MRC Global Inc. (NYSE: MRC) announced today that it has agreed to

repurchase all 363,000 shares of its 6.50% Series A

Convertible Perpetual Preferred Stock as part of an agreement with

Mario Investments, LLC, the holder of the preferred stock, which is

contingent upon, among other things, the completion of a successful

term loan financing.

Upon satisfaction of the required conditions in

the repurchase agreement, the company will repurchase the preferred

stock for a total payment of approximately $361 million,

representing 99.5% of the liquidation preference of the preferred

stock. The company will also pay accrued dividends through the

closing date of the repurchase. MRC Global expects to finance the

repurchase with a new senior secured term loan “B” (“Term Loan

B”) and a combination of existing cash or borrowings from the

company’s asset-based lending (“ABL”) facility.

Rob Saltiel, MRC Global President & CEO

stated, “Our strong execution in recent years has strengthened our

balance sheet, and in conjunction with increasingly consistent

levels of cash generation, has positioned us to have the financial

flexibility to pursue this opportunity now. We believe that

repurchasing the preferred stock will simplify our capital

structure and eliminate shareholder concerns about potential equity

dilution through conversion of the preferred stock into common

shares. We also expect that this repurchase will be accretive to

both cash generation and earnings per share in 2025 and beyond

based on current capital market conditions and anticipated

financing terms”.

In order to finance the repurchase of the

preferred stock, MRC Global is launching later today a $350 million

Term Loan B financing with an expected term of seven years. The

company is also pursuing an amendment to its ABL facility that

would extend its term until 2029. Post-transaction, the company’s

net debt leverage ratio is expected to be less than 2 times, based

on the previous twelve months of adjusted EBITDA.

There can be no assurance that the company will

be able to obtain the Term Loan B or amend the ABL facility, or

what the ultimate terms of the facilities will be. The company's

ability to enter into the Term Loan B and amend the ABL

facility, and use the proceeds therefrom, depends on, among

other things, market conditions, reaching final agreement with

lenders and the approval of the company's board of directors.

In addition, the company is providing selected

preliminary third quarter 2024 financial results.

Preliminary Third Quarter 2024 Financial

Results(All of the amounts set forth below are subject to

finalization)

- Revenue of approximately $797 million

- Adjusted EBITDA of approximately $48 million, or 6.0%

of sales

- Cash flow from operations of approximately $95 million

The company expects to release its full third quarter 2024

results on November 5, 2024, after the market close, as previously

scheduled. The company will also hold a conference call to discuss

its third quarter 2024 results at 10:00 a.m. Eastern Time (9:00

a.m. Central Time) on November 6, 2024, as previously

scheduled.

Non-GAAP Measures

Reconciling the company’s preliminary third

quarter 2024 Adjusted EBITDA (and the resulting Adjusted EBITDA

percentage of sales) to the company’s preliminary third quarter net

income is not reasonably possible as the company has not yet fully

closed its third quarter books and there may be variations in

income taxes, among other items, to determine net income. The

company has estimated preliminary third quarter Adjusted EBITDA,

even though the final net income numbers are not yet available, as

the impact of items such as taxes are excluded by definition from

Adjusted EBITDA. The company will provide a full reconciliation

when it finalizes its books, releases its third quarter 2024

results and files its quarterly report on Form 10-Q for the

quarter.

The company defines Adjusted EBITDA as net

income plus interest, income taxes, depreciation and amortization,

amortization of intangibles and certain other expenses, including

non-cash expenses (such as equity-based compensation), plus or

minus the impact of its last-in, first-out (LIFO) inventory costing

methodology.

The company presents Adjusted EBITDA because the

company believes Adjusted EBITDA is a useful indicator of the

company’s operating performance. Among other things, Adjusted

EBITDA measures the company’s operating performance without regard

to certain non-recurring, non-cash or transaction-related expenses.

Adjusted EBITDA, however, does not represent and should not be

considered as an alternative to net income, cash flow from

operations or any other measure of financial performance calculated

and presented in accordance with GAAP. Because Adjusted EBITDA does

not account for certain expenses, its utility as a measure of the

company’s operating performance has material limitations. Because

of these limitations, the company does not view Adjusted EBITDA in

isolation or as a primary performance measure and also uses other

measures, such as net income and sales, to measure operating

performance.

About MRC Global Inc.

Headquartered in Houston, Texas, MRC Global

(NYSE: MRC) is the leading global distributor of pipe,

valves, fittings (PVF) and other infrastructure products

and services to diversified end-markets including the gas

utilities, downstream, industrial and energy transition, and

production and transmission infrastructure sectors. With over

100 years of experience, MRC Global has provided customers with

innovative supply chain solutions, technical product expertise and

a robust digital platform from a worldwide network of 219

locations including valve and engineering centers. The company’s

unmatched quality assurance program offers over 300,000 SKUs from

over 8,500 suppliers, simplifying the supply chain for

approximately 10,000 customers. Find out more at

www.mrcglobal.com.

