MOGU Inc. (NYSE: MOGU) (“MOGU” or the “Company”), a KOL-driven

online fashion and lifestyle destination in China, today announced

its unaudited financial results for the six months ended March 31,

2024 and fiscal year 2024.

Mr. Fan Yiming, Chief Executive Officer of MOGU, commented, “In

the second half of 2024, competition in China’s online retail

industry continued to intensify. Having entered its seventh year,

the live streaming e-commerce industry is experiencing a new

lifecycle of key opinion leaders (KOLs). Major platforms are

overseeing the rise and cultivation of new KOLs, while veteran KOLs

are cycling out of mainstream prominence. With evolving dynamics

and challenges spanning the online retail industry, MOGU has also

been impacted. In the second half of fiscal year 2024, MOGU’s gross

merchandise value (GMV) decreased by 6% to RMB3.04 billion.

“To mitigate these challenges, we have been implementing a new

operational strategy that was proposed during this fiscal year to

restructure into a professional services platform. MOGU now

provides KOLs with more comprehensive services including merchant

sourcing, product promotion, and streaming assistance in an attempt

to further reduce operational costs for merchants and KOLs.

Alongside this, we are leveraging the sales expertise and service

capabilities we have accrued over the years to conduct live

streaming operations for merchants and KOL agency businesses. These

live streaming operations run across a diverse array of channels,

notably including Douyin, Kuaishou and Xiaohongshu. We believe this

segment offers great potential and will be beneficial to

diversifying our revenue structure.”

“During the second half of fiscal year of 2024, our total

revenues decreased by 34.3% to RMB77.0 million. The loss from

operations was RMB27.1 million, compared to RMB139.4 million for

the same period of fiscal year 2023. Over the past six months, we

have diligently optimized our cost structure and improved

operational efficiency, yielding positive outcomes. However,

despite these efforts, the increasing cost of acquiring new

customers and a decline in revenue prevented us from achieving our

targeted operational results. Looking ahead, we will continue to

focus on cost reduction and efficiency enhancements and continue

looking for new revenue growth opportunities. We are confident that

these measures will contribute to our overall financial resilience

and sustainable growth,” added Ms. Qi Feng, Financial

Controller.

Highlights For the Six Months Ended March 31, 2024

- Total revenues for the six months ended March 31, 2024

decreased by 34.3% to RMB77.0 million (US$10.7 million) from

RMB117.2 million during the same period of fiscal year 2023.

- Live video broadcast (“LVB”) associated GMV for

the six months ended March 31, 2024 decreased by 6.8%

period-over-period to RMB2,950 million (US$408.6 million2).

- GMV for the six months ended March 31, 2024 was RMB3,036

million (US$420.5 million), a decrease of 6.3%

period-over-period.

Financial Results For the Six Months Ended March 31,

2024

Total revenues for the six months ended March 31, 2024

decreased by 34.3% to RMB77.0 million (US$10.7 million) from

RMB117.2 million during the same period of fiscal year 2023.

- Commission revenues for the six months ended March 31,

2024 decreased by 28.6% to RMB54.1 million (US$7.5 million) from

RMB75.8 million in the same period of fiscal year 2023, primarily

attributable to the lower GMV due to the heightened competitive

environment.

- Marketing services revenues for the six months ended

March 31, 2024 decreased by 85.0% to RMB0.2 million (US$0.03

million) from RMB1.4 million in the same period of fiscal year

2023, primarily due to the challenging competitive

environment.

- Financing solutions revenues for the six months ended

March 31, 2024 decreased by 19.2% to RMB4.9 million (US$0.7

million) from RMB6.0 million in the same period of fiscal year

2023. The decrease was primarily due to the decrease in the service

fee of loans to users in line with the lower GMV.

- Technology service revenues for the six months ended

March 31, 2024 decreased by 51.6% to RMB14.9 million (US$2.1

million) from RMB30.8 million in the same period of fiscal year

2023, primarily attributable to the decrease of insurance

technology service revenue.

- Other revenues for the six months ended March 31, 2024

decreased by 7.4% to RMB2.9 million (US$0.4 million) from RMB3.2

million in the same period of fiscal year 2023.

