievements expressed or implied by these statements. In some

cases, you can identify forward-looking statements by the use of

words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,”

“anticipate,” “believe,” “estimate,” “predict,” “potential” or

“continue,” or the negative of these terms or other comparable

terminology. You should not place undue reliance on forward-looking

statements because they involve known and unknown risks,

uncertainties and other factors that are, in some cases, beyond

MSCI’s control and that could materially affect actual results,

levels of activity, performance or achievements.

Other factors that could materially affect actual results,

levels of activity, performance or achievements can be found in

MSCI’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023 filed with the Securities and Exchange Commission

(“SEC”) on February 9, 2024 and in quarterly reports on Form 10-Q

and current reports on Form 8-K filed or furnished with the SEC. If

any of these risks or uncertainties materialize, or if MSCI’s

underlying assumptions prove to be incorrect, actual results may

vary significantly from what MSCI projected. Any forward-looking

statement in this earnings release reflects MSCI’s current views

with respect to future events and is subject to these and other

risks, uncertainties and assumptions relating to MSCI’s operations,

results of operations, growth strategy and liquidity. MSCI assumes

no obligation to publicly update or revise these forward-looking

statements for any reason, whether as a result of new information,

future events, or otherwise, except as required by law.

Website and Social Media Disclosure

MSCI uses its Investor Relations homepage and its Corporate

Responsibility homepage as channels of distribution of company

information. The information MSCI posts through these channels may

be deemed material. Accordingly, investors should monitor these

channels, in addition to following MSCI’s press releases, SEC

filings and public conference calls and webcasts. In addition, you

may automatically receive email alerts and other information about

MSCI when you enroll your email address by visiting the “Email

Alerts” section of MSCI’s Investor Relations homepage at

http://ir.msci.com/email-alerts. The contents of MSCI’s website,

including its quarterly updates, blog, podcasts and social media

channels are not, however, incorporated by reference into this

earnings release.

Notes Regarding the Use of Operating Metrics

MSCI has presented supplemental key operating metrics as part of

this earnings release, including Retention Rate, Run Rate,

subscription sales, subscription cancellations and non-recurring

sales.

Retention Rate is an important metric because subscription

cancellations decrease our Run Rate and ultimately our future

operating revenues over time. The annual Retention Rate represents

the retained subscription Run Rate (subscription Run Rate at the

beginning of the fiscal year less actual cancels during the year)

as a percentage of the subscription Run Rate at the beginning of

the fiscal year.

The Retention Rate for a non-annual period is calculated by

annualizing the cancellations for which we have received a notice

of termination or for which we believe there is an intention not to

renew or discontinue the subscription during the non-annual period,

and we believe that such notice or intention evidences the client’s

final decision to terminate or not renew the applicable agreement,

even though such notice is not effective until a later date. This

annualized cancellation figure is then divided by the subscription

Run Rate at the beginning of the fiscal year to calculate a

cancellation rate. This cancellation rate is then subtracted from

100% to derive the annualized Retention Rate for the period.

Retention Rate is computed by operating segment on a

product/service-by-product/service basis. In general, if a client

reduces the number of products or services to which it subscribes

within a segment, or switches between products or services within a

segment, we treat it as a cancellation for purposes of calculating

our Retention Rate except in the case of a product or service

switch that management considers to be a replacement product or

service. In those replacement cases, only the net change to the

client subscription, if a decrease, is reported as a cancel. In the

Analytics and the ESG and Climate operating segments, substantially

all product or service switches are treated as replacement products

or services and netted in this manner, while in our Index and Real

Assets operating segments, product or service switches that are

treated as replacement products or services and receive netting

treatment occur only in certain limited instances. In addition, we

treat any reduction in fees resulting from a down-sell of the same

product or service as a cancellation to the extent of the

reduction. We do not calculate Retention Rate for that portion of

our Run Rate attributable to assets in index-linked investment

products or futures and options contracts, in each case, linked to

our indexes.