This news release contains forward-looking

statements within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act. Words such as “will,”

“expect,” “expected,” “anticipating,” “intend,” “believes,”

"on-track," “well positioned,” “strong position,” “looking

forward,” “guidance,” “plans,” “can,” "target," "targeted" and

similar expressions are intended to identify forward-looking

statements.

Statements about the company’s business,

including its strategy, its industry, the company’s future

profitability, the company’s guidance on its sales, Adjusted

EBITDA, Adjusted EBITDA margin, tax rate,

capital expenditures, achieving cost savings and cash flow,

debt reduction, liquidity, growth in the company’s various markets

and the company’s expectations, beliefs, plans, strategies,

objectives, prospects and assumptions are not guarantees of future

performance. These statements are based on management’s

expectations that involve a number of business risks and

uncertainties, any of which could cause actual results to differ

materially from those expressed in or implied by the

forward-looking statements. These statements involve known and

unknown risks, uncertainties and other factors, most of which are

difficult to predict and many of which are beyond MRC Global’s

control, including the factors described in the company’s SEC

filings that may cause the company’s actual results and performance

to be materially different from any future results or performance

expressed or implied by these forward-looking statements.

These risks and uncertainties include (among

others) decreases in capital and other expenditure levels in

the industries that the company serves; U.S. and international

general economic conditions; geopolitical events; decreases in oil

and natural gas prices; unexpected supply shortages; loss of

third-party transportation providers; cost increases by the

company’s suppliers and transportation providers; increases in

steel prices, which the company may be unable to pass along to its

customers which could significantly lower the company’s profit; the

company’s lack of long-term contracts with most of its suppliers;

suppliers’ price reductions of products that the company sells,

which could cause the value of its inventory to decline; decreases

in steel prices, which could significantly lower the company’s

profit; a decline in demand for certain of the products the company

distributes if tariffs and duties on these products are imposed or

lifted; holding more inventory than can be sold in a commercial

time frame; significant substitution of renewables and low-carbon

fuels for oil and gas, impacting demand for the company’s

products; risks related to adverse weather events or natural

disasters; environmental, health and safety laws and regulations

and the interpretation or implementation thereof; changes in the

company’s customer and product mix; the risk that manufacturers of

the products that the company distributes will sell a substantial

amount of goods directly to end users in the industry sectors that

the company serves; failure to operate the company’s business in an

efficient or optimized manner; the company’s ability to compete

successfully with other companies; the company’s lack of

long-term contracts with many of its customers and the company’s

lack of contracts with customers that require minimum purchase

volumes; inability to attract and retain employees or the potential

loss of key personnel; adverse health events, such as a pandemic;

interruption in the proper functioning of the company’s information

systems; the occurrence of cybersecurity incidents; risks related

to the company’s customers’ creditworthiness; the success of

acquisition strategies; the potential adverse effects associated

with integrating acquisitions and whether these acquisitions will

yield their intended benefits; impairment of the company’s goodwill

or other intangible assets; adverse changes in political or

economic conditions in the countries in which the company operates;

the company’s significant indebtedness; the dependence on the

company’s subsidiaries for cash to meet parent company obligations;

changes in the company’s credit profile; potential inability to

obtain necessary capital; the sufficiency of the company’s

insurance policies to cover losses, including liabilities arising

from litigation; product liability claims against the company;

pending or future asbestos-related claims against the company;

exposure to U.S. and international laws and regulations, regulating

corruption, limiting imports or exports or imposing economic

sanctions; risks relating to ongoing evaluations of internal

controls required by Section 404 of the Sarbanes-Oxley Act; risks

related to changing laws and regulations including trade policies

and tariffs; and the potential share price volatility and costs

incurred in response to any shareholder activism campaigns.

For a discussion of key risk factors, please see

the risk factors disclosed in the company’s SEC filings, which are

available on the SEC’s website at www.sec.gov and on the company’s

website, www.mrcglobal.com. MRC Global’s filings and other

important information are also available on the Investors page

of the company’s website at www.mrcglobal.com.

Undue reliance should not be placed on the

company’s forward-looking statements. Although forward-looking

statements reflect the company’s good faith beliefs, reliance

should not be placed on forward-looking statements because they

involve known and unknown risks, uncertainties and other factors,

which may cause the company’s actual results, performance or

achievements or future events to differ materially from anticipated

future results, performance or achievements or future events

expressed or implied by such forward-looking statements. The

company undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events, changed circumstances or otherwise, except to the

extent required by law.

Contact:

|

|

|

Monica BroughtonVP, Investor Relations & Treasury |

|

MRC Global Inc. |

|

Monica.Broughton@mrcglobal.com |

|

832-308-2847 |

|

|

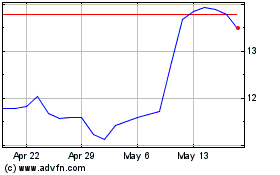

MRC Global (NYSE:MRC)

Historical Stock Chart

From Nov 2024 to Dec 2024

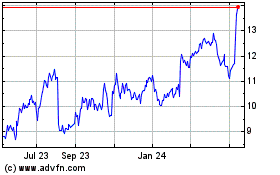

MRC Global (NYSE:MRC)

Historical Stock Chart

From Dec 2023 to Dec 2024