Cost of revenues for the six months ended March 31, 2024

decreased by 23.3% to RMB41.6 million (US$5.8 million) from RMB54.2

million in the same period of fiscal year 2023, which was primarily

due to a decrease in IT-related expenses of RMB7.3 million and

decrease in payroll costs of RMB5.4 million, in line with the

overall reduction in revenue.

Sales and marketing expenses for the six months ended March 31,

2024 decreased by 14.1% to RMB30.1 million (US$4.2 million) from

RMB35.1 million in the same period of fiscal year 2023, primarily

due to a decrease in performance-related year-end bonus.

Research and development expenses for the six months ended March

31, 2024 decreased by 20.4% to RMB12.8 million (US$1.8 million)

from RMB16.1 million in the same period of fiscal year 2023,

primarily due to a decrease in performance-related year-end

bonus.

General and administrative expenses for the six months ended

March 31, 2024 decreased by 11.3% to RMB27.2 million (US$3.8

million) from RMB30.7 million in the same period of fiscal year

2023, primarily due to a decrease in performance-related year-end

bonus.

Amortization of intangible assets for the six months ended March

31, 2024 decreased by 99.8% to RMB0.08 million (US$0.01 million)

from RMB40.0 million in the same period of the fiscal year 2023,

primarily because the intangible assets recorded as a result of the

business cooperation agreement MOGU entered into with Tencent in

July 2018 had been fully amortized as of December 31, 2022.

Impairment of goodwill and intangible assets for the six months

ended March 31, 2024 decreased by 100.0% to nil from RMB84.7

million in the same period of fiscal year 2023, primarily due to

the Company’s recognition of a full impairment charge of RMB63.5

million against its remaining goodwill balance and impairments

totaling of RMB21.2 million for intangible assets which had been

recorded in connection with the acquisition of Hangzhou Ruisha

Technology Co., Ltd. (“Ruisha Technology”) in the same period of

fiscal year 2023.

Loss from operations for the six months ended March 31,

2024 was RMB27.1 million (US$3.8 million), compared to the loss

from operations of RMB139.4 million in the same period of fiscal

year 2023.

Net loss attributable to MOGU Inc. for the six months

ended March 31, 2024 was RMB23.9 million (US$3.3 million), compared

to the net loss attributable to MOGU Inc. of RMB120.5 million in

the same period of fiscal year 2023.

Adjusted EBITDA3 for the six months ended March 31, 2024

was negative RMB20.7 million (US$2.9 million), compared to negative

RMB6.8 million in the same period of fiscal year 2023.

Adjusted net loss4 for the six months ended March 31,

2024 was RMB22.3 million (US$3.1 million), compared to the adjusted

net loss of RMB46.7 million in the same period of fiscal year

2023.

Basic and diluted loss per ADS for the six months ended

March 31, 2024 were RMB2.74 (US$0.38) and RMB2.74 (US$0.38),

respectively, compared with RMB14.07 and RMB14.07, respectively, in

the same period of fiscal year 2023. One ADS represents 300 Class A

ordinary shares.

Cash and cash equivalents, Restricted cash and Short-term

investments were RMB420.6 million (US$58.3 million) as of March

31, 2024, compared with RMB562.8 million as of March 31, 2023.

Fiscal Year 2024 Financial Results

Total revenues decreased by 30.9% to RMB160.3 million

(US$22.2 million) from RMB232.1 million in fiscal year 2023.

- Commission revenues decreased by 25.6% to RMB109.7

million (US$15.2 million) from RMB147.5 million in fiscal year

2023, primarily attributable to the lower GMV due to the heightened

competitive environment.

- Marketing services revenues decreased by 78.2% to RMB1.0

million (US$0.1 million) from RMB4.4 million in fiscal year 2023.

The decrease was primarily due to the challenging competitive

environment.

- Financing solutions revenues decreased by 20.7% to

RMB10.3 million (US$1.4 million) from RMB12.9 million in the same

period of fiscal year 2023. The decrease was primarily due to the

decrease in service fees of loans to users in line with the lower

GMV.

- Technology service revenues increased by 43.5% to

RMB33.3 million (US$4.6 million) from RMB58.9 million in the fiscal

year 2023, primarily attributable to a decrease in insurance

technology services and software services revenue due to the

challenging competitive environment.

