false

0001807846

0001807846

2024-08-02

2024-08-02

0001807846

ML:ClassCommonStockParValue0.0001PerShareMember

2024-08-02

2024-08-02

0001807846

ML:RedeemableWarrantsEachWholeWarrantExercisableFor130thOfOneShareOfClassCommonStockMember

2024-08-02

2024-08-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August 6, 2024 (August 2, 2024)

MONEYLION INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-39346 |

|

85-0849243 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

249-245 West 17th Street, Floor 4

New York, NY 10011

(Address

of principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (212) 300-9865

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class A common stock,

par value $0.0001 per share |

|

ML |

|

The New York Stock Exchange |

| Redeemable warrants:

each whole warrant exercisable for 1/30th of one share of Class A common stock |

|

ML WS |

|

The New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

Third

Amendment to Account Servicing Agreement

On

August 2, 2024, ML Plus LLC (the “Company”), a wholly-owned indirect subsidiary of MoneyLion Inc. (“MoneyLion”),

entered into the Third Amendment to Account Servicing Agreement (“Third Amendment”) with Pathward, N.A. (“Pathward”)

to amend that certain Account Servicing Agreement, dated as of January 14, 2020 (as amended from time to time, the “Agreement”),

pursuant to which the Company provides its RoarMoney demand deposit accounts and debit cards with Pathward, as partner issuing bank (the

“Program Services”), in order to enable the Company to offer overdraft protection in connection with the Program Services.

The Third Amendment also extends the term of the Agreement to January 2029 (with automatic renewal for successive two-year periods unless

either party provides written notice of non-renewal, which may be without cause, at least 180 days prior to the end of any such term).

The

foregoing description of the Third Amendment does not purport to be complete and is qualified in its entirety by reference to the full

text of the Third Amendment, which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item

2.02. Results of Operations and Financial Condition.

On

August 6, 2024, MoneyLion issued a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the

press release is attached hereto as Exhibit 99.1 to this report.

The

information furnished pursuant to this Item 2.02, including Exhibit 99.1, is being “furnished” herewith and shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities under that section, or incorporated by reference in any filing made by MoneyLion under the Securities

Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings, except as shall be expressly

set forth by specific reference in such a filing.

Item

9.01. Financial Statements and Exhibits

(d) Exhibits

| * | Filed herewith. |

| ** | Furnished

herewith. |

| † | Certain

schedules and exhibits to this exhibit have been omitted pursuant to Regulation S-K Item 601(a)(5), or certain portions of this exhibit

have been redacted pursuant to Regulation S-K Item 601(b)(iv). |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

MONEYLION INC. |

| |

|

|

| |

By: |

/s/ Richard Correia |

| |

Name: |

Richard Correia |

| |

Title: |

President, Chief Financial

Officer and Treasurer |

Date:

August 6, 2024

2

Exhibit

10.1

[*****]

= Certain identified information has been excluded from the exhibit because it is both not material and is the type that the Registrant treats

as private or confidential

THIRD

AMENDMENT TO ACCOUNT SERVICING AGREEMENT

This Third

Amendment to Account Servicing Agreement (“Third Amendment”) is entered into as of August 2, 2024 (the “Third

Amendment Effective Date”) by and between Pathward, N.A. (f/k/a MetaBank, National Association) (“Bank”),

and ML Plus LLC (“Servicer”), each referred to as a “Party” individually and “Parties”

collectively. Any capitalized terms used but not otherwise defined in this Third Amendment have the same meaning as defined in the Agreement.

WHEREAS,

Bank and Servicer offer certain Programs to their customers pursuant to an Account Servicing Agreement between the Parties dated January

14, 2020, as amended by that certain Program Features Addendum dated March 25, 2020, as further amended by that certain Check Refund Services

Addendum dated May 12, 2020, as further amended by that certain First Amendment to Account Servicing Agreement dated December 8, 2021,

and as further amended by that certain Second Amendment to Account Servicing Agreement dated September 6, 2022 (as so amended and as further

amended or restated from time to time, the “Agreement”);

WHEREAS,

both Parties desire to enter into this Third Amendment for purposes of enabling the offering of an

overdraft protection service with the Programs;

NOW,

THEREFORE, in consideration of the mutual covenants and promises of the Parties and other good

and valuable consideration, the sufficiency and receipt of which is hereby acknowledged, the Parties agree as follows intending to be

legally bound:

1. Section 3.13 of the Agreement is hereby deleted in its entirety and replaced with the following:

“SECTION

3.13 Service Level Agreement (SLA) Standards

(a)

Servicer shall provide all services contemplated by this Agreement with promptness and diligence and in a professional and

workmanlike manner (unless some other time frame or manner is set forth herein, in which case such other time frame or manner shall

apply), and, as applicable, at least in accordance with the service levels set forth in Schedule B (each service level set forth in

Schedule B, an “SLA”), which shall be effective only six (6) months after the Launch Date. Servicer and Bank

shall periodically review and measure overall performance against the SLAs to ensure consistency with the goals and objectives of

this Agreement, and the Parties shall reasonably cooperate to update such SLAs as necessary.

(b)

If any services are not provided in accordance with the SLAs other than the SLA for Timeliness of Remediating Findings (each

instance, a “Failed SLA”), Servicer shall, for each Failed SLA: (i) promptly investigate and report to Bank

on the causes of the problem; (ii) provide a root cause analysis of such failure as soon as practicable after such failure or

Bank’s request; (iii) initiate remedial action to correct the problem and resume meeting the relevant SLA as soon as

practicable but, in any event, within five (5) Business Days of the date of the occurrence of the Failed SLA; and (iv) advise

Bank, as and to the extent requested by Bank, of the status of remedial efforts being undertaken with respect to such problem and,

within ten (10) Business Days, provide Bank reasonable evidence that the causes of such problem have been corrected on a permanent

basis (such steps, an “SLA Corrective Action Plan”).