Run Rate estimates at a particular point in time the annualized

value of the recurring revenues under our client license agreements

(“Client Contracts”) for the next 12 months, assuming all Client

Contracts that come up for renewal, or reach the end of the

committed subscription period, are renewed and assuming

then-current currency exchange rates, subject to the adjustments

and exclusions described below. For any Client Contract where fees

are linked to an investment product’s assets or trading

volume/fees, the Run Rate calculation reflects, for ETFs, the

market value on the last trading day of the period, for futures and

options, the most recent quarterly volumes and/or reported exchange

fees, and for other non-ETF products, the most recent

client-reported assets. Run Rate does not include fees associated

with “one-time” and other non-recurring transactions. In addition,

we add to Run Rate the annualized fee value of recurring new sales,

whether to existing or new clients, when we execute Client

Contracts, even though the license start date, and associated

revenue recognition, may not be effective until a later date. We

remove from Run Rate the annualized fee value associated with

products or services under any Client Contract with respect to

which we have received a notice of termination, non-renewal or an

indication the client does not intend to continue their

subscription during the period and have determined that such notice

evidences the client’s final decision to terminate or not renew the

applicable products or services, even though such notice is not

effective until a later date.

“Organic recurring subscription Run Rate growth” is defined as

the period over period Run Rate growth, excluding the impact of

changes in foreign currency and the first year impact of any

acquisitions. It is also adjusted for divestitures. Changes in

foreign currency are calculated by applying the currency exchange

rate from the comparable prior period to current period foreign

currency denominated Run Rate.

Sales represents the annualized value of products and services

clients commit to purchase from MSCI and will result in additional

operating revenues. Non-recurring sales represent the actual value

of the customer agreements entered into during the period and are

not a component of Run Rate. New recurring subscription sales

represent additional selling activities, such as new customer

agreements, additions to existing agreements or increases in price

that occurred during the period and are additions to Run Rate.

Subscription cancellations reflect client activities during the

period, such as discontinuing products and services and/or

reductions in price, resulting in reductions to Run Rate. Net new

recurring subscription sales represent the amount of new recurring

subscription sales net of subscription cancellations during the

period, which reflects the net impact to Run Rate during the

period.

Total gross sales represent the sum of new recurring

subscription sales and non-recurring sales. Total net sales

represent the total gross sales net of the impact from subscription

cancellations.

Notes Regarding the Use of Non-GAAP Financial

Measures

MSCI has presented supplemental non-GAAP financial measures as

part of this earnings release. Reconciliations are provided in

Tables 9 through 13 below that reconcile each non-GAAP financial

measure with the most comparable GAAP measure. The non-GAAP

financial measures presented in this earnings release should not be

considered as alternative measures for the most directly comparable

GAAP financial measures. The non-GAAP financial measures presented

in this earnings release are used by management to monitor the

financial performance of the business, inform business

decision-making and forecast future results.

“Adjusted EBITDA” is defined as net income before (1) provision

for income taxes, (2) other expense (income), net, (3) depreciation

and amortization of property, equipment and leasehold improvements,

(4) amortization of intangible assets and, at times, (5) certain

other transactions or adjustments, including, when applicable,

certain acquisition-related integration and transaction costs.

“Adjusted EBITDA expenses” is defined as operating expenses less

depreciation and amortization of property, equipment and leasehold

improvements and amortization of intangible assets and, at times,

certain other transactions or adjustments, including, when

applicable, certain acquisition-related integration and transaction

costs.

“Adjusted EBITDA margin” is defined as adjusted EBITDA divided

by operating revenues.

“Adjusted net income” and “adjusted EPS” are defined as net

income and diluted EPS, respectively, before the after-tax impact

of: the amortization of acquired intangible assets, including the

amortization of the basis difference between the cost of the equity

method investment and MSCI’s share of the net assets of the

investee at historical carrying value and, at times, certain other

transactions or adjustments, including, when applicable, the impact

related to certain acquisition-related integration and transaction

costs, the impact related to write-off of deferred fees on debt

extinguishment and the impact related to gain from changes in

ownership interest of investees.

“Capex” is defined as capital expenditures plus capitalized

software development costs.

“Free cash flow” is defined as net cash provided by operating

activities, less Capex.

“Organic operating revenue growth” is defined as operating

revenue growth compared to the prior year period excluding the

impact of acquired businesses, divested businesses and foreign

currency exchange rate fluctuations.