- Other revenues decreased by 27.0% to RMB6.1 million

(US$0.8 million) from RMB8.3 million in fiscal year 2023, primarily

due to the decrease in branding services revenue.

Cost of revenues decreased by 19.9% to RMB91.2 million (US$12.6

million) from RMB113.9 million in fiscal year 2023, which was

primarily due to a decrease in IT-related expenses of RMB11.3

million, payroll cost of RMB9.9 million and payment handling costs

of RMB2.5 million, in relation to the overall reduction in

revenue.

Sales and marketing expenses decreased by 0.5% to RMB67.4

million (US$9.3 million) from RMB67.7 million in fiscal year 2023,

primarily due to a decrease in payroll cost of RMB13.2 million in

relation to the decrease of performance-related year-end bonus,

partially offset by spending on branding and user acquisition

activities of RMB12.9 million.

Research and development expenses decreased by 27.9% to RMB26.7

million (US$3.7 million) from RMB37.1 million in fiscal year 2023,

primarily due to a decrease in performance-related year-end

bonus.

General and administrative expenses decreased by 13.1% to

RMB55.1 million (US$7.6 million) from RMB63.4 million in fiscal

year 2023, primarily due to a decrease in performance-related

year-end bonus of RMB7.2 million and professional service fees of

RMB1.8 million.

Amortization of intangible assets decreased by 96.8% to RMB1.9

million (US$0.3 million) from RMB60.0 million in fiscal year 2023,

primarily because the majority of the intangible assets recorded as

a result of the business cooperation agreement MOGU entered into

with Tencent in July 2018 had been fully amortized as of December

31, 2022.

Impairment of goodwill and intangible assets for the year ended

March 31, 2024 was RMB9.9 million (US$1.4 million), compared to

RMB84.7 million in the fiscal year 2023. In fiscal year 2023, the

Company recognized a full impairment charge of RMB63.5 million

against its remaining goodwill balance and impairments totaling of

RMB21.2 million for intangible assets which had been recorded in

connection with the acquisition of Ruisha Technology. In fiscal

year 2024, the Company recognized a full impairment charge of

RMB9.9 million against its intangible assets arising from the

acquisition of Ruisha Technology. The recorded impairments resulted

from weaker-than-expected operating results which reflect an

increasingly competitive business environment and the related

limited future economic benefits expected to be generated from

these intangible assets.

Loss from operations was RMB79.2 million (US$11.0

million), compared to the loss from operations of RMB187.4 million

in fiscal year 2023.

Net loss attributable to MOGU Inc. was RMB59.3 million

(US$8.2 million), compared to the net loss attributable to MOGU

Inc. of RMB178.0 million in fiscal year 2023.

Adjusted EBITDA was negative RMB54.6 million (US$7.6

million), compared to negative RMB23.9 million in fiscal year

2023.

Adjusted net loss was RMB55.1 million (US$7.6 million),

compared to the adjusted net loss of RMB78.5 million in fiscal year

2023.

Basic and diluted loss per ADS were RMB6.85 (US$0.95) and

RMB6.85 (US$0.95) respectively, compared with RMB20.90 and

RMB20.90, respectively, in fiscal year 2023. One ADS represents 300

Class A ordinary shares.

Subsequent event

On May 14, 2024, the board of directors of the Company approved

a new share repurchase program where the Company is authorized to

repurchase up to US$8 million of its shares, effective until May

12, 2025.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company considers and uses

non-GAAP measures, such as Adjusted EBITDA and Adjusted net

income/loss as supplemental measures to review and assess operating

performance. The presentation of these non-GAAP financial measures

is not intended to be considered in isolation or as a substitute

for the financial information prepared and presented in accordance

with accounting principles generally accepted in the United States

of America (“U.S. GAAP”). The Company defines Adjusted EBITDA as

net loss before interest income, interest expense, (gain)/loss from

investments, net, income tax (benefits)/expenses, share of results

of equity investees, impairment of goodwill and intangible assets,

share-based compensation expenses, amortization of intangible

assets, and depreciation of property and equipment. The Company

defines Adjusted net loss as net loss excluding (gain)/loss from

investments, net, impairment of goodwill and intangible assets,

share-based compensation expenses, and adjustments for tax effects.

See “Unaudited Reconciliations of GAAP and Non-GAAP Results” at the

end of this press release.