(c) Fees

for Failed SLAs. For each Failed SLA other than the SLA for Timeliness of Remediating Findings which is subject to

Non-Compliance Fees as provided below, Bank may assess a fee in accordance with the chart below. A failure of the same SLA on one or

more occasions shall result in fees imposed under the Single Offense category. A failure of two or more different SLA’s shall

result in fees imposed under the Multiple Offense category. All Failed SLA fees in any month will be deducted from Net Revenues for

that month.

| | |

Single

Offense | |

Multiple

Offense |

| [*****] | |

[*****] | |

[*****] |

| [*****] | |

[*****] | |

[*****] |

| [*****] | |

[*****] | |

[*****] |

| [*****] | |

[*****] | |

[*****] |

(d) Non-Compliance

Fees for Past Due Findings. If Servicer fails to remediate a Finding by the end of the Cure Period, then Bank reserves the right to

assess a fee in the amount of [*****] per month (the “Non-Compliance Fee”) for each Finding until Servicer fully remediates

the applicable Finding, in the reasonable determination of Bank; provided, however, that if such Finding has not been fully remediated

within one year of the identification of the Finding, then Bank reserves the right to increase the Non-Compliance Fee to [*****] per month

until Servicer fully remediates the applicable Finding, in the reasonable determination of Bank. For purposes of clarity, Bank reserves

the right to assess a separate Non-Compliance Fee for each Finding in each calendar month that the Finding remains unremediated, from

the end of the Cure Period until Servicer fully remediates the applicable Finding, in the reasonable determination of Bank. Notwithstanding

the foregoing, Bank shall have the right to impose a Non-Compliance Fee until a Finding is remediated without affording Servicer a Cure

Period in the event that a substantially similar Finding has occurred on two or more occasions in the prior twelve-month period.

(e) The

Parties acknowledge and agree that Bank’s actual damages for Servicer’s delay in responding to a Finding and for Failed SLAs

are difficult to calculate and the Non-Compliance Fee and fees for single and multiple Failed SLAs are a fair and reasonable estimate

of Bank’s damages for such delay and Failed SLAs. The Parties further acknowledge and agree that Non-Compliance Fees and fees for

single and multiple Failed SLAs shall constitute liquidated damages and not a penalty for Servicer’s delay in responding to a Finding

or for Failed SLAs, and shall be in addition to, and is not intended to limit, the obligations of the Servicer and other rights and remedies

of Bank under this Agreement, including, but not limited to, Bank’s right to terminate the Agreement or recover damages or other

amounts in connection with the occurrence or remediation of a Finding.

(f) For

any given month in which Servicer suffers any Failed SLA, such month shall be considered to be a “Failed Month.” If

there are three (3) consecutive Failed Months or five (5) Failed Months during any twelve month period, Bank may, at its option, either

terminate the specific subject service or terminate this Agreement in its entirety by giving written notice of termination to Servicer,

in which case the date of termination shall be as set forth in such notice.

(g) Servicer

shall implement measurement and monitoring tools and metrics as well as standard reporting procedures to measure and report Servicer’s

performance of the services against the applicable SLAs, and shall provide Bank with monthly reports detailing service standards performance

(each, an “SLA Report”). Servicer shall also provide Bank with information and access to the measurement and monitoring

tools and procedures utilized by Servicer for purpose of audit verification.

(h) Servicer

or a Processor may schedule planned outages of the Processing Services upon not less than three (3) Business Days prior written notice

to Bank, and during such planned outage, the affected Processing Services shall be exempt from being deemed a Failed SLA for purposes

of this Schedule for the time period of the outage identified by Servicer in the prior written notification to Bank. Planned outages must

only occur on Mondays between the hours of 1:00 AM and 5:00 AM (Eastern Standard Time). Servicer and Processors shall use commercially

reasonable efforts to minimize any adverse impact to the Program and the Accountholders as a result of any such planned outages.

(i) Servicer

shall appoint an individual as Bank’s primary point of contact on day-to-day operational matters (the “Pathward Relationship

Officer”). The Pathward Relationship Officer shall be capable of answering questions and resolving discrepancies that arise

between the Parties relating to Processing Services and shall be well-versed in the functionality of Servicer’s system, the Processor

System, and any applicable Subcontractor’s system.

(j) Servicer

shall provide to Bank a support group (the “Support Group”) which will be available 24 hours a day, 7 days a week,

to take incoming calls from Bank at a telephone number maintained by Servicer, respectively, for assistance requests and to address Processor

System and Servicer system issues, including outages or emergency maintenance. The Support Group will attempt to resolve issues reported

on each call, provided, however, that if the Support Group is unable to do so, the appropriate level of Servicer support staff will assist

in the resolution. The response of the Support Group to any outage or emergency shall be governed by the SLAs set forth above.