Asset-based fees ex-FX does not adjust for the impact from

foreign currency exchange rate fluctuations on the underlying

assets under management (“AUM”).

We believe adjusted EBITDA, adjusted EBITDA margin and adjusted

EBITDA expenses are meaningful measures of the operating

performance of MSCI because they adjust for significant one-time,

unusual or non-recurring items as well as eliminate the accounting

effects of certain capital spending and acquisitions that do not

directly affect what management considers to be our ongoing

operating performance in the period.

We believe adjusted net income and adjusted EPS are meaningful

measures of the performance of MSCI because they adjust for the

after-tax impact of significant one-time, unusual or non-recurring

items as well as eliminate the impact of any transactions that do

not directly affect what management considers to be our ongoing

operating performance in the period. We also exclude the after-tax

impact of the amortization of acquired intangible assets and

amortization of the basis difference between the cost of the equity

method investment and MSCI’s share of the net assets of the

investee at historical carrying value, as these non-cash amounts

are significantly impacted by the timing and size of each

acquisition and therefore not meaningful to the ongoing operating

performance in the period.

We believe that free cash flow is useful to investors because it

relates the operating cash flow of MSCI to the capital that is

spent to continue and improve business operations, such as

investment in MSCI’s existing products. Further, free cash flow

indicates our ability to strengthen MSCI’s balance sheet, repay our

debt obligations, pay cash dividends and repurchase shares of our

common stock.

We believe organic operating revenue growth is a meaningful

measure of the operating performance of MSCI because it adjusts for

the impact of foreign currency exchange rate fluctuations and

excludes the impact of operating revenues attributable to acquired

and divested businesses for the comparable prior year period,

providing insight into our ongoing operating performance for the

period(s) presented.

We believe that the non-GAAP financial measures presented in

this earnings release facilitate meaningful period-to-period

comparisons and provide a baseline for the evaluation of future

results.

Adjusted EBITDA expenses, adjusted EBITDA margin, adjusted

EBITDA, adjusted net income, adjusted EPS, Capex, free cash flow

and organic operating revenue growth are not defined in the same

manner by all companies and may not be comparable to

similarly-titled non-GAAP financial measures of other companies.

These measures can differ significantly from company to company

depending on, among other things, long-term strategic decisions

regarding capital structure, the tax jurisdictions in which

companies operate and capital investments. Accordingly, the

Company’s computation of these measures may not be comparable to

similarly-titled measures computed by other companies.

Notes Regarding Adjusting for the Impact of Foreign Currency

Exchange Rate Fluctuations

Foreign currency exchange rate fluctuations reflect the

difference between the current period results as reported compared

to the current period results recalculated using the foreign

currency exchange rates in effect for the comparable prior period.

While operating revenues adjusted for the impact of foreign

currency fluctuations includes asset-based fees that have been

adjusted for the impact of foreign currency fluctuations, the

underlying AUM, which is the primary component of asset-based fees,

is not adjusted for foreign currency fluctuations. Approximately

three-fifths of the AUM is invested in securities denominated in

currencies other than the U.S. dollar, and accordingly, any such

impact is excluded from the disclosed foreign currency-adjusted

variances.

Table 2: Condensed Consolidated Statements of Income

(unaudited)

Three Months Ended

Mar. 31,

Mar. 31,

%

In thousands, except per share

data

2024

2023

Change

Operating revenues

$

679,965

$

592,218

14.8

%

Operating expenses:

Cost of revenues (exclusive of

depreciation and amortization)

128,514

108,647

18.3

%

Selling and marketing

72,168

66,475

8.6

%

Research and development

40,525

31,323

29.4

%

General and administrative

56,691

41,044

38.1

%

Amortization of intangible assets

38,604

24,667

56.5

%

Depreciation and amortization of

property,

equipment and leasehold improvements

4,081

5,460

(25.3

)%

Total operating expenses(1)

340,583

277,616

22.7

%

Operating income

339,382

314,602

7.9

%

Interest income

(6,048

)

(10,362

)

(41.6

)%

Interest expense

46,674

46,206

1.0

%

Other expense (income)

2,863

2,386

20.0

%

Other expense (income), net

43,489

38,230

13.8

%

Income before provision for income

taxes

295,893

276,372

7.1

%

Provision for income taxes

39,939

37,644

6.1

%

Net income

$

255,954

$

238,728

7.2

%

Earnings per basic common share

$

3.23

$

2.98

8.4

%

Earnings per diluted common share

$

3.22

$

2.97

8.4

%

Weighted average shares outstanding used

in computing earnings per share:

Basic

79,195

80,041

(1.1

)%

Diluted

79,508

80,482

(1.2

)%

(1) Includes stock-based compensation

expense of $34.7 million and $21.6 million for the three months

ended Mar. 31, 2024 and 2023, respectively.