The Company presents these non-GAAP financial measures because

they are used by management to evaluate operating performance and

formulate business plans. The Company believes that the non-GAAP

financial measures help identify underlying trends in its business

by excluding certain expenses, gain/loss and other items that are

not expected to result in future cash payments or that are

nonrecurring in nature or may not be indicative of the Company’s

core operating results and business outlook. The Company also

believes that the non-GAAP financial measures could provide further

information about the Company’s results of operations, enhance the

overall understanding of the Company’s past performance and future

prospects.

The non-GAAP financial measures are not defined under U.S. GAAP

and are not presented in accordance with U.S. GAAP. The non-GAAP

financial measures have limitations as analytical tools. The

Company’s non-GAAP financial measures do not reflect all items of

income and expense that affect the Company’s operations and do not

represent the residual cash flow available for discretionary

expenditures. Further, these non-GAAP measures may differ from the

non-GAAP information used by other companies, including peer

companies, and therefore their comparability may be limited. The

Company compensates for these limitations by reconciling the

non-GAAP financial measures to the nearest U.S. GAAP performance

measure, all of which should be considered when evaluating

performance. The Company encourages you to review the Company’s

financial information in its entirety and not rely on a single

financial measure.

For more information on the non-GAAP financial measures, please

see the table captioned “Unaudited Reconciliations of GAAP and

Non-GAAP Results” set forth at the end of this press release.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “aims,” “future,” “intends,”

“plans,” “believes,” “estimates,” “confident,” “potential,”

“continue” or other similar expressions. Among other things, the

business outlook and quotations from management in this

announcement, as well as MOGU’s strategic and operational plans,

contain forward-looking statements. MOGU may also make written or

oral forward-looking statements in its periodic reports to the U.S.

Securities and Exchange Commission (the “SEC”), in its annual

report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including but not limited to statements about MOGU’s beliefs

and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: MOGU’s growth strategies; the risk that

COVID-19 or other health risks in China or globally could adversely

affect its operations or financial results; its future business

development, results of operations and financial condition; its

ability to understand buyer needs and provide products and services

to attract and retain buyers; its ability to maintain and enhance

the recognition and reputation of its brand; its ability to rely on

merchants and third-party logistics service providers to provide

delivery services to buyers; its ability to maintain and improve

quality control policies and measures; its ability to establish and

maintain relationships with merchants; trends and competition in

China’s ecommerce market; changes in its revenues and certain cost

or expense items; the expected growth of China’s ecommerce market;

PRC governmental policies and regulations relating to MOGU’s

industry, and general economic and business conditions globally and

in China and assumptions underlying or related to any of the

foregoing. Further information regarding these and other risks is

included in MOGU’s filings with the SEC. All information provided

in this press release and in the attachments is as of the date of

this press release, and MOGU undertakes no obligation to update any

forward-looking statement, except as required under applicable

law.

About MOGU Inc.

MOGU Inc. (NYSE: MOGU) is a KOL-driven online fashion and

lifestyle destination in China. MOGU provides people with a more

accessible and enjoyable shopping experience for everyday fashion,

particularly as they increasingly live their lives online. By

connecting merchants, KOLs and users together, MOGU’s platform

serves as a valuable marketing channel for merchants, a powerful

incubator for KOLs, and a vibrant and dynamic community for people

to discover and share the latest fashion trends with others, where

users can enjoy a truly comprehensive online shopping

experience.

MOGU INC.

Unaudited Condensed

Consolidated Balance Sheets

(All amounts in thousands,

except for share and per share data)

As of March 31,

As of March 31,

2023

2024

RMB

RMB

US$

ASSETS

Current assets:

Cash and cash equivalents

416,201

358,787

49,691

Restricted cash

810

511

71

Short-term investments

145,836

61,312

8,492

Inventories, net

144

98

14

Loan receivables, net

32,229

31,564

4,372

Prepayments, receivables and other current

assets

69,126

54,956

7,610

Amounts due from related parties

1,260

587

81

Total current assets

665,606

507,815

70,331

Non-current assets:

Property and equipment, net

194,589

299,741

41,514

Intangible assets, net

12,554

949

131

Right-of-use assets

5,441

2,576

357

Investments

69,318

81,808

11,330

Other non-current assets

63,640

45,473

6,298

Total non-current assets

345,542

430,547

59,630

Total assets

1,011,148

938,362

129,961

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Accounts payable

8,179

6,862

950

Salaries and welfare payable

13,550

6,936

961

Advances from customers

245

207

29

Taxes payable

11,126

1,285

178

Amounts due to related parties

4,196

5,341

740

Current portion of lease liabilities

2,654

1,888

261

Accruals and other current liabilities

295,717

299,317

41,455

Total current liabilities

335,667

321,836

44,574

Non-current liabilities:

Non-current lease liabilities

753

773

107

Deferred tax liabilities

3,369

1,299

180

Total non-current liabilities

4,122

2,072

287

Total liabilities

339,789

323,908

44,861

Shareholders’ equity

Ordinary shares

181

181

25

Treasury stock

(137,446

)

(137,446

)

(19,036

)

Statutory reserves

3,331

3,331

461

Additional paid-in capital

9,484,664

9,489,254

1,314,246

Accumulated other comprehensive income

82,396

89,567

12,405

Accumulated deficit

(8,795,764

)

(8,856,494

)

(1,226,610

)

Total MOGU Inc. shareholders’ equity

637,362

588,393

81,491

Non-controlling interests

33,997

26,061

3,609

Total shareholders’ equity

671,359

614,454

85,100

Total liabilities and shareholders’

equity

1,011,148

938,362

129,961

The financial statements as of March 31, 2023 are being revised

to correct an error related to the receipts from users, amounting

to RMB 25 million, which was previously accounted for as repayments

of loan receivables. It has been revised to record the receipts in

the accruals and other current liabilities as of March 31, 2023.

The impacts of the revision on the previously issued consolidated

financial statements are not considered material to the financial

statements taken as a whole.

MOGU INC.

Unaudited Condensed

Consolidated Statements of Operations and Comprehensive

Loss

(All amounts in thousands,

except for share and per share data)

For the six months

ended

For the years ended

March 31,

March 31,

2023

2024

2023

2024

RMB

RMB

US$

RMB

RMB

US$

Net revenues

Commission revenues

75,814

54,123

7,496

147,514

109,742

15,199

Marketing services revenues

1,434

215

30

4,416

961

133

Financing solutions revenues

6,017

4,864

674

12,947

10,267

1,422

Technology service revenues

30,790

14,900

2,064

58,867

33,288

4,610

Other revenues

3,175

2,940

407

8,332

6,086

843

Total revenues

117,230

77,042

10,671

232,076

160,344

22,207

Cost of revenues (exclusive of

amortization of intangible assets shown separately below)

(54,243

)

(41,589

)

(5,760

)

(113,884

)

(91,191

)

(12,629

)

Sales and marketing expenses

(35,063

)

(30,117

)

(4,171

)

(67,709

)

(67,391

)

(9,334

)

Research and development expenses

(16,146

)

(12,845

)

(1,779

)

(37,068

)

(26,724

)

(3,701

)

General and administrative expenses

(30,704

)

(27,234

)

(3,772

)

(63,445

)

(55,148

)

(7,638

)

Amortization of intangible assets

(39,970

)

(75

)

(10

)

(59,992

)

(1,901

)

(263

)

Impairment of goodwill and intangible

assets

(84,693

)

—

—

(84,693

)

(9,945

)

(1,377

)

Other income, net

4,201

7,725

1,070

7,267

12,784

1,771

Loss from operations

(139,388

)

(27,093

)

(3,751

)

(187,448

)

(79,172

)

(10,964

)

Interest income

8,376

5,577

772

17,389

12,719

1,762

Interest expense

(270

)

(191

)

(26

)

(598

)

(191

)

(26

)

Gain/(loss) from investments, net

816

(314

)

(43

)

(18,615

)

953

132

Loss before income tax and share of

results of equity investees

(130,466

)

(22,021

)

(3,048

)

(189,272

)

(65,691

)

(9,096

)

Income tax benefits/(expenses)

897

(44

)

(6

)

1,983

1,618

224

Share of results of equity investee

2,008

(2,382

)

(330

)

883

(2,886

)

(400

)

Net loss

(127,561

)

(24,447

)

(3,384

)

(186,406

)

(66,959

)

(9,272

)

Net loss attributable to non-controlling

interests

(7,015

)

(569

)

(79

)

(8,422

)

(7,674

)

(1,063

)

Net loss attributable to MOGU

Inc.