2. Section 3.18 of the Agreement is hereby deleted in its entirety and replaced with the following:

“SECTION

3.18 Audit and Financial Information

(a)

Servicer agrees that Bank or its authorized representatives and agents, and any Regulatory Authority or System (collectively the “Auditing

Party”) shall have the right, at any time during normal business hours and upon reasonable prior written notice, or at any

other time required by Applicable Law or by a Regulatory Authority, to inspect, audit, and examine all of Servicer’s facilities,

records, personnel, books, accounts, data, reports, papers and computer records relating to the activities contemplated by this Agreement

including, but not limited to, financial records and reports, the Security Program, associated audit reports, summaries of test results

or equivalent measures taken by Servicer or any Program Critical Subcontractor to ensure that the Security Programs are in accordance

with Applicable Law and this Agreement and that Servicer is otherwise in compliance with the terms of this Agreement. Servicer shall

make all such facilities, records, personnel, books, accounts, data, reports, papers, and computer records available to the Auditing

Party for the purpose of conducting such inspections and audits, and the Auditing Party shall have the right to make copies and abstracts

from Servicer’s books, accounts, data, reports, papers, and computer records directly pertaining to the subject matter of this

Agreement. Servicer shall require each Program Critical Subcontractor to make its facilities, records, personnel, books, accounts, data,

reports, papers, and computer records available to the Auditing Party as provided in this Section.

(b) Servicer

agrees to reasonably cooperate with any examination, inquiry, audit, information request, site visit or the like, which may be required

by any Regulatory Authority or System with audit examination or supervisory authority over Bank or Servicer, to the fullest extent requested

by such Regulatory Authority, System or Bank. Servicer shall also provide to Bank any information which may be required by any Regulatory

Authority or System in connection with their audit or review of Bank or any Program and shall reasonably cooperate with such Regulatory

Authority or System in connection with any audit or review of Bank or any Program. Servicer shall also provide such other information

as Bank, Regulatory Authorities or System may from time to time reasonably request with respect to the financial condition of Servicer

and such other information as Bank may from time to time reasonably request with respect to third parties who have contracted with Servicer

relating to or in connection with this Agreement.

(c) Servicer

shall prepare a written response to Bank (a “Finding Response”) to all criticisms, recommendations, deficiencies, and

violations of Applicable Law or Bank Policies identified in audits or other reviews conducted by Bank, any Regulatory Authority or System

or self-identified by Servicer (each, a “Finding”). The Finding Response shall be delivered to Bank within twenty (20)

Business Days of Servicer’s receipt of such Finding or discovery by Servicer, as applicable, unless directed otherwise by a Regulatory

Authority. The Finding Response shall include the planned corrective action (or an explanation of why corrective action is not possible

or necessary) to address the Finding, including remedial actions to be taken for current or past Accountholders negatively impacted by

the Finding, and to prevent any recurrence of the Finding (“Corrective Action Plan”), with a timeframe, subject to

Bank’s approval, for completion of the Corrective Action Plan (“Cure Period”). The Finding Response shall identify

any Finding disputed by Servicer, supported by a detailed explanation of Servicer’s position. Servicer shall implement and complete

the Corrective Action Plan in accordance with its terms by the end of the Cure Period.

3. The following Section 3.23 is hereby added to the Agreement:

“SECTION

3.23 Exclusivity

During the

Term, Bank shall have 90% exclusivity with respect to issuance of Servicer’s or its Affiliates’ demand deposit accounts (“DDAs,”

and each, a “DDA”) for Servicer or Affiliate customers or in support of financial products or services offered by Servicer

or its Affiliates (for the avoidance of doubt, excluding any financial products or services that are offered by any Person that is not

an Affiliate of Servicer). In the event Servicer or its Affiliates makes arrangements with one or more banks or other financial institutions

other than Bank to establish and issue DDAs for Servicer or Affiliate customers or in support of financial products or services offered

by Servicer or its Affiliates during the Term, unless otherwise agreed to by Bank, Servicer and its Affiliates shall limit the number

of DDAs established and issued by banks or financial institutions other than Bank to no more than ten percent (10%) of the total aggregate

number of DDAs established, issued and outstanding for Servicer or Affiliate customers or in support of financial products or services

offered by Servicer or its Affiliate.

4. Section 9.1 of the Agreement is hereby deleted in its entirety and replaced with the following:

“SECTION

9.1 Term

The

term of this Agreement shall commence on the Effective Date and continue until January 13, 2029 (the “Initial Term”)

unless terminated earlier as provided below. After the Initial Term, this Agreement shall automatically extend for additional periods

of two (2) years each (each a “Renewal Term”, and collectively with the Initial Term, the “Term”)

unless either Party terminates this Agreement for any reason pursuant to Section 9.2 of this Agreement, or by providing written notice

of non-renewal to the other at least one hundred eighty (180) days prior to the commencement of the next Renewal Term.”

5. Schedule A to the Agreement is hereby deleted and replaced with the attached Schedule A.

6. Schedule B to the Agreement is hereby deleted and replaced with the attached Schedule B.

7. Schedule C to the Agreement is hereby deleted and replaced with the attached Schedule C.

8. The attached Schedule C-1 is hereby added to the Agreement.

9. This

Third Amendment constitutes the entire agreement among the Parties concerning the subject matter of the Third Amendment. Except as specifically

set forth herein, all terms and conditions of the Agreement shall remain in full force and effect. This Third Amendment may be executed

in counterparts, including by facsimile signature, each of which counterpart will be deemed an original.