Table 3: Selected Balance Sheet Items (unaudited)

As of

Mar. 31,

Dec. 31,

In thousands

2024

2023

Cash and cash equivalents (1)

$519,315

$461,693

Accounts receivable, net of allowances

$745,611

$839,555

Current deferred revenue

$1,053,961

$1,083,864

Current portion of long-term debt (2)

$—

$10,902

Long-term debt (3)

$4,507,686

$4,496,826

(1) Includes restricted cash of $3.8

million at Mar. 31, 2024 and $3.9 million at Dec. 31, 2023.

(2) Consists of gross current portion of

long-term debt, net of deferred financing fees. Gross current

portion of long-term debt was $0.0 million at Mar. 31, 2024 and

$10.9 million at Dec. 31, 2023.

(3) Consists of gross long-term debt, net

of deferred financing fees. Gross long-term debt was $4,536.9

million at Mar. 31, 2024 and $4,528.1 million at Dec. 31, 2023.

Table 4: Selected Cash Flow Items (unaudited)

Three Months Ended

Mar. 31,

Mar. 31,

%

In thousands

2024

2023

Change

Net cash provided by operating

activities

$

300,137

$

264,141

13.6

%

Net cash used in investing activities

(32,333

)

(21,762

)

(48.6

)%

Net cash (used in) provided by financing

activities

(207,223

)

(158,293

)

(30.9

)%

Effect of exchange rate changes

(2,959

)

2,958

(200.0

)%

Net (decrease) increase in cash, cash

equivalents and restricted cash

$

57,622

$

87,044

(33.8

)%

Table 5: Operating Results by Segment and Revenue Type

(unaudited)

Index

Three Months Ended

Mar. 31,

Mar. 31,

%

In thousands

2024

2023

Change

Operating revenues:

Recurring subscriptions

$

212,952

$

196,678

8.3

%

Asset-based fees

150,259

133,126

12.9

%

Non-recurring

10,661

9,578

11.3

%

Total operating revenues

373,872

339,382

10.2

%

Adjusted EBITDA expenses

96,112

85,700

12.1

%

Adjusted EBITDA

$

277,760

$

253,682

9.5

%

Adjusted EBITDA margin %

74.3

%

74.7

%

Analytics

Three Months Ended

Mar. 31,

Mar. 31,

%

In thousands

2024

2023

Change

Operating revenues:

Recurring subscriptions

$

160,551

$

144,503

11.1

%

Non-recurring

3,415

2,567

33.0

%

Total operating revenues

163,966

147,070

11.5

%

Adjusted EBITDA expenses

91,754

86,290

6.3

%

Adjusted EBITDA

$

72,212

$

60,780

18.8

%

Adjusted EBITDA margin %

44.0

%

41.3

%

ESG and Climate

Three Months Ended

Mar. 31,

Mar. 31,

%

In thousands

2024

2023

Change

Operating revenues:

Recurring subscriptions

$

76,418

$

65,732

16.3

%

Non-recurring

1,466

1,326

10.6

%

Total operating revenues

77,884

67,058

16.1

%

Adjusted EBITDA expenses

56,793

49,182

15.5

%

Adjusted EBITDA

$

21,091

$

17,876

18.0

%

Adjusted EBITDA margin %

27.1

%

26.7

%

All Other - Private Assets

Three Months Ended

Mar. 31,

Mar. 31,

%

In thousands

2024

2023

Change

Operating revenues:

Recurring subscriptions

$

63,134

$

38,334

64.7

%

Non-recurring

1,109

374

196.5

%

Total operating revenues

64,243

38,708

66.0

%

Adjusted EBITDA expenses

51,733

26,317

96.6

%

Adjusted EBITDA

$

12,510

$

12,391

1.0

%

Adjusted EBITDA margin %

19.5

%

32.0

%

Consolidated

Three Months Ended

Mar. 31,

Mar. 31,

%

In thousands

2024

2023

Change

Operating revenues:

Recurring subscriptions

$

513,055

$

445,247

15.2

%

Asset-based fees

150,259

133,126

12.9

%

Non-recurring

16,651

13,845

20.3

%

Operating revenues total

679,965

592,218

14.8

%

Adjusted EBITDA expenses

296,392

247,489

19.8

%

Adjusted EBITDA

$

383,573

$

344,729

11.3

%

Operating margin %

49.9

%

53.1

%

Adjusted EBITDA margin %

56.4

%

58.2

%

Table 6: Sales and Retention Rate by Segment

(unaudited)(1)

Three Months Ended

Mar. 31,

Mar. 31,

In thousands

2024

2023

Index

New recurring subscription sales

$

23,513

$

25,090

Subscription cancellations

(14,702

)

(7,082

)

Net new recurring subscription sales

$

8,811

$

18,008

Non-recurring sales

$

12,811

$

12,782

Total gross sales

$

36,324

$

37,872

Total Index net sales

$

21,622

$

30,790

Index Retention Rate

93.2

%

96.4

%

Analytics

New recurring subscription sales

$

14,088

$

13,674

Subscription cancellations

(10,794

)

(9,183

)

Net new recurring subscription sales

$

3,294

$

4,491

Non-recurring sales

$

2,462

$

1,370

Total gross sales

$

16,550

$

15,044

Total Analytics net sales

$

5,756

$

5,861

Analytics Retention Rate(2)

93.5

%

94.0

%

ESG and Climate

New recurring subscription sales

$

11,471

$

12,486

Subscription cancellations

(7,351

)

(2,635

)

Net new recurring subscription sales

$

4,120

$

9,851

Non-recurring sales

$

1,672

$

1,219

Total gross sales

$

13,143

$

13,705

Total ESG and Climate net sales

$

5,792

$

11,070

ESG and Climate Retention Rate(3)

90.8

%

96.1

%

All Other - Private Assets

New recurring subscription sales

$

8,264

$

5,143

Subscription cancellations

(4,922

)

(2,856

)

Net new recurring subscription sales

$

3,342

$

2,287

Non-recurring sales

$

1,089

$

213

Total gross sales

$

9,353

$

5,356

Total All Other - Private Assets net

sales

$

4,431

$

2,500

All Other - Private Assets Retention

Rate(4)

92.2

%

92.1

%

Consolidated

New recurring subscription sales

$

57,336

$

56,393

Subscription cancellations

(37,769

)

(21,756

)

Net new recurring subscription sales

$

19,567

$

34,637

Non-recurring sales

$

18,034

$

15,584

Total gross sales

$

75,370

$

71,977

Total net sales

$

37,601

$

50,221

Total Retention Rate(5)

92.8

%

95.2

%

(1) See "Notes Regarding the Use of

Operating Metrics" for details regarding the definition of new

recurring subscription sales, subscription cancellations, net new

recurring subscription sales, non-recurring sales, total gross

sales, total net sales and Retention Rate.

(2) Retention rate for Analytics excluding

the impact of the acquisition of Fabric was 93.5% for the three

months ended Mar. 31, 2024.

(3) Retention rate for ESG and Climate

excluding the impact of the acquisition of Trove was 90.7% for the

three months ended Mar. 31, 2024.

(4) Retention rate for All Other – Private

Assets excluding the impact of the acquisition of Burgiss was 89.9%

for the three months ended Mar. 31, 2024.

(5) Total retention rate excluding the

impact of the acquisitions of Fabric, Trove and Burgiss was 92.6%

for the three months ended Mar. 31, 2024.