(120,546

)

(23,878

)

(3,305

)

(177,984

)

(59,285

)

(8,209

)

Net loss

(127,561

)

(24,447

)

(3,384

)

(186,406

)

(66,959

)

(9,272

)

Other comprehensive

(loss)/income:

Foreign currency translation adjustments,

net of nil tax

(4,231

)

(1,295

)

(179

)

14,264

3,675

509

Unrealized securities holding

gains/(losses), net of tax

302

1,794

248

(884

)

3,496

484

Total comprehensive loss

(131,490

)

(23,948

)

(3,315

)

(173,026

)

(59,788

)

(8,279

)

Total comprehensive loss attributable to

non-controlling interests

(7,015

)

(569

)

(79

)

(8,422

)

(7,674

)

(1,063

)

Total comprehensive loss attributable

to MOGU Inc.

(124,475

)

(23,379

)

(3,236

)

(164,604

)

(52,114

)

(7,216

)

Net loss per share attributable to

ordinary shareholders

Basic

(0.05

)

(0.01

)

(0.00

)

(0.07

)

(0.02

)

(0.00

)

Diluted

(0.05

)

(0.01

)

(0.00

)

(0.07

)

(0.02

)

(0.00

)

Net loss per ADS

Basic

(14.07

)

(2.74

)

(0.38

)

(20.90

)

(6.85

)

(0.95

)

Diluted

(14.07

)

(2.74

)

(0.38

)

(20.90

)

(6.85

)

(0.95

)

Weighted average number of shares used

in computing net loss per share

Basic

2,570,915,725

2,613,782,580

2,613,782,580

2,554,338,579

2,597,764,333

2,597,764,333

Diluted

2,570,915,725

2,613,782,580

2,613,782,580

2,554,338,579

2,597,764,333

2,597,764,333

Share-based compensation expenses

included in:

Cost of revenues

640

75

10

1,448

490

68

General and administrative expenses

2,786

1,579

219

7,855

3,342

463

Sales and marketing expenses

950

20

3

3,398

439

61

Research and development expenses

351

127

18

862

319

44

MOGU INC.

Unaudited Condensed

Consolidated Statements of Cash Flows

(All amounts in thousands,

except for share and per share data)

For the six months

ended

For the years ended

March 31,

March 31,

2023

2024

2023

2024

RMB

RMB

US$

RMB

RMB

US$

Net cash provided by/(used in)

operating activities

5,930

(7,554

)

(1,046

)

(10,090

)

(40,461

)

(5,604

)

Net cash provided by/(used in)

investing activities

28,763

1,013

140

608

(19,766

)

(2,738

)

Net cash used in financing

activities

(9,092

)

—

—

(12,064

)

—

—

Effect of foreign exchange rate changes on

cash and cash equivalents and restricted cash

(2,369

)

(822

)

(114

)

(860

)

2,514

349

Net increase/(decrease) in cash and cash

equivalents and restricted cash

23,232

(7,363

)

(1,020

)

(22,406

)

(57,713

)

(7,993

)

Cash and cash equivalents and restricted

cash at beginning of period

393,779

366,661

50,782

439,417

417,011

57,755

Cash and cash equivalents and restricted

cash at end of period

417,011

359,298

49,762

417,011

359,298

49,762

MOGU INC.

Unaudited Reconciliations of

GAAP and Non-GAAP Results

(All amounts in thousands,

except for share and per share data)

For the six months

ended

For the years ended

March 31,

March 31,

2023

2024

2023

2024

RMB

RMB

US$

RMB

RMB

US$

Net loss

(127,561

)

(24,447

)

(3,384

)

(186,406

)

(66,959

)

(9,272

)

Add:

Interest expense

270

191

26

598

191

26

Less:

Income tax (benefits)/expenses

(897

)

44

6

(1,983

)

(1,618

)

(224

)

Less:

Interest income

(8,376

)

(5,577

)

(772

)

(17,389

)

(12,719

)

(1,762

)

Add:

Amortization of intangible assets

39,970

75

10

59,992

1,901

263

Add:

Depreciation of property and equipment

3,244

4,562

632

5,311

8,091

1,121

EBITDA

(93,350

)

(25,152

)

(3,482

)

(139,877

)

(71,113

)

(9,848

)

Add:

Impairment of goodwill and intangible

assets

84,693

—

—

84,693

9,945

1,377

Add:

Share-based compensation expenses

4,727

1,801

250

13,563

4,590

636

Add:

Share of result of equity investees

(2,008

)

2,382

330

(883

)

2,886

400

Less:

(Gain)/Loss from investments, net

(816

)

314

43

18,615

(953

)

(132

)

Adjusted EBITDA

(6,754

)

(20,655

)

(2,859

)

(23,889

)

(54,645

)

(7,567

)

Net loss

(127,561

)

(24,447

)

(3,384

)

(186,406

)

(66,959

)

(9,272

)

Add:

(Gain)/Loss from investments, net

(816

)

314

43

18,615

(953

)

(132

)

Add:

Share-based compensation expenses

4,727

1,801

250

13,563

4,590

636

Add:

Impairment of goodwill and intangible

assets

84,693

—

—

84,693

9,945

1,377

Less:

Adjusted for tax effects

(7,713

)

—

—

(8,948

)

(1,755

)

(243

)

Adjusted net loss

(46,670

)

(22,332

)

(3,091

)

(78,483

)

(55,132

)

(7,634

)

1 GMV are to gross merchandise volume, refers to the total value

of orders placed on the MOGU platform regardless of whether the

products are sold, delivered or returned, calculated based on the

listed prices of the ordered products without taking into

consideration any discounts on the listed prices. Buyers on the

MOGU platform are not charged for separate shipping fees over the

listed price of a product. If merchants include certain shipping

fees in the listed price of a product, such shipping fees will be

included in GMV. As a prudent matter aiming at eliminating any

influence on MOGU’s GMV of irregular transactions, the Company

excludes from its calculation of GMV transactions over a certain

amount (RMB100,000) and transactions by users over a certain amount

(RMB1,000,000) per day.

2 The U.S. dollar (US$) amounts disclosed in this press release,

except for those transaction amounts that were actually settled in

U.S. dollars, are presented solely for the convenience of the

readers. The conversion of Renminbi (RMB) into US$ in this press

release is based on the exchange rate set forth in the H.10

statistical release of the Board of Governors of the Federal

Reserve System as of March 31, 2024, which was RMB7.2203 to

US$1.00. The percentages stated in this press release are

calculated based on the RMB amounts.

3 Adjusted EBITDA represents net loss before (i) interest

income, interest expense, (gain)/loss from investments, net, income

tax (benefits)/expenses and share of results of equity investees,

impairment of goodwill and intangible assets and (ii) certain

non-cash expenses, consisting of share-based compensation expenses,

amortization of intangible assets, and depreciation of property and

equipment. See “Unaudited Reconciliations of GAAP and Non-GAAP

Results” at the end of this press release.

4 Adjusted net loss represents net loss excluding (i)

(gain)/loss from investments, net, (ii) share-based compensation

expenses, (iii) impairment of goodwill and intangible assets, (iv)

adjustments for tax effects. See “Unaudited Reconciliations of GAAP

and Non-GAAP Results” at the end of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240709745398/en/

For investor and media inquiries, please contact:

MOGU Inc. Ms. Qi Feng Phone: +86-571-8530-8201 E-mail:

ir@mogu.com

Christensen In China Ms. Rachel Xia Phone: +852-2232-3980

E-mail: rachel.xia@christensencomms.com

In the United States Ms. Linda Bergkamp Phone: +1-480-614-3004

Email: linda.bergkamp@christensencomms.com

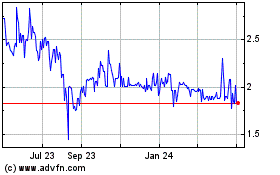

MOGU (NYSE:MOGU)

Historical Stock Chart

From Nov 2024 to Dec 2024

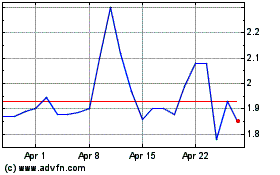

MOGU (NYSE:MOGU)

Historical Stock Chart

From Dec 2023 to Dec 2024