IN WITNESS

WHEREOF, the undersigned have executed this Third Amendment as of the Third Amendment Effective Date.

| ML Plus LLC | | Pathward,

N.A. |

| By: |

/s/ Rick Correia |

|

By: |

/s/ Will Sowell |

| Name: |

Rick Correia |

|

Name: |

Will Sowell |

| Title: |

CFO |

|

Title: |

Divisional Pres BaaS |

SCHEDULE A

ACCOUNTS, FLOW OF FUNDS, REVENUES,

AND COMPENSATION

[*****]

SCHEDULE

B

SERVICE LEVEL

AGREEMENTS (SLAs)

[*****]

SCHEDULE C

DDA AND CARD SERVICES SCHEDULE

[*****]

SCHEDULE C-1

ODP SERVICE

[*****]

8

Exhibit 99.1

MoneyLion Announces Second Quarter 2024 Results

Record Revenue of $131 Million, Up 23% Year-over-Year

GAAP Net Income of $3.1 Million; Diluted EPS

of $0.26

Adjusted EBITDA of $18.5 Million, Representing

14.2% Adjusted EBITDA Margin

Management Provides Q3 & FY 2024 Guidance

NEW YORK, NY, August 6, 2024 – MoneyLion

Inc. (“MoneyLion”) (NYSE: ML), a digital ecosystem for consumer finance that empowers everyone to make their best financial

decisions, today announced financial results for the second quarter ended June 30, 2024. MoneyLion will host a conference call and webcast

at 8:30 a.m. ET today. An earnings presentation and link to the webcast are available at investors.moneylion.com.

“Our second

quarter 2024 results reflect MoneyLion’s leading position as the first digital ecosystem for consumer finance and continued progress

towards becoming the number one destination for Americans to make financial decisions,”

said Dee Choubey, MoneyLion’s Co-Founder and Chief Executive Officer.

Choubey continued, “We have all the ingredients

needed to build a digital ecosystem and disrupt consumer finance, and the success of this approach is already reflected in our numbers.

We are putting our ecosystem approach into action through a number of products, services, and technologies that serve our partners and

consumers alike, with features like AI-driven financial product search, MoneyLion checkout, content-as-a-service, web services, and much

more.”

“While other business models are seeing

weakness, we are enjoying growth and profitability given our unique ecosystem position. We expect to finish strong in each of the next

two quarters and create significant momentum going into 2025,” said Rick Correia, MoneyLion’s Chief Financial Officer.

Correia continued, “We generated record

revenue of $131 million and Adjusted EBITDA of $18.5 million in the second quarter. Importantly, our Q2 results met or exceeded our guidance

across all metrics. For the third quarter of 2024, we expect revenue of $133 to $138 million and Adjusted EBITDA of $18 to $21 million.

For full-year 2024, we expect revenue of $525 million to $535 million and Adjusted EBITDA of $80 to $87 million.”

Financial Results(1)

| | |

Three Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

% Change | |

| (in thousands) | |

(unaudited) | | |

| |

| Financial Metrics | |

| | | |

| | | |

| | |

| Total revenues, net | |

$ | 130,846 | | |

$ | 106,541 | | |

| 23 | % |

| Net income (loss) | |

| 3,137 | | |

| (27,723 | ) | |

| — | |

| Adjusted EBITDA | |

| 18,518 | | |

| 9,233 | | |

| 101 | % |

| Adjusted EBITDA margin | |

| 14.2 | % | |

| 8.7 | % | |

| 63 | % |

| | |

| | | |

| | | |

| | |

| (in millions) | |

| | | |

| | | |

| | |

| Key Operating Metrics | |

| | | |

| | | |

| | |

| Total Customers | |

| 17.0 | | |

| 9.9 | | |

| 73 | % |

| Total Products | |

| 27.7 | | |

| 17.3 | | |

| 60 | % |

| Total Originations | |

$ | 770 | | |

$ | 550 | | |

| 40 | % |

Total revenues, net increased 23% to $130.8 million

for the second quarter of 2024 compared to the second quarter of 2023.

MoneyLion recorded net income of $3.1 million

for the second quarter of 2024 versus a net loss of $27.7 million in the second quarter of 2023. Adjusted EBITDA was $18.5 million for

the second quarter of 2024 versus $9.2 million in the second quarter of 2023, when adjusted for the following non-operating costs:

| | |

Three Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| (in thousands) | |

(unaudited) | |

| Net income (loss) | |

$ | 3,137 | | |

$ | (27,723 | ) |

| Add back: | |

| | | |

| | |

| Interest related to corporate debt | |

| 2,576 | | |

| 3,475 | |

| Income tax benefit | |

| (1,824 | ) | |

| (262 | ) |

| Depreciation and amortization expense | |

| 6,331 | | |

| 6,113 | |

| Changes in fair value of warrant liability | |

| 81 | | |

| (162 | ) |

| Change in fair value of contingent consideration from mergers and acquisitions | |

| — | | |

| (6,367 | ) |

| Goodwill impairment loss | |

| — | | |

| 26,721 | |

| Stock-based compensation expense | |

| 7,531 | | |

| 5,250 | |

| Other expenses | |

| 686 | | |

| 2,188 | |

| Adjusted EBITDA | |

$ | 18,518 | | |

$ | 9,233 | |

Customer, Product and Origination Growth

Total Customers grew 73% year-over-year to 17.0

million in the second quarter of 2024. Total Products grew 60% year-over-year to 27.7 million in the second quarter of 2024. Total Originations

grew 40% year-over-year to $770 million for the second quarter of 2024.

Financial Guidance:

For the third quarter

of 2024, MoneyLion expects:

| ● | Total revenues, net of $133 to $138 million, reflecting 21% - 25% growth vs. Q3 2023 |

| | | |

| ● | Adjusted EBITDA of $18 to $21 million, reflecting 13.0% - 15.8% Adjusted EBITDA margin vs. 12.1% in Q3

2023 |

For the full year of

2024, MoneyLion expects:

| ● | Total revenues, net of $525 to $535 million, reflecting 24% - 26% growth vs. FY 2023 |

| | | |

| ● | Adjusted EBITDA of $80 to $87 million, reflecting 15.0% - 16.6% Adjusted EBITDA margin vs. 11.0% in FY

2023 |

(1) Adjusted EBITDA is a non-GAAP measure. Refer

to the definition of Adjusted EBITDA in the discussion of non-GAAP financial measures and the accompanying reconciliation below.