Table 7: AUM in ETFs Linked to MSCI Equity Indexes

(unaudited)(1)(2)

Three Months Ended

Mar. 31

Jun. 30

Sep. 30

Dec. 31

Mar. 31

In billions

2023

2023

2023

2023

2024

Beginning Period AUM in ETFs linked to

MSCI equity indexes

$

1,222.9

$

1,305.4

$

1,372.5

$

1,322.8

$

1,468.9

Market Appreciation/(Depreciation)

75.1

48.4

(56.1

)

130.5

92.8

Cash Inflows

7.4

18.7

6.4

15.6

20.9

Period-End AUM in ETFs linked to

MSCI equity indexes

$

1,305.4

$

1,372.5

$

1,322.8

$

1,468.9

$

1,582.6

Period Average AUM in ETFs linked to

MSCI equity indexes

$

1,287.5

$

1,333.8

$

1,376.5

$

1,364.9

$

1,508.8

Period-End Basis Point Fee(3)

2.53

2.52

2.51

2.50

2.48

(1) The historical values of the AUM in

ETFs linked to our equity indexes as of the last day of the month

and the monthly average balance can be found under the link “AUM in

ETFs Linked to MSCI Equity Indexes” on our Investor Relations

homepage at http://ir.msci.com. Information contained on our

website is not incorporated by reference into this Press Release or

any other report furnished or filed with the SEC. The AUM in ETFs

also includes AUM in Exchange Traded Notes, the value of which is

less than 1.0% of the AUM amounts presented.

(2) The value of AUM in ETFs linked to

MSCI equity indexes is calculated by multiplying the equity ETFs

net asset value by the number of shares outstanding.

(3) Based on period-end Run Rate for ETFs

linked to MSCI equity indexes using period-end AUM.

Table 8: Run Rate by Segment and Type (unaudited)(1)

As of

Mar. 31,

Mar. 31,

%

In thousands

2024

2023

Change

Index

Recurring subscriptions

$

869,931

$

795,621

9.3

%

Asset-based fees

619,431

534,491

15.9

%

Index Run Rate

1,489,362

1,330,112

12.0

%

Analytics Run Rate

662,079

621,611

6.5

%

ESG and Climate Run Rate

320,611

278,947

14.9

%

All Other - Private Assets Run

Rate

254,432

148,440

71.4

%

Total Run Rate

$

2,726,484

$

2,379,110

14.6

%

Total recurring subscriptions

$

2,107,053

$

1,844,619

14.2

%

Total asset-based fees

619,431

534,491

15.9

%

Total Run Rate

$

2,726,484

$

2,379,110

14.6

%

(1) See "Notes Regarding the Use of

Operating Metrics" for details regarding the definition of Run

Rate.

Table 9: Reconciliation of Net Income to Adjusted EBITDA

(unaudited)

Three Months Ended

Mar. 31,

Mar. 31,

In thousands

2024

2023

Net income

$

255,954

$

238,728

Provision for income taxes

39,939

37,644

Other expense (income), net

43,489

38,230

Operating income

339,382

314,602

Amortization of intangible assets

38,604

24,667

Depreciation and amortization of

property,

equipment and leasehold improvements

4,081

5,460

Acquisition-related integration and

transaction costs(1)

1,506

—

Consolidated adjusted EBITDA

$

383,573

$

344,729

Index adjusted EBITDA

$

277,760

$

253,682

Analytics adjusted EBITDA

72,212

60,780

ESG and Climate adjusted EBITDA

21,091

17,876

All Other - Private Assets adjusted

EBITDA

12,510

12,391

Consolidated adjusted EBITDA

$

383,573

$

344,729

(1) Represents transaction expenses and

other costs directly related to the acquisition and integration of

acquired businesses, including professional fees, severance

expenses, regulatory filing fees and other costs, in each case that

are incurred no later than 12 months after the close of the

relevant acquisition.