Conference Call

MoneyLion will hold a conference call today at

8:30 a.m. ET to discuss its second quarter 2024 results. A live webcast will be available on MoneyLion’s Investor Relations website

at investors.moneylion.com. Please dial into the conference 5-10 minutes prior to the start time and ask for the MoneyLion second quarter

2024 earnings call.

Toll-free dial-in number: 1-877-502-7184

International dial-in number: 1-201-689-8875

Following the call, a replay and transcript will

be available on the same website.

About MoneyLion

MoneyLion is a leader in financial technology

powering the next generation of personalized products, content, and marketplace technology, with a top consumer finance super app, a premier

embedded finance platform for enterprise businesses and a world-class media arm. MoneyLion’s mission is to give everyone the power

to make their best financial decisions. We pride ourselves on serving the many, not the few; providing confidence through guidance, choice,

and personalization; and shortening the distance to an informed action. In our go-to money app for consumers, we deliver curated content

on finance and related topics, through a tailored feed that engages people to learn and share. People take control of their finances with

our innovative financial products and marketplace - including our full-fledged suite of features to save, borrow, spend, and invest -

seamlessly bringing together the best offers and content from MoneyLion and our 1,200+ Enterprise Partner network, together in one experience.

MoneyLion’s enterprise technology provides

the definitive search engine and marketplace for financial products, enabling any company to add embedded finance to their business, with

advanced AI-backed data and tools through our platform and API. Established in 2013, MoneyLion connects millions of people with the financial

products and content they need, when and where they need it.

For more information about MoneyLion, please visit

www.moneylion.com. For information about Engine by MoneyLion for enterprise businesses, please visit www.engine.tech. For investor information

and updates, visit investors.moneylion.com and follow @MoneyLionIR on X.

Forward-Looking Statements

The information in this press release includes

“forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,”

“project,” “forecast,” “intend,” “will,” “expect,” “anticipate,”

“believe,” “seek,” “target” or other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements

regarding, among other things, MoneyLion’s financial position, results of operations, cash flows, prospects and growth strategies.

These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of

MoneyLion’s management, are subject to a number of risks and uncertainties and are not predictions of actual performance. Actual

events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances

are beyond the control of MoneyLion.

Factors that could cause actual results and outcomes

to differ from those reflected in forward-looking statements include, among other things: factors relating to the business, operations

and financial performance of MoneyLion, including market conditions and global and economic factors beyond MoneyLion’s control;

MoneyLion’s ability to acquire, engage and retain customers and clients and sell or develop additional functionality, products and services

to them on the MoneyLion platform; MoneyLion’s reliance on third-party partners, service providers and vendors, including its ability

to comply with applicable requirements of such third parties; demand for and consumer confidence in MoneyLion’s products and services,

including as a result of any adverse publicity concerning MoneyLion; any inaccurate or fraudulent information provided to MoneyLion by

customers or other third parties; MoneyLion’s ability to realize strategic objectives and avoid difficulties and risks of any acquisitions,

strategic investments, entries into new businesses, joint ventures, divestitures and other transactions; MoneyLion’s success in

attracting, retaining and motivating its senior management and other key personnel; MoneyLion’s ability to renew or replace its

existing funding arrangements and raise financing in the future, to comply with restrictive covenants related to its long-term indebtedness

and to manage the effects of changes in the cost of capital; MoneyLion’s ability to achieve or maintain profitability in the future; intense

and increasing competition in the industries in which MoneyLion and its subsidiaries operate; risks related to the proper functioning

of MoneyLion’s information technology systems and data storage, including as a result of cyberattacks, data security breaches or

other similar incidents or disruptions suffered by MoneyLion or third parties upon which it relies; MoneyLion’s ability to protect

its intellectual property and other proprietary rights and its ability to obtain or maintain intellectual property, proprietary rights

and technology licensed from third parties; MoneyLion’s ability to comply with extensive and evolving laws and regulations applicable

to its business and the outcome of any legal or governmental proceedings that may be instituted against MoneyLion; MoneyLion’s ability

to establish and maintain an effective system of internal controls over financial reporting; MoneyLion’s ability to maintain the

listing of MoneyLion’s Class A common stock and its publicly traded warrants to purchase MoneyLion Class A common stock on the New

York Stock Exchange and any volatility in the market price of MoneyLion’s securities; and factors discussed in MoneyLion’s

filings with the Securities and Exchange Commission. There may be additional risks that MoneyLion presently knows or that MoneyLion currently

believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements.

In addition, forward-looking statements reflect

MoneyLion’s expectations, plans or forecasts of future events and views as of the date of this press release. MoneyLion anticipates

that subsequent events and developments will cause its assessments to change. However, while MoneyLion may elect to update these forward-looking

statements at some point in the future, MoneyLion specifically disclaims any obligation to do so. These forward-looking statements should

not be relied upon as representing MoneyLion’s assessments as of any date subsequent to the date of this press release. Accordingly,

undue reliance should not be placed upon the forward-looking statements.

Financial Information; Non-GAAP Financial Measures

Adjusted EBITDA has not been prepared in accordance

with United States generally accepted accounting principles (“GAAP”). MoneyLion management historically used and uses Adjusted

EBITDA for various purposes, including as measures of performance and as a basis for strategic planning and forecasting. MoneyLion believes

presenting Adjusted EBITDA provides relevant and useful information to management and investors regarding certain financial and business

trends relating to MoneyLion’s results of operations. MoneyLion’s method of calculating Adjusted EBITDA may be different from

other companies’ methods and, therefore, may not be comparable to those used by other companies and MoneyLion does not recommend

the sole use of Adjusted EBITDA to assess its financial performance. MoneyLion management does not consider Adjusted EBITDA in isolation

or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of non-GAAP financial measures

is that they exclude significant expenses and income that are required by GAAP to be recorded in MoneyLion’s financial statements.

In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and

income are excluded or included in determining non-GAAP financial measures. In order to compensate for these limitations, management presents

Adjusted EBITDA in connection with MoneyLion’s GAAP results. You should review MoneyLion’s financial statements, which are

included in MoneyLion’s filings with the U.S. Securities and Exchange Commission, and not rely on any single financial measure to

evaluate MoneyLion’s business.

A reconciliation of Adjusted EBITDA to net income

(loss), the most directly comparable GAAP measure, is set forth below. To the extent that forward-looking non-GAAP financial measures

are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures, due to the inherent

difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, which could be material based on

historical adjustments. Accordingly, a reconciliation is not available without unreasonable effort.

Definitions:

Adjusted EBITDA: A non-GAAP measure, defined

as net income (loss) plus interest expense related to corporate debt, income tax expense (benefit), depreciation and amortization expense,

change in fair value of warrant liability, change in fair value of contingent consideration from mergers and acquisitions, goodwill impairment

loss, stock-based compensation and certain other expenses that management does not consider in measuring performance.

Total Customers: Defined as the cumulative

number of customers that have opened at least one account, including banking, membership subscription, secured personal loan, Instacash

advance, managed investment account, cryptocurrency account and customers that are monetized through our marketplace and affiliate products.

Total Customers also include customers that have submitted for, received or clicked on at least one marketplace credit offer.

Total Products: Defined as the total number

of products that our Total Customers have opened, including banking, membership subscription, secured personal loan, Instacash advance,

managed investment account, cryptocurrency account and monetized marketplace and affiliate products, as well as customers who signed up

for our financial tracking services (with either credit tracking enabled or external linked accounts), whether or not the customer is

still registered for the product. Total Products also include marketplace credit offers that our Total Customers have submitted for, received

or clicked on through our marketplace. If a customer has funded multiple secured personal loans or Instacash advances or opened multiple

products through our marketplace, it is only counted once for each product type.

Total Originations: Defined as the dollar

volume of the secured personal loans originated and Instacash advances funded within the stated period. All originations were originated

directly by MoneyLion.

Enterprise Partners: Composed of Product

Partners and Channel Partners. Product Partners are the providers of the financial and non-financial products and services that we offer

in our marketplaces, including financial institutions, financial service providers and other affiliate partners. Channel Partners are

organizations that allow us to reach a wide base of consumers, including but not limited to news sites, content publishers, product comparison

sites and financial institutions.

MONEYLION INC

CONSOLIDATED STATEMENTS OF OPERATIONS

(dollar amounts in thousands, except

per share amounts)

| | |

Three Months Ended

June 30, | | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue | |

| | |

| | |

| | |

| |

| Service and subscription revenue | |

$ | 127,890 | | |

$ | 103,237 | | |

$ | 245,963 | | |

$ | 193,978 | |

| Net interest income on loan receivables | |

| 2,956 | | |

| 3,304 | | |

| 5,889 | | |

| 6,232 | |

| Total revenue, net | |

| 130,846 | | |

| 106,541 | | |

| 251,852 | | |

| 200,210 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Provision for credit losses on consumer receivables | |

| 33,431 | | |

| 25,562 | | |

| 53,661 | | |

| 42,073 | |

| Compensation and benefits | |

| 24,852 | | |

| 22,572 | | |

| 49,638 | | |

| 46,980 | |

| Marketing | |

| 10,530 | | |

| 6,549 | | |

| 21,396 | | |

| 12,941 | |

| Direct costs | |

| 34,449 | | |

| 32,230 | | |

| 65,838 | | |

| 62,032 | |

| Professional services | |

| 11,007 | | |

| 4,518 | | |

| 16,773 | | |

| 9,517 | |

| Technology-related costs | |

| 6,512 | | |

| 5,611 | | |

| 13,098 | | |

| 11,649 | |

| Other operating expenses | |

| 4,338 | | |

| 11,219 | | |

| 14,658 | | |

| 20,214 | |

| Total operating expenses | |

| 125,119 | | |

| 108,261 | | |

| 235,062 | | |

| 205,406 | |

| Net income (loss) before other (expense) income and income taxes | |

| 5,727 | | |

| (1,720 | ) | |

| 16,790 | | |

| (5,196 | ) |

| Interest expense | |

| (6,714 | ) | |

| (7,330 | ) | |

| (13,531 | ) | |

| (14,841 | ) |

| Change in fair value of warrant liability | |

| (81 | ) | |

| 162 | | |

| — | | |

| 13 | |

| Change in fair value of contingent consideration from mergers and acquisitions | |

| — | | |

| 6,367 | | |

| — | | |

| 6,613 | |

| Goodwill impairment loss | |

| — | | |

| (26,721 | ) | |

| — | | |

| (26,721 | ) |

| Other income | |

| 2,381 | | |

| 1,257 | | |

| 4,740 | | |

| 2,906 | |

| Net income (loss) before income taxes | |

| 1,313 | | |

| (27,985 | ) | |

| 7,999 | | |

| (37,226 | ) |

| Income tax benefit | |

| (1,824 | ) | |

| (262 | ) | |

| (2,213 | ) | |

| (286 | ) |

| Net income (loss) | |

| 3,137 | | |

| (27,723 | ) | |

| 10,212 | | |

| (36,940 | ) |

| Reversal of previously accrued dividends on preferred stock | |

| — | | |

| 2,667 | | |

| — | | |

| 690 | |

| Net income (loss) attributable to common shareholders | |

$ | 3,137 | | |

$ | (25,056 | ) | |

$ | 10,212 | | |

$ | (36,250 | ) |

| Net income (loss) per share, basic | |

$ | 0.29 | | |

$ | (2.71 | ) | |

$ | 0.95 | | |

$ | (4.05 | ) |

| Net income (loss) per share, diluted | |

$ | 0.26 | | |

$ | (2.71 | ) | |

$ | 0.85 | | |

$ | (4.05 | ) |

| Weighted average shares used in computing net income (loss) per share, basic | |