Table 10: Reconciliation of Net Income and Diluted EPS to

Adjusted Net Income and Adjusted EPS (unaudited)

Three Months Ended

Mar. 31,

Mar. 31,

In thousands, except per share

data

2024

2023

Net income

$

255,954

$

238,728

Plus: Amortization of acquired intangible

assets and

equity method investment basis

difference

25,267

16,809

Plus: Acquisition-related integration and

transaction costs(1)

1,506

—

Plus: Write-off of deferred fees on debt

extinguishment

1,510

—

Less: Gain from changes in ownership

interest of investees

—

(447

)

Less: Income tax effect(2)

(4,008

)

(2,196

)

Adjusted net income

$

280,229

$

252,894

Diluted EPS

$

3.22

$

2.97

Plus: Amortization of acquired intangible

assets and

equity method investment basis

difference

0.32

0.21

Plus: Acquisition-related integration and

transaction costs(1)

0.02

—

Plus: Write-off of deferred fees on debt

extinguishment

0.02

—

Less: Gain from changes in ownership

interest of investees

—

(0.01

)

Less: Income tax effect(2)

(0.06

)

(0.03

)

Adjusted EPS

$

3.52

$

3.14

Diluted weighted average common shares

outstanding

79,508

80,482

(1) Represents transaction expenses and

other costs directly related to the acquisition and integration of

acquired businesses, including professional fees, severance

expenses, regulatory filing fees and other costs, in each case that

are incurred no later than 12 months after the close of the

relevant acquisition.

(2) Adjustments relate to the tax effect

of non-GAAP adjustments, which were determined based on the nature

of the underlying non-GAAP adjustments and their relevant

jurisdictional tax rates.

Table 11: Reconciliation of Operating Expenses to Adjusted

EBITDA Expenses (unaudited)

Three Months Ended

Full-Year

Mar. 31,

Mar. 31,

2024

In thousands

2024

2023

Guidance(1)

Total operating expenses

$

340,583

$

277,616

$1,300,000 - $1,340,000

Amortization of intangible assets

38,604

24,667

Depreciation and amortization of

property,

equipment and leasehold improvements

4,081

5,460

$170,000 - $180,000

Acquisition-related integration and

transaction costs(2)

1,506

—

Consolidated adjusted EBITDA

expenses

$

296,392

$

247,489

$1,130,000 -

$1,160,000

Index adjusted EBITDA expenses

$

96,112

$

85,700

Analytics adjusted EBITDA expenses

91,754

86,290

ESG and Climate adjusted EBITDA

expenses

56,793

49,182

All Other - Private Assets adjusted EBITDA

expenses

51,733

26,317

Consolidated adjusted EBITDA

expenses

$

296,392

$

247,489

$1,130,000 -

$1,160,000

(1) We have not provided a full line-item

reconciliation for total operating expenses to adjusted EBITDA

expenses for this future period because we believe such a

reconciliation would imply a degree of precision and certainty that

could be confusing to investors and we are unable to reasonably

predict certain items contained in the GAAP measure without

unreasonable efforts. This is due to the inherent difficulty of

forecasting the timing or amount of various items that have not yet

occurred and are out of the Company's control or cannot be

reasonably predicted. For the same reasons, the Company is unable

to address the probable significance of the unavailable

information. Forward-looking non-GAAP financial measures provided

without the most directly comparable GAAP financial measures may

vary materially from the corresponding GAAP financial measures. See

“Forward-Looking Statements” above.

(2) Represents transaction expenses and

other costs directly related to the acquisition and integration of

acquired businesses, including professional fees, severance

expenses, regulatory filing fees and other costs, in each case that

are incurred no later than 12 months after the close of the

relevant acquisition.

Table 12: Reconciliation of Net Cash Provided by Operating

Activities to Free Cash Flow (unaudited)

Three Months Ended

Full-Year

Mar. 31,

Mar. 31,

2024

In thousands

2024

2023

Guidance(1)

Net cash provided by operating

activities

$

300,137

$

264,141

$1,330,000 -

$1,380,000

Capital expenditures

(4,271

)

(6,225

)

Capitalized software development costs

(19,966

)

(15,351

)

Capex

(24,237

)

(21,576

)

($95,000 - $105,000)

Free cash flow

$

275,900

$

242,565

$1,225,000 -

$1,285,000

(1) We have not provided a line-item

reconciliation for free cash flow to net cash provided by operating

activities for this future period because we believe such a

reconciliation would imply a degree of precision and certainty that

could be confusing to investors and we are unable to reasonably

predict certain items contained in the GAAP measure without

unreasonable efforts. This is due to the inherent difficulty of

forecasting the timing or amount of various items that have not yet

occurred and are out of the Company's control or cannot be

reasonably predicted. For the same reasons, the Company is unable

to address the probable significance of the unavailable

information. Forward-looking non-GAAP financial measures provided

without the most directly comparable GAAP financial measures may

vary materially from the corresponding GAAP financial measures. See

“Forward-Looking Statements” above.