| 10,862,853 | | |

| 9,234,238 | | |

| 10,694,635 | | |

| 8,944,836 | |

| Weighted average shares used in computing net income (loss) per share, diluted | |

| 12,091,421 | | |

| 9,234,238 | | |

| 11,954,975 | | |

| 8,944,836 | |

MONEYLION INC

CONSOLIDATED BALANCE SHEETS

(dollar amounts in thousands, except per share amounts)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Assets | |

| | |

| |

| Cash | |

$ | 98,361 | | |

$ | 92,195 | |

| Restricted cash, including amounts held by variable interest entities (VIEs) of $1,585 and $128 | |

| 4,749 | | |

| 2,284 | |

| Consumer receivables | |

| 237,358 | | |

| 208,167 | |

| Allowance for credit losses on consumer receivables | |

| (40,523 | ) | |

| (35,329 | ) |

| Consumer receivables, net, including amounts held by VIEs of $150,174 and $131,283 | |

| 196,835 | | |

| 172,838 | |

| Enterprise receivables, net | |

| 23,045 | | |

| 15,978 | |

| Property and equipment, net | |

| 1,961 | | |

| 1,864 | |

| Intangible assets, net | |

| 168,302 | | |

| 176,541 | |

| Other assets | |

| 52,490 | | |

| 53,559 | |

| Total assets | |

$ | 545,743 | | |

$ | 515,259 | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Liabilities: | |

| | | |

| | |

| Secured loans, net | |

$ | 64,482 | | |

$ | 64,334 | |

| Accounts payable and accrued liabilities | |

| 48,984 | | |

| 52,396 | |

| Warrant liability | |

| 810 | | |

| 810 | |

| Other debt, net, including amounts held by VIEs of $129,932 and $125,419 | |

| 129,932 | | |

| 125,419 | |

| Other liabilities | |

| 23,079 | | |

| 15,077 | |

| Total liabilities | |

| 267,287 | | |

| 258,036 | |

| Commitments and contingencies (Note 15) | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Class A Common Stock, $0.0001 par value; 66,666,666 shares authorized as of June 30, 2024 and December 31, 2023, 10,977,991 and 10,945,658 issued and outstanding, respectively, as of June 30, 2024 and 10,444,627 and 10,412,294 issued and outstanding, respectively, as of December 31, 2023 | |

| 1 | | |

| 1 | |

| Additional paid-in capital | |

| 980,662 | | |

| 969,641 | |

| Accumulated deficit | |

| (692,507 | ) | |

| (702,719 | ) |

| Treasury stock at cost, 32,333 shares as of June 30, 2024 and December 31, 2023 | |

| (9,700 | ) | |

| (9,700 | ) |

| Total stockholders’ equity | |

| 278,456 | | |

| 257,223 | |

| Total liabilities and stockholders’ equity | |

$ | 545,743 | | |

$ | 515,259 | |

MONEYLION INC

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollar amounts in thousands, except per share amounts)

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | |

| | |

| | |

| |

| Net income (loss) | |

$ | 3,137 | | |

$ | (27,723 | ) | |

$ | 10,212 | | |

$ | (36,940 | ) |

| Adjustments to reconcile net income (loss) to net cash from operating activities: | |

| | | |

| | | |

| | | |

| | |

| Provision for losses on receivables | |

| 33,431 | | |

| 25,562 | | |

| 53,661 | | |

| 42,073 | |

| Depreciation and amortization expense | |

| 6,331 | | |

| 6,113 | | |

| 12,543 | | |

| 12,297 | |

| Change in deferred fees and costs, net | |

| 322 | | |

| 782 | | |

| 678 | | |

| 1,398 | |

| Change in fair value of warrants | |

| 81 | | |

| (162 | ) | |

| — | | |

| (13 | ) |

| Change in fair value of contingent consideration from mergers and acquisitions | |

| — | | |

| (6,367 | ) | |

| — | | |

| (6,613 | ) |

| Loss (gain) on foreign currency translation | |

| 44 | | |

| (171 | ) | |

| (53 | ) | |

| (178 | ) |

| Goodwill impairment loss | |

| — | | |

| 26,721 | | |

| — | | |

| 26,721 | |

| Stock compensation expense | |

| 7,531 | | |

| 5,250 | | |

| 14,028 | | |

| 10,955 | |

| Deferred income taxes | |

| 235 | | |

| (400 | ) | |

| 471 | | |

| (493 | ) |

| Changes in assets and liabilities: | |

| | | |

| | | |

| | | |

| | |

| Accrued interest receivable | |

| (38 | ) | |

| (211 | ) | |

| (76 | ) | |

| (238 | ) |

| Enterprise receivables, net | |

| (5,527 | ) | |

| 1,708 | | |

| (7,067 | ) | |

| (2,422 | ) |

| Other assets | |

| 3,117 | | |

| 5,610 | | |

| 1,753 | | |

| 4,360 | |

| Accounts payable and accrued liabilities | |

| (1,103 | ) | |

| 1,156 | | |

| (3,359 | ) | |

| (8,649 | ) |

| Other liabilities | |

| 237 | | |

| (2,505 | ) | |

| (1,354 | ) | |

| (4,215 | ) |

| Net cash provided by operating activities | |

| 47,798 | | |

| 35,363 | | |

| 81,437 | | |

| 38,043 | |

| Cash flows from investing activities: | |

| | | |

| | | |

| | | |

| | |

| Net originations and collections of finance receivables | |

| (41,676 | ) | |

| (33,185 | ) | |

| (69,398 | ) | |

| (52,832 | ) |

| Purchase of property and equipment and software development | |

| (2,244 | ) | |

| (1,638 | ) | |

| (4,401 | ) | |

| (2,675 | ) |

| Settlement of contingent consideration related to mergers and acquisitions | |

| — | | |

| (766 | ) | |

| — | | |

| (1,116 | ) |

| Net cash used in investing activities | |

| (43,920 | ) | |

| (35,589 | ) | |

| (73,799 | ) | |

| (56,623 | ) |

| Cash flows from financing activities: | |

| | | |

| | | |

| | | |

| | |

| Net proceeds from (repayments to) special purpose vehicle credit facilities | |

| — | | |

| — | | |

| 4,000 | | |

| (24,000 | ) |

| Repayments to secured/senior lenders | |

| — | | |

| (5,000 | ) | |

| — | | |

| (5,000 | ) |

| Payment of deferred financing costs | |

| — | | |

| (154 | ) | |

| — | | |

| (154 | ) |

| Payments related to the automatic conversion of redeemable convertible preferred stock (Series A) in lieu of fractional shares of common stock and dividends on preferred stock | |

| — | | |

| (3,007 | ) | |

| — | | |

| (3,007 | ) |

| Payments related to issuance of common stock related to exercise of stock options and warrants, net of tax withholdings related to vesting of stock-based compensation | |

| (2,670 | ) | |

| (183 | ) | |

| (3,007 | ) | |

| (782 | ) |

| Other | |

| — | | |

| (12 | ) | |

| — | | |

| (12 | ) |

| Net cash (used in) provided by financing activities | |

| (2,670 | ) | |

| (8,356 | ) | |

| 993 | | |

| (32,955 | ) |

| Net change in cash and restricted cash | |

| 1,208 | | |

| (8,582 | ) | |

| 8,631 | | |

| (51,535 | ) |

| Cash and restricted cash, beginning of period | |

| 101,902 | | |

| 110,756 | | |

| 94,479 | | |

| 153,709 | |

| Cash and restricted cash, end of period | |

$ | 103,110 | | |

$ | 102,174 | | |

$ | 103,110 | | |

$ | 102,174 | |

MONEYLION INC.

RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA

(dollar amounts in thousands)

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net income (loss) | |

$ | 3,137 | | |

$ | (27,723 | ) | |

$ | 10,212 | | |

$ | (36,940 | ) |

| Add back: | |

| | | |

| | | |

| | | |

| | |

| Interest related to corporate debt | |

| 2,576 | | |

| 3,475 | | |

| 5,371 | | |

| 7,035 | |

| Income tax benefit | |

| (1,824 | ) | |

| (262 | ) | |

| (2,213 | ) | |

| (286 | ) |

| Depreciation and amortization expense | |

| 6,331 | | |

| 6,113 | | |

| 12,543 | | |

| 12,297 | |

| Changes in fair value of warrant liability | |

| 81 | | |

| (162 | ) | |

| — | | |

| (13 | ) |

| Change in fair value of contingent consideration from mergers and acquisitions | |

| — | | |

| (6,367 | ) | |

| — | | |

| (6,613 | ) |

| Goodwill impairment loss | |

| — | | |

| 26,721 | | |

| — | | |

| 26,721 | |

| Stock-based compensation expense | |

| 7,531 | | |

| 5,250 | | |

| 14,028 | | |

| 10,955 | |

| Other expenses | |

| 686 | | |

| 2,188 | | |

| 2,062 | | |

| 3,373 | |

| Adjusted EBITDA | |

$ | 18,518 | | |

$ | 9,233 | | |

$ | 42,003 | | |

$ | 16,529 | |

Contacts

MoneyLion Investor Relations

ir@moneylion.com

MoneyLion Communications

pr@moneylion.com

v3.24.2.u1

Cover

|

Aug. 02, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 02, 2024

|

| Entity File Number |

001-39346

|

| Entity Registrant Name |

MONEYLION INC.

|

| Entity Central Index Key |

0001807846

|

| Entity Tax Identification Number |

85-0849243

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

249-245 West 17th Street

|

| Entity Address, Address Line Two |

Floor 4

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10011

|

| City Area Code |

212

|

| Local Phone Number |

300-9865

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A common stock,

par value $0.0001 per share

|

| Trading Symbol |

ML

|

| Security Exchange Name |

NYSE

|

| Redeemable warrants: each whole warrant exercisable for 1/30th of one share of Class A common stock |

|

| Title of 12(b) Security |

Redeemable warrants:

each whole warrant exercisable for 1/30th of one share of Class A common stock

|

| Trading Symbol |

ML WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ML_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ML_RedeemableWarrantsEachWholeWarrantExercisableFor130thOfOneShareOfClassCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

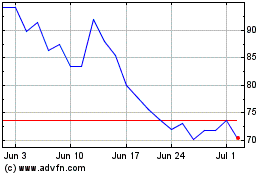

MoneyLion (NYSE:ML)

Historical Stock Chart

From Oct 2024 to Nov 2024

MoneyLion (NYSE:ML)

Historical Stock Chart

From Nov 2023 to Nov 2024