Table 13: First Quarter 2024 Reconciliation of Operating

Revenue Growth to Organic Operating Revenue Growth

(unaudited)

Comparison of the Three Months

Ended March 31, 2024 and 2023

Total

Recurring Subscription

Asset-Based Fees

Non-Recurring Revenues

Index

Change Percentage

Change Percentage

Change Percentage

Change Percentage

Operating revenue growth

10.2

%

8.3

%

12.9

%

11.3

%

Impact of acquisitions and

divestitures

—

%

—

%

—

%

—

%

Impact of foreign currency exchange rate

fluctuations

0.2

%

0.3

%

0.1

%

—

%

Organic operating revenue growth

10.4

%

8.6

%

13.0

%

11.3

%

Total

Recurring Subscription

Asset-Based Fees

Non-Recurring Revenues

Analytics

Change Percentage

Change Percentage

Change Percentage

Change Percentage

Operating revenue growth

11.5

%

11.1

%

—

%

33.0

%

Impact of acquisitions and

divestitures

(0.1

)%

(0.1

)%

—

%

—

%

Impact of foreign currency exchange rate

fluctuations

0.5

%

0.5

%

—

%

1.7

%

Organic operating revenue growth

11.9

%

11.5

%

—

%

34.7

%

Total

Recurring Subscription

Asset-Based Fees

Non-Recurring Revenues

ESG and Climate

Change Percentage

Change Percentage

Change Percentage

Change Percentage

Operating revenue growth

16.1

%

16.3

%

—

%

10.6

%

Impact of acquisitions and

divestitures

(1.9

)%

(1.9

)%

—

%

(3.1

)%

Impact of foreign currency exchange rate

fluctuations

(3.2

)%

(3.3

)%

—

%

(0.3

)%

Organic operating revenue growth

11.0

%

11.1

%

—

%

7.2

%

Total

Recurring Subscription

Asset-Based Fees

Non-Recurring Revenues

All Other - Private Assets

Change Percentage

Change Percentage

Change Percentage

Change Percentage

Operating revenue growth

66.0

%

64.7

%

—

%

196.5

%

Impact of acquisitions and

divestitures

(62.6

)%

(62.6

)%

—

%

(67.6

)%

Impact of foreign currency exchange rate

fluctuations

(0.8

)%

(0.8

)%

—

%

(0.3

)%

Organic operating revenue growth

2.6

%

1.3

%

—

%

128.6

%

Total

Recurring Subscription

Asset-Based Fees

Non-Recurring Revenues

Consolidated

Change Percentage

Change Percentage

Change Percentage

Change Percentage

Operating revenue growth

14.8

%

15.2

%

12.9

%

20.3

%

Impact of acquisitions and

divestitures

(4.3

)%

(5.7

)%

—

%

(2.2

)%

Impact of foreign currency exchange rate

fluctuations

(0.2

)%

(0.2

)%

0.1

%

0.3

%

Organic operating revenue growth

10.3

%

9.3

%

13.0

%

18.4

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240423155431/en/

MSCI Inc. Investor Inquiries jeremy.ulan@msci.com

Jeremy Ulan +1 646 778 4184

jisoo.suh@msci.com Jisoo Suh + 1 917 825 7111

Media Inquiries PR@msci.com Melanie Blanco +1 212 981

1049 Konstantinos Makrygiannis +44 (0)7768 930056 Tina Tan + 852

2844 9320

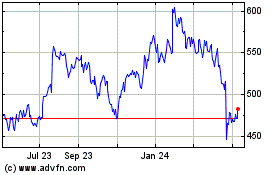

MSCI (NYSE:MSCI)

Historical Stock Chart

From Oct 2024 to Nov 2024

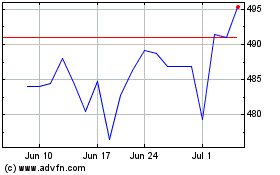

MSCI (NYSE:MSCI)

Historical Stock Chart

From Nov 2023 to Nov